When is a certificate needed?

The main purpose of such a document is to provide the social service with information about the financial situation of a family or individual citizen. With its help, the condition is assessed and the degree of need for individual benefits or benefits is determined.

Help may be required upon receipt of:

- Unemployment benefits

Material payments after the birth of a child- State scholarships

- Benefits for utility bills

- Benefits for travel on public transport

- Government subsidies

- Financial assistance to single mothers, persons with disabilities, pensioners, large families

In general, a document can be requested from almost all social services whose activities are related to the provision of certain benefits. The information obtained from it is compared with the cost of living. Based on this, a decision is made on the calculation of social benefits.

When it's needed

A certificate of income will be required by the social service, usually in three cases, to receive compensation for housing and communal services, to receive benefits, benefits, guarantees that are due if a family or individual living separately has an income below the subsistence level, to apply for child benefits .

The law does not provide a special form for such a certificate in either case. It’s just that most often income is recorded in a certificate in form 2-NDFL.

Decree of the Government of the Russian Federation dated August 29, 2005 N 541 provides for the maximum share of income that can be spent on paying for services in the housing and communal services sector and is equal to 22%. The calculation rules are established by the law of the subject in accordance with the regulations in force there. If the income per person is less than the subsistence level, the amount of expenses is reduced by an additional correction factor.

The payment can be used by:

- living in municipal or federal housing;

- living in a rented apartment;

- owners;

- citizens belonging to a housing cooperative.

Housing Code of the Russian Federation in Art. 159 defines the main condition for payment - the absence of debt. In the event of a dispute, the court takes into account Resolution of the Plenum of the Supreme Court of June 27, 2017 N 22, which states that debt in a difficult life situation and in the presence of good reasons cannot be a basis for refusing assistance.

When determining income, the rules of Federal Law No. 44 of April 5, 2003 are applied, which states that it includes all cash receipts, including compensation for housing and communal services, social benefits, wages, scholarships, and pensions. The Decree of the Government of the Russian Federation of December 14, 2005 N 761 defines the procedure and amount of payments, and establishes separate rules for certain categories.

The second situation when it is required is the registration of benefits and additional payments as low-income citizens. This category is provided with various benefits, payments and compensation. Since they are carried out mainly at the expense of the regional budget, special laws have been developed in each subject regulating their receipt, including a description of the package of documents required for registration.

A certificate of income will be required to recognize a family as low-income

Federal Law 44 of 04/05/2003 stipulates the conditions for recognizing citizens as low-income. It states that a family or individual living separately can be recognized as poor if the funds received over the previous 3 months, divided among all family members, are less than the minimum subsistence level agreed upon in each region.

This amount is calculated by the executive branch of the subject every quarter of the year. All income is taken into account, before the procedure for calculating tax deductions, from all types of property; their list is approved by Government Decree No. 512 of August 20, 2003.

A certificate for applying for child benefits is needed when both federal and regional payments are issued. General benefits include payments for a newborn, child care benefits up to 1.5 years old. The sample income certificate for a child benefit is absolutely the same as for other payments, the only difference is the area of occupation of the person who provides it.

All about child birth benefits in this article.

What social benefits do single mothers have?

What benefits does a mother of many children have?

Legal basis

There is no approved law or other legal act directly related to the preparation of income certificates. However, several legal acts are indirectly related to such a document.

Among them:

Decree of the Government of the Russian Federation “On the list of types of income taken into account when calculating average per capita income”- Labor Code of the Russian Federation Art. 62 (Procedure for issuing work-related documents)

- Order of the Ministry of Labor No. 182 “On approval of the form and procedure for issuing a certificate of the amount of salary and other payments”

Typically, information about income for social services is requested on the basis of local regulations that apply in certain regions of the Russian Federation.

Certificates for subsidies

Many people are interested in what certificates are needed for a subsidy besides the above? You need a certificate from the BTI, which will indicate the size of the area. Mandatory is:

- certificate of ownership of real estate/lease agreement,

- extract from the house register, personal account,

- warrant for premises

- certificate of family composition.

Official papers are provided in their original form and copies are made. The subsidy is only available to those individuals who use more than 22% of their joint monthly income to pay for housing and communal services. The amount of such compensation depends on the region of the country and is given only for those square meters of housing that are established in accordance with social norms per resident. If there are more squares in the house, then the rest are paid at 100%, regardless of the salary level.

