Certificates of arrears of wages and absence of arrears of wages

The purpose of the certificate of arrears of wages is to certify on the part of the employing organization the fact of the existence of arrears to the employee, as well as to confirm the specific amount of such arrears.

This certificate may be required:

- An employee of a bankrupt company. In this case, the certificate is submitted to the arbitration manager to include the employee in the register of creditors.

- An employee of a company that is delaying or not paying wages - to present it to the court, and then to the bailiffs in order to collect the accumulated debt. On this topic, our articles on the links Peculiarities of consideration of labor disputes regarding wages and What is the statute of limitations for wages?

- The organization itself filing for bankruptcy. In this case, the certificate serves to take into account the total debt of the organization to creditors and is taken into account when assessing the volume of property intended to satisfy the claims of creditors of such an organization (for example, the decision of the Vologda Region AS dated June 14, 2017 in case No. A13-4034/2017).

Thus, the mentioned certificates, properly executed, play in court the role of one of the proofs of the fact of debt, along with, for example, protocols, inspection reports, certificates of the labor dispute commission (for more details about this document and the procedure for issuing it, read our article at the link Certificate of the labor dispute commission - sample), balance sheets, etc.

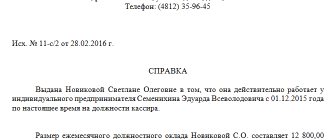

Certificate of arrears of wages: sample

A unified/standard form of such a certificate has not been developed, therefore it is compiled in free form, provided that all necessary attributes are included in its structure. For example, the structure of a certificate of arrears of wages may be as follows:

- Registration details of the document (date of issue and registration number according to the internal nomenclature of the organization).

- Information about the debtor, i.e. the employer. If the text of the certificate is placed on the organization’s letterhead, then it is quite enough to provide its name. Otherwise, in addition to the name, you must indicate the registration details and the address of the company, which would allow it to be uniquely identified.

- Information about the creditor, i.e. the employee to whom there is a wage arrears. In addition to the employee’s last name, first name and patronymic, it is recommended to indicate his passport details.

- The amount of debt, including a breakdown by type of payment (for example, salary, bonus, severance pay, compensation for unused vacation, etc.) and indicating the period for which such debt arose. If there are no debts, the employer may indicate in the certificate that it has no debt to the employee.

- Signature of the head of the organization and the chief accountant, seal of the organization (if available).

We recommend using the template we have developed for issuing a certificate of debt / absence of wage arrears, which can be downloaded from the link: Certificate of arrears of wages - sample.

How to fill out the form?

The certificate is issued in free form after the employee submits a written application. No unified form for its preparation has been developed.

It is important to take into account that when writing it, the rules of the Russian language must be observed.

Also, when writing, they adhere to a business style of storytelling.

The company letterhead can be used to fill out the document. If it is not available, use an A4 sheet.

The following information must be reflected on paper:

- full name of the company, its details;

- organization address;

- information about the specialist who was involved in issuing the certificate, his contact details;

- the duration of the employee's employment;

- the position held by the employee, his initials;

- the amount of calculated and accrued wages for the requested time, which is listed as debt;

- date of issue of the certificate;

- signatures of responsible persons, company seal.

A certificate of wage debts is considered valid only if there are signatures of the accountant who compiled the document and the immediate manager of the enterprise. The seal of the organization is no less important.

If there is no arrears in wages, the certificate indicates the same amounts of calculated and accrued wages. A note is also made indicating that there is no debt for the requested period of time.

.

Design features for the prosecutor's office

If the employer has not repaid the debt to the employee after receiving the claim, the employee may contact the prosecutor's office for further proceedings.

As in all other cases, he must provide the appropriate certificate confirming the fact of the delay. It is important to note that it is formatted in a standard way.

The document must contain information about the period during which the amount of money earned by the citizen and its amount were not paid.

Some companies deliberately refuse to issue employees with certificates confirming the existence of debt.

It is in such situations that it is best to contact the prosecutor's office. To do this, you need to draw up a statement in which you need to reflect the fact of refusal.

During the investigation, specialists from the authorized body will independently require the necessary documents from the employer and determine the total amount of the debt.

The absence of a certificate is not a reason for refusing to contact the prosecutor’s office in order to protect your labor rights.

certificate of salary arrears to the employee – word.

This is what the sample looks like:

Sample certificate of salary payment deadlines

A certificate of this type may be required, for example, by an employer to submit to the labor inspectorate in case of disputes with an employee regarding delayed wages or to draw up an agreement with a bank on making payments to employees’ card accounts, etc. Such a certificate can be issued by the employer and employee at the latter's request.

