What is wage indexation?

Often the concept of wage indexation is confused with its increase. The main difference in this case is the fact that an increase in salary or tariff rates, the size of monthly bonuses, for example, when increasing the grade of professional skill of a subordinate skill, is permissible for individual employees.

The manager has the right to single out conscientious employees by issuing an appropriate written order, taking into account the financial capabilities of the enterprise (if there is profit from production activities). Also, the salary can be increased due to established limits in accordance with the approved staffing table (the so-called “fork” of minimum and maximum values).

From an economic point of view, the term “indexation” is used as a way to protect against inflation by linking earnings to the consumer price index.

Thus, we come to the conclusion that indexation, in simple words, are measures that contribute to full or partial compensation of losses in real income associated with rising prices for goods and increased tariffs for paid services (for example, for electricity, water supply and heat supply).

Important! Everyone is equal before the law. This means that salary indexation must be carried out for all full-time employees.

Let's summarize

All employees in our country operating under an employment contract have the right to wage indexation by an amount not less than the annual increase in the consumer price index, regardless of the type of business entity, form of ownership, founders and other circumstances.

This rule, which determines the obligation to increase wages, is set regardless of the economic situation of the enterprise, lack of profit and other external factors.

Lack of indexation is a violation of labor legislation and employee rights.

Be healthy! And if possible, appreciate the author’s efforts with a favorable like; this is the best motivation for further “creativity.”

Grounds for recalculation

Despite the fact that, as one of the measures to bring closer the level of real wages in connection with inflation, the legislator in Art. 134 of the Labor Code of the Russian Federation indicates indexation; this does not mean that price increases serve as an indicator for the recalculation of earnings.

There is no clearly defined mechanism, frequency and order of the indexation procedure. Owners and those authorized by them to manage the activities of enterprises and organizations have the right to make a decision on the need to index payments at their own discretion, having approved these norms by local legal acts of internal use.

It is possible, but not necessary, to accept the relevant publications of Rosstat as the basis for indexing. As the practice of judicial proceedings in which citizens file claims for the protection of guaranteed labor rights shows, these indicators should be regarded as a reason for increasing the level of payments.

As a condition for wage indexation, the employer remains entitled to be guided by price increase data:

- countrywide;

- in the region of location of the enterprise acting as a legal entity or the actual activity of the entrepreneur using the labor of hired workers;

- an increase in the cost of living of the working population.

For information! According to official statistics for 2021, Russia is ahead of all countries in terms of inflation, taking 1st place. Already in January 2021, this figure increased by 0.04 compared to the data for December 2021.

According to background information prepared by ConsultantPlus specialists, the cost of living per capita for the first quarter of 2021 in March of this year has not been established for the country. Last year’s indicators for the third quarter of 2021 are taken as the basic benchmark:

Categories

Read in the article:

- What does the Labor Code of the Russian Federation say about wage indexation?

- What actions should the employer take?

- What decisions do the courts make on this issue?

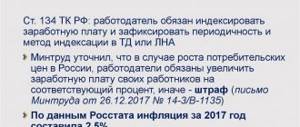

According to Art. 134 of the Labor Code of the Russian Federation, ensuring an increase in the level of real wages includes indexation of wages in connection with the increase in consumer prices for goods and services. State bodies, local government bodies, state and municipal institutions carry out wage indexation in the manner established by labor legislation and other regulatory legal acts containing labor law norms, other employers - in the manner established by the collective agreement, agreements, local regulations (hereinafter - LNA).

From the norm of Art. 134 of the Labor Code of the Russian Federation it follows that in organizations not related to the public sector, the employer establishes the indexation procedure in the LNA or, taking into account the opinion of the representative body of employees, in the collective agreement. If the corresponding LNA has not been developed, there is no collective agreement, then even if the employer increases the wages of employees, as a rule, there is no talk of wage indexation.

Let us note that the Moscow City Court, in its Appeal ruling dated December 24, 2013 in case No. 11-42489, came to the conclusion that if an organization does not have a collective agreement, there is no LNA providing for the procedure for indexing wages, and there is no corresponding condition in employment contracts with employees, The plaintiff's demands for wage indexation due to rising consumer prices for goods and services cannot be satisfied.

Note!

