02.12.2018

Is it necessary to create reserves for vacation pay in an autonomous institution? How to correctly form and reflect such reserves in accounting and tax accounting? How to conduct an inventory of reserves? What should be included in the accounting policy? You will find answers to these questions below.

According to labor legislation, employers are required to provide employees with annual paid leave while maintaining their place of work (position) and average earnings (Articles 114, 115 of the Labor Code of the Russian Federation).

By virtue of this norm, a state (municipal) autonomous institution has an obligation to provide employees with annual paid leave. But at the same time, there is no certainty regarding the time of execution of the upcoming vacation payment for the time actually worked, since it is possible to postpone the planned vacation dates and, in addition, the amount of such an obligation cannot be accurately determined. In addition, the bulk of vacations fall in the spring-summer period, which entails an increase in labor costs at this time.

In order to evenly attribute the expenses under consideration to the financial result of the institution for obligations that are not determined by the amount and (or) time of execution, reserves for future expenses are created in accounting.

At the same time, the institution’s obligations, the value of which is determined at the time of their acceptance conditionally (calculated) and (or) for which the time (period) for their fulfillment is not determined, provided that a reserve for future expenses is created in the institution’s accounting for these obligations, are reflected in the expense authorization accounts as deferred obligations.

Based on the above, it is advisable to create reserves for vacation pay for actually worked hours in order to reflect complete and reliable information about the institution’s deferred obligations, as well as to evenly attribute expenses to the institution’s financial result. The need to form such reserves is also stated in letters of the Ministry of Finance of the Russian Federation dated 03/07/2018 No. 02-07-10/14688, dated 06/05/2017 No. 02-06-10/34914, dated 11/09/2016 No. 02-06-10/65506.

The purpose of conducting a comparative check of the “vacation” reserve

The formation of a reserve for vacation pay is mandatory in accordance with the rules set out in PBU 8/2010 “Estimated liabilities, contingent liabilities and contingent assets”, approved by Order of the Ministry of Finance of Russia dated December 13, 2010 N 167n. In accordance with the “Guidelines for the inventory of property and financial liabilities”, approved by Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 N 49, estimated liabilities are necessarily inventoried.

As a result of the inventory of the reserve for vacation pay, the initially determined estimate of the reserve for future expenses must be adjusted when the circumstances for each employee are clarified. For example, if not all days included in the reserve were used or the average daily salary changed.

Such adjustments should confirm the validity of the amount of the reserve for future expenses for payment of vacation pay recorded in the accounting records.

Inventory of vacation reserve

Topic: Vacation reserve (Vacation reserve), Vacation pay accounting (Vacation reserve).

If the company has not previously used a vacation reserve, read the page About the first vacation inventory.

Additionally: Download the “Accountant's Handbook”

On what date is the vacation reserve inventory ?

According to paragraph 7 of the Regulations on the inventory of assets and liabilities, approved by order of the Ministry of Finance of Ukraine No. 879 dated 02.09.

Sequence of actions when checking the validity of the reserve

Like any comparative check, inventory monitoring of the reserve for upcoming vacation expenses begins according to the order of the manager, which approves the composition of the inspection commission and the duration of the monitoring.

The inspection itself, mandatory at the end of the year, is carried out on employees of each department separately and consists of:

- determining the volume of unused vacation days at the end of the year. The source of this data is information from the organization’s personnel records;

- determining the average daily earnings and corresponding insurance premiums for calculating the reserve;

- determining the amount required to pay for all unused vacations at the end of the year and comparing its value with the balance of the reserve in accounting;

- reflecting the results on the accounting accounts.

- the amount of vacation pay is 108,210 rubles. (RUB 27,570 / 29.3 days * 115 calendar days)

- insurance premiums 32,679 rub. ((22% insurance premiums for compulsory health insurance + 5.1% insurance premiums for compulsory health insurance + (2.9% + 0.2%) contributions for compulsory health insurance) * 108,210 rub.)

