The economy of the Russian Federation is increasingly taking on a market character, which also has an impact on the social sphere. In the harsh conditions of a planned economy, it was not possible for specific forms of labor relations to develop. Market reforms corrected this situation, allowing for the emergence of new forms and types of employment. Thanks to this, the employment market has become more optimized. The public sector is quite popular among the population. Private, although it occupies a certain niche in the market, is not to the extent that it suppresses the public one. This material will describe the concept and types of employment.

What is included in the concept of employment?

Many definitions describe the concept of “rational employment”. Species are completely different definitions. But in a broad sense, the essence lies in a set of specific activities that are of a different nature. These are activities related to organization, finance and law. All of them are aimed at providing the residents of the state with work.

All types of employment in Russia are only forms of activity permitted by law. This also includes types that are characterized by individual provision. This is, for example, private enterprise or farming. Also, types of employment are forms of activity that can be carried out thanks to an existing license from government agencies or private organizations.

What does the concept of employment mean?

Employment is a human activity, the purpose of which is to satisfy personal needs (mainly material), that is, to generate income. These actions must comply with government regulations. According to Russian legislation, every citizen has the right to dispose of labor resources and creative potential at his own discretion. It is the fulfillment of such requirements that is necessary in order to characterize rational employment. Types of employment, regardless of their characteristics, do not imply any coercive measures. The Constitution of the Russian Federation states that the implementation of the right to work should be initiated only by the person himself and carried out by him in a free form.

GPC - how to reclassify it as an employment contract

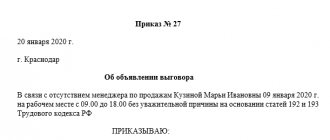

Previously, only the court had the right to make a decision (Part 4 of Article 11 of the Labor Code of the Russian Federation). Article 19.1 of the Labor Code of the Russian Federation in the new edition has changed this provision. She found that retraining was possible using the following options.

First option. Phys. a person, namely the performer, writes a statement to the customer.

Second option. The labor inspectorate or tax authority files a lawsuit.

Third option. A person performing labor duties files a claim in court if the customer has ignored a written request.

Fourth option. The labor inspector writes a presentation document. It has not previously been appealed in court. The employer fulfills the obligation as prescribed.

When considering a claim in court, the dispute will be interpreted in the direction of the employment contract (Part 3, Article 19.1 of the Labor Code of the Russian Federation). A disadvantage is created for the employer. All relationships will be considered labor relations from the date of their execution. Payments, compensations, and contributions to the employee will have to be compensated. The plaintiff has the right to demand compensation for moral damage. Most likely, the court will grant the claim. During judicial retraining, the assistance of lawyers is necessary.

Employed segments of the population

The concept of employment and employment (their types) cannot be complete without describing the circle of persons who are the subjects of such relations. The subjects of labor relations are citizens who apply for work, as well as employers.

All types of employment are targeted actions in relation to any subject. An employed person is a person who is a citizen of the Russian Federation, who works thanks to the conclusion of an agreement establishing an employment relationship. The list of such persons is quite extensive and includes the following categories:

- People who perform a specific set of actions that have a paid basis. The employee is paid remuneration for the work done, which he carries out as part of a full-time or short-time working day. This includes both permanent service and temporary, seasonal types of employment.

- Persons who have the status of private entrepreneurs and are engaged in commercial activities.

- Ancillary workers whose main source of income is the sale of goods in accordance with the conclusion of supply contracts.

- Persons who have entered into contracts that have a civil legal basis. They are compiled regarding the performance of work or provision of services. The parties to the agreement may be individual entrepreneurs.

- People who have received a position or assignment for which compensation is due.

- Persons involved in law enforcement agencies, such as the fire service, internal affairs agencies, and criminal authorities.

- People in military or alternative civil service.

- Students and students of general education institutions, primary, secondary and higher professional institutions.

- Persons who, for certain reasons, cannot carry out their usual work activities. Among such factors are inability to work, completion of advanced training courses, vacation, sick leave, retraining, temporary suspension of the institution, preparation for service in the armed forces, and more.

