A report on the average number of employees is submitted by all organizations and individual entrepreneurs that acted as employers in the calendar year. It does not matter whether financial and economic activities were carried out. In calculations, the accountant must rely on Rosstat Order No. 428 dated October 28, 2013.

Information on the average number of employees is submitted by:

- operating organizations based on the results of the calendar year - no later than January 20

; - new organizations for the first time - no later than the 20th day of the month following the month in which the organization was created, and the second time - at the end of the year no later than January 20;

- upon liquidation of an enterprise or individual entrepreneur - no later than the official date of liquidation of the organization or closure of the individual entrepreneur.

Let's count heads

The average payroll number is based on the payroll number. This data summary shows the full composition of employees, including those who are on sick leave, on vacation or on business trips. The payroll does not include only employees who are on maternity leave, maternity leave and unpaid educational leave.

The headcount is always compiled for a specific date: the first or last day of the month. Weekends and holidays are counted according to the previous working day.

Looking for the average

The average number of employees is the total number of employees of an enterprise for a certain period of time. This period can be a year, a quarter, a half-year or a month.

When calculating the average headcount, we must not forget that the requirements of Rosstat and the tax inspectorate for the SSC report differ from the requirements of the Pension Fund and the Social Insurance Fund. In the first case, the information does not include external part-time workers and those who work under a contract or civil contract. Internal part-time workers are counted only once - at the main place. Information on the average number of employees submitted to the Pension Fund and the Social Insurance Fund includes both of these categories of workers. In this case, part-time workers take into account both the main and additional workload.

Calculation for full working days

We will step by step consider how to calculate the average number of employees of an enterprise. Start with the number of employees working full days. We summarize the data for the month and divide the resulting amount by the number of calendar (!) days of the month. That is, in January we divide by 31, in February - by 28 (29) and so on, regardless of how many holidays/weekends/working days there were.

An example of calculating the average number of employees: the organization employs 47 people, in July 29 of them worked 31 days, 15 people worked 20 days, 3 people worked only in the last 4 days.

The average will look like this: (29 * 31) + (15 * 20) + (3 * 4) = 1211 / 31 = 39.06

Calculation for part-time working days

At the second stage, it is necessary to obtain data on employees who worked part-time or on a shift schedule. The average headcount for such categories is determined in relation to the generally accepted schedule at the enterprise and the standard length of the day. For example, with a 40-hour work week it will be equal to 8 hours, for a 48-hour week it will be 9.6.

The formula for calculations looks like this: we divide the number of hours worked by a person per month by the standard length of the working day and divide by the number of working (!) days in the month.

Example: an organization hired two employees to perform a number of tasks for a 4-hour working day. In April, one worked 12 days, the other 18. The average number of part-time employees for the reporting month was 0.7:

- first - 48 / 8 / 21 = 0.28;

- second - 72 / 8 / 21 = 0.42;

- total - 0.28 + 0.42 = 0.7.

Summing up the results for the year

To obtain the annual average headcount, add up the monthly results for all employees (full-time and part-time). The resulting number must be divided by 12 months.

Information on the average number of employees in any of the departments is submitted as a whole number. Rosstat does not regulate how to round the results of calculations. Most often in practice, mathematical rounding is used: a number up to 0.5 is rounded to zero, over 0.5 - to one.

The question often arises: what to do if there is one person on the staff of an individual entrepreneur, he worked for less than a full month, and the SCH is 0.33? In this case, make an exception and put a unit in the report.

Please remember that only the final number is rounded. If you want to get a summary of data for the year, there is no need to change the results quarterly or monthly. The same is true if you want to draw up a monthly report: you should not bring the numbers for each employee to the whole. Always round the total.

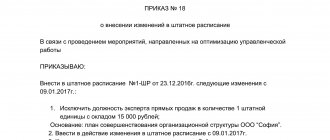

In accordance with paragraph 3 of Art. 80 of the Tax Code of the Russian Federation, information on the average number of employees for the previous calendar year is submitted by the organization (individual entrepreneur who attracted employees during the specified period) to the tax authority no later than January 20 of the current year, and in the case of creation (reorganization) of the organization - no later than the 20th the day of the month following the month in which the organization was created (reorganized).