The inspection is completed using a self-developed report form, because There is no approved form for checking reserves for future expenses. A calculation of the above values is attached to the act.

Carrying out inventory in the enterprise

Inventory begins only on the basis of an order from the manager. The check includes the following steps:

- the volume of unused vacation days at the end of the year is determined;

- the reserve amount of insurance premiums and average daily earnings is calculated;

- the amount that needs to be paid for all unused vacations for the year is calculated, and the result is compared with the balance of the reserve;

- the results obtained are reflected in the accounting accounts.

How to take an inventory and document it

Inventory entries for the reserve for vacation pay are filled in depending on the reserve balance. If the reserve balance is greater, then fill in the following entries:

- Dt 20, 23, 25, 26, 29 and 44;

- Kt 96.

In this case, an additional reserve for vacation pay occurs.

If the balance reserve is lower, then the following entries are filled in:

- Dt 20, 23, 25, 26, 29 and 44;

- Kt 96.

In this case, differences in expense amounts from the reserve are reversed.

Similar articles

- Inventory of estimated reserves

- Vacation reserve in accounting

- Reserve for vacations in tax accounting

- The most important things about the vacation reserve, including the calculation procedure with an example

- Inventory of the reserve for vacation pay (sample order)

Reflection of the results of checking “vacation” reserves in accounting

If the amount of the unused part of the reserve reflected in the accounting and the newly calculated amount do not coincide, the results of the inventory of the reserve for vacation pay are always reflected by postings to the debit of the cost accounting accounts (in accordance with the employees of which department the adjustment is made) in correspondence with the accounting account reserves for future expenses.

If the newly calculated amount of the reserve balance is greater than the balance reflected in the accounting, i.e., for settlements with employees, a larger amount will be required than is listed in the accounting, the differences are additionally accrued to the reserve for future expenses.

| Wiring | Content |

| Dt 20, 23, 25, 26, 29, 44 Kt 96 | The reserve for vacation pay was added based on the results of inventory monitoring |

If the newly calculated amount of the reserve balance is less than the balance reflected in the accounting, i.e., for settlements with employees, a smaller amount will be required than is listed in the accounting, the differences are reversed from the reserve for future expenses.

How is the reserve calculated?

An inventory of the reserve for vacation pay, a sample of which will be presented below, implies the inclusion not of actually accrued vacation pay amounts, but of monthly deduction amounts.

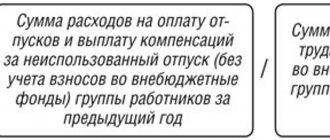

First you need to calculate the percentage of monthly deductions. The following formula is used for this:

x 100% = percentage of monthly deductions

The possible amount of expenses is approved by the accounting policy. This amount can be determined in the following ways:

- use information from last year;

- take into account the number of vacation pay planned for the year (you can use the vacation schedule) and the average earnings of employees.

The possible amount of expenses is the maximum amount of reserve contributions. This means that deductions must be made until their amount equals the limit.

The estimated amount of expenses for wages is also determined by several options:

- information for the previous year is taken into account;

- use salary data for the current year.

The second method will be relevant for enterprises where salaries consist of a salary component.

Potential labor costs may not include:

- vacation pay - in cases where the amounts of wages paid for the previous year are applied, all amounts of accrued vacation pay must be excluded;

- payments for individuals under civil law agreements.

The calculation of deductions made is drawn up in an internal document called an estimate.

(Sample of filling) Estimate of the reserve for upcoming expenses for vacation pay

Inventory of the reserve for payment of upcoming vacations

“Personnel issue”, 2012, N 8

INVENTORY OF RESERVE FOR PAYMENT FOR UPCOMING HOLIDAYS

At the end of the year, as of December 31, it is necessary to compare the amount accrued to the reserve for the current year and the amount of actual expenses for vacation pay, taking into account insurance premiums and deductions for injuries, i.e., carry out an inventory (clause 3 of Article 324.1 of the Tax Code of the Russian Federation ). In accounting, the rules for conducting inventory are established by the Federal Law of November 21, 1996 N 129-FZ “On Accounting” and the Methodological Guidelines for the Inventory of Property and Financial Liabilities, approved by Order of the Ministry of Finance of Russia of June 13, 1995 N 49.

