What is financial assistance for vacation?

In order to answer the question of whether financial assistance is included in the calculation of vacation pay, you should decide what is meant by financial assistance in the context of vacation payments.

The Presidium of the Supreme Arbitration Court of the Russian Federation, in its resolution dated November 30, 2010 No. VAS-4350/10, states that financial assistance should include employer payments that are not related to the employee’s performance of a labor function and aimed at meeting the social needs of a citizen in a difficult situation. This could be, for example, damage to property and/or health due to an emergency, serious illness, death of a close relative, birth (adoption) of a child, etc.

According to the logic of this resolution, financial assistance—including vacation—should also include payments that:

- are not included in the wage system;

- are not paid on a regular basis;

- not related to labor productivity;

- are not stimulating.

And if this or that payment (it does not matter whether it is one-time or multiple) meets the specified 4 criteria, then it may well be classified as financial assistance.

In order to prove to the inspectors that such payments are precisely material assistance - for vacation or not, it does not matter - the employer company can provide a clear definition of material assistance, as well as the criteria for its provision, in the collective labor agreement or in the regulations on financial assistance. We can take the theses of the Supreme Arbitration Court of the Russian Federation that we have considered as a basis.

See the material “Regulations on the provision of financial assistance to employees” for more details.

The decision to pay financial assistance in a particular case is made by the director

Financial assistance is money that is paid to individuals (employees of the organization, their relatives, strangers) in connection with certain circumstances requiring financial support from the outside: the birth of a child, the death of a family member, vacation, holiday, etc.

The decision to spend part of the profit on the payment of financial assistance is made by the founders of the organization. Within the limits of the amounts allocated by them, the head of the company can pay money to employees in need of help (for more information, see “Providing financial assistance to an employee”).

For information If the enterprise has a single founder, then a decision must be drawn up on the use of net profit, including for the payment of financial assistance (clause 3 of article 47 of the Federal Law of December 26, 1995 No. 208-FZ, article 39 of the Federal Law of 02/08/1998 No. 14-FZ).

If the organization has several founders (participants or shareholders), then the results of the general meeting must be documented in minutes (Article 63 of the Federal Law of December 26, 1995 No. 208-FZ, paragraph 6 of Article 37 of the Federal Law of February 8, 1998 No. 14-FZ ). The minutes of the general meeting in an LLC can be drawn up in any form, while the minutes in joint-stock companies must include mandatory details (clause 2, article 63 of the Federal Law of December 26, 1995 No. 208-FZ, clause 4.29 of the Regulations, approved By Order of the Federal Financial Markets Service of Russia dated 02/02/2012 No. 12-b/pz-n).

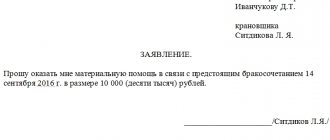

The procedure for applying for financial assistance looks like this:

- an employee of an organization writes an application addressed to the manager to provide him with financial assistance (for more information, see “Writing an application for financial assistance (sample)”);

- the organization issues an order signed by the manager (for more information, see “We issue an order for the payment of financial assistance (sample)”).

What is the significance of the fact that payments are classified as financial assistance?

The criteria for classifying certain payments as financial assistance for an employer may play a role:

1. When maintaining tax records.

The fact is that material assistance cannot be included in expenses when calculating the taxable base for income tax (clause 23 of Article 270 of the Tax Code of the Russian Federation). In turn, payments to employees that are not recognized as financial assistance are included in expenses.

Find out how financial assistance affects the amount of income tax in the Ready-made solution from ConsultantPlus by receiving a free trial access.

How financial assistance is subject to insurance premiums, read this article.

See also:

- “Is financial assistance to an employee subject to personal income tax?”;

- “We reflect financial assistance under the simplified tax system “income minus expenses”.

