ConsultantPlus: Forums

Did I miss something?

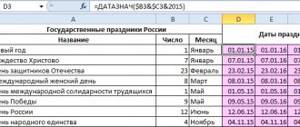

What are the new interpretations of Proposition 922? See point 10! If the days when the employee retains his average earnings are excluded from the calculation period, the denominator for the average will be determined as follows: calendar days falling on days worked (that is, calendar days - a business trip is also in calendar days) * 29.4 / number of calendar days in a month . Due to errors, this value will differ from what it would be if the employee did not go on a business trip, but not by much. Did I miss something? What are the new interpretations of Proposition 922? See point 10! If the days when the employee retains his average earnings are excluded from the calculation period, the denominator for the average will be determined as follows: calendar days falling on days worked (that is, calendar days - a business trip is also in calendar days) * 29.4 / number of calendar days in a month . Due to errors, this value will differ from what it would be if the employee did not go on a business trip, but not by much

Labor Code: business trips, payment

How are employee travel days paid: from average earnings or is the salary simply issued? As Art. 167 of the Labor Code of the Russian Federation, when an employee is sent on a trip, he is guaranteed the preservation of his job and average earnings (clause 9 of Regulation No. 749 of October 13, 2008), as well as reimbursement of expenses. Therefore, during his stay on a business trip, he should be paid such earnings.

Payment for business trips is usually made on payday. Accounting calculates the average amount that an employee could receive at his place of employment, and then issues it along with an advance or monthly payment.

Are travel allowances included in the calculation of vacation pay?

Art. 114 of the Labor Code of the Russian Federation regulates the employee’s right to annual leave, during which he is guaranteed the retention of his position and payment of the average salary. The calculation of the average daily earnings in this case is in many ways similar to its calculation for business trips. The calculation period is also the last 12 months. The periods specified in paragraph 5 of Resolution No. 922 associated with payment based on average earnings and social payments are removed.

The calculation of vacation pay should not include periods of absence of an employee from the workplace, paid according to average earnings (clause 5 of Resolution No. 922). As we have already found out, payment for the time spent on a business trip is based on the average salary. But is a business trip the same as being away from work?

Is it necessary to include travel allowances in average earnings?

Not all payments are taken into account when calculating average income. Only labor accruals are used in calculations. These include:

- wage;

- bonuses regulated by the provisions of the employment contract or local acts of the enterprise;

- funds given to an employee as compensation.

The following are not taken into account when calculating average daily earnings:

- material aid;

- money issued to pay for food, accommodation, travel, fuel;

- sick leave benefits, including maternity leave;

- maternity leave for children up to 1.5 years;

- remuneration at the average salary.

Average earnings are calculated according to the rules that are posted in Decree of the Government of the Russian Federation No. 922 and Art. 139 of the Labor Code of the Russian Federation. The following formula applies:

Salary per year / 12

IMPORTANT! During work trips, a citizen receives an average income. In this regard, travel allowances are not included in the calculation of vacation pay.

Average earnings for vacation pay, business trips, severance pay: calculation nuances

: You do not need to determine the number of working days per billing period. After all, regardless of the operating mode, calendar days are used to calculate vacation pay. For all employees, vacation pay for full months of the pay period is calculated based on the average monthly number of calendar days. And for incomplete months, it is necessary to determine the number of calendar, and not working days, falling on the non-excludable time of clause 10 of the Regulations.

: Since your employee has a summarized record of working time, you had to determine his average hourly earnings for the billing period (12 months before dismissal) clause 13 of the Regulations. After dismissal, a work schedule for the employee is not drawn up. Therefore, when calculating severance pay, it is necessary to take the standard working time in hours for this employee in accordance with the production calendar, and not according to his work schedule. That is, you had to multiply the employee’s average hourly earnings by 80 hours (the number of working hours according to the production calendar with a 40-hour work week for the period from 07/29/2014 to 08/11/2014 (10 days x 8 hours)).

Results

The issue of excluding business travel expenses from the calculation of vacation pay causes so much controversy because many consider it unfair to equate a business trip with absence from work.

However, legal norms are the main argument here, and according to the instructions of the Government and the Ministry of Labor of the Russian Federation, it is the exclusion of travel allowances from the base when calculating vacation pay that is the only correct one. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How to calculate travel allowances in 2019: formulas and examples

Most employers pay for the days that an employee travels on company business in the amount of the average wage. The payment is due exactly for the number of days during which he was on a business trip. That is, if the travel time was, for example, 12 days, including weekends, these hours are distributed over those days that are considered working days and are paid accordingly.

As an example, we can cite the following situation: a certain Sidorov, whose average salary is about 15,000 rubles per month, taking into account bonuses and various types of payments, was absent from the workplace for 3 days because he was sent on a business trip. Let's calculate how much he should be credited for these 3 days:

Budgeting

When drawing up a summary estimate to determine the final amount of payments due to an employee who was on a business trip, it is necessary to enter into it data on all expenses incurred by the person during his stay on a business trip.

This data must be documented, that is, the employee is obliged to provide the accounting department with various receipts indicating payment of expenses for renting housing, food, travel on public transport, the purchase of any goods necessary for carrying out official activities, and so on.

These calculations are made after the person returns from a business trip and summarize the following basic data:

- Number of working hours spent on business travel.

- The cost of tickets that were purchased by an employee in order to get to the place of business trip and return back.

- Expenses for rented housing incurred by a person during a trip.

- Expenses for food, travel on public transport and other expenses agreed in advance with the management of the enterprise.

- The number of people who were away, if several people were sent on a business trip at the same time.

- The amount of payments required for the employee’s accommodation, called “daily allowance”.

- Any other expenses incurred in the event of unforeseen situations from the employee’s personal budget.

Based on this estimate, the final amount of money due to be paid to the employee is formed.

How does a business trip affect the amount of vacation pay?

The employee used vacation in the amount of 28 calendar days from July 4, 2011. The employee did not fully work the billing period (July 2010 - June 2011). He was not on vacation, but he went on business trips twice: from December 20 to 24, 2010, the employee was on a business trip to St. Petersburg and from April 11 to 15, 2011, the employee was on a business trip to Tver. At the same time, the monthly salary of an employee is 40,000 rubles. Thus, in just 12 months, the employee received 461,780.53 rubles in wages (excluding business trips). and average earnings during a business trip in the amount of 16,180 rubles. How was the amount of vacation pay for the employee calculated?

In our opinion, this position of Rostrud is not flawless. One of the principles of legal regulation of labor relations is to ensure the right of every employee to timely and full payment of fair wages, as well as a combination of state and contractual regulation of labor relations (Article 2 of the Labor Code of the Russian Federation). In accordance with Art. 5 of the Labor Code of the Russian Federation, labor relations are also regulated by collective agreements, agreements and local regulations containing labor law norms.

How to count trips abroad

When an employee is sent on a business trip abroad, payment for this trip is made in accordance with the wording adopted by law. Considering that in this case the time spent by a person staying at the place of business trip takes up a fairly large number of hours, it is also paid in accordance with accepted standards.

The amounts expected to pay for tickets for a vehicle can either be written off as travel allowances or paid in full by the company.

In this case, the form of payment depends on the management of the enterprise. Also, a person traveling abroad for official reasons is entitled to payments called “daily allowances,” that is, funds allocated by the enterprise for daily expenses, including food, travel on public transport, etc.

Payment for the accommodation of a person sent on a business trip, payments for processing various types of documents, as well as other expenses can either be included in the total amount of the travel allowance or be paid by the enterprise in full independently.

Tags: accountant, tax, expense, tool

Calculation of travel allowances: cheat sheet for an accountant

The calculation of average earnings includes all payments that are provided for by the remuneration system, except for sick leave, vacation pay, financial assistance and other social payments (see 2 and 3 of the Regulations on the specifics of the procedure for calculating the average salary of the Russian Federation Government of December 24, 2007 No. 922 ). For details of the accounting for various bonuses, see paragraph 15 there.

Petrova A.A. has been working since 02/10/2006, on 02/25/2014 she was sent on a business trip for 5 days. There are a total of 247 working days in the billing period (from February 2013 to January 2014). There were excluded periods: in August the sick leave period accounted for 8 working days, and in September the annual paid leave period accounted for 14 working days. Then 247 - 8 - 14 = 225 days actually worked.

Actual earnings

When calculating average earnings, the employee’s actual earnings include all types of payments provided for by the remuneration system and accrued to the employee in the billing period, regardless of the source of funds. In other words, the calculation of the average includes all payments established by the employer in the remuneration system as wages.

In addition, the following are included in the calculation:

- allowances and additional payments to tariff rates and salaries for professional skills, experience, knowledge of a foreign language, combining professions, increasing the volume of work, etc.;

- payments related to working conditions (regional coefficients, additional payments for work in harmful, dangerous and difficult conditions, for working overtime at night, on days off);

- bonuses and remunerations provided for by the remuneration system, fixed in local regulations;

- other types of wage payments from the employer.

Please note that one-time bonuses that are not part of the remuneration system do not participate in the calculation of average earnings. In the 1C: Salary and Personnel Management 8 program, edition 3, all types of calculations for which the Accrual Purpose is set to Bonus are necessarily included in the calculation of average earnings.

The Include in accruals base when calculating average earnings flag in the calculation type card on the Average earnings tab for such accruals is set by default and is not available for switching. For bonuses that are not included in average earnings, you should create new types of calculation with Accrual Purpose - Other accruals and payments.

The employee was on a business trip from to

It is said: if one or more months of the billing period are not fully worked out or time is excluded from it in accordance with clause 5 of Regulation No. 922, the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days ( 29.3), multiplied by the number of complete calendar months, and the number of calendar days in incomplete calendar months. In this case, the number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.3) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in this month.

Rationale. As a general rule, the duration of an employee’s annual basic paid leave is 28 calendar days (Article 115 of the Labor Code of the Russian Federation). According to clause 4 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages” (hereinafter referred to as Regulation No. 922), the calculation of the average earnings of an employee, regardless of his mode of work, is carried out based on the wages actually accrued to him and the time actually worked by him for the 12 calendar months preceding the period during which the employee retains his average wage.

How does it affect?

While on a business trip, the employee retains his place of work, his salary, and his length of service is calculated. All employee expenses are covered by the organization, and the amount of travel allowance is paid.

The following expenses are reimbursed:

- Housing or utility costs.

- Travel expenses. Fuel costs can be included in this item.

- Daily allowance.

- Other expenses that the organization will be able to pay.

Travel allowances are paid after the person returns to their main job. The employee must provide all documents confirming his expenses; without them, the organization does not return the money spent.

How does a business trip affect the procedure for granting vacation and payment of vacation pay:

- days spent on a trip are not included in the billing period;

- travel payments are not included in the calculation of average earnings;

- business trips retain the right to vacation days and are taken into account in the length of service.

Explanations for these findings are given below.

We also recommend reading the article about how past vacation pay affects the current vacation calculation.

Is a business trip included in the length of service?

Article 121 of the Labor Code of the Russian Federation states that vacation time is calculated not only from the period worked.

It also includes the time during which the person simply retained his job.

Taking this into account, time spent on a business trip is also included in the length of service that gives the right to annual paid leave.

Consequently, despite the presence, number and duration of the employee’s business trips over the entire working period, the end of his working year does not change, and the start date of the rest does not shift.

The only things not included in this length of service are absenteeism and time spent caring for a child under 3 years of age.

Are days counted in the billing period?

For a year worked, a citizen can go on vacation with a minimum duration of 28 calendar days. He himself decides to break it into parts or use the whole thing.

Some employees using the benefit may extend this rest period. According to Russian law, some citizens have the right to take additional leave. The number of vacation days includes calendar weekends and does not take into account non-working holidays.

To calculate the estimated period for calculating vacation pay, you need to take the previous 12 months worked, not taking into account the one in which the person wants to go on vacation. If less work is done, then the actual time worked in the company is taken.

If business trips fall within this time period, then such days are excluded from the billing period.

Months during which business trips occurred are considered not fully worked. A separate time calculation is carried out for them.

The calculated period for vacation pay consists of the number of working days per year, while it is recognized that in a full month there are 29.3 days, and in an incomplete month, the calculation is carried out by multiplying the calendar days worked minus the business trip by 29.3, the result of the multiplication is divided by the total number of calendar days in the month . An example of the calculation is given below in the article.

Thus, if there are business trips in the billing period, calculations for such months must be carried out according to special rules.

In addition to business trips, the calculation period for vacation pay also does not include:

- sick leave;

- maternity leave;

- other types of vacations;

- downtime;

- additional days off to care for disabled children.

Is payment of expenses included in average earnings?

According to the law, some payments should not be included in the average daily earnings when calculating vacation pay.

These payments are discussed in the Regulations dated 12/24/07. According to this regulatory document, it is not necessary to include the following payments:

- Rewards or bonuses that are not specified in the remuneration system.

- Some payments that are listed in paragraph 5. These include social benefits, travel compensation, and downtime pay.

- Optional payments that cannot be attributed to wages. They may be social in nature.

Travel expenses are not included in the calculation of average daily earnings for vacation pay, since the business trip period is paid based on average earnings and falls under paragraph a, paragraph 5 of the Regulations.

Average daily earnings (ADE) are calculated as follows:

Formula:

SDZ = Amount of income for the billing period / (12 months * 29.3).

If in such and such a month a person has events that need to be removed from the calculation, for example, a business trip, then it is considered not fully worked out.

If the month is incomplete, you need to do the following calculations:

Formula:

SDZ for incomplete = Income for the billing period / (Number of full months * 29.3 + ((Number of days actually worked in an incomplete month * 29.3 / Calendar number of days in a month)).

Calculation example for 2021

Example conditions:

The person was hired on 02/01/2018. On January 26, 2021, he wants to go on vacation for two weeks. Estimated time from 02/01/2018 to 12/31/2018, that is, 11 months. The monthly salary consists of salary and is 50,000.

In April, the employee was on a business trip for 21 days. During this time, he received a payment of 30,000, the salary for April was 15,000.

April is considered incomplete, so the calculation of days worked for it is carried out according to special rules.

Calculation:

- Days worked in April = 9 * 29.3 / 30 = 8.8.

- Total days worked = 10*29.3 + 8.8 = 301.8.

- Total earnings = 50,000 * 10 + 15,000 = 515,000 (we do not take into account travel allowances).

- Average daily earnings = 515,000 / 301.8 = 1,706.43.

- Vacation pay = 1706.43 * 14 = 23890.02.

See the step-by-step procedure for calculating vacation pay here.

Business travel is included in vacation pay

10. Average daily earnings for payment of vacations provided in calendar days and payment of compensation for unused vacations are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days (29.4). If one or more months of the billing period are not fully worked out or time is excluded from it in accordance with paragraph 5 of these Regulations, the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.4) , multiplied by the number of complete calendar months, and the number of calendar days in incomplete calendar months.

The calculation of average earnings for business trips and vacation pay has been clarified (Negrebetskaya O

Solution. Calculation of vacation pay taking into account the position of the Ministry of Labor of Russia Accountable payments. If we take into account the recommendations from the Letter of the Ministry of Labor of Russia dated August 13, 2015 N 14-1/B-608, when calculating vacation pay, you need to take into account the payments listed in lines 1, 2 and 3 of the table. In this case, the annual bonus is taken into account in the full amount (paragraph 5, paragraph 15 of the Regulations on Average Earnings). The total amount of payments taken into account is RUB 443,114.16. (RUB 418,000 + RUB 20,000 + RUB 5,114.16). Average daily earnings. The number of calendar days taken into account in fully worked months is 293 calendar days. days (10 months x 29.3). The number of calendar days taken into account in months not fully worked: - in April - 16.6 calendars. days [29.3: 30 calendar days days x (30 calendar days - 13 calendar days)]; — in August — 20.79 calendar days. days [29.3: 31 calendar. days x (31 calendar days - 9 calendar days)]. The total number of calendar days taken into account is 330.39 calendar days. days (293 calendar days + 16.6 calendar days + 20.79 calendar days). Average daily earnings - 1341.19 rubles. (RUB 443,114.16: 330.39 calendar days). The amount of vacation pay will be 18,776.66 rubles. (RUB 1,341.19 x 14 calendar days). For comparison: another calculation option How much will the amount of vacation pay increase or decrease if you do not exclude worked days off and payment for them from the calculation? To find out, let's do a second calculation. The amount of payments taken into account will be RUB 445,645.92. (RUB 443,114.16 + RUB 2,531.76). The number of calendar days taken into account will also change. For August we will take into account 21.74 calendars. days [29.3: 31 calendar. days x (31 calendar days - 8 calendar days)]. And in total - 331.34 calendars. days (293 calendar days + 16.6 calendar days + 21.74 calendar days). The average daily earnings will be 1344.98 rubles. (445,645.92 rubles: 331.34 calendar days), and the amount of vacation pay is 18,829.72 rubles. (RUB 1,344.98 x 14 calendar days). With the second calculation option, the amount of vacation pay turned out to be higher by 53.06 rubles. (RUB 18,829.72 - RUB 18,776.66).

Example. Employee A.I. Miroshnikov has been working for the company since 2010. The employee works on a five-day workweek schedule. The working day lasts 8 hours. The employee's days off are Saturday and Sunday. From December 7, he goes on vacation for 14 calendar days. We need to calculate vacation pay. Payments accrued to the employee in the pay period are shown in the table below.