What is it (concept)

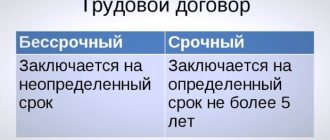

A civil contract is an agreement between the parties to perform certain works or provide services, regulated by the norms of the Civil Code of the Russian Federation. The parties to a civil law contract can be state and municipal bodies, organizations, individual entrepreneurs and ordinary citizens.

Depending on the subject of the contract, there are:

- agreements aimed at the transfer of property and property rights (purchase and sale agreements, exchange, donation, rental, leasing);

- contracts for the performance of work (construction or household contract, contract for the provision of contract and survey work, etc.);

- contracts for the provision of services (agency contract, insurance contract, transportation, storage, commission, etc.).

Risks of the parties: what to pay attention to

Theoretically, concluding a civil contract brings more benefits to the employer than to the employee. In practice, in many cases this is true, because:

- the company is not obliged to pay taxes, insurance premiums, sick leave, vacation pay, etc.;

- only the actual amount of work is paid (non-working time, breaks and other downtime are not compensated);

- “dismissing” such an “employee” is much simpler: there is no need to pay severance pay, there is no obligation to work 14 days while he can find another job.

For the employee himself, these advantages can be automatically presented as disadvantages. However, it also has advantages:

- more flexible schedule;

- lack of obligation to comply with labor instructions and other regulations;

- the ability to choose between different customers in order to find a more profitable job, etc.

That is, his risk is that there is no pension provision, no official length of service, no sick leave, maternity leave, vacation pay, etc. And the only significant risk for the employer is that his “employee” may sue to officially recognize the relationship as labor rather than civil . In addition, the Federal Tax Service and the labor inspectorate are also indirectly not interested in formalizing a civil contract: no taxes or contributions are received into the budget.

Therefore, when signing such a document, it is important to ensure that the service provided cannot really be recognized as a permanent employment relationship. Usually we are talking about the criterion of time: the longer the cooperation lasts, the more it resembles the relationship between the employee and the employer.

The lawyer's comment can be seen here.

Types and samples of civil contracts

The main types of civil contracts concluded with individuals are contracts for the performance of work and for the provision of services:

Work contracts

This type of civil law contracts includes, first of all, construction contracts (domestic and construction), and in more rare cases, R&D and DDU contracts.

Work agreement

Under a contract, one party (contractor) undertakes to perform certain work for the other party (customer), and the customer undertakes to accept and pay for it.

The contract is divided into:

- domestic;

- building;

- provision of contracting and survey work;

- contract work for state and municipal needs.

In practice, a contract is drawn up when performing work on sewing clothes or shoes, repairing household appliances, dry cleaning, installing plastic windows, renovating apartments and offices, and so on.

The fact of delivery of the work by the contractor and its acceptance by the customer is documented in the work acceptance certificate.

Household contract - .

Construction contract - .

Service contracts

This type of civil law contracts includes:

- contract for paid services;

- contract of agency;

- agency contract;

- storage agreement and some others.

Contract for paid services

Under a contract for the provision of services for a fee, one party (the contractor), at the request of the other party (the customer), undertakes to provide certain services, and the customer to pay for them. The specified agreement, as a rule, covers medical, veterinary, consulting, auditing, information and other types of services.

Sample of filling out a contract for paid services ().

Agency agreement

Under an agency agreement, one party (the attorney) undertakes to perform certain legal actions on behalf and at the expense of the second party (the principal). The specified agreement, as a rule, formalizes the services of representation in court, tax and other government bodies, in transactions with counterparties.

Sample of filling out an agency agreement ().

Agency contract

Under an agency agreement, one party (agent) undertakes to perform certain legal actions on its own behalf and at the expense of the second party (principal), or on behalf and at the expense of the principal. The specified agreement, as a rule, formalizes services for finding clients, purchasing products, monitoring the market, and delivering products.

Sample agency agreement for the provision of services on behalf of an agent ()

Sample agency agreement for the provision of services on behalf of the principal ()

Termination

Termination of the GPC agreement is possible on the following grounds.

