Astral

September 27, 2021 7901

Lifehack

Charity has long become the norm for many people. Unfortunately, there are people and organizations that need help. Therefore, many entrepreneurs donate money or necessary items to foundations, schools and other organizations. However, the accountant must correctly account for all “good” expenses.

What is included in the concept of charitable assistance?

According to the aforementioned Federal Law No. 135, charitable assistance is any assistance provided on a voluntary basis in the form of:

- transfer (transfer) of money;

- transfer of property, goods, products;

- work performed (services provided);

- transfer of rights to intangible assets;

- other voluntary means of support.

How to use a charitable donation ?

Not every gratuitous operation can be recognized as charity. In particular, the following forms of gratuitous donation are not recognized as charitable assistance:

- Giving. Such an agreement is concluded according to the rules of the Civil Code of the Russian Federation, Ch. 32. You can give things or property rights as a gift; in addition, exemption from property obligations is also considered a gift. Monetary donation (within the meaning of Article 128 of the Civil Code) can also take place. The concept of “charity” includes not only the fact of donation itself, but also the preferential conditions accompanying such a gratuitous transfer. In addition, gratuitous work and services are also classified as charity, while “gifting” a service (work), according to the law, is impossible. Donations also include donations of goods for purposes beneficial to society (Article 582-1 of the Civil Code of the Russian Federation).

- Sponsorship. In the course of providing such assistance, for example, when organizing public events, the sponsor receives benefits in the form of advertising of its brand or products, i.e. essentially provides assistance for a fee.

On a note! The question of whether a charitable transfer is classified as a gift transaction has not been fully regulated. For example, the Federal Antimonopoly Service of the Moscow Region, by its resolution No. A40-42066/12-11-389 dated 06/12/12, states that the norms of the Civil Code of the Russian Federation are applicable to charity.

Donation to a non-profit organization (NPO)

Documents that can confirm that the item received is a donation and is used for its intended purpose:

- a written agreement of voluntary donation;

- a payment order indicating the purpose - a donation, if the subject of the agreement is funds transferred to the institution's current account;

- documents that confirm expenses.

At the end of the tax period, a non-profit organization is required to submit a report on the intended use of the donation to the territorial tax authority. Accounting for donations to NPOs Non-profit organizations are required to maintain accounting records and prepare financial statements in the manner established by the legislation of the Russian Federation. Accounting statements contain information about the statutory and business activities of the institution.

Accounting and taxes

The accounting of charitable contributions reflects their type: property, cash, provision of services, etc. In addition, accounting is the basis for calculating tax indicators.

a gratuitously received charitable donation (charitable contribution) reflected

According to PBU 10/99 (clause 12), charitable contributions are recorded in account 91 as other expenses. In the accounting system, the “input” VAT on charity is taken into account, but in the accounting system it is not, which leads to the emergence of tax differences and PIT. Liabilities are calculated by multiplying the tax difference by the income tax rate (PBU 18/02).

For current payments on contributions, benefactors usually use account 76, with the opening of a corresponding sub-account.

Postings:

- D 76 K 51, 50 – transfer, transfer of money for a charitable contribution.

- D 76 K 41, 10, 01, etc. – transfer of materials, goods, property for charity.

- Dt 76 Kt 20, 23, etc. – provision of services, performance of work for charity.

- Dt 76 Kt 60 - the company purchased inventory items, services and transferred them to a third party as a charitable contribution.

- Dt 91 Kt 76 – material assets and money, work are taken into account in other expenses for charity.

- Dt 91 Kt 68 – VAT charged.

- Dt 99 Kt 68 – reflected PNO from the value of money, inventory items, etc.

These are standard entries in the benefactor's accounting.

Are charitable expenses taken into account for income tax purposes ?

Now let's look at the nuances of providing such assistance and reflecting it in accounting. Charity, as a business transaction, is not subject to VAT (Tax Code of the Russian Federation, Article 149-3, paragraph 12). It should be borne in mind that the Tax Code directly indicates compliance of activities with Federal Law No. 135.

If a fixed asset that is not classified as an excisable asset is transferred as a charitable contribution, the VAT on it should be restored and charged to other expenses (Tax Code of the Russian Federation, Article 170-3, paragraph 2). VAT on “charitable” non-excise fixed assets is calculated at the residual value, using the appropriate interest rate.

Charity is also not taken into account in the tax base for income tax, simplified tax system (Tax Code of the Russian Federation, Art. 270-16, Art. 346.16-1), i.e. Such expenses cannot be recognized by the benefactor.

So, if a previously purchased OS has a residual value of 180,000 rubles and should be donated to charity, you need to make the following entries:

- Dt 91-2 Kt 01 180,000 rub. — fixed assets were disposed of at residual value.

- Dt 19 Kt 68 32400 rub. (180000*18%) – VAT has been restored. From 2019, a basic tax rate of 20% will apply, which should be taken into account in your calculations.

- Dt 91/2 Kt 19 RUR 31,400 — the restored VAT is reflected in other expenses.

- Dt 99 Kt 68 RUR 36,000 — PNO was recorded (180,000*20%).

Accounting entries donation

According to the terms of the agreement, the school is obliged to report on the intended use of these funds. In addition, under the same agreement, the company donated sports equipment worth 50,000 rubles.

Civil law (Article 582 of the Civil Code of the Russian Federation) allows the following resources to be transferred to NPOs as a donation:

- tangible assets (movable and immovable property, securities, monetary resources);

- property rights.

