Mandatory payments upon dismissal

Upon dismissal due to liquidation of the organization or staff reduction, pay the employee:

- severance pay in the amount of average monthly earnings;

- average earnings for the period of employment, as a rule, no more than two months from the date of dismissal (including severance pay).

At the same time, keep in mind that there are restrictions on the amount of payments for managers (their deputies) and chief accountants of organizations in the authorized capitals of which the participation (shares) of the Russian Federation is more than fifty percent, as well as members of collegial executive bodies who have entered into employment contracts with these organizations.

The total amount of severance pay, compensation and other payments upon dismissal paid to these employees cannot exceed three times the average monthly salary. Therefore, if payments to such employees threaten to exceed the established amount, pay them in an amount that will not exceed the amount.

When determining the total amount, do not take into account the amount of the following payments:

- wages due to employees;

- average earnings retained when sent on a business trip, for off-the-job vocational training, and in other cases when the employee retains average earnings under labor legislation;

- reimbursement of expenses associated with business trips and relocation to work in another area;

- compensation for all unused vacations;

- average monthly earnings saved for the period of employment.

This procedure is established in Article 349.3 of the Labor Code of the Russian Federation.

How to calculate compensation paid not exceeding three times the average monthly salary

139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Resolution of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to paragraphs 4, 9 of the Regulations, the calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary (calculated period).

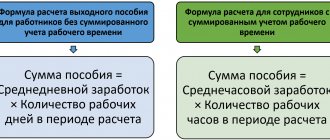

When determining average earnings, average daily earnings are used.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with clause 15 of the Regulations, by the number of days actually worked during this period.

In this case, the organization can calculate the average daily earnings in the specified order, but the multiplier “number of days (calendar, working) in the period subject to payment” for calculating the average earnings is missing, since there is no period itself subject to payment. After all, the organization does not pay the employee severance pay several months in advance after dismissal, but compensation upon dismissal by agreement of the parties without indicating any period for which it is paid.

And the above norms of paragraph 3 of Art. 217, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation also speaks of three (six) times the average monthly earnings, and not the average earnings for three (six) months after dismissal.

In other words, we are talking about the average monthly earnings of the dismissed employee, multiplied by three (six).

In our opinion, in this regard, the organization should calculate the employee’s average monthly earnings based on the average monthly number of working days in the billing period, and not the average earnings based on the number of working days in three months after dismissal.

The average monthly number of working days should be determined by dividing the number of working days in the billing period according to the production calendar of a five-day working week by 12.

Based on the foregoing, we believe that for the purposes of exemption from personal income tax and insurance contributions, compensation paid to an employee upon dismissal by agreement of the parties without indicating the period for which it is paid, an organization working on a five-day workweek schedule should calculate three times the employee’s average monthly earnings by dividing the wages actually accrued to him for the 12 months preceding his dismissal (payroll period) by the number of days actually worked during this period and multiplying the resulting average daily earnings by the average monthly number of working days in the payroll period and by three.

No votes yet.

Please wait…

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art. 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to clause

Calculation of severance pay

Calculate severance pay using the formula:

| Severance pay | = | Number of working days (hours) in the first month after dismissal (from the day following the day of dismissal) | × | Average daily (hourly) earnings |

Severance pay in the amount of average monthly earnings is the minimum limit. At the same time, the average monthly earnings of an employee who worked the full working hours during the billing period cannot be less than 1 minimum wage. After all, such a minimum is established for wages (Article 133 of the Labor Code of the Russian Federation).

Average earnings for the period of employment

The amount of average earnings for the period of employment depends on when the employee gets a job again:

- if he does not get a job within the first month after dismissal, then count his severance pay against the average earnings for the first month;

- if he does not get a job within the second month after dismissal, then pay him the average salary for that month;

- if he does not get a job within the third month after dismissal, then pay the average salary only if within two weeks after dismissal the employee applied to the employment service, but was not employed (confirmed by the decision of the employment service).

Thus, severance pay is paid for the first month after dismissal. In this regard, the average earnings for the period of employment for the first month after dismissal do not need to be calculated.

Calculate the average earnings for the period of employment for the second and third months using the formula:

| Average earnings for the period of employment for the second (third) month after dismissal | = | Number of working days (hours) in the second (third) month after dismissal (from the day following the end of the first (second) month) | × | Average daily (hourly) earnings |

Such rules for the payment of severance pay and average earnings for the period of employment upon dismissal in connection with the liquidation of an organization (reduction of staff) are provided for in Article 178 of the Labor Code of the Russian Federation.