- Voluntary agreement of both parties. In this case, absolutely any date can be agreed upon.

- In accordance with the initiative of one of the parties. However, you will have to comply with the conditions established by law or contract and, most likely, return the remuneration received under the contract, and perhaps even pay penalties.

- At the initiative of one of the parties by way of judicial appeal, if this party believes that its rights have been violated and the terms of the contract are unlawful, or due to improper performance of its duties by the other party.

In what cases can a civil law contract be reclassified as an employment contract?

A civil law contract can be forcibly reclassified as an employment contract if:

- The text of the contract includes conditions characteristic of labor relations or indicating them (provisions on regular wages, vacation, social guarantees, sick pay, personal performance of work, work schedule and subordination to labor regulations, information about position, specialty, profession, etc. .);

- the implementation of work under a civil law contract is permanent and not one-time in nature;

- there is no document confirming the fact of performance of work under a civil contract (if its execution is mandatory as required by law);

- the contract was renegotiated several times after its expiration;

- remuneration is paid on the same basis as full-time employees, according to the tariff schedule, at least twice a month.

Pros and cons of a civil law agreement with an individual

Currently, civil contracts with individuals are very popular among business entities. Let us consider in more detail the negative and positive aspects of such agreements.

Pros and cons for the employee

| pros | Minuses |

| The minimum package of documents for registration of this agreement is a passport, SNILS, INN. | A civil contract is not reflected in an individual’s work record book. |

| There is no strictly established daily routine; the performer independently determines how to work, the main thing is to meet the deadline for completing the work or providing the service. | The norms of the Labor Code of the Russian Federation do not apply to him, therefore an individual is not provided with sick leave, vacations, or the opportunity to receive additional payment on holidays and weekends. |

| These payments are still subject to deductions for compulsory types of insurance, so this period is included in the length of service. | If an individual decides to terminate such an agreement early, then he may be subject to penalties, penalties, as well as compensation for damages due to failure to comply with the terms of the civil agreement. |

| A contractor can find work even if he does not have the appropriate level of education; having professional skills is sufficient. | Possibility of exclusion when signing a contract for insurance of the performer against accidents. |

| The remuneration is paid immediately after the completion of the work or within the terms established by the contract. |

Pros and cons for the employer

There are the following positive and negative sides for the customer company when a GPC agreement is executed.

| pros | Minuses |

| The GPC agreement is aimed at a specific result, therefore it clearly defines the timing and scope of work that must be performed. | There is no possibility of monitoring the work during its implementation. The customer can only put forward requirements for the quality of the final result. |

| The customer is given the opportunity to use tools and materials belonging to the contractor for the agreed work. | When drawing up a civil contract, only civil liability is applied, and disciplinary measures against the contractor are excluded. |

| Reduce your expenses on mandatory payments to the budget (the GPC agreement does not include taxes on contributions to the Social Insurance Fund). | A civil contract with an individual can be reclassified as an employment agreement through the court, and this will entail an appropriate punishment for the company. |

| Reduced labor costs due to the absence of the need to fulfill social guarantees for individuals. | |

| Payment of remuneration under the contract is carried out immediately for the work performed, and is not obligatory periodic. | |

| Possibility to refuse reimbursement of additional expenses. | |

| No need to adhere to staffing schedule |

What consequences will the reclassification of a civil law contract into an employment contract entail?

If a civil law contract is recognized as an employment contract, the employer may be required to:

- recalculate and pay taxes and insurance premiums;

- recalculate and pay additional wages and other payments to which the employee is entitled in accordance with labor legislation;

- compensate the employee for moral damage (if such a claim is filed);

- add an employee to the staff.

In addition, the employer may be held administratively liable under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation in the form of a fine in the amount of 5,000 to 10,000 rubles. for individual entrepreneurs, from 50,000 to 100,000 rubles. for organization and from 10,000 to 20,000 rubles. for an official.

In order to avoid the above consequences, it is necessary to carefully draw up the contract, avoiding the inclusion of provisions specific to labor relations.

