What is black wages?

The concept of “black salary” as such does not exist in the legislation of the Russian Federation. This phrase is used when it is necessary to describe the earnings of an employee from which the employer does not make any deductions and which for some reason he does not indicate in the report.

There are only three types of black wages. First of all, this is what they call salary “in an envelope” . This is the salary that is considered completely unofficial. As a rule, both the employer and the employee are aware that part of the earnings is not deducted either to the tax authorities or to other authorities.

Another type of black salary is a salary that an employee receives, but part of which in fact does not go to the tax office. As a rule, the employee is not aware of the violation of labor standards. Such black wages are quite rare, since the tax authorities quickly suppress such payments.

The last type of black salary is the so-called gray salary. Gray salary is that part of official earnings that is not included in the general report. It can be given as bonuses, compensation for overtime, etc. - its essence does not change.

As you can see, there are different types of black wages. However, not all of them are legal and returning them is quite difficult. But it is possible to return black wages, and public services will help you with this. Moreover, regardless of the type of salary, the method of receiving it will always be the same.

Pros and cons of gray salary

The positive and negative aspects of receiving a gray salary must be considered through the prism of the benefits of each side of the labor relationship - for the employee and for the employer.

“Gray” and “black” salaries are a real problem for the state’s economy, since multi-billion-dollar payments to various funds are lost annually due to illegal concealment of income. However, the legislation does not give citizens an alternative, forcing them to participate in the transfer of funds to the Pension Fund, which provides a meager pension under the current policy of increasing the retirement age, as well as to other funds. Perhaps, if the state allowed citizens to decide for themselves how to manage the full amount of their income and independently participate in the formation of pension savings without the “mandatory” part, then the situation with unofficial salaries could radically change.

general information

An unscrupulous employer may indicate in the employment contract only part of the due payments. Thus, he receives a number of advantages:

- reducing the level of contributions to social security and the pension fund;

- tax reduction;

- obtaining a way to put pressure on an employee.

This method of registration is a direct violation of labor laws. Personnel department specialists and the chief accountant are considered accomplices in the crime. The employee himself will not be prosecuted for this violation, but he may be charged with failing to disclose information about receiving a gray salary.

Unofficial registration carries with it a lot of negative consequences. A person receives small vacation pay, since it is calculated on the basis of official income. Maternity payments are not particularly large either. In the future, this form of employment will result in a meager pension.

Legal regulation of “gray” wages

Official salaries do not always correspond to reality. Companies with a large turnover of money often use a shadow salary system in an attempt to reduce taxes.

Issuing envelope salaries is an administrative offense - a practice that remains frequently used by Russian companies.

An employee receiving so-called gray wages is not responsible for management’s violations. The exception is when he agrees to an unlawful act. Who is fully responsible for issuing the shadow salary:

- accounting employee;

- HR representative;

- director, direct management.

The Criminal and Tax Codes describe the procedure for punishing the relevant violation. The Labor Code does not regulate this process. He only determines the size of the salary and the method of payment.

The fact of tax evasion is the primary fault of the employer. It is regarded as the most serious offense. The manager bears the greatest responsibility for calculating personal income tax. He is responsible for the performance of his direct duties as an accountant and representative of the personnel department.

The employee in this situation has the opportunity to avoid legal consequences. Before the law, he bears no responsibility for the violations of management. He has the right to request the transfer of earned funds in any official way.

If the allowances were issued as a bonus

A bonus is a monetary incentive for good work. When an employee quits, the employer has no interest in rewarding him financially. But if the employee was promised a bonus in advance for achieving specific indicators, he retains the right to it even if he leaves the company. You can try to recover the unpaid premium through the court.

For example, this happened in Khanty-Mansiysk. The woman resigned from the position of financial director and demanded that the employer pay her money in full, including a bonus, which was part of the salary. The court analyzed the bonus regulations in force in this organization and came to the conclusion that the monthly bonus was a guaranteed payment if the employee performed his duties conscientiously. The employer had no evidence that the employee worked poorly, so the court recovered the unpaid bonus.

If there is no such provision at all or it says that the bonus is paid each time at the discretion of the employer, it will most likely not be possible to obtain it even through the court.