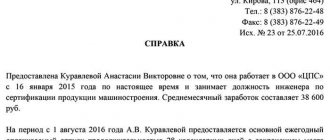

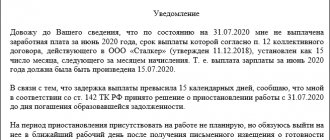

Sample certificate for salary subsidy. Screenshot: ipshnik.com

Debit card #CandoEVERYTHING from Rosbank - up to 8% on balance

Apply now

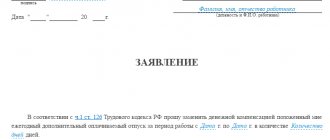

Free form

This filling option is the most common. The form is drawn up on a landscape sheet in printed form. To do this, you can use a ready-made form in which you only need to enter the necessary information.

Previously, income could be certified in writing by hand. This option is not currently available. Hand-filled forms are not accepted by social security authorities or any other services.

List of documents for receiving maternity benefits

To apply for maternity benefits (M&B), the employee must provide the employer with the following package of documents:

- sick leave;

- application for payment of benefits;

- certificates of the amount of earnings from previous places of work for the estimated 2 years, if any;

- an application to replace the years of the calculation period if the amount of benefits increases when changing periods.

IMPORTANT! The benefit is not paid if the employee applied for it 6 months after the end of the BiR leave (Article 12 of the Law “On Compulsory Social Insurance” dated December 29, 2006 No. 255-FZ).

An addition to the B&R benefit is a benefit in connection with registration in the early stages of pregnancy. The basis document for receiving this benefit is a certificate issued by a medical institution. As a rule, both of these benefits are paid at the same time. Therefore, if the employee submitted a certificate of registration in the early stages of pregnancy along with the documents necessary for payment of maternity benefits, ask her to write one application for both benefits.

The employer, having received the entire package of documents from the employee, is obliged to transfer them to the Social Insurance Fund within 5 calendar days. The fund makes a decision on payment within 10 days and transfers benefits to the maternity leaver.

You will find ready-made instructions for receiving maternity benefits in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Filling out 2-NDFL

This is a unified form that reflects the citizen’s income, as well as the amount of contributions to the Tax Service. You can only fill out a ready-made form, which you just need to download from the official Internet resource of the Federal Tax Service.

Typically, 2-NDFL is required not to reflect a citizen’s income, but to determine the amount of deductions in the form of taxes. This is necessary when applying for subsidies and receiving some other types of financial assistance.

Instructions for filling out a salary certificate for 3 months: basic methods

Those who wish to receive child benefits or other subsidies apply for a report reflecting three months' earnings. If it is filled out correctly, experts will be able to calculate the profit that accrues to each family member.

If, as a result of the study, it turns out that it is below the subsistence level established in the region, the support payment organization will decide to transfer additional funds.

According to established instructions, to determine the correct transfer size, the following factors must be taken into account:

- Area of residence.

- Family members.

- Establishing the status of large families.

- Disability, if any.

Based on the information, a decision is made whether to pay subsidies in cash or in the form of benefits.

Content requirements

The certificate must contain information not only about the citizen’s income, but also about the enterprise where he is employed. Otherwise, the document is declared invalid.

Table 1. Main points that are requested by most social security authorities.

| Item name | Classification |

| Information about the place of employment | Name TIN Company details Actual and legal address contact number |

| Information about the citizen to whom the certificate was issued | Full name Passport details Position held Start date of the employment contract |

| Income information | Information on accruals received, taking into account tax payments for the last 3, 6 or 12 months |

| Confirmation marks | Signatures of the manager and chief accountant Organizational stamp (not required for individual entrepreneurs) |

It is recommended to include information regarding income in the form of a table. This simplifies the calculation procedure and eliminates the risk of errors.

Documents for receiving child benefits, watch the video:

Child benefit for single mothers

Financial support for single mothers is considered an additional measure and has been transferred to the responsibility of regional authorities. Depending on the place of actual residence of the woman, the payment can range from several hundred to one and a half ten thousand rubles per month (the highest payments are expected to be assigned in Moscow and St. Petersburg). At the same time, a single mother can apply for other types of monthly additional payments and enjoy other benefits (to pay for utilities, for education, etc.).

You need to understand that only those women who put a dash in the “Father” column in the birth certificate of their baby are recognized as single mothers. Those who are divorced, have lost their spouse, or have not heard from him for a long time can only go to court for alimony, seek a survivor's pension, or prove that the family is now classified as low-income.

What types of income are taken into account?

When applying for a job, only income received at the place of employment is included in the list. For most citizens, work is the main source of material resources.

However, when issuing certificates and making decisions in social services on the provision of financial assistance, other factors are also taken into account.

