Home / Labor Law / Employment / Employment contract

Back

Published: 07/08/2016

Reading time: 6 min

0

1141

For an ordinary person, it is not at all shameful to confuse an employment contract and an employment agreement. But when hiring, knowing the differences between these acts can literally decide your fate as an employee.

The thing is that an employment contract and an employment agreement are concepts from different areas of law and they regulate a different range of relations.

- Employment contract - what is it?

- Employment agreement - concept and features

- Differences between an employment contract and an agreement

Legal basis

Unlike an employment contract, the drafting of an employment agreement is regulated by the provisions of the Civil Code. This is due to the specifics of the employment agreement, which is concluded to perform a specific type of work.

In connection with the existing features of such an employment agreement, its regulation is carried out, first of all, using Article 420 of the Civil Code of the Russian Federation. In addition, the norms of the specified legal act devoted to the regulation of relations related to the organization of work performance through the conclusion of a work contract or other agreements devoted to various mechanisms for performing work can be additionally used.

The basis for drawing up an employment contract, in turn, is Section 3 of the Labor Code of the Russian Federation, in particular, Article 57 of this legal act.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Employment Agreement - Option”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

What is an employment agreement?

An employment agreement, as follows from established law enforcement practice, is a special legal act that is concluded not between an employer and an employee, but between a customer and a contractor. At the same time, due to the almost complete lack of regulatory opportunities, from a regulatory and legal point of view, labor agreements represent a rather complex structure in the sphere of regulation of existing labor relations.

In general, an employment agreement is a civil contract that is concluded with a particular employee to perform a specific type of work.

At the same time, the ultimate goal of such a document and the work performed on it is the final result, for which the employee will or will not receive remuneration, depending on what the final result will be.

Definition of terms

During the period of validity of the predecessor of the Labor Code until February 1, 2002, the Labor Code, an employment contract was identified with an employment agreement with an employee, concluded by the employer bilaterally. In addition, according to Article 15 of the Labor Code of the Russian Federation, contract and employment contract were considered synonymous; the difference was not recorded so much that the word “contract” was written in parentheses after the definition of contract.

The articles of the Labor Code of the Russian Federation do not contain the concept of what an employment agreement and contract are. Therefore, formalizing relations according to these formulations requires a careful reading of the documents with an in-depth understanding of the essence of the definition from the point of view of the correct application of the formulations from a legal point of view.

A number of HR specialists equate employment agreements and the procedure for their execution to civil contracts. From a legal point of view, a civil contract and an agreement, the difference in which is determined already at the stage of regulating the first by the Civil Code, the second by the Labor Code, cannot be equated in essence.

Contract literally translated from Latin means deal. According to the logic following from the definition, this is a document with more stringent conditions compared to a contract, limiting the actions of the signatory parties. Differences in wording allow you to draw up documents and file a claim in court, bypassing a number of instances.

An employment agreement is also understood as an addition to existing agreements to change the range of conditions relating to a bilateral agreement up to the termination of relations as a result of mutual consensus.

An agreement in labor law is an act that builds the principles of regulation of social and economic legal relations on labor issues, concluded between authorized representatives of employers and employed citizens within the scope of their competence, defining a list of mutual obligations.

The main differences between an employment contract and an employment agreement

There are a number of differences between an employment contract and an employment agreement, which are caused by some features of these documents. These differences include:

- parties to the contract being concluded . In accordance with current legislation, when concluding an employment contract, its participants are the employer and the employee. In an employment agreement, the parties are the customer and the contractor;

- The main regulation and key value under an employment contract is the scope of work, regulation of the basic rights and obligations of participants in such a legal act , as well as the fulfillment by the employee of basic rights and obligations, including compliance with the rules of labor discipline. In an employment agreement, what matters, first of all, is the final result, for the achievement of which the assignment and subsequent payment of remuneration occurs;

- The remuneration mechanism is also regulated differently in the employment contract and employment agreement . According to the employment contract, regular wage payments are mandatory, since such a condition is necessarily provided for by the current legislation of the Russian Federation. At the same time, according to the requirements of existing regulations governing labor relations, a mandatory condition is the payment of wages several times a month. According to the employment agreement, payment is made only upon completion of a certain stage of work or the entire complex of specified actions;

- In the employment contract, issues related to the time of work and rest of a particular employee must be fixed . If we are talking about a civil law contract, called an employment agreement, then in such a legal act this issue is not fixed and is not reflected in any way, since compliance with the work schedule is not important in it - the key role is played by the results of the work and the timing of its completion;

- the duration of the employment contract may not be defined , since the employer and employee may agree that their employment relationship should be of unlimited duration. In an employment agreement, the validity period is always specified either in the form of a calendar designation by indicating a specific date, or by indicating the end of a particular stage;

- According to the employment contract, the employee receives a fairly large number of guarantees , for example, payment of sick leave benefits, provision of annual leave. According to the employment agreement, such guarantees are not provided for in any way, and their provision remains entirely at the discretion of the employer;