If the employer does not pay taxes on additional payments

Then this is really an unofficial salary - black or gray. These are not legal terms, but everyone says so, including accountants and HR people.

A black salary means that the employee is not registered in any way and receives all the money illegally. That is, the employer does not pay taxes on his wages at all. Here you will need to provide evidence that the person actually works for this company. If there is evidence, most likely, the court will oblige the employer to conclude an employment contract with the person and collect arrears of wages.

Part 2 Art. 67 of the Labor Code of the Russian Federation - the employer is obliged to conclude an employment contract

For example, in one of the restaurants in Kirov, the service staff was not registered. The management agreed with the employees on salaries, but did not enter into employment contracts. Over time, they stopped paying bonuses, and then they were all fired. The employees went to court and proved that they were allowed to work, which means they were actually restaurant employees. Now the company must pay off the salary debts owed to them by a court decision.

What to do if the relationship is not formalized?

The main reason for employment without a contract is material benefit: both the employee and the employer can save on taxes and other payments. But there is also a downside to such activity: the lack of official work experience, pension savings, and insurance.

The lack of rights for unregistered employees is a myth. According to Article 67 of the Labor Code of the Russian Federation, the fact of employment is recognized immediately after the employee begins to perform his duties.

What to do if they don’t pay black wages?

You can do it in several ways:

- File a complaint with the employer in an attempt to negotiate a peaceful resolution to the conflict over non-payment of wages.

- File a complaint with the tax authority or other government supervisory services. As a rule, claims for non-payment of wages are resolved by the labor inspectorate.

- If it is impossible to collect unpaid income peacefully, an employee, even if not registered under the Labor Code of the Russian Federation, has the right to file a lawsuit and demand wages.

It is possible that the employer will resolve the dispute over delayed wages peacefully, without involving supervisory authorities in the proceedings. After all, paying wages “in an envelope” is a violation of labor and tax laws.

How to extract money from an employer without going to court?

Many people who are not officially employed and receive income “in an envelope” are interested in what to do if they did not pay a gray salary upon dismissal.

It is worth noting that the current legislation establishes a fairly short period during which an employee can go to court to protect his own rights. It is only three months. At the same time, not everyone wants to bring the case to court and are looking for ways to influence a dishonest employer.

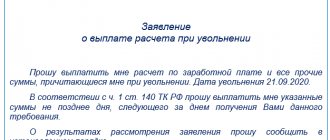

In such a situation, you should write a written statement to the employer, in which you need to set out in detail when and what position you held. It is recommended to describe in detail how wages were calculated and indicate the amount of debt. You need to make it clear to the employer that your rights have been violated.

It is required to write that for late payment of wages upon dismissal, the head of a particular organization may be prosecuted under Article 145.1 of the Criminal Code of the Russian Federation. It is important to establish a requirement to immediately pay due wages. It must be returned within three days.

If the request is ignored, indicate that otherwise you will be forced to go to court to protect your rights. In addition, a corresponding application will be drawn up to law enforcement authorities to bring the head of the company to criminal liability for non-payment of wages or incomplete payment of taxes. As a rule, this method really works, since company managers do not want to get involved with the tax office.

Where to go

In order to appeal the amount of salary, the employee will have to contact a judicial organization since in this case it will be a dispute with the boss over the amount of earnings. Such disagreements are beyond the competence of the prosecutor's office and the labor inspectorate.

Thus, a citizen with black income has no choice but to prove his black income in court. This is the only opportunity for him to get all his money in the event of a delay in salary or incomplete payment.

Try to convince the employer to resolve everything peacefully

Remember: by agreeing to a negligible salary, you also broke the law. Therefore, try to come to a compromise with the employer. It is better to receive less from him than promised than to go to court, which, most likely, will refuse to collect the gray salary.

When talking to your employer, remember that extortion is a crime in Russia. For this they can be imprisoned for up to four years. The employer can record the conversation and report you to the police.

So speak calmly. Say that your rights have been violated and you will complain to the tax office, prosecutor's office, labor inspectorate, and if that doesn't help, to the court. Don't ask for what you clearly don't deserve. Do not charge additional interest or compensation for moral damages. Avoid threats, direct blackmail and ultimatum forms of communication.