From the provisions of this paragraph it follows that on the basis of information on the average number of employees for the previous calendar year, the taxpayer’s obligation to submit data in the current year is determined.

In this situation, the organization is liquidated in 2017, and accordingly, it will not submit tax returns next year.

And in the Tax Code of the Russian Federation there is no direct obligation to submit in the current year information on the average number of employees for the current calendar year.

Articles 21, 22.3 of the Federal Law of 08.08.2001 No. 129-FZ “On state registration of legal entities and individual entrepreneurs” do not provide for the provision of information on the average number of employees for state registration of liquidation of an organization.

Thus, the organization was required to submit data only for 2016. There is no need to submit such information on the date of liquidation.

Alexander Sorokin answers,

Deputy Head of the Operational Control Department of the Federal Tax Service of Russia

“Cash payment systems should be used only in cases where the seller provides the buyer, including its employees, with a deferment or installment plan for payment for its goods, work, and services. It is these cases, according to the Federal Tax Service, that relate to the provision and repayment of a loan to pay for goods, work, and services. If an organization issues a cash loan, receives a repayment of such a loan, or itself receives and repays a loan, do not use the cash register. When exactly you need to punch a check, see the recommendations."

- Download forms on the topic:

- An example of filling out a notice of concluding an employment (civil law) contract with a foreigner

- An example of filling out a notice of concluding an employment (civil law) contract with a foreigner from the EAEU

- An example of filling out a notice of concluding an employment (civil law) contract with a temporary resident foreigner

Any entrepreneur needs to report to the tax authorities. There, in addition to the tax return and other reporting, you will need to submit information about the SSC. The average number of individual entrepreneurs is needed to determine taxation and statistical purposes. Therefore, whether you like it or not, you will have to prepare a certificate.

Information on the average headcount upon liquidation of an LLC

Good day to all! Today is an article that continues the section: the sequence of actions after registering an LLC.

I’ll start from the very beginning, SSC reporting is submitted only to organizations and entrepreneurs that are registered as employers. Entrepreneurs who are not registered as employers do not have to submit reports to the SSC. These changes came into force this year.

LLCs and entrepreneurs who are registered as employers must submit reports to the SSC without fail, even if you do not have employees; this only applies to individual entrepreneurs, since an LLC has at least 1 employee - this is the director.

If an individual entrepreneur is registered as an employer, but has no employees, then it is necessary to submit zero reports to the SSC. The average number of employees is the average number of employees in an LLC or individual entrepreneur if the individual entrepreneur is registered as an employer for a certain period of time.

As can be seen from the formula, in order to calculate the MSP for a year, it is necessary to add up the MSP for each month of the year and divide the number of months by 12. Now we have a question of how to calculate the average number of employees for each month.

In order to calculate the monthly average, you need to add up the number of employees for each day in the month and divide by the number of days in the month. Let's say we calculate the average value for the month of September. Let's assume that we had 3 people working from September 1 to 12, 2 people working from September 13 to 20, and 4 people working from September 21 to 30.

As you can see, I added up the number of employees for each day in the month and divided it by the number of days in September. Since when calculating the average value for a month, you need to have integers, so we round as we were taught in school.

Let's assume that the organization began its work in the same September. The organization has a director, an accountant and 2 employees. And to complicate the task, let's assume that in December 1 employee quit.

Here I will not calculate for these months and will indicate ready-made numbers. You can recalculate by these months and you will get exactly the same numbers.

Since we increase values greater than 0.5 or decrease values less than 0.5, which is taught in school, we get: If you do not submit by January 20, the organization will be subject to a fine of RUB.

Currently, many entrepreneurs use this Internet accounting to calculate taxes, contributions and submit reports online, try it for free. The service helped me save on accountant services and saved me from going to the tax office.

That's probably all! After opening and registering a limited liability company LLC, it is necessary to perform a number of certain actions: open a settlement account, notify the Pension Fund of the Russian Federation, Social Insurance Fund, Compulsory Medical Insurance Fund.

