Contrary to popular belief, the liability of the head of a legal entity and founders is not always limited to the assets of the legal entity.

There is a stereotype in the minds of entrepreneurs that you can accumulate a lot of debts, then not pay them off, getting rid of the legal entity using simple methods. And you can continue your business simply by opening a new legal entity. Large entrepreneurs have a number of legal entities in the hundreds and thousands.

But time passes and everything changes.

In 2009, changes to the Federal Law “On Insolvency (Bankruptcy)” came into force, which allow, under certain conditions, to bring the head of a legal entity and founders to subsidiary liability for the debts of a legal entity.

Vicarious liability is a type of civil liability. At its core, this is an additional responsibility of persons who, along with the debtor, are responsible to the creditor for the proper fulfillment of the obligation.

In other words, if the property of a legal entity is not enough to cover debts to creditors, the obligation to pay them rests, in our case, on the director and founders of this legal entity

Who is the person who controls the debtor?

The person controlling the debtor is a person who has, or had within less than two years before the arbitration court accepted the application

on declaring a debtor bankrupt,

the right to give instructions that are binding on the debtor or the opportunity to otherwise determine the actions of the debtor

, including by coercing the head or members of the debtor’s management bodies or otherwise exerting a decisive influence on the head or members of the debtor’s management bodies in another way.

Who can be held vicariously liable?

Firstly, this is a person who was authorized by virtue of the charter to act on behalf of this legal entity. We are talking about the sole executive body - the director, as well as the manager to whom such powers have been transferred in accordance with Article 42 of the Federal Law “On Limited Liability Companies”.

Secondly, these are members of collegial executive bodies.

Thirdly, these are other persons who have the actual ability to determine the actions of a legal entity. This includes, among other things, persons who give instructions to the bodies of a legal entity what decisions they should make.

For questions regarding bringing to subsidiary liability, call + or send your questions by email. I, lawyer Vladimir Chikin, will definitely answer you.

What is the algorithm for bringing to subsidiary liability?

1) The arbitration manager identifies the circumstances and responsibility for which clause 3 provides. and point 4. Art. 10 of the Insolvency Law.

After declaring the debtor bankrupt, selling the debtor's property and closing the register, the insolvency administrator may file a lawsuit to bring the perpetrators to subsidiary liability.

It is also effective for the bankruptcy manager to submit a petition to the court to appoint an examination to identify signs of fictitious and deliberate bankruptcy, as well as the circumstances specified in paragraph 3. and point 4. Art. 10 of the Insolvency Law.

2) A creditor who believes that the manager does not identify the circumstances for which liability is provided for in paragraph 3. and point 4. Art. 10 of the Insolvency Law, may also apply to the court with a similar request for an examination. If the examination gives a positive conclusion, then the creditors have the right to demand that the arbitration manager file a claim for subsidiary liability, or to file a claim themselves in accordance with Part 3 of Art. 56 of the Civil Code of the Russian Federation.

How to remove subsidiary liability?

If you are found to be the culprit in an LLC bankruptcy, there are some consequences. You have millions in debt, and you need to pay them off somehow. Compensation for damages usually occurs as follows:

- Creditors receive a court decision and apply to the FSSP.

- You are given a period of time to pay off the debt yourself. If you do not do this, the bailiff will open enforcement proceedings.

- Further, the measures provided for by No. 229-FZ are applied: forced write-off of funds, arrest and seizure of property, introduction of restrictions.

What to do if you are held vicariously liable, but there is no property? Do not delude yourself: you are still considered the culprit. Enforcement proceedings are carried out within 2-4 months. If the result turns out that there is no property, the case is closed. But creditors have the right to initiate the procedure again after six months.

There is one more aspect to consider. Creditors who have settled the debt may challenge your transactions. Their cancellation will allow the property to be returned for seizure and sale. The same risks arise in relation to your relatives - their property can also be confiscated if their enrichment occurred due to the bankruptcy of the company.

If the case drags on, the debtor can use the statute of limitations

when brought to vicarious liability, the application can be filed within three years from the date on which the reason for this penalty was discovered.

