Indexation or promotion

Some managers have the misconception that if the company carries out periodic increases in salaries or the variable part of wages, then indexation is not necessary. In fact, recalculation to the inflation rate has nothing to do with salary growth; it is an independent process that should be carried out everywhere, regardless of the form of ownership: state, joint or private.

An increase in salaries occurs at the initiative of the employer, with an increase in his financial well-being or in order to increase the motivation of employees. And indexation refers to state guarantees, which are prescribed in the Labor Code in Art. 130 and 134. The main difference is that in the public sector this is regulated by the Labor Code of the Russian Federation and acts, and in private business structures it is prescribed individually by internal orders, or in an employment or collective agreement.

Private organizations are required to issue their orders, instructions or plans for indexing workers’ salaries by the amount of growth in consumer prices, but they can take as a basis not inflation, but other related indicators. Entrepreneurs or mini-firms also recalculate payments to employees, guided by clauses 13 and 15 of Government Decree No. 858 of August 27, 2016.

The only category of employees whose wages are not indexed are individuals who work under civil contracts.

Is indexation of earnings the responsibility of the employer?

In the Russian Federation, the need to compensate for the depreciating income of the population is enshrined at the legislative level. And first of all, this concerns the salary paid to the employee in accordance with labor legislation. The Labor Code of the Russian Federation defines for it:

- the minimum possible amount (minimum wage), below which payment cannot be set for a fully worked month, subject to the fulfillment of the labor standards agreed upon for the relevant work (Articles 133, 133.1);

- the need for indexation aimed at maintaining compliance between the levels of paid income and rising consumer prices (Article 134).

Indexation should be carried out based on the results of the year in which the price increase recorded by Rosstat took place. These are the explanations posted on the Rostrud website.

No employer exceptions are made to these rules. Therefore, the requirements to correlate the minimum amount of wages paid with the amount of the legally established minimum wage and regular salary increases due to inflation apply to absolutely all employers.

The only difference is from what sources the funds will be taken to increase wages:

- from budget funds (federal, regional or local), if we are talking about the salaries of employees of government agencies and government institutions (state employees);

- from the funds of a specific employer, which independently provides financing for its activities.

Indexation terms

Government structures and organizations receive orders through regulations from higher ministries and departments. In private business, the percentage and term are specified either in employment contracts or in internal regulations. In this case, the documents must indicate the following parameters:

- Indexation frequency: year, half-year, quarter, month. You can change the frequency when drawing up a local document indicating new deadlines. Carrying out less than once a year is prohibited.

- What is subject to indexation: salary, variable part or the entire amount received by employees. It is prohibited to carry out indexations when any indicators are achieved or not achieved, for example, production plans. Inflation and price increases exist regardless of the stability of the enterprise and its financial indicators, so it is imperative to recalculate employee salaries.

- Indexation percentage at which recalculation will be made. The main rule is that this indicator cannot be negative, so that when employees’ salaries are recalculated, its value does not become less than before. The percentage is the same for all employees of the enterprise, regardless of salary level or position.

The guarantee of indexation is spelled out in the Labor Code.

Samples of an order at an enterprise on the recalculation of wages taking into account indexation:

The indexing percentage can be set to:

- consumer price index CPI, which is recorded by Rosstat;

- inflation percentage approved by the Government;

- growth rate of the worker's living wage.

The choice of indicator determines the frequency of salary indexation once a year, half a year, quarter or month. When using inflation percentage, it is easier to carry out annual indexation. If we take the price index from Rosstat data, then the recalculation can be carried out once every three months.

When indexing salaries, management issues an internal order, and employees are informed and familiarized with it against signature. Recalculation of payments to employees is also carried out when calculating vacation pay, sick leave, maternity pay and dismissal.

Indexation of salaries of budgetary organizations in 2021

The indexation of salaries of public sector employees occurs at the expense of state, regional or local budgets. Categories of persons financed from state budgets:

- military personnel, civilian government employees and law enforcement officials;

- employees of medical, educational, cultural, scientific, social organizations.

From February 2021, doctors, education and cultural workers will have their salaries indexed by 6%. For those categories that were not included in the May decree of the President of the Russian Federation No. 597, its coefficient will be 4.3%, according to the 2021 inflation rate.

