What is the point of bonuses?

The key goal of bonuses is to stimulate the interest of employees to perform assigned tasks efficiently and promptly, maintain labor discipline, and fulfill plans.

Even within one organization, it is possible to provide several types of bonuses at once. The incentive is established based on the results of work over a certain period of time:

- monthly;

- quarterly;

- once every six months;

- at the end of the year;

- seasonal;

- at the end of the reporting company;

- based on the results of the project;

- other.

The most common type is payment based on quarterly performance results. What is a quarterly bonus? In fact, it is the same incentive payment for conscientious work, only calculated based on the results of work for three reporting months. Maximum - four times a year. But the employer has the right to provide additional types of payments in addition to quarterly amounts. For example, at the end of the year, it is allowed to pay two types of incentives at once: based on the results of work for the 4th quarter and the final one for the entire year, even though the employee already received quarterly money during the reporting year.

There are a lot of nuances in calculating bonuses. The key rules are set by the employer. Let's look at how the quarterly bonus in the company's budget is calculated using specific examples.

The minimum wage is being raised again! What about bonuses?

The employer is obliged to recalculate salaries. But is this necessary if the employee is entitled to bonuses? Read free consultation from ConsultantPlus experts.

One-time bonus payments

It was previously noted that one-time incentive payments are generally not included in the calculation of vacation payments. However, there are documents (for example, letter of the Ministry of Finance No. 03-03-06/1/150 dated 03/22/12, similar to an earlier period - the Ministry of Health and Social Development), according to which taking into account bonuses for an anniversary or professional holiday when calculating average earnings can take place if these payments are specified in the LNA, accrued in the calculation period and, most importantly, are part of the remuneration system.

In fact, whether or not to include bonuses for unearned services in vacation pay when calculating them is decided by the management of the company with full responsibility for this decision.

One-time, one-time bonus payments are usually not associated with a specific time interval. It may or may not coincide with the billing period. The specified bonuses accrued during the billing period are taken into account in full when calculating vacation pay.

However, if the accrual documents (order) indicate that the bonus was paid for work indicating the period, it must be taken into account in vacation pay as a bonus precisely for the period specified in the order. The period may be non-standard: six months, 2.3 or more years.

Question: On September 7, 2021, the employee was paid a one-time bonus provided for in the bonus regulations for the successful presentation of a new product collection. The presentation was held during working hours from September 3 to 5. During the period from September 14 to September 23, the employee was on vacation. Do I need to include bonuses when calculating vacation pay and in what amount? View answer

If the premium is accrued for a period of more than a year (it exceeds the billing period - 12 months), then it is distributed monthly. Further, the bonus is taken into account in full if the period is fully worked out. The billing period has been partially worked out - the bonus payment is included in proportion to the actual working time during the billing period.

Important! The “regular” bonus for half a year is taken into account in vacation pay according to the same rules as monthly and quarterly.

Premiums for periods throughout the year and annually

Annual bonus payments are included in the calculation of vacation payments if the accrual was for the year preceding the vacation (in 2018 - for 2021).

If it is provided for by the LNA, but for some reason the accrual has not yet taken place, then the vacation pay will have to be recalculated when the accrual occurs (Rostrud, letter No. 1253-6-1 dated 05/03/07).

It is necessary to take into account this nuance: if the billing period is fully worked out, the bonus is fully included in the vacation pay calculation formula. It does not matter in this case whether the time worked was taken into account when calculating. The billing period may not have been fully worked out, but the period for calculating bonuses corresponds to it absolutely, and the bonus was calculated taking into account the actual time worked. And in this case, the amount must be included in full.

There are situations in which the billing period has been partially worked out and the bonus is included in the calculation in proportion to the time worked in the billing period:

- The bonus accrual period fully corresponds to the calculated one, but the bonus was accrued without reference to the actual time worked.

- The accrual period does not apply to the calculation period. In this case, it does not matter whether working time was taken into account or not.