Situation: is it necessary to pay a dismissed employee the average salary for the period of employment if he got a new job in the middle or at the end of the second month after dismissal?

Yes need. Proportional to the time during which the dismissed employee was not employed.

It is explained this way. Upon dismissal due to liquidation of the organization or reduction of staff, in addition to severance pay, the organization is obliged to pay the dismissed employee the average salary for the period of employment, not exceeding two months from the date of dismissal (in exceptional cases - three months). This is provided for by Part 1 of Article 178 of the Labor Code of the Russian Federation.

This means that in case of employment within the second month, the employer is obliged to pay the former employee the retained average salary. But only for those working days of the month during which this person did not work.

This position is adhered to by specialists from the Russian Ministry of Labor in oral explanations.

An example of paying average earnings for the period of employment. The employee started a new job in the middle of the second month after being fired

In the organization P.A. Bespalov works as a storekeeper, his salary is 20,000 rubles. per month. On January 12, 2015, he was fired due to the liquidation of the organization. Therefore, Bespalov is entitled to:

- severance pay;

- average earnings for the period of employment.

Bespalov's severance pay was paid on the day of his dismissal - January 12, 2015. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Bespalov's earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days.

Bespalov's average daily earnings were: 240,000 rubles. : 247 days = 971.66 rub./day.

In the first month after dismissal (from January 13 to February 12, 2015) there are 23 working days. The severance pay was: 23 days. × 971.66 rub./day = 22,348.18 rub.

The day after his dismissal, Bespalov registered with the employment service.

During the first month after his dismissal (from January 13 to February 12, 2015), Bespalov was unable to find a job. To maintain the average earnings for the first month after dismissal, the accountant offset the amount of severance pay paid in connection with the dismissal.

During the second month (from February 13 to March 12, 2015) after his dismissal, Bespalov got a new job. His employment date was March 2, 2015. The number of days during which Bespalov was listed as unemployed was 11 working days (from February 13 to February 27 inclusive), which is confirmed by the absence of entries in his work book. On March 2, he was paid the average salary for 11 working days. The amount of average earnings for the period of employment for the second month after dismissal was: 11 days. × 971.66 rub./day = 10,688.26 rub.

Situation: how to calculate the average monthly earnings for payment of severance pay, average earnings for the period of employment and compensation upon dismissal?

The legislation does not provide for a methodology for calculating average monthly earnings. For all cases of maintaining average earnings, a uniform procedure has been established for its calculation based on the average daily (hourly) earnings (Article 139 of the Labor Code of the Russian Federation). Therefore, when calculating the amount of severance pay, average earnings for the period of employment and compensation upon dismissal, it is necessary to use it. The different names that are used to determine the amount of payments cannot serve as a basis for using any other procedure.

For example, severance pay upon dismissal due to staff reduction (liquidation of an organization) must be paid in the amount of the employee’s average monthly earnings (Article 178 of the Labor Code of the Russian Federation). This means that the employee’s average daily (hourly) earnings must be maintained for a month after dismissal. Calculate compensation to an employee for early dismissal in proportion to the time remaining before the expiration of the notice period for termination of the employment contract (Article 180 of the Labor Code of the Russian Federation).

When a manager is dismissed by decision of the owner, he is paid compensation in the amount of three times the average monthly salary (Articles 181, 279 of the Labor Code of the Russian Federation, Resolution of the Constitutional Court of the Russian Federation of March 15, 2005 No. 3-P). In this case, compensation should be calculated based on the average daily (hourly) earnings and working days (hours) during the first month after dismissal (Article 139 of the Labor Code of the Russian Federation, clause 9 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922 ). Then it needs to be multiplied by three.

Situation: how to calculate the average earnings for the period of employment of a laid-off person if the organization has established a part-time working week?

Calculate your average earnings based on the number of working days in a month, focusing on the part-time working week calendar.

In this case, the general rule applies: to calculate the average earnings, you need to multiply the average daily earnings by the number of actual working days in the period for which payment is due (clause 9 of the Regulations approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922). There are no specific provisions in the law for cases where an organization establishes a part-time work week. Just pay for the number of working days per month, taking into account this operating mode.

An example of paying average earnings for the period of employment. The employee did not start a new job in the middle of the second month after being fired. After the dismissal, the organization switched to part-time work

A.V. Volkov worked as a storekeeper, his salary was 20,000 rubles. per month. On January 13, 2015, he was fired due to staff reduction.

After the dismissal (from January 14, 2015), the organization introduced a four-day working week.

In connection with his dismissal due to staff reduction, Volkov is entitled to:

- severance pay;

- average earnings for the period of employment.