Among the responsibilities of the head of a newly opened limited liability company there is also the obligation to send the average number of employees of the organization to the Tax Inspectorate. The Tax Code establishes that when opening an LLC, the average number of employees must be sent no later than the 20th day of the month following the month the LLC was opened.

According to current legislation, the average number of employees is filled out in a specially approved form and can be either in paper form or on electronic media, depending on the number of employees. The exceptions will be:.

These enterprises will be able to submit the average payroll on paper, but on the condition that they do not receive invoices when selling goods, works, and services. Companies receiving such invoices are required to switch to transmitting the average number of employees in electronic form. As a general rule, the information in the form is filled out by the taxpayer.

Some columns at the end of the form are filled out by a Tax Inspectorate employee. The lawyers of our company offer you qualified legal assistance in the following areas:. Does an individual entrepreneur without employees rent out the average number of employees?

This question worries many entrepreneurs, since legislation is constantly changing and clarified. The average number of employees of individual entrepreneurs without employees of the year of the example is a form representing reporting to the Inspectorate of the Federal Tax Service, previously it was required to be filled out, but last season changes were made to paragraph.

Is it necessary to submit the average number of individual entrepreneurs without employees in connection with the above changes?

The answer is later in the article; first, let’s define the goals of this report and the general procedure for filling it out. SSC is a small report that represents data on the number of workers in an enterprise: those employed by a personal entrepreneur or in an organization.

Information on the average number of individual entrepreneurs without staff was constantly submitted using the same form, the form looks quite simple, but you need to know the specifics of calculating the number of workers. It is contained in the Instructions set out in the order of Rosstat dated So, the SSC report allows tax authorities to control some aspects of the enterprise’s activities.

For what reason do individual entrepreneurs without employees rent out the average number? This question has arisen for many people in practice. In addition to them, legal entities without employees, as well as newly organized LLCs, had to submit this report. The fact is that the legislator proceeded from the position that if there are currently no employees on staff, during the reporting period of the year in this case they could be hired and fired from work.

How to fill out the average number of individual entrepreneurs without employees? Isn’t it necessary for a personal entrepreneur to still make such a report, including himself in it?

Let's figure out why a personal entrepreneur should not do this. So, the average headcount of an individual entrepreneur without employees would have the opportunity to include the entrepreneur himself, but this contradicts the following logical conclusions based on the analysis of laws:

No, this obligation has been abolished by the legislator. How was this form previously filled out, taking into account the fact that there were no employees on the staffing table at the time of submission?

A certificate of the average number of individual entrepreneurs without employees in this case was filled out according to the general rules. The calculation of the value in the form must be made taking into account the established rules set out in the instructions of Rosstat.

Since the total value is the sum of the values calculated for each month. So, if employees worked at the enterprise during the period specified in the form, this should be reflected in the final figure.

Along with this, the calculation rules are specific and spelled out in detail; there are special instructions for accounting for part-time workers, part-time workers, etc.

By

Fill out and submit the SSC information form

Information about the SSC must be submitted to the tax office once a year no later than January 20. Opening an individual entrepreneur does not oblige you to submit a report on the number of employees for the next month after registration. And the closure of an individual entrepreneur is obligatory. These reports are submitted no later than the actual date of deregistration of the entrepreneur.

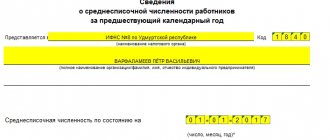

An individual entrepreneur submits information on the number of employees using the KND form 1110018 in accordance with Order of the Federal Tax Service of the Russian Federation N MM-3-25/174. To submit information, you must enter the following information:

- Taxpayer INN;

- full name of the tax authority at the place of residence of the individual entrepreneur;

- FULL NAME. individual entrepreneur;

- form according to form No. P-4;

- The date of recording the number of employees is January 1 of the reporting year.

- date of filing, signature of the individual entrepreneur and its transcript.

The remaining fields are filled out by the tax officer. The certificate must be drawn up in 2 copies, one of which you keep for yourself to confirm the submission of data to the Federal Tax Service.

Where to submit information about the number of employees

Submit information on the average number of employees to the inspectorate at the location of the company. Determine the number of employees for the company as a whole, taking into account employees of separate divisions. Do not provide information separately for separate divisions (letter of the Ministry of Finance of Russia dated February 14, 2012 No. 03-02-07/1-38). The tax code does not require this.