- People who are founders of organizations. An exception to this clause are religious, public and charitable organizations, because there are no property rights in relation to such created structures.

Agency labor

Agency labor is the work of employees at the order of the employer, carried out in the interests, under the management and control of persons with whom they do not have an employment relationship. Since 2021, agency work, with the exception of certain cases, is prohibited in the Russian Federation.

There are 2 types of agency work:

1. Outsourcing.

2. Outstaffing.

Outsourcing is the transfer of certain functions or tasks to a third party (organization, individual entrepreneur, individual). Relations within the framework of outsourcing in most cases are formalized by a contract for the provision of paid services. Most often, accounting, tax and personnel records (preparation and submission of declarations, reporting, etc.), and legal support are outsourced. Since outsourcing does not involve the transfer of the contractor’s employees to the customer, this form of agency labor is permitted and can be used by the employer to reduce the cost of maintaining staff.

Outstaffing is the transfer of employees from the contractor to the customer. Employees who are on the contractor's staff carry out their work and are subordinate to a third party. This work has been prohibited since 2021 and its use will result in administrative liability.

An exception to the use of agency labor is made for:

— private employment agencies that meet certain conditions (accreditation, application of the general taxation system).

— legal entities when sending an employee to their affiliates, subject to the conditions and procedure for providing employees approved by the relevant federal law. To date, this law has not been adopted.

How is employment carried out?

All types of employment in Russia have a common essence, which is the order of successive steps that should ultimately lead to obtaining a job. In a narrower sense, this definition means the assistance of government agencies to its citizens in the form of providing vacancies. This includes not only assistance in finding appropriate work, but also retraining, retraining, and transfer. That is, these are those actions that are aimed at a person realizing his right to free work. But at the same time, the law does not prohibit a person from carrying out actions to find a job on an individual basis. It follows from this that the types of employment for work according to such a classification criterion as the method of implementation are as follows:

- independent;

- through government agencies.

This process plays an important role in public and social life as it helps a person to exercise his right to get a job. On the part of employers, this is a plus in terms of selecting qualified workers or the necessary strength. Another advantage of employment is a good efficiency factor, that is, a person makes the most of his working time without wasting time searching for a vacancy.

Employment

Employment is the process of filling a position in a public or private enterprise, provided by an employment center or found independently. Specially authorized bodies often help citizens find a suitable vacancy based on their training, existing profession and experience.

The main importance of getting a job through an employment center is as follows:

- Implementation of the right to work established by law.

- Assistance to business entities in finding specialists, labor, qualified craftsmen to organize the process.

- Providing advice on the possibility of retraining or vocational training if there are vacancies on the market.

- Reducing the time it takes to find a suitable job.

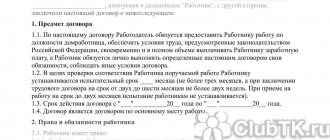

The hiring of people is associated with the conclusion of an employment contract, which will further regulate the relationship between the employee and the company. It is signed only when agreement is reached regarding the release schedule, wages, and social guarantees.

It is important to know! The employee has the right to receive complete and reliable information about the conditions provided by the company, and also to demand that it strictly comply with the stated clauses in the contract.

Types of employment

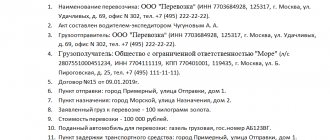

Employment is a set of measures taken by government or public organizations to speed up the process of finding a suitable place of work for citizens, based on their abilities, education, and experience. The responsibility rests with the territorial bodies of the State Health Service. The main law on employment is Federal Law No. 1032-1 of April 19, 1991 “On employment in the Russian Federation.” In addition, the employer must be guided by:

- Labor and Civil Code of the Russian Federation;

- Government Decree No. 225 of April 16, 2003;

- Letters of the Ministry of Labor No. 69 dated October 10, 2003;

- Resolution of the State Statistics Committee No. 1 of 01/05/2004.