2. When calculating vacation pay.

Financial assistance can be either completely excluded from the formula for calculating vacation pay (clause 3 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of Russia dated December 24, 2007 No. 922), or in a number of cases and with certain restrictions included in it (clause 6 Rules for calculating the salary of federal civil servants, approved by Decree of the Government of the Russian Federation dated September 6, 2007 No. 562, hereinafter referred to as the Rules).

But when should financial assistance for vacation (or provided before it) be included in the calculation of vacation pay?

The answer to this question depends on the legal status of the employer's company. The fact is that the legislation of the Russian Federation establishes separate rules for calculating vacation for:

- federal civil servants;

- other employees (including employees of regional and municipal departments).

How to take into account financial assistance for vacation in accounting, as well as correctly calculate personal income tax and insurance premiums, ConsultantPlus experts explained. Get trial access to the system and study the issue in more detail.

FAQ

The process of calculating vacation pay quite often raises questions among employees. Indeed, the law says little about making calculations.

In fact, all actions are carried out by the accounting department and it can be very difficult to determine the correctness of the calculations.

In addition, in practice, different situations arise that should also be taken into account when making calculations. For example, how is the average salary for a part-time worker calculated, will income for an incompletely worked month be taken into account, and are all bonuses excluded from the income base?

Partial month worked

We have already mentioned that when calculating average earnings, only fully worked months are taken into account. What to do if an employee was sick or on maternity leave during the billing period? Or in his case there were other periods that should be excluded.

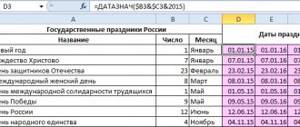

If such a situation arises, then it is necessary to take into account not the entire month, but only those days that the employee performed his labor function, then in order to calculate the days included in the total period, the following calculations must be performed:

29.3/number of days in a month*days that the employee performed his job function.

Let's demonstrate with an example. Ivanov A.P. goes on vacation. In September he took sick leave for 14 days. Accordingly, he actually worked for 16 days. Now let’s calculate the number of days that will be included in the billing period: 29.3/30*16=15.63

Do bonuses count?

Cash rewards are part of the remuneration system, so they are included in the income part. The timing of the accrual of the incentive does not matter.

Payments that are made per day, month or year are taken into account equally if they were issued during the billing period.

But these rules apply only to bonuses that are defined by internal documents and are not one-time in nature.

This is interesting: Does an employer have the right to divide vacation without the employee’s consent?

When should vacation pay be transferred according to the law? Read here.

Do I need to pay insurance premiums from vacation pay? Details in this article.

Part-time job

The part-time worker has the right to leave. Weekends at additional work are provided in parallel with the rest period at the main place.

Vacation pay is calculated according to the same rules.

Financial assistance (one-time payments) when calculating leave for federal employees: nuances

Federal civil servants include employees of departments who receive salaries from the federal budget without attracting other budgetary sources of funding (Clause 1, Article 10 of the Law “On the Public Service System” dated May 27, 2003 No. 58-FZ).

Financial assistance is a type of additional payments for a federal civil servant (clause 2 of the Rules). It is isolated from various allowances and incentives and therefore can be considered as unrelated to the remuneration system.

At the same time, in accordance with clause 6 of the Rules, financial assistance is included in the calculation of vacation pay for employees of federal departments. But not completely, but limitedly - like 1/12 of each accrued payment for the billing period before the vacation (12 months).

In this case, only actual payments are taken into account, and not regulatory ones, if any are provided for (letter of the Federal Tax Service of Russia dated November 23, 2007 No. BE-6-16/906). The formula for calculating vacation pay can take into account several payments of financial assistance - before or before the vacation (letter of the Ministry of Health and Social Development of the Russian Federation dated November 15, 2007 No. 3495-17).

The jurisdiction of the Rules introduced by Resolution 562 applies to all positions in federal departments, except for those for which the amount of remuneration is determined based on performance indicators (in the manner established by paragraph 14 of Article 50 of the Law “On the State Civil Service” dated July 27. 2004 No. 79-FZ).

Is financial assistance taken into account when calculating vacation in a private company?

In private firms and all those business entities that do not belong to the system of federal departments, material assistance is not taken into account when calculating the amount of vacation pay - like other social payments. This rule applies, in particular, to municipal employees (decision of the Kovylkinsky District Court of the Republic of Mordovia dated March 25, 2015 No. 2-116/2015).

It should be noted that the very fact of using the concept of “material assistance” in local and industry-wide departmental (at levels below federal) standards will mean nothing if the payments associated with this concept do not actually meet the criteria for material assistance. Payments called material assistance in the local act, but not corresponding to them in essence, will be considered labor payments (letter of the Ministry of Finance dated June 26, 2012 No. ED-4-3 / [email protected] ). They will need to be taken into account when calculating vacation.

If in the regulations governing the work of specifically federal departments, the concept of “material assistance” is directly associated with the wage system (and does not fall under clause 3 of the Regulations under Resolution 922), then, nevertheless, such assistance should be taken into account when calculating vacation pay for federal employees necessary according to the Rules approved by Resolution 562.

Thus, paragraph 32 of the Regulations, introduced by order of Rosobrnadzor dated July 17, 2015 No. 1247, establishes that employees of the Federal Service for Supervision in Education and Science are entitled to a one-time provision of financial assistance in the amount of one salary. The connection between financial assistance and labor function is obvious, but its amount is not included in the calculation of vacation pay in full, but only in 1/12 of the part - as prescribed by a higher departmental regulation.

See also “Financial assistance upon dismissal of one’s own free will.”

Results

Financial assistance for vacation is included in the calculation of vacation pay by an employer in the status of a federal department, but not in full, but in the amount of 1/12 of the actual payments. For other employers - it is included only on the condition that the payments, which are called financial assistance by local standards, are actually labor payments (incentives, incentives). Payments in the form of financial assistance that are not related to the labor function in private firms and budgetary organizations that are not related to federal departments are not taken into account when calculating vacation pay.

As a rule, the frequency of payments is not a criterion for classifying them as financial assistance or labor incentives.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

- Law “On State Civil Service” dated July 27, 2004 No. 79-FZ

- Decree of the Government of Russia dated December 24, 2007 No. 922

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

How are financial aid and one-time bonus taken into account when calculating vacation pay in an organization?

First of all, it is necessary to understand what the payments due to the employee before going on vacation should consist of. According to Art. 115 of the Labor Code of the Russian Federation, each employee, regardless of length of service and other circumstances, is granted leave for a period of at least 28 calendar days per year worked, and in cases established by law, leave may be longer. According to Art. 136 of the Labor Code of the Russian Federation, vacation is paid at least 3 days before its actual start.

At the same time, according to Art. 114 of the Labor Code of the Russian Federation, during the vacation the employee must retain his average earnings. Accordingly, when paying vacation pay, you need to determine what exactly is included in the concept of “average” and what is not. And all the questions are precisely related to whether financial assistance is included in the calculation of vacation pay or not?

In this case, you need to proceed from the following:

- Part 2 art. 139 of the Labor Code of the Russian Federation, which directly indicates the procedure for calculating the average salary, states that all payments to the employee should be included in it, and it does not matter from what sources they are made.

- The issue of payments used to calculate the average salary is examined in more detail in paragraph 2 of the regulation “On the peculiarities of calculation...”, approved by Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 (hereinafter referred to as the Regulation). It mentions various types of bonuses and other remunerations that are provided for by the payment system in force in the organization.

- However, clause 3 of the Regulations directly states that payments that are not provided for by the payment system should not be taken into account. And among other similar payments not included in the average salary, financial assistance is indicated.

Thus, the preliminary conclusion will be as follows: financial assistance provided to an employee from an enterprise cannot be taken into account when calculating the average salary, which means that the amount of vacation pay should not increase proportionally. The same applies to any other payments not provided for by law or local regulations that apply to the enterprise.