Are maternity workers included in the average payroll?

Related publications

One of the most common questions that arises when preparing data for reporting in the KND form 1110018 is the question of whether maternity workers are included in the average number.

You can answer this question in one word, but this will not provide an understanding of the principle of calculating payroll and average payroll numbers as a whole, so it is simply necessary to thoroughly understand this problem at least once.

Average payroll number of parental leave

Currently, the form of information on the average number of employees has been approved by order of the Federal Tax Service of Russia dated March 29, 2007 No. MM-3-25/ “On approval of the form of information on the average number of employees for the previous calendar year” (registered with the Ministry of Justice of the Russian Federation on April 24, 2007 No. 9320 ).

The FSS of Russia, by order No. 59 dated February 26, 2015 (the order comes into force on April 4, 2015), approved the 4-FSS calculation form, which must be used for reporting for the first quarter of 2015. The same order also approved the procedure for filling out the specified form (hereinafter referred to as the Procedure). The new form of calculation compared to the previous form (approved by order of the Ministry of Labor of Russia dated March 19, 2013 No. 107n) contains a number of differences. Let's look at them in order.

Payroll and average payroll

The accounting of hired workers is carried out according to two criteria of number - payroll and average, and in order to understand whether maternity leave is included in the average number, you need to clearly understand the difference between these two accounting positions.

The payroll number is the full composition of employees who, on the day of reporting, are in an employment relationship with the employer:

- under an open-ended or fixed-term employment contract;

- hired to perform seasonal or one-time work.

In addition to these categories of employees, the payroll also includes the owners of the organization if they actually work in it and receive wages.

Average headcount - calculation of the composition of hired workers actually involved in work. It is calculated based on data from time sheets of employees going to work.

Indicators for the average and payroll numbers may coincide, but in most cases they differ. Moreover, if the accounting data differs, then the payroll number is always greater than the average payroll.

How to calculate the average number of employees for 4-FSS

Employers report on insurance contributions imposed on employees' wages by submitting to the Social Security Fund.

insurance form 4-FSS. In this article we will learn how to calculate the average headcount indicator for this report.

Contents In accordance with Order of the Federal Tax Service of the Russian Federation N 381, the updated form 4-FSS began to be effective in the first quarter of this year. According to clause 5.15 of this Order, the average headcount is calculated in accordance with the forms approved by Rosstat. Rosstat instructions (Order N 498) state that the average payroll number for 1 month includes the payroll number for each day (30 or 31, and in February - 28 or 29), divided by 12.

Both weekends and holidays are taken into account. Because this report is submitted quarterly, the corresponding figure will be calculated by summing the three-month average headcount divided by three.

The calculation of the average headcount for FSS-4 will be reflected in the following example: The staff of company N. for the month of January is 15 people, for February - 13, and for March - 12. The average headcount reflected in 4-FSS for the first quarter will be equal to (15 +13+12):3 = 13,333 = 13 people.

The following categories of workers are excluded from the calculation of the headcount:

- Part-time employees (external);

- Workers on maternity leave and caring for children under one and a half years old;

- Employees who have entered into GPC agreements with the company (contractors);

- Employees who are temporarily on unpaid study leave.

A detailed list of employees included in the payroll is contained in clause 79 of the Instructions for filling out form N P-1. In this case, part-time employees are reflected in proportion to the time worked per month.

- Finding the monthly average number of full-time employees.

- Calculation of the monthly average number of part-time workers.

- Quarterly calculation of the average number of employees by summing clauses 1 and 2

Step 1.

Let’s say that from October 1 to October 15, company N had 50 employees, and from October 16 to October 31, 40 (ten people were absent due to study leave); in November and December, the number of employees remains the same. The payroll number is: (50*15+40*16)+50*30+50*31 = 1390+1500+1550 = 4440 people.

Next, we divide the payroll number of employees each month (January-March) by the number of days: 1390:31 + 1500:30 +1550:31 = 45+50+50=145 people.

Step 2. Suppose that the company has 5 specialists on staff, working part-time for 3 hours from Monday to Friday.