Recalculation according to minimum wage

If employees receive wages that do not reach the minimum wage, then the employer’s accounting department is obliged to add the amount missing to the minimum. From January 1, 2021, it is 11,280 rubles. Some regions and districts have introduced their own regulatory minimum wage coefficients, so managers need to take such points into account and take into account the territorial component.

You can also carry out indexation once every six months, quarter or month

If the manager has not previously refused the regional adjusted minimum wage, then when calculating wages, the local rather than the federal level is of paramount importance. This is precisely what is laid down when forming the workers' compensation fund.

Wage indexation: right or obligation of the employer?

Employers often confuse two concepts: salary indexation and salary increases. In contrast to the salary increase, which the employer carries out according to his decision and if there are financial opportunities, indexation is a guarantee of wages and must be made to all employees working under an employment contract (Definition of the Constitutional Court of the Russian Federation No. 913-O-O).

Art. 130 of the Labor Code of the Russian Federation states that measures that ensure an increase in the level of real wages are included in the system of basic state guarantees for the remuneration of workers. These measures, according to Art. 134 of the Labor Code of the Russian Federation, consist of indexing wages taking into account the increase in consumer prices for goods and services. The amount of wage indexation may correspond to the consumer price index for goods and services officially established at the end of a certain period (for the country as a whole or in a particular region). The consumer price index for goods and services can be found on the official website of Rosstat. It may also correspond to the amount of inflation, which is enshrined in the federal law on the federal budget. In addition, the amount of wage indexation may correspond to the increase in the cost of living of the working population.

It is important to take into account that government agencies and municipal institutions index wages in the order that comes down from above through regulatory documents. Other employers are required to prescribe the indexation procedure in local regulations. Letter of Rostrud dated 04/19/2010 No. 1073-6-1 states that “if the organization’s local regulations do not provide for such a procedure, then, given that wage indexation is the responsibility of the employer, we believe it is necessary to make appropriate changes (additions) to local regulations in force in the organization.” That is, Rostrud directly says that the employer is obliged to prescribe the procedure for wage indexation.

Frequency and procedure for salary indexation

If an inspector from the state labor inspectorate during an inspection reveals that none of the company’s local regulations stipulate the conditions and procedure for wage indexation, this will be the basis for bringing the employer to administrative liability under Part 1 of Art. 5.27 Code of Administrative Offences. Violation entails a warning or the imposition of an administrative fine on officials in the amount of 1,000 to 5,000 rubles; for persons carrying out entrepreneurial activities without forming a legal entity - from 1,000 to 5,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

What needs to be specified in local regulations:

- frequency of salary indexation;

- the amount of salary indexation (the company can focus on the consumer price index for goods and services published on the Rosstat website, or on the inflation rate published in the federal law on the budget of the Russian Federation);

- part of the salary that will be indexed.

The frequency largely depends on both the integrity of the employer and his financial capabilities. Depending on which increase factor the employer chooses, indexation can be carried out once a month, once a quarter or once a year. At the same time, for quarterly indexation it is better to choose the cost of living indicator, and for annual indexation - the inflation indicator.

The procedure for indexing wages chosen by the employer is enshrined in a collective agreement or local regulation.

Since the current legislation does not establish a specific procedure for indexing wages, the employer making it for the first time must include a provision on the employer’s obligation to periodically increase wages in a local regulation or collective agreement. For this purpose, you can provide a separate chapter in one of these documents or adopt a new local regulation. After this, all employees must familiarize themselves with the rules of indexation against signature.

Indexation of the patch is carried out by order of the manager. The order is the basis on which changes are made to the staffing table and additional agreements are concluded to employment contracts on salary indexation. It is registered in the journal for registering orders or instructions.

Next, you need to familiarize employees with the order on salary indexation. Employment contracts indicate non-indexed salaries and allowances, therefore additional agreements must be concluded with employees to change the terms of employment contracts and indicate new indexed allowances and salaries.

