The dismissal of an employee, according to the Labor Code of the Russian Federation (Article 140), is accompanied by a full settlement with him. All amounts due must be paid on the date of termination. However, there are always many questions regarding bonus payments. At the time of dismissal, the amount of the bonus may not yet be determined. How to calculate dismissal pay in this case? Is it necessary to pay a bonus to an employee who no longer intends to work for the organization? A bonus is an incentive payment. Does it make sense to use it in this case? How to avoid breaking the law and sanctions from regulatory authorities?

Question: Is it legal to include in the organization’s remuneration regulations a condition that employees who quit voluntarily receive a bonus for the current period at the discretion of the manager? View answer

General issues of bonuses for resigning employees

Forms of remuneration in an organization, the system of this payment (SOT) can include not only payments for the performance of their duties by employees, but also be of an incentive, bonus nature. The payment of bonuses is regulated by all-Russian legislation and local regulations relating to labor relations (LRA).

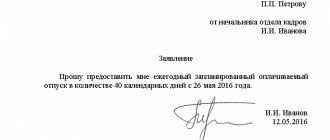

The Labor Code does not consider bonus issues in detail, indicating only that in the event of controversial situations, the employer must pay the employee an undisputed amount. To avoid problematic issues, bonuses and their payment are described in detail in the organization’s regulatory documents. The procedure for calculating and paying bonuses in the organization is prescribed:

- in a collective agreement;

- in the employment contract (agreement) with the employee;

- in the Regulations on remuneration;

- in orders and regulations on individual bonuses for individual employees.

It is advisable to reflect the bonus payment procedure in the individual agreement of the parties, while at the same time specifying detailed conditions for such payments in the collective agreement or Regulations.

All bonus amounts due to the employee according to regulatory documents must be paid upon his dismissal. The amounts of accrued bonuses are included in the amount of dismissal payments (for example, compensation for unused vacation), in accordance with the current government Decree No. 922 of 12/24/07 on average earnings. According to Federal Law No. 272 and subsequent clarifications of the Ministry of Labor (see Letter No. 14-1/B-800 dated 08/23/16), payment of bonuses must be completed no later than the 15th day after the period for which it was accrued, and LNA must contain appropriate wording regarding deadlines.

How to arrange payment of a bonus to an employee after his dismissal ?

Types of personnel bonuses

According to the current standards of the Labor Code of the Russian Federation, an employee is rewarded not only for conscientious work, but also on other grounds. Key ones:

- based on the results of work for a certain period of time (month, quarter, half year, year);

- for meeting indicators and achieving results;

- dedicated to special occasions and anniversaries;

- one-time amounts.

Another interesting question: how and whether a bonus is given to employees upon dismissal, depending on its type.

Bonuses for the employee’s anniversary, which comes after dismissal, will not be paid. They will not be awarded on a special occasion (professional holiday, company anniversary, etc.) if it occurs after the termination of the employment contract.

And the incentive based on the results of the reporting period is paid, but only if the following conditions are met:

- In local regulations of the employer, the bonus payment is stated as a guaranteed part of the salary.

- The dismissed employee met production targets and achieved the labor results that were planned for execution.

- The former subordinate worked the period for which bonuses are accrued, in full or only in part (according to the regulations). In this case, the amount is calculated in proportion to the time worked.

If the conditions are met, the bonus to the dismissed is paid a month after the dismissal or in another period of time corresponding to the timing of the accrual and transfer of bonus payments from the employer.

IMPORTANT!

The employer is authorized to stipulate in a local act that bonuses based on the results of the period are paid only if the period is worked in full. If an employee leaves before the end of the period, then he is not entitled to a bonus. For example, an annual bonus after dismissal is not paid if the employee has not worked the entire pay year.

Special opinion of the Ministry of Labor

In a letter dated March 14, 2018 No. 14-1/OOG-1874, representatives of the Russian Ministry of Labor and Social Protection expressed the opinion that payment of a bonus to a dismissed employee after full payment is due only in one case: if bonuses were accrued according to an order approved before the dismissal date.

If the order is adopted later than the date of termination of the employment contract, then there is no need to provide bonuses to former subordinates.

This letter is not a legal norm. And if the employer does not pay the bonus that was guaranteed by the provisions or labor or collective agreement, if there are grounds, the employee has the right to challenge the decision in court.