The content of the certificate must indicate:

- timing of receipt of funds for wages, broken down for the first (advance) and second half of the month;

- a link to regulations (for example, the Labor Code of the Russian Federation) and local documentation (for example, regulations on remuneration of an organization, a collective agreement, an employment contract, etc.).

It is also recommended to indicate the fact that the employer is the payer of insurance contributions to extra-budgetary funds.

There is no standard/unified form developed, so the employer can draw it up in any form. The text of the document is placed either on the employer’s letterhead or includes the registration details of the organization, allowing it to be clearly identified.

For example, you can issue such a certificate in accordance with our template, which can be downloaded from the link: Certificate on the timing of payment of wages - sample.

Deadline

Failure to pay earned amounts violates the terms of employment contracts. The current provisions of the law allow the employee to act in permitted ways on his part to resolve a conflict situation.

For example, delaying the payment of accrued salaries for more than 15 days allows employees to suspend their work duties without further consequences. But to do this, you will need to write an application addressed to the employer and take a note of its receipt. Otherwise, further actions may be regarded as a violation of labor discipline with the ensuing consequences. In accordance with the law, for each day of delay in payment of earnings, compensation is due in the amount of 1/300 of the debt.

If organizations do not take any action to resolve the situation, employees have the right to seek support from the labor inspectorate, the prosecutor’s office, and the courts. As a rule, employers strive to avoid such extreme measures, since, in addition to settling the debt, this may entail administrative and sometimes criminal liability.

In cases in which there are no disagreements regarding accrued amounts between the parties, complaints about non-payments are allowed to the prosecutor's office or labor inspectorate. In this case, you can make 2 requests simultaneously, since the executive authority makes decisions depending on the degree of criminal liability. Cases of administrative offenses fall under the competence of the labor inspectorate.

If there is a discrepancy in the amounts of accrued earnings, the injured party should go directly to court. Cases of incomplete payment or underpayment will be considered here.

Non-payment of wages may result in proceedings involving the prosecutor's office

Sample certificate of lack of wages

Such a document confirming the fact of lack of income in the presence of official employment may be required, for example, by a citizen applying for a subsidy, or for submission to the court to calculate the amount of alimony or deferment of debt payment, deferment or installment plan for payment of state duty and other purposes.

The form of such a certificate is not regulated at the legislative level, so it can be drawn up in free form indicating the required attributes. In this case, it can either simply indicate the period during which the employee does not have a salary (for example, due to being on leave without pay), or a monthly breakdown can be provided. Including such information can be presented in form 2-NDFL (see order of the Federal Tax Service of Russia dated October 30, 2015 No. ММВ-7-11 / [email protected] ) with zeros entered in the columns for the corresponding months.

A sample certificate in free form can be downloaded from the link: Certificate of lack of wages - sample.

When should a manager transfer money?

In accordance with Art. 136 of the Labor Code of the Russian Federation, the procedure, place and timing of salary payments in 2015 are determined by an internal collective or labor contract, but the gap between payments cannot exceed 15 days. For example: every month on the 20th - advance payment, on the 5th - salary. Clear dates are established by the regulatory documents of the organization itself. The standard order for the timing of salary payment (download in attachment N1) is not established by any legislative act, and the director fills it out without the help of others, but it must contain a reference to Art. 136 TC and certain numbers by which funds will be transferred. The employer can also set payments at other times, but taking into account the provisions of Art. 136 Labor Code of the Russian Federation.

If the accrual date falls on a calendar holiday or weekend, then the money must be transferred or issued in cash before this day. When going on regular or extraordinary vacation, an employee must receive vacation pay no later than 3 days before its official start.

An employee can be given money either in cash directly at the enterprise’s accounting department or through a credit company (bank). To do this, the company must have a service contract, and employees are issued plastic cards.

To design a contract with the bank, you will need a certificate about the timing of salary payments. (download file No. 2) Its standard is compiled by the organization itself in printed form, and must contain the signature of the chief accountant and the manager himself, as well as a seal.

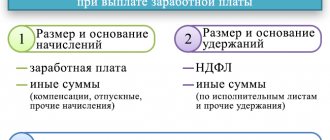

Guided by paragraphs 1-4 of Art. 136 of the Labor Code of the Russian Federation, when transferring funds for his own work, the employee has the right to familiarize himself with the receipt, which contains the following information:

- About the components (salary, monthly bonus).