Individual entrepreneurs submit information about their number to the inspectorate at their place of residence.

Information is a form of tax reporting, but not a declaration or calculation of taxes and fees. Therefore, there are no mandatory requirements for how to take them. A company or individual entrepreneur has the right to independently decide how it will report - on paper or electronically.

Reporting forms for average headcount free download

Average headcount form

How to calculate MSS

An individual entrepreneur is not included in the number of his employees - he cannot conclude an employment contract with himself and set his own salary. If you don’t have employees, then you don’t need to report in 2021. Such amendments were made to paragraph 3 of Art. 80 Tax Code of the Russian Federation. If you are on UTII, then when calculating the average headcount you are required to include yourself as a unit in the physical indicator. This is stated in Art. 346.29 Tax Code of the Russian Federation. Otherwise, the principle of calculating the MSS is no different.

An individual entrepreneur is not included in the number of his employees - he cannot conclude an employment contract with himself and set his own salary.

So, we fill out the form according to form No. P-4. It is necessary to calculate the average number of employees for the reporting year in several stages:

- The average number of full-time employees is determined. It is necessary to establish how many days each person worked in a month. Weekends and holidays should also be taken into account. The number of calculated days of all employees is summed up and divided by the number of days of the month for which the calculation is being made. The resulting value cannot be rounded.

- We calculate the average number of employees who work part-time. To do this, you need to calculate the number of hours they worked for the entire month, divide this value by the length of the working day, and then distribute the resulting value among the days of the month. That is, in this case, the average number of employees will be proportional to the time they worked. The resulting value cannot be rounded.

- The final step is to calculate the annual value. All data received for each month for full-time and part-time employees must be summed up and divided by 12. Now the resulting value must be rounded and entered into the reporting form.

If an individual entrepreneur deems it necessary, he has the right to calculate the SCH as if part-time employees are full-time.

Make sure that the data reaches the Federal Tax Service on time. Otherwise, you will be fined 200 rubles. By the way, a fine will not relieve you of the obligation to submit a report. The average headcount is necessary to calculate a number of taxes. It is an indicator for the use of UTII or simplified tax system - if the number of employees exceeds 100 people, then the entrepreneur will not be able to use these modes.

A certificate of the average number of individual entrepreneurs is needed to determine the tax base. The amount of payments to the tax office will depend on it. If you work without employees, you can forget about the certificate, but if you have at least one person on staff, you won’t be able to evade responsibility.

How does the closure of an individual entrepreneur take place, and how is the average headcount taken into account? These questions concern businessmen. All enterprises someday begin their life activities and sooner or later end. But upon closure, any entrepreneur must notify the tax office officially and bring documents confirming the liquidation in order. At the same time, we must not forget about such an important accounting as the average number of employees. How is the average headcount determined when closing an individual entrepreneur?

Information about the average number of employees is important, as it allows you to save enterprise statistics and calculate taxation.

How to calculate the average number of employees

Typically, an accountant or a human resources worker is responsible for determining this indicator at an enterprise.

Due to the fact that the average number is of great importance, its calculation must be approached responsibly to ensure maximum accuracy of the calculation. After all, on its basis the right to use preferential treatment will be determined, for example. In addition, the regulatory authority itself can double-check it.

Initial information for calculation must be obtained from documents on recording working hours, issued orders for the hiring, transfer, dismissal of employees and others.

Computer programs for maintaining personnel or accounting records make it possible to make calculations automatically. However, in this case, you still need to check the sources of information used in this case.

The employee tasked with calculating the indicator must understand the entire algorithm for determining it, so that at any time he can double-check the data received.

Step 1. Calculate the number for all days of the month

At the first stage, the responsible employee must determine the number of employees who performed work duties in the company every day of every month. For a working day, this indicator is formed from the number of people with whom employment agreements have been concluded on that day, including all those who are on sick leave or on a business trip.