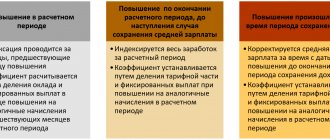

Indexation applies to all employees of the organization, therefore, when calculating average earnings when calculating vacation pay, this increase must also be taken into account. In this case, there are two options for calculating the increasing coefficient:

- If only salaries are indexed, then the formula is used: New salary / salary before increase

- If indexation affects the entire wage system, then the formula is used: New salary + new monthly payments / salary before increase + previous monthly payments

Requirements for salary indexation in 2021: comments from the Ministry of Labor

In the Letter of the Ministry of Labor dated December 24, 2018 No. 14-1/OOG-10305, the department once again recalled the contents of Art. 134 of the Labor Code of the Russian Federation and that ensuring an increase in the level of real wages includes indexation of wages in connection with the increase in consumer prices for goods and services. Ordinary employers, unlike government agencies, local governments, state and municipal institutions, index salaries in the manner established by the collective agreement, agreements, and local regulations. Government agencies and municipal institutions do this in the manner established by labor legislation and other regulatory legal acts containing labor law norms.

Since labor legislation does not provide for a uniform method of wage indexation for all employees, the rules are determined based on certain factors:

- depending on the source of financing of organizations;

- laws and by-laws - for government agencies;

- collective agreement, agreement, local regulations - for other organizations.

Indexation is an increase in workers’ wages at the rate of inflation, while the employer has the right to further increase wages for certain categories of workers, as specified in the Letter of the Ministry of Labor.

Experts note that salary increases can be achieved in different ways:

- by proportionally increasing all payments provided for by the organization’s remuneration system and, accordingly, the employees’ employment contract;

- by increasing individual payments included in the salary (for example, increasing the salary (the share of the tariff in the salary structure)).

The employer chooses the most appropriate method, taking into account the opinion of the representative body of employees. But the most important thing that the Ministry of Labor draws attention to is that ensuring an increase in real wages is the responsibility of the employer.

Indexation procedure in 2019

Indexation is carried out by the percentage specified in the regulatory document: order, regulation or other regulatory document. What method is used in a commercial structure is decided by the management, the main thing is that this is indicated in the internal documentation. There is no clear provision on the procedure, but wages can be indexed in 2021 according to the following scheme:

- Checking the presence of internal regulations at the enterprise. A fine can be imposed on an employer for failure to carry out indexation, even if it was done, but the appropriate regulatory document was not issued.

- An order or instruction from a manager for indexation. It indicates the coefficient for calculation and the date when it is made. Accounting and personnel officers must endorse such a document against signature.

- Recalculation of employee salaries. The accounting department, based on the order of the manager, recalculates the amounts. Data on what is subject to recalculation: salary, variable part or total payment; are enshrined in internal employee documentation.

- Adjustment of staffing. Data with new salaries is entered into the updated staffing table by personnel workers.

- Additional agreements to the employment contract. Changes in salaries must be specified in the employment contract. In order not to change all the documentation, it is enough to make an additional agreement with each employee. The preparation of documents is carried out by the HR department. All employees of the organization are required to sign these agreements and receive a second copy in their hands.

You can use additional agreements, adjustments to the staffing table and other regulatory documents

Who is obliged to index salaries?

Absence in Art. 134 of the Labor Code of the Russian Federation, a clear procedure for indexing salaries leads to the fact that a number of commercial organizations do not increase the salaries of their employees at all.

At the same time, they refer to this same article, which states that employers carry out indexation in the manner established in the collective agreement or other local act. Accordingly, in their opinion, if a local act does not contain a provision on indexation, then it is not necessary to carry it out.

In fact, this point of view is wrong. This has been repeatedly recognized by the Constitutional Court (decision of the Constitutional Court of the Russian Federation of November 19, 2015 No. 2618-O, determination of July 17, 2014 No. 1707-O).

The court explained that the Labor Code of the Russian Federation does not allow an employer not related to the public sector to deprive employees of the right to a salary increase. Nor does it allow one to evade the establishment of wage indexation. Therefore, when formalizing an employment relationship, the employer must negotiate with the employee the procedure for increasing his salary. The procedure for indexing wages is determined in a collective agreement, agreement or any other local regulatory act.

At the end of 2021, Rostrud warned employers that the absence of a salary indexation provision in an organization does not exempt the employer from such indexation. If at the end of the year Rosstat recorded an increase in consumer prices, and the employer did not index salaries, he will be fined. If the employer did not approve the indexation provision, he will be obliged to do so.

The Ministry of Labor also recalled the indexation of wages in 2021, clarifying that the employer is obliged to ensure an increase in the real content of workers’ wages.

Thus, all employers without exception are required to index employee salaries. Moreover, regardless of the presence or absence of indexation provisions in the organization.

