Home / Labor Law / Responsibility / Material

Back

Published: 05/21/2016

Reading time: 8 min

0

1267

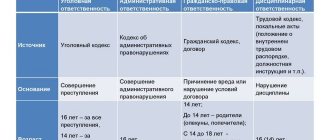

The financial liability (ML) of an employee to the employer is provided for by the Labor Code of the Russian Federation, which establishes the rules and boundaries of attraction to it.

There are nuances in the procedure for attracting to the Ministry of Defense:

- Not everyone is subject to it.

- Compensation for damage caused is not always possible in full.

- What is considered damage?

- Reasons for occurrence

- Stages of involvement Establishing the fact of causing losses and documenting it

- Conducting an investigation to determine the causes of damage

- Determining the amount of damage

- Establishing the scope of an employee’s financial liability

- Recovery of damages

When will they be brought to full financial responsibility?

According to the requirements of the law (Chapter 39 of the Labor Code of the Russian Federation), bringing employees to financial liability for causing damage is possible if:

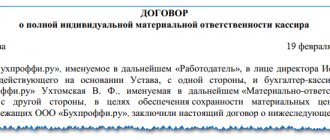

- an agreement on full financial liability has been concluded;

- the absence of valuables transferred to the employee using a one-time document was discovered;

- the harm was caused intentionally;

- the harm was caused while under the influence of alcohol, drugs or other toxic substances;

- the employee’s actions were recognized as criminal by a court verdict;

- he committed an administrative offense;

- information constituting a state, official, commercial or other secret protected by law was disclosed;

- the damage was caused during non-working hours.

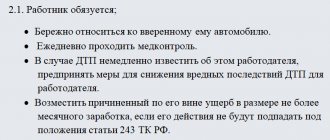

It is possible to bring a subordinate to full compensation for damage if a written agreement has been concluded with him on full individual or collective (team) financial responsibility. For the Deputy General Director and Chief Accountant, the responsibility is specified in the employment contract. According to the law, the General Director bears full financial responsibility for the valuables entrusted to him.

But such an agreement is concluded only with employees performing certain types of activities: warehouse employees, cashiers, sellers, etc. The list of such positions and works is given in Resolution of the Ministry of Labor and Social Development of the Russian Federation dated December 31, 2002 No. 85.

The rest (including minors) are liable within the limits of their average monthly earnings (Article 241 of the Labor Code of the Russian Federation), unless this contradicts the requirements of the law.

The employer himself, in accordance with Art. 240 of the Labor Code of the Russian Federation, has the right to refuse to recover losses in whole or in part.

What is the employee’s financial liability for damage to the employer’s property?

Everything is simple here - the employee’s responsibility is that he must necessarily compensate for the damage caused (if it can be calculated). In this case, the owner cannot demand compensation from the person for lost profits, and interest is not charged on the amount of damage. Now about what can be classified as damage:

- Detected shortage

- Damage to property

- Forced expenses for repairing damaged property

- Costs due to employee absence from work

- The amount of a possible fine that the employer is forced to pay due to the employee’s negligence

- The employee may also cause damage to third parties, to whom the owner must now pay compensation. But only on the condition that his guilt is proven and that he will not be forced to compensate the owner for “over-compensation.”

Financial liability: terms of engagement

First of all, it is necessary to prove the guilt of a particular employee and the amount of losses caused by him (Article 233 of the Labor Code of the Russian Federation). The conditions and procedure for bringing to financial responsibility must be observed. Punishment is imposed in cases where:

- the employer suffered direct actual damage;

- the employee’s guilt (intentional or negligent) has been proven;

- an offense has been committed - actions (or inaction) that violate the law;

- a causal relationship has been proven between the behavior of the subordinate and the direct actual losses incurred by the employer.

In addition, when assessing the actions of an employee, it is necessary to take into account cases that relieve him of financial responsibility (Article 239 of the Labor Code of the Russian Federation). These include:

- force majeure (flood, hurricane, etc.);

- normal business risk (or wear and tear);

- extreme necessity or necessary defense;

- the employer has not provided the necessary conditions for the safety of the valuables entrusted to the employee.

Through the court

If the culprit evades his duties, the employer must go to court. The court may issue an order and procedure for bringing the employee to full financial liability. With all this, the claim must indicate:

- what position the employee is in;

- under what circumstances was he entrusted with property that was subsequently damaged;

- when and how the property was damaged;

- whether an inspection was carried out at the site of the damage;

- what the employee says and how he explains the circumstances of the breakdown;

- the basis for demanding a particular amount from the employee.