Your complaint may lead to an audit, including regarding payments to other employees. The employer may be afraid of this and voluntarily give you an unofficial part of the gray salary. To prevent him from demanding this money back and claiming extortion, ask him to formalize everything. For example, you can draw up an agreement on payment of compensation upon dismissal.

How to resolve the issue of paying gray wages without going to court

If an employee does not plan to go to court, he has one option left - appealing directly to management. The former employee's main argument is the danger of tax audits, even if they do not reveal a problem.

Dismissal and further recourse to court bring losses to the company, so management makes concessions. Legislation will not help resolve a controversial issue before going to court.

The employee will have to defend his rights orally. If there is evidence of a violation of the law, the employee is obliged to present it and then put forward conditions for resolving the issue.

If persuasion is ineffective, the next authority is the tax office. A former employee petitions for a review of a particular company. The inspector's decision becomes the reason for further recourse to court if the employer remains adamant.

If things don’t work out peacefully, complain to the prosecutor’s office, the labor inspectorate and the tax office.

If you are still working, then evaluate the pros and cons before writing complaints. A complaint is not grounds for dismissal. But, most likely, you will completely ruin your relationship with your employer.

First, you can complain to the supervisory authorities: the prosecutor's office and the labor inspectorate. These bodies are still working on statistics: the more violations identified, the better. Therefore, they are interested in punishing the unscrupulous employer.

Art. 5.27 Code of Administrative Offenses of the Russian Federation - fine for violation of labor laws

An organization can be fined 50,000 RUR, and an individual entrepreneur – 5,000 RUR.

If the labor inspectorate reveals facts of payment of black or gray wages, it is obliged to immediately report this to the local tax office and the investigative committee.

The tax office may collect a fine from the employer in the amount of 20% of the unpaid amount of tax and insurance contributions. But keep in mind that the tax office may also fine you, because if the employer does not pay payroll tax, the employee must do it himself.

The more authorities you complain to, the higher the likelihood that one of them will satisfy your complaint. It is possible that during the proceedings new circumstances will be revealed or additional evidence will appear. If all your complaints are denied, carefully study the reasons for the refusals. Perhaps you do not have enough evidence or, in fact, you were not paid a gray salary at all. If you are sure that your rights have been violated, file a lawsuit.

To which authorities to complain: instructions

Employees of any enterprise can seek help in resolving a labor dispute from special supervisory agencies . For example, if unpaid wages are not paid, employees need to:

- Submit a complaint to the tax office alleging that your employer is paying illegal wages, thereby evading taxes.

- File a statement about unpaid wages to the labor inspectorate. By the way, you can contact this body anonymously.

- Write a letter to law enforcement agencies if your employer is maliciously evading payment of wages and has previously been held accountable.

You may find the following information interesting: a complaint to the tax office against an employer for black wages.

As a rule, most complaints regarding wages or other disputes with management are sent to the labor inspectorate. The government agency must respond to each request within 30 days.

In the absence of an employment contract, the applicant must prepare evidence of employment and receipt of salary.

One of the features of collecting black wages is the need to prove its size and the very fact of performing work duties. Since there is no employment contract, you need to prepare some documentary evidence of employment.

Where to complain about “gray” and “black” wages?

“White” is the official salary specified in the hiring order, in the employment contract, and so on. According to the Tax Code of the Russian Federation, this amount is subject to personal income tax (NDFL) of 13%. The employer also deducts insurance premiums from it. To reduce the amount of deductions, some employers use a “gray” salary scheme, when the salary consists of two parts - “white”, subject to taxes, and “black”, that is, paid “in envelopes”.

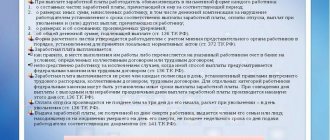

Both “gray” and completely “black” salaries are considered illegal. They are disadvantageous to the employee because he is paid less money for sick leave, vacation, or in case of layoff or dismissal by agreement of the parties. In addition, the size of pension contributions is reduced. If your employer uses such a scheme, you can:

- complain to the tax office (online or in person, to the inspectorate at the location of the organization), the period for consideration of the appeal is 30 days from the date of its registration;

- complain to the district prosecutor's office at the location of the organization;

- sue the employer (in the district court at your place of residence or at the location of the organization).