According to the above, annual and quarterly bonuses are also taken into account. So, if the billing period is partially worked out, in this case:

- hours worked were not taken into account; despite the fact that the bonus is fully included in the billing period, it is recalculated in proportion to the actual working time worked in the billing period;

- hours worked were taken into account; the premium is not included in the billing period (partially not included), it is recalculated in the same way, i.e. in proportion to the amount worked in the calculation period of the FW.

Question: LNA has the right to pay special bonuses to employees. The organization provided bonuses to employees in connection with their participation in city holiday events (celebratory procession) on a non-working day. Is the specified bonus taken into account in calculating average earnings for calculating vacation pay? View answer

Reason for appointment

The basis for a bonus is an event or a set of certain factors, upon the occurrence or fulfillment of which the employee is entitled to an incentive bonus in the form of a bonus. The list of grounds for bonuses is determined solely by the employer. The decision will have to be enshrined in local regulations for the organization, otherwise problems with the State Labor Inspectorate and disputes with employees cannot be avoided.

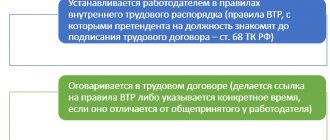

Set the grounds for assigning bonuses:

- in the employment contract with the employee;

- in a collective agreement;

- in the wage situation;

- in a separate provision on bonuses;

- in the provision on employee incentives;

- at other disposal of management.

Please note that in addition to monetary incentives, other forms of incentives for conscientious work are provided for workers. For example, an employer has the right to express gratitude or award a distinguished employee with a valuable gift, a certificate of honor, or assign him an honorary title. For special labor services to society and the state, employees are nominated for state awards.

Is it necessary to pay an employee a bonus for a year or a quarter if the payment order is issued after his dismissal?

The answer is in the consultation of experts ConsultantPlus.

Recommendations for state employees

There is no special procedure for calculating the quarterly bonus in a budget organization. Issues in the area of remuneration for public sector employees are resolved by management independently, but taking into account the recommendations and standards communicated by the founders, higher ministries and departments.

The following grounds are possible for annual, monthly or quarterly bonuses for civil servants and other public sector employees:

- for conscientious performance of labor duties;

- for achieving certain labor indicators;

- in connection with anniversaries;

- in connection with professional holidays, etc.

Please note that for each reason you will have to describe in detail the events and indicators for bonuses. For example, for payments on an anniversary or holiday, specific holidays and dates of events should be indicated. Otherwise, workers will demand money for every holiday on the calendar.

With regard to bonuses for achieving labor indicators or conscientious work, it is possible to develop a point system of criteria and factors. For each task completed or goal achieved, a point is awarded. At the end of the quarter, the total amount of accumulated points and their value are determined, depending on the wage fund.

Recommendations for commercial organizations

For commercial structures, bonus rates are somewhat different. Here the employer has the right to establish a direct link with the quantitative or qualitative indicators of the business:

- for quality indicators, for example, employees of the sales department, it is allowed to establish a quarterly incentive for fulfilling the sales plan by 100% or more;

- for quality indicators, for example, employees of the accounting department and human resources department are often paid monthly bonuses for timely submission of reports, compliance with cash and contractual discipline, and successful completion of inspections.

It is important to describe the terms and principles of accrual in as much detail and clearly as possible. The more detailed the procedure for how the quarterly bonus is calculated, the fewer problems with calculations.

When is it paid?

Considering that the results are calculated at the end of the quarter, that is, in the first days of the next month, you must follow the following rules for transferring funds to an employee:

- the bonus is provided separately from the salary;

- frequency of provision – once every three months;

- The maximum transfer period is the 15th of the next month.

As practice shows, a quarterly bonus is a good stimulator for the work of subordinates. Especially if the size of the incentive significantly increases the amount of income, depending on the total salary.

Documenting

Fix the procedure for paying bonuses to employees in the local act of the organization. For example, develop a separate provision on bonuses for employees. Be sure to write down:

- how and when the right to receive a bonus arises;

- who evaluates the performance of a particular employee;

- how this result is recorded;

- who makes the final decision on payment;

- when quarterly bonuses are paid in the company.

