One of the most popular legal documents today is a contract between individuals.

A contract for the provision of services is a document that reflects the responsibilities of one of the parties, represented by the contractor, to perform some work on time, and the other party, represented by the customer, to pay for the services. The subject of this contract can be services in various areas:

- In accounting

- In the real estate

- In legal

- In the consulting room

- In security

- In courier and other areas

As a rule, the contract for the performance of work is accompanied by an estimate, specification of the services performed and various additional materials. Upon completion of the agreement, an acceptance certificate for the work performed is drawn up.

How to fill out a service agreement?

The following mandatory information is included in the service agreement:

- Date and city of conclusion of the contract.

- Data of the customer and contractor: full name, passport details, residential addresses. Legal entities indicate their details, as well as who acts on their behalf and on what basis.

- The subject of the contract indicating the services that the contractor is obliged to provide, their timing and cost (or links to applications where this information is indicated).

- Rights and obligations of the customer and contractor

- Information about the cost of work and the procedure for making payments between the customer and the contractor.

- Information about the procedure in which services will be accepted.

- Information about the responsibilities of the parties.

- Information on resolving disputes between the customer and the contractor.

- Information on the procedure for concluding and terminating the contract, and the duration of the contract.

- Other important information regarding the essence of the contract.

- Details and signatures (seals) of the parties.

Have you changed your mind about downloading document templates online?

With the KUB service you can save 29 minutes on issuing documents without a single error, and that’s not all. Get KUB - an online service for automating invoicing and other documents.

Start using the CUBE right now 14 days FREE ACCESS

In what cases is it compiled?

A service agreement is drawn up when the contractor is ready to undertake obligations for the performance of certain services, and the customer is ready to pay for them on time and in full. It is personal in nature and serves as official confirmation of the agreement.

Who can be a participant

The parties to the agreement can be both individuals and legal entities. There are service agreements between:

- legal and natural person;

- individuals;

- legal entities.

In what cases is

A contract for the provision of services is concluded if:

- the contractor undertakes to perform the service on his own, and not to involve someone from the outside for this;

- the result obtained after the contractor fulfills his obligations under the contract does not have a material form.

Kinds

Russian legislation has established that agreements signed with individuals can be considered civil law . So, we can conclude that with the help of an agreement, legal relations appear, change and cease.

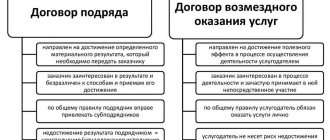

Contracts are divided into two types:

- paid provision of services. The employee provides a service to the Customer, who must pay for it in the future. For example, a medical company undertakes to perform a primary type of medical examination when hiring Igor Petrov. The cost of these services is 6,000 rubles. Acceptance is made through the acquisition of a therapist’s report;

- contract work. The employee undertakes to carry out, on the instructions of the employer, a list of construction manipulations within a specific period. For example, Makarov P.A. undertakes to replace the floor in the house of G.D. Ivanov. until December 10, 2018. The cost of replacement is 30,000 rubles. Acceptance is carried out according to the work completion certificate, which is signed by the parties.

In the case of concluding such agreements, the customer must not provide the specialist with a workplace and construction materials , and the fulfillment of obligations under the contract shifts all responsibility to the employee.

Sample form of contract for the provision of services 2021

We offer a free form for a contract for the provision of services between individual legal entities, valid in 2021:

- Form of contract for the provision of services 2021 in Word.

- Form of contract for the provision of services 2021 in PDF.

What types of services can be purchased

Services, the provision of which may be the subject of a contract, are specified in the Civil Code of the Russian Federation. These may be services in the field of:

- medicine;

- training;

- real estate;

- communications;

- audit;

- tourism;

- Catering;

- consulting;

- other.

The peculiarity of a contract for the provision of services is that its subject can be both the final result and intermediate actions performed to achieve it.

Mandatory conditions of the preschool educational institution

The legislation does not impose strict requirements on the form of a preschool educational institution. The main thing is that when registering, the mandatory conditions are met: the availability of the subject, the deadline and the place of execution. Other essential conditions include quality requirements and the presence of a clear payment schedule for the customer.

The KUB service allows you to fill out contracts for paid services and other documents automatically. Evaluate the ease of use of the system by registering on the website .