Among them:

Family members own real estate- Recent purchases involving large sums of money

- Materials received in the form of an inheritance or gift from relatives

- Traveling abroad

In addition, income certificates often indicate only the official salary stipulated by the employment contract, while information about additional accruals is not included. In this regard, the document becomes unreliable.

Help form

A certificate of income is a document confirming the receipt of funds from various sources for a specific period. They happen in 3, 6, 12 months. It expires at the end of the month in which it is issued.

free

The legislation does not provide for a specific form, however, a sample social security certificate must include a number of important information:

- name of the organization, its data – TIN, KPP, BIC;

- full details of the person to whom this paper is issued;

- information about funds for each month;

- signatures of the accountant and manager;

- stamp and date.

It should also include a telephone number so that a social service employee, if he or she has questions, can quickly find answers to them.

The data listed above is mandatory for a certificate of income for social security in any form, but at the request of the compiler, data on deductible income tax can also be entered into it, the average income for the months can be indicated and a subsequent breakdown for each separately or the total amount, and for those for each month .

All accrued funds, travel combinations, bonuses, surcharges, etc. are included in the certificate. Sample certificate of income to the social service

2-NDFL

Often, when you contact the accounting department for such a certificate, they provide it in form 2-NDFL.

In its current form, it has been used since 2015 and was approved by Order of the Federal Tax Service of Russia dated October 30, 2015 MMV-7-11/485. The same order also approves the procedure for filling it out. In this case, all data must strictly comply with the prescribed rules; each column must contain a number corresponding to the law.

When writing it, you should pay attention that payment codes are clearly regulated by Order of the Federal Tax Service 09/10/2015 N ММВ-7-11/387. Certificate form 2-NDFL

Intelligence

All income is included in the certificate

The certificate takes into account income according to the list approved by Decree of the Government of the Russian Federation No. 512 of August 20, 2003. These include:

- salary;

- sick leave, student leave;

- benefits upon dismissal or liquidation of an organization;

- pensions;

- scholarships;

- funds paid to the unemployed;

- additional payments to the wives of military personnel in case of deployment where they cannot find professional employment;

- benefit from the use of property;

- remuneration for work under a civil contract;

- financial assistance to the employee from the organization;

- funds received for the results of intellectual activity;

- funds from being an individual entrepreneur;

- alimony;

- income from capitalization of deposits;

- donated money or inheritance;

- funds received as part of the provision of social guarantees and benefits;

- income from sick leave, maternity benefits, child care benefits, child benefits.

Income is taken into account with the amount of tax deduction, that is, as they say, “dirty”. The amount is reduced by paid alimony, payments in connection with damage caused to life, health, property, as well as the amount of social assistance.

Validity periods

Social security authorities request certificates for certain months. Often, information about income is requested not for recent months, but, for example, for the past year. To receive child benefits, information for the last 24 months may be required. Thus, the validity period of the certificate is not related to the information specified in it, so it remains valid forever. As for 2-NDFL, such a certificate is valid for 1 month from the date of issue.

Can they refuse?

It all depends on the woman’s social status and the type of government support. For example, everyone receives money for early registration, a lump sum payment for the birth of a baby, and maternity capital.

Receipt of maternity benefits, as well as for caring for a child up to 1.5 years old, is influenced by the form of employment:

- the employee receives in any case;

- Individual entrepreneur - only if there is an agreement with the Social Insurance Fund and contributions for the previous year;

- an unemployed person does not receive it unless she confirms that she is a student or was laid off within a year before giving birth.

If there is no certificate of non-receipt of maternity benefits by the second parent, but it is listed in the child’s records, the answer is: no.

These payments may be denied if both the mother and father decided to return to work early, lost parental rights, or moved to another country.

Special requirements

Before issuing a certificate, you should clarify with the social security authority what information must be contained in the completed form. This eliminates the possibility of errors and subsequent refusal to provide assistance.

Primary requirements:

- When applying at work, the date of issue of the certificate must be recorded in the journal

- After the table with monthly income, you need to indicate the average monthly earnings, entering it in both numbers and capital letters

- The certificate should leave space for entering information about the service to which it is transferred

- When providing a certificate, the manager may request written permission to use personal data

You can issue a certificate through an intermediary if the citizen himself, for certain reasons, is not able to do it himself. The intermediary receives a certificate instead of an employee only if there is a power of attorney.

How is the benefit calculated?

In the process of calculating the required support based on a salary certificate for 3 months, all categories of accruals are taken into account:

- Awards for achievements;

- Scholarships for students;

- Insurance transfers;

- Vacation pay;

- Maternity leave;

- Maternity benefits.