The indexation procedure can be established in an industry agreement, which, as is known, is mandatory for organizations in the relevant industry that have not sent a reasoned refusal to join such an agreement within the established time frame. For example, the Federal Industry Agreement on Communications and Information Technologies Organizations of the Russian Federation for 2015–2017 established an annual indexation of wages for industry workers. In this case, organizations cannot establish indexation less frequently than once a year in collective agreements and LNAs.

The Judicial Collegium for Civil Cases of the Moscow City Court (Appeal ruling dated December 12, 2013 No. 11-36261/13) indicated that the procedure, size, and frequency of indexation of the plaintiff’s wages should have been determined by the employer in the relevant collective agreement, agreement, LNA , the adoption of which, by virtue of Art. 8, part 1 art. 22, art. 40, 45 of the Labor Code of the Russian Federation, is the right of the employer. (Note that the adoption of a number of LNA or the consolidation of certain provisions in the LNA is the responsibility of the employer, in particular, the rules on wage indexation for non-budgetary employers.)

At the same time, the Constitutional Court of the Russian Federation, in its ruling dated June 17, 2010 No. 913-О-О, noted that, by virtue of the provisions of Art. 2, 130 and 134 of the Labor Code of the Russian Federation, wage indexation must be provided to all persons working under an employment contract . Regulatory provisions that provide employers who do not receive budget funding with the right to independently (including with the participation of employee representatives) establish the procedure for wage indexation provide them (unlike employers financed from the relevant budgets) with the opportunity to take into account the entire set of circumstances significant for both employees and employers.

Rostrud also believes that the employer is obliged to index wages. According to letter No. 1073-6-1 dated April 19, 2010, if the organization’s LNA does not provide for the procedure for wage indexation, then, given that wage indexation is the responsibility of the employer, it is necessary to make appropriate changes (additions) to those in force in the organization LNA.

Attempts to make wage indexation mandatory at the legislative level

Amend Art. 134 of the Labor Code of the Russian Federation, which would make indexation mandatory, including for organizations not related to the public sector, has been proposed repeatedly.

On August 10, 2015, Bill No. 858149-6 “On Amendments to the Labor Code of the Russian Federation” was introduced into the State Duma of the Russian Federation, which proposes:

1. Article 134 shall be stated as follows:

“Article 134. Ensuring an increase in the level of real wages[1]

Ensuring an increase in the level of real wages includes indexation of wages in connection with rising consumer prices for goods and services. State bodies, local government bodies, state and municipal institutions carry out annual indexation of wages in the manner established by labor legislation and other regulatory legal acts containing labor law norms; other employers are obliged to carry out indexation at least once a year in an amount not lower than that established by the normative a legal act of a constituent entity of the Russian Federation the minimum amount of wage indexation in a constituent entity of the Russian Federation in the manner established by the collective agreement, agreements, local regulations.”

2. Add article 134.1 with the following content:

«Article 134.1. Establishing a minimum wage indexation in connection with rising consumer prices for goods and services

In a constituent entity of the Russian Federation, a regulatory legal act of a constituent entity of the Russian Federation establishes the minimum amount of wage indexation in a constituent entity of the Russian Federation.

The minimum amount of wage indexation in a constituent entity of the Russian Federation is established for employees working in the territory of the corresponding constituent entity of the Russian Federation, with the exception of employees of organizations financed from the federal budget.

The minimum wage indexation in a constituent entity of the Russian Federation is established taking into account socio-economic conditions, the cost of living of the working population, and the growth of consumer prices for goods and services in the corresponding constituent entity of the Russian Federation.

The minimum amount of wage indexation in a constituent entity of the Russian Federation cannot be lower than the minimum amount of the consumer price index , approved by the federal executive body exercising the functions of developing state policy and legal regulation in the field of official statistical accounting, the formation of official statistical information on social, economic , demographic, environmental and other social processes in the Russian Federation.

The minimum wage indexation in a constituent entity of the Russian Federation is ensured by:

organizations financed from the budgets of the constituent entities of the Russian Federation - at the expense of the budgets of the constituent entities of the Russian Federation, extra-budgetary funds, as well as funds received from entrepreneurial and other income-generating activities;

organizations financed from local budgets - at the expense of local budgets, extra-budgetary funds, as well as funds received from business and other income-generating activities;

other employers - at their own expense."