In this case, non-payment of bonuses after the dismissal of an employee is illegal; judicial practice recognizes this as discrimination against workers’ rights. The employer will be required to make due payments and compensation. They will also apply administrative liability measures under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Premium accounting

Accounting for bonuses to a dismissed employee is kept in the accounts for wages, other payments and those corresponding to them. The bonus is calculated on the debit of production and similar accounts: D 20, 23, 25, 26, 44, etc. K 70.76 . Payment is made in the usual manner, through a cashier or bank: D 70, 76 K 50.51 .

Annual and quarterly bonuses are subject to personal income tax (Article 208-1 of the Tax Code of the Russian Federation) and are reflected by the posting: Dt 70, 76 Kt 68/NDFL .

On a note! There is Art. 217-7 of the Tax Code of the Russian Federation, which contains a mention of non-taxable bonuses (for example, for outstanding achievements in science or cultural activities), in addition, bonuses of 4,000 rubles or less specified in Art. 217-28 Tax Code of the Russian Federation.

The inclusion of bonus payments not specified in the LNA in the calculation of income tax to reduce the base is illegal (Article 270-21 of the Tax Code of the Russian Federation). Premiums are subject to insurance charges, according to Art. 420 Tax Code of the Russian Federation, Art. 20.1-1 Federal Law No. 125 dated July 24, 1998. Costs for them are recorded as standard: Dt 20, 23, etc. K69 (according to accounting subaccounts) .

How to assign a bonus to a departing employee. Consequences for the parties

According to correspondence with account 76, personal income tax is written off. This need is evidenced by Art. 208 NK. We use the value Dt 76 Kt 68. For the bonus itself, the code Dt 76 Kt 50 (51) is provided.

Bonus appointments occur in a period that goes beyond the period of time accepted when calculating average earnings. Consequently, when determining compensation for vacation, it will not be taken into account. It will affect this indicator only in a situation where the amount was paid for the year preceding the year of dismissal.

Features of accrual

According to the standard, incentive amounts for a quarter, month, or year are calculated at the end of this period. But it is not possible to fulfill this condition by way of dismissal. Thus, the bonus to an employee who leaves the company is repaid in the same way as to working representatives.

Calculation procedure:

- Designation of interest for a specified period.

- Determination of the amount of earnings for the past period.

- Accounting for the amount for the period actually worked.

- The amount is calculated by multiplying the assignment percentage by real income.

- Subtraction of personal income tax and mandatory taxes.

The employee quits, and the amount of the bonus has not yet been determined

If the size of the bonus is known at the time of dismissal, the accounting accountant does not have any problems; he includes it in the calculation of dismissal amounts. If the amount of bonuses is not determined at the time of dismissal, you should recalculate later and adjust the amount due to the former employee. It is obligatory to make an additional payment, recording its receipt by the employee in any legal way. Otherwise, there is a high probability of going to court. The timing of payment of bonuses to employees after their dismissal must be prescribed by the LNA (Article 8 of the Labor Code of the Russian Federation) - Regulations on Labor Protection, bonuses, etc. The specified position is contained in Letters of the Ministry of Finance, for example, No. 03-03-04/1/294 dated 25-10 -05, recommendations of Razgulin S.V., state adviser 3rd class, arbitration judicial practice.

How is a bonus paid to an employee after dismissal taxed ?

Video about employee benefits

The company is obliged to provide workers with special clothing or equipment. However, the items provided must be returned on the last day of employment.

If an employee refuses to return the workwear or damages it, the employer can go to court to demand reimbursement of the cost.

This situation is dangerous because in the event of a conflict, a person risks being fired with payment only of the official part of the salary, and, accordingly, compensation for vacation. Moreover, after being hired for a new job, a small official salary will be used to accrue sick leave for two years.

If a person agrees to work in such conditions, then he must always remember all the risks and, if possible, prepare in order to later prove that there was money in the envelope and the employer does not pay wages after dismissal,

What can be evidence:

- Video and audio recordings, ideally if there is a recording of a conversation during employment, when such details are discussed.

- Referral from the employment center or printout of a job advertisement.

- Envelopes in which the “black” part of the salary is issued often contain the employee’s name and the amount due to him.

- Gazette. Even “black” salaries can be issued according to the statement, especially if the company is large and it maintains double accounting.

- Witness's testimonies.

If an employment contract has not even been signed with the employee, he is in an even more difficult position, since he does not even need to be fired or paid any salary. In this case, you need to collect evidence not only about the amount of salary, but also that the employment relationship took place at all.

This can be proven as follows:

- To prove that there was actual permission to work, this is especially easy to do if the employee signed somewhere, for example, in the register for handing over the premises for alarm to the janitor or in the invoice for the release of goods, etc.

- Bring in witnesses who will prove that the person actually worked at this enterprise.