The following are excluded from the calculation:

- Part-time employees for whom this is not their main place of work;

- Performing work under contract agreements;

- Employees who are on maternity leave or maternity leave;

- Employees whose signed agreement provides for reduced working hours. However, if a short day is defined at the legislative level, then such an employee must be included in the calculation.

For weekends and workdays, the number of employees on that day is taken according to the number of employees on the workday preceding it. This means that if the employment agreement was terminated on Friday, then this employee will still participate in determining the average number on Saturday and Sunday.

Attention! If the organization on that day did not have a single employee with a valid employment agreement, then the number for him is taken as “1” - in any case, it is necessary to take into account the director, who is enshrined in the registration documents, even if his salary is not accrued.

Step 2: Determine the number of full-time employees for each month

This rate is calculated by adding the number of workers who have contracts for each day of the month and then dividing the result by the total number of days of the month.

You might be interested in:

How to send tax returns by mail: what date will documents be accepted, how to confirm deadlines

WorkP=(Day1+Day2+..+Day31)/Number of days of the month,

Where D1, D2, etc. – the number of registered employees on each day of this month.

For example: There are 30 days in a month. From the 1st to the 14th, 21 people worked, from the 15th to the 21st - 18 people, from the 22nd to the 31st - 19 people.

The number of employees for this month will be: (14x21 + 7x18 + 10x19)/31 = 19.67 people.

Attention! According to the calculation rules, the final result must be rounded to the second digit after the decimal point.

Step 3: Determine the average number of part-time employees

First of all, at this stage, the number of hours attributable to the labor activity of part-time workers per calendar month is considered. In this case, the rule applies that the number of hours on vacation or sick leave is equal to the number of hours on the previous day of work.

After this, you can calculate the average number of such employees. For this purpose, the value obtained above must be divided by the number of hours of work for this month, which is defined as the product of days of work by working hours.

WORKCH=HOUR/(WORKDAY*WORKHOUR), where

RABch - average number of part-time workers;

HOURS - the number of hours actually spent on work by part-time workers.

RABDN – number of days of work in a month (norm);

WORKING HOUR - the duration of a full working day. For a 40-hour week this figure is 8 hours; for a 32-hour week it is 7.2 hours.

For example. Ivanova I.P. worked in July 2021 for 15 days, 7 hours each. The company has a 40-hour work week, the norm of working days in July 2021 is 21 days.

Calculation of average headcount:

(15*7)/(21*8)=0,63

In this case, the resulting value must be rounded to hundredths using the rules of mathematics.

Step 4. Calculation of the number of all employees per month

The average number of all employees is determined by summing the obtained values of the average number of employees for each type.

The determined result will need to be rounded to a whole number, taking into account the rule according to which the fractional part up to 0.5 is discarded, and above 0.5 is counted as 1.

RABM=RABP+RABh, where

RABM - average number of employees per month;

RABP - average number of full-time employees;

RABCH - the average number of part-time employees.

For example. Based on these previous examples, we determine the average number of employees per month:

19,67+0,63= 20,3

After rounding, the result will be 20.

Step 5. Calculate the average number of employees for the entire year

The annual figure is formed on the basis of the data obtained on the average headcount for each month of the year.

For this purpose, you need to add the average number of employees of the company for each month and divide by 12.

RABG=(RABM1+RABM2+…+RABM12)/12, where

RABG – average headcount for the year

RABM1, RABM2, etc. – average number for January, February, etc.

The resulting result is rounded according to the rules of mathematics.

The peculiarity of this calculation is that if the company began operating not at the beginning of the year, but, for example, in July, then the divisor in the formula will still be the number 12.

Attention! Often, in addition to the annual average number, it is necessary to determine the quarterly or average number of employees for six months. This algorithm for calculating this indicator is used, only the indicators for the required number of months are summed up, and the resulting total is divided by the corresponding number of these periods.

Determination of the average headcount when closing an individual entrepreneur

Thanks to the time sheet, you can determine the number of all employees. The entire team is taken into account, this also includes those who are sick and absent for a good reason.

But when calculating, the following are not included in the indicators:

- the owner of an enterprise who does not receive a salary on a general basis;

- those employees who work under a contract concluded as a result of professional training and receive a stipend;

- women who are on maternity or child care leave during this period;

- vacationers who have signed up for free days due to admission or study at an educational institution, but their salary will not be retained;

- working under civil contracts or part-time;

- sent to work abroad;

- those who wished to quit, but interrupted their working relationship before the expiration of official relations with the enterprise.