According to information from the St. Petersburg Legal Portal[2], members of the Cabinet of Ministers considered the measures proposed by the deputies of the Legislative Assembly of Karelia to be excessive. The government expressed concern that this could even lead to an increase in cases of bankruptcy of commercial organizations.

On December 23, 2015, the responsible committee (State Duma Committee on Labor, Social Policy and Veterans Affairs) proposed to reject the bill.

POSSIBLE WAYS OF IMPLEMENTING SALARY INDEXATION

Based on the norms of the Labor Code of the Russian Federation and taking into account the opinions of the Constitutional Court of the Russian Federation and Rostrud, in order to avoid claims from inspection bodies and dissatisfaction of employees, a non-budgetary employer must establish in a collective agreement or LNA a procedure for indexing wages and implement it regularly. Let's consider several ways that will reduce the adverse consequences of salary indexation for the employer.

1. Determine the procedure for indexing wages not in a collective agreement or in employment contracts with employees, but in LNA, which will allow the employer in the future, if necessary, to adjust the procedure for indexing wages without making changes to the collective agreement (which is quite difficult) or employment contracts (which requires execution of additional agreements with all employees of the organization).

ARBITRAGE PRACTICE

The court explained that the legal regulation of the procedure for indexing wages as a form of state guarantee for employees is aimed at taking into account the peculiarities of the legal status of an employer not related to the budgetary sector, and at the same time does not allow him to deprive employees of the guarantee provided by law and evade establishing compensation, since it presupposes determination of its size, procedure and conditions for its provision when concluding a collective agreement or employment contract or in the LNA , adopted taking into account the opinion of the elected body of the primary trade union organization.

Determination of the Constitutional Court of the Russian Federation dated July 17, 2014 No. 1707-O

2. If the employer does not have the opportunity to index employees’ salaries quarterly, the LNA may provide for indexation once a year (or once every three years, etc.).

ARBITRAGE PRACTICE

The Leningrad Regional Court points out: the court does not have the right to interfere in issues related to the establishment of wage conditions by the employer, including issues related to wage increases.

As follows from the case materials, the Regulations on the remuneration of workers provide for wage indexation at least once every three years.

The panel of judges concluded that the court of first instance correctly assumed that the current labor legislation does not contain mandatory rules regarding the obligation of employers not financed from the relevant budgets to carry out monthly wage indexation based on the consumer price index. The court of first instance rightly stated in its decision that labor legislation does not establish mandatory requirements for the indexation mechanism, and therefore the employer has the right to independently select criteria for indexation.

According to the court, regulations that provide employers who do not receive budget funding with the right to independently (including with the participation of employee representatives) establish the procedure for wage indexation provide them (unlike employers financed from the relevant budgets) with the opportunity to take into account the entire set of circumstances that are significant for both employees and the employer, and cannot be considered as uncertain and violating their constitutional rights .

Thus, the issue of wage indexation for employers that are not financed from the relevant budgets is assigned by the legislator to the exclusive competence of employers, who resolve issues of wage indexation at the local level, taking into account specific circumstances, the specifics of the organization’s activities, and its level of solvency . At the same time, the employer’s discretion in this matter is limited by the fact that these issues are resolved jointly with employees through the conclusion of a collective agreement or other LNA, taking into account the opinion of the representative body of employees (if there is such a representative body).

In this regard, other bodies, including the court, do not have the right to interfere in matters related to the establishment of wage conditions by the employer, including issues related to wage increases. The subject of the court's consideration can only be issues of violation of the employee's rights related to the employer's non-payment of wages, taking into account the indexation that was carried out by the employer during the employee's period of work .

Determination of the Leningrad Regional Court dated September 18, 2013 No. 33-4335/2013

3. The employer may provide in the LNA, which determines the indexation of wages, the necessary conditions for its implementation, for example, indicate that the possibility of indexation depends on the financial situation of the company.

ARBITRAGE PRACTICE

The court found no grounds for satisfying the claims for wage indexation, finding that the collective agreement stipulates that the increase in workers' wages is carried out, first of all, by increasing production volumes and increasing labor efficiency. That is, the employer’s obligation to index wages is not unconditional , but depends on various factors, including the economic indicators of the organization. These provisions provide the employer with the opportunity to take into account the entire set of circumstances when implementing measures to ensure indexation.