The tax inspectorate and the prosecutor's office have the right to initiate an audit at your enterprise (in your company). If this audit confirms non-payment of taxes and insurance premiums, depending on the circumstances, your employer may face fines, forced labor, and even imprisonment.

At the same time, if you received a “black” salary, you are obliged to independently declare this income to the tax office by April 30 of the next year and pay the tax by July 15. Otherwise, you may be charged not only the amount of unpaid personal income tax, but also a fine. And in some cases, you may face criminal prosecution.

What is due to a resigning employee?

Upon dismissal, an employee has the right to count on:

- Unpaid wages for time worked in the current month.

- Severance pay, if the company is liquidated, the staff is reduced. In case of dismissal by agreement of the parties, payment of benefits remains at the discretion of management.

- The thirteenth salary, if it is provided for by the local regulations of the enterprise.

- Bonuses, which in most cases an employee receives as part of his salary on the day of dismissal. If the company accepts periodic bonus payments (quarterly, annual), during the calculation, a portion of the money is issued, proportional to the period worked.

- Compensation for vacation that was not used in the current and previous years.

In fact, the only mandatory type of payment due to all resigning employees without exception is salary. All others depend on the specific circumstances. When collecting wages in court, the employee additionally has the right to claim compensation for moral damage.

How to prove the real amount of earnings?

The following evidence will be very helpful:

- testimony of witnesses (other employees);

- payrolls;

- audio, video and photographic materials.

Various evidence may also be required to confirm the amount of salary, these include the following:

- statements that indicate the amounts received by employees;

- envelopes in which salaries were issued with notes;

- advertisements in newspapers and websites with a detailed description of the vacancy and salary;

- testimony of other employees.

What evidence of gray wages will be required for court

Before going to court, you need to collect evidence that your salary is actually more than what is stated in the contract.

You write that an unofficial additional payment was transferred to your card and you can request a statement of account. This is excellent evidence, but it may not be enough. Your employer may have provided you with additional payments as an informal reward for good work or as reimbursement for expenses. During the investigation of your complaint, he may declare that the grounds for such additional payments have disappeared. It is unlikely that the court will punish the employer for providing additional assistance to you, even if he did not formalize everything properly.

Please note the purpose of the payment. For example, an accountant could indicate “Bonus” or “Salary” in the assignment - such notes would confirm the gray salary.

How to file a lawsuit

You also write that your colleagues can act as witnesses. This is also good evidence, but it may not be enough. Dismissed colleagues are themselves interested in the court awarding you and them additional wages. And employed employees most likely will not testify against their employer.

For example, employees of one city enterprise gave different testimony to the court. Some said that most of the salaries were paid illegally, while others said that these were rumors. As a result, the court refused to collect the gray salary.

While you're still working, start collecting other evidence. Employers often keep unofficial records where they record the issuance of gray wages. If you manage to obtain such papers, this can be a good argument in court.

For example, one accountant brought to court a time sheet and salary slips. From these documents it followed that the accountant actually received more than was indicated in the employment contract. The court decided that in order to evade taxes, the employer kept double accounting, so the employee has the right to a higher salary.

In another case, the dismissed deputy director brought to the court statements with accrued wages, from which it followed that he received a higher salary. The court ordered the employer to pay the entire salary according to the statement, although the employment contract stated a different amount.

The problem is that an ordinary employee is unlikely to be able to obtain documents that will confirm double-entry bookkeeping. There is other evidence. Sometimes employers post job advertisements with a higher salary than they officially pay. Such announcements can also be presented to the court.

How to prove illegal wages in court

To force them to pay back wages, workers often have to go to court. However, in order to recover the required amounts from the violating employer, the employee will need to prove that he actually worked in this organization and was promised a salary in a certain amount. This is not easy to do, because documentary evidence of these circumstances is very difficult to find, especially if the employee worked for the employer without official employment.

By submitting a statement of claim to the court, the employee will have the opportunity to sue for black wages. In this case, the expenses incurred by him during the trial will be borne by the employer, in particular, the payment of legal services (within reasonable limits). Therefore, it is better to resort to the services of a specialist who will help you correctly draw up a statement of claim, correctly formulate the plaintiff’s demands and collect the necessary evidence.

