The labor exchange is a government agency that acts as an intermediary between employers and employees free of charge. Any applicant has the right to register at the labor exchange and receive official unemployed status if he is looking for a job for the first time (age 16 years or older) or changes it after being fired for various reasons.

What does registering with an employment center give citizens?

- Firstly, the right to receive severance pay in the amount of one month’s salary during the period until he finds a new place of work;

- Secondly, for the payment of unemployment benefits, the amount of which depends on the amount of wages received by the unemployed at his last place of work.

Dismissal at one's own request does not exclude the possibility of registration at the labor exchange (Article 30 of the Labor Code of the Russian Federation).

Registration at the employment center upon dismissal of one's own free will also provides for the payment of benefits until the employee finds a new place of employment. In this case, the accrual of payments begins from the moment the applicant registers at the labor exchange.

There is an important condition for paying benefits for those who quit on their own initiative: they must work in their last place officially (based on an employment contract), and also provide a salary certificate for the last three months to the employment center. In this case, the amount of payments will depend on the length of work experience and the amount of remuneration.

If it turns out that the applicant has an unclaimed specialty, then the employees of the Employment Center have every right to send him for retraining as part of free courses so that the specialist becomes a significant personnel at the labor exchange.

After registration, a citizen must confirm his or her unemployed status twice a month. This allows him to retain his benefits, continue training through free courses and continue to receive payments from his previous employer.

In what cases is unemployment benefit paid?

Important! Not every unemployed citizen is entitled to receive unemployment benefits - certain conditions must be met.

A candidate for receiving benefits from the Employment Center must meet the following conditions:

- The citizen should not have an official place of employment at the time of applying for benefits.

- No state or regional payments such as scholarships, benefits, or pensions should be issued.

- The applicant must have reached the age at which the law allows employment.

- A person must register as unemployed with the Employment Service at their place of residence.

- There should not be any reasons for refusing to assign a benefit or for stopping its accrual.

How to join the labor exchange: step-by-step instructions

You can register as unemployed not only at the Employment Center itself, but also through the MFC. This is necessary to receive benefits. If a citizen does not plan to receive payments, but wants to be provided with information about vacancies, he can use the electronic service for registration, if one is provided on the CZN website.

How does the registration procedure work at the Employment Center:

- An applicant for unemployed status pre-registers for an appointment through the official website of the labor exchange. Here you can choose a convenient date and time. You can come without an appointment, but then there is no chance that you will be accepted as quickly as possible.

- On the appointed day, the citizen comes to the CZ with a package of documents.

- Within 10 days, the head of the government agency makes a decision to assign the citizen the status of unemployed.

- Based on the results on the 11th day, the applicant is given a decision to establish status and grant benefits, and a personal file is also created.

Expert commentary

Gorchakov Vladimir

Lawyer

If the benefit is issued through the MFC, the step-by-step algorithm looks the same. The only difference is in the pre-registration procedure: it is also available through the MFC website, but upon arrival at the department, the applicant will have to take a coupon from the terminal. Sometimes you have to wait a few minutes for your turn, but the appointment is usually carried out no later than the appointed time.

Documentation

When visiting an Employment Center or MFC, a citizen is provided with:

- passport;

- educational documents;

- employment history;

- certificate of average earnings for the last 3 months of employment.

Disabled people will need an individual rehabilitation program received at a medical institution after passing a commission, because the choice of place of work must take into account the recommendations of specialists.

After receiving the documents, the Employment Center employee will ask the applicant to sign the notification, which will indicate the date of readiness of the decision - no later than 11 days from the date of receipt of the application.

How to make an application for registration

A blank application form is issued to the applicant at the time of submitting documents to the Employment Center. To fill out you will need the following information:

- FULL NAME. applicant;

- gender, date of birth, registered address;

- phone number;

- education;

- year of graduation and name of educational institution;

- qualification;

- position and length of service;

- additional qualifications and skills;

- conditions at the last place of work: salary, position, period and nature of work.

The applicant's signature is placed at the end of the document.

Where to apply for unemployment benefits

Important! The status of unemployed in the Central Employment Center will not be assigned on the day of application - specialists will need about 10 days to make a decision on assigning the status of unemployed or refusing to assign it.

In order to be able to receive unemployment benefits until employment (or for a shorter period - in cases specified by law), you must first of all contact the regional Employment Center and register as unemployed - this is how the person is assigned the appropriate official status.

Reasons for refusal

Only citizens who have received official unemployed status can receive cash unemployment assistance. The assignment of such status will be denied to persons who have not reached the age of 16, persons of retirement age (women - 55 years old, men - 60 years old).

Also, the official status of unemployed cannot be assigned to persons who do not come to the next appointment at the Central Work Center within 10 days from the date of submission of documents. If during the inspection it turns out that a citizen has been sentenced to imprisonment or forced labor, or has provided false information about himself, he will be denied registration and payment of benefits.

Important! Lack of registration at the place of residence, as well as a lack of funds from the approved employment fund, cannot be a reason for refusing to pay benefits.

For how long are unemployment benefits paid?

Important! To ensure that the central worker does not cancel the payment of benefits, you must regularly check in, go to interviews, agree to community service or training courses.

Unemployment benefits are paid to a citizen for 1 calendar year from the date of application to the Employment Center, but the amount of payment decreases every few months. If a job has not been found within a year, you need to apply for a repeat payment period - for another 1 year. This time the minimum possible benefit is assigned. The payment period cannot be extended a third time.

In the following cases, the benefit is paid only for six months, and it is not possible to extend the payment period:

- a person is looking for a job for the first time in his life;

- the citizen has not worked for more than 1 year after his last dismissal, and has now decided to resume the labor process;

- the applicant worked for the last employer for less than 26 weeks;

- the person was fired due to a violation of the provisions of the Labor Code of the Russian Federation;

- the citizen quit his job without good reason and of his own free will;

- The applicant was expelled from the training courses, which he had attended at the insistence of a CZN employee, for any misconduct.

Procedure

There are usually no difficulties in the process of filing, but it requires knowledge of many legal features.

The first step is to decide on the location of the Employment Center. It must be in your locality. Next, you need to prepare a complete package of documents.

What actions need to be taken when registered at the labor exchange:

- Confirm your unemployed status. This needs to be done every 2 weeks. The employment center sets the exact date and time of the applicant’s visits. If the latter does not show up on time, his payments will be reduced. If this point is systematically ignored, he will be deprived of benefits.

- Attend interviews. The main goal of the Employment Center is to find jobs for job seekers in the shortest possible time. Therefore, the applicant will be regularly called for interviews for suitable vacancies. From the moment the labor exchange is notified of the vacant position, the applicant can undergo an interview at the specified location within 3 days.

- Deadline. It is advisable for the employee to find a new job within 12 months. Either from those vacancies that the labor exchange offers him, or on his own. If in the first year he was unable to do this, then in the second year he will be regarded as a person suitable for any vacancy without experience, qualifications or education.

- Special situations. When registering with the Employment Center for a person with disabilities, a special rehabilitation program is applied to him, taking into account the specific working conditions for this citizen.

The optimal action would be to register with the Employment Center in the first month after dismissal. This gives an advantage. The applicant will receive not only unemployment benefits, but also compensation from the employer.

The work of the labor exchange in general looks something like this:

- The Center's employees are looking for vacancies that match the qualifications and work experience of the applicant.

- After finding and collecting several options, the applicant is given information about them and assigned a place and time for the interview.

- A possible employer evaluates the applicant and sends it to the Employment Center.

It happens that an applicant is not hired due to missing skills and abilities. Then the labor exchange redirects him to retraining and training.

In what cases will unemployment benefits be suspended?

In some cases determined by current legislation, the accrual of benefits may be terminated or suspended. Such situations include:

- the citizen finds a job and officially settles in a new place;

- an unemployed person moves to another subject of the Russian Federation (he will have to register again at his new place of residence);

- the unemployed person is assigned a pension benefit;

- a citizen goes to prison;

- the unemployed person refuses the job offered at the Labor Center several times, does not go to interviews scheduled for him, refuses to undergo retraining, or free training courses (benefits are not paid for 3 months).