- About other amounts (one-time bonus, vacation pay, compensation from the employer for late payment, etc.).

- On deductions for payment of income tax to the Federal Tax Service and contributions to the Pension Fund, indicating all amounts.

- About the total amount to be transferred.

Certificate of timely payment of wages

This certificate can be compiled using any of the certificate templates proposed above, including by combining them, depending on the purpose of its execution. The simplest option is to indicate the deadlines established by the organization for the payment of remuneration to employees and at the same time payments and deductions for the period of interest in relation to a specific employee.

An alternative to such a certificate in certain circumstances may be, for example, a certificate of no arrears in payment of wages.

Thus, a certificate of arrears of wages, the absence of such, the timing of payment of wages and the timeliness of its payment are drawn up in free form. It is recommended to place the text of each of these documents on the employer’s letterhead - one way or another, the employer’s details must be clearly defined. The certificate is signed by the head of the organization and, if available, the organization's seal is affixed.

In what cases is it issued?

The reason for requesting a certificate of absence of debts by an individual is the execution of:

- ownership;

- privatization;

- real estate;

- credit and loans;

- citizenship.

For legal entities, such a certificate may be needed to confirm the absence of debt:

- on wages and other payments;

- on taxes to the budget;

- on insurance premiums;

- to the pension fund;

- on customs payments, interest;

- when participating in tenders and trades;

- upon liquidation of an organization, upon termination of a business

Certificates of absence of debt are necessary for solving investment transactions, concluding any type of transaction, issuing loans and advances, etc.

If you need a certificate of overdue debt from the employer to the employee, you can download a sample here.

When does an employee need a certificate about non-payment of wages?

An employee may need the document in question in the following cases:

- to obtain a deferred loan payment. If the employee provides proof to the bank that he is not making deposits through no fault of his own, loan payments may be reduced or delayed;

- to protect rights in court when collecting alimony or other debts;

- to collect wage arrears in the event of enterprise bankruptcy. The paper gives the right to include the employee in the list of creditors. To do this, it must be provided to the arbitration manager;

- to protect your rights in the State Labor Inspectorate when the employer delays wages.

Read also: There is compensation for insurance

The employer may need this document:

- during a scheduled inspection by the labor inspectorate as evidence of fulfillment of obligations to employees;

- to initiate bankruptcy proceedings. Salary is included in the amount of accounts payable.

Application to the labor inspectorate for non-payment of wages

Attention

Please note that the 3-month deadline for filing an application starts from the date your rights were violated (salary was not paid, for example). If a claim is filed after 3 months, the court will not accept the claim.

You can restore the period if you prove that you had good reasons for doing so.

Info

Example: As the court decided in case No. 33-1182/2016, the plaintiff’s care for her son, a disabled person of group I, is not considered a sufficient reason for missing the time period for filing a claim, since he was looked after earlier (during the period of work for defendant), such actions could not prevent the plaintiff from going to court. The death of relatives and ignorance of legal norms are also not valid reasons (case No. 33-550/17, court of the Karachay-Cherkess Republic). Applying to the labor inspectorate Compile an application to the labor inspectorate in free form.

Sample certificate of arrears of wages

Existing legislation does not contain requirements for the preparation of this document. Compilation in free form is allowed. However, it is worth adhering to some rules developed in practice. In this regard, the sample calculation of arrears of wages must contain the following details:

- Business name;

- date of preparation and document number;

- information about the presence (absence) of debt;

- Full name, signature of the compiler.

A certificate confirming the timely payment of wages or its delay is endorsed by the General Director. In addition, a seal is affixed if the organization has one.

The paper can be prepared in a general form or for a specific employee. In the first case, it is indicated whether there are debts to all employees of the company.

Sample certificate of arrears of wages

In the second case, the full name is indicated. employee, period of debt, its amount broken down by month and type of payment.

Legal Aid Center We provide free legal assistance to the population

What is it for?

The procedure for calculating and paying wages is regulated by the Labor Code of the Russian Federation. In accordance with the established rules, an employed citizen must receive the specified amount of wages 2 times a month.

In this case, a delay is considered to be the period during which the money earned for the month has not been paid.

Even with small delays, the employer is entitled to penalties, and employees are entitled to compensation.

Online calculator for calculating compensation for delayed wages.

If the money is not paid within 2 months, the head of the company may be prosecuted.

To protect his rights, the employee must take care of obtaining a certificate confirming the fact of non-payment of the earned amount and the existence of a debt.

This certificate is attached to the general package of documents submitted to the regulatory authorities for the purpose of collecting wage arrears from the employer.