At the same time, the court found that the defendant has unfulfilled monetary obligations, including debt to employees (plaintiffs) on the basis of court decisions, which indicates the difficult financial situation of the enterprise, the absence of an increase in production volumes, an increase in labor efficiency, high economic indicators and , therefore, about the absence of conditions for increasing wages for employees .

Appeal ruling of the Moscow City Court dated May 28, 2014 in case No. 33-15195/2014

ARBITRAGE PRACTICE

The court found that the conditions and procedure for indexation at the OJSC were established by a collective agreement.

In accordance with clause 4.22 of the Collective Agreement, the administration has the right to index wages taking into account the growth of inflation and the financial situation of the enterprise .

Thus, the employer’s obligation to index wages is not unconditional, but depends on the financial situation of the enterprise.

As follows from the financial results report for January–December 2013, the company has a loss from financial and economic activities of 12,818,000 rubles. These circumstances indicate the difficult financial situation of the enterprise and, therefore, the absence of conditions for increasing wages for employees .

Thus, the court’s conclusion that there are no grounds to satisfy the claims is correct.

Ruling of the Primorsky Regional Court dated August 12, 2014 in case No. 33-7028

4. The employer can establish in the LNA the optimal amount of salary increase for itself, which does not depend on the consumer price index, or a norm according to which the amount of indexation will depend on the financial situation of the employer.

Norm Art. 134 of the Labor Code of the Russian Federation, which establishes wage indexation in connection with rising consumer prices for goods and services, only says that rising consumer prices are the basis for wage indexation, but does not oblige the employer to carry out wage indexation in strict accordance with the growth index consumer prices and precisely for this reason.

ARBITRAGE PRACTICE

The court, having established that the employer, before including the wage indexation procedure in the Regulations on Remuneration, for several years regularly - twice a year - increased the employee's wages, agreed with the decision of the trial court, which rejected as unfounded the plaintiff's arguments that that wage increases should be made by the employer using the consumer price index.

The panel of judges indicated that labor legislation does not contain mandatory rules regarding the obligation of employers not financed from the relevant budgets to index wages based on the consumer price index.

Within the meaning of Art. 134 of the Labor Code of the Russian Federation, an increase in consumer prices for goods and services is the basis (reason) for indexing workers’ wages, but not a mandatory value for such indexation .

The court noted that labor legislation does not establish requirements for the indexation mechanism, and therefore the employer has the right to independently select criteria for indexation .

Based on the fact that during the plaintiff’s work his salary was repeatedly increased and more than doubled for the period from April 1, 2007, it should be recognized as justified the court’s conclusion that the plaintiff did not prove the fact of violation of his labor rights and, as a consequence, the court’s conclusion about the absence of legal grounds for satisfying the claims.

Determination of the Leningrad Regional Court dated January 23, 2013 No. 33-217/2013

If the employer does not have a procedure for indexation (there is no collective agreement or LNA in which it would be enshrined, there is no provision for wage indexation in employment contracts with employees), in the event of a legal dispute, the court may use the consumer price growth index to calculate wage indexation , calculated by Rosstat and its divisions for the constituent entities of the Russian Federation, which is confirmed by judicial practice.

ARBITRAGE PRACTICE

The Moscow City Court agreed with the decision of the court of first instance, which ordered the indexation of wages collected from the defendant in favor of the plaintiff.

The panel of judges found that, when calculating the amount to be recovered taking into account indexation, the court was reasonably guided by data from the Moscow City Statistics Service, from which it is clear that the dynamics of the consolidated consumer price index for goods and paid services for the population in Moscow in percentage terms in November 2009 to December 2008 was 109.3%.

Having checked the correctness of the calculation of the amount to be recovered given in the Court's Ruling, the judicial panel believes it is possible to agree with it, since it does not contain arithmetic errors and corresponds to the evidence available in the case file.

Ruling of the Moscow City Court dated July 27, 2010 in case No. 33-20134

5. Some employers choose another way: not to include provisions on indexation in the collective agreement and LNA, hoping that this will protect them from increasing the cost of paying staff and the courts in this case will not be able to force them to index wages. But, as we have already said, the courts can make decisions in favor of workers, and the State Labor Inspectorate (SIT) and the prosecutor's office have the right to force the employer to comply with the requirement of Art. 134 of the Labor Code of the Russian Federation, punishing him administratively for failure to comply.