- Refer to video surveillance data, which is installed in many organizations, etc.

In this case, it will be possible to talk about wage arrears only after the fact of the employment relationship has been established.

The calculations include:

- wages for the period worked after the last payment;

- compensation payments and additional payments for work in special, harmful working conditions in proportion to the actual time worked;

- the appropriate amount of incentive and incentive bonuses paid in accordance with the current regulations on the remuneration system;

- compensation for unused days of paid leave.

From the amounts accrued during the calculation, the following may be withheld:

- vacation pay paid in advance;

- damage caused by the guilty actions of the employee, if an additional liability agreement has been concluded with him (the amount cannot exceed his average monthly earnings, Article 241 of the Labor Code of the Russian Federation).

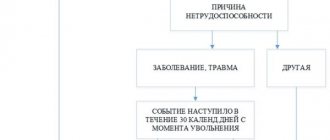

A dismissed employee is paid severance pay if:

- he was subject to reduction in staff or numbers;

- the enterprise ceased its activities, was liquidated by decision of the owner, or declared bankrupt by a court decision;

- he was called up for military service;

- according to a medical report, he cannot continue to work under the same conditions, refused to be transferred to light work, or the employer does not have suitable vacancies;

- termination of employment relations is due to other reasons provided for in Art. 178 Labor Code of the Russian Federation.

Mistakes and Consequences

Errors that arise during the calculation of bonuses can be divided into 3 categories:

- arithmetic;

- arising as a result of incorrect application of established calculation rules;

- relating to tax accounting.

The latter have already been discussed: they arise, for example, if a premium that is not legally fixed is included in the calculation of the income tax base in order to reduce it. Such actions are considered by the Federal Tax Service as a reason to apply fines and sanctions when checking payments.

Accounting errors lead to incorrect payment of funds to the former employee during settlement. An underestimated amount of the bonus can be recalculated and an additional payment made, while an overestimated amount of the bonus paid represents a problem for the organization, since it can be resolved in court. According to Art. 137 of the Labor Code of the Russian Federation, the overpaid amount can be withheld from an employee, but the specified citizen is not actually an employee. In addition, the already mentioned Art. 140 of the Labor Code of the Russian Federation speaks of the possibility for an employee to challenge the amounts paid. It is therefore advisable to resolve this dispute out of court.

Errors of a different nature, in addition to arithmetic, that overstate bonus payments to a dismissed employee, are resolved only at the expense of the organization (Civil Code of the Russian Federation, Art. 1109). In any case, the court will be on the side of the dismissed citizen.

Question: Are the costs of paying a bonus to a dismissed employee taken into account for income tax purposes if the order assigning a bonus is issued and signed after the dismissal? View answer

If things don’t work out peacefully, complain to the prosecutor’s office, the labor inspectorate and the tax office.

For example, in one of the restaurants in Kirov, the service staff was not registered. The management agreed with the employees on salaries, but did not enter into employment contracts. Over time, they stopped paying bonuses, and then they were all fired. The employees went to court and proved that they were allowed to work, which means they were actually restaurant employees. Now the company must pay off the salary debts owed to them by a court decision.

This is a gray salary: you have an employment contract, the official part of the salary is transferred twice a month and you are given a pay slip every month. In addition, you receive bonuses that are not indicated on the payslip. The salary is divided into two parts - official and illegal. The employer pays taxes and insurance premiums only on the official part.

Unfortunately, most courts believe that the employer is not obliged to transfer the illegal part of the gray salary. According to the courts, the employee must receive the salary specified in his employment contract. If the employee has signed an employment contract, then he has agreed to the amount of remuneration for his work. Even if the contract says that the employee receives 12,000 RUB, but in fact - 40,000 RUB, the employee can only demand 12,000 RUB.

For example, a dismissed employee from Ulyanovsk filed a lawsuit against the employer who owed her money. The court collected the debt, but calculated it based on the official salary. The employee appealed the court decision and stated that she received part of her salary in an envelope. The higher court refused to satisfy her complaint. According to the court, the legislation does not know such a thing as unofficial wages. Therefore, it cannot be recovered through the court.

A similar decision was made on the claim of a worker from Lipetsk. She was fired without paying the unofficial part of her salary. But, according to the court, only the salary specified in the contract can be recovered.

Here's an example. The court recovered the unofficial salary already paid to the employee in favor of the employer. Such amounts were transferred to the employee’s card with the purpose of payment “Representation expenses”. At the same time, the employee’s job responsibilities did not include actions that required such entertainment expenses. The court decided that the employee had a gray salary and he must return the unreasonably paid amounts.