Solving the problem of delayed wages is carried out in several ways. Among them it is necessary to highlight the following:

- by sending a complaint to the employer;

- by applying to the judicial authorities;

- by contacting the labor inspectorate;

- transfer of the complaint to the prosecutor's office.

Initially, you need to try to establish contact with the employer.

If, after receiving a claim about the debt, he did not take measures to normalize the situation and pay wages, the employee has the right to stop performing his job duties, notifying the manager.

This right of a working citizen is established by Article 142 of the Labor Code of the Russian Federation. The claim must be made in several copies.

One of them remains with the employee. If necessary, it is subsequently transferred to the authorized bodies.

A certificate of arrears in payment of wages due to a delay is required to be submitted to the labor inspectorate.

In addition, it is important to prepare a statement of the established form.

After checking the employer’s activities, inspectors can impose a fine on him, the amount of which reaches 100 thousand rubles.

The certificate will be needed if the matter comes to trial. An application for management can be filed within a year from the date of violation.

Based on the results of the trial, the employee is paid compensation calculated for each day of delay. Its amount depends on the Central Bank key rate in effect at that time.

Certificate of absence of wage arrears

If an employer in a business activity owes wages to an employee, then considerable fines are imposed on him. Indeed, recently penalties for business entities have been tightened. However, many employees still face this situation. Most workers expect the employer to pay in full and do not believe that this can be done easily. In addition to their basic earnings, such employees are entitled to compensation for overdue payments.

Information on overdue wages - form 3-f

The instructions required to fill out the overdue wages form contain a number of terms, including the meaning of wages and overdue. Salary includes money that was accrued by the company to the employee in the form of payment in cash for a certain amount of time worked. This includes allowances, bonuses, incentives, including accommodation and meals, which are paid systematically.

Certificate of absence of wage arrears - sample

A statement about the absence of wage arrears can be drawn up in any form, but in accordance with generally accepted legislation. It must be attached to the main package of documents, which is collected to confirm the absence of payments. The company has only three working days to issue such a certificate. The rules are established by labor legislation. The document must contain the following information:

- Current company details;

- Legal and actual address of the organization;

- Full company name;

- Contact information - in a specific situation, the name of the company employee.

The certificate may also contain information about the position held by the employee, how long he has been cooperating with the company, as well as the amount of wages he receives for a specific period without deductions to the tax service.

Calculation of wage arrears for the court

First, you need to get a calculation of your wage arrears in order to submit documents to the court. A letter with the condition for providing a calculation must either be taken to the company yourself and registered, or sent by registered mail with subsequent notification. In addition, request a copy of the hiring and dismissal orders. Just in case, ask for a copy of your work record.

After you have received the calculation and other documents, file an application with the court to recover accrued wages that have not been paid. Attach all collected and relevant documents to your application. The application should state your requirements and confirm this with legislative acts and attached documents.

If the decision is in your favor, the court will issue an order to collect back wages. Sometimes, if there is no evidence, he may refuse to satisfy the claim. If he did this, you can go to court again, but this time taking into account the claim proceedings. Also, only by this method can you recover unpaid wages if the company refused to issue a certificate of settlement of your debt and other documents. In this case, the statement of claim is filed independently in court, and the calculation is made by the plaintiff, that is, the employee. During the process, the court will independently request the necessary documents from the company.

Statute of limitations for wage arrears

As Article 392 of the Labor Code of the Russian Federation , the statute of limitations for unpaid wages is 90 days. However, the employer must inform about this pass. In this case, you can go to court with a corresponding claim. If the employer says that the period has expired, the court will refuse to satisfy the claim. According to the law, it can be restored only in case of valid reasons:

- Serious illness;

- Caring for a loved one and the like.

Where can I get an income certificate if you don’t work?

The economic crisis has not spared anyone. Some already have a loan and more than one, others are just about to take it out or buy an apartment with a mortgage while housing prices have dropped a little. And often people come to us with the question of where to get an income certificate if you don’t work.

Really, where? After all, this certificate can be useful when applying for a loan at any banking organization. Well, we hasten to please you - getting it is not very difficult. There are several ways to get a 2-NDFL income certificate. And today we will tell you about everyone.

You are required to pay increased attention to the text of the article and nothing more.

A 2-NDFL certificate is an official document reporting the level of your income and tax deductions.

If you have an official workplace, and along with it a “white” salary, you should contact your direct employer (as a rule, this is the management or management of the company) with a corresponding request.