What taxes and contributions are paid on employee income under a GPC agreement?

The amount stipulated by the civil contract consists of two parts:

- remuneration for the performer;

- reimbursement of costs associated with work under the contract.

Taxes are taken into account for each of these parts in a certain order.

Taxation of remuneration

Payments to performers are the income of individuals, and therefore are subject to personal income tax (subclause 6, clause 1, article 208 and clause 1, article 210 of the Tax Code of the Russian Federation). For these payments, the employer must report to the Federal Tax Service as a tax agent within the established time frame, by submitting Form 2-NDFL and Form 6-NDFL within the established time frame.

The personal income tax rate depends on the category of the performer:

- 13% is supposed to be deducted from the income of residents of the Russian Federation, including foreign highly qualified specialists;

- 30% applies to non-residents, including foreign performers.

This tax must be withheld upon payment of remuneration and transferred either on the day of actual transfer of money or on the day of crediting to the performer’s account. If the performer is given a non-monetary reward, the tax office must be informed about this.

Important! When concluding a GPC agreement with an individual entrepreneur, personal income tax does not need to be withheld, because individual entrepreneurs pay income from their business activities themselves.

Tax deductions

Personal income tax taxpayers have the right to make tax deductions permitted by law (Chapter 23 of the Tax Code of the Russian Federation):

- professional deduction – you can reduce the tax base by the amount of costs actually incurred under the contract;

- standard deduction - applied at a personal income tax rate of 13% (these are ordinary deductions for yourself and a child tax deduction);

- property deduction is not provided under the GPC agreement.

Payment of contributions to social funds

Remuneration under a GPC agreement is subject to insurance contributions to the Pension Fund in the same way as wages under an employment contract. At the same time, the rate of contributions to the pension fund is 26% of the employee’s salary.

An exception is the payment to the Social Insurance Fund, since the customer does not control the work process of the contractor, and therefore is not responsible for possible injuries, accidents or occupational diseases.

Attention! Also, maternity benefits will not be paid. But such insurance can be provided for as an additional clause in the contract.

What should a GPC agreement contain?

When drawing up this agreement, it is necessary to exclude from it any concepts used in the Labor Code. Also, the words “Salary”, “Vacation”, “Employee”, “Employer” and the like should not be used anywhere in the text of the document.

Preamble to the treaty

In this part of the contract, you need to describe each party to the agreement - who exactly is the contractor and who is the customer. It is also necessary to indicate here the persons who have the right to make decisions on behalf of each party. If a company acts as one party, its name is written down in full.

Before the agreement is signed, it is better for each party to request documents from the other - a power of attorney to perform actions, an extract from the Unified State Register of Legal Entities. With their help, you can determine whether the power of attorney is still valid, whether the company and its director are still valid, etc.

Subject of the agreement

The subject of the contract is the performance of any specific work or provision of services. The agreement must indicate that the work must be performed on the instructions of the customer, and the final result will be his property.

Attention: if one of these points is not specified, then such a GPC agreement is re-qualified as a purchase and sale (when the customer does not indicate a specific list of works), or a contract for the provision of paid services (if there is no result of the work and it is not transferred to the customer).

As a rule, as a result of a contract, the customer receives something. Therefore, it is necessary to describe the final result in detail.

There may also be a situation where the purpose of the contract is not to create a new product, but to carry out work on an existing one (for example, repairing a building). Then the original item is described here, as well as the work that needs to be done.

Deadline

This section is one of the essential ones when concluding an agreement. If the deadline is not established, the contract cannot be considered concluded.

The parties must determine the following terms and fix them in the contract:

- Work start day;

- Day of completion of work;

- Deadlines for completing intermediate stages - if the amount of work is significant, then stage-by-stage delivery of results can be established.

Each of these dates can be defined as follows:

- Specific date - i.e. the exact day and month in which work must begin and be completed.

- Specific event - the beginning and completion of work is determined by the occurrence of an event;

- Completion period - work or services must be provided within a certain period of time. Their start date can be set either by a date or by some event.