Calculation example

To understand how wages are recalculated during indexation in 2021 for public sector employees and in a commercial organization, we give two examples:

1 example

Nadezhda, an employee of a budget organization, works at the Ministry of Culture. Her salary in 2021 was 15,000 rubles. Taking into account the accepted indexation percentage of 6% for workers in this field, her salary in 2021 will be:

15,000 * 1.06 = 15,900 rubles.

2 example

Ivan Sergeevich receives a salary of 35,000 rubles at the enterprise. When combining positions, the employer pays him an additional 25% of the salary of 16,000 rubles of the unit he is combining. For 2021, the employer accepts an order to index salaries to the officially approved inflation level of 4.3%, adopted in 2021. Before recalculation, Ivan Sergeevich’s salary was: 35,000 + 25% * 16,000 = 39,000 rubles.

The indexed salary will look like this: (35,000 + 25% * 16,000) * 1,043 = 40,677 rubles.

Employees are allowed to receive wages using personal bank cards. In this case, you select the conditions that you need, for example, they will help you accumulate the missing amount when adding funds to the account balance. Or choose a plastic card, where it is profitable to receive cashbacks from partners or participate in a loyalty program that is attractive to you.

Parameters to which the indexing level is linked

The inflation rate can be characterized quantitatively, since it is associated with processes described by numerical indicators. Comparison of these indicators for comparable periods will give a ratio expressed in the form of either their growth rate or a percentage reflecting the share of the increase.

There are no specific requirements either for the periods subject to comparison or for the indicators being compared in the current legislation. Therefore, it is acceptable:

- comparison of the current period not only with the past, but also with the future;

- using as comparable indicators not only the consumer price level itself, but also any other indicators that depend on this level.

Responsibility for violation

If an employer ignores the Labor Code of the Russian Federation and does not index payments to employees, then he will face administrative penalties:

- In case of non-compliance by officials or entrepreneurs, the amounts amount to 1-5 thousand rubles; legal – 30-50 thousand rubles. Such punishment will follow in case of non-compliance with the norms of legal acts or non-compliance with the Labor Code, Art. 5.27 Code of Administrative Offenses of the Russian Federation.

- If the contract stipulates indexation, but in fact it was “missed”, then, depending on the decision made by the inspection authorities, a warning or a fine of 3-5 thousand rubles is expected. In this case, we are guided by Art. 5.31 Code of Administrative Offenses of the Russian Federation.

Fines and warnings are real punishments for those who neglect the law.

Incomplete payment of earned funds, which is equivalent to the lack of indexation, leads to a violation by the employer of Art. 22 Labor Code of the Russian Federation. This point and its regulation are spelled out in Art. 5.27 of the Code of Administrative Offenses of the Russian Federation and a fine of up to 50 thousand rubles is imposed for it. But at the same time, the employer is obliged to make additional payments to all employees and make contributions to the budget for all taxes that are withheld from employee income, as well as to medical and insurance funds.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Let's sum it up

- The need to index wages in connection with inflation in the Russian Federation is enshrined in law. This obligation applies to all (without exceptions) employers who have employees hired under an employment contract. Rostrud recommends that it be carried out based on the results of each year in which inflation occurred. However, an increase in income, as a rule, does not lead to full compensation for losses from inflation.

- As a parameter that determines the level of income decline, both the inflation level itself (all-Russian or regional, actual or projected) and other indicators depending on the level of consumer prices (including such as the minimum wage or subsistence level) can be used.

- The development of rules by which indexation is carried out depends on who the employer is. For structures financed from budgets (federal, regional or local), they are established uniformly for the corresponding budget. Other employers develop such rules independently.

- Failure to carry out indexation if there are grounds for it, as well as the absence of a document establishing the rules for indexing, is regarded as a violation of labor legislation and leads to administrative punishment.

If you find an error, please select a piece of text and press Ctrl+Enter.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Svetlana

11/14/2019 at 6:19 pm I work in a budget healthcare organization. Which categories of citizens by position are subject to indexation at 4.3%. Or all employees are subject to indexation.

Reply ↓ Anna Popovich

14.11.2019 at 21:28In accordance with labor legislation, the salaries of employees of state bodies, local governments, state and municipal institutions are indexed, regardless of the sector of employment and the specific position.