You must write a written statement indicating the reason why you needed the certificate and for what dates. Next, management forwards the request to the accounting department, where the certificate is directly processed.

After which it is necessary to take it to the manager for signature and register it in the book of outgoing documents (this is done there, in the accounting department). And only then will you be able to transfer it to the banking organization, attaching it to the application.

But this method is only valid for people who have an official job with pension contributions. What should people do if all their income is unofficial? Will it really be impossible to get a loan due to the impossibility of obtaining a certificate and will you have to apply for a loan to a microfinance organization? There is a solution and now we will tell you about it in as much detail as possible.

The process of obtaining a certificate for persons without official income

In case you receive unofficial income , we have come up with a free-form income certificate. To get one, you need to visit a bank branch.

Moreover, you need to somehow confirm the receipt of “gray” wages, otherwise no one will simply believe you. In addition, the fact is that the manager will in any case have to leave his “autograph” on it.

There are two possible scenarios here - he will either sign the certificate, thereby confirming that you have received “gray” wages, or he will refuse to do so, so as not to expose himself to the tax authorities.

Therefore, the likelihood of confirming “gray” income is sharply reduced; few people will want to present their company on a silver platter to the tax inspectorate. And this signature will pop up no matter how you look at it.

Income certificate for the unemployed

Unemployed people registered with the Employment Center cannot receive a certificate of income, but there is an analogue - based on the social benefits received. payments.

Well, those citizens of the state who do not work and are not members of the Employment Center can provide a work book instead of such a certificate.

Only two pages have significance for a banking organization - the first and last, where records of employment and, as a result, dismissal are located.

However, you can hardly count on issuing a significant amount (if any bank approves your application at all), because you cannot provide a certificate of income, only a copy of the work book or a certificate of social benefits.

Finally, I would like to remind you that it is extremely important to indicate all the data in the certificate: the name of the company where you work, code, legal entity. and actual address, all kinds of company phone numbers, stamps, numbers and dates.

In addition, it should also contain all your data: from the start of your work activity to the TIN code and the amount of income during the quarter or six months, as well as signatures from the accountant and the employer himself. Without this information, the certificate will be rejected.

How to get back wages in case of bankruptcy of an enterprise?

The answer to this question is controlled by the Federal Insolvency Law. According to it, first of all, payments are made according to the claims of employees to whom the debtor has an obligation. Calculations are also made for the payment of benefits and wages to persons who work or have worked under an employment contract. If there are not enough funds to satisfy all the conditions of creditors of one priority, then the available amount is divided proportionally among all persons. Bankruptcy proceedings can usually drag on for up to several years, so they may prevent you from receiving the amount quickly. However, there is no guarantee that you will receive your amount, since it may not be enough even for second-line employees.

What to do if your salary is late

If a wage debt arises, the employee must write a statement addressed to the employer with a request to transfer funds for work performed in accordance with the employment contract.

Please note that to confirm the fact of transfer of the letter of demand, lawyers recommend preparing two copies of the application in advance, one of which must be given to the employer, and the second remains with the employee to record the act of transfer of the document, indicating the date and registration number. In a situation where the company is in no hurry to pay wages in a short time, the employee has every right to notify the employer in writing of the termination of employment until the debt is paid

In a situation where the company is in no hurry to pay wages in a short time, the employee has every right to notify the employer in writing of the termination of work until the debt is paid.

It is imperative to give notice of suspension of work to the director so that the employer does not regard absence from work as absenteeism, for which one may incur serious liability in the future.

When may a certificate of absence or presence of wage arrears be required?

There are many such situations, and in some cases the certificate is needed by the employee, and in others by the employer himself. Here are just a few of them:

- The employer company is bankrupt. In order for an employee to be included in the register of creditors and receive the salary unpaid to him by the company, he will need to provide a certificate of salary debts to the arbitration manager.

- The employer operates, but delays or does not pay wages. To protect their rights, the employee will need to confirm the amount of debt with the State Labor Inspectorate (GTI) or in court.

- And again - bankruptcy. Only now the bankrupt company itself will need a certificate in order to be recognized as such. After all, the amount of salary arrears is included in the total amount of the creditor, and it, in turn, is taken into account in the total value of the property used to cover the creditors’ claims.

- At the request of the State Technical Inspectorate during scheduled inspections. A certificate of absence of salary debts will show that the employer regularly fulfills its obligations to employees, which means there should be no claims against it from government agencies.

- Inability to make loan payments due to late wages. A certificate of debt provided to the bank will confirm the fact of non-receipt of wages and will help to postpone or temporarily reduce payments.

