An employment contract is the main legal document regulating the relationship between an employee and an employer. The document has legal force; the provisions specified in it must be strictly observed by both parties to the labor relationship. A properly drafted employment agreement will help protect the interests of the employer without infringing on the interests of the hired personnel. The document must be drawn up in writing in two copies.

Many employers are interested in the question: has the standard form of an employment contract been approved in 2021? Or can it still be composed in free form? The answers to these and other questions are in our material.

Is there a standard form of an employment contract?

Today, there is one standard form of employment agreement approved at the government level. It is intended for micro-enterprises and can replace all personnel documentation with them (Article 309.2 of the Labor Code of the Russian Federation). The standard form of an employment contract for microenterprises was approved by Government Decree No. 858 dated August 27, 2016. The document came into force in January 2017.

The approval of the standard form made it possible to solve two problems of micro-business:

- optimize personnel records management;

- introduce common standards for drawing up documentation on the legal regulation of relationships between hired employees and the employer.

We would like to remind you that micro-enterprises include organizations and individual entrepreneurs that employ no more than 15 employees, and the level of income for the previous year amounted to no more than 120 million rubles.

Who are SMEs?

The criteria for classification as small businesses in 2021 are established by the state. The main requirements, subject to which it is possible to classify a businessman as a small and medium-sized enterprise (SME), relate to the number of employees and the amount of income received.

Thanks to the amendments made to Law No. 209-FZ, more enterprises and individual entrepreneurs can be classified as small businesses.

- The maximum allowable amount of annual revenue excluding VAT for the previous year for micro-enterprises increased from 60 to 120 million rubles, and for small enterprises - from 400 to 800 million rubles.

- The permitted share of participation in the authorized capital of a small enterprise of other commercial organizations that are not small and medium-sized businesses has increased - from 25% to 49%.

But the permissible average number of employees has not changed: no more than 15 people for micro-enterprises and no more than 100 people for small enterprises.

| Category of SME subject | Revenue excluding VAT for the year | Average number of employees |

| Microenterprise | 120 million rubles | no more than 15 people |

| Small business | 800 million rubles | no more than 100 people |

| Medium enterprise | 2 billion rubles | no more than 250 people |

For individual entrepreneurs, the same criteria for dividing into business categories apply: according to annual revenue and number of employees. If an individual entrepreneur does not have employees, then its SME category is determined only by the amount of revenue. And all entrepreneurs working only on the patent taxation system are classified as micro-enterprises.

The period during which a businessman continues to be considered a SME has been extended, even if he has exceeded the permissible limit on the number of employees or revenue received. Before 2021 it was two years, and now it’s three. For example, if the limit was exceeded in 2017, then the organization will lose the right to be considered small only in 2021.

Drawing up an employment agreement according to a standard form, as an alternative to maintaining personnel documentation

If a micro-enterprise formalizes labor relations with employees using this document, it has the right not to adopt other local acts (regarding labor law), including internal regulations, regulations on wages, bonuses, etc. This is very convenient, as it reduces the documentary and administrative burden.

Requirements for an employee for a certain position, rights, responsibilities and other essential conditions must be specified in the text of the contract. In order for the introduction of such personnel document flow to have a legal basis, the head of a business entity must record the use of a standard form of an employment contract in the relevant order.

Micro-enterprise criteria, number

The Labor Code has been supplemented with a new chapter 48.1, which establishes the specifics of regulating the labor of persons working for employers - small businesses included in the category of micro-enterprises. In particular, from January 2021, “micro-babies” will have the right to organize simplified personnel document flow.

Individual entrepreneurs and organizations related to micro-enterprises (Article 4 of Law No. 209-FZ) included in the relevant register, the average number of which for the previous calendar year does not exceed 15 people and the total income from all types of business activities for the previous year, determined in the manner established by the legislation of the Russian Federation on taxes and fees, does not exceed 120 million rubles - received the right from 01/01/2017 to simplify their personnel document flow.

Expert opinion

Makarov Igor Tarasovich

Legal consultant with 8 years of experience. Specialization: criminal law. Extensive experience in document examination.

You will lose the status of a MICRO enterprise if the amount of income or the average number of employees exceeds the limit values for three calendar years in a row (Part 4 of Art.

4 of the Law of July 24, 2007 No. 209-FZ). And even if the upper values are for a Small Enterprise, then the company will be excluded from the register no earlier than July 1 in three years (letter of the Federal Tax Service of Russia dated August 23, 2016 No. SA-4-14/15480).

If a micro-enterprise loses its status, then within four months the employer will have to bring labor relations to the general order.

In particular, the named subjects may not adopt local acts containing labor law norms, such as (Article 309.2 of the Labor Code of the Russian Federation):

- labor regulations of the organization;

- wage regulations;

- bonus regulations;

- shift schedule.

The list is open - the norm also provides for “other documents”. But this “openness” is still conditional, otherwise it is unlikely that some of the relaxations (initially stated in the bill) would have been “lost.”