During the inventory, the organization determines the actual amount of vacation expenses incurred in the current year and compares it with the actual amount of contributions to the reserve. This allows you to identify the difference. How to take this difference into account depends on whether the organization will create a reserve for vacation pay next year or not.

There are two options:

1) actual expenses for vacation pay exceeded the reserve accrued for the year;

2) the amount of the reserve at the end of the year will be greater than the amount of actual expenses for vacation pay.

The Letter states that if, based on the results of an inventory of the reserve for upcoming expenses for vacation pay, the amount of the calculated reserve in terms of unused vacation, determined based on the average daily amount of labor costs and the number of days of unused vacation at the end of the year:

- exceeds the actual balance of the unused reserve at the end of the year (option 1), then the excess amount is subject to inclusion in labor costs;

- turns out to be less than the actual balance of the unused reserve at the end of the year (option 2), then the negative difference must be included in non-operating income.

If the taxpayer decides not to form a reserve for the next tax period, then the entire actual balance of the reserve is included in income (expenses) as of December 31 of the current year.

In accordance with Art. 12 of the Federal Law of November 21, 1996 N 129-FZ, an inventory of the reserve for vacation pay for accounting purposes is carried out to ensure the reliability of accounting data and financial statements before drawing up annual financial statements.

If, as a result of the inventory, it is revealed that the amounts of the actually accrued reserve exceed the amount of actual expenses for vacation pay for the year, on December 31 of the reporting year, the excessively accrued amount of the reserve is reversed (clause 3.51 of the Methodological Instructions). This is reflected in accounting by posting:

Debit 20, 26, 44 Credit 96 - the amount of the excessively accrued reserve for vacation pay is reversed.

If, as a result of the inventory, it is revealed that the amount of actual expenses for paying for vacations exceeds the amount of the created reserve, it is necessary to reflect in the accounting records additional contributions to the reserve for paying for vacations and include them in production and distribution costs:

Debit 20, 26, 44 Credit 96 - additional reserve has been accrued for the amount of excess of actual expenses for vacation pay (from insurance premiums and contributions for compulsory insurance against industrial accidents) over the reserve amount.

If a reserve is not created next year, for example, the company is a small enterprise and decided not to accrue a reserve next year:

Debit 20, 26, 44 Credit 96 - the amount of the excessively accrued reserve for vacation pay is reversed.

For clarity, we give examples.

Example (the actual balance of the unused reserve at the end of the year exceeds the amount of the accrued reserve). Let’s say that a transport company, in accordance with its accounting policies, has formed a reserve to pay for upcoming vacation expenses for accounting and tax purposes in the current period and is going to create it in the next one. The method of forming a reserve for accounting purposes coincides with the method of forming a reserve for tax accounting purposes.

Monthly amounts of contributions to the reserve are reflected in the accounting entries:

Debit 44 Credit 96.

The reserve amounts used to pay for vacations are reflected in the accounting entries:

Debit 96 Credit 70 - vacation pay accrued from the reserve;

Debit 96 Credit 69 - insurance premiums and contributions for compulsory social insurance against industrial accidents and occupational diseases have been accrued.

Based on the provisions of paragraph 5 of Art. 324.1 of the Tax Code of the Russian Federation, contributions to the reserve for the payment of remuneration based on the results of work for the year are made with the right to carry over the reserve that was not used at the end of the reporting tax period to the next tax period, if the organization creates such a reserve in the next tax period.

The amount of the carry-over unused reserve for upcoming vacation expenses is specified based on the number of days of unused vacation, the average daily amount of labor expenses (taking into account the established methodology for calculating average earnings), mandatory contributions to insurance premiums and contributions to compulsory social insurance against accidents at work and occupational diseases. Consequently, the amount of the reserve for vacation pay, which is carried over to the next year, is determined not by the estimated (as when creating a reserve), but by actual data.