After the conditions and procedure for bonuses are approved, the criteria and amounts are calculated, the employer issues an order for bonuses. To do this, use unified order forms. For example, to pay a quarterly bonus to one employee, fill out form No. T-11. For bonuses for several employees - form No. T-11a.

Reward system

How often and in what amounts to reward employees is determined by the bonus system adopted by the company. There are usually several types of incentive systems.

1. Bonuses for current performance indicators. In this system, we observe both personalized bonuses, when the remuneration of each employee is related to the level of fulfillment and overfulfillment of established standards, and collective current bonuses for the implementation of the plan by the entire team (group of employees).

2. Additional payments and bonuses of an incentive nature (for example, for combining professions, for professional skills, etc.). In this system, remuneration is linked to the employee’s personal business qualities, the level of his professional skills, his individual qualities, and his attitude to work.

3. One-time (periodic) bonuses that are paid for achieving certain results or based on the performance of an enterprise (possibly a group of employees) for a period. The system links the salary of an employee or group of employees with some specific achievements that are not systematic in nature, or with any general collective results of work over a sufficiently long period (for example, a year).

The evaluation criteria (composition of indicators) for bonuses depend on the characteristics of the production cycle (for example, order-based work), the degree of process automation, and the importance of a particular production area. As a rule, the organization uses standard (industry) financial incentive systems.

Here, for example, are the types of incentive payments in federal budgetary institutions (approved by order of the Ministry of Health and Social Development of Russia dated December 29, 2007 No. 818):

- for intensity and high results of work;

- for the quality of work performed;

- for continuous work experience, length of service;

- for the results of the work.

The key principle of the bonus system is, first of all, that the amount of remuneration of an employee should directly depend on the results of his work. For the bonus system to truly become stimulating, it must be simple and transparent. The employee must clearly know that the bonus indicator is the result the achievement of which he directly influences. For example, if a worker is employed in a time-based bonus wage system, then the time spent working is paid to him on a time-based basis, and the payment of the bonus and its size depend on what result the employee has achieved, that is, whether he has fulfilled his personal plan or not. At the same time, the influence of such factors as the production load level should be reduced, because this depends not on the performing worker, but on the manager. This approach will significantly increase the motivation of workers to achieve better results.

But when developing a bonus system, an employer can also take into account all the nuances that allow optimizing incentive payments. He can establish the necessary ratio of the size of the constant and variable parts of employees’ income (salary to bonus part), differentiated levels of incentive payments depending on the qualifications of employees, the importance of the profession (production site) in the technological process, etc.

Special rules

Since incentive payments are made on the basis of documents regulating labor relations (collective agreement, employment contract, regulations on bonuses for employees), bonuses are paid only to employees of the organization. The provision on bonuses does not apply to employees who cooperate with the company under a civil contract or receive remuneration under copyright agreements.

Entry of bonus in work book

All information about employee awards for labor successes is entered into the work book (Part 4 of Article 66 of the Labor Code of the Russian Federation). But there is no talk of assigning bonus payments. In the work book, enter only the following types of incentives for employees (clause 10 of the rules approved by Decree of the Government of the Russian Federation of April 16, 2003 No. 225):

- on the awarding of state awards, including the conferment of state honorary titles on the basis of relevant decrees and other decisions;

- awarding certificates of honor, conferring titles and awarding badges, badges, diplomas, certificates of honor by employers;

- other types of incentives provided for by the legislation of the Russian Federation, collective agreements, internal labor regulations, charters and regulations on discipline.

At the same time, entries about bonuses provided for by the current wage system or paid on a regular basis are not entered into work books (clause 25 of the rules).

According to Rostrud specialists, information about one-time bonuses, which are paid on the basis of an individual order of management, is entered into the work book. But information about bonuses provided for by local regulations establishing the remuneration system for the current employer should not be entered into the work book.

Taxation of quarterly bonus

The inclusion of a quarterly bonus in the wage system clearly requires that its amount be subject to all salary taxes: personal income tax and insurance contributions. But these payments will also have to be calculated even in cases where the quarterly bonus:

- not included in the wage system;

- accrued on grounds not related to the employee’s work activity.