When donations are received in non-cash form, in any case, a posting is generated according to Dt 51 or account 52 if the receipt is in foreign currency. When arriving in cash – Dt50.01. Believing that his funds had been misused, he decided to sue to have the donation transaction reversed. At the court hearing K.

Personal income tax

IMPORTANT! A sample agreement for the implementation of free charitable activities by a benefactor - a legal entity from ConsultantPlus is available at the link

Personal income tax and charity are a special case that is worth considering in more detail. Tax Code of the Russian Federation, art. 217-8.2, indicates that accepted charitable assistance is not subject to income tax, however, with one clarification: it must be received through a charitable organization (most often we are talking about a charitable foundation - BF).

Assistance received from an organization not named in Federal Law-135 (Article 6-1) is subject to personal income tax. The tax will have to be calculated and withheld.

On a note. A citizen providing charitable assistance can apply to the tax office for a deduction (Tax Code of the Russian Federation, Art. 219-2), since such assistance is exempt from income tax (ibid., clause 1). The deduction is provided only for contributions made through a specialized organization. The deduction is provided in the amount of no more than a quarter of all income subject to taxation for the year.

Reflection of donations in accounting

All organizations that receive or provide charitable assistance in the form of donations are required to record these transactions in accounting records.

In the accounting of a charitable company, expenses for donations are reflected in account 91. To reflect transactions with donations, the beneficiary organization uses account 86 (targeted financing).

Let's look at the basic entries for accounting for donations using examples.

Accounting for donations received

Let’s say that the religious organization “Light of Hope” received the following types of free assistance at the end of the month:

- humanitarian aid in the amount of 146,000 rubles. (of which 113,000 rubles were distributed among those in need);

- cash in the donation box in the amount of RUB 56,000;

- donations from the company as a money transfer in the amount of RUB 124,00.

The accountant of Svet Nadezhda made the following entries:

How to reflect in accounting

The general procedure for recognizing expenses in accounting is established in PBU 10/99. Paragraph 17 states: “the expenses of a business entity are subject to recognition in accounting, regardless of its intention to receive revenue.” All expenses are divided into:

- expenses for ordinary activities;

- other expenses.

Other expenses include charity. Therefore, in the organization’s accounting, the transfer of donations will be reflected using account 91 “Other income and expenses.”

An organization must exclude charitable expenses from the calculation of its income tax base. This must be done in all reporting periods. According to this indicator, a permanent tax liability is formed in accounting. The wiring is as follows:

Debit 76 – Credit 51

— funds were transferred in the form of donations;

Debit 76 – Credit 41

— goods were donated as part of charitable assistance;

Debit 91 – Credit 76

— donation costs are included in other expenses;

Debit 91 – Credit 76

— the cost of goods donated is included in other expenses;

What is charity

Charity is voluntary assistance provided by legal entities and individuals to any other person. The form varies:

- transfer of property and funds;

- performing work or services free of charge;

- other support.

The goals of charitable activities are established by law. For example, you can help the low-income, unemployed and disabled.

In charity there are always two participants: someone provides help, and someone receives it. The legislation divides everyone into three categories:

- Philanthropists

are those who “unselfishly transfer property or funds into ownership.” This also includes the provision of services. - Volunteers

are individuals who perform work and provide services for free. In other words, these are volunteers and volunteer organizations. - Beneficiaries

are those who receive help from philanthropists and volunteers.

How to account for charitable expenses

Charitable assistance is a type of financial and non-financial support. Despite good intentions, funds for charity must be taken into account.

Charity has long become the norm for many people. Unfortunately, there are people and organizations that need help. Therefore, many entrepreneurs donate money or necessary items to foundations, schools and other organizations. However, the accountant must correctly account for all “good” expenses.

Beneficiary accounting

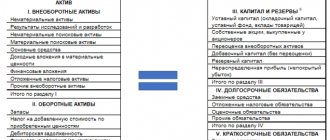

The main feature of the beneficiary's accounting is the maintenance of a separate account for targeted financing of activities (account 86).

Receipt of charitable donations

As part of the charity program we received:

- fixed assets;

- inventories;

- goods.

Services received free of charge (work completed)

The accrual of charitable income can be accounted for through the account. 76 (according to sub-accounts of thanks).

Benefactor accounting

According to Art. 270 of the Tax Code of the Russian Federation, organizations can make donations only from net profit; when determining the taxable base for income tax, these expenses of funds are not taken into account. In accounting they are shown as part of other non-operating expenses.

As part of the charity program, funds were transferred (deposited in cash to the cash desk of the recipient company)

As part of the charity program, the following were donated:

- fixed assets;

- inventories;

- goods.

Services provided free of charge (work completed)

For charitable purposes, goods and supplies were purchased, services and work of suppliers were paid for in the interests of the recipient of the donation

Charitable assistance can be processed through accounting in another way. If a charitable company keeps records of several recipients of donations, then it can additionally use account 76 broken down by counterparty. For example, assistance in the form of transfer of funds will be displayed by the following transactions:

Case Study

Limited Liability Company "Calculator" in May 2019 purchased 5 laser printers with a total cost of 175,000 rubles. (including VAT 20% - 29,166.67 rubles). In August 2021, all printers were transferred to Luchik LLC as part of a charity campaign.

Accounting entries for business transactions.

145,833.33 rubles – printers as part of the MPZ were capitalized.

RUB 29,166.67 – “input” VAT is displayed.

RUB 29,166.67 – VAT from the supplier is accepted for deduction.

RUB 145,833.33 – printers transferred to Luchik LLC were written off.

RUB 29,166.67 – VAT restoration.

RUB 29,166.67 – the restored VAT is taken into account as part of other costs.