Reply ↓

Salary increase due to the increase in the minimum wage from January 1, 2020

From January 1, 2021, an updated minimum wage is in force in the amount of RUB 12,130. Please note that in the regions the minimum wage amount may be higher if a regional minimum wage agreement is in force.

| Table of minimum wages for 2021 by region of the Russian Federation |

Salaries should be indexed in accordance with this minimum. Otherwise, the employer risks receiving a call to the salary commission or an employee complaint to the labor inspectorate.

Look in the table at how much the salary in 2020 should be for an employee who has worked a monthly standard of working hours.

| Regions | Minimum wage for full-time employment |

| Subjects of the Russian Federation where there is no regional agreement on the minimum wage for 2020 | RUB 12,130 |

| Subjects of the Russian Federation that have signed a regional agreement, but they have set a minimum wage below 12,130 rubles. | RUB 12,130 |

| Subjects of the Russian Federation that signed a regional agreement, which provides for a minimum wage of at least 12,130 rubles, the company did not refuse to participate in the agreement | According to regional agreement for all employers |

| RUB 12,130 for employers who have signed a reasoned refusal to join the regional agreement |

In 2021, the Prosecutor General’s Office may enter the game

You may receive a fine for not indexing your employees' salaries. This is the responsibility of every company (Article 134 of the Labor Code). The prosecutor’s office will now check whether the company indexes employees’ salaries (Order of the Prosecutor General’s Office dated March 15, 2020 No. 196). Previously, only labor inspectors were involved in this, but they are not able to control all companies - there are not enough people. To begin an investigation, prosecutors only need an employee’s statement that his salary is not being increased. If this information is confirmed, prosecutors will forward the information to labor inspectors. They will fine the company up to 50,000 rubles. (Part 1 of Article 5.27 of the Administrative Code). The draft order of the Prosecutor General is already undergoing anti-corruption examination. Therefore, it is worth specifying the indexing order now, if you have not already done so.

If the salary is not indexed and does not increase for several years

If the employer does not comply with the provisions of the collective agreement, agreement, local regulations on wage indexation, his actions can be appealed to the State Labor Inspectorate of the relevant constituent entity of the Russian Federation, the prosecutor's office, as well as to the court (Articles 352, 353 of the Labor Code of the Russian Federation). Remember that if the salary does not increase at all and bonuses are not paid for a long time, then this is a violation! You can complain about this, for example, through the Rostrud website .

Read also

14.02.2019

When is it carried out?

The period during which indexation must be carried out is established by the administration of the business entity after agreement with the trade union, and is fixed in the collective agreement, regulations or other internal document.

The date of February 1 is very common, since by this day the Government Regulations determining the level of inflation are usually already issued.

But you can also choose the first day of any other month as such a day. The most important thing is that this date is agreed upon with the trade union and indicated in internal documents. This means that indexation can be carried out on May 1, April 1, and any other first day.

Attention: if indexation is carried out from the 1st day of the month, then the salary, taking into account the increasing coefficient, should already be used when calculating for a given month.

Indexation can be done either once for the entire year or by equal coefficients every quarter. The main thing is that this method is enshrined in internal regulations.

Magnification factor (indexing size)

The growth of wages is ensured at the expense of federal budget funds in relation to federal civil servants, employees of law enforcement agencies, and other law enforcement agencies, including courts. These expenditure obligations are provided for in the Russian budget for 2021.

The wage indexation coefficient for 2021 for these categories of employees is 1.043, or 4.3%.

The answer to the question of whether it is permissible to index wages by a minimum percentage of price increases can be found in ConsultantPlus. You will receive even more relevant information by signing up for a free trial access to K+.

Financing of measures to increase wages for other public sector employees due to the distribution of powers of the Russian Federation and its constituent entities, as well as the provisions of Decree No. 597, is carried out both from the federal budget and from regional budgets.

In addition, in pursuance of the mentioned decree, by order of the Government of the Russian Federation dated November 26, 2012 No. 2190-r, a program for the gradual improvement of the wage system in state (municipal) institutions for 2012–2018 was approved, under the terms of which most of the funds should come for these purposes from budgets of the constituent entities of the Russian Federation. However, by 2021 the planned level was not achieved, and therefore the process of indexing salaries for public sector employees in the regions continued. At the same time, the increase coefficient due to the solution of this issue at the regional level is individual for each subject of Russia.

Indexation coefficient

When the administration selects an indexation coefficient, it can use one of the following methods:

- The officially adopted consumer price growth index. This indicator can be set both by regional authorities and throughout the country. A business entity has the right to independently choose which coefficient to apply. He must record his choice in the company’s internal regulations.

