What you need to know about salary reporting

First, the reporting period for which you will submit salary information for your employees. The tax office requires annual reporting regarding deductions. The accountant fills out a special form 2-NDFL or 3-NDFL.

Secondly, it is necessary to accurately enter data into the salary reporting form and monitor changes in the Legislation of the Russian Federation. In order to avoid fines and reprimands from the tax service, it is necessary to carefully consider the new regulations and immediately adjust the reporting documents.

Reporting on personal income tax to the Federal Tax Service

When submitting one or another salary report, you must have all the information about the deadlines for its submission, as well as about the features in the certificate.

A sign is a conditional code that allows fiscal authorities to find out all the necessary information about amounts, the number of payers and other important indicators, for example, debt. Speaking about the reporting that is submitted to the Federal Tax Service, it makes sense to focus on the fact that it must be submitted before April 1 with sign 1, and no later than March 1 with sign 2.

The characteristics are indicated at the top of the certificate, in a special column. One is the code of the person from whose salary deductions are made, and two is the taxpayer code.

Calculation according to form 6-NDFL

Calculation using Form 6-NDFL is valid from the beginning of 2021. It must be submitted to all organizations that have hired employees. Completing salary reporting in this form does not eliminate the need to fill out 2-NDFL, in contrast to which, 6-NDFL applies to the entire organization as a whole. This type of document is also submitted to your Federal Tax Service. Please note that a new form has been approved since 2021, a sample of which can be downloaded from the official websites.

The calculation must be submitted four times a year, and the data must be presented in an accrual form:

| The reporting month | Deadline |

| For 2021 | 01.04.2019 |

| For the 1st quarter of 2021 | 30.04.2019 |

| For the first half of 2021 | 31.07.2019 |

| For 9 months of 2021 | 31.10.2019 |

| For 2021 | 01.04.2020. |

Reporting on insurance premiums to the Federal Tax Service

Reporting on insurance premiums is provided for all employers whose organizations employ employees. KND 1151111 is a new form that is approved for reporting. The form must record information about the individual himself, as well as information about the payer of the contribution, his obligations and personalized information about officially insured persons.

Data on accrued contributions and amounts paid must be reflected in the DAM on an accrual basis. In this case, the report is required to be submitted after every 3 months on the 30th day.

Deadlines for submitting calculations for insurance premiums in 2019:

| The reporting month | Deadline |

| For the 1st quarter of 2021 | 30.04.2019 |

| For the first half of 2021 | 30.07.2019 |

| For 9 months of 2021 | 30.10.2019 |

| For 2021 | 30.01.2020 |

Since 2021, there have been quite a few innovations in the procedure and rules for submitting salary reports. Officials introduced new forms, for example, they updated the DAM form for the 1st quarter and subsequent periods of 2020. Some deadlines for submitting wage reports have also been updated (annual 6-NDFL and 2-NDFL). The adjustments also affected the reporting procedure. Individual reports will be combined altogether. For example, a law was adopted on the merger of 6-personal income tax and 2-personal income tax, the DAM and information on the average number of employees. Consequently, new forms will also be approved.

Things to consider when submitting reports in 2020:

- New procedure for submitting reports to the Federal Tax Service. If the company has 10 or more employees, reporting must be done electronically. Innovations affected reporting on personal income tax and insurance premiums. In addition, there are innovations for organizations with separate divisions.

- The deadline for filing 2-NDFL has been reduced by a whole month. Previously, reporting on income from which personal income tax was withheld was submitted before April 1. Now 2-NDFL certificates with all the characteristics of a taxpayer are submitted before March 1 of the year following the reporting year. For 2021 - until 03/02/2020, since March 1 is a Sunday.

- A new deadline has also been set for 6-personal income tax. For reporting for 2021, you will have to submit your calculations by 03/02/2020 (March 1 - Sunday).

- The DAM report form has been updated. You will have to use the new form when filling out information for the 1st quarter of 2021. The old form will not be accepted. The changes in form are minor and more of a technical nature.

For ease of use, all documents are grouped into folders in the following sections:

— Reporting for 2021.

- December salary and annual bonuses in salary reporting;

- 6-NDFL for the year;

- 2-personal income tax for the year;

- RSV for the year.

— Changes 2021.

— Reporting for the first quarter of 2021.

- 6-NDFL for the first quarter of 2021;

- DAM for the first quarter of 2021.

— Features of calculating insurance premiums.

— Features of personal income tax calculation.

The most important and interesting points have been bookmarked.