Article 61.14. The right to file an application for subsidiary liability

- An application for holding liable on the grounds provided for in this chapter may be filed within three years from the day when the person entitled to file such an application learned or should have learned about the existence of appropriate grounds for bringing to subsidiary liability, but no later than three years from the date of declaring the debtor bankrupt (termination of bankruptcy proceedings or return to the authorized body of the application for declaring the debtor bankrupt) and no later than ten years from the date on which the actions and (or) inactions that constitute the basis for prosecution took place. If the deadline for filing an application is missed for a good reason, it may be restored by the arbitration court, unless two years have elapsed from the end of the period specified in paragraph one of this paragraph.

(introduced by Federal Law dated July 29, 2017 N 266-FZ)Federal Law of October 26, 2002 N 127-FZ (as amended on December 30, 2020) “On Insolvency (Bankruptcy)” (as amended and supplemented, entered into force on January 2, 2021)

Read completely

Source

How to write off a debt? Unfortunately, there are no effective methods here. Termination of subsidiary liability is impossible either in connection with bankruptcy or amnesty. You can find an option if:

- the company is just on the verge of bankruptcy;

- The organization is undergoing bankruptcy proceedings.

Remember the golden rule: a hopeless situation is a consequence of inaction.

Need help avoiding liability? Don't hesitate! Call us, we will provide legal protection and support.

We will write off debts through bankruptcy with a guarantee

Our lawyer will call you in a few minutes and answer all your questions

Examples from judicial practice

- The general director was held vicariously liable for the withdrawal of property from the debtor's organization.

Case number:

A41-5664/08 (the decision was appealed to the Supreme Arbitration Court of the Russian Federation and upheld)

Grounds of claim:

the general director sold the debtor's real estate, but did not contribute funds to the enterprise, which subsequently made it impossible to satisfy the claims of all creditors.

The court's decision:

Assign subsidiary liability for the obligations of PAK-INVEST LLC (INVEST-ST LLC) to the former General Director of PAK-INVEST LLC, Boris Alekseevich Rossinsky, collecting money from him in the amount of 1,586,432 rubles. 11 kopecks

Evasion of debts through fictitious transformations of a legal entity.

Case number:

A07-7955/2009

Grounds of claim:

The founders transformed the legal entity into a newly created legal entity, transferring all assets to it. As a result of such transfer, the debtor was unable to fulfill all obligations to creditors.

The court's decision:

Claims of the bankruptcy trustee of Duslyk LLC

to satisfy. Assign subsidiary liability to the founders of the LLC

“Duslyk”: Nasima Vadutovna Bayanova, Guzel Nazebovna Bayanova, Ildus Nazebovich Bayanova in the amount of 674,595 rubles…..

Failure to timely submit an application to the Arbitration Court to declare the debtor bankrupt.

Case number:

A50-20763/09

Grounds for the claim: The general director and the sole founder (in one person) did not promptly apply to the court to declare the debtor bankrupt.

According to paragraph 2 of Art. 10 of the Law, failure to submit a debtor’s application to the arbitration court in the cases and within the time period established by Article 9 of the Federal Law “On Insolvency (Bankruptcy)” entails subsidiary liability of persons who are charged by Federal Law with the obligation to make a decision on filing the debtor’s application to the arbitration court. court and filing such an application for the debtor’s obligations arising after the expiration of the period provided for in paragraph 3 of Article 9 of the Law.

The condition for the obligation of the debtor's manager to submit the debtor's application to the arbitration court is (in particular) the satisfaction of the demands of one creditor or several creditors, which leads to the impossibility of the debtor fulfilling monetary obligations, the obligation to pay obligatory payments and (or) other payments in full to other creditors.

The court's decision:

To collect from Igor Valerievich Gilev (residing: Perm, Revolyutsii St. 3/5-91) in favor of Rusagro LLC in the manner of subsidiary liability for the obligations of Rusagro LLC, 206,541 rubles. 62 kop.