Volkov’s severance pay was paid on the day of his dismissal – January 13, 2015. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Volkov’s earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days.

Volkov's average daily earnings were:

240,000 rub. : 247 days = 971.66 rub./day.

In the first month after dismissal (from January 14 to February 13, 2015), according to the four-day working week calendar, there are 18 working days. The severance pay was:

18 days × 971.66 rub./day = 17,489.88 rub.

Within two months after his dismissal, Volkov was unable to find a job, which is confirmed by his work book.

To maintain the average earnings for the first month, the accountant counted the paid severance pay.

In the second month (from February 14 to March 13, 2015), according to the four-day working week calendar, there are 14 working days. Average earnings for the second month were:

14 days × 971.66 rub./day = 13,603.24 rub.

An example of calculating severance pay and average earnings for the period of employment for an employee dismissed due to the liquidation of the organization

In the organization P.A. Bespalov works as a storekeeper, his salary is 20,000 rubles. per month. On January 12, 2015, he was fired due to the liquidation of the organization. Therefore, Bespalov is entitled to:

- severance pay;

- average earnings for the period of employment.

Bespalov's severance pay was paid on the day of his dismissal - January 12, 2015. To determine severance pay, the calculation period is the time from January 1 to December 31, 2014. Bespalov's earnings for this period amounted to 240,000 rubles. (RUB 20,000/month × 12 months). During the pay period he worked 247 days.

Bespalov's average daily earnings were: 240,000 rubles. : 247 days = 971.66 rub./day.

In the first month after dismissal (from January 13 to February 12, 2015) there are 23 working days. The severance pay was: 23 days. × 971.66 rub./day = 22,348.18 rub.

The day after his dismissal, Bespalov registered with the employment service.

During the first month after his dismissal (from January 13 to February 12, 2015), Bespalov was unable to find a job. To maintain the average earnings for the first month after dismissal, the accountant offset the amount of severance pay paid in connection with the dismissal.

During the second month (from February 13 to March 12, 2015) after his dismissal, Bespalov was also unable to find a job, which is confirmed by the lack of entries in his work book. Therefore, on March 13, 2015, he was paid his average salary. In the second month after dismissal (from February 13 to March 12, 2015) 18 working days. The amount of average earnings for the period of employment for the second month after dismissal was: 18 days. × 971.66 rub./day = 17,489.88 rub.

During the third month (from March 13 to April 12, 2015) after his dismissal, Bespalov was also unable to find a job, which was confirmed by the lack of entries in his work book and the decision of the employment service. Since he contacted the employment service in a timely manner, the organization is obliged to pay him the average salary for the period of employment for the third month after dismissal. Therefore, on April 13, 2015, Bespalov was paid his average salary. In the third month after dismissal (from March 13 to April 12, 2015) there are 21 working days. The amount of average earnings for the period of employment for the third month after dismissal was: 21 days. × 971.66 rub./day = 20,404.86 rub.

Situation: is it necessary to pay the average salary for the period of employment for the third month to a pensioner dismissed due to the liquidation of the organization (staff reduction)?

Yes need.

Pensioners have the same rights and responsibilities as other employees of the organization. Despite the fact that pensioners are not recognized as unemployed (clause 3 of Article 3 of Law No. 1032-1 of April 19, 1991), they are entitled to payment of average earnings for the period of employment. Article 178 of the Labor Code of the Russian Federation does not provide for any exceptions for them.

A similar point of view was expressed in the letter of Rostrud dated February 11, 2010 No. 594-TZ.

Average monthly salary according to the Labor Code of the Russian Federation

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art. 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to paragraphs 4, 9 of the Regulations, the calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary (calculated period).

When determining average earnings, average daily earnings are used.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with clause 15 of the Regulations, by the number of days actually worked during this period.

In this case, the organization can calculate the average daily earnings in the specified order, but the multiplier “number of days (calendar, working) in the period subject to payment” for calculating the average earnings is missing, since there is no period itself subject to payment. After all, the organization does not pay the employee severance pay several months in advance after dismissal, but compensation upon dismissal by agreement of the parties without indicating any period for which it is paid.

And the above norms of paragraph 3 of Art. 217, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation also speaks of three (six) times the average monthly earnings, and not the average earnings for three (six) months after dismissal.

In other words, we are talking about the average monthly earnings of the dismissed employee, multiplied by three (six).

In our opinion, in this regard, the organization should calculate the employee’s average monthly earnings based on the average monthly number of working days in the billing period, and not the average earnings based on the number of working days in three months after dismissal.

The average monthly number of working days should be determined by dividing the number of working days in the billing period according to the production calendar of a five-day working week by 12.