Quality of work

Since the conclusion of a contract implies that work will be carried out to create a new thing or change an existing one, the contract must include the parameters that the final result should have, or what functions it should perform.

This section also includes information about the warranty period, during which the customer has the right to put forward demands on the contractor for the quality of work, and the contractor has the right to correct identified deficiencies free of charge.

Attention: it is also necessary to establish a procedure for correcting defects. For example, a period is specified here during which the contractor must eliminate the identified deficiencies. Or the customer can correct the defects at his own expense, but the contractor is obliged to compensate for all costs incurred.

In the same paragraph it is possible to indicate the actions that the customer has the right to take if the contractor does not correct the deficiencies on time.

Work order

This section records the customer's requirements for the work procedure. This is expressed in the indication of regulatory documents, GOSTs and similar acts. If the ordered work is unique, then you can fully indicate the entire process of its execution.

One of the important conditions is who will provide equipment or materials for the work. If all this is provided by the customer, then it is necessary to indicate the procedure for their transfer, return, and the responsibility of the contractor for their loss or damage.

If the customer is against involving subcontractors in the work, then a prohibition must be indicated. Or you can specify a specific list of who can be invited.

Cost of work

The price for performing work or services can be set as a fixed amount, a tariff based on the time the work is completed or by volume, or a final estimate. It is necessary to indicate whether this contract price includes the contractor’s expenses for the purchase of materials, transportation services, and any other costs.

If VAT is used in the calculations, then it must be immediately included in the cost of the work, highlighting the amount of the tax in a separate line.

Payment procedure for work

In this section it is necessary to indicate exactly how the customer will pay for the work performed (cash or in kind), as well as in cash or by bank transfer. When making non-cash payments, it is recommended to indicate the event at the moment of which the payment is considered completed - when funds are written off from the customer’s account, or when funds are credited to the contractor’s account.

This paragraph may also indicate the condition for making an advance payment. Then it is necessary to indicate the deadline for its payment and amount, as well as in what period of time the final payment is made.

Attention: payment may be provided for each stage of work completed. Then it is necessary to determine these stages, as well as the amount and timing of payment.

Acceptance of work results

In this section, it is necessary to describe in detail the procedure according to which the contractor will transfer the work and the customer will accept it. It is possible to establish a condition under which third-party specialists will be involved to determine the quality of work.

In this section, it is advisable to describe the following points:

- How exactly the contractor will notify about the completion of work;

- How long does it take for the customer to accept the result?

- Who is responsible for damage to the result before the acceptance procedure;

- Where will the delivery and acceptance of the result take place?

- How long does it take to assess the quality of performance?

- Does the contractor have the right to sell the result of the work to third parties if the customer does not accept it?

Responsibility of the parties

In this section it is necessary to introduce penalties that will be applied to the customer or contractor if he violates the provisions of the agreement. Most often, the punishment is written here for the fact that the customer does not pay for the accepted work on time, or if the contractor does not complete the necessary work on time.

It is recommended to indicate the amount of the fine for each violation, and you can indicate it as a percentage of the contract amount, or as a fixed amount.

Change and termination of the agreement

In this section it is necessary to write down the conditions on the basis of which it is possible to change the terms of the agreement or terminate it. This section can include the possibility of unilateral termination of the agreement if one of the conditions is violated. A list of such conditions must also be indicated in the section.

Dispute Resolution

This section sets out how the parties will resolve claims arising against each other - through litigation or through an exchange of claims. If the second method is chosen, then until the necessary exchange of claims has been made, it will not be possible to transfer the case to court.

Also, it is necessary to describe in detail the procedure for submitting claims and responding to them. If you indicate that the dispute is being resolved through court, then you need to indicate its location or name.

Final provisions

In this section, it is necessary to specify the period of validity of the agreement, as well as by what means legally significant messages are exchanged.

Standard form of contract for the provision of legal services

| Saint Petersburg | "__" ________ 201__ |

Romashka LLC, hereinafter referred to as the “Customer”, represented by General Director ____________________, acting on the basis of the Charter, on the one hand, and Online Legal Consultation, hereinafter referred to as the “Contractor”, represented by Director Ivanov I.I., acting on On the basis of the Charter, on the other hand, we have concluded this Agreement as follows:

What mistakes are made most often in the preamble of a contract?