It must be emphasized that filing a claim must be within the limitation period, which is 3 years from the date of discovery of the damage. With all this, the current regulatory legal acts allow the filing of an appeal even after the expiration of this period, but the plaintiff will have to provide indisputable evidence and explanations of why he failed to go to court in a timely manner.

To hold an employee to disciplinary and financial liability, the following points should be taken into account:

- according to the criteria of contracts (labor or material liability), the employer’s obligation to the employee cannot be higher, and the employee’s lower, than it is established by the Labor Code of the Russian Federation or other national laws;

- When an employment contract is terminated, neither party is released from fulfilling its terms.

How to register correctly

To confirm that the specified conditions exist, it is necessary to follow the procedure for holding an employee financially liable:

- Establish the amount of damage. The employer is obliged to fulfill this point before making a decision to reimburse the amount from employees (Article 247 of the Labor Code of the Russian Federation). To do this, they organize an inspection (internal investigation) and/or an inventory. For these purposes, a commission is created (Part 1 of Article 247 of the Labor Code of the Russian Federation), which includes specialists from the legal, financial, economic, personnel and security services. Its tasks, as a rule, include establishing:

- absence of circumstances excluding financial liability;

- violation of the law in the actions of an employee;

- the employee’s guilt in causing the damage;

- the relationship between the employee’s actions and the resulting damage;

- direct actual losses of the property owner.

- Requesting a written explanation from the perpetrator (Part 2 of Article 247 of the Labor Code of the Russian Federation). This item is required. If the subordinate refuses or avoids giving explanations, the necessary act is drawn up.

- Drawing up a commission conclusion (act) based on the results of an internal investigation into the causes of damage. The document is signed by all members of the commission. The report reflects the established facts of the inspection and encloses all materials received during the inspection.

- Issuance of an order. This document is drawn up within one month after completion of the inspection and determination of the final amount of damage (Part 1 of Article 248 of the Labor Code of the Russian Federation). The employee reads and agrees with the contents of the order. To do this, under the text of the document, he makes a written note of consent, signs and dates the review.

If the order is not issued within the specified period or the employee does not agree with the conclusions of the commission and refuses to pay for the losses incurred by the employer, and the amount to be withheld is higher than the amount of his average monthly income, the damage caused is recovered in court (Part 2 of Article 248 of the Labor Code of the Russian Federation).

How to recover damages

To withhold losses in an amount less than the average salary of an employee per month, the employer only needs to issue an appropriate order (Part 1 of Article 248 of the Labor Code of the Russian Federation). It is necessary to remember that a one-time deduction of the entire amount from wages is not allowed! Payments must be split in such a way that the amount of one payment is no more than 20% of the monthly salary, and in cases provided for by the Federal Law - 50% until the final reimbursement. The employee voluntarily pays the debt in full or some part of it, or transfers property equivalent to the damaged one, or repairs it at his own expense (Parts 4, 5 of Article 248 of the Labor Code of the Russian Federation). The parties have the right to agree to pay the entire amount in installments.

To prove the existence of an agreement to compensate for the damage caused, an agreement is drawn up. It specifies the amount to be refunded and the deadline for paying the fee.

IMPORTANT!

If the employer violates the established procedure for withholding incurred losses, the employee has the right to appeal his actions in court.

If a subordinate has given a written undertaking to voluntarily compensate for losses and quit, and is not going to compensate for the remaining debt, it is possible to collect it only in court.

Limitation periods in labor disputes. Material liability

Author: Anastasia Volkova, practicing lawyer

Email : [email protected]

Analyzing the judicial practice of considering cases related to the financial liability of employees, the courts in their decisions correctly use the norms of substantive and procedural law that resolve controversial relations.

In resolving cases of this category, the courts take into account the norms of the Labor Code of the Russian Federation, the explanations of the Plenum of the Supreme Court of the Russian Federation, which are contained in Resolution No. 2 of March 17, 2004 and No. 52 of November 16, 2006.

But there are cases when, when considering cases, the circumstances that are relevant to the case are not always correctly determined, the norms of labor legislation are incorrectly interpreted, or when making a decision, norms that are not subject to application in this category of labor disputes were used.