This means that the time they worked will be:

- October – 3 hours * 22 working days * 5 people = 330 hours;

- November – 3*21*5 = 315 hours;

- December – 3*21*5 = 315 hours.

With an 8-hour working day, their average number is as follows:

- October – 330/8*22 = 1.875 = 2 people;

- November – 315/8*21 = 1.875 = 2 people;

- December – 315/8*21= 1.875 = 2 people.

Total 6 people. Step 3. Add the numbers obtained in step 1 and 2 and divide by 3.

(145+6)/3 = 24.166=50 people. We will show this average number on the 4-FSS title page for the fourth quarter. Following the calculation methodology, it is quite easy to obtain the average headcount; you just need to take into account all the necessary nuances.

Average headcount calculated by 4-FSS (nuances)

For a sample of filling out the 4-FSS calculation, see

. The calculation of the indicator under consideration for a particular quarter is carried out in 5 stages: 1. Calculation of the average number of employees for all days of the month from the beginning of the year, that is, if the report is submitted for the 4th quarter of 2021, then the average number is calculated for January-December 2021.

2. Calculation of the average headcount for part-time employees for all days of the month from the beginning of the year.

3. Calculation of the average number of employees separately for each month. 4. Calculation of the average number of part-time workers for each month.

5. Determination of the average number of specialists for the period from the beginning of the year. This algorithm corresponds to the procedure for determining the average headcount, which Rosstat recommends using when filling out statistical reporting forms.

For use in 2021, this procedure was approved by Rosstat order No. 772 dated November 22, 2017.

Who should be taken into account and where?

You can find out whether maternity leavers are included in the payroll if you understand the fundamental difference between the payroll and average payroll numbers. To do this, you need to understand which employees need to be classified in which group. Thus, the headcount data includes:

- employees who actually arrived at the workplace (including those who arrived but did not perform their duties for reasons beyond their control (downtime));

- employees on business trips (including foreign ones), if they retain their official salary or wages for this period;

- employees absent due to illness (regardless of the type of illness);

- employees who have a reduced working day or working week, including those who are paid half the rate;

- employees absent for valid reasons specified by the Labor Code (fulfillment of public or state duties).

When calculating the average number of employees of an enterprise, the determination and calculation of the indicator is carried out in proportion to the actual time worked, based on the data specified in the working time sheets.

Based on this, to the question:

- are maternity leavers included in the payroll - you should answer “YES”;

- Are maternity leavers included in the average payroll - you should answer “NO”.

Average payroll number of parental leave

By order of the Federal State Statistics Service dated February 2, 2020 (as amended on September 2, 2020), Form N P-4 “Information on the number and wages of employees” was approved. A little later, on October 27, 2020, changes were made to the Order of the same body (dated October 26, 2015 N 498), by which the Instructions for filling out the form are brought into line with the new form. The new form is effective from the January 2021 report.

2) Instructions for filling out federal statistical observation forms: No. P-1 “Information on the production and shipment of goods and products”, No. P-3 “Information on the financial condition of the organization”, No. P-4 “Information on the number, wages and movement of workers” , No. P-5(m) “Basic information about the activities of the organization”[2].

Accounting nuances

Possible statements that the average number includes maternity workers are incorrect, since their absence from the workplace is based on sick leave for pregnancy and/or childbirth, and in addition, the absence of a maternity leaver at work is marked in the work time sheet with a special symbol (“B” ).

Moreover, we must not forget that, according to current legislation, during maternity leave and child care leave for up to 1 year, 3, and in some cases 6 years, the employee (regardless of whether it is a woman or a man) retains workplace, and they are not excluded from the workforce, so the answer to the question of whether maternity leavers are included in the payroll is clear - yes, maternity leavers are included in the payroll of the enterprise.

In order not to be lost in doubt when preparing reports for KND 1110018 whether maternity leavers are included in the average number of employees or not, it should be remembered that the law establishes a list of employees who are taken into account in the payroll, but are not taken into account when calculating the indicator for the average number of employees:

- maternity leavers whose absence is confirmed by a sick leave certificate for pregnancy and childbirth, including adoptive parents who took the child from the maternity hospital;

- employees who have been granted parental leave;

- employees combining work with distance learning, or passing certification exams at an educational institution, when provided with additional leave without saving their salary;

- employees employed externally.