Before going to court, try talking to your employer.

An organization can be fined 50,000 RUR, and an individual entrepreneur – 5,000 RUR.

The more authorities you complain to, the higher the likelihood that one of them will satisfy your complaint. It is possible that during the proceedings new circumstances will be revealed or additional evidence will appear. If all your complaints are denied, carefully study the reasons for the refusals. Perhaps you do not have enough evidence or, in fact, you were not paid a gray salary at all. If you are sure that your rights have been violated, file a lawsuit.

If you are not paid unpaid wages after dismissal, you can try filing a complaint with the appropriate authorities. But at the same time, you need to collect as much evidence as possible about the amount of actual wages and that you actually worked at the specified enterprise.

Is it possible not to pay a bonus upon dismissal?

All grounds for which the premium is paid must be specified in local acts agreed upon by each other. If there are vague formulations or contradictions, the emergence of a conflict in the event of a refusal to pay a bonus to a resigning employee is inevitable. Thus, the wording: “The manager has the right to pay incentive payments to employees - bonuses” is not obligatory for payment, and the phrase “The manager must pay bonuses” fixes the mandatory nature of such payments.

Cases of deprivation of a bonus in the LNA must also be clearly stated. Every employee must be familiar with the labor regulations adopted by the organization. Consent must be recorded with his signature.

Failure to pay the bonus specified in the LNA to a dismissed employee on the basis of a disciplinary sanction is not recommended. If you go to court, most likely, such a decision by the organization’s management will be declared illegal.

On a note! The period for going to court is 3 months from the moment the employee became aware of a violation of his rights, i.e. from the date of receipt of settlement amounts from the organization.

Features of bonus formation

An employee’s total income for the period worked is usually formed from three components. This includes payment for work, additional compensation (most often in hazardous industries or for difficult working conditions), as well as bonuses.

Bonuses are set at each enterprise individually. Internal regulations must clearly formulate the size of bonuses, their frequency and the grounds for payments.

The amount of bonus accruals may depend on:

- percentage of wages established as a bonus;

- the position held by the employee;

- the period worked at this place of work;

- the amount of contribution to the development of the enterprise, etc.

Depending on the frequency of payments, bonuses can be regular or one-time. Regular payments are monthly, quarterly or annual.

One-time financial incentives for employees are most often used for special achievements in work or on the eve of special dates. For example, an employee’s anniversary or a holiday.

Important. The bonus may have a fixed amount or be calculated depending on the employee’s salary.

Main

- The bonus to the dismissed employee must be paid in the vast majority of cases. Non-payment of bonuses must be recorded in the organization’s local acts relating to labor relations, otherwise legal disputes with the former employee are likely, not in favor of the organization.

- Errors made in the direction of overestimating payments to a dismissed person can be corrected at the expense of the former employee only if they are of an arithmetic nature, in court.

- Quarterly and annual premiums are subject to personal income tax, insurance premiums and are included in the calculation of income tax only if they are registered in the LNA.

- Postings reflecting bonus payments are made in a similar way to taking into account wages.

Accounting for annual bonuses in average earnings

When calculating compensation upon dismissal, the average earnings include the annual bonus for the year preceding the payment upon dismissal (clause 15 of the Regulations, approved by Resolution on the specifics of calculating average earnings No. 922 of December 24, 2007). The date of accrual of the bonus does not matter, i.e. if the compensation is paid, but the bonus for the past year was accrued later, then the vacation compensation must be recalculated.

Example. Additional accrual of vacation compensation upon dismissal

The employee resigned from employment on February 15, 2021. He did not use 32 days of vacation. The calculation period for calculating average earnings is from February 1, 2015 to January 31, 2021. During this time, the employee’s salary was 27,500 rubles. per month. No other accruals were made. The period has been fully completed.

The accountant calculated compensation for unused vacation:

27,500 * 12 = 330,000 rub. — income for the period;

330,000 / 12 / 29.3 = 938.57 rubles. — average earnings per day;

938.57 * 32 = 30,034.24 rub. — vacation compensation upon dismissal.

The employee was awarded an annual bonus for 2015 on February 20, 2016 in the amount of RUR 14,000. In this regard, the accountant adjusted the calculation of compensation upon dismissal:

330,000 + 14,000 = 344,000 rubles;

344,000 / 12 / 29.3 = 978.38 rubles;

978.38 * 32 = 31,308.16 rubles. — compensation for vacation taking into account the annual bonus;

31,308.16 – 30,034.24 = 1,273.92—additional amount of compensation.

You will not have to recalculate if you accrue the annual incentive on December 31 of the current year.