The following entries will be made in the accounting records as of December 31 of the current period:

Dt 44 “Sales expenses” Kt 96 “Reserves for future expenses”

Dt 44 “Sales expenses” Kt 96 “Reserves for future expenses”

Inventory algorithm

- For each employee, the number of unused vacation days and his average earnings are loaded (the same as when calculating vacation). In our example, for employee Astrov, the number of unused vacation days will be 23.33 days, and the average earnings will be 1,029.99 rubles.

The period for calculating the average is taken for January - December of the year in which the inventory of estimated liabilities is carried out. At the same time, the salary for December at the time of calculating the reserve has already been calculated, so the average earnings will be determined correctly. The choice of such a period for calculating the average is explained by the fact that the inventory is carried out at the end of the year and this is not actually granted vacation in December, but the balance at the end of the year. These holidays will be provided next year. If necessary, the setting for the period for calculating average earnings during the annual reserve inventory can only be changed manually by the user for each line.

- The amount of the obligation is obtained by multiplying the days of unused vacation by the average earnings:

- 23.33 (number of unused vacation days) * 1,029.99 (average earnings) = 24,029.67 rubles. It is this amount of estimated liabilities and reserves that is reflected in the column counted:

- The accumulated amount of liabilities and reserves is loaded. This data is taken from the previous document Vacation reserves, i.e. from the November document. If in December an employee is granted leave at the expense of estimated liabilities and reserves, then the accumulated amount from the previous month is reduced by this value. The received data goes into the column accumulated:

- The difference between the calculated and accumulated amounts is calculated and a positive amount (additional accrual) or a negative amount (write-off) is obtained. This information goes into the column passed. In our example, the result for the employee is as follows:

- in accounting: 24,029.67 (calculated) – 21,629.79 (accumulated) = 2,399.88 rubles. (additional accrual);

- in NU: 24,029.67 (calculated) - 25,334.31 (accumulated) = - 1,304.64 rubles. (write-off).

- For insurance premiums and separately for “injury” premiums, the overall rate is determined in a year:

- For the employee, the taxable base and the amount of calculated contributions are taken;

- the rate is calculated by dividing the amount of contributions by the taxable base. For employee Astrov, for the year as a whole, the rate on insurance premiums was equal to 30%, for the Social Insurance Fund - 0.2%:

- The amount of contributions for obligations is obtained by multiplying the amount of the obligation by the rate:

- 24,029.67 (amount of estimated liabilities) * 30 (rate of insurance premiums) / 100 = 7,208.90 rubles.

- 24,029.67 (amount of estimated liabilities) * 0.2 (rate according to the Federal Social Insurance Fund) / 100 = 48.06 rubles. This data is reflected in the columns counted for insurance premiums and Social Insurance Fund:

- The accumulated amount for insurance premiums and contributions for injuries is loaded. As well as the amount of estimated liabilities, this amount is taken from the previous November document Vacation reserves. Next, the obtained figures are reduced by the amount of insurance contributions / Social Insurance Fund for December vacation pay provided at the expense of estimated liabilities and reserves:

- The difference between the calculated and accumulated amount of contributions is calculated and a positive amount (additional accrual) or a negative amount (write-off) is obtained. This information is reflected in the credited .

In our case, the result for the employee is as follows:

- for insurance premiums: in accounting: 7,208.90 (calculated) – 6,488.94 (accumulated) = 719.96 rubles. (additional accrual)

- in NU: 7,208.90 (calculated) – 7,600.29 (accumulated) = - 391.39 rubles. (write-off)

- in accounting: 48.06 (calculated) – 43.26 (accumulated) = 4.80 rubles. (additional accrual)

The resulting results (write-offs/additional accruals from the credited ) for estimated liabilities and reserves, insurance premiums and Social Security Social Insurance Fund are further reflected for each employee on the Liabilities and reserves for employees tab, broken down by departments and methods of reflection:

The total values, for which transactions will be generated later in the accounting program, are reflected in the context of divisions and methods of reflection on the Liabilities and reserves tab of the current month :

Inventory of vacation reserve at the end of the year

In tax accounting, unlike accounting, creating a reserve for upcoming expenses for vacations is the right of the organization, and not an obligation. This is explained primarily by the fact that the purposes of creating a “vacation” reserve in accounting and tax accounting differ. It is necessary to reflect the estimated obligation to pay for vacations in accounting so that users of the financial statements are presented with a real picture of the company’s financial condition. In turn, in tax accounting, vacation pay is “reserved” in order to evenly account for vacation expenses throughout the year. At the same time, at the end of the year it is necessary to conduct an inventory of this reserve. And the procedure for accounting for the results of this event depends on whether the vacation pay will continue or whether it will refuse to create this reserve.

The provisions of Ch. 25 of the Tax Code (hereinafter referred to as the Code) provides for two options for accounting for vacation payments for profit tax purposes.

What are vacation liabilities (reserves)

The vacation reserve is an estimated liability that allows for settlements of unused compulsory vacations.

It can be calculated in several ways. An example calculation looks like this: RO (FIRM) = RO (STR N1) + RO (STR N2) ... + RO STR (Nx),

Where:

RO (FIRM) - reserve for vacations within the entire organization;

RO (STR N) - reserve for vacations within a separate group of positions with comparable pay (as an option - within one structural unit).

The RO indicator (STR N) is calculated using the formula:

RO (STR N) = RD × (SZ / COEF),

Where:

RO (STR N) - vacation reserve for a group of positions (structural unit);

RD - the number of unused vacation days of department employees (or man-days) as of the date of formation of the reserve;

SZ - average salary (plus insurance contributions from the amount) in the department from the beginning of the year to the date of formation of the reserve;

COEF is a fixed coefficient for calculating vacation pay (in 2020-2021 it is 29.3).

You will be introduced to how reserves for vacation pay are created in tax accounting using the ready-made solution of the ConsultantPlus reference and legal system. To do this, you can use free online access to the system.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

"Backup" option

At the same time, in practice, companies often face the problem when the majority of employees “book” their vacation for the summer months. In this case, the cost of vacation pay falls over certain periods, and in a significant amount. In order to account for vacation pay evenly throughout the tax period, the company may decide to create a reserve for upcoming vacation expenses.

The procedure for “working” with this reserve is described in Art. 324.1 of the Code. Thus, having decided to form a “vacation” reserve, the company must reflect it in its accounting policy, also stating in it:

- accepted method of reservation;

- maximum contribution amount;

- monthly percentage of contributions to the reserve.

For this purpose, a special calculation (estimate) is drawn up.

The percentage of contributions to the “vacation” reserve is determined as the ratio of the estimated annual amount of expenses for vacation pay to the estimated annual amount of labor costs. In this case, both of these indicators are taken taking into account the corresponding amounts of insurance premiums.

And, finally, the amount of monthly deductions is calculated as the product of the amount of actual labor costs for the month, taking into account contributions, by the previously calculated percentage of deductions.

Note! When determining the expected amount of vacation expenses, it is necessary to take into account, among other things, vacation days not used by employees for previous periods, as well as additional vacations.

When forming a “vacation” reserve, actually paid vacation pay and the corresponding amounts of insurance premiums are written off from this reserve. Write-offs are made until the amount of the reserve accrued since the beginning of the year reaches the maximum amount of contributions to the reserve - from this moment on, no contributions to the reserve are made.

Vacation reserve in accounting policy

According to paragraph 1 of Art. 324.1 of the Tax Code of the Russian Federation , a taxpayer who has decided to uniformly account for upcoming expenses for paying employees’ vacations for tax purposes is obliged to reflect in the accounting policy for tax purposes, firstly, the method of reservation adopted by him, and secondly, the maximum amount of deductions and the monthly percentage of deductions to the specified reserve.