In addition to the requirements for payment of wages, by virtue of Art. 236 of the Labor Code of the Russian Federation, an employee may demand payment of interest for non-payment of unpaid wages on time; this interest is 1/300 of the refinancing rate of the Central Bank of the Russian Federation on unpaid wages for each day of delay.

To prove that the employee actually worked for the organization, evidence may be required such as:

- testimony of witnesses (other employees);

- payrolls;

- photographs and videos.

This evidence will help establish the existence of an employment relationship between the employee and the employer.

You will also need evidence confirming a certain salary amount. These may include:

- pay slips showing the amounts received by employees;

- envelopes in which salaries were paid, with notes;

- advertisements in newspapers and the Internet describing the vacancy and salary levels;

- testimony of other employees of the organization who can confirm the amount of remuneration in the organization;

- statistical information on wages for certain specialties.

If the court considers that the evidence presented by the employee is sufficient to confirm the plaintiff’s position, then it will make a decision to establish the fact of an employment relationship and collect unpaid wages.

In addition, the court has the right to issue a private ruling to the violating organization, which may indicate the need to comply with the requirements of the law and the inadmissibility of violating the labor rights of employees. The employer must correct existing violations of the labor rights of employees within a month, and then inform the court. If such actions are not taken, the employer may face administrative liability for failure to comply with the requirements specified in the private court ruling.

How to prove illegal wages if the case goes to court

Along with the method described above, there are other, less exotic ways to prove a gray salary. To be fair, we note that it is often simply impossible to prove the existence of an employment relationship between an employee and an employer in the absence of documentation . The employer, as a rule, still has the opportunity to deny in court any involvement of the employee in the enterprise. Since it is difficult to prove unofficial wages after non-payments begin, evidence collected before the critical period of delay or refusal to pay wages works best . These include copies of pay slips, albeit unofficial ones, documents from the company’s internal circulation, which include the name and signature of the employee and, one way or another, mention the unofficial salary. Collected in advance, they can serve well in the event of conflicts with the employer and help ensure that the payment of gray wages becomes a reality.

If such documents cannot be found and presented to the court, then two options remain. The first and rather unpromising one is to contact the company’s accounting department with a request to provide documents that are somehow related to you and prove that you have received wages. The second, which often helps in practice, is to find witnesses who are ready to confirm your labor involvement in the activities of the enterprise. If such people are found, the chances of a court decision in your favor increase significantly.

And, returning to recording evidence using a voice recorder of conversations with management or an accountant, it is worth noting that such effective and compelling arguments should be collected before the conflict with the employer becomes acute. In principle, this also applies to all other methods of collecting evidence of “black” wages, since when an employee displays a tough and decisive position, management often simply prohibits other employees from communicating with him as “unreliable.”

Considering the issue of the legality of collecting information by secretly recording personal conversations with an employer, we can conclude that such an act does not entail any legal consequences for you . But it should be remembered that this applies specifically to personal communication and the installation of listening or intercepting devices is unacceptable - at best, the court will not accept evidence collected by this method.

We force the employer to pay the amount

Based on a complaint, any government body can initiate an inspection at the enterprise and the manager will face liability for the detected fact of unofficial employment. If they do not pay black wages, then you will most likely have to demand it in full in court. Where to contact and in what order?

Pre-trial solution to the problem

A pre-trial agreement will save time for the employer and employee. In the process of signing a new contract that takes into account unofficial earnings, the company will not be subject to inspections. The employee's benefit will be safe.

A pre-trial agreement prevents the registration and payment of large fines.

Contractual relations exclude recourse to court. The case will not be made public, and you will not have to pay all legal costs. The employee will receive the full amount, benefits, unpaid leave.

The total amount is calculated taking into account the real salary. It is included in the contract.

Disadvantages of contractual relations - the employee’s pension will be calculated without taking into account the gray salary. Insurance premiums will also be lower. The amount of termination payments will be fair, but the future of the former employee is not protected.

Judicial order

In practice, filing a claim for recovery of unpaid wages is a necessary measure. For example, if an employer refuses to voluntarily repay a debt to an employee upon dismissal. Remember your rights: it is possible to recover in court not only official wages, but also black ones.