The salary of each person in the family is taken into account, and accordingly a report is given to all spouses. All obtained indicators are summed up. The result is divided by the number of persons specified in the document. The digital indicator is compared with the minimum. If it is less than the PM, the request for material support is approved.

Sources for workers

To exercise a right, knowing about its existence is not enough. It is required to rely on the law and insist on strict adherence to the legal order. When issuing extracts from the place of employment, the following acts are applied:

- 255 law on insurance for recorded social cases.

- Labor Code of the Russian Federation.

- Article 62, indicating the period for issuing statements. The report must be issued within three days.

- Order 182 from the Ministry of Labor of the Russian Federation - presents a standard type of salary certificate and instructions for correct formation.

At the level of city municipalities and regions, special standards have been established. They are also taken into account.

Child benefit

A certificate of average earnings for the last 3 months for the employment center is required for families that are classified as low-income. This form of accrual should not be confused with payments for childbirth and pregnancy. They are due to all women without exception, regardless of their income level.

Special child benefits intended for the poor have been raised to a completely new level. They adopted a purely targeted approach and were graded according to special categories. Distribution is carried out according to the level of need to all recipients of assistance.

The new adopted system continues to develop rapidly in 2021. Moreover, it has serious prospects for time periods. The rate of the required benefit is established exclusively by the regional authorities. The budgetary capabilities of the individual and the characteristics of families are taken into account. The following parameters are taken into account:

- Completeness of the family.

- Total number of children.

- One of the members has a disability.

Child benefits are not always in cash form. These include a variety of discounts, benefits and other benefits.

Possible mistakes

Often, issuing a certificate of income for social security is accompanied by erroneous actions on the part of the filler. In this case, the form is considered invalid and a new one is required instead. Typically, errors consist of incorrect information about employers or employees.

Among the common mistakes:

Lack of legal status and details of the enterprise- Lack of address, contact information

- Errors when filling out a citizen’s passport data

- Incorrect calculation of average income

The possibility of such errors once again emphasizes that filling out the certificate should be done by an authorized employee, using a ready-made form.

An income certificate is one of the documents required to receive social assistance from the state. The form is filled out in a free or unified form, depending on the requests of the service. When compiling, it is necessary to take into account several aspects and follow the general filling procedure.

Top

Write your question in the form below

Where to get it

If a citizen works, he should contact his boss directly for information. When there is no management at the enterprise, the chief accountant should be responsible for issuing certificates.

If a citizen does not officially work, he can apply for a document to the Employment Center, which is located at the place of registration. This institution will issue a certificate stating that the person has had no official income for the last 3 months .

Read the Model Charter of SNT in the new edition

Individual entrepreneurs are not required to have income certificates. They must submit reports regularly. To do this, you can use any papers that confirm income for a certain period. The basis for a certificate to the social security authorities will be information from documents certified by the tax office.

List of documents for obtaining a one-time benefit for the birth of a child

After the birth of a child, one of the parents has the right to receive a one-time benefit in the amount of 18,004.12 rubles if the child was born before 01/31/2021 inclusive or in the amount of 18,886.32 rubles if the child’s birthday is after 02/01/2021.

The composition of the documents is as follows:

- application for assignment and payment of benefits;

- a certificate from the second parent’s place of work (or from social security if the other parent does not work) about non-receipt of benefits (see sample here);

- birth certificate issued by the civil registry office.

IMPORTANT! If the parents are divorced, a certificate of non-receipt of benefits from the second parent is not needed. Instead, you will need a divorce certificate and a certificate of the child living together with the employee.

Documents for receiving Putin benefits

Currently, there are several payments that can be called “Putin’s”.

Firstly, since 2021, the law “On monthly payments to families with children” dated December 28, 2017 No. 418-FZ has been in force, according to which citizens who gave birth to the 1st or 2nd child in 2021 and after are entitled to so-called presidential payments .

Read more about this benefit in the material “Presidency payments at the birth of a child in 2021 - 2021”

To receive this benefit, you must contact social security (at the birth of the 1st child) or the Pension Fund of the Russian Federation (at the birth of the 2nd child) with a complete package of documents.

The list of papers for both departments will be the same (Appendix No. 2 to the order of the Ministry of Labor and Social Protection dated December 29, 2017 No. 889n):

- application for benefits;

- child's birth certificate;

- documents confirming the citizenship of the Russian Federation of the parent and child;

- information about the income of all family members;

- a certificate from the military commissariat about the parent’s conscription for military service;

- bank account details.