Main sections of the Regulations on remuneration and bonuses for employees

The Labor Code states: remuneration systems (including the size of tariff rates and salaries), as well as additional payments and allowances of a compensatory and incentive nature, and bonus systems, are established by collective agreements, agreements, local regulations of the employer (Part 2 of Article 135 of the Labor Code of the Russian Federation) .

And since payment of wages is one of the main responsibilities of any employer (Article of the Labor Code of the Russian Federation), each organization or individual entrepreneur that hires employees must either issue a separate local act - Regulations on wages, or include the necessary data in another internal document, to for example, in the Internal Labor Regulations. In particular, it is necessary to reflect the remuneration system and the size of tariff rates or salaries. Draw up regulations on remuneration and internal labor regulations using ready-made templates

REFERENCE

Both employers - organizations and employers - individual entrepreneurs (Article of the Labor Code of the Russian Federation) can issue local regulatory acts (LNA), the content of labor law norms.

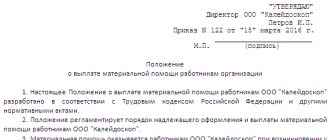

There is no standard form for the Regulations on remuneration and bonuses. Therefore, the employer can independently develop the structure and content of such a document, based on the specifics of the activity, financial capabilities and staff. At the same time, as already mentioned, the Regulations must include a minimum set of information - about the remuneration system and the size of tariff rates or salaries applicable to the employer.

What kind of document is this

The regulation was approved by the Labor Code in force on the territory of the Russian Federation. The main purpose of this document is to record on paper all existing remuneration mechanisms at a particular enterprise .

When drawing up this local act, the manager (or an authorized person) must indicate both the rules used for calculating wages and all possible systems of material incentives.

This Regulation primarily has an informational function. It is tasked with uniting and consolidating the rules for remuneration of employees applied in a state or commercial organization.

Its structure is not regulated by any legal act of the Russian Federation, therefore, when drawing it up, a business entity can use a free form.

At large enterprises with a large number of employees, this local act may consist of several volumes and be placed in more than one folder. For smaller companies (mostly private), the Regulations, which will consist of several pages of printed text, will be sufficient.

Requirements for the structure of the Regulations on remuneration

When drawing up any local regulatory act, including the Regulations on remuneration, you must adhere to the general requirements of legal technology. This, in particular, means that the glossary used must be fixed directly in the document, giving a clear definition of each term.

It is also customary in the LNA to allocate a section with general provisions. It indicates the goals and procedure for applying the document, and also provides links to laws, regulations and local acts of the organization that are in force in regulating relevant legal relations. In the same section you can provide information about persons responsible for resolving issues related to bonuses, consideration of conflict situations, etc.

The two named sections—general provisions and a glossary (also called “terms and definitions”)—form the introductory part of the document. The main part of the Regulation follows.

Usually it opens with a section regulating the procedure and conditions of remuneration. Here the applied remuneration system is indicated and its description is given. If different remuneration systems are introduced for different categories of workers, then separate paragraphs should be devoted to each of them. They indicate the categories of employees who fall under a particular system.

REFERENCE

There are two main wage systems: time-based and piece-rate. In the first case, payment is made for the time worked, and in the second - for the volume completed. Each of the main payment systems has its own variations. Thus, the time-based system can be simple and time-bonus. And piecework can be direct, piecework-bonus, piecework-progressive, indirect piecework, piecework or commission. Also see “Crib sheet for calculating salaries, vacation pay and sick leave”.

Calculate “complex” salaries with coefficients and bonuses for a large number of employees

It is also permissible to establish one of the payment systems as the main one, and establish exceptions for certain categories of workers. In this case, the basic system will apply to all employees except those who are exempt.

The second section of the main part of the Regulations is usually devoted to the rules of remuneration in conditions deviating from normal ones. Here you need to describe in detail the additional payments that employees are entitled to for performing the duties of a temporarily absent employee, when combining professions or expanding service areas. This also includes the rules for payment of overtime work, work on weekends and holidays, at night, as well as when performing work of various qualifications or temporarily increasing the volume of work. The payment procedure for non-compliance with labor standards and downtime is separately fixed.

The next section of the Regulations, as a rule, concerns guarantee and compensation payments. In particular, it prescribes the procedure for paying for business trips and work while traveling (see “Instructions for processing business trips and accounting for travel expenses”). This section also records payments transferred to employees in the following cases: when moving to work in another area; when performing state or public duties; when combining work with training; when sending for training for the purpose of advanced training; when transferred to another permanent lower-paid job; in case of an accident at work or occupational disease; when referred for a medical examination; when using the employee’s personal property, etc.

Calculate your advance and salary for free, taking into account all current indicators

The following is a section that provides for the procedure for calculating and paying wages. Here you need to establish the requirements that employees must comply with for payroll purposes. And also fix the form of remuneration: in cash through the cash register or by transfer to employees’ bank cards, and the percentage of possible remuneration in kind. The same section specifies the procedure, place and deadline for payment of wages, as well as the rules, form and deadlines for submitting pay slips to employees.

The fifth section of the main part of the Regulations usually concerns the indexation of wages. The terms and procedure for increasing wages are fixed here.

IMPORTANT

Indexation can be carried out annually depending on the growth of the price index, which characterizes the level of inflation, or depending on changes in the minimum wage. It is permissible to replace indexation with the payment of a bonus (Decision of the Supreme Court dated 04/24/17 No. 18-KG17-10, Resolution of the Presidium of the Supreme Arbitration Court dated 01/25/11 No. 11879/10 in case No. A12-16306/2009). Also see: “What fines do employers face for refusing to index wages: explanations from Rostrud.”

Calculate your salary and benefits taking into account the increase in the minimum wage from 2021 Calculate for free

The sixth section of the Regulations on Remuneration is most often devoted to bonuses. Here you need to fix the types of bonuses that will be applied by the employer (current, periodic, one-time, individual, collective, etc.), and for each of them set bonus indicators. It should be taken into account that these indicators must be as clear, understandable and objective as possible. If necessary, you can prescribe the procedure for determining the criteria for assigning bonuses and indicate the persons responsible for this.

REFERENCE

Bonus indicators can be quantitative (increase in production volume, sales, net profit) or qualitative (lack of defects, ensuring uninterrupted operation, compliance with technical specifications and standards).

Next, in the section on bonuses, you should establish the categories of employees being awarded and the amount of each bonus (or the procedure for determining it). The amount of the bonus can be indicated both in absolute numbers and in relative ones (as a percentage of salary, profit, contract value, etc.). After this, you can proceed to fixing the persons who make the decision on the appointment and payment of bonuses, as well as specify the timing and procedure for issuing bonuses.

Calculate your salary according to current rules, taking into account all current local and regional coefficients and allowances

This concludes the preparation of the main part of the Regulations on remuneration. It remains to prepare sections from the final part of the document. This includes rules on the employer’s liability for delay or non-payment of wages and for other violations of the procedure for remuneration and bonuses. And also a section with other conditions. Usually it sets out the rules for the entry into force of the document and making changes to it, and other procedural issues.

Errors in drawing up the Regulations on remuneration

When developing a local act on remuneration, it is important to observe the basic rule - the norms of this document cannot worsen the situation of workers in comparison with those established by law and the collective agreement and agreements (Article of the Labor Code of the Russian Federation). Therefore, when drawing up the Regulations, it is necessary to take into account the relevant norms of the Labor Code of the Russian Federation. It is also necessary to check the requirements of industry and inter-industry agreements binding on the employer.

IMPORTANT

Employers join the agreements automatically. This can only be avoided if an official refusal to participate in the agreement is sent within the prescribed period (Article of the Labor Code of the Russian Federation).

The next common mistake that is made when drawing up any local act is confusion in terminology. It is necessary to ensure that terms and definitions in the text of the document are not substituted or replaced with others. It is also important that they are used exactly as specified in the glossary. For example, if the term “bonus” is introduced, then it is precisely this term that should be used in the text of the Regulations. Replacing this term with others (addition, encouragement, bonus, etc.) is unacceptable.

Special attention should be paid to the wording used in the section on bonuses. The fact is that the term “bonus” in labor legislation is ambiguous. Thus, according to Article 129 of the Labor Code of the Russian Federation, a bonus is an incentive part of wages. And by virtue of Article 191 of the Labor Code of the Russian Federation, this is a type of incentive for work that is not part of remuneration.

The bonus established under Article 129 of the Labor Code of the Russian Federation is given to any employee who has fulfilled the labor standard. And the bonus provided for in Article 191 of the Labor Code of the Russian Federation is given only to those employees who conscientiously perform their job duties. The decision to pay an “incentive” bonus (and not to apply other incentive measures - gratitude, a valuable gift, etc.) is made by the employer. That is, this is no longer a mandatory payment, to which any employee has the right, but some kind of optional additional payment for conscientious work.

In this regard, when drawing up the section on bonuses, it is necessary to clearly indicate which bonuses are included in the system of additional payments and incentive allowances and are part of the wages that must be paid to the employee who has fulfilled the work standard. Which ones are incentives for work, and the decision to pay them can be made by the employer in each specific situation.

ATTENTION

It is better to start the section on bonuses with incentive bonuses, using “neutral” wording: “the bonus can be paid”, “by decision of the head of the organization ...”, “if there are financial opportunities ...”, etc. And bonuses that are part of wages should be separated into a separate subsection on incentive payments and allowances. When establishing them, you can use “binding” wording: “the bonus is paid...”, “have the right to receive simultaneously with wages...”.

Keep personnel records and prepare all personnel reports for free in the “Kontur.Personnel” service

And one more point related to the establishment of bonuses, in which mistakes are often made. All criteria for paying bonuses (regardless of their type) must be objective. It is unacceptable to secure the right of an employer, at its discretion, to pay a bonus to one employee and, under the same circumstances, not to accrue it to another employee (Decision of the Supreme Court dated November 27, 2017 No. 69-KG17-22).

Also see:

“We reward employees correctly: how to arrange bonuses in an organization”;

“We reward employees correctly: timing of bonus payments and deprivation of bonuses”;

“Taxes on bonuses: we calculate personal income tax and contributions, take them into account in expenses, and reflect them in reporting.”

Calculate salaries and bonuses with all taxes and contributions in an understandable service for small businesses Calculate for free

Purpose of compilation

The regulation regulates the procedure for calculating remuneration, calculated in monetary terms, which is due to an employee for his work. Many people are accustomed to thinking that there is only salary and bonus, but this opinion is wrong. Due to the fact that wages are formed from different components that differ greatly from each other, it is recommended to draw up such a document in a timely manner.

The employer needs this act in order to use it as a regulator of wage amounts. It is worth noting that this Regulation will not allow managers to use the “carrot and stick” method in the workforce, since it clearly states both all the incentive measures used and the conditions of punishment. If the norms of this document are violated, the manager may face the fact that the injured employee will sue him and will most likely win the case. At the same time, the document can protect the management of any state and commercial company from unreasonable financial claims from staff.

You can get more detailed information about this act from the following video:

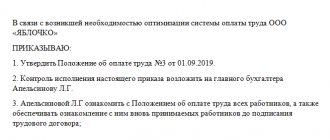

The procedure for adopting the Regulations on remuneration

The prepared draft of this local act is approved by the employer. This can be done in one of two ways: put the appropriate inscription on the LNA itself or accept a separate document (order or instructions), to which the Regulations on Remuneration will become an appendix. The approved document must be brought to the attention of all employees of the organization against signature (Part 2 of Article of the Labor Code of the Russian Federation, Part 3 of Article of the Labor Code of the Russian Federation). Employees can sign on the familiarization sheet, which is part of the Regulations, or in the log of familiarization with local regulations (you must indicate the document details in it). If the Regulation is introduced to replace the existing one and at the same time the terms of remuneration are changed, then employees must be notified about this at least two months before the new document enters into force (Part 2 of Article of the Labor Code of the Russian Federation).

Draw up and print an employment contract tailored to your situation using a special constructor Draw up for free

IMPORTANT

The regulation on wages and bonuses comes into force for all employees simultaneously from the date of acceptance by the employer or from the date specified in the document itself, regardless of the fact that the entire team has become familiar with it (Part 7 of Article of the Labor Code of the Russian Federation, ruling of the St. Petersburg City Court dated 08.23.10 No. 11564, appeal rulings of the Arkhangelsk Regional Court dated 07.04.13 No. 33-3933/2013, Moscow City Court dated 06.20.12 No. 11-6193, Chelyabinsk Regional Court dated 09.30.13 No. 11-10255/2013).

Results

Regulations on wages are necessary for both employees and the employer. With the help of this internal document, it is easier for the taxpayer to defend to the tax authorities the validity of reducing the tax base for income tax or the simplified tax system for various salary payments. And employees will be confident that they will not be deceived when calculating their salaries and they will be able to receive legal bonuses and compensation (including through legal proceedings).

This document does not have a legally established form; each employer has its own form.

Its validity period is set by the employer independently. The provision may be revised as necessary or remain in effect indefinitely. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.