Have you changed your mind about downloading document templates online?

With the KUB service you can save 29 minutes on issuing documents without a single error, and that’s not all. Get KUB - an online service for automating invoicing and other documents.

Start using the CUBE right now 14 days FREE ACCESS

Agreement between individuals, if one of them is a foreign worker

In practice, foreign citizens who have received a special patent often work for individuals under an employment contract. Until 2015, foreign citizens could work for individuals under an employment contract only as domestic staff. Now having a patent gives them the opportunity to work for any employer.

At the same time, it is possible to conclude an employment contract with a foreigner only when he has received a patent or work permit. Otherwise, an individual who acts as an employer may be fined for violating the law in accordance with Article 18.15 of the Code of Administrative Offenses of the Russian Federation. The fine is 5,000 rubles. In addition, if a foreign citizen acts as an employee, the relevant department of the Federal Migration Service must be notified about the beginning and end of his activities.

why is a cube more convenient?

Convenient online invoicing

Instantly send invoices by e-mail to your buyer

Debt control for each customer

Management reporting

Organized storage of all your documents

20% discount on accounting services from your accountant

Have you changed your mind about downloading document templates online?

With the KUB service you can save 29 minutes on issuing documents without a single error, and that’s not all. Get KUB - an online service for automating invoicing and other documents.

Start using the CUBE right now 14 days FREE ACCESS

Do you need help filling out documents or advice?

Get help from expert accountants to prepare documents

+7

[email protected] kub-24

Contract agreement and staffing schedule

You should not attempt to draft a contract as if the contractors were full-time employees of the client. The clauses stating that the contractor must comply with labor discipline do not have legal force, unlike what is stated above. Labor discipline, adherence to the daily routine, execution of orders and instructions of the customer’s managers go beyond the scope of relations between the parties under the contract, since they relate to the Labor Code of the Russian Federation, which does not regulate the activities of contractors.

The tradition that has emerged in recent years of contracting out regular full-time employees contains a large number of pitfalls. The team ceases to be manageable, and the tax service can impose quite impressive fines at any time. And the employees themselves always have the potential opportunity to remember their rights and declare that they are performing work on an ongoing basis, so there are signs of labor rather than civil law relations.

Form

DDA is one of the types of civil law agreements.

It can be issued with both individuals and legal entities. The main point in such an agreement is the designation of conditions for fast and high-quality execution of work. The DDA can be compiled in 2 versions:

- Orally, if the agreement is drawn up between individuals, the amount of which does not exceed 10,000 rubles.

- In writing, if the contract amount is over 10,000 rubles, as well as for any contract value, if one party is a legal entity. face. It is not necessary to notarize the DDA (Article 161 of the Civil Code of the Russian Federation).

DVR has the following features:

- The agreement is drawn up on a voluntary basis.

- The executor of the contract agreement should not be included in the staffing schedule of an employee of the enterprise and is not obliged to comply with the operating hours of the enterprise.

- The enterprise does not issue an order on the employment of the performer, does not keep a report card of his appearance at work, and does not record the period of performance of work in his work book.

- Financial payments for work performed are transferred to the contractor on the basis of a formalized agreement, and not from the payroll.

- The main factor in such cooperation is the high-quality execution of work and timely delivery of the completed volume.

- The contractor does not have the right to the benefits inherent in the personnel of the enterprise; he is not accrued vacation pay, sick leave and other compensation payments established for employed persons.

How to draw up a contract for work in 2021?

DDA, today, is a fairly common phenomenon.

The agreement is drawn up in writing on the basis of the provisions of the Civil Code of the Russian Federation. An agreement with an individual can be filled out in any style, since there is no approved template established by law. However, such a document is drawn up in accordance with generally accepted rules for such agreements.

Below is an example of drawing up a DDA, the form and sample of which can be downloaded at the end of the article.

Filling out the agreement begins with the title of the document “Contract for Work”.

Below is the place and date of filling out the document.

Then the preamble is filled in, indicating the details of the parties, including:

For the customer:

- Names of the institution.

- INN/KPP.

- Legal address.

- r/s and k/s)

- FULL NAME. and the position of director or trustee of the enterprise.

For the performer:

- FULL NAME.

- Passport details.