Subject of the agreement

1.1. The Customer instructs and the Contractor undertakes to personally provide the following legal services (hereinafter referred to as the Services):

- oral and written legal advice to the Customer on issues of its current business activities;

- drafting civil law contracts;

- preparation of claims and suits.

1.2. The Customer undertakes to accept and timely pay for the Services.

What mistakes are made most often in the subject of the contract?

Duties of the parties

2.1. The customer is obliged:

2.1.1. pay for the Services provided by the Contractor in accordance with the terms of this agreement;

2.1.2. ensure timely provision to the Contractor of all information and primary documentation necessary for the provision of Services;

2.1.3. provide conditions for the provision of Services by issuing appropriate powers of attorney and/or authorities.

2.2. The performer is obliged:

2.2.1. provide Services in a timely and high-quality manner;

2.2.2. apply legal and objective methods and means when providing services;

2.2.3. provide services in a timely manner and in full.

Procedure for the provision of services

3.1. The Contractor has the right to engage third parties to provide Services under this agreement, while observing the terms of this agreement on trade secrets (confidential information), as agreed with the Customer.

3.2. If the Customer does not send the signed Certificate or a reasoned objection to the Contractor within 3 (three) working days from the date of receipt of the Service Provision Certificate, then the services provided are considered accepted by the Customer in full.

3.3. The Customer's objections to the volume and quality of the Services provided must be justified and contain specific references to the inconsistency of the Services with the results. In this case, the Parties are obliged to immediately agree on the conditions for eliminating this claim.

3.4. Services under this agreement not provided for in clause 1.1. are formalized in an additional agreement.

Cost of Services and payment procedure

4.1. The cost of the Contractor's Services is _______ (_____________________) rubles per month, including VAT _________________ per month.

4.2. The Customer pays the Contractor monthly as specified in clause 4.1. of this agreement the amount no later than the 10th day of the current month.

4.3. Payment is made by transferring funds from the Customer's current account to the Contractor's current account based on issued invoices. The Customer's payment obligations are considered fulfilled from the moment funds are received into the Contractor's bank account.

4.4. In the event of the Customer’s unlawful refusal to sign the Certificate of Acceptance of Services, the payment deadline for this certificate shall begin the next day after the date on which the Certificate of Acceptance of Services should have been signed.

4.5. After signing this agreement, the Customer transfers to the Contractor an advance payment in the amount of the monthly fee.

The beginning of the provision of Services is determined by the date of receipt of the first advance payment.

What mistakes are made most often when formulating the calculation procedure?

Confidentiality

5.1. The Contractor undertakes not to use the information received under this agreement for purposes directly or indirectly causing damage to the Customer and/or to obtain any advantages and benefits during the term of the Agreement.

5.2. Confidential information does not include information that is classified as open by existing legislation and the disclosure of which is the responsibility of the Customer.

5.3. For losses incurred from the disclosure of confidential information, the Parties are liable in accordance with the current legislation of the Russian Federation.

Early termination of the contract

6.1. This agreement may be terminated at the initiative of the Customer in the event of:

6.1.1. disclosure by the Contractor of confidential information;

6.1.2. in other cases provided for by the current legislation of the Russian Federation.

6.2. This agreement may be terminated at the initiative of the Contractor in the event of:

6.2.1 failure by the Customer to fulfill obligations to pay for services provided;

6.2.2. failure to provide the Contractor with the Customer with the information required for the Contractor to fulfill its obligations under this agreement;

6.2.3. creation by the Customer of conditions that prevent the Contractor from fulfilling the obligations assumed under this agreement;

6.2.4. in other cases provided for by current legislation.

6.3. The party that initiated the termination of this agreement is obliged to notify the other party of the termination of the provision of Services at least 5 (five) business days before the expected date of termination of the Services.