By the way, some of them disappeared after public discussion of the project by the time it was submitted to the State Duma: the first version assumed that the vacation schedule would no longer be mandatory for micro-enterprises (Article 123 of the Labor Code of the Russian Federation), such employers would not have to approve the form of the pay slip (Article

136 of the Labor Code of the Russian Federation).

Structure of a standard contract form

The standard form of an employment contract provides for various options for labor relations, including, incl. home and remote work. The form consists of the following sections:

- Preamble - information about the employer and the employee being hired.

- General provisions. The section contains information about the position and place of work, probationary period. Here they state the date when the employee must begin performing the job functions assigned to him, as well as the validity period of the contract.

- Rights and responsibilities of an employee. This section should clearly state the job function and indicate what exactly is included in the job responsibilities. The rights of an employee include timely receipt of wages, compensation for harm caused to him during the performance of work duties, etc.

- Rights and obligations of the employer. Here you can indicate that the head of the company has the right to demand that the hired employee perform the work assigned to him, take care of the company’s property, etc. Responsibilities include providing the work specified in this employment agreement, providing the employee with tools and personal protective equipment, etc.

- Salary. In this section, you should indicate the amount of the monthly salary that the hired employee will receive, the timing of salary payment, the method (cash or through a bank), and the payment details where the funds will be transferred.

- Working time and rest time. The following is indicated here: the length of the working week, the start and end time of the work shift, the duration of annual leave.

- Occupational Safety and Health.

- Conditions of social insurance.

- Other terms of the employment agreement.

- Changing the terms of the employment contract.

- Responsibility of the parties.

- Final provisions.

The final part of the agreement displays detailed information about the parties to the agreement. The General Director and the employee put their signatures on the document and the date of familiarization with it.

The list of sections given here is not exhaustive. Participants in labor relations have the right to include other sections in the contract at their discretion. If necessary, additional agreements concluded with the employee may be attached to the standard employment contract.

Sample of filling out a standard employment contract

Where is the completed copy of the agreement stored?

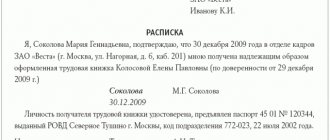

The employment contract form is usually filled out by HR employees, and the employee only has to sign, thereby confirming his familiarity with the sample standard employment contract and agreement with its terms. If the company accepts that the document is filled out by the employee himself, then the HR department will need a sample of filling out the employment contract.

The document is drawn up and signed in two copies (one copy for each party). The completed employment contract form is given to the HR employee, who, in turn, submits it to the head of the organization for signature (if this has not already been done).

After the signing procedure, one copy is kept by the employer, the other is given to the employee. Evasion from signing a contract by the employer or failure to provide a copy to an employee is an offense for which the manager bears responsibility under labor legislation.

This is important to know: Civil contract with an employee: sample 2021

Documents that can be refused

What local acts can confidently replace the standard employment contract of 2021? Most of those currently in circulation.

Internal labor regulations . They can be completely abandoned by filling out Section 5 of the standard agreement in detail.

Regulations on remuneration and bonuses . Can be painlessly replaced by section 4 of the above form: “Employee remuneration.” Where the employer will describe all the nuances: size, procedure, specific dates for receiving salaries, availability of social guarantees, conditions for assigning bonus payments and their sizes and other details.

Regulations on irregular working hours . Its conditions may well be described by paragraph 9 of the standard form.

Job descriptions are generally not a mandatory document for micro-enterprises. Thus, in the letter of the Federal Service for Labor and Employment No. 3042-6-0 dated 08/09/2007, it is explained that the absence of a job description is not regarded as a violation of labor legislation and does not entail liability, but may have negative consequences in the form of the employer making illegal decisions due to her absence.

They are required to be developed only for government agencies. This provision is enshrined in Art. 47 of the Federal Law of July 27, 2004 No. 79-FZ. But the presence of such a document helps employers detail the duties of employees and their level of responsibility. This means that in cases of controversial situations or emergencies, it will be easier to prove in court that one or another side of the conflict is right. Such clearly defined conditions will also help if it is necessary to dismiss an employee. And in “ordinary life” they will facilitate certification and competent distribution of responsibilities among team members.

The job description is not officially a local regulatory act. It is usually drawn up as an annex to the employment contract or as a separate document. It can quite authentically be replaced by a detailed elaboration of the clauses of the employment contract describing the responsibilities of the parties and the special conditions for their implementation.

As for shift schedules, the situation is similar: all the standards for actual working hours, information about shifts, permitted breaks and other details easily fit into the contract format.

Labor protection rules and relevant instructions. Paragraph 23 of Part 2 of Article 212 of the Labor Code of the Russian Federation obliges to register them in internal documents. The basic rules are easy to describe in Section 6 “Occupational Safety and Health” of the employment contract; there are the necessary clauses and wording for this.

But instructions in this direction are usually very voluminous, and this is justified. Their violations are fraught with very serious consequences. To avoid cluttering the contract with the details of these provisions, it is most likely preferable to keep the instructions as a separate document. Especially if the work involves danger to the health and life of employees.