Procedure for going to court for non-payment of black wages:

- Evidence of employment and salary receipt should be prepared.

- Then you need to draw up a statement of claim, describing the situation and the plaintiff’s requirements.

- The prepared papers must be sent to the court at the place of registration of the plaintiff.

Let's learn how to draw up a statement of claim for the recovery of wages by reading this article.

One of the important conditions is the presence of documentary evidence that the applicant actually worked without an employment contract and was not paid a salary in a certain amount. For the court, the claim must describe in detail the amounts received, as well as indicate the procedure for calculating unpaid wages.

The calculation given in the statement of claim must be based on some evidence. For example, you can attach a photo of your payslip to the case. If there are no such papers, then it will be more difficult for the court to establish the real size of your salary and the amount of debt.

Evidence of informal employment and the existence of wage arrears will be:

- Internal documents of the enterprise, which contain the employee’s information (invoices, invoices, statements, logs of time of arrival and departure);

- Video or audio recordings of negotiations with the employer, photographs of documents or salary slips;

- Written statements from witnesses indicating that the applicant actually performed his official duties.

If you are still working and receiving wages “in an envelope,” then it is advisable to save such evidence now. At the peak of a conflict with management over receiving a salary, collecting evidence will be more difficult.

Calculation and collection of compensation

Through the court, an employee (current or former) has the right to demand not only arrears of wages from the employer, but also compensation for each day of delay in payments. This possibility is provided for in Article 236 of the Labor Code of the Russian Federation : for one day of non-payment, an employee is subject to a penalty in the amount of at least 1/150 of the rate of the Central Bank of the Russian Federation on the amount of the debt.

A special material has been prepared on the topic of calculating interest for late payment of wages - we recommend that you read it.

For example, the current rate of the Central Bank of the Russian Federation is 7.25%. If your employer does not pay you a salary of 30 thousand rubles for a month, then the compensation will be about 430 rubles. Depending on the circumstances (moral or material damage), the plaintiff may request a larger amount of penalties. The claim and calculation for compensation must be indicated in the statement of claim.

How to force an employer to pay a “gray” salary upon dismissal

The most difficult aspect when claiming unpaid unofficial earnings is the need to prove the existence of such income and its specific amount on the part of the employee. Since gray wages are not taken into account in official accounting documents, audit and tax audits will not be able to identify actual violations on the part of the employer. At the same time, the legislation does not indicate factors that could clearly establish the presence of a gray salary and its size.

In general, there are two main ways to force an employer to pay an employee, taking into account his unofficial salary - going to court, or pre-trial resolution of this issue in person. Each of these methods has both certain advantages and disadvantages. So, a legal dispute with an employer:

- It will provide an opportunity to recalculate pension and insurance contributions and increase subsequent pension benefits;

- Guarantees payment of increased severance pay and compensation upon dismissal due to downsizing or liquidation of the organization;

- It will require a significant investment of time to solve the problem;

- It will necessitate the independent collection of evidence of the fact of payment of gray wages and their size;

- It can ruin the employee’s business reputation and indirectly interfere with further employment.

A pre-trial decision can also be beneficial for both the employer and the dismissed employee, since:

- Will not entail any inspections, investigations, fines and possible criminal prosecution;

- Will not lead to the need for a legal dispute and payment of related costs;

- It will allow the employee to receive a large amount of funds, since personal income tax and other deductions will not have to be paid from the “gray” salary;

- Will not entail the need to recalculate payments for alimony and other obligatory payments of the employee;

- It will not affect the amount of pension, severance pay and benefits from the unemployment center.

Responsibility of the employee for gray wages

The employee’s responsibility when receiving a gray or black salary is in the form of penalties in accordance with the provisions of the Tax Code and the Code of Administrative Offenses of the Russian Federation. Every working citizen is required to pay income tax in the amount of 13% of all earnings. Failure to pay taxes, which are provided for by tax legislation, involves the forced collection of unpaid funds for the employee, as well as the imposition of a fine for concealing actual income.

In this case, various difficulties may arise for such an employee, including:

- Difficulties in obtaining a targeted or non-targeted loan, since the creditworthiness of a citizen without an official salary or with a low salary at the minimum wage level is assessed very low by banks.