- Protecting the rights of a citizen in court, for example when collecting alimony. A certificate of salary arrears will confirm that this citizen was not able to pay alimony because he did not receive remuneration for his work from the employer.

Read also: Are payments to pregnant women subject to income tax in 2019?

Thus, a certificate of arrears of wages is an important supporting document, and therefore it must be drawn up carefully and taking into account the circumstances in connection with which it is required.

IMPORTANT! This document should not be confused with certificates confirming the employee’s income. They are needed in other cases and are designed differently.

Where to get help if you have a salary debt to employees?

To obtain a certificate of debt, an employee must contact the accounting department of the company in which he carries out his professional activities.

The document must be issued to the employee within 3 days from the date of application.

In most cases, a certificate is issued upon verbal request. If you receive a refusal, you should prepare a special request, which is sent to the employer via registered mail.

If difficulties arise in the process of obtaining the document, labor inspectorate specialists can request a certificate of debt. Otherwise, to solve the problem you need to contact the judicial authorities.

Certificate of absence of wage arrears to confirm the total amount of debt

Such a certificate is suitable in cases where there is no need to indicate a debt to a specific employee, but only the fact of the absence (presence) of a debt needs to be certified, for example, at the request of the State Tax Inspectorate, another government agency or bank.

There is no strict form of the certificate, however, based on established business practice, it reflects:

- employer name;

- outgoing number and date of document preparation;

- wording about the absence or presence of debt (if there is a debt, give its amount - total or broken down);

- FULL NAME. the compiler, to whom you can contact for clarification, his telephone number.

The certificate is endorsed by the general director (possibly together with the chief accountant), and if available, a stamp is placed.

For those who are officially allowed to do without a seal, read this publication.

For a sample certificate of arrears of wages drawn up in the form discussed above, please see the link below:

Dates of issue and validity

The employer has 3 days to issue the document at the employee’s request. This is directly stated in Article 62 of the Labor Code of the Russian Federation - a certificate of debt refers to documents related to work. The request to confirm the debt can be oral, but in a controversial situation it is recommended to submit a written application and have it registered in the general office work procedure.

The document is valid until the debt is paid off or its size is changed. For example, if during the month the company’s debt to an employee has increased, it is necessary to request a fresh version with new amounts. On the contrary, if the employer has paid the money, it is appropriate to issue the employee a new document notifying him that all obligations have been fulfilled.

Certificate (calculation) of salary arrears: confirmation of debt to a specific employee

The employee himself may need this document to submit to the authority that needs to confirm the fact of non-receipt of wages. Its form is also not regulated by law.

The certificate is drawn up in the same way as the case discussed above, with the only exception that the wording changes: in the “individual” certificate it is necessary to indicate to whom and in what amount there is a “salary” debt. Various variations are possible:

- indicate the generalized amount of debt to the employee as of a certain date;

- provide a calculation of wage arrears with a monthly breakdown of debt by type of income.

One or another version of a salary arrears certificate is selected depending on where and why it is required.

A sample certificate of arrears of wages, including a breakdown by type of income, can be found at the link below:

A 2-NDFL certificate with zeros entered in the appropriate lines may be suitable as confirmation of the lack of income. This material tells you how to design it.

A certificate of arrears of wages (or, conversely, of the absence of debt) is a document that can substantiate your claims or confirm insolvency. The legislation does not impose any specific requirements for this document. However, such a certificate must be drawn up taking into account the circumstances in connection with which it was needed, and include information that will help solve the problems of its bearer.

Compensation for delayed wages: how much should the employer pay?

With the help of an employment contract and internal company documents, not only the amount of wages is established, but also the days of the month on which the employer is obliged to pay wages in approximately equal shares to the employee.

Companies have the right to use any form of salary certificate, including one compiled individually. But keep in mind that in some cases it is necessary to fill out a document based on the requirements of the organization to which it is provided. Therefore, ask the employees for what purposes the certificate is needed.

The legislator does not provide a unified form that can be used when issuing a certificate of no debt. This allows employers to draw up a document in free form, taking into account the general requirements for outgoing letters.

Currently, banks are not interested in salary arrears, their task is to collect interest and debt.

Certificate of absence of wage arrears (sample)

The activities of enterprises are controlled by government departments. Moreover, the key role here is played by monitoring the compliance of the head of the organization with obligations to the staff.