The rules for employment are regulated by law, so the employer is obliged to strictly comply with them. Any violations will lead to penalties and prosecution of officials.

The algorithm of actions will differ depending on the type of employment:

- Permanent basis. The rights and obligations of the parties are strictly regulated by law and the employment contract, so they are maximally protected. This is especially true for social guarantees for citizens. Insurance contributions to the Pension Fund and the Social Insurance Fund are regularly made from wages. If you lose your job, you can always count on receiving unemployment benefits, in case of illness - compensation, and upon reaching retirement age, a pension.

- By contract. This type of employment does not involve deductions from the salary; the entire amount is given to the citizen in person. Tax and insurance payments must be made independently. This also means that you cannot count on sick leave compensation or paid vacation.

- Part-time job. Involves performing other paid activities in your free time from your main job. For example, night duty as a watchman.

- Part-time employment. One of the lowest paid types of work. It is used in most cases as a part-time job for students, minors, mothers on maternity leave, pensioners and other categories of citizens who are not able to work full time.

- Volunteering. The staff does not receive wages for this activity, as they perform it on a voluntary basis. It is suitable for students during their studies, as it allows them to gain invaluable experience in the desired field and benefit people.

- Free schedule. This also includes remote work, which does not involve constant presence in the office. The assigned tasks are completed by the employee at any time convenient for him, including from home.

Each type of employment has its advantages and disadvantages. Citizens registered under a permanent contract can receive loans from banks on more favorable terms. Part-time work frees up more personal time, which is important when you have children. Contract work requires wages several times higher.

How is this process carried out with the help of government agencies?

This process can be carried out with the help of special bodies. These mainly include institutions such as employment services. This method of performing this action is called special. Its distinctive feature is that, unlike the independent option, it characterizes only types of official employment.

Although labor is considered, according to the legislation in the Russian Federation, to be free, strict measures can characterize the implementation of this process with the help of state influence. For example, this may include recruitment, which is carried out in an organized manner, and the direction of persons to objects. This was more popular during the period of active development of the planned economy and is practically absent in this period of time. This was used to make this area more rational and provide human resources to those regions where they are sorely lacking.

Also, special employment refers to the placement of students who have graduated from vocational educational institutions. This is done through the conclusion of appropriate types of agreements with enterprises and institutions, which imply the hiring of young employees.

Another advantage of carrying out this process with the help of government agencies is that they have the right to subject jobs to quotas. This allows special segments of the population to find employment.

Issuing a certificate of employment

To obtain a certificate of employment, the employee must personally submit a written application to either the head of the organization or an employee of the company's human resources department. Satisfaction of the request (issuance of a certificate) in accordance with the Labor Code of the Russian Federation must be made no later than three days after the employee submits the application. The same requirements apply to a certificate confirming the amount of wages.

A document confirming the fact of employment of an employee in a specific organization is issued by the personnel service of the enterprise. Before issuing a certificate, the employee has the right to clarify exactly what data should be reflected in the document. You will be required to consent to the disclosure of personal data. If this requirement is not met, the organization may be subject to penalties for unauthorized disclosure of data.

The employee is recommended to order two copies of the certificate at once, when issuing it, write on the form about receipt of the document in hand, and indicate the date of issue. Both copies must be stamped and signed by the manager. After this, each certificate from the employer for a visa or other purposes can be used for its intended purpose.

Still have questions? Ask them in the comments to the article

What categories of citizens are entitled to preferential jobs?

Some segments of the population have the right to social protection in the form of assistance in realizing the right to work. The list of such people includes the following categories:

- those who have disabilities;

- those who have been in prison;

- those who have not reached eighteen years of age;

- those who have two years left to work before retirement;

- migrants and refugees;

- single mothers and those with many children;

- parents raising a child with a disability;

- those who are looking for a job for the first time;

- those who graduated from specialized educational institutions.