All individual entrepreneurs must provide average list information to the tax authorities at the end of the reporting year, and the date for this is set before January 20.

But when a businessman declares the termination of the activities of an individual entrepreneur, then such information must be in the fiscal authorities no later than the date when liquidation was officially announced and the enterprise was deregistered and ceased to exist. If the information was delayed for some reason, then you must pay a fine of 200 rubles. This is only for violation of delivery deadlines, and the organization also bears a penalty of 200 rubles and the entrepreneur himself suffers, having paid from 300 to 500 rubles.

Documents are submitted for closing an individual entrepreneur at the place of his residence, for an organization - to the tax office that is located at the place of its legal address. If an enterprise has branches located in different parts of the locality, then they are collected into a single document and submitted in one general average list report - for the entire organization.

Documents are provided by the entrepreneur in the following way:

- In personal presence at the tax authority or through a proxy, but this will require permission from a notary through a power of attorney. The completed declaration must be in 2 copies, 1 remains with the former owner of the individual entrepreneur.

- Electronic.

- By mail - a valuable letter with an attached list of enclosed documents.

Return to contents

What is the average headcount?

SSCh is the average number of full-time employees who worked for you during a certain time (month, quarter, year). This information is used when:

- resolving the issue of classifying an organization or individual entrepreneur as a small or medium-sized enterprise (SME); this status provides a number of benefits: it exempts microenterprises from the obligation to adopt local regulations, provides benefits when participating in government procurement, etc.;

- formation of a register of small and medium enterprises by tax authorities;

- conducting an analysis of the level of salaries and the amount of salary taxes;

- submission of reports and application of certain benefits: enterprises with over 100 employees. Tax reporting is provided only in electronic form; in some regions, the size of this indicator is one of the conditions for applying a reduced rate under the simplified tax system.

In other words, information about the capital balance is one of the important indicators of the activity of an economic entity.

The form for providing the SSC for the report for 2021 was approved by Order of the Federal Tax Service of the Russian Federation dated March 29, 2007 No. MM-3-25/ And instructions for filling it out are given in the Letter of the Federal Tax Service of the Russian Federation dated April 26, 2007 No. CHD-6-25/.

What documents need to be provided

Documents must be submitted to the tax office with the help of which the entrepreneur notifies about the closure of his organization.

He submits an application containing a request to terminate the activities of an individual as an entrepreneur. For this, form P26001 has been adopted. A receipt will be provided. This document proves that the state fee has been paid.

If a tax inspector demands to pay the remaining debts without signing the closing documents, he is acting unlawfully: if any shortcomings remain, the individual will be held responsible for them, even though the person is not an individual entrepreneur.

But it is still better to keep the documents in order, and such reporting must be provided within 5 days from the date the company no longer exists. Submit a declaration in form 3-NDFL to OSNO, and pay debts on taxes and insurance contributions within 15 days.

For VAT, all reporting documents must be in the relevant organization no later than 20 days before the end of the quarter.

Under other taxation systems, papers must be submitted on the basis common to all individual entrepreneurs - within the usual time limits established by law.

It is necessary to submit reports to the Pension Fund and the Social Insurance Fund regarding the employees of the enterprise even before it is closed. And employees must go through the deregistration procedure in these organizations on their own. Withdrawals occur automatically only in the Pension Fund, but only when information is received from the Federal Tax Service that the enterprise no longer exists.

When an individual entrepreneur is closed, the average list reporting is not submitted to the tax office. All authorities that must be notified about the operation or closure of an individual entrepreneur will learn about this from information received from the Federal Tax Service. All necessary information is provided to them.

Firms and businessmen are required to send a report on the average number of employees to the Federal Tax Service. Due date for 2017

year and some nuances for newly created organizations are discussed in our article.