Since conflicts regarding such relationships arise due to delays in the payment of remuneration to employees, the purpose of inspections by the labor inspectorate is to identify wage arrears. Let's find out how to write a certificate of absence of wage arrears when the claims of the inspection authorities are groundless.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Basic information

The Labor Code regulates the relationship between employees and employer. It states here that the company undertakes to transfer payment to staff for work performed at least twice a month.

However, due to the instability of the country's economy or internal reasons, the organization reduces costs through such payments. In this situation, employees have the right to defend their own rights in court by filing a statement of claim.

Let us note that the opposite situations, when the employer transfers the required funds to the staff on time and in the amount established by the contract, do not exclude inspections of the enterprise by regulatory organizations.

Accordingly, in these circumstances, documents are required confirming the legality of the actions of the company manager. Moreover, one of the required documents is a certificate of absence of wage arrears to employees.

Note! Legal regulations do not establish a single unified form for the cases under consideration. For this reason, the form is compiled in free form.

True, here it is advisable to take into account the norms of business correspondence, which establish the basic requirements for such documentation.

Thus, a certificate of absence of salary arrears becomes evidence of the good faith and timely fulfillment of the employer’s obligations to employees.

Please note that this paper is issued exclusively at the request of an employee or official.

Read also: Official website of the Department of Compensation of Insurance Payments by compulsory medical insurance number

In addition, current legislation requires compliance with established rules when preparing and issuing such documentation.

To understand these aspects in more detail, let’s consider the most important nuances that should be taken into account when writing such forms. Such knowledge will be useful to both employers and employees.

Basic definitions

Current legislation obliges entrepreneurs and business owners to pay salaries to their employees on time and in full. Moreover, according to the provisions of the Labor Code of the Russian Federation, payments are made 2 times a month, while the deadline for transfers is no later than the 15th day after the end of the worked period. Failure to comply with the established rules entails administrative liability.

Delays in payments lead to the formation of debt to staff. If their rights are violated, workers have the right to seek help from the prosecutor's office and the labor inspectorate. Confirmation of the status of settlements is a certificate of the presence or absence of wage arrears to employees. The authenticity of the document is verified by the competent authorities, including based on the testimony of employees.

Wage debts arise in several cases:

- If the company is bankrupt. The inability to pay off one’s obligations negatively affects not only the organization’s creditors. Lack of funds does not allow timely payments to employees.

- Difficult economic situation, including delays in receipts from customers, lack of orders, financing and other factors.

- In some cases, wage debts are the result of employers' dishonesty.

In order to protect his interests, an employee has the right to demand that he be given a document on the status of payments for the time worked. The form must be generated upon request and issued free of charge.

Sometimes an employee may need a certificate of salary arrears

Reasons for writing

Let's start with a detailed clarification of the circumstances when the form in question needs to be issued at the place of request. Typically, there are probably several options here.

An employee of an enterprise has the right to request such a certificate for independent reconciliation of accrued and paid amounts or upon dismissal.

Note that in such circumstances, this document is duplicated by another form - personal income tax-2.

Such papers are presented during routine and unscheduled inspections of the organization by employees of the labor inspectorate, prosecutor's office, and investigative committee.

Please note that these circumstances usually arise due to staff complaints about unlawful actions of the employer. Accordingly, it is appropriate for the head of the enterprise to independently monitor such issues in order to avoid sudden troubles.

Attention! Violations of labor legislation are fraught with administrative fines and criminal liability for responsible persons of the offending enterprise.

If, during the inspection, regulatory inspections do not reveal any violations, the applicants’ claims remain unaddressed. Let us note one more key nuance.

Accruals and transfers of funds to an employee are reflected by the company’s accounting department in the balance sheet.

For this reason, the information specified in the certificate ideally corresponds to the entries in the accounting book and primary documentation of the company.

When this rule is violated, the question of financial fraud arises. In this situation, the head of the organization risks prosecution under Article 177 of the Criminal Code of the Russian Federation.

Thus, the indication of incorrect or unreliable information in the cases under consideration leads to the involvement of responsible persons of the company in criminal cases.

Design features

Let's move on to the development of the forms discussed in the review. Let us remind you that there is no single form here; the enterprise prepares and issues its own sample to the staff.

The certificate of absence of arrears in payment of wages contains two main blocks: information about the organization that issued the document and information about the issue of interest to the applicant. Please note that the position and initials of the employee are indicated here.

Remember, the law allows both handwritten and typewritten versions of the specified documentation . In situations involving the production of paper on letterhead, a combined method of filling out the form is also appropriate. The main requirement is the reliability of the information reflected in the certificate.

Important! The document gains legal force after the form is signed by the director of the company and stamped.