What documents will be needed to register with the Employment Center?

Important! Providing a certificate of income from your last place of work to the Employment Center is mandatory, since it is on the basis of information from this document that unemployment benefits are calculated.

To register with the labor exchange, you need to prepare a set of documents, including:

| Document | Clarification |

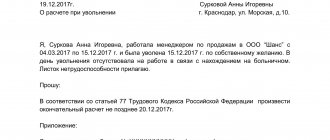

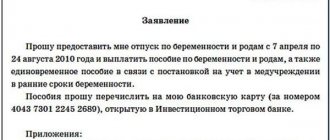

| Application for registration with the Employment Center | View sample application |

| Russian passport | Photocopy and original |

| Employment history | Original and photocopy (not certified, regular) |

| Certificate from the accounting department for the last place of work | Indicating the amount of average monthly income for the previous 3 months |

| Various documents proving the presence of specialized education, qualifications (or rank) | Diploma, certificate, certificates, etc. |

What errors and difficulties are possible?

In the process of assigning unemployed status and calculating benefits, a citizen may encounter some difficulties and make a number of mistakes.

The fundamental document for registration with the Central Employment Center is a certificate of the applicant’s average earnings at the place of work. The document is drawn up in the form proposed by the Ministry of Labor in letter No. 16-5/B-421 dated August 15, 2016, or in a free format within 3 days from the moment the employee submits an application (Article 62 of the Labor Code of the Russian Federation).

For help, the employee must contact:

- to the accounting department, if the company has a full-time accountant;

- to the manager in the absence of an accountant.

To receive benefits, you must contact the Central Employment Service no later than 10 days from the date of registration in order to find a job, and also no later than the deadline established for periodic re-registration.

Thus, if you resign at your own request, in order to register for unemployment, you must contact the Employment Center at your place of registration , submit a package of documents with a certificate of average earnings and wait for the application to be reviewed within 11 days.

The decision to accrue benefits is made simultaneously with the assignment of unemployed status. In the future, it is necessary to comply with the requirements of the law and the Employment Center in order to avoid the risk of suspension or termination of benefit payment.

Unemployment benefits upon voluntary dismissal

Depending on whether the dismissal by personal will occurred for good reasons or not, a minimum or increased benefit will be accrued. Good reasons for leaving work include the following cases:

- An employee who left her job is raising a child under 14 years old.

- I had to leave my job because it became impossible to work after an emergency at work.

- The employer violates the terms of the contract (individual or collective).

- The employee had to quit his job in order to look after and care for a seriously ill family member (including group I disabled people), for whom there was no one else to look after.

- The employee received an illness or injury, which made it impossible to continue his usual work activity (or he had to move to a more favorable area in terms of living conditions).

- The employee had to move to a permanent place of residence in another subject of the Russian Federation (this category also includes spouses of military personnel transferred to another region).

Termination of employment relations at one's own request

The most common situation in the labor market. The registration procedure at the Employment Center after dismissal on your own initiative can be completed at any time.

The amount of unemployment benefits will be determined based on your salary from your previous employer and the deadline for filing documents. If it exceeded one year from the date of dismissal or the period of work at the previous place was less than 26 weeks, you will receive a minimum benefit amount of 1,500 rubles.

If an unemployed person wants to maintain the continuity of his work experience, then there is one caveat: he should contact the labor exchange no later than two weeks following the day of termination of the employment relationship.

Konstantin Frolov

Lawyer, ready to answer your questions. Ask a lawyer a question

If you need

a free consultation on payment of benefits, or you do not agree with its amount, contact our experienced lawyers by phone or through an online consultant. They will answer your questions and offer solutions.