Methods for filing SCR in 2021

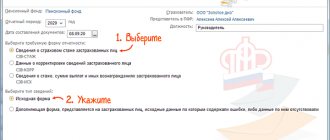

The average number of employees can be submitted:

- In paper form (in 2 copies). One copy will remain with the tax office, and the second (with the necessary marking) will be returned. It will serve as confirmation that you have submitted the declaration.

- By mail as a registered item with a description of the contents. In this case, there should be an inventory of the investment and a receipt, the number in which will be considered the date of delivery of the number.

- In electronic form via the Internet (under an agreement through an EDF operator or a service on the Federal Tax Service website).

Please note that when submitting SCR information in paper form, some Federal Tax Service Inspectors may additionally require you to attach a file with an electronic version of the report on a floppy disk or flash drive.

Features of the document

The law requires that all organizations and private entrepreneurs using hired personnel in their activities provide information on the average number of employees to the tax authority. Due dates

must be strictly observed.

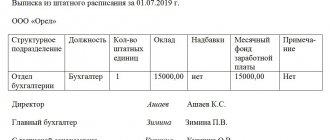

This document includes information on the number of staff members who worked at the enterprise during the reporting year. It is filled out on form KND 1110018. It contains the following information:

- name of organization/full name individual entrepreneur (no abbreviations);

- the date when the report on the average number of employees is submitted

; - name and code of the Federal Tax Service to which the report is submitted;

- FULL NAME. and the signature of the head of the organization;

- stamp (if available).

The document consists of only one page, which looks like a tax return.

The filling process is straightforward. The main thing is to correctly calculate the indicator and comply.

Data must be submitted on the form that was used last year. He hasn't changed. And when filling it out, you can follow the recommendations from the Federal Tax Service letter No. CHD-6-25/353. It describes the specifics of filling out a number of details.

Filling rules

The rules for filling out the form are contained in Letter No. CHD-6-25 of the Federal Tax Service of the Russian Federation dated April 26, 2007. According to the Letter, all information in the form is entered by the taxpayer himself, except for the section “To be filled out by a tax authority employee.”

So, the following sections must be completed:

- information about the taxpayer himself (TIN, KPP, full name - for organizations; TIN and full name of the entrepreneur - for individual entrepreneurs);

- name of the tax authority and its code;

- the date on which the average number of employees was determined;

- information on the number and wages of employees;

- personal signature and seal of the head of the company.

The tax inspector also enters information into the form received from the taxpayer. It records: the date of receipt of the completed document; report number; your personal data: Full name and signature.

Why take it?

It is necessary to submit the report in question to tax inspectors so that they can monitor compliance with tax legislation. For example, the average headcount indicator will tell them:

- whether the enterprise is truly small or large;

- Is it allowed to submit tax reports in printed form, etc.

At the same time, it is important to comply with the deadlines for submitting the average number of employees

. Because otherwise the tax authorities will issue a fine and recalculate the amount of mandatory payments that should go to the treasury from a specific enterprise, individual entrepreneur.

Who should take it?

the average list to the tax authority at the place of registration on time

reporting should:

- legal entities - regardless of their legal form;

- businessmen using hired labor;

- persons engaged in private practice and concluding employment contracts (notaries, lawyers, etc.).

An important nuance: all legal entities must know and comply with the deadlines for submitting a report on the average headcount

regardless of the presence/absence of hired workers, since they are required to hand over it.

Who rents and why it is necessary to know the number of employees according to KND 1110018

The obligation for employers to provide reporting on the payroll is established by the third paragraph of Art. 80 Tax Code of the Russian Federation. The information specified in it is needed for maintaining statistics and monitoring business by tax authorities.

According to Letter No. 03-02-07/1/4390 of the Ministry of Finance of the Russian Federation dated 02/04/2014, the following must submit a report on the average number of employees:

- newly registered legal entities, regardless of the availability of personnel;

- individual entrepreneurs with employees;

- organizations that have entered into employment contracts;

- organizations that have not yet recruited staff.

IMPORTANT!

Only individual entrepreneurs who do not have employees are exempt from submitting reports (clause 3 of article 80 of the Tax Code of the Russian Federation).

New companies

In Russia, new enterprises open literally every day. At the same time, both large and small organizations (legal form and size do not matter), registered in January 2021, are not required to submit information for the 2017 year.