Based on all these provisions and legislative norms, a conclusion should be drawn: persons on maternity leave, as well as on parental leave, are not included in the calculation of the average headcount of an enterprise.

How to calculate the average number of external part-time workers

The answer is contained in the Instructions on statistics of the number and wages of workers and employees at enterprises, institutions and organizations, approved by the State Statistics Committee of the USSR on September 17, 1987.

Also, it is important to remember that in accordance with the norms of the current legislation, for the period of maternity leave and child care leave of up to one year, three years, and in some cases - up to six years (moreover, such leave can be taken as a woman, and a man), a person on maternity leave retains his job, and is not excluded from the staff.

Based on the number of employees, a statistical report of form No. P-4 and a report to the tax inspectorate KND 1110018 (Article 80, paragraph 3 of the Tax Code of the Russian Federation) are submitted. The last document is submitted by legal entities to regulatory authorities even in the absence of employees (letter of the Ministry of Finance dated February 4, 2014 No. 03-02-07/1/4390). The deadline for submitting the report is January 20.

The list of categories of employees who need to be included in the calculation of the average headcount is given in.

The list of employees of the enterprise must include the following employees:

- those who showed up for work and those who did not work due to downtime;

- those who did not come to work due to illness;

- part-time workers;

- working from home (homeworkers);

- working on a probationary period;

- those who improve their qualifications away from work while maintaining their wages;

- those who went on business trips;

- on maternity leave;

- those who did not come to work due to the obligation to perform public or government duties;

- hired for the period of absent employees;

- on vacation (annual, additional, annual additional);

- those who went on leave without pay for good reasons;

- those on parental leave (before the child turns 1.5 years old);

- those under investigation until the court makes a decision;

- those who committed absenteeism;

- subjected to administrative arrest;

- other employees specified in clause 79 of the Instructions.

An external employee works at his main place of work, and in his free time works part-time for another employer.

GOVERNMENT OF THE RUSSIAN FEDERATION RESOLUTION of February 25, 2003 N 123 ON APPROVAL OF THE REGULATIONS ON MILITARY MEDICAL EXAMINATION (as amended by Resolutions of the Government of the Russian Federation of January 20, 2004 N 20, dated December 31, 2004 N 886, dated April 30, 2004 005 N 274, dated 26.01 .2007 N 46, dated 09.11.2007 N 767, dated 28.07.2008 ...

The list should include only those employees of the enterprise who receive wages from the employer.

Since a woman, despite the fact that she is on maternity leave, actually works part-time, in our opinion, she must be taken into account when calculating the average number of employees in proportion to the time she worked. Details in the materials of the Personnel System: 1.

Order No. 772). Certificate of staffing strength - sample Maternity leave in the average payroll and payroll strength - example of calculation Let's look at an example of how to determine the payroll and average payroll number for March 2021. Let's assume that on March 5 there are 75 people in the company. On March 6, 5 more employees were hired, and on March 12, 2 employees went on maternity leave.

The payroll number for each day must coincide with the data in the employee time sheet.

General procedure and formula for calculating the average number of employees

The result of calculations of the average number of employees is entered into a special form P-4 “Information on the number and wages of employees,” which was approved by Rosstat in February last year.

Six months later, some changes were made to this form and certain instructions were drawn up for its completion. The report is mandatory for enterprises from January 2021. The calculation is submitted based on the results of the year, until January 21 of the next period. In case of violation of the deadlines, a fine of 200 rubles is imposed on the company.

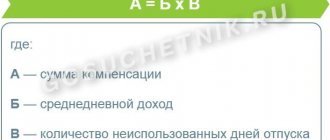

The formula for calculating the average number of employees is presented below:

To make the calculation, it is necessary to determine the number of employed employees for the specified period. Each employee is one unit. The calculation takes into account all employees with whom an employment contract has been concluded and who receive a salary.

Get 267 video lessons on 1C for free:

Women who are officially employed but are on maternity leave are maternity leavers. This category of employees has the right to take advantage of certain advantages and benefits that the state guarantees to them. First of all, the woman retains her job during maternity leave, and the employer makes all necessary payments.