Thematic selection “Salary reporting for 2019. New in reporting for the 1st quarter of 2021" will allow:

— will significantly save a specialist’s time on studying changes regarding the taxation of personal income tax and insurance contributions for various employee benefits;

— will help you take into account the requirements of tax legislation and submit reports in accordance with them, which means avoiding fines.

- will help to competently organize work in the “salary taxes” section, and then an unscheduled audit by the tax authority will not be scary.

Reporting on the number of employees

The average headcount is an indicator that is familiar to entrepreneurs and owners of enterprises that employ hired workers. If you are an individual entrepreneur and you do not have employees with an employment or agency agreement, reporting will not be required.

Taxpayers with 100 employees or fewer can choose between electronic and paper filing.

In addition, the number affects the right to apply special tax regimes. For example, for simplification, the average number cannot exceed 100 people, and for PSN - 15 people.

The number must be reported annually, including when it does not change compared to the previous year.

| Organization status | Deadline |

| Current individual entrepreneurs and organizations for 2021 | Until January 20, 2021. |

| Newly created organizations | No later than the 20th day of the month following the month in which the organization was created. |

| Upon liquidation of an organization or closure of an individual entrepreneur | No later than the official date of liquidation of the organization or closure of the individual entrepreneur |

The fine for violating the deadline for submitting the SCR is 200 rubles. They may also additionally fine the chief accountant or the head of the organization in the amount of 300 to 500 rubles. There is no penalty for providing incorrect information.

Other employer reports

Reporting income and personal income taxes is not the only responsibility of an employer.

There are other reports:

- For hired employees, in addition to personal income tax, it is mandatory to pay insurance premiums, and therefore to report on them. To do this, within 30 days after each quarter, a calculation of insurance premiums is sent to the Federal Tax Service.

- In order for the state to track working pensioners, all employers must submit a report to the Pension Fund in the SZV-M form and include not only pensioners, but all their employees with whom labor relations or service contracts have been formalized. Deadline: until the 15th of every month.

- To generate data on the length of service of employees, the SZV-STAZH form is provided. It will be handed over to the Pension Fund starting in 2021. Deadline: March 1st. In addition, SZV-STAZH is formed every time an employee retires. In such cases, only the data of the departing pensioner is included in the report.

- Accident insurance contributions are reported quarterly to the Social Insurance Fund. Form 4-FSS is submitted quarterly within 20 days after the reporting quarter, electronically - within 25 days.

In addition, all organizations and individual entrepreneurs that use hired labor send information about the average number of employees to the Federal Tax Service by January 20 of each year.

Reporting on the number of employees

The average headcount is an indicator that is familiar to entrepreneurs and owners of enterprises that employ hired workers. If you are an individual entrepreneur and you do not have employees with an employment or agency agreement, reporting will not be required.

Taxpayers with 100 employees or fewer can choose between electronic and paper filing.

In addition, the number affects the right to apply special tax regimes. For example, for simplification, the average number cannot exceed 100 people, and for PSN - 15 people.

The number must be reported annually, including when it does not change compared to the previous year.

| Organization status | Deadline |

| Current individual entrepreneurs and organizations for 2021 | Until January 20, 2021. |

| Newly created organizations | No later than the 20th day of the month following the month in which the organization was created. |

| Upon liquidation of an organization or closure of an individual entrepreneur | No later than the official date of liquidation of the organization or closure of the individual entrepreneur |

The fine for violating the deadline for submitting the SCR is 200 rubles. They may also additionally fine the chief accountant or the head of the organization in the amount of 300 to 500 rubles. There is no penalty for providing incorrect information.

Salary reporting to the Federal Tax Service

Salary reporting is submitted taking into account the new form approved in 2021. You can download it from official sources. In order to avoid fines, pay attention to the deadlines for submitting this documentation.

| The reporting month | Deadline |

| For the 1st quarter of 2021 | 30.04.2019 |

| For the first half of 2021 | 30.07.2019 |

| For 9 months of 2021 | 30.10.2019 |

| For 2021 | 30.01.2020 |

Salary reporting to the Pension Fund of Russia

Salary reporting to the Pension Fund of the Russian Federation is submitted in two forms. The SZV-M form requires the submission of documentation by the 15th day of the month following the reporting month. It is filled out every month for those employees who are employed by the company on the basis of an employment or civil contract. If the company has more than 25 employees, the form must be filled out electronically. Completing salary reporting can be done quickly and without wasting time - for this you can use online services or the help of a specialist from an outsourcing company.

The SZV-STAZH form is submitted by the specialist before March 1 of the year following the reporting year. It is important to know that the form is submitted even if no payments have been made.

These reports are mandatory due to the fact that thanks to them, the fund monitors the work of pensioners (and limits indexation) and learns all the information about the length of service of the insured persons. It is on the basis of these data that the pension will be formed.