6.4. From the moment the Party receives notice of termination of this agreement, the Contractor has no right to continue to provide Services, and the Customer has no right to demand continued provision of services.

6.4.1. in such a situation, the Contractor prepares a report on the work done, the results of the activities carried out, and also calculates the remuneration due to him for the services actually rendered.

6.4.2. Based on the Report provided by the Contractor, the Parties determine the cost of the services provided and make the final payment within 5 (five) business days after signing the relevant document confirming the termination of the Agreement and determining the cost of the Contractor’s Services.

Final provisions

7.1. Disagreements and disputes that may arise during the execution of this agreement will, if possible, be resolved through negotiations between the parties.

7.2. All disputes and disagreements under this agreement that are not resolved by the Parties through negotiations are subject to consideration in the appropriate arbitration court at the location of the plaintiff.

7.3. This agreement is considered concluded and comes into force from the moment the Contractor receives the appropriate advance payment and is valid until the Parties fully fulfill their obligations under this agreement. In terms of unfulfilled obligations, this agreement continues to be valid even in the event of its termination until the Parties fully and properly fulfill these obligations.

7.4. Any changes and additions to this agreement are valid only if they are made in writing and signed by authorized representatives of the parties. The appendices to this agreement constitute its integral part.

7.5. The rights to use the results of the Services under this agreement in any form belong to the Customer; transfer of the results of the Services to a third party can be carried out by the Contractor only by agreement with the Customer.

7.6. In all other cases not mentioned in this agreement, the parties are guided by the provisions and norms of the current legislation.

7.7. This agreement has been drawn up in two copies, one for each party, both copies have equal legal force.

7.8. Attached to the agreement:

7.8.1. Service acceptance certificate

LEGAL ADDRESSES

Customer: ____________________________ (location address)

current account No. __________________________ in Bank _______________

Contractor: _______________________________ (location address)

current account No. __________________________ in Bank _______________

SIGNATURES OF THE PARTIES:

| From the Customer: General Director of Romashka LLC _________________ Last name I.O. m.p. | From the Contractor: Director of Online Legal Consultation _________________ Ivanov I.I. m.p. |

How to correctly draw up an acceptance certificate for services provided

Appendix No. 1 to the Contract for the provision of legal services for a fee

Certificate of acceptance of services provided

| G. _____________ | "__" ________ 201__ |

Romashka LLC, hereinafter referred to as the “Customer”, represented by General Director ____________________, acting on the basis of the Charter, on the one hand, and Online Legal Consultation, hereinafter referred to as the “Contractor”, represented by Director Ivanov I.I., acting on on the basis of the Charter, on the other hand, we drew up this Certificate of acceptance and delivery of services provided (hereinafter referred to as the Certificate) under the Agreement for the provision of paid legal services ___________ _____ (hereinafter referred to as the Agreement) on the following.

- In pursuance of clause 1.1 of the Agreement, the Contractor, during the period from “__” _______ ___ to “__” _______ ___, fulfilled its obligations to provide services, namely, provided the Customer with the following services:

- ________________________________________

- ________________________________________

- ________________________________________

- The above services were completed in full and on time. The customer has no complaints regarding the volume, quality and timing of the provision of legal services.

- According to the Agreement, the total cost of services provided is _____ (__________) rubles, including VAT __% in the amount of _______ (__________) rubles.

- This Act is drawn up in two copies, one each for the Contractor and the Customer.

The total amount of the transferred advance amounted to _____ (__________) rubles, including VAT __% in the amount of _______ (__________) rubles. Under this Act, _____ (__________) rubles are due, including VAT ___% in the amount of _____ (__________) rubles.

| From the Customer: General Director of Romashka LLC _________________ Last name I.O. m.p. | From the Contractor: Director of Online Legal Consultation _________________ Ivanov I.I. m.p. |

Essential terms of the contract for the provision of legal services

Under an agreement for the provision of legal services for a fee, the contractor undertakes, on the instructions of the customer, to provide services (perform certain actions or carry out certain activities), and the customer undertakes to pay for these services (clause 1 of Article 779 of the Civil Code of the Russian Federation).