IF THE LNA ESTABLISHING THE PROCEDURE FOR SALARY INDEXATION IS NOT IN THE ORGANIZATION

It should be noted that if the employer, despite the norms of the Labor Code of the Russian Federation, the position of the Constitutional Court of the Russian Federation and the opinion of Rostrud, LNA, which establishes the procedure for wage indexation, does not have workers' appeal to the court with a claim for the employer's obligation to approve the corresponding LNA may be meaningless.

ARBITRAGE PRACTICE

The court does not have the right to oblige the employer to accept the LNA on establishing a procedure for ensuring the level of real wages of employees, since it does not have the right to interfere with the employer’s activities in rule-making in the field of regulating labor relations .

The panel of judges agreed with the court's conclusion that it rejected the claim regarding the defendant's obligation to accept the LNA in accordance with the requirements of Art. 134 of the Labor Code of the Russian Federation to establish the procedure for wage indexation.

Appeal ruling of the Supreme Court of the Komi Republic dated October 29, 2012 in case No. 33-4838AP/2012

It should be noted that the State Labor Inspectorate or the prosecutor's office are authorized to issue an order to eliminate violations of labor legislation requirements (Article 134 of the Labor Code of the Russian Federation).

ARBITRAGE PRACTICE

The court pointed out that the indexation of the plaintiff’s wages is not provided for by the collective agreement, agreements, or the defendant’s LNA, and the court does not have the right to interfere with the defendant’s rule-making activities, and therefore the plaintiff’s demands for indexation of his wages in accordance with Art. 134 of the Labor Code of the Russian Federation are not subject to satisfaction .

Appeal ruling of the Moscow City Court dated July 18, 2013 in case No. 11-22647/13

ARBITRAGE PRACTICE

The panel of judges for civil cases found that in the limited liability company there is no collective agreement and LNA that would provide for an increase in the official salaries of the defendant’s employees. The employment contract concluded with the employee also does not provide for wage indexation due to rising consumer prices for goods and services.

The court concluded that the plaintiff’s demands for wage indexation due to rising consumer prices for goods and services cannot be satisfied.

Appeal ruling of the Moscow City Court dated December 24, 2013 in case No. 11-42489

ARBITRAGE PRACTICE

The judicial panel for civil cases agreed with the decision of the court of first instance to refuse to pay the indexation of average earnings for the period of forced absence from July 2010 to January 2014. From the case materials it follows that the defendant does not have a collective agreement and LNA that would provide for an increase official salaries of workers that significantly exceed the minimum wage and the subsistence level both in the Russian Federation as a whole and in Moscow. The employment contract concluded with the plaintiff also does not provide for wage indexation in connection with rising consumer prices for goods and services.

Appeal ruling of the Moscow City Court dated January 22, 2015 in case No. 33-1720/2015

On the contrary, a number of judicial acts contain requirements for the employer to accept the appropriate LNA (but not to index the wages of employees due to the absence of such a document at the time of the decision!).

ARBITRAGE PRACTICE

The court ordered the defendant, within three months from the date the court decision entered into legal force, to make changes to the Regulations on remuneration of employees of the enterprise or to adopt another LNA providing for the procedure for indexing wages to employees of the enterprise.

Determination of the Leningrad Regional Court dated May 15, 2013 No. 33-1971/2013

The court, citing Art. 134 of the Labor Code of the Russian Federation and letter of Rostrud dated April 19, 2010 No. 1073-6-1, satisfied the claim of the district prosecutor in defense of the interests of an indefinite number of persons regarding the obligation of the employer - an agricultural production cooperative to establish a procedure for indexing wages, since such a procedure is neither a collective agreement nor LNA not installed.

Appeal ruling of the Volgograd Regional Court dated July 19, 2012 in case No. 33-6936/2012

If the collective agreement or LNA nevertheless provides for a procedure for indexing wages, the court may oblige the employer to index the wages of employees in connection with rising consumer prices.

ARBITRAGE PRACTICE

During the consideration of the case, the court found that in the period from 2009 to 2010. JSC in violation of Art. 134 of the Labor Code of the Russian Federation did not ensure an increase in the level of real wages of the employee and did not index it in connection with the increase in consumer prices for goods and services in the manner established by the collective agreement or industry tariff agreement.