Calculation example

Citizen Vasiliev worked at the company for 18 months until he quit of his own free will due to the need to care for his seriously ill wife. Vasiliev’s salary was 32,000 rubles per month throughout the entire period of employment. He registered with the Center for Labor Protection, and the benefits were calculated for him:

- For the first 3 months, Vasiliev will receive 4,900 rubles per month, since the benefit calculated based on the income of the last employer would exceed the established maximum: 32,000 rubles. x 75% = 24,000 rubles.

- For the next 4 months, the benefit will also be 4,900 rubles, for the same reason: 32,000 rubles. x 60% = 19,200 rubles.

- For the remaining 5 months, the benefit will be accrued in the same amount - 4,900 rubles: 32,000 rubles. x 45% = 14,400 rub.

- Vasiliev did not find a job in the first year, which means that for the next 12 months he will be paid 850 rubles per month (the minimum allowance).

How much pay?

Payments at the labor exchange upon dismissal at will depend on various factors:

- Do you have work experience?

- how many months of continuous work experience at the last place of work;

- whether they were fired under an article, due to a disciplinary offense, etc.

Payments in all branches of employment centers are made according to the principle:

- The first 3 months at the labor exchange - 75% of the average earnings from the previous place of work.

- For the next 4 months, the benefit amount will not exceed 60% .

- Over the next 5 months, the maximum amount will reach 45% .

Each district has the right to pay supplements to payments at the discretion of local governments.

Taking into account all allowances, the amount will not exceed the norm established by law:

- The minimum assistance in cash equivalent is 850 rubles;

- The maximum allowance you can receive at the employment center is 4,900 rubles. There are no plans for changes in the amount of payments for 2021.

Expert opinion

According to experts from the Employment Center, if a citizen is dismissed on his own initiative without valid reasons, he can only count on unemployment benefits in the minimum amount. If there is documentary evidence of the fact that voluntary dismissal occurred for a good reason, a much more significant benefit in amount is assigned:

- 75% average monthly income for the last 3 months during the first 90 days after registration with the Central Tax Service;

- 60% the same amount for the next 120 days;

- 45% the same amount until the end of the payment period.

Every year the Government sets the minimum and maximum benefit amounts, and these values should also be taken into account. It should also be remembered that only official income minus insurance and tax payments is taken into account when calculating the benefit amount.

Amount of payment at the employment center and deadline for receipt

Cash benefits are awarded to registered citizens who were dismissed on their own initiative (by agreement of the parties) and who provided the required documents when registering. The amount of cash payments is calculated based on the person’s average earnings for the last 3 months. This calculation procedure applies only to those citizens who were officially employed during the last year.

If the applicant does not have work experience, is employed for the first time or wants to start working again after a year, then the amount of the benefit will be minimal.

Persons who quit of their own free will have a guaranteed right to receive benefits. But such rules do not apply to the category of persons who were forced to resign for good reasons. Such circumstances include:

- moving to another region or republic for permanent residence;

- presence of an officially confirmed diagnosis prohibiting work in certain conditions;

- the need to care for a sick relative;

- violation of labor laws by the employer;

- impossibility of performing a labor function due to an emergency situation at the place of work;

- a woman raising a child under 14 years of age on her own.

Such persons may receive larger benefits. To do this, you must present an official document, according to which confirmation of a valid reason is made.

If an employee is dismissed with a valid reason, the amount of his payments will be 75% of the average earnings for the past year , will be transferred within 3 months. Gradually, the benefit amount will decrease to 60% and ultimately amount to 45%.

It should be taken into account that the law provides for a minimum benefit threshold; it cannot be lower than the minimum wage established by the Government of the Russian Federation. Although in some republics there are compensations and bonuses for such benefits.

Legislative acts on the topic

| Federal Law of April 19, 1991 No. 1032-1 | About employment |

| Decree of the Government of the Russian Federation of November 24, 2017 No. 1423 | On the amounts of minimum and maximum unemployment benefits |

| Decree of the Government of the Russian Federation of September 7, 2012 No. 891 | The procedure for registering the unemployed in the Employment Center |

| Resolution of the Ministry of Labor of the Russian Federation dated August 12, 2003 No. 6221 | Procedure for calculating the amount of unemployment benefits |

How much do they pay after dismissal at the labor exchange?