4. Failure to submit accounting and other reports to the arbitration manager

Case number:

A21-12997/2009 (link to the case https://kad.arbitr.ru/Card/5fa23bcc-5afa-4bc1-a9e8-a89317a34bb2)

Grounds of claim:

As established by the court, Fedorov S.G. was the sole founder of the company, performing the functions of its sole executive body - the general director from the moment of establishment of the company until the date of the arbitration court's decision to declare the debtor bankrupt and to open bankruptcy proceedings.

As follows from the presented materials, the application for the involvement of Fedorov S.G. to subsidiary liability for the obligations of the debtor is motivated by the provisions of paragraphs 2, 4 and 5 of Article 10 of the Federal Law “On Insolvency (Bankruptcy)” (hereinafter referred to as the Bankruptcy Law) as amended by Federal Law No. 73-FZ (hereinafter referred to as Law No. 73-FZ), paragraph 3 of article 56 of the Civil Code of the Russian Federation.

In accordance with paragraph 5 of Article 10 of the Bankruptcy Law, the head of the debtor bears subsidiary liability for the debtor’s obligations if the accounting and (or) reporting documents, the obligation to collect, compile, maintain and store, which are established by the legislation of the Russian Federation, by the time the ruling is made introduction of supervision or making a decision to declare the debtor bankrupt are absent or do not contain

information about the property and obligations of the debtor and their movement, the collection, registration, and generalization of which are mandatory in accordance with the legislation of the Russian Federation, or if the specified information is distorted.

The court's decision:

The recovered amount of subsidiary liability in the amount of RUB 3,829,093. 16 kopecks

It is important to note that the reorganization of a legal entity for the purpose of evading the payment of debts may lead to loss of control over the enterprise, and as a result to bringing to subsidiary liability on formal grounds - lack of accounting reports.

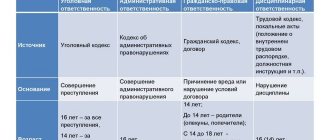

Types of subsidiary liability

Russians do not have a developed “taxpayer sense,” laments the head of the Accounts Chamber, Alexei Kudrin. Small and medium-sized enterprises do not pay taxes. They came up with a scheme: as soon as an LLC owes money to the state, it goes bankrupt. In its place, another appears, with the same staff, in the same office. Business ties remain with old business partners.

In 2021, 11,135 enterprises went bankrupt, of which 60% were in profitable industries - construction, trade, real estate transactions.

The scheme worked successfully. There is nothing to take from a bankrupt, although the concept of “subsidiary liability” was introduced back in 2002. It arose in cases of bankruptcy of an organization with unpaid tax debts. Legislatively, members of management were given financial responsibility for outstanding tax obligations. Persons must answer with their own property.

In 2012, tax officials began to enforce the law through the courts. The enterprise “went bankrupt”, there were no assets, no property, but the persons who controlled the debtors (KDL) remained. They began to be held financially responsible. The persons controlling the debtor are subsidiary debtors; they are responsible for another person - the main debtor (legal entity).

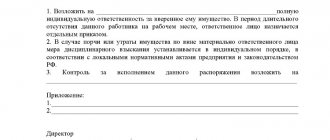

Subsidiary liability without bankruptcy

If the company’s funds are not enough to pay all debts, then the court can recover the missing funds from its founders and management.

This procedure is called bringing to subsidiary (additional) liability. Most often, subsidiary liability is applied in bankruptcy . However, the personal property of business owners and managers may be at risk in some other cases.

Let's consider when, in addition to bankruptcy , subsidiary liability can be applied to the “first persons” of the company.

Conclusion

The owners and managers of a company can be held vicariously liable not only in bankruptcy, but also in a number of other situations.

If the owners “abandoned” a legal entity with debts, then within three years after its liquidation, creditors can recover their funds from the responsible persons.

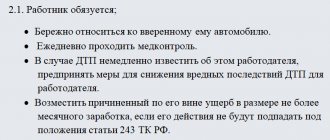

Employees who signed a guarantee agreement may lose their property if the company fails to repay the loans.

It is also possible to collect company tax debts from individuals and bring them to subsidiary liability. But to do this, inspectors must prove that the persons controlling the company deliberately evaded taxes, “hiding behind” the activities of their organization.