The first example of judicial practice concerns a violation of the rights of an employee by the employer, which is associated with the refusal to issue a work book. According to Art. 392 of the Labor Code of the Russian Federation, such an action is long-term in nature, and the period for going to court is calculated from the moment the employee receives a work book or from the moment he receives a notification from the employer about the need to appear to receive documents.

Thus, citizen K. went to court with a demand to recover from the employer IP N. compensation for the delay in issuing a work book, as well as to compensate for the moral damage caused by such a case.

The court did not satisfy the plaintiff’s demands, citing that citizen K. missed the deadline for filing a lawsuit, the beginning of which the court determined from the moment of citizen K’s dismissal. The panel of judges did not agree with the decision of the lower court. In this case, the court made an erroneous decision, the basis of which was the incorrect interpretation and application of Art. 392 of the Labor Code of the Russian Federation, which establishes that if a labor dispute arises, an employee has the right to go to court within three months from the moment he became aware that his right was violated.

In turn, in Part 4 of Art. 84.1 of the Labor Code of the Russian Federation stipulates that the issuance of a work book is carried out on the day the employment contract expires. If it is impossible to issue a document due to the absence of an employee or refusal to receive it, the employer must notify the employee with a notice of the need to come to the enterprise to receive a work book or give consent to send the document by mail. If the employer sent this notification, in this case he is not responsible for the delay in issuing or non-issuance of the work book (Part 6 of Article 84.1 of the Labor Code of the Russian Federation).

Also according to Art. 234 part 1 clause 3 of the Labor Code of the Russian Federation, the employer pays wages not received by an employee when he was illegally deprived of the opportunity to work due to a delay in issuing a work book.

As a result, the conclusion follows that according to the law, the employer is obliged to issue a work book on the day the employment relationship with the employee ends. If the assigned duties are not fulfilled, the legislator provides for an additional obligation in this case to compensate for damage caused during the delay in issuing the work book until the day of actual issue. Accordingly, this labor dispute over a violation of the employee’s rights associated with the non-issuance of a work book is ongoing, and this violation lasted until the employer issued a work book. The plaintiff received a work book on November 4, 2013, and he went to court on November 23, 2013. In such a situation, the court’s refusal to satisfy the plaintiff’s demands, citing the missed deadline for applying for judicial protection and the application of a statute of limitations to controversial labor relations, is not based on the above substantive norms.

The panel of judges based on Art. 361 of the Code of Civil Procedure of the Russian Federation considered the cassation appeal and overturned the decision of the lower court. The case was sent for a new trial because the identified violations cannot be corrected by the court of cassation due to the fact that the case materials did not contain accurate information about the average salary of the plaintiff. Citizen K., when considering the case in the court of first instance, indicated different salary amounts, justifying this with various written evidence.

The deadline for going to court in labor disputes regarding the collection of monetary compensation if the employer violates the specified deadline for payments upon dismissal in accordance with Art. 392 part 1 of the Labor Code of the Russian Federation begins not from the date of dismissal, but from the moment of repayment of all debts to the employee by the employer (Article 236 of the Labor Code of the Russian Federation).

Citizen P. appealed to the court with a demand to recover from the enterprise arrears in payment of monetary compensation for non-received material property, as well as interest for violation of deadlines for dismissal payments and compensation for moral damage.

The court did not satisfy the claims of citizen P.

When making a decision regarding the collection of interest for violation of deadlines for payments upon dismissal, as well as compensation for moral damage, the court proceeded from the fact that the defendant, before the court decision, had paid all compensation for the lost property. As for the collection of interest for violation of deadlines for dismissal payments and compensation for moral damage, the plaintiff missed the deadline for filing a lawsuit, which, according to Art. 392 of the Labor Code of the Russian Federation is three months, the application of which was announced by the representative of the defendant. The court decided that the period should be calculated from the moment of citizen P.’s dismissal - from 08/04/2010.

The panel of judges, when considering the case materials, did not agree with the court's decision and considered it erroneous due to the fact that the court incorrectly interpreted and applied the rules of substantive law that govern this labor dispute.

According to Part 1 of Art. 392 of the Labor Code of the Russian Federation, each employee has the right to go to court if an individual labor dispute arises within 3 months. The period begins to run from the moment the employee learns of a violation of his rights.