- The inflation rate officially established by the authorities at the end of the year, adopted to index the salaries of public sector workers. This indicator can also be set both at the federal level and by local authorities of a particular region. The value for 2019 of this indicator has not yet been determined; for 2021, a value of 4% was adopted.

- The coefficient of change in the cost of living established for the working population. This indicator, like the others, can be taken at the country level and in each individual region.

- Any other indicator that is chosen by the company’s administration, agreed upon with the trade union body and recorded in internal regulations.

When determining the indexation coefficient, in some cases it will be necessary to prove its validity.

This is due to the fact that regulatory authorities, and especially the tax service, may question the appropriateness of the expenses incurred and refuse to include the revised salary in the base when calculating the tax.

Attention: it is very important here to correctly record the choice and justify it in internal documents. To avoid this, many business entities prefer to rely on official indicators when indexing.

The procedure for salary indexation

Wage indexation is discussed in Article 134 of the Labor Code of the Russian Federation. However, there is no clear and understandable procedure for wage indexation. Therefore, in commercial organizations, wages are indexed, including in 2021, according to the rules of the collective agreement or from local regulations.

When drawing up a document on the basis of which you will index salaries, you must remember that it must contain the following information:

- The nature of payments subject to indexation.

This usually concerns salaries or tariff rates at the enterprise. Moreover, the employer can index not the entire amount of the salary, but some part of it, limited to a certain amount. For example: the salary is 30,000 rubles, and only 14,000 rubles from it are indexed. The remaining 16,000 rubles are not subject to indexation.

- Indexation period.

The employer can choose the frequency at his discretion (once a month, six months, a year).

- The procedure for determining the wage indexation coefficient.

- The sequence of calculating wages after indexation.

Keep in mind: the absence of any of these points implies a violation of labor laws and entails consequences. This means that simply drawing up an internal document is not enough. It also needs to comply with existing standards. To avoid possible mistakes, it is better to carefully study any example of wage indexation.

If we talk about reality, then in the collective agreement the clause on annual wage indexation is most often included by large companies that have joined industry agreements with such an obligation. For example, such a norm is in the Federal Industry Agreement on Communications and Information Technologies Organizations of the Russian Federation for 2015–2021. The Ministry of Labor invited companies to join it by letter dated May 5, 2015 No. 14-4/10/B-3127.

If we talk about small organizations, a collective agreement is not always concluded. But even if such an agreement has been drawn up, it often either does not contain a clause on salary indexation.

Another option is to provide for a condition on indexation in the Regulations on remuneration:

How is indexing done?

For commercial companies, according to Art. 134 of the Labor Code of the Russian Federation, the rule applies: indexation must be specified in the collective agreement or other LNA. If a collective agreement has not been concluded (at present it is drawn up, as a rule, by large commercial structures), adjustments are made to the wage regulations.

Indexation always leads to a change in the terms of the employment agreement, which cannot be done unilaterally. The procedure for registering wage indexation in a commercial company is as follows:

- the proposal for indexation is announced at a general meeting of the labor collective or its representatives;

- if the initiative (it does not matter who it comes from - from employees or from management) is accepted and the consent of the parties is documented, changes are made to the LNA;

- the increase in wages is included in the text of a separate order;

- Additional agreements are drawn up for employment contracts.

LNA must contain a detailed calculation (procedure for determining) the coefficient, a list of payments that will be increased by it (salary, bonus payments, etc.), an indexation calendar (once a year, once a quarter, once a month) or an indexation date.

It is advisable to avoid vague phrases, inaccuracies in calculations, and negligence in registration: regulatory authorities may interpret such points as a violation of the law with corresponding negative consequences for the company.

A collective agreement or local act usually contains an indexation mechanism, while an order is a guide to action for accounting employees, containing specific data: by what percentage to index, starting from what date to recalculate wages, who is responsible for indexing.

For example, the collective agreement states the following: “Employee salaries are indexed in accordance with the regional inflation rate,” “indexation is carried out once a quarter, payment is made in the first month of the next quarter.” At the same time, the following wording is appropriate in the order: “Increase employee salaries in accordance with the regional inflation rate by 5% in the 1st quarter of 2019.” The text of the order must contain a reference to regulatory acts: the Labor Code of the Russian Federation (Article 134) and the LNA (collective agreement).