Each contract is unique and its terms depend on the specifics of a number of conditions and the will of the parties. Nevertheless, there are conditions (they are called essential) that any contract for the provision of legal services must contain and without which the contract is considered not concluded. The essential terms of the contract include the conditions that determine the specific type of service provided (clause 1 of Article 779 of the Civil Code of the Russian Federation), i.e.:

- The subject of the contract for the provision of legal services for a fee (according to Article 779 of the Civil Code of the Russian Federation), i.e. It should be clear from the contract what legal services will be provided.

- Legal services include the following:

- oral and written consultations;

- drafting documents (contracts, claims, lawsuits, etc.);

- legal support of the organization’s economic activities;

- registration of organizations and obtaining extracts from the Unified State Register of Legal Entities;

- legal support of real estate transactions;

- registration of ownership rights to real estate in the Unified State Register and obtaining extracts from the Unified State Register;

- conducting cases and protecting client interests in court;

- collection of receivables and control over enforcement proceedings.

The price of the services provided is not an essential condition. If there is no such condition in the contract, the price is determined according to the rules of clause 3 of Art. 424 of the Civil Code (clause 54 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 6, Plenum of the Supreme Arbitration Court of the Russian Federation No. 8 of 07/01/1996), i.e. at the price that, under comparable circumstances, would normally be charged for similar goods, work or services.

Other features of the contract for the provision of legal services

- The agreement must be concluded in simple written form (clause 1 of Article 161 of the Civil Code).

- The general provisions on contracts (Articles 702 - 729 of the Civil Code) and provisions on household contracts (Articles 730 - 739 of the Civil Code) apply to the contract, unless this contradicts the norms of Chapter. 39 of the Civil Code, as well as the specifics of the subject of the contract for the provision of legal services for a fee (Article 783 of the Civil Code).

- If the customer is a citizen, then the Law of the Russian Federation of 02/07/1992 N 2300-1 “On the Protection of Consumer Rights” also applies to the relations of the parties.

- Because the:

- the result obtained from the service cannot be seen or touched;

- the service itself is consumed at the time it is provided to the customer;

- the service is considered provided after the signing of the acceptance certificate for the services provided;

- for accounting and tax accounting purposes, it is necessary to prove the fact of provision of services,

Therefore, the preparation of primary documents is important for both the customer and the contractor.

To reflect services, the main documents are:

— contract for the provision of services;

— certificate of delivery and acceptance of services;

— invoice (invoice) of the service provider;

- payment documents.

- Court expenses.

- those that can be attributed to legal expenses (costs);

- those that cannot be classified as such expenses. Judicial practice proceeds from the fact that legal expenses cannot include the costs of:

- lawyer consulting;

- conducting legal due diligence;

- collecting evidence in the case;

- reward for a positive outcome of the case.

All expenses under a contract for the provision of legal services can be divided into 2 categories:

Reason : Information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 13, 2004 N 82 (as amended on July 1, 2014) “On some issues of application of the Arbitration Procedure Code of the Russian Federation”; Ruling of the Supreme Court of the Russian Federation dated February 26, 2015 No. 309-ES14-3167 in case No. A60-11353/2013; Resolution of the Volga Region Autonomous District Court dated March 3, 2016 in case No. A65-20192/2014.

Legal expenses are subject to reasonable reimbursement. It means that:

- determining the reasonableness of the limits for satisfying a claim for reimbursement of legal expenses for the services of a representative does not depend on the amount of remuneration established by the state for remuneration of a lawyer participating in a criminal trial as appointed by the bodies of inquiry, preliminary investigation, prosecutor or court (clause 7 of the Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 05.12.2007 N 121 “Review of judicial practice on issues related to the distribution of legal costs between the parties for the services of lawyers and other persons acting as representatives in arbitration courts”);

- the reasonableness of legal costs for paying for the services of a representative cannot be justified by the fame of the representative of the person participating in the case (paragraph 13 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of January 21, 2016 No. 1 “On some issues of application of the legislation on reimbursement of costs associated with the consideration of the case”).