Unofficial employment

The phenomenon of informal employment does not lose its relevance and has always existed. This path is possible if you enter into a civil law agreement. In this case, the employer does not pay taxes. An employee receives an offer to increase their salary above the market rate. It's profitable. But is it as profitable as it seems at first glance? You will lose your right to a pension. The country's budget is losing billions.

Advantages of informal employment for the employer:

- no need to pay the state social insurance pension fund;

- the possibility of terminating informal labor relations with an employee at any time after he has completed the required amount of work;

- no need to notify the employee about layoffs or payment of compensation;

- lack of document flow related to the hiring, employment and dismissal of an employee;

- no additional payments;

- non-compliance with the work and rest regime.

Advantages of informal employment for an employee:

- higher income due to the absence of the need to pay personal income tax (NDFL), contributions to extra-budgetary funds;

- the ability to terminate the contract without obligation;

- the possibility of evading obligations, alimony payments, and debt to the bank.

How is this process of employing disabled people carried out?

Types of employment of disabled people are very important in the social sphere, since these people constitute a special category of employed people. Quotas apply to vacancies that can allow people with disabilities to work. These individuals cannot be one hundred percent active in society. It is the search for work that helps disabled people regain their place in society, recover morally and become full-fledged members of society. Thanks to this process, a person can again feel needed and important, and feel that he is benefiting other people.

Quotas are an officially established requirement that applies to all private entrepreneurs. Entrepreneurs must allocate a certain proportion of vacancies for people with disabilities. However, the percentage established by law in Russia is quite low.

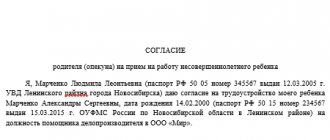

How is this process carried out for minors?

Types of employment of minors occupy their own niche in the employment market. This process is carried out regarding this category of citizens according to specific rules. In most countries of the world, for persons under eighteen years of age, the possibility of obtaining a job is regulated separately by law.

According to Russian regulations, the opportunity to enter into an agreement with employers appears upon reaching the age of sixteen. But the exception is fifteen-year-old teenagers who have received a secondary school education or are studying under an individual program. They are allowed to perform simple tasks that do not have a negative impact on health and do not interfere with development and functioning. A younger age category can be involved in the work process only as part-time employment. Work should allow the teenager to continue his education. But this age category is allowed to do this only with consent from parents or guardians.

That is, persons who have not reached the age of majority can be involved in any type of work, with the exception of gambling-type establishments and nightclubs. They are prohibited from dealing with cigarettes, alcohol and psychotropic substances. They should not be engaged in work that could potentially harm their health. That is, the transfer of heavy loads is limited to a certain weight.

All types of employment involving minors are accompanied by a medical commission, which must issue its conclusion.

Teenagers cannot be employed at work on holidays and at night. Working beyond the norm is also prohibited for this category. It is not allowed to send them on a business trip.

For such employees, a shortened working week is established. For persons under sixteen years of age, this number is twenty-four hours. For teenagers from sixteen to eighteen years old, this time is thirty-five hours a week.

Minor workers have additional guarantees. That is, an employer cannot voluntarily fire a teenager. This can only be done with the help of the state labor inspectorate.

An employer who hires a minor must understand that he is obliged to provide annual leave. It must be at least one month. And he is entitled to financial compensation.

Remuneration for work done for teenagers is calculated based on hours worked.

Employment agreement between an individual entrepreneur and an individual. face

When an agreement is concluded between an individual entrepreneur and an individual, where the individual entrepreneur is the customer, there are also some nuances:

Types of agreement

- The customer may refuse to pay pension and insurance contributions

- The customer may also not pay sick leave and vacation pay.

- An individual entrepreneur can legally withhold wages

- An employee who has gone on maternity leave is not retained a position and, accordingly, maternity benefits are not paid.

- The customer is not obliged to provide an equipped workplace to the contractor

This document regulates the work activity of the performer for the remuneration specified in it. An individual entrepreneur reserves the right to pay additional bonuses and other incentives or not. An employer entering into an agreement with an individual is required to make tax payments on the individual’s income.