- on the basis of a signed employment contract, the employer can hire only a limited number of employees , since their number is limited by the staffing table of the employing organization. According to the employment agreement, any number of employees can be hired, since they are not included in the staff;

- There is also a difference regarding existing liability measures between an employment contract and an employment agreement . According to the employment contract, an employee can only be subject to disciplinary action, for example, in the form of a fine. If the damage is caused by an employee who works under an employment agreement, then he will have to pay both the amount of the fine and compensation for the damage caused by his actions. In this case, the percentage of such compensation is determined by the employer at his own discretion;

- When concluding an employment contract, it is mandatory to provide documents confirming the employee’s education and the availability of appropriate qualification standards . When concluding an employment agreement, you will not need to confirm the general level of education - it will only be enough to provide information about whether the potential employee has qualifications that will be sufficient to perform a specific type of work;

- under an employment contract, both employment and termination of employment relations occur over a fairly long period of time . If we are talking about an employment agreement, then both signing and termination occur in shortened periods of time.

Advantages and disadvantages

The employer can see the positive aspects of using this type of interaction when hiring a team, which will not require him to constantly monitor the activities of builders (other specialists).

Payment will be made upon high-quality completion of the work, after which mutual settlements will be carried out. This form of relationship does not provide for vacation pay and sick leave , which makes it possible to save some money.

If certain duties are not fulfilled or performed poorly, the employer has the right not to pay wages , including through the court or on the basis of the law on consumer rights. These categories of persons are dismissed without any special legal consequences for the employer.

The vagueness of the legal basis leads to the fact that the relationship becomes blurred, making it difficult to manage the work.

Often this type of relationship attracts unreliable or unscrupulous partners, since penalties for this type of hiring are more than difficult to regulate and impose.

By entrusting urgent and important work to such a partner, you may find yourself in a difficult situation if it involves obligations to third parties.

ATTENTION! If an employer formalizes in an employment agreement types of work that are subject to registration under the Labor Code of the Russian Federation, he is charged with liability on the basis of Part 3 of Article 5.27 of the Code of Administrative Offenses, with the imposition of penalties.

The positive aspects for hired workers (specialists) are that the procedure requires a minimum of provided documentation, characteristics and confirmation of qualifications .

Getting a job, as well as dismissal upon completion, is done quickly.

This gives you the opportunity to manage your time and adjust to receiving orders at your discretion. Since the work schedule is flexible, it is convenient to manage the schedule.

Negative can be called the meager guarantees received from the hiring person. Dismissal can follow at the slightest violation, when the claim for severance pay will have to be defended in court, without a guarantee of recognition of the claim.

If an illness occurs, you will have to adjust the delivery time of services or disrupt them, which can lead to a breakdown in relationships . It’s even worse if the work depends on the supply of resources from the customer or third parties.

The employee will have to engage in organizational activities that are not his responsibility, or take risks .

Features of the employment agreement

Based on the differences listed above from an employment contract, an employment agreement is characterized by a number of its own features:

- the document is concluded for a limited period of time , which is completed together with the completion of the work provided for in such an agreement;

- the procedure for concluding and terminating an employment contract is in no way regulated from the point of view of current legislation (if we talk about the algorithm for concluding and terminating this document);

- payment is made only upon completion of the work provided for in the contents of the document , and the amount of payment directly depends on the volume of the foreseen that was actually completed by the hired employee;

- the employer's requirement of all documents confirming education is illegal , since only those documents must be provided that confirm qualifications for the specific type of work performed.

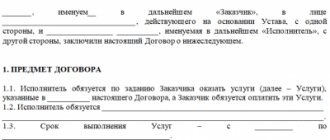

How to compose and sample

Sample employment agreement

When drawing up an employment agreement, the following points should be agreed upon:

- Name of the parties. Full name must be indicated. citizen and name of the organization that act as contractor and customer, respectively;

- Subject of the agreement. It is necessary to indicate what task is assigned to the performer. If many operations must be performed to achieve a result, then they can be described in more detail in the annex to the contract;

- Deadlines. The parties should set a specific date for completion of the work, or tie it to the occurrence of some event. For example, 6 months from the date of receipt of the advance payment to the contractor’s account;

- Rights and obligations of the parties. The contractor must complete the work (provide the service) on time and has the right to receive money for it. The customer has the right to demand that the work be performed in accordance with normal quality conditions.

Note! When performing work, it should be indicated whether the contractor has the right to entrust his work to other persons at his own expense or is obliged to do everything personally.

- Cost and payment procedure. The contract price is established by the parties based on costs and market prices for specific work or services. Often, an appendix to a contract details the price of individual operations to be performed. As a rule, the calculation is made a few days after the acceptance certificate is signed by representatives of both parties;

- The procedure for delivery and acceptance of work. The form of the act should be approved, which must be signed by the parties after the completion of the contract or provision of services. The parties also agree on the terms of acceptance, the composition of the commission;

- Procedure for terminating the agreement. It is worthwhile to provide a mechanism for early termination of the contract;

- At the end of the agreement the legal addresses and details of the parties are indicated. The agreement is signed by the contractor and an authorized representative of the customer.

Employment agreement to perform work with an individual

Registration of labor relations

The usual settlement mechanism in the “gateway” between two individuals does not provide legal guarantees to the participants. If the service is provided poorly or receives defective products, the payer will have nowhere to file a complaint.

The intended recipient of the payment may not be made the actual recipient or the agreed amount may be reduced significantly. What if a citizen did not show up to perform his duties at the agreed time or spat on the agreement during the execution process?

All types of responsibility, preservation of rights and provision of guarantees are provided for by an employment contract between individuals; the conclusion is equivalent for the parties to employment in the persons of the employer and the employee, respectively.

From a legal point of view, can an individual be an employer? Article 57 of the Labor Code of the Russian Federation, dedicated to the content of the document, listing possible employers, provides a link to indicating the full name when attracting a citizen without the status of an entrepreneur.

Compared to concluding legal relations with enterprises and institutions, the features of employment contracts with an individual employer are as follows:

- Mandatory registration with representative offices of the executive branch. The registration period is 3 days from the date of conclusion. The same period is valid for recording changes in conditions, including termination.

- Personnel document flow. An admission order is not drawn up and an entry is not made in the work book. However, an employment contract with an individual gives the right to receive social guarantees in the general manner. The insurance period is calculated based on the period specified in the contract with a private person.

- Nuances of taxation. The amount of withheld personal income tax depends on the citizenship or absence of the employee, and the obligation to accrue and transfer to the budget and extra-budgetary insurance funds is determined by the presence or absence of entrepreneurial status.

Who forms the additional agreements

Typically, the responsibility for drawing up additional agreements to employment contracts lies either with the organization’s legal adviser or with a specialist/head of the human resources department. In any case, this must be an employee who has an idea of how to draw up documents of this kind and is well acquainted with the civil and labor legislation of the Russian Federation.

After writing, the additional agreement must be signed by the head of the company - without his autograph it will not receive the status of a legally valid document.

Advantages and disadvantages for the employer

For an employer, there are a number of advantages of an employment agreement over an employment contract. Often there is a need to perform one-time work or provide a one-time specific service; in such a situation, the best option would be a civil contract.

It allows you to save space on the employer’s territory, and, accordingly, money, because it eliminates the obligation to create a separate workplace, the presence of which is mandatory when concluding an employment contract.

Payment of remuneration is made based on the results of the work , and first the quality, volume, and period specified in the agreement are assessed; there is no frequency of payment. There is no need to compensate for travel expenses, severance pay, sick leave, and the employer does not have to keep the job if the employee temporarily loses his ability to work.

On a note. The social package that an employee’s employment contract provides is absent in civil law relations, which significantly reduces the customer’s costs and narrows the range of responsibilities.

When formalizing relations with an individual in a civil law manner, the customer has a certain benefit in the form of the opportunity to reduce the amount of accrued insurance premiums, and sometimes there is no need to accrue them at all.

Here, remunerations are not subject to contributions for compulsory social insurance in case of temporary disability and in connection with maternity, and the amounts of income accrued to employees are not subject to contributions for insurance against accidents and industrial injuries, unless this is expressly stated in the terms of the contract.

If a GPC agreement is concluded with an individual in the status of an individual entrepreneur, then he is obliged to calculate and pay insurance premiums independently. This is due to the fact that in the light of Art. 419 of the Tax Code of the Russian Federation, private entrepreneurs are allocated to a separate class of payers ; the customer will not be a tax agent in this case.

The disadvantage of concluding such a document for the employer will be the risk of incorrect drafting and the existence of an employment relationship, which may serve as a reason for recognizing it as an employment contract, as well as penalties and litigation.

Where is the additional agreement, conditions and period of its storage recorded?

A properly formed and endorsed additional agreement must be recorded in the journal of employment contracts and additional agreements to them.

After the document goes through all stages of registration, it is transferred for storage to the personnel department of the enterprise, where the entire period of the employee’s work in the organization lies in a separate folder, along with the main employment contract.

After the dismissal of an employee, it can be transferred to the archive of the enterprise, where it must be kept for the period established for such documents by local regulations of the company or the legislation of the Russian Federation.

Civil contracts with employees

The employee will not have to pay income tax. For the amount of these expenses, he will receive a professional deduction (letter from the Department of Tax Administration for Moscow dated March 18, 2002 No. 27-11a/11731). To do this, he needs to write an application and attach supporting documents (tickets, checks, receipts).

For tax expenses, an accountant has the right to reduce only the cost of remunerating his labor (clause 21, article 255 of the Tax Code of the Russian Federation). In order for the costs of reimbursement of travel allowances for a freelancer to be included in them, two conditions must be met: such expenses must be economically justified and documented (clause 1 of Article 252 of the Tax Code of the Russian Federation).