Taking into account the increase in the basic monthly tariff rate of a first-class worker in accordance with the consumer price index in the Russian Federation, paragraphs. 2.3, 2.4 of the Industry Tariff Agreement in the Housing and Communal Services of the Russian Federation for 2008–2010, the court ordered the OJSC to recalculate wages.

The Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Buryatia believes that the debt was collected lawfully.

Cassation ruling of the Supreme Court of the Republic of Buryatia dated August 15, 2011 in case No. 33-2552

The court, taking into account that the industry agreement and the collective agreement in force at the employer’s enterprise provided for an increase in the minimum monthly tariff rate by the amount of the actual increase in the consumer price index of the Russian Federation based on data from the State Statistics Committee of Russia and the joint information letter of the RaEl Association and the All-Russian Committee for Economic Economic Policy in within the limits of funds for wages approved by the authorized state regulatory body in tariffs for electrical and thermal energy, and also having established that the indexation of wages of employees of the executive office of OJSC "Yenisei TGC (TGK-13)" was not carried out by the employer, came to a reasonable conclusion about the existence The plaintiff has the right to recover it .

Appeal ruling of the Krasnoyarsk Regional Court dated 09/03/2012 in case No. 33-7513B-09

[1] Here and below it is emphasized by the author.

[2] https://ppt.ru/news/133991.

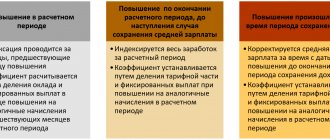

The procedure for indexing wages

As such, there is no common recalculation algorithm for all. The only thing the legislator refers to is that state and municipal employees have their salaries increased by a certain coefficient, indexing wages, in the manner established by the Labor Code of the Russian Federation, other federal laws, and regulations. Other owners and managers must establish order themselves.

The frequency and indexation rules are approved by internal regulations and stipulated by the terms of a collective or individual employment contract concluded upon hiring. In the event of the adoption of certain local legal acts, all employees are familiarized with this document against their personal signature. For example, this could be a provision on wages, where it is necessary to clearly indicate which payments are subject to indexation.

It is allowed to recalculate salaries and tariff rates, while bonuses remain in fixed amounts. It is not prohibited to set limits on the maximum income of subordinates, which will be indexed:

Lawyers have differing opinions on whether it is necessary to conclude additional agreements to existing employment contracts on changes in wages.

The amount of earnings must be specified in the agreement concluded with the new employee. To avoid paperwork before each recalculation, you can initially clarify that the employee’s salary is a salary taking into account indexation carried out in accordance with the current Regulations on remuneration:

Court positions

In order to form uniform judicial practice and correct interpretation of Article 134 of the Labor Code of the Russian Federation, the highest courts have formed the following legal positions:

In accordance with the ruling of the Supreme Court of the Russian Federation dated 04/08/2019 No. 89-KG 18-14, the absence of an established procedure for indexing employees’ wages cannot be a basis for non-indexation.

In accordance with the definition of the Constitutional Court of the Russian Federation dated June 17, 2010 No. 913-О-О, wage indexation is aimed at ensuring an increase in the level of real wage content, its purchasing power and, by its legal nature, represents a state guarantee for the remuneration of workers... Wage indexation must be provided to all persons working under an employment contract...

The above means that the organization must specify specific procedures, criteria, and frequency of wage indexation, and the employer must follow them.

If the collective agreement or local regulations do not specify the indexation procedure, the employer needs to make the necessary changes to them, which is confirmed by Rostrud’s letter No. 1073-6-1 dated April 19, 2010.

Requirements for wage indexation

Once again, I would like to note that indexation of wages is only one of the methods offered to employers to actually increase the level of income of workers.

In the next response given in letter No. 14-1/ОOG-10305 dated December 24, 2018 to an appeal received on the website of the Ministry of Labor, the Department of Labor Remuneration and Social Protection, emphasized:

- the department's opinion is not a normative legal act;

- the norms of the current legislation regulating issues of labor relations do not provide for a uniform procedure for indexing payments;

- the employer retains the right to increase the amount of earnings for certain categories of employees;

- The result of increasing wages can be achieved by proportionally increasing all payments provided for in the remuneration system or only certain of them, for example, salary or tariff rate.