In terms of personal income tax, this requires clause 1 of Art. 210 of the Tax Code of the Russian Federation, and in relation to insurance premiums - clause 1 of Art. 420 Tax Code of the Russian Federation IP. 1 tbsp. 20.1 of the Law “On Compulsory Social Insurance against Accidents...” dated July 24, 1998 No. 125-FZ.

Insurance premiums accrued for premiums not related to work activities can be included in expenses taken into account when calculating the profit base (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 2, 2010 No. 03-03-06 /1/220), despite the fact that such a bonus itself is not included in expenses for calculating the profit base.

How to calculate the bonus amount

The algorithm for calculating bonuses is set by the employer on an individual basis. Premium calculation options:

- in absolute amount - the amount of payment is set at a fixed amount;

- in percentage or fractional terms - the bonus amount is calculated as a percentage or share of the established official salary, tariff rate, average salary and other indicators;

- how to calculate the bonus for the time actually worked - the amount of payment is recalculated depending on the amount of time worked in the billing quarter;

- according to a point system - the number of accumulated points is determined for the reporting period, then the cost of one point is multiplied by the total number of points for the employee;

- percentage of revenue, plan fulfilled, concluded contracts - relevant for trade organizations, for example, a quarterly bonus is established for an employee in the amount of 5% of the amount of concluded contracts;

- other ways.

Answers to common questions about how to calculate bonuses for actual hours worked

Question No. 1: When I got a job, the employer invited me to familiarize myself with the employment contract, which stated his obligation to pay me a bonus. Nothing was said about the deprivation of the bonus. Did my employer act legally if he deprived me of my bonus payment after I committed absenteeism?

Answer: If the text of the employment contract does not state the reasons why an employee may be deprived of a bonus, then this payment is equal to the main income, and the employee cannot be deprived of a bonus.

Question No. 2: Is it necessary to include days spent on sick leave in the number of days actually worked when calculating the bonus for time actually worked? After all, during sick leave the employee is paid the average salary.

Answer: No, sick leave should not be included in the calculation.

In addition to providing employees with mandatory wages as a reward for work done, employers have the right to additionally assign other types of incentives. This could be optional cash payments, the provision of material goods - the products of the enterprise, or the registration of additional paid days off.

Regardless of the chosen incentive category, the possibility of receiving support should be provided for in the employment agreement, as well as in the company’s charter. Each employee should have the same opportunity to receive incentives for the work performed.

Calculation examples

Let's look at the procedure for calculating quarterly bonuses using specific examples.

Example No. 1. How to calculate a quarterly bonus from an employee’s salary

An employee of Vesna LLC was awarded a bonus for the 3rd quarter of 2021 in the amount of 150% of the official salary. According to the staffing table, the salary is 50,000 rubles.

Calculation of quarterly bonus payment: RUB 50,000. × 150% = 75,000 rubles.

Let’s assume that the employee’s bonus is set at 3/4 of the official salary.

Calculation: 50,000 rub. × 3/4 = 37,500 rubles.

Example No. 2. Example of calculating bonuses for actual time worked for the 3rd quarter of 2021

Vesna LLC has a five-day work week. In the 3rd quarter of 2021, the norm is 57 working days. The specialist was sick from September 16 to September 25, 2021, of which 8 working days. The amount of the bonus is determined in the amount of the official salary, taking into account the actual time worked. The salary was 85,500 rubles.

Calculation: 85,500 rubles / 57 days (work norm) × 49 days (57 days - 8 days is actually time worked) = 73,500 rubles.

Example No. 3. Percentage of revenue - an example of calculating a quarterly bonus for trade workers

TORG LLC has established that bonuses for the quarter are calculated as 10% of the revenue received by the company based on the results of the work of the sales agent. The company employs three sales representatives, their revenue for the 3rd quarter of 2021 was:

- Ivanov I.I. — 1,000,000 rubles;

- Petrov P.P. — 800,000 rubles;

- Sidorov S.S. — 900,000 rubles.