Reports to the Pension Fund must be submitted within the following deadlines:

| Reporting type | For what period is it represented? | Deadline for submission to the Pension Fund |

| Information about insured persons in the Pension Fund (SZV-M) | For December 2021 | No later than 01/15/2019 |

| For January 2021 | No later than 02/15/2019 | |

| For February 2021 | No later than 03/15/2019 | |

| For March 2021 | No later than 04/15/2019 | |

| For April 2021 | No later than 05/15/2019 | |

| For May 2021 | No later than 06/17/2019 | |

| For June 2021 | No later than 07/15/2019 | |

| For July 2021 | No later than 08/15/2019 | |

| For August 2021 | No later than September 16, 2019 | |

| For September 2021 | No later than 10/15/2019 | |

| For October 2021 | No later than 11/15/2019 | |

| For November 2021 | No later than December 16, 2019 | |

| For December 2021 | No later than 01/15/2020 | |

| Information about the insurance experience of the insured persons (SZV-STAZH) | For 2021 | No later than 03/01/2019 |

| For 2021 | No later than 03/02/2020 | |

| Information on the policyholder transferred to the Pension Fund for maintaining individual (personalized) records (EFV-1) | For 2021 | No later than 03/01/2019 |

| For 2021 | No later than 03/02/2020 |

“1C-Reporting” in “1C: Salaries and personnel of a government institution”: overview of opportunities

For accountants, the time for submitting 9-monthly reports to the tax authorities, the Pension Fund and Rosstat is approaching. The 1C: Salaries and Personnel of a Government Institution program has a built-in 1C-Reporting service, which allows you to submit reports and other types of documents via the Internet.

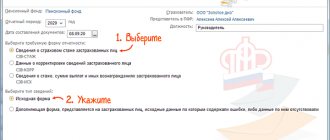

Window of the program “1C: Salaries and personnel of a government institution” - tab “Reporting and certificates”

Salary reports in 2021 are submitted to several departments at once. Let's consider the formation of documents in “1C: Salaries and personnel of government institutions” in more detail. In order to report the salaries of company employees to the Federal Tax Service, the accountant must provide:

- quarterly reporting form 6-NDFL, which indicates information on employee income and calculated and withheld amounts of personal income tax (NDFL) for the reporting period;

- unified calculation of insurance premiums.

Reporting on Form 6-NDFL for nine months must be submitted to the tax office by October 31, 2021. If the number of company employees exceeds 25 people, reporting is submitted only in electronic form. For untimely or incorrect provision of information, fines are provided: 1 thousand rubles and 500 rubles, respectively. Collection can be avoided if you provide a corrective certificate before the inaccuracy is noticed by the Federal Tax Service.

Calculation of insurance premiums is submitted to the tax office by all LLCs and individual entrepreneurs based on the results of the first quarter, first half of the year, nine months and calendar year. You must report by October 30, 2021, including data on pension contributions, social and health insurance contributions for employees.

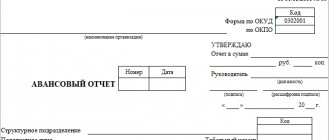

Report form 6-NDFL in “1C-Reporting”

To submit nine-monthly reports, the Pension Fund of the Russian Federation (PFR) is provided with the SZV-M form, which helps the state track working pensioners. The SZV-M calculation is submitted monthly within 15 days after the reporting month. Reporting for September 2021 is due by October 15, 2018.

Types of reporting forms for individuals in 1C-Reporting

The Social Insurance Fund is required to send the 4-FSS calculation based on the results of the quarter, six months, nine months and year. To submit nine-month reports on time, Form 4-FSS must be provided:

- in paper form – until October 20, 2021;

- in electronic form – until October 25, 2021.

Report form 4-FSS in “1C-Reporting”

It is also necessary to submit financial statements to Rosstat. For state and municipal institutions operating in the social and scientific spheres, officials have provided special forms for statistics: information on the number and remuneration of workers in various fields by personnel categories - salary-education, salary-science, salary-health, salary-social, salary -culture.

So, “1C-Reporting” allows you to:

- maintain correspondence with the Federal Tax Service, Pension Fund, Rosstat;

- make reconciliations with the Federal Tax Service;

- make reconciliations with the Pension Fund;

- send documents at the request of the Federal Tax Service and receive various notifications from the Federal Tax Service;

- certify electronically personal accounting information previously transferred to the Pension Fund on paper;

- check online for accuracy of reports;

- send reports generated in third-party programs to regulatory authorities.