Decree of the Government of the Russian Federation of March 27, 2021 N 346 “On the amounts of the minimum and maximum amounts of unemployment benefits for 2021” approved the minimum and maximum amounts of benefits for 2021:

- minimum – 1,500 rub. for all;

- maximum – 12,130 rubles. for people of pre-retirement age.

The detailed details of the calculation depend on the category of citizen. Minimum benefit in the amount of 1,500 rubles. is assigned as follows:

- first time job seekers;

- those trying to find a job after a long break - more than 1 year;

- who have ceased to be an individual entrepreneur;

- dismissed for committing guilty actions provided for in Art. 81 Labor Code of the Russian Federation;

- those who terminated employment contracts within 1 year, if the period of work at the previous place does not exceed 26 weeks;

- sent by the Central Employment Center to courses and other training, and expelled through their own fault;

- who did not provide a certificate of average salary for the last 3 months.

In connection with the pension reform, the highest possible payments have been established for persons of pre-retirement age. This was done in order to provide additional material support from the state, since after 50 years of age, finding a job can be problematic. Such persons are paid benefits in the following amount based on average earnings:

- first 3 months – 75%;

- from 4 to 8 months – 60%;

- further – 45%.

Let's look at an example calculation:

At the last workplace, the average income of a citizen for 3 months was 40,000 rubles. Registration was completed within two weeks from the date of voluntary dismissal. For the first three months he will be paid the following allowance: 40,000 x 75% = 30,000 rubles.

It can be seen here that the average monthly salary exceeds the maximum allowable benefit level, so only 11,280 rubles will be paid.

If the applicant quit for any reason, had an employment relationship with the employer for at least 26 weeks and applied to the Employment Center within 1 year after termination of the contract, in the first 3 months he will be paid 75% of the average monthly earnings for the last 3 months before dismissal, and the amount of the benefit decreases to 60%.

For example:

The citizen worked at the enterprise for 5 years; he does not belong to the category of persons of pre-retirement age. In 2021, he decided to resign of his own free will, and after his dismissal, he submitted an application to the Employment Center within 10 days. The average salary over the last 3 months was 20,000 rubles. How is the calculation made:

20,000 x 75% = 15,000 rub. This amount exceeds the maximum limit, so he will only be paid RUB 8,000.

Benefit payment terms

It is important to take into account that the benefit is not assigned for life, but for a certain period depending on the situation, after which payments stop:

| Dismissed for any reason within 12 months before registration, if the work activity in the company exceeded 26 weeks | Never officially worked, fired for wrongdoing, or worked less than 26 weeks |

| Total duration – 6 months for 1 year | 3 months in total for 1 year |

The maximum duration of receiving payments is 24 months. Benefits for more than 1 year are transferred only if the applicant complies with the rules established by the Central Employment Service:

- regular receipt of referrals without refusing vacancies;

- lack of official employment.

Common mistakes

Error: A citizen serving in the army after voluntary dismissal applies for unemployment benefits.

Comment: During conscription service, the payment of unemployment benefits is suspended, since the citizen is on government support.

Error: A woman who quit her job on her own initiative during pregnancy applies for unemployment benefits.

Comment: During maternity leave, a woman receives benefits at her place of work or, in case of dismissal, directly from the Social Insurance Fund or from social protection authorities. During this time, unemployment benefits are not paid.

Online employment center

Today, employment exchanges in large cities have their own websites on the Internet. You can get acquainted with the database of existing vacancies without leaving your home. But, alas, the Center’s employees register or issue job assignments only in the personal presence of the citizen. Registration via the Internet is not provided for such cases. The online service is convenient because you can always find out up-to-date information about when seminars, trainings, and job fairs take place. The labor exchange is the official government intermediary between the employer and the candidate. The Center’s employees can only provide a vacancy from the database they have, so for speedy employment, it is better to simultaneously contact recruitment agencies.