In this case, the court of first instance accepted the date of dismissal as the beginning of the expiration of the term, but in this situation the date of the beginning of the period should be the date of full repayment of the debt by the employer to the employee, namely November 28, 2013.

The plaintiff went to court on November 5, 2013. Therefore, the decision of the court of first instance that the plaintiff missed the deadline to go to court is considered incorrect and subject to cancellation.

According to Art. 236 of the Labor Code of the Russian Federation, if the employer has not paid wages, vacation pay and other payments due to the employee on time, the employer pays the above payments, taking into account the payment of interest, which must be at least 1/300 of the refinancing rate of the Central Bank of the Russian Federation from the unpaid amounts for every day of delay, starting from the next day after the due date for payments until the day of actual settlement. Payment compensation may be increased in accordance with a collective agreement or other local act. The employer is obliged to pay these payments regardless of whether the employer is at fault or not.

Taking into account the above, the judicial panel decided that for the period from 08/05/2010 to 11/28/2013 inclusive, in favor of the plaintiff, the defendant is obliged to pay interest for violating the deadline for dismissal payments, which are calculated in accordance with Art. 236 Labor Code of the Russian Federation.

In judicial practice, there are often cases related to the financial responsibility of an employee regarding his training. The essence of the claim is that the enterprise LLC “A” filed a lawsuit against citizen S. with a demand to recover the costs incurred by the enterprise to pay for the plaintiff’s training in the amount of 57,000 rubles. According to the defendant’s explanations, citizen S. was hired on the basis of an employment contract and an additional agreement to it on sending an employee for training at the expense of the employer for the period from 04/07/2013 to 04/12/2013, as well as from 04/28/2013 to 05/02/2013. According to the terms of the employment contract, if the latter is terminated at the initiative of the employee, within 12 months he must reimburse the company’s costs in full. Citizen S. knew about these conditions, because her signature was on the documents. On 10/08/2013, the defendant decided to resign of her own free will; by order dated 10/15/2013, she was dismissed, but refused to reimburse training costs. The plaintiff maintains that since she resigned within 12 months of signing the contract, she is obligated to pay the expenses incurred.

On November 30, 2013, LLC “I” ceded to the new creditor LLC “A” the right to claim the return of funds incurred for tuition fees on the basis of an employment contract and an additional agreement to it. The plaintiff was notified of this event regarding the assignment of the right of claim, but the obligations were never fulfilled. The plaintiff believes that the statute of limitations has not expired in this case, since reimbursement of costs to the plaintiff does not constitute damage to the employer, and in this case Art. 392 of the Labor Code of the Russian Federation cannot be applied in court. The defendant believes that the change in persons in the obligation in accordance with Art. 201 of the Civil Code of the Russian Federation does not change the limitation period and the moment when it begins to be calculated. And according to Art. 238 of the Labor Code of the Russian Federation, the employee’s financial liability provides for compensation for direct damage caused.

In Art. 249 of the Labor Code of the Russian Federation directly states that upon dismissal of one’s own free will before the end of the contract and in the presence of an agreement on training at the expense of the employer, the employee is obliged to reimburse the costs incurred in proportion to the actual time not worked after training. Reimbursement of funds provides for the full financial responsibility of the employee.

Since the defendant was fired on October 15, 2013, the limitation period should be calculated from October 16, 2013, and believes that the plaintiff missed the limitation period, which is one year, calculated from the moment the damage was caused. Therefore, the court requires the plaintiff to refuse due to the missed statute of limitations.

The court, based on the case materials, found that the claim was filed only on January 20, 2015. According to Art. 392 of the Labor Code of the Russian Federation, the employer has the right to file a claim in court for compensation for damage incurred by the employee within a year from the day the employer discovered the damage caused to him.

Therefore, the statute of limitations must be calculated from the moment the employee was dismissed, i.e. from October 16, 2013. In this case, the court did not satisfy the plaintiff’s demands on the basis that, in accordance with Art. 392 of the Labor Code of the Russian Federation, he missed the statute of limitations. The plaintiff, in turn, did not provide the court with written evidence that confirms a valid reason for missing such a deadline.

Having analyzed the category of labor relations associated with financial liability, we come to the conclusion that the courts in most cases made the right decisions in these labor disputes. Difficulties most often arose with the application and interpretation of labor legislation, as well as the calculation of the moment from which the statute of limitations begins to run.