- Place of residence.

- Contact details.

In the next section, fill out the section “Subject of the contract”, where a list of works is noted, with their detailed characteristics, as well as the address where they need to be performed.

An essential condition of the DDA is the completion date of the work, indicating the initial, intermediate and final period for the fulfillment of obligations. You can also indicate in the contract the deadline for acceptance of completed work; if this is not indicated, then the customer undertakes to accept the completed work immediately when it is ready.

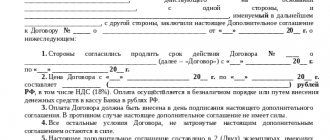

The section “Price and payment procedure” indicates the cost of work, the method of payment for work performed, as well as possible measures taken by the Contractor if the Customer violates the terms of the settlement agreement.

The price of the agreement can be indicated according to a fixed or flexible estimate.

- A firm estimate is used when the initial data for the execution of work is known. Changes cannot be made to such an estimate.

- A flexible estimate is drawn up if it is impossible to accurately calculate the number of works and their volume.

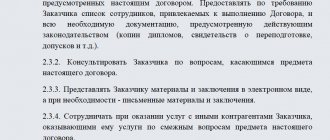

The section “Obligations of the Parties” sets out the obligations of the parties to the transaction for the execution of the DDA.

If the DDA does not indicate the contractor’s obligations to carry out the work personally, then he has the right to involve subcontractors in the execution of the work. Responsibility for the timing and quality of work in this option rests with the general contractor.

The next section, “Responsibility of the Parties,” displays penalties imposed on parties that violate the terms of the agreement. Sanctions must be prescribed in accordance with the legislative norms of the Russian Federation.

The procedure for resolving disputes between the parties may also be spelled out here.

The Final Provisions section displays other information, including:

- Number of signed copies of the agreement

- The effective date of the agreement and other conditions.

Finally, fill out the section “Legal addresses and details of the parties.”

The printed DDA is signed by the parties to the agreement. If the customer is a legal entity. face, then the signature is sealed. Notarization of the document is not required. This completes the registration of the DDA and after signing it, the Contractor is obliged to immediately begin performing the work.

Payment of taxes and contributions when drawing up an agreement between individuals. persons

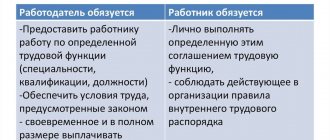

Regarding the provisions regarding the procedure for paying taxes in labor relations, it should be noted:

Agreement

- If the employer is an entrepreneur, then the responsibility for making contributions to social funds and paying taxes lies with him. For example, when calculating wages, the employer withholds a tax of 13% from the due amount and transfers it to the budget.

- If an agreement is concluded between persons who are not entrepreneurs, then the employee or the person who provided the service is independently responsible for paying tax on such income and reporting it to the tax authority.

- With regard to contributions to various funds, a similar procedure applies - the individual entrepreneur reports and deducts funds to the funds for hired workers, but if the relationship involves receiving remuneration for the work of an individual from an individual, then the party who received the payment deducts the required amounts independently.

- In the case of an employment relationship with a citizen of another country, the person or organization that paid him wages does not make contributions to the budget - these actions are performed by the foreign citizen himself. The need for contributions to social funds depends on whether the foreigner resides permanently, temporarily or temporarily. If a foreigner does not have the appropriate legal status in the Russian Federation, therefore, he is not required to pay contributions.

So, the documents we have considered are mandatory components regulating relations between individuals. The correctness of their preparation, reflection of all the points that interest you, taking into account the requirements of the Labor and Tax Code, will protect you from the undesirable consequences of failure to fulfill obligations and problems with the law.

Top

Write your question in the form below

Rights of the customer under a contract for paid services

When registering a DVOU, the customer receives significant rights, including the following.

- If there is a delay, the customer has the right to charge the contractor a penalty of 3% every day of the amount of services provided (This right of the customer is enshrined in the Law on the Protection of Consumer Rights).

- The customer has the right to refuse to continue cooperation at any time, even if the contractor fulfills the contract in good faith. However, using this right, the customer is obliged to notify the contractor of his intention in writing, and also to pay the contractor for the services provided.

Note. DVOU is obligatory for the execution of the order from beginning to end only for the contractor.