On the other hand, no one guarantees that the contractor will perform the work properly and will not unilaterally terminate the contract at any time. The employee sets his own hours and place of work. Therefore, the customer has no right to demand his presence in the office at a certain time.

In the case where the entrepreneur acts as a performer of work, the employment contract for an individual entrepreneur implies the absence of tax payments. An individual entrepreneur hired as a performer pays his taxes to the state himself. In this case, the customer exempts himself from additional deductions.

How is this process carried out without a work book?

Types of employment without a work book are a very real option in the Russian Federation. This option is within the law. However, a work book is a document that confirms that a person was involved in the work process. It contains complete information about the person, which is necessary for the further implementation of such activities. That is, this is information about education, specialty acquired, dates of employment and name of the organization. The document indicates the position and reasons for dismissal.

The work book confirms the fact of employment. But there are quite possible options when providing this document is not necessary. This is quite possible, but at the same time it requires the execution of another document, which is a civil contract. The second way is to work part-time. That is, one main job is issued in accordance with the work book, and the second - according to a special agreement.

The last option for a device without this document is all types of hired employment. That is, this is labor provided by agreement with an individual. If this is done legally, then an agreement must be drawn up between the employer and the employee. At the same time, the one who pays for the provision of the service must also make contributions to organizations such as the Pension Fund and the Social Insurance Fund.

But most often, institutions that do not make entries in the work book are thus trying to hide from the law. This is mainly due to concealment of the current financial situation, that is, non-payment of contributions.

Those who agree to work under such conditions most often face problems such as lack of vacation, sick leave and maternity pay. And you can’t be one hundred percent sure of the stability of such work.

An important point is that the contract, which is concluded instead of being recorded in the work book, is of a civil nature, and not of a labor nature. The parties to it are the customer and the contractor. There are several types of such agreements:

- author's;

- agent;

- for contract work.

All of the above types have common features. For example, they must be in duplicate, specify the details of the parties, deadlines for completion and the amount of remuneration.

Comparison of employment and civil law contracts

More details about the types of civil contract, its pros and cons for the employer and employee can be found here.

Distant work

Remote work is recognized as the employee’s activities carried out outside the stationary place of work (at home, in transport, cafes, abroad, etc.). An employee usually receives a task from an employer remotely: by mail, via the Internet, etc.

What types of employment are there?

Types of employment in the Russian Federation are represented by four main categories. The most common job is one that has a permanent basis. It is she who brings a stable income. It is preferred because this type provides certain social guarantees. A person is protected, both socially and legally. In the event of job loss or unemployment, such a person may qualify for benefits. A certain percentage of the salary goes to the Pension Fund, which provides financial support in old age. Another advantage of this type of employment is the possibility of obtaining a loan.

The second type is part-time work. Most often this is a part-time job that brings in a small income. Such employment is common among students.

The third type is work under a contract. The amount stated in it is fixed and no deductions are made from it. In this case, taxes must be paid independently.

Types of employment do not necessarily provide financial compensation. An example of this is volunteering. Although it does not provide any financial benefits, its advantage is the acquisition of useful skills and connections.

At the moment, several more types of employment can be distinguished. These include freelancing and remote work via the Internet. Professionals in many industries can provide their services to employers from all over the world.

Distant work

Remote work is recognized as the employee’s activities carried out outside the stationary place of work (at home, in transport, cafes, abroad, etc.). An employee usually receives a task from an employer remotely: by mail, via the Internet, etc.

There are two types of remote work:

- Home-based.

- Remote.

Home work

involves the manufacture of products that have a tangible form, for example, collecting pens, growing mushrooms, embroidery, knitting, etc.

The result of remote work

is not a thing, but information, information, objects of intellectual property. Remote employees can be journalists, editors, content managers, copywriters, programmers, etc.

A remote worker can be registered under both an employment contract and a civil law contract.

Note

: payment of mandatory payments and contributions depends entirely on the method of registration of the employee, and whether he has the status of an individual entrepreneur.