In this regard, any manager and accountant of an enterprise has a logical question: are women on maternity leave included in the average number of employees of the enterprise? A similar situation arises with external part-time workers – workers who are employed in several companies at once.

The procedure for submitting a report (certificate) on the average headcount

In order to fulfill the tax requirements of paragraph 3 of Art. 80 all taxpayers, with the exception of individual entrepreneurs without hired employees, are required to annually submit a certificate of headcount. The current form of the document was approved by the Federal Tax Service in Order No. MM-3-25/174 dated March 29, 2007. The federal deadline for submitting the form is January 20, and for newly created companies - the 20th of the month nearest after registration. This rule also applies to reorganized companies.

Filling out the document includes calculating the headcount indicator for the year. Read more about the calculation method here. Submission format – electronic or “on paper”. Failure to comply with the deadline for submitting a report will result in a fine of 200 rubles. according to stat. 126 of the Code.

Are employees on maternity leave and external part-time workers included in the general list?

Before answering this question, it should be noted that the calculation of the average number of employees is carried out based on the results of daily accounting of employees hired.

In addition, the payroll must include not only present employees, but also those who are absent, regardless of the reasons. The most important criterion in this case is the presence of this employee on the staff of the enterprise.

Women on maternity leave have the right to resume their work activities after the end of maternity leave. In other words, the woman retains her job and they are not excluded from the staff of the enterprise. Based on these factors, maternity workers and external part-time workers are included in the payroll.

However, there is a separate list of employees who are not included in the average headcount, although they are included in the payroll. These include:

- maternity leavers;

- external part-time workers;

- persons who went on leave to care for an adopted newborn;

- employees on maternity leave;

Thus, the question of whether maternity leavers and external part-time workers are included in the average payroll can be answered unequivocally - no. As a rule, the average number of employees is always less than the payroll number. An employee will be counted in the average headcount only after returning to work. Accounting for external part-time workers is maintained separately.

Are external part-time workers included in the payroll?

Great Patriotic War, who received additional leave without pay for up to two weeks, as well as working women with two or more children under the age of 12, who received additional leave to care for children without pay for up to two weeks; 9.33. those working in the Far North and equivalent areas who have been granted leave with subsequent dismissal; 9.34. patients with chronic alcoholism, placed for treatment in drug treatment departments of psychiatric (psychoneurological) institutions and attracted to work at enterprises for therapeutic purposes. In the payroll number, these workers are taken into account at the place of their main work, and in the average payroll number - according to the place where they are brought to work for medical purposes (see.

paragraph 17); 9.35.

Home → Accounting consultations → Number of employees Updated: March 22, 2021 All organizations must keep records of their entire workforce. The list of employees of the enterprise includes all hired employees:

- temporary (for a period of one day or more);

- seasonal;

- constant.

Regulatory framework When compiling the payroll, the employer must be guided by:

- Instructions for filling out forms approved by Order of Rosstat dated October 26, 2015 N 498;

- Instruction, which was approved by the State Statistics Committee of the USSR back in 1987 N 17-10-0370 (as amended on April 20, 1993).

Calculation example

Let's try to calculate the average headcount for an organization using an example.

The following data is known: as of April 8, the company employed 200 people. Since April 8, 12 more people were hired, and after the 15th, 18 employees were fired. One employee went on maternity leave on April 28, and another came back from maternity leave on the 29th.

Let's try to calculate the indicator:

- the first 8 days of the NSR is 200 people;

- from April 8 to April 15, the NFR was 200 + 12 = 212 people;

- from April 15 to April 28, the NCR is 212 – 18 = 194 people;

- as of April 28, the NFR is 194 – 1 = 193 people;

- as of April 29, 193 + 1 = 194 people;

- Let's use the formula and calculate the total NFR = (204* 8+ 212*7 + 194*13 + 193*1 + 194*2) / 30 = (1632+ 1484+2522+193+388)/30 = 6219/30= 207 people.