We calculate quarterly bonuses:

- Ivanov I.I. — 1,000,000 rub. × 10% = 100,000 rubles.

- Petrov P.P. — 800,000 rub. × 10% = 80,000 rubles.

- Sidorov S.S. — 900,000 rub. × 10% = 90,000 rubles.

An example of calculating average earnings taking into account the annual bonus

The cashier will go on vacation in February 2021 for 15 calendar days. According to the current version of the Regulations on Remuneration, the enterprise practices annual payment of annual bonuses. The cashier's salary is RUB 45,805. At the end of 2021, bonuses were accrued in the amount of RUB 99,800.

Here is an algorithm for calculating average income:

| Accountant's actions | Calculations |

| The amount of wages for the annual interval is determined | RUB 549,660 (45,805 × 12) |

| The amount of bonuses involved in the calculation is displayed | RUB 99,800 |

| The total amount of annual income accrued in favor of a specialist going on vacation is calculated | RUB 649,460 (549 660 + 99 800) |

| The average monthly earnings are calculated | RUB 54,121.67 (649,460 ÷ 12) |

| The average daily income is fixed | 1847.16 rub. (54,121.67 ÷ 29.3) |

| Vacation pay is accrued | RUB 27,707.40 (1847.16 ÷ 15) |

Taxation of insurance premiums

Let's move on to the rules for calculating insurance premiums on premium amounts. According to Part 1 of Article 7 of Federal Law No. 212-FZ of July 24, 2009, all payments and other remuneration in favor of individuals are subject to insurance premiums if they are accrued under employment, civil law, or copyright agreements. Bonuses not provided for in the employment contract, or one-time bonuses that are paid by separate order of the head of the company, are still subject to insurance premiums. Thus, according to the Ministry of Health and Social Development of Russia, payments to employees that are not directly stated in their employment contracts are nevertheless subject to insurance contributions as made within the framework of the labor legal relationship of employees with the employer, and therefore related to employment contracts (letters dated March 23, 2010 No. 647-19, dated May 19, 2010 No. 1239-19).

Until 2011, there was some controversy surrounding this issue. Some experts believed that the ministry was wrong. Since the legislation on insurance premiums does not directly state that payments made on the basis of a collective agreement or local administrative document are subject to insurance premiums, then there is no need to charge contributions for such remuneration. For example, bonuses to employees for anniversaries that are not provided for in employment contracts are not taxed. But if the employment contract contains a reference to a collective agreement or an order on bonuses, then the same anniversary bonus, paid in accordance with the provisions of these documents, should be subject to insurance premiums.

Since 2011, the situation has changed dramatically. Federal Law No. 339-FZ of December 8, 2010 amended Part 1 of Article 7 of the Law on Insurance Contributions, and now all payments made within the framework of an employment relationship without exception are subject to insurance premiums (previously the wording included an employment contract, not labor Relations). Of course, with the exception of those that are not taxed and are named in Article 9 of Federal Law 212-FZ. But this article does not include awards.

Taxation of contributions from accidents

Similarly, since 2011, the situation with the taxation of accident insurance premiums has changed. Previously, the rules for including certain payments into the taxable base were established by a separate provision of Federal Law No. 125-FZ of July 24, 1998.

Federal Law No. 348-FZ of December 8, 2010 amended this law, according to which, when calculating contributions for injuries, a list of non-taxable payments in favor of employees was established. There are no awards on this list. Let us note that in the previously valid list established by a separate document (Resolution of the Government of the Russian Federation of July 7, 1999 No. 765), there were no bonuses.

In addition, the new Article 20.1 of Law No. 125-FZ stipulates that the base for calculating contributions from industrial accidents and occupational diseases now includes all payments made within the framework of labor relations. As you can see, for these contributions the main argument is the fact of the labor relationship between the employee and the employer. And the object for calculating contributions for injuries has practically become identical to the object for calculating insurance premiums provided for by Federal Law No. 212-FZ.