Employer's liability for failure to comply with indexation rules

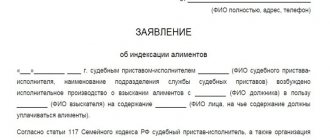

If an employer voluntarily, citing financial difficulties and other reasons, does not carry out indexation, guided by the provisions of Section XIII of the Labor Code of the Russian Federation, in order to provide assistance in protecting labor rights, you can file a complaint with the territorial labor inspectorate.

A written appeal is drawn up in any form individually or on behalf of the entire workforce or individual representatives.

Statement:

- taken personally to the inspection;

- sent by registered mail with notification of delivery to the addressee;

- compiled on the Rostrud website by filling out a specially proposed form in the “online inspection” section.

Within 30 days from the date of registration of the received appeal, an authorized representative shall verify the specified facts of violations of labor guarantees.

If the employer, ignoring his responsibilities to his subordinates, has not approved the procedure for indexing earnings or, if there are relevant provisions, does not recalculate the payments due within the established time frame:

- information about violations will be reflected in the unscheduled control measures report;

- the inspector will draw up a protocol of administrative violations, which is fraught with penalties both for the guilty officials and at the same time for the enterprise acting as a legal entity;

- will issue an order to take measures to eliminate violations within a specified time frame.

Note! Failure to comply with the orders of the supervisory authority will result in the employer being subject to the collection of an additional fine to the state, without removing the obligation to comply with instructions to restore the labor rights of subordinates.

You can also submit an application to the prosecutor's office or directly to the district court.

Tax consequences of salary indexation

Depending on the means by which the employer plans to increase the amounts paid to employees to amounts corresponding to consumer capabilities, the company faces the consequences of deductions of income taxes, personal income tax and insurance premiums.

For example, if salary indexation is carried out at the expense of the current expenses of the enterprise, the accrued amounts must be taxed in the calendar month when the recalculation was made. When indexing at the expense of retained earnings of past years, expenses are not taken into account when taxing profits.

As for mandatory insurance contributions to the Pension Fund, Social Insurance Fund and others, they must be accrued for any source of financing.

Despite the fact that wage indexation may only include a change in salary or tariff rate, since they are considered components of earnings, they are subject to personal income tax. That is, 13% tax is withheld from employees on the accrued total amounts.

How often is it carried out?

Due to the lack of a unified procedure for increasing salaries under federal law, commercial organizations can independently determine the form of salary increases and its frequency. Thus, based on clause 10 of the Review of Judicial Practice of the Supreme Court No. 4, approved in 2021, indexation may take the form of a salary increase, payment of bonuses and other methods.

Wage indexation can be carried out at the following frequency:

- One year . The indicated time frames for indexing are maximum. That is, the enterprise is obliged to carry out indexation during the calendar year, and the time of indexation can be any: for example, the last month of the year.

- Six months . Indexation can be carried out every six months, which can increase staff motivation.

- Quarter.

- Month . These are the minimum terms for indexing.

Too frequent indexation of wages, although not a violation of labor laws, increases the burden on HR specialists and accounting employees.

Any date for salary indexation can be specified in local documentation: it can be the 5th or the 10th. But usually the salary is indexed from the first day, which makes it easier to calculate the income indexed to employees.

Paperwork

Having decided on the need for periodic recalculation of employee earnings, a procedure is developed, taking into account the opinion of the trade union (if one operates in the organization), which is approved by any local legal act:

- collective agreement;

- provisions on the remuneration system or a separate provision specifically relating to indexation.

It is necessary to clarify:

- frequency (this can be done monthly, but in practice it is more acceptable to make changes quarterly, every six months or year);

- what components of earnings are subject to indexation;

- what serves as a guideline for increasing wages (for example, the rate of inflation, the increase in the cost of living of the working-age population in the region or country).

- payment procedure.

Example:

We recommend issuing an order indicating the timing and value of the coefficient used when recalculating earnings during each indexation.

Sample:

Features of the procedure

Indexation should be carried out for all employees of the organization according to established rules, regardless of how much time has passed since the person was hired, position held, social, gender, race and other distinguishing characteristics.

Rostrud specialists believe that allowances, bonuses and other additional payments to the salary or tariff rate, established as a percentage of these payments, do not need to be indexed, since they are calculated from an already increased amount.