Average number of employees for 4-FSS 2021: how to calculate

Read how to calculate the average number of employees for the 4-FSS report. We have shown a step-by-step example taking into account the latest changes. And they told us in which case the average number of employees equal to zero would not be an error.

Contents: On the title page of the 4-FSS calculation there are three fields for indicating the number of personnel:

- Average number of employees,

- Number of working disabled people,

- Number of workers in harmful and dangerous jobs.

The procedure for filling out these fields was approved by order of the Social Insurance Fund dated June 7, 2017 No. 275. The average headcount is reflected for the reporting period, that is, from the beginning of the year. Previously, this indicator was filled out at the reporting date.

The other two indicators (number of disabled people and hazardous workers) are still filled in as of the reporting date.

Important to know: The methodology for calculating the average headcount is given in Rosstat Order No. 772 dated November 22, 2017.

It is used to calculate the average headcount for the annual report to the Federal Tax Service, filling out statistical reports and for 4-FSS. The algorithm includes five steps:

- For full-time staff: calculate the total headcount for each month,

- For the same employees: determine the average number of employees,

- For part-time staff: calculate the number of hours worked for each month,

- For part-time workers: calculate the average number of employees for each month,

- Calculate the final average number of employees for the reporting period.

Let us show with an example how to calculate the average headcount in the 4-FSS report for the 2nd quarter of 2021.

Step 1. Calculation of the total number of employees Employees working full time are taken into account. Excluded from the list:

- Part-time workers

- Working part time,

- Those on maternity leave or parental leave, including those working part-time or at home while maintaining the right to receive benefits,

- Those on unpaid study leave,

- Lawyers,

- Owners of a company who do not receive a salary

- Persons performing work under GPC contracts.

Employees who are temporarily absent from the workplace for a valid reason, for example, on vacation or sick leave, are taken into account as full units.

For the calculation, the number of calendar days of each month is taken into account. The number of employees on a day off is considered the same as on the previous working day.

Example In January–April, the organization employed 22 people; on May 15, two employees quit; on June 11, 4 employees were hired. We calculate the total payroll number: Month Number of people Calculation January 682 22 * 31 February 616 22 * 28 March 682 22 * 31 April 660 22 * 30 May 648 22 * 14 + 20 * 17 June 680 20 * 10 + 24 * 20 Step 2 .

Calculation of the average number of full-time employees The total number obtained in step 1 is divided by the number of days in the month.

Example (continued) Month Average headcount, people Calculation January 22,682 / 31 February 22,616 / 28 March 22,682 / 31 April 22,660 / 30 May 21,648 / 31 June 23,680 / 30 Step 3. Number of hours worked by part-time employees Employment In this step, you need to determine the number of hours worked by part-time staff. Example (continued) An organization has 2 employees working 3 hours a day from Monday to Friday.

We count the number of hours worked: Month Number of hours Calculation January 102 2 people * 17 working days * 3 hours February 114 2 * 19 * 3 March 120 2 * 20 * 3 April 126 2 * 21 * 3 May 120 2 * 20 * 3 June 120 2 * 20 * 3 Step 4. Calculation of the average number of part-time workers At this step, the number of hours worked is divided by the length of the standard working day and the number of working days in the month. Example (continued) In an organization, a standard working day lasts 8 hours, we determine which average headcount to indicate: Month Average headcount, people Calculation January 1,102 / 8 / 17 February 1,114 / 8 / 19 March 1,120 / 8 / 20 April 1,126 / 8 / 21 May 1 120 / 8 / 20 June 1 120 / 8 / 20 Step 5.

Calculation of the average number of employees for six months To calculate the overall indicator, you need to add the results obtained in steps 2 and 4 and divide the resulting amount by the number of months in the reporting period.

Since we are filling out 4-FSS for the 2nd quarter of 2021, we take six months into account. This number of months must also be taken for those companies that were not registered from the beginning of the year.

For example, if a company was registered in May 2021 and it employs 1 person. Calculating using the above algorithm, we get 0.33 ([1+1]/6). After rounding in 4-FSS for the six months, the average number of employees will be zero; this result should not confuse you.