- Difficulties in obtaining a mortgage with state support, which allows you to pay part of the loan using income tax funds paid by the employee over the past few years to the state treasury.

- The actual impossibility of collecting wage debts if the employer for some reason refuses to pay the earnings. Unfortunately, judicial practice is not on the employee’s side, because... in fact, he carried out his labor activity on a minimum wage salary.

- Risks associated with a tax audit if an employee applies to the inspection authorities with a statement of non-payment of gray or black wages. In this case, the check will be carried out not only in relation to the employer, but also in relation to the applicant, because for the specified period of work, the employee did not pay a large amount of personal income tax to the state treasury. In this case, the employee will be required to pay all unpaid taxes due to concealment of actual income.

For an employee of an organization, “gray” wages can have the most unfavorable effect, since it does not guarantee the fulfillment of obligations to pay wages on the part of the employer, and also will not allow the employee to count on any bonuses when applying for a loan.

Details of the trial

At the first stage, it is worth filing a statement of claim, which indicates clear requirements on the part of the employee.

Sometimes a person turns to the authorities if the white part of the salary is paid or it is completely delayed. Sometimes, upon dismissal, it is not issued in full. Often vacation pay and other entitlements are calculated only on the basis of the official salary. In some cases, the claims indicate the need to conclude a legal employment contract, which will spell out all the working conditions, including payment for activities.

The court's decision is influenced by the results of tax and labor audits. Therefore, writing complaints to the appropriate authorities is very useful. Organizations issue fines and indicate what needs to be corrected by a certain date.

During the meeting, all presented evidence is considered. None of them can be completely exhaustive. Therefore, the court may refuse the claims or partially satisfy them. Both parties can appeal the decision in court within ten days.

Non-payment of wages imposes different types of liability. All types of fines may be applied to the employer. Most often, administrative responsibility is imposed. It consists of imposing penalties on an enterprise or official.

The most difficult thing to prove is the amount of black wages. Even with evidence, this is not so easy to do. The court may not satisfy the requirements. Therefore, it is best to get a job in places with official registration.

Difficulties in receiving black wages

Anyone who wants to receive the menial wages he earned upon dismissal will have to face two very serious problems. The first is the difficulty in calculating the exact salary amount . It all depends on what kind of evidence you used to point to its existence. The more accurate your data, the easier it is to get an accurate figure.

The second problem is very serious and can easily pose the question “Is this black salary necessary at all?” The fact is that during an inspection, civil service employees may have a simple question - were you in collusion with the employer? If it is proven that the black salary was paid to you on your own initiative, then you may be charged with tax evasion. So you may well face administrative or even criminal liability.

Collection of evidence

These disputes are not resolved by the labor inspectorate or the prosecutor's office, so the employee has a direct route to court. First, he needs to independently collect the necessary evidence. It is better to take care of this in advance, since the very fact of unofficial employment sooner or later threatens a number of problems. The ideal option is documentary evidence of the salary amount. It is unlikely that you will be able to obtain an employment contract, payslips, etc.

You can record the moment of discussion on a voice recorder. Just keep in mind that this will have to be done secretly. Almost all smartphones have audio recording capabilities. Another possible option is witness testimony. They can be given by any person who saw the moment of transfer of money and its quantity.

In some cases, proof may be a job advertisement.

The amount of wages is often written in the text. If it was posted on the website, then it is allowed to take a screenshot, which it is advisable to have certified by a notary. Many companies have double-entry bookkeeping. In this case, the collection of evidence is simplified. Any documents that indicate the amount of wages may be presented in court. In some places, employees are issued income certificates, which also serve as proof. They are given for obtaining a mortgage, loan, etc.

The easiest way to receive a black salary upon dismissal is if it was transferred to a bank card. In this case, it is enough to receive an account statement, which will indicate all receipts during a certain period of time.

What's the result?

The employer can be punished for black or gray wages, so you can try to reach an agreement with him before the trial.

You can complain about a gray salary to the prosecutor's office, the labor inspectorate and the tax office. But keep in mind that tax authorities may also have claims against you.

You can try to recover the gray salary through the court. To do this, you need to prepare evidence in advance. Account statements and witness statements may not be enough.

The courts do not always side with workers. Some judges refuse to collect the unofficial part of the gray salary.