“1C” constantly makes changes to the program so that all reporting complies with legislation and improvements for the convenience of users. For example, on September 12, the release “1C: Salaries and personnel of a government institution” 3.1.7.128 was released. In terms of taxes, it implements automatic completion of the 6-NDFL title page at the location for separate divisions and for the largest taxpayers.

In addition to sending all types of reporting established by law and built-in checks for the correct completion of reports, 1C-Reporting supports various types of information interaction and exchange of documents with the listed regulatory authorities.

Salary reporting to the Social Insurance Fund

In 2021, legal entities with employees will have to report to the Social Insurance Fund four times - submit report form 4-FSS based on the results of 2021, the first quarter, half a year and nine months. Salary reporting to the Social Insurance Fund is provided electronically or in paper form .

| Reporting period | On paper | Electronic |

| For 2021 | Until January 21, 2019 | Until January 25, 2019 |

| For the first quarter of 2021 | Until April 22, 2019 | Until April 25, 2019 |

| For the first half of 2021 | Until July 22, 2019 | Until July 25, 2019 |

| For 9 months of 2021 | Until October 21, 2019 | Until October 25, 2019 |

| For 2021 | Until January 21, 2020 | Until January 25, 2020 |

Reporting to the Social Insurance Fund in 209: what's new?

Since January 1, 2021, the 4-FSS report has not changed in any way (when compared with the 2021 version of the form). Therefore, we can say with confidence that in 2021 the “old” form 4-FSS will be used. The procedure for filling it out is prescribed in the Order of the Social Insurance Fund dated September 26, 2016 No. 381 and as amended by the Order dated June 7, 2017 No. 275. The only thing is that in the new form, entrepreneurs need to indicate the code only according to the OKVED2 classifier. The level of insurance premiums in 2021 remains the same - 30%, but benefits are canceled from 01/01/19.

Deadline

6-NDFL is submitted 4 times a year.

Based on the results of the first quarter, half a year and nine months - within a month after the end of the reporting period.

At the end of the year - until April 1.

6-NDFL, just like 2-NDFL, can be submitted in paper form only if information is submitted for 24 or fewer people. If more, the form will only be accepted electronically.

Is it necessary to generate salary reports if there were no payments during the reporting period? No no need. Zero salary reports are not provided. But if you have employees, and you have previously submitted salary reports, for peace of mind it would not hurt to contact the tax office and send them an explanation of why you are not submitting anything this time (for example, because all employees are on administrative leave).

Filling out 6-NDFL quickly and without errors in the “My Business” online service

The service will remind you of deadlines, take into account all the nuances of filling out, generate, check and send reports.

Get free access

Salary reporting to Rosstat

Forms are submitted to Rosstat, which must be completed by certain dates established by the Legislation of the Russian Federation. P-4 - every month, no later than the 15th day of the next month, P-4 (NZ) - every quarter, no later than the 8th day of the month following the reporting month. 1-T (professional) - until November 28, 1-T (working conditions), 1-T - no later than January 20 of the year that follows the reporting period (year). 3-F is submitted every month before the 2nd day of the month following the reporting period.

Rosstat has updated reporting forms for labor and wages (order No. 404 dated July 15, 2019). The following reports have been changed:

- P-4 “Information on the number and wages of employees”;

- P-4 (NZ) “Information on underemployment and movement of workers”;

- 57-T “Information on wages of employees by profession and position”;

- 1-T “Information on the number and wages of employees”;

- 1-T (working conditions) “Information on the state of working conditions and compensation for work with harmful and (or) dangerous working conditions”;

- 3-F “Information on overdue wages”;

- 1-Z “Labor Force Sample Survey Questionnaire”;

- 1-PR “Information on the suspension (strike) and resumption of work of labor collectives”, etc.

All forms will begin to apply in 2021. The exception is form 57-T. It will need to be submitted on a new form by November 29, 2019. Let us remind you that this report is submitted every two years as of October 1. Employers included in the Rosstat sample must submit it.

Do you have any questions about completing salary reporting? Contact us in any convenient way.

Salary reports into statistics

Employers submit the following salary forms to the statistical authorities:

- P-4 - monthly, until the 15th day of the month following the reporting month;

- P-4 (NZ) - quarterly, until the 8th day of the month following the reporting period;

- 1-T, 1-T (working conditions) - until January 20 of the year following the reporting year;

- 1-T (professional) - with the highest probability (more on this later in the article) until November 28;

- 3-F - monthly, until the 2nd day of each month following the reporting month.

Please note that for small and medium-sized enterprises, these reports are required only if the enterprise is included in the Rosstat sample. You can find out whether an economic entity is in the sample using a special service on the website of this department - https://statreg.gks.ru/.