Sample

Download

- Form of contract for paid services

- Sample contract for paid services (completed form)

Conditions

The law requires that an agreement be drawn up in writing, but in practice an oral form is possible.

This is theoretically possible if the following conditions are met:

- both parties are individuals;

- the amount of remuneration does not exceed 10,000 rubles.

If the payment amount exceeds the transaction, the transaction must be documented.

When considering whether the contractor's status meets the established requirements, one should be guided by the fact that an individual may be indicated in the contract when performing one-time work.

If this happens all the time, you need to register as an individual entrepreneur. Otherwise, a fine is applied in accordance with Art. 14.1 Civil Code of the Russian Federation.

Thus, a contractor is a person who carries out such work on a professional level. Moreover, the type of organizational form of the contractor does not matter. This could be an LLC or individual entrepreneur.

When extensive work is envisaged, an estimate is attached to the contract, indicating the cost of individual services under the contract.

If the document does not indicate the fact that the developed estimate is approximate, then it is approved as firm. This implies the exclusion of situations of deviation from the original cost in a larger direction.

The Civil Code allows the customer to refuse cooperation if the contractor exceeds the agreed firm estimate. But if the overrun is confirmed for objective reasons, the contractor may request compensation for the work performed (for example, there has been an increase in prices).

If any conditions are not met, the parties to the contract may refuse the terms of the transaction and demand compensation for losses incurred. To do this, the other party must first be informed.

If the first attempt fails, the customer or contractor repeats the claim request and cancels the contract.

Contractors can sell the result of completed work when a month has passed since the last notice. The received funds remain with him in a certain share, and the second part is sent to the customer.

Acceptance of the finished result

Fulfilled terms of the agreement imply payment for services after signing the act of acceptance of work. For domestic work, this document is often not issued, but in the construction industry it is a necessary condition. Its presence will allow, as a last resort, to recover the due remuneration through the court.

When drawing up, you should take into account the following nuances:

- the legislative form has not been approved;

- the signing procedure is provided;

- deadlines for signing have been established;

- persons authorized to sign are deciphered.

There must be a record of the parties' responsibilities.

Contract structure

As noted earlier, when drawing up the agreement, it is recommended to follow the accepted structure of the document indicating the essential conditions without which the agreement will be invalid.

The essential terms of the agreement in the structure of the document should be:

- Subject of the agreement. The subject of the contract is usually work that the Contractor undertakes to perform by a specified date for a fee. The list of works is determined by the customer.

- Deadlines for completing the agreed list of works. They are discussed between the parties and written down in the appropriate section. Sometimes the customer can set intermediate deadlines for the completion of work.

- Cost and payment procedure. For the most part, the cost of work is set on the basis of an estimate. If unexpected work occurs, the contractor may require additional remuneration.

In addition to the essential terms of the DDA, the structure of the document contains additional sections describing the terms of the agreement, including:

- Duties of the parties.

- Responsibility of the parties to the transaction.

- Final provisions.

- Other conditions that can be noted are whether the involvement of third-party workers is allowed and warranty obligations for the quality of work performed.

- Legal addresses and details of the parties.

- Signatures of the parties to the transaction.

Below is a sample DDA.

Sample contract for work performance

Lease agreement between individuals

General provisions on concluding a lease agreement can be read in another article on our blog. Now let’s talk about the nuances of contractual relations within the framework of a lease agreement between individuals.

First of all, it is worth recalling that if an agreement regarding the rental of residential premises is concluded between individuals, then such an agreement is called a rental agreement between individuals.

The correct wording is “hiring”, not “renting”. In everyday life, these two concepts are often identified.

If non-residential property (for example, a garage, land) or other property (car, equipment, etc.) is leased, then in this case we are talking about a lease.

Essential terms of the lease agreement for residential and non-residential real estate:

- information about the parties to the agreement;

- exact description of the property: address,

- footage, number of rooms (for an apartment or house),

- description of the object (material of construction, condition);

Let me remind you that an agreement for a period of less than 1 year does not need to be registered with Rosreestr (Article 651, clause 2 of the Civil Code);

The remaining (standard) clauses of the contract are stated at the beginning of this article.

Sample rental agreement for an apartment between individuals (1 page):

You can download this form in its entirety here.