How to calculate the indexation size

Despite the strict regulations, the manager has the opportunity to prescribe the procedure and calculate the index based on his own needs and funding levels. The indexation coefficient, as well as the salary increase coefficient when calculating vacation pay, is determined by the formula:

- CI - coefficient;

- And - indexing.

The indicator of old and new salaries includes all amounts paid monthly to an employee in the form of remuneration for work - compensatory and incentive additional payments and allowances, bonuses and other payments. The index also applies when recalculating the average earnings, which is adjusted when salaries or tariffs change.

How to index correctly

Legislatively, the procedure for indexation and recalculation of salaries is enshrined in the Regulations approved by the RF Government No. 922 dated December 24, 2007. Based on current standards, the employer must establish rules for indexing wages in his institution and spell them out in local legal acts.

The indexing procedure is accompanied by the signing of additional agreements with each employee. The document specifies the amount of the new salary and the final monthly remuneration, as well as the legal basis in accordance with the regulations on remuneration (Article 134 of the Labor Code of the Russian Federation).

How to recalculate vacation pay

The reporting period for calculating payments is 12 months preceding the start of the vacation.

Legislative regulations do not stipulate how to index vacation pay when increasing salaries, but when adjusting the amount of payments, certain aspects must be taken into account:

| Order of increase | Recount procedure |

| Salaries increased in the billing period | The CI established in the organization is applied to the average earnings for the entire period, which is taken into account when calculating vacation payments |

| The salary increased not during the pay period, but before the start of the vacation | Average earnings are indexed to the CI value |

| Income growth occurred during the holidays | Average earnings are indexed to CI directly from the date when the salary actually increased |

The calculation procedure itself is carried out as follows:

- We calculate CI.

- We recalculate the average earnings by a coefficient for further calculation of vacation pay.

Do I need to index vacation pay?

Earnings are clear, but is it necessary to index vacation pay when increasing salaries? With such indexation, the average earnings are also recalculated. Article 139 of the Labor Code of the Russian Federation states that the amount of average earnings for a certain period is the basis for calculating vacation pay. This means that after increasing remuneration for work, vacation payments are also indexed.

But the Regulations, which were approved by RF PP No. 922 (clause 16 of the Regulations), indicate that average earnings are adjusted if the salaries or tariffs of absolutely all employees employed in the institution are indexed. If the tariff rate or salary, and therefore the final remuneration of at least one employee, were not indexed, then the average earnings are not subject to adjustment (Letter of Rostrud No. 5920-TZ dated October 31, 2008, Letter of the Ministry of Health and Social Development No. 22-2-176 dated January 30. 2009).

IMPORTANT!

If average earnings do not increase, then vacation pay does not increase.

What happens if the employer does not recalculate vacation pay?

If the indexation procedure is established in local regulatory legal acts, but the organization does not carry out this procedure, then it will face administrative liability and penalties from 3,000 to 5,000 rubles. (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

Every employee has the right to annual paid leave. Accrual and payment of vacation pay is based on average earnings. Therefore, any changes in earnings are reflected in changes in vacation pay.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

Is it possible to hold an employer liable if indexation was not carried out?

When a violation is established again, the amount of the fine increases. In particular, penalties for an enterprise amount to 50-70 thousand rubles. When an enterprise specifies the indexation process in a collective agreement, but does not increase payments to employees, a fine of 3-5 thousand rubles is imposed on it.

Some employers, in order not to increase the organization's costs, do not want to index salaries. However, such savings may entail administrative liability for the employer:

- If a local document contains information about wage indexation, but the actual absence of such a procedure, a fine in the amount of 3,000 to 5,000 rubles is imposed on the employer. (Article 5.31 of the Code of Administrative Offenses of the Russian Federation).

- If there is a simultaneous lack of information about indexation in local documents and the indexation itself, a fine for the legal entity employer is from 30,000 to 50,000 rubles, for officials and individual entrepreneurs - from 1,000 to 5,000 rubles. (Part 1 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Please note that these are not the only costs that an employer may incur due to the lack of indexation. If an employee, whose interests in relation to indexation are infringed, goes to court, then the employer, in the event of a positive outcome, will have to pay the lost salary for all periods of violation of the law.

Let us note that some arbitrators take the employer’s side and believe that salary indexation is not his responsibility (appeal ruling of the Judicial Collegium for Civil Cases of the Supreme Court of the Republic of Mordovia dated April 30, 2015 in case No. 33-918/2015).

In addition, there are a number of valid reasons for not indexing. These include:

- the difficult financial situation of the employer (appeal ruling of the Kostroma Regional Court dated May 26, 2014 No. 33-797/2014);

- a good level of employee salaries that does not require an increase (appeal ruling of the Omsk Regional Court dated November 25, 2015 No. 33-8541/2015).

Is it necessary to index vacation pay?

An increase in wages at an enterprise can occur through an increase in salary or through income indexation.

Despite the similarity of these methods in terms of their final result (increase in employee salaries), they have some fundamental differences. In particular, salary increases occur on a voluntary basis by decision of the employer.

It can only apply to an individual employee and is a kind of reward for conscientious work. The amount of the increase is set by the employer at its discretion, taking into account current financial capabilities.

Indexation of earnings serves as a guarantee, which is ensured by labor legislation and fixed at the highest state level. It is provided for by the provisions of Art. 130, 134 Labor Code.

Income indexation is carried out under the influence of rising prices and applies to all employees. Its size is regulated at the federal level.

Determining the indexation coefficient can be attributed to the competence of the employer.

During the period a citizen is on annual leave, he is entitled to vacation pay, which is determined on the basis of average monthly earnings for the previous 12 months. Vacation pay is accrued in accordance with the Labor Code and its articles 114, 139, 167.

The specifics for calculating average earnings are contained in Government Decree No. 922 of 2007 . This document contains the regulations and procedure for calculating vacation pay when salaries increase. In this case, vacation pay must be indexed by an increase factor.

If the organization has increased tariff rates and monthly additional payments to them, then the average earnings for calculating vacation pay are indexed (according to clause 16 of Government Decree No. 922) by the calculated indexation coefficient.

It is worth considering that the procedure specified here applies only if the payment change is made en masse - across the organization, its branch or structural unit (section or department).

But when we are talking about a salary increase in favor of an individual (for example, an employee’s salary was increased at the end of a probationary period or due to a change in job function), then vacation pay is not indexed. In this situation, vacation pay must be calculated on the basis of actually accrued income without adjusting it (according to the letter of Rostrud of 2008 No. 5920-TZ).

Therefore, if the indexation carried out in the company did not affect at least one person, then it will not be taken into account in the calculation of vacation pay.

The above rules for indexing vacation pay are relevant for both main employees and part-time employees (according to clause 19 of Government Decree No. 922). When an internal part-time worker goes on vacation, his average earnings are calculated for both the main and part-time positions.

How to calculate the indexing coefficient for vacation pay

Vacation payments are indexed taking into account the indexation coefficient. It is important to take into account that the indexation coefficient involves taking into account both the increase in tariff rates and monthly additional payments to them.

This is due to the fact that in the process of calculating average earnings, it is necessary to calculate all payments provided for by the remuneration system . These are wages, various bonuses and additional payments for length of service, working conditions, and combinations.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

In particular, we are also talking about supplements and allowances for work in harmful or dangerous conditions, for work on weekends and weekdays, night shifts, etc. These payments also increase proportionally after indexation.

In practice, a situation may arise that it will not be necessary to apply the indexation coefficient, despite the fact that salaries have been increased. For example, the salary was increased by 15% and at the same time the monthly bonus was reduced by the amount of the salary increase.

When dividing the new salary after indexation (taking into account the bonus) by the old one, a coefficient of 1 is obtained. Therefore, in fact, indexation of average earnings does not occur.

Companies that pay additional amounts to employees should remember that not all payments that are taken into account when determining average earnings are subject to adjustment by the increase factor . Thus, when recalculating average earnings, payments that are set not as a fixed value, but as a range of values (for example, as a percentage or a multiple of a certain value), as well as payments taken into account when determining average earnings in an absolute amount, are not adjusted.

Indexing order

The procedure for indexing vacation pay largely depends on the moment at which income indexation was carried out:

- If indexation was carried out in the billing period , then all payments from the beginning of the billing period to the month of indexation must be increased by the indexation factor.

- If indexation was made after the billing period , but before the vacation pay was paid, then the accrued payments are multiplied by the indexation coefficient.

- If during the billing period the salary was first increased, and then the salary was reduced due to difficult economic conditions , then indexation of average earnings is also carried out, but in relation to income before indexation. That is, indexation is also needed if, at the time an employee goes on vacation, his salary decreases below previous values.

In general, the procedure for indexing vacation pay occurs according to the following algorithm:

- The indexation coefficient is calculated.

- Income before indexation is adjusted for it.

- The total earnings for the billing period are calculated.

- It is divided by the number of months and 29.3.

- The average earnings received are multiplied by the number of vacation days.

Let's look at the procedure for indexing vacation pay using an example. Employee Ivanov will go on annual paid leave for 14 days from February 25, 2021. The calculation period for determining earnings will be: February 1, 2021 – January 31, 2019. For simplicity, we will assume that the employee worked the pay period in full.

The employee’s salary, taking into account changes in the organization as a whole (due to different economic situations), was as follows:

- From January to February – 23,000 rub.

Thus, in May, employee income was indexed.

We adjust the employee’s income before indexation for three months from February to April by this amount and calculate the total amount of income taken into account when calculating vacation pay:

Finally, the amount of vacation pay to be paid is determined : 14059.33 rubles. (1004.24 * 14 days).

The calculation of vacation pay will be : ((25000 * 1.0 8* 12) / 12 / 29.3) * 28 days = 25802.05 rub.

When indexation of income was made during vacation, separate accounting will be required.

Vacation pay was accrued to the employee without taking into account indexation as follows::

(23000 * 12 / 12 / 29.3) * 14 days = 10989.76 rub.

After the employee returned from vacation, the amount of vacation pay was recalculated for him.

In the period from June 25 to June 30, 2021, vacation pay for 5 days was calculated without taking into account indexation as follows:

((23000 * 12) / 12 / 29.3) * 5 = 3924.91 rub.

For the remaining 9 days, vacation pay was recalculated taking into account the indexation coefficient of 1.17:

((23000 * 1.17 * 12) / 12 / 29.3) * 9 days = 8265.87 rub.

The total amount of indexed vacation pay was : (8265.87 + 3924.91) = 12190.78 rubles.

As a result, the employee was paid additionally : 1201.02 rubles. (12190.78 – 10989.76).

Thus, indexation of average earnings is carried out if the salary increase affected all employees without exception. You also need to take into account that bonuses, allowances and supplements set in a range of values and in absolute terms are not adjusted by the coefficient.

To index the income received before the salary increase, you need to calculate the indexation coefficient. It is determined by the formula: employee’s salary with allowances after indexation / employee’s salary before indexation.

Among the main state guarantees for wages, Article 130 of the Labor Code of the Russian Federation names measures that are taken to increase the level of real earnings of employees.

One of such measures, which is carried out due to an increase in prices for primary services and goods, is considered to be indexation of earnings. How does this affect the amount of vacation pay, and should it be taken into account when calculating vacation pay?

- Should it be indexed?

- How to calculate the indexing coefficient for vacation when salary increases?

- Step-by-step procedure for calculating average earnings

- Salary increased in the billing period

- Salary increased after the billing period

- Salary increased after the start of vacation

- If the employer does not increase income for employees

- Useful video

- conclusions

Should it be indexed?

The system according to which the amount due to a worker is calculated when he goes on a well-deserved rest for 28 (or more) days has long been established. In 2021, no new rules for calculating vacation pay have been developed.

Vacation pay = Average daily salary × Number of vacation days

When calculating vacation pay, you need to take into account all the employee’s income that is associated with the wage system. That is, these are salaries, allowances, bonus payments and other additional payments. There is no need to take into account amounts that are not assigned in the form of labor compensation (in particular, sick leave or financial assistance).

The internal documentation of the institution must prescribe specific rules for the implementation of wage indexation:

- frequency of the process of increasing salaries and tariff rates (monthly, quarterly, annual, and so on);

- list of payments to employees that are subject to indexation (salaries, bonuses, etc.);

- rules according to which the indexation coefficient is calculated to increase income.

The approved adjustments begin to take effect with the approval of the order of the head of the enterprise, which must indicate the coefficient of increase in earnings and the date from which the changes made will take effect.

Based on such a document, changes to the organization’s staffing table are approved - a new increased amount of employee salaries is indicated. HR officers prepare additional agreements to employees’ employment agreements and send them to each of them for signing.

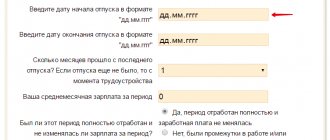

You can calculate vacation pay for a salary increase using the online calculator here.

Simple, convenient and free calculator.

How to calculate the indexing coefficient for vacation when salary increases?

Article 135 of the Labor Code of the Russian Federation determines that municipal and state departments index salaries in accordance with established legal standards in the field of labor protection.

Commercial enterprises independently develop a procedure for increasing salaries, enshrining it in collective agreements or other internal agreements.

In accordance with practice, indexation conditions are specified in the internal documents of large companies that have joined inter-industry agreements.

Small companies often neglect this responsibility. They do not sign collective agreements with employees or include provisions for periodic salary increases. Attempts at such “savings” result in proceedings with the labor inspectorate, after which a fine may be imposed on the enterprise.

Thus, if immediately before the employee’s vacation the company’s salary was increased, then it is necessary to recalculate the average salary, on the basis of which vacation pay is calculated.

The measure to increase salaries applies to every employee, except for persons who are involved in work under a civil agreement.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

To carry out indexation of vacation pay when increasing tariff rates and salaries, you must be guided by clause 16 of the Regulations on average earnings.

First you need to determine the CI - the salary indexation coefficient (salary increase).

To do this, you need to divide the new increased salary by the old one.

Indexation coefficient = New salary / Old salary.

Let’s say that the salary portion of an employee’s salary was 25 thousand rubles, and after an increase - 30 thousand rubles. In this case, the salary increase factor will be as follows:

CI = 30 thousand rubles. / 25 thousand rubles = 1.2

Step-by-step procedure for calculating average earnings

Step 1. Calculate the indexation coefficient using the formula given in the previous paragraph.

Step 2. Recalculation (indexation) of average earnings for vacation pay, taking into account the moment of the increase in staff salaries.

In this case, there are 3 options for calculation: indexation can occur in the billing period, after its end, but before the start of the vacation, or while on annual vacation.

Salary increased in the billing period

Option 1 - the salary increase occurred in the RP (settlement period).

In this case, it is necessary to multiply all payments directly from the beginning of the billing period to the month when the salary increased by the resulting indexation coefficient.

Example, if indexation is included in the billing period:

The employee is granted vacation, its duration is 28 days. The date from which it begins is February 9, 2021. The salary is 24 thousand rubles. There were no exclusion days during the billing period. It is equal to 12 months - from February 1, 2021 to January 31, 2021.

Between February and December 2021, salaries did not change. In January 2021, it was increased by 5 thousand rubles.

The indexation coefficient is calculated as follows: 29 thousand/24 thousand = 1.208.

After this, the formula determines the average salary for vacation pay: (24 thousand × 1.2 × 11 months + 29 thousand × 1 month): (29.3 × 12) = 983.5 rubles.

Salary increased after the billing period

Option 2 is when the salary increase occurred after the end of the pay period, but before the 1st vacation day.

In this case, the entire average salary of the billing period is multiplied by the indexation coefficient.

Example for indexation after the billing period:

Leave for 28 days is provided to the employee from March 9, 2019.

Earnings for the last year - from March 1, 2021 to February 31, 2019 - equal to 240 thousand rubles.

There are no exclusion days.

Increase in earnings - from March 1, 2021

The indexation coefficient is 1.25.

The average salary is determined by the corresponding formula: (240 thousand / 11 / 29.3) = 744.65 rubles.

Salary increased after the start of vacation

The third option is the case of a salary increase after the employee has already gone on vacation. In this case, the part of the vacation pay that remained at the time when new salaries were introduced is multiplied by the indexation coefficient.

An example of a salary increase while staying in the period of maintaining average earnings:

The employee goes on vacation on March 10. 2021

Its duration is 28 days.

Over the last year, I earned 150 thousand rubles. (from March 1, 2021 to February 31, 2021).

There are also no exclusion days.

From 19.03. 2021 salary increase - by 1.23.

According to the corresponding formula, the average salary is determined: (150 thousand / 12 / 29.3) = 427 rubles.

The amount of vacation pay is calculated taking into account the salary increase:

In the period from March 10 to March 18, 2021 - for 9 days - 3840 rubles are released. (427x9).

From March 19 to April 5, 2021 - for 19 days - the amount will be 9970 rubles. (4271 × 1.23 × 19).

After indexation, according to 1 of 3 options, the amount of vacation funds that should be paid to the employee going on vacation is determined.

If the employer does not increase income for employees

The institution where an employee works may sometimes “forget” to index the average earnings for the billing period for vacation pay if the salary was increased.

However, in accordance with clause 16 of the above-mentioned government resolution number 922, if rates increase in the cases provided for in clause 16, then it is necessary to recalculate vacation payments.

Expert opinion

Mikhailov Vladislav Ivanovich

Lawyer with 6 years of experience. Specializes in family law. Knows everything about the law.

In particular, such “forgetfulness” manifests itself in relation to women on maternity leave. And this is a violation of Article 132 of the Labor Code of the Russian Federation, which is considered an infringement in the field of wages.

It should be taken into account that when a company has not prescribed a procedure for increasing earnings in internal regulations and has not changed the salaries of its employees for years, then an administrative fine may be imposed on it under Article 5.27 of the Russian Administrative Code.

The following penalties have been established:

- for enterprise managers – from 1 to 5 thousand rubles;

- for individual entrepreneurs - from 1 to 5 thousand rubles;

When an enterprise specifies the indexation process in a collective agreement, but does not increase payments to employees, a fine of 3-5 thousand rubles is imposed on it.

Example 3

The date from which it begins is February 9, 2021. The salary is 24 thousand rubles. There were no exclusion days during the billing period. It is equal to 12 months - from February 1, 2021 to January 31, 2021. During the period from February to December 2021, the salary did not change. In January 2021, it was increased by 5 thousand rubles. Calculation: The indexation coefficient is calculated as follows: 29 thousand/24 thousand = 1.208.

Info

After this, the formula determines the average salary for vacation pay: (24 thousand × 1.2 × 11 months 29 thousand × 1 month): (29.3 × 12) = 983.5 rubles. The amount of vacation pay will be: 983.5 × 28 = 27,540 rubles.

In the organization LLC "Company", salaries of all employees have been increased by 10% from 03/01/2018. Senior manager Ilya Vadimovich Muravyov goes on vacation from May 21 for 14 calendar days. Before the promotion, his salary was set at 20,000 rubles. After the increase, his salary was 22,000 rubles. The employee is also given a bonus for qualifications in the amount of 5,000 rubles. There were no other charges. The entire billing period has been fully worked out.

The calculation period for calculating vacation pay is from 05/01/2017 to 04/30/2018.

Since the change occurred in the billing period before the onset of vacation, therefore, all payments calculated from the salary portion must be indexed by a coefficient.

Since the bonus for qualifications is set at a fixed amount, it does not need to be recalculated.

| Month | Accrued | Indexed | ||

| Salary | Surcharge | Salary | Surcharge | |

| May | 20 000 | 5000 | 22 000 | 5000 |

| June | 20 000 | 5000 | 22 000 | 5000 |

| July | 20 000 | 5000 | 22 000 | 5000 |

| August | 20 000 | 5000 | 22 000 | 5000 |

| September | 20 000 | 5000 | 22 000 | 5000 |

| October | 20 000 | 5000 | 22 000 | 5000 |

| November | 20 000 | 5000 | 22 000 | 5000 |

| December | 20 000 | 5000 | 22 000 | 5000 |

| January | 20000 | 5000 | 22000 | 5000 |

| February | 20000 | 5000 | 22000 | 5000 |

| March | 22000 | 5000 | 22000 | 5000 |

| April | 22000 | 5000 | 22000 | 5000 |

| Total | 244000 | 60000 | 264000 | 60000 |

We suggest you read: Is it possible to round vacation pay to the nearest ruble?

The increase occurred once during the billing period: Lapin A. was granted another paid leave of 28 days from July 7, 2015. His salary is 28,000 rubles monthly. The billing period has been fully worked out and is assumed to be 12 months - from July 1, 2014. until June 30, 2015

In June 2015, there was an increase in wages and his salary increased by 3,000 rubles. The recalculation of vacation pay for salary increases is as follows:

- indexing factor: 31000 / 28000 = 1.11

- average daily earnings: (28000 * 11 months * 1.11 31000) / 12 months / 29.3 = 1061 rubles

- vacation pay amount: 1061 * 28 days = 29,709 rubles.

Several salary increases throughout the year. Romantsev I. since April 3, 2015 28 days leave was granted. The billing period is from April 1, 2014. until March 31, 2015

Salary from April to July 2014 — 25,000 rubles, from August to December 2014. — 27,000 rubles, from January 2015. until March 2015 - 30,000 rubles. The period has been fully completed.

Vacation pay calculation:

- indexing factor 1: 30000 / 25000 = 1.2

- indexing factor 2: 30000 / 27000 = 1.11

- average daily earnings: (25000 * 4 months * 1.2 27000 * 5 months * 1.11 30000 * 3 months) = 1104 rubles

- Vacation pay amount: 1104 rubles * 28 days = 30912 rubles.

Salary indexation was carried out after the payroll period, but before the onset of vacation. Leave to Pavlov E. was granted from March 15, 2015. for 28 days. The total income for 12 months was 260,000 rubles. The reporting period has been fully processed. The salary increase was made on March 1, 2015. Indexation coefficient – 1.5.

Let's make the following calculations:

- average daily earnings: 260,000 rubles / 12 months / 29.3 = 739 rubles

- amount of vacation pay taking into account the increase: 739 rubles * 28 days * 1.5 = 31038 rubles

The promotion was made while the employee was on vacation. In this case, only part of the amount is recalculated from the date of increase until the end of the vacation. Sokolov D. was granted leave from March 18, 2015. Vacation 28 days. The total amount of charges is 170,000 rubles. The period has been fully completed. From March 20, 2015, the salary was indexed by 1.2.

Calculation:

- average daily earnings: 170,000 / 12 / 29.3 = 483 rubles

- amount of vacation pay: from 18.03. to 19.03.: 483 * 2 days. = 966

- from 20.03. until March 14: 483 * 26 days. * 1.2 = 15070

- Total: 966 15070 = 16036 rubles.

Payments that are not subject to increase when salary increases:

- established as a percentage (shares) of the salary (tariff rate),

- accrued in a fixed (absolute) form and accepted when calculating average earnings.

There are some points that need to be taken into account when calculating vacation pay:

- when the salary increase is made to only one person (department), the amount of vacation pay is not subject to recalculation. Recalculation is carried out when the increase affected the entire staff of the company;

- If for any reason there is a reduction in salary, a downward recalculation is not carried out. The actual accrued payments for the previous 12 months are taken into account,

- when combining positions, the vacation amount is calculated according to the generally accepted scheme.

Let's look at examples of how vacation pay is indexed depending on the indexation period.

Example 1

From June 1, 2021, Markova T.V. was on vacation for 14 days. During the billing period from June 1, 2021 to May 31, 2021, the employee’s salary was indexed from 20,000 rubles. up to 25,000 rub. Indexation date is October 2021. Markova's billing period was fully worked out. She did not receive bonuses or other payments.

CI = 25,000 / 20,000 = 1.25.

To determine the size of the SZ, it is necessary to divide the billing period into 2 parts: the first part, preceding the increase, was 5 months - from June to October 2021; the second - from November 2016 to May 2021 - 7 months. Due to the fact that indexation took place before the period for which vacation pay is paid, SZ should be indexed for calculating vacation pay from the beginning of the billing period. Thus, the formula should contain a reflection of indexation for 5 months (20,000 × 1.25 × 5) and the calculation of SZ taking into account the new salary (25,000 × 7).

SZ = (20,000 × 1.25 × 5 25,000 × 7) / (29.3 × 12) = 853.25 rubles.

The amount of vacation pay will be: 853.25 × 14 = 11,945.50 rubles.

Example 2

Pushkov A.A. was on vacation from May 17 to May 26, 2021. During the period from May 17, 2021 to May 16, 2021, the employee was not on vacation. The employee’s salary during this period was 759 rubles. On May 22, the organization carried out an indexation of 5%.

The amount of vacation pay due to indexation must be recalculated starting from May 22.

To calculate the amount of vacation pay, we determine how many days were spent on vacation without indexation and after indexation: from May 17 to May 21 inclusive - 5 days, from May 22 to May 26 - 5 days. In this case, to calculate vacation pay for the first 5 days, the indexation coefficient will not be applied; for the remainder of the vacation, a coefficient of 1.05 must be used.

5 × 759 5 × 759 × 1.05 = 7,779.75 rub.

That is, the amount of vacation pay will be recalculated for the employee from the moment of such indexation.

From the above examples, you can once again be convinced that the rules that should be followed when indexing vacation pay depend primarily on the moment when the salary indexation was made: before the date of accrual of the corresponding payments or after.

Calculation of average earnings to determine the amount of vacation pay

The procedure for calculating average employee earnings is spelled out in detail in the Regulations of the Government of the Russian Federation, adopted on December twenty-four, 2007 (number nine hundred twenty-two). The document prescribes an increase in payments taken into account when determining average earnings by a special coefficient if the organization has indexed salaries or tariff rates.

This coefficient is usually called the conversion factor; its size is determined as follows:

KP – increase coefficient;

ZPP – the average salary of an employee after a promotion;

ZPA is the average salary of an employee before promotion.

The procedure for recalculating vacation pay depends on the moment at which wages were indexed at the enterprise.

- The situation when the salary increase was carried out in the billing period. In this case, all payments taken into account in the billing period that occurred before the salary indexation (with the exception of payments that are not subject to adjustment under current legislation) must be increased by the conversion factor.

- A situation where the salary increase occurred before the start of the vacation, but after the expiration of the billing period. With this option, the entire calculated amount will be increased by the conversion factor (except for payments that are not subject to adjustment).

- A situation where an increase in wages occurred during vacation. In such a case, the average earnings for the vacation period that passed before the indexation are not subject to change, and the earnings are increased by a conversion factor from the day the indexation came into force for the enterprise until the end of the vacation period.

- A situation where the promotion took place after the employee returned from vacation. In this case, no recalculations are made.

What amounts are not adjusted when recalculating vacation pay?

Let's look at what amounts are not adjusted when calculating vacation payments:

- Cash payments that are set in relation to the tariff rate, salary or other types of remuneration in a specific range of values (in the form of a multiple, percentage of salary, etc.);

- Cash payments that are taken into account when calculating the average “salary” if they are set in an absolute amount (for example, various compensations: for travel, for food, permanent bonuses set in a specific amount)

Are vacation pay indexed when salary increases?

Payment for vacation is made based on average earnings (Article 114 of the Labor Code of the Russian Federation).

The rules for its calculation are established by the Procedure approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922. Paragraph 16 of the Procedure states that average earnings must be recalculated when indexing wages. When calculating the amount of vacation pay, indexed salaries and tariff rates, as well as payments and remunerations established as a percentage of them, are subject to recalculation. The exception is remuneration set for the salary in a range of values (for example, from 5 to 25%).

Allowances and other additional payments established in absolute amounts are not subject to recalculation when calculating vacation.

Examples of calculating vacation pay in various situations

Example #1. Indexation occurred during the billing period

To calculate the average salary in the period before indexation (August 2014 – January 2015), we will use the KP:

Vacation payments for 21 days will be:

784.98*21 days = 16484.58 rubles

Example #2. Indexation occurred after the billing period, but before the onset of vacation

To calculate the average salary for the entire period, we will use the KP:

Vacation payments for 14 days will be:

784.98*14 days = 10989.72 rubles

Example No. 3. Indexation occurred during vacation

(20000 * 12) / (29.3 * 12) * 7 days = 4778.15 rubles

To recalculate vacation payments for 2 days of vacation (August 15 and 16, the vacation period from the moment of indexation), we will use the CP:

Vacation payments will be:

682.59 *5 days + 682.59 *1.15 *2 days = 4982.90 rubles

Recalculation of vacation pay when salary increases

Example 2. Several salary changes during the pay period for I.E. Romanov. from February 5, 2015, they were granted leave of 28 days. The billing period from February 1, 2014 to January 31, 2015 is 12 months.

Salary from February to May 2014 - 22,000 rubles, from June to October 2014 - 29,000 rubles, from November 2014 to January 2015 - 28,000 rubles. There were no excluded periods. Let's do the calculations. We determine the coefficient: 29,000/22,000 = 1.3 coefficient No. 2: 28,000/29,000 = 0.96.

We suggest you read: What to do if you transferred money to the wrong account?

We use them to adjust the amounts taking into account indexation (22000×1.3×4 months 29000×0.96×5 months 28000×3 months): (29.3×12) = 960.18 rubles of average earnings. Accordingly, the amount of vacation pay will be: 960.18 × 28 = 26,885 rubles. Option 2. Filimonov took another paid vacation for 2 weeks (14 calendar days). The billing period will be the period from August 1, 2014 to July 31, 2015.

The employee worked fully for the entire period. The salary in 2014 was fixed, similar to the salary of freight forwarders, the salary was 20,000 rubles. From August 1, 2015, salaries for all company employees were increased by 15%, and indexation took place.

784.98*14 days = 10,989.72 rubles Example No. 3. Watch the video about indexing vacation pay. You must first calculate the average earnings for calculating vacation pay. Thus, the rate was increased in the billing period, which means that payments for the period July-December 2014 will increase by the indexation factor.

The coefficient will be 1.1 (new salary of 11,000 rubles: divide by the old one - 10,000 rubles). (10,000 x 1.1 x 6 11,000 x 6): (29.3 x 12) = 375.43 rub. - average earnings per day. RUB 375.43 x 28 days = 10,512.04 rub. - amount of vacation pay. Next example. 04/16/14 manager of LLC Seleznev and Co. Zolotarevskaya N.V.

went on another vacation lasting 28 calendar days. We calculate average earnings. For the billing period 04/01/13 - 03/31/14 it was calculated by the company’s accountant and amounted to 420 rubles. No additional payments were accrued for the billing period; vacation pay amounted to 11,760 rubles. (RUR 420 x 28 days). From 1.05.14