Note that an additional advantage here is that the form must be endorsed by the chief accountant or economic director of the company. In short, the form is signed by the persons responsible for the financial policy of the enterprise. An approximate development of such a form is provided for readers at this link. And the video below will tell you about writing the accompanying certificate in the form of personal income tax-2.

Introductory part

Here the employer lists the legal details of the organization. Please note that in situations where information is printed on letterhead, it is not necessary.

However, in such circumstances, the forms indicate the information necessary to identify the enterprise.

As a rule, this includes the name of the company, legal and postal addresses, contact number, TIN and OGRN details.

In the same block, the date the document was written is indicated and the outgoing number is indicated..

The numbering of papers at the enterprise helps to systematize the search for the required form when the need arises. In addition, such a requirement eliminates the chances of falsification of documentation by unscrupulous management of the company. Let's move on to studying aspects of the formation of the content of this paper.

Main unit

In this situation, the recipient for whom the paper is made is important.

If the form is sent to confirm the inspection by the labor inspectorate, it is advisable to indicate the fact that there are no debts, specifying the date of registration of the paper, the average earnings of the team and the number of employees in the enterprise.

Below it is appropriate to draw up a table showing the average monthly salary of workers in a particular specialty.

Let us remind you that after presenting the information of interest to the organization, the director signs and endorses the form with the stamp of the organization. However, sometimes applications are received for specific individuals from among the company’s personnel.

In such circumstances, the actual amount of income of the desired employee is clarified. Of course, here it is advisable to indicate the initials and position of this employee.

Note! The form of a letter about the absence of arrears in wages, the sample of which meets the established rules, is issued three days from the date of submission of the request.

Thus, there is no difficulty in writing the form in question. The key condition here is the accuracy of the information reflected and the submission, at the request of the inspection commission, of additional documentation confirming the veracity of the employer’s words. For this reason, timely and accurate accounting becomes an important point in an enterprise.

How is it compiled if there is no employer’s debt to employees?

How to fill out the certificate depends on the location of the request and the authority for which it is issued.

This form can become a necessary document for an employee to present to the bank for a loan, for personal reconciliation of accrued and paid amounts, or upon dismissal.

In this case, the certificate is issued upon prior request within 3 working days from the date of submission of the application in writing.

An application for a certificate may be drawn up in any form.

A document confirming the absence of salary debt is filled out by an accounting employee.

The main requirement for the content of this document is reliable information on the calculation and payment of wages, which must correspond to the entries in the primary accounting documentation.

A standard sample certificate of absence of arrears of wages consists of:

- The introductory part, which indicates the details of the organization, the outgoing number of the letter and the date of signing.

- The main part, which reflects data about the person to whom the certificate will be issued, information about the absence (presence) of debt to the employee as of a specific date or for a certain period.

- The final block indicates the addressee, that is, the one to whom the certificate is provided, the signature of the employee responsible for drawing up the document, the seal of the organization that issued the document and the date of issue.

The document will be considered valid after it is signed by the manager and certified with a seal.

Registration of information about the absence of overdue wages for the bank

To submit to the bank a certificate of absence of salary debt, it must contain more detailed information about the employee’s accruals:

- average monthly salary;

- the amount of actually accrued and paid wages for 6 months;

- the amount of money withheld from wages for the same period (taxes, insurance premiums and other deductions);

- data on the presence or absence of debt of the organization to pay wages to the employee.

Sample certificate

certificates of salary arrears for the bank – word.

Sample for labor inspection

In the event of a regular or unscheduled inspection at an enterprise, regulatory authorities request from the head of the organization a list of documents that confirm the legality of their actions.

One of such documents is a certificate of no debt to employees.

The law does not provide for a single standard form, but requires compliance with established rules when drawing up and issuing a document, taking into account all the nuances when preparing this form.

As a rule, a certificate of personal income taxes is sent to regulatory organizations, namely the labor inspectorate, which will reflect more detailed information about the source of income of employees, wages and withheld taxes.

Issued by the employer for a certain period (usually a year). This form is filled out by an accountant of an enterprise or organization on a form that reflects the following information:

- name of the organization, details, telephone number;

- information about the income recipient (employee): Last name, First name, Patronymic name, passport details, place of residence or registration, citizenship;

- the amount of income for the period, scheduled by month and broken down by code;

- information about tax deductions indicating codes;

- tax base (income minus deductions) and calculated tax.

The accuracy of the information specified in the form is certified by the signature of the manager and the seal of the enterprise.

certificate of absence of debt to the employee for the labor inspectorate - word.