It is quite logical that the deadline for submitting the average number of employees for new organizations

in this case, fall on February 20, 2021 (this will be Tuesday). This is established by tax legislation. And then according to the same principle: the month of creation, followed by the month of submission of information on the number of personnel.

New IP

Many individuals seek to create their own business in order to offer their services in various fields of activity. Registration as an individual entrepreneur opens up a lot of opportunities, but also obliges you to complete certain formalities. All businessmen who plan to use hired labor as part of their activities should know when to submit information on the average headcount

.

Thus, upon receipt of an entrepreneurial certificate in 2017, the report in question is submitted to the Federal Tax Service no later than January 22, 2018.

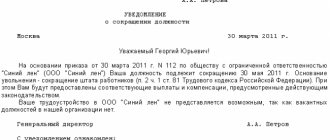

Liquidation: until what date should the average number of employees go to the Federal Tax Service?

Termination of activity may not always be associated with bankruptcy. Sometimes they do this in order to obtain a higher legal status and expand their capabilities. And regardless of the reason, when closing an individual entrepreneur or liquidating an enterprise, you must not only officially notify the tax authorities about the decision made, but also submit a certain package of documents. When is the average number of employees handed over?

in a similar situation?

The legislation sets the deadline:

no later than the actual date of deregistration. All necessary certificates and documents are submitted to the Federal Tax Service at the place of residence of the individual entrepreneur and location of the company.

Deadline

The taxpayer must submit a form containing data on the number of personnel on the average list for the previous calendar year to the tax office:

- in the standard case - no later than January 20 of the current year. It turns out that the report for 2021 must be submitted by 01/20/2019. But since January 20, 2021 is a Sunday, the last day of delivery is January 21, Monday;

- in case of registration of a new company, the form must be submitted no later than the 20th day of the month following the month of creation of the company (Article 80 of the Tax Code of the Russian Federation). For example, if an organization was founded in January 2020, then the accountant must submit KND form 1110018 for the first time no later than February 20, 2021.

- When liquidating an organization or closing an individual entrepreneur, the completed report is submitted no later than the actual date of deregistration.

Reorganization: when to submit the average headcount of a newly created organization

There is no concept of a “newly created organization” in Russian legislation. But in practice, these also include companies that have been re-registered as a legal entity. For example, after reorganization.

Such enterprises also submit a certificate about the number of employed employees. For a newly created organization, the deadline for submitting the average number of employees is

– no later than the 20th day of the month following the month of opening.

EXAMPLE

Situation During the reorganization of Guru LLC on February 6, 2021, Guru-M LLC was separated from its composition. At the same time, the first company continued to exist. And the new company hired 13 people. When to submit the average headcount of a newly created organization

?

Decision The management of Guru-M LLC must submit information no later than March 20, 2021. If up to this point the number remains the same, the document indicates - 13.

"Separates"

Branches, representative offices, etc. are geographically remote from the parent company and are equipped with stationary workstations. They perform part of the tasks of the main organization. This is the main difference between the separate units. What are the deadlines for submitting information on the average number of employees?

for similar structures?

So: data is not submitted separately for each branch or other division. They are accumulated by the parent organization. Based on the collected information about personnel, it calculates the indicator and then submits uniform information to the Federal Tax Service.

Fines for violating the deadline for submitting information on the average headcount in 2020

It is necessary to pay attention to the fact that January 20 in the accountant’s calendar is not only information about the average number of employees. This is also a 4-FSS calculation (for those who submit a report to the fund in paper form), a log of received and issued invoices and a UTII declaration for the 4th quarter of 2021 (or a single simplified reporting for 2021). Therefore, in order to meet the deadline for submitting headcount information, you should report immediately after the New Year holidays.

For failure to submit information on the average headcount in 2021 within the period established by the Tax Code of the Russian Federation, a fine of 200 rubles is provided (clause 1 of Article 126 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated 06/07/11 No. 03-02-07/1-179).

In this case, the head of the organization may be fined 300-500 rubles for failure to submit numerical information (Article 15.6 of the Code of Administrative Offenses of the Russian Federation).

Learn more about liability for failure to provide information on time in the video.