Based on the foregoing, we believe that for the purposes of exemption from personal income tax and insurance contributions, compensation paid to an employee upon dismissal by agreement of the parties without indicating the period for which it is paid, an organization working on a five-day workweek schedule should calculate three times the employee’s average monthly earnings by dividing the wages actually accrued to him for the 12 months preceding his dismissal (payroll period) by the number of days actually worked during this period and multiplying the resulting average daily earnings by the average monthly number of working days in the payroll period and by three.

No votes yet.

Please wait…

In accordance with paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, compensation payments related to the dismissal of employees are not subject to personal income tax taxation, with the exception, in particular, of the amount of payments in the form of severance pay, average monthly earnings for the period of employment, compensation to the manager, deputy managers and chief accountant of the organization in part exceeding in general, three times the average monthly earnings or six times the average monthly earnings for workers dismissed from organizations located in the Far North and equivalent areas.

Thus, compensation payments upon dismissal within three (six times) average monthly earnings are not subject to personal income tax.

From a similar norm, paragraphs. 2 p. 1 art. 422 of the Tax Code of the Russian Federation it follows that compensation payments upon dismissal within three (six times) average monthly earnings are also not subject to insurance contributions.

At the same time, the procedure for calculating the specified threefold (sixfold) amount of average monthly earnings has not been established by the Tax Code of the Russian Federation.

From the Letters of the Ministry of Finance of Russia dated N 03-04-06/31391, the Ministry of Labor of Russia dated N 17-4/B-283, it follows that in the situation under consideration, the general procedure for calculating the average wage (average earnings) established by Art. 139 of the Labor Code of the Russian Federation, Regulations on the specifics of the procedure for calculating average wages (approved by Decree of the Government of the Russian Federation No. 922) (hereinafter referred to as the Regulations).

According to paragraphs 4, 9 of the Regulations, the calculation of the average salary of an employee, regardless of his mode of work, is based on the salary actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains the average salary (calculated period).

When determining average earnings, average daily earnings are used.

The average employee's earnings are determined by multiplying the average daily earnings by the number of days (calendar, working) in the period subject to payment.

Average daily earnings, except in cases of determining average earnings for vacation pay and payment of compensation for unused vacations, are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph.

Payments in the Far North

Average earnings for a period of employment of up to three months (including severance pay) are retained for employees who work in the Far North and equivalent areas upon dismissal due to:

- liquidation of the organization;

- staff reduction.

Unlike the general rule, such employees do not need a decision from the employment service to maintain their average earnings for the third month of employment. This is stated in Part 1 of Article 318 of the Labor Code of the Russian Federation.

In addition, the average earnings in these cases can be retained for such employees for a period of up to six months based on the decision of the employment service. This is possible if, within a month after dismissal, the employee contacted this service, but was not employed by it. These are the rules of Part 2 of Article 318 of the Labor Code of the Russian Federation.

A similar procedure for dismissal due to liquidation of an organization or reduction of staff applies to employees working:

- in areas not classified as regions of the Far North and equivalent areas, but included in the list of territories where regional coefficients and percentage increases in wages are paid (determination of the Supreme Court of the Russian Federation of November 11, 2005 No. 53-B05-9). For example, in the southern regions of the Irkutsk region and Krasnoyarsk Territory;

- on the territory of closed administrative-territorial entities (clause 4 of article 7 of the Law of July 14, 1992 No. 3297–1).

Dismissal by agreement of the parties: formula and calculation of average monthly earnings

Attention There are no such difficulties and nuances here. As you can see, dismissal by agreement of the parties is indeed much easier to implement both in practice and when preparing documents. How dismissal is formalized In addition to its peculiarities, the removal of an employee from performing duties has a number of requirements for the execution of the contract. It is produced in several stages:

- Drawing up an agreement between the parties. This is the basis for dismissing an employee. Therefore, you need to be as careful as possible when drafting it. However, there is no clear law that would regulate the procedure for drawing up the document. Therefore, it can be written in any form. The main thing is that it states:

- the grounds on which the employee is dismissed.

Payments to union members

Employees who were elected to the trade union and released from their main job are paid the average salary not by the organization, but by the all-Russian (interregional) trade union in the following order.

Their average earnings for the period of employment, but not more than six months, are retained upon dismissal due to:

- the inability to provide the previous or other equivalent job (position) at the end of the employee’s term of office in the trade union;

- liquidation of the organization.

If an employee undergoes retraining or training, then his average salary can be retained for up to a year after dismissal.

Such rules are established by Article 375 of the Labor Code of the Russian Federation.