Example (total) The average headcount in our example is 23 people ([22 + 1 + 22 + 1 + 22 + 1 + 22 + 1 + 21 + 1 + 23 + 1] / 6).

How long does maternity leave take?

Women who are in a position and have official employment have the right to apply to the head of the enterprise for leave. The state guarantees the provision of maternity leave based on the certificate of incapacity for work received by the employee.

The length of leave can be different and vary depending on a number of circumstances:

- 70 days before and after the birth of the child;

- 70 days before and 110 days after the birth of two or more children;

- 70 and 86 days before and after the birth of the baby if complications arise;

- 70 and 84 days before and after the birth of children in case of multiple pregnancy.

During pregnancy, the woman is paid funds for the period of incapacity for work on behalf of the employer. Subsequently, the company applies to the Social Insurance Fund and receives compensation for this expense item.

Payment is calculated based on the total number of vacation days, regardless of how many days the woman used before the birth of the child and after this event.

Add a comment Cancel reply

You must be logged in to post a comment.

This site uses Akismet to reduce spam. Find out how your comment data is processed.

Average number of employees calculated by 4-FSS in 2021: examples

How to reflect the average number of employees in the calculation of 4-FSS in 2021?

Let me explain. On the title page of 4-FSS in 2021, indicate (p.

5.15 Procedure for filling out 4-FSS):

- in the “Average number of employees” field – the average number of employees for the 1st quarter of 2021, calculated in the usual manner;

- in the field “Number of working disabled people” – the list number of disabled people as of 03/31/2019;

- in the field “Number of employees engaged in work with harmful and (or) hazardous production factors” - the list number of employees in hazardous work as of March 31, 2021.

Let's give an example of calculating the average number of employees for 4-FSS in 2021.

Monthly indicators of the number of employees of the enterprise:

- for January is equal to twelve;

- for February it is equal to eleven;

- for March is thirteen.

The calculation indicator for the 1st quarter of 2021 of the average headcount for FSS-4 in this example will be equal to twelve ((12 + 11 + 13) / 3 = 12).

It is this indicator that is to be reflected in the corresponding line of the 4-FSS calculation. The calculation of the number of employees in question is carried out using information from the payroll records for each day. The daily indicator must be equal to the corresponding indicator reflected in the time sheet maintained by the enterprise.

When calculating the average headcount indicator, in particular, the following are taken into account:

- those who actually showed up for work, regardless of whether they worked or not due to downtime;

- those who worked on business trips;

- disabled people who did not show up for work;

- performing state or public duties outside the place of work;

- being tested;

- vacationers (including at their own expense);

- truants;

- persons under investigation, etc.

An internal part-time worker is included in the calculation at the place of main work. When in calculation 4 - FSS, table 1 “Calculation of the base for calculating insurance premiums” is filled out, indicating in it the amounts of payments and remunerations in favor of individuals and other sections, but at the same time on the title page in the field “Average number of employees” 0 will be indicated (zero)?

This can happen if the organization employs only external part-time workers. Since they are not included in the calculation of the average headcount, the payments accrued to them, as well as the amount of contributions from these payments, must be reflected in the calculation of 4 - FSS.

If you find an error, please select a piece of text and press Ctrl+Enter.

Headcount

The full list of employees who are included in the payroll contains clause 88 of the Resolution. Let's present it below, but for now we'll suggest you remember a few rules for calculating payroll numbers:

1. The payroll includes all employees who have an employment relationship with the employer. Simply put, those with whom an employment contract (both fixed-term and indefinite) was concluded and who performed permanent, temporary or seasonal work for one day or more.

2. When calculating the indicator, owners of organizations who worked and received wages in their company are taken into account.

3. The list of employees for each calendar month takes into account both those actually working and those absent from the workplace for any reason (for example, sick or absenteeism).

4. The payroll number for each day must coincide with the data in the employees’ working time sheet.

Document fragment. Clause 88 of Rosstat Resolution No. 69 dated November 20, 2006.

Workers who are not included in the payroll are listed in paragraph 89 of the Resolution. There are not many of them, so we advise you to remember them all:

- external part-time workers;

- performing work under civil contracts;

- working under special contracts with government organizations for the provision of labor (military personnel and persons serving sentences of imprisonment) and are included in the average number of employees;

- transferred to work in another organization without pay, as well as sent to work abroad;

- those aimed at studying outside of work, receiving a scholarship at the expense of these organizations;

- those who submitted a letter of resignation and stopped working before the expiration of the notice period or stopped working without warning the administration. Such employees are excluded from the payroll from the first day of absence from work;

- owners of the organization who do not receive wages;

- lawyers;

- military personnel.

Reference. The following categories of employees are counted in the payroll: units for each calendar day:

- homeworkers,

- internal part-timers,

- employees registered in one organization for two, one and a half or less than one rate,

- persons hired on a part-time, part-time or half-time basis.

Who is not included in the list of employees

Resolutions). The calculation algorithm is given in example 3. Please note: if a shortened (part-time) working day (working week) is provided to employees in accordance with the law or at the initiative of the employer, then they should be counted as whole units for each day.

Let's assume that an organization needs to determine the headcount indicator for the month of December for reporting to Rosstat. Which employees need to be considered? In order to correctly perform the calculations, check out the full list of personnel changes in this period.

Hired on a part-time basis, part-time, etc. In this case, when calculating, such persons are indicated as whole units.

In section 1, column 3 shows the actual number of persons on the payroll (as of December 31). An employee hired on a part-time basis in accordance with an employment contract is counted in the actual number as one person. An employee registered in an organization as an internal part-time worker is also counted as one person at his main place of work.

Average headcount

The very name of the indicator tells us that the average number of employees is the average number of employees for a certain period of time. As a rule, for a month, quarter and year. Quarterly and annual calculations will be based on monthly calculations. Next, we will show all the calculations using examples. But first we draw your attention to an important point. Not all employees on the payroll are included in the average payroll (clause 89 of the Resolution). It will not include:

- women on maternity leave;

- persons who were on leave in connection with the adoption of a newborn child directly from the parental home, as well as on additional parental leave;

- employees studying in educational institutions and on additional leave without pay;

- employees entering educational institutions and on leave without pay to take entrance exams.

Reference. The following documents will help you calculate the payroll and average headcount:

- Order for employment (form N T-1),

- Order on transfer of employees to another job (Form N T-5),

- Order on granting leave (Form N T-6),

- Order to terminate the employment contract (Form N T-8),

- Order to send an employee on a business trip (Form N T-9),

- Employee personal card (form N T-2),

- Timesheet for recording working hours and calculating wages (form N T-12),

- Time sheet (form N T-13),

- Payroll statement (Form N T-49).

Average payroll number of parental leave

According to paragraph 7 of Article 5 of Law No. 268-FZ of December 30, 2006, each head of an enterprise, whether an individual entrepreneur or the head of a limited liability company, must submit information about the average number of employees to the tax service at the place of registration of the organization. In the article below we will try to explain in detail how to calculate the average number of employees, because since 2007, absolutely all entrepreneurs must submit such information, even those who do not have a single employee on their staff (in this case, in the reporting form in the corresponding chapter they simply write zero).

One of the first things an accountant does in the new year is to notify his inspectorate about the average number of employees for the previous calendar year. Tax authorities need this to understand how a company should submit reports - on paper or according to the TKS. And this must be done no later than January 20 using a certain form. in paper or electronic form of your choice. The form is filled out according to the rules established by Rosstat.

Let's move on to the calculations

The average number of employees per month is equal to the sum of the number of employees for each calendar day of the month, divided by the number of calendar days in the month.

Please note: the calculation takes into account holidays (non-working days) and weekends. The number of employees for these days is equal to the payroll number for the previous working day. Moreover, if weekends or holidays span several days, then the payroll number of employees for each day will be the same and equal to the payroll number for the working day preceding the weekend or holiday. This condition is contained in paragraph 87 of the Resolution.

Example 1. LLC “Kadry Plus” employs 25 people under employment contracts. The established work schedule is a 40-hour, five-day work week. The headcount as of November 30 was 25 people.

From December 3 to December 16 inclusive, employee Ivanov went on his next annual paid leave.

On December 5, accountant Petrova went on maternity leave. To fill this position, from December 10, employee Sidorov was hired on the basis of a fixed-term employment contract.

From December 10 to December 14 inclusive, student Kuznetsov was sent to the company for practical training. No employment contract was concluded with him.

On December 18, 19 and 20, 3 people (Alekseeva, Bortyakova and Vikulov) were hired under an employment contract with a probationary period of two months.

On December 24, driver Gorbachev submitted his resignation and did not return to work the next day.

It is necessary to calculate the average number of employees for December.

Weekends and holidays in December were the 1st, 2nd, 8th, 9th, 15th, 16th, 22nd, 23rd, 30th, 31st. Therefore, on these days the payroll number of employees will be equal to the payroll for the previous working days. That is, this figure on December 1 and 2 will be equal to the payroll number for November 30, December 8 and 9 - for December 7, and so on.

Of the workers listed above, the December payroll will include:

- Ivanov - from December 1 to December 31,

- Petrova - from December 1 to December 31,

- Sidorov - from December 10 to 31,

- Alekseeva - from December 18 to 31,

- Bortyakova - from December 19 to 31,

- Vikulov - from December 20 to 31,

- Gorbachev - from December 1 to December 24.

Petrov’s accountant is not taken into account in the average headcount (from December 5). And student Kuznetsov is not included in the payroll at all, since he does not hold any position in the company.

For clarity, let’s draw up a table that defines the payroll for December 2007:

The number of employees of LLC "Kadry Plus" in December 2007

Headcount, people.

Of these, they are not included in the average headcount, people.

Included in the average headcount, people. (gr. 2 - gr. 3)

Features and procedure for calculating the MSS

Based on the payroll number, the average number of employees per month is calculated using the formula.

When calculating, the number of workers on weekends and holidays is taken to be equal to this indicator for the working day before the weekend.

Let’s calculate using the example of an organization’s SSC for April 2019 according to the report card on a daily basis:

| Days of the month | Number of people | Days of the month | Number of people |

| 1 | 100 | 16 | 109 |

| 2 | 102 | 17 | 108 |

| 3 | 110 | 18 | 107 |

| 4 | 104 | 19 | 106 |

| 5 | 105 | 20 (Saturday) | 106 |

| 6 (Saturday) | 105 | 21 (Sunday) | 106 |

| 7 (Sunday) | 105 | 22 | 107 |

| 8 | 100 | 23 | 108 |

| 9 | 100 | 24 | 109 |

| 10 | 100 | 25 | 110 |

| 11 | 100 | 26 | 111 |

| 12 | 102 | 27 (Saturday) | 111 |

| 13 (Saturday) | 102 | 28 (Sunday) | 111 |

| 14 (Sunday) | 102 | 29 | 110 |

| 15 | 104 | 30 | 100 |

| Total | 3160 |

The average number of people in April was 105 people (3160 / 30).

The average headcount in reports can be shown with one decimal place after the decimal point (Appendix 15. Approved by Rosstat Order No. 404 dated July 15, 2019).

If part-time work for an employee is established by an employment contract, then such employees in the average number are taken into account in proportion to the time worked (clause 79.3 of the Order). For example, someone who works 4 hours in an 8-hour working day is counted as 0.5 people.

At the same time, employees who have a shortened working day in accordance with the legislation of the Russian Federation (persons under 18 years of age, disabled people of groups I and II, employees engaged in hazardous work) are taken into account as whole units when calculating the SCH. Each of the internal part-time workers is counted as one person for the main position.

Employees on maternity leave, child care leave, employees on additional unpaid educational leave, external part-time workers are not included in the calculation of the average headcount (clause 79.1 of the order).

To calculate the average value for a period (quarter, half-year, year), the average value for each month of the period is summed up and divided by the number of months in the reporting period. For example:

An organization that has worked for an incomplete reporting period should still be divided by the number of months of the entire reporting period when calculating the SCH. For example, an organization was formed in June, and the average headcount in June was 240 people. The average number of employees for the 2nd quarter will be 80 people (240 ÷ 3), and for the first half of the year - 40 people (240 ÷ 6) (clause 79.9 of the Order).