Each employee is always happy to receive for his work not only a fixed payment amount, but also a certain amount of compensation as bonuses.

It is always important for any employee to know why he was paid remuneration, how it is calculated, and what documents set out the rules for its formation.

The employer has one difficulty in this regard - deciding what should be included in the bonus wording, since different employees are often rewarded for different merits. All aspects of bonuses will be considered within the framework of this article.

What is a bonus?

The most fundamental definition of this concept: it is the amount that is given to an employee on top of his wