The wage regulations or collective agreement of a budgetary or non-profit organization may provide for financial assistance to an employee. This is a one-time cash payment of a non-productive nature. It does not depend on the performance of the enterprise or the work activity of the employee, while the employer or trade union has the right to establish certain conditions and procedures for its provision. To receive a payment, you must fill out the application correctly. In some cases, close relatives can apply.

How to write an application for financial assistance

There is no one-size-fits-all standard form for writing this statement, so each person can write it in free form. True, large enterprises that independently develop their own forms of documents most often have their own unified form for providing financial assistance. The main thing when filling out an application is to honestly state the problem, choose the right wording and provide the employer with an evidence base. This means that when writing out financial assistance for yourself, it is advisable to attach certificates and other documents confirming its need to the corresponding application.

What can be considered a serious reason for applying for financial assistance?

As a rule, employers react positively to such a request if it is caused by an upcoming marriage, the birth of a child, a serious illness, the loss of a loved one, an accident, etc. An important role is played by how productively and responsibly the employee works (disciplinary sanctions, reprimands and other previously shown negative reactions from management will be a minus when making a decision).

In any case, the final decision on this issue falls on the head of the enterprise, who, based on his life experience and the financial capabilities of the company, will assess the degree of importance of the situation, as well as options for solving it in other ways.

Instructions for writing an application

In order for an application for financial assistance to be considered by the employer, it must be completed properly.

- In the upper right part of the document, you must indicate in the genitive case the position of the manager (director, general director, etc.), the full name of the company (indicating its legal status), as well as the last name, first name, and patronymic of the manager (the first and middle names can be put in in the form of initials).

- Then the same is indicated from the applicant.

- Then in the middle of the document the word “Statement” is written and a dot is placed.

The main part of the application for financial assistance

The second part of the statement includes its actual text. This describes a request, which should begin with the wording: “I ask you to provide me with financial assistance . Then you need to clearly indicate the reason why such a need arose, but this must be done succinctly and clearly - in one or two sentences (for example, in connection with the upcoming wedding on September 14, 2016). And after this, you need to enter the amount that you would like to receive in the form of financial assistance (in numbers and in words).

After writing the text of the application, the document must be certified with a signature (with a transcript), as well as the date of its completion.

Financial difficulties

List of reasons why you can count on financial assistance. very extensive. The application form for financial assistance differs from all of the above only in the text of the application. Here are some text options:

- “I ask for financial assistance in the amount (amount in words and figures) in connection with the need to purchase a school uniform and school supplies for my daughter (indicate full name, age). I am a single mother."

- “I ask you to provide financial assistance in the amount of (amount in capital and digital versions) in connection with the need to purchase an expensive prosthesis (wheelchair) for my son (full name and date of birth of the child), who is disabled. I am attaching supporting documents."

The attached documents may include: the child’s birth certificate, the mother’s passport, the father’s passport, a certificate of disability, a referral from the attending physician to purchase a prosthesis, receipts confirming the fact of purchase. All listed documents are provided in the form of originals and copies and are listed in the “Appendix” section.

After writing the application

After the application is completed, it must be given either to the secretary of the organization, or to the human resources department, or to the accounting department, along with all the papers confirming the request for financial support. The responsible persons will submit it for consideration to the director of the company, and if the decision is positive, he will put his resolution and signature on the petition. If the employer decides to pay out the amount in full, then on the application he will write something like: “give out in full,” but if it is decided to help partially, then in his resolution he will clearly indicate the amount that the applicant will receive.

Then the document goes to the personnel department, where an order for the issuance of financial assistance is written, which is also then signed by the head of the organization, and finally, the applicant, after all these stages, can receive the amount authorized for issue at the cash desk.

It is important to note one point: material assistance to an employee of an organization from management is a gratuitous act, that is, it does not imply any further compensation or compensation or deduction from the employee’s salary.

It is also not subject to accounting when calculating personal income tax (but only if its amount is within the limits permitted by the law of the Russian Federation - for a given year it is 4,000 rubles, everything above this amount is already taken into account for taxation).

Application for financial assistance in connection with the death of a relative

The grief that comes to a family not only has an emotional impact on all relatives, but also, as a rule, makes a significant hole in the budget. The employer, taking care of the staff, can help the bereaved employee a little financially. In this case, the funds are paid from the organization’s profit fund; these expenses have tax benefits.

To do this, the organization’s local regulations must stipulate this possibility and its regulations. For this purpose, a special Regulation may be created or the relevant information should be contained in the employment contract or collective agreement. Usually, not only the employee who has lost a loved one has the right to such a payment, but also, conversely, his relatives if the employee himself has died.

The first document required for the accrual of this type of financial assistance is the employee’s request, drawn up in the form of an application. In addition to the request for one-time financial support, the text must indicate:

- Full name of the manager (general director);

- all employee data (position and full name);

- degree of relationship with the deceased (close relatives in connection with whose death financial assistance is provided are brothers and sisters, children or parents of the employee);

- you can indicate the amount that the employer is asking for (it cannot be more than two months’ salary);

- a list of documents confirming relationship and death attached to the application;

- date, painting with transcript.

ATTENTION! It does not matter whether the amount of assistance is indicated in the application; in any case, the manager enters it into the Order, on the basis of which it will be calculated.

Sample application for financial assistance in connection with the death of a relative

To the General Director of Zarathustra LLC, Nikipelov Roman Olegovich, from the manager of the supply department, Anatoly Petrovich Rostovsky

STATEMENT

I ask you to provide me with financial assistance in connection with the death of a close relative - Rostovsky’s brother Mikhail Petrovich.

I am attaching to the application:

- certificate of family composition;

- death certificate of Rostovsky M.P.

06.20.2017 /Rostovsky/ A.P. Rostovsky

Who provides

Most often, an application for financial assistance is written to the manager. The manager, based on the complexity of the life situation and the norms prescribed in the local regulations of the organization, issues an order to provide financial assistance to an employee of the organization.

If a trade union organization has been formed at enterprises, then its responsibilities include resolving labor disputes. And providing one-time financial assistance in the event of unforeseen difficult life situations is within its competence.

Let's look at when there are grounds for paying financial assistance to an employee and to whom to send the petition.

Application for financial assistance for vacation

Financial assistance paid in connection with vacation can be called differently in local regulations: vacation pay, allowance, vacation bonus, “health benefits,” etc. Its essence in tax terms depends on how exactly the employer will formalize this one-time payment - as social or labor.

Most often, such a payment is considered simply as financial assistance, the amount of which is fixed for all employees, and it does not matter how qualified they are and how well they worked during the pre-vacation period.

But it is also possible to “link” the amount of vacation assistance and its very fact to the results of performing the labor function. In this case, the procedure for calculating the size should be clearly stated in special local acts. As a rule, this is a percentage of the salary that is paid in the absence of disciplinary complaints.

If all employees are required to receive vacation payments, each of them does not have to write a statement, but this practice is usually accepted in companies for confirmation in the accounting department. It is also worth writing a statement if we are not talking about the next scheduled vacation, but about vacation at an unaccounted time. This paper must be submitted in advance because the payment must be made before the vacation begins.

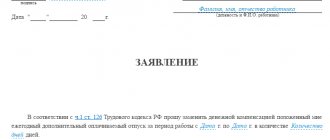

The application form is quite free, but it must contain the following mandatory components:

- Full name of the director;

- employee personal data;

- start and end dates of the vacation period;

- basis for providing assistance (collective agreement, employment contract, regulations on vacation pay, etc.);

- The usual completion of the application is a date and signature.

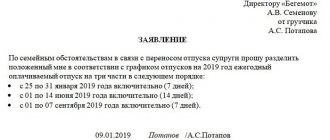

Sample application for financial assistance for vacation

To the General Director of Galakton-Service LLC, Konstantin Artemyevich Leontovich, from the chief accountant, Elena Stanislavovna Sergeeva

STATEMENT

In connection with my upcoming vacation from August 6 to August 19, 2016, I ask you to provide me with financial assistance, which is paid on the basis of a collective agreement.

08/01/2016 /Sergeeva/ E.S. Sergeeva

Vacation

After all the disasters listed above, let's talk about pleasant little things - vacation and bonuses for it.

This type of financial assistance is not provided to all employees, but to those who have especially distinguished themselves, have extensive work experience, and exceed the plan.

If you are such an employee, you should not write an application for financial assistance in connection with vacation. This will be done automatically in accordance with the collective agreement (if such a clause is included in it). If not, then you are unlikely to receive anything other than a bonus for valiant work.

If for some reason you decide to refuse leave, then your statement may look like this: “I request that my annual leave be replaced with monetary compensation.” You must indicate the period when the vacation should have taken place and the number of days. Such a statement can be written not for the entire vacation, but for part of it. This is not considered financial assistance, although you are also asking for cash.

Application for financial assistance in connection with treatment, surgery

An employer who values his employees, of his own free will or at their request, can help them financially if they need funds for treatment or surgery.

The law of the Russian Federation does not limit the amount of compensation for funds spent on treatment; the only limit is related to the amount not subject to taxes and contributions to social funds - the amount of such assistance should not exceed 4,000 rubles. per year for 1 person. In any case, the decision to authorize the payment, as well as the amount, is made by the employer.

Since this assistance is of an individual nature, it is not included in the employee compensation system. It is paid from the profit fund or unused funds for expenses.

An employee application is required to provide this assistance. In it, in addition to the usual details - “header”, title of the document, requests for financial assistance - you need to indicate the event due to which the employee urgently needs funds or compensation for expenses. There is no need to go into detail, describing the diagnosis and expenses; this information is provided in the documents attached to the application.

The decision to assign payment or refuse remains with the manager. If the decision is positive, an order is issued and funds are credited.

Sample application for financial assistance in connection with treatment or surgery

To the General Director of Fizkultprivet LLC, Alexander Rostislavovich Samodelkin, from the teacher of the chess section, Leonid Alekseevich Ferzenko

STATEMENT

In connection with the injury received as a result of a road traffic accident, I ask you to provide me with financial assistance for the expensive treatment ahead of me, including surgery.

I am attaching the following documents to the application:

- certificate from the traffic police about the accident;

- a copy of the sick leave certificate;

- a prescription issued by the attending physician;

- cash receipts for purchased medications;

- contract for paid surgical intervention;

- extract from the medical record.

06.25.2017 /Ferzenko/ L.A. Ferzenko

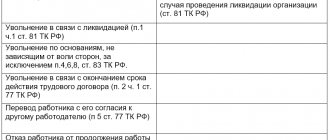

In what cases is it necessary

The labor law in the provisions of Article 135 reflects the employer’s ability to pay financial assistance to employees. This should be seen as a right, not an obligation. That is, the management of the enterprise makes a decision as to whether to transfer money to a specific employee or not.

First, the financial capabilities of the organization are assessed, then a decision is made on payment. These provisions must be specified in the local regulations that the company uses.

In most companies, collective agreements specify the procedure according to which the team is provided with material support. This happens if unforeseen circumstances arise in the employee’s life. This circumstance entails the formation of additional expenses.

It is taken into account that the amount of such costs is large. It is important to note that the list of such situations cannot be unlimited. In this case, the provisions of Article 270 of the Labor Code of the Russian Federation are taken into account.

The legislator indicates that the payment should not be subject to taxes, provided that its size does not exceed 4 thousand rubles. This point is subject to special control by the fiscal authorities. Currently, a certain list of such circumstances is applied, in the event of which assistance is paid. Most often, these situations are described in local regulations and are considered the basis for providing funds from the company’s budget.

These include:

- the birth of a child;

- marriage;

- vacation;

- death of a close relative;

- difficult situations in life.

Each case is assessed separately by the management of the enterprise. It is taken into account that now the citizen will have to unplannedly spend a large amount.

Application for financial assistance due to a difficult life situation

The employer has the right to provide financial support to employees in any ups and downs of life, although it is not obliged to do so. His good will should be reflected in the local documentation of the organization: the law allows you to determine the parameters of such assistance independently, the main thing is not to contradict the Labor and Tax Code of the Russian Federation. What employers and employees should remember in connection with financial support:

- payment of assistance cannot be permanent, this payment is one-time and individual in nature;

- exceeding the amount of 4000 rubles. per year leads to mandatory deduction of interest from it to social funds;

- the amount to be paid is determined solely by the employer and cannot be disputed.

The employer should be notified of life difficulties that require financial support to overcome in writing. The application is submitted to the head of the organization. It must explain the reason for the request for help, supporting it with documentary evidence. The employer can offer help to the employee himself, but it is still better to write a statement.

The amount is calculated depending on the expenses incurred to overcome difficulties (these, of course, need to be confirmed).

A difficult life situation is one in which, as a result of poverty, the life of an employee or his family may be disrupted. The law includes the following circumstances:

- the appearance of a dependent relative over 65 years of age or the employee reaching this age;

- difficulties in finding a job for an able-bodied family member (assigning him the status of unemployed);

- the presence of small (minor) children or one child in the family;

- disability of one of the family members.

Some employers do not allow difficulties to be described in the application, limiting the applicant to the vague wording “due to difficult financial situation.”

Sample application for financial assistance due to a difficult life situation

To the General Director of Kolovrat LLC, Anton Leonidovich Evstigneev, from the caretaker Liliya Nikolaevna Rusinskaya

STATEMENT

I ask you to provide my family with the financial assistance necessary to prepare my three children for the start of the school year.

I am attaching to the application:

- certificate of family composition;

- certificate of a mother of many children;

- cash receipts for stationery and school uniforms.

08/18/2016 /Rusinskaya/ L.N. Rusinskaya

Do I need to pay personal income tax on financial assistance?

Is the payment amount approved by the employer subject to tax? The employer as a tax agent needs to think about this. But the recipient should clarify this point in order to know how much he can subsequently receive a deduction for.

In accordance with Article 217 of the Tax Code, not all payments of this kind are subject to personal income tax. Exempt from it:

- victims of natural disaster;

- victims of terrorist attacks;

- family members of the deceased employee;

- adoptive parents of an orphan who received up to 50,000 rubles;

- a close relative who is sick or needs treatment.

It is important here that the payment be a one-time payment and carried out according to one order. If there are several, then the second and subsequent amounts will be included in the tax base.

Also, the amount of 4,000 rubles from any financial aid issued is exempt from taxation. That is, if 10,000 rubles are paid to an employee, then the tax will be withheld only from 6,000.

About the author of the article

Natalia Goncharova

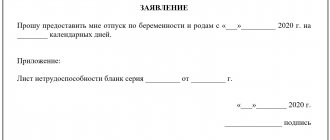

Application for financial assistance in connection with the birth of a child

One of the happiest, but also financially costly events in an employee’s family is the birth of a long-awaited offspring. A caring employer has the right to share the joy and, to some extent, the costs of his employee.

The reasons for financial support, which may well include the birth of a baby, are listed in the relevant local regulatory act of the organization, for example, a collective agreement. Even if such a document has not been adopted by the company, the law does not prevent an employee from asking for financial assistance from his superiors, and the employer from satisfying this request, or, indeed, from refusing.

You need to contact the employer by writing and submitting an application in his name, where you need to indicate the reason for providing assistance and justify it with documents. The application form will be standard, accepted for this company. The main thing to remember when submitting this document is the need to attach a copy of the child’s birth certificate to it, this will become documentary evidence of this fact for accounting and management.

IMPORTANT! We are not talking about a benefit paid at the birth of a child without fail. In addition to this legally defined payment, the employer can award the happy father or mother an amount in excess of social guarantees.

The amount is determined by the employer, but the employee can indicate a certain figure in the application. The employee will receive it based on the order signed by the manager.

When they contact

Deputies are obliged to consider citizens' appeals and respond to them. Here are the cases in which you have the right to submit an official appeal:

- If the applicant has an intractable problem or a difficult life situation. Government representatives help in finding employment, purchasing housing, receiving social benefits and benefits.

- If civil rights and freedoms are violated. In this case, direct work is carried out with voters, their complaints are considered, and violations are eliminated if possible.

- If you need sponsorship or financial assistance for improvement. Citizens and subordinate institutions send requests for improvement of territories, material assistance and the acquisition of necessary goods (machinery, equipment, furniture).

This is not a complete list of situations in which you can turn to the people's representative. Write a complaint or statement when your rights are violated or you are unable to influence the situation on your own. Your elected representative has the opportunity to directly contact higher authorities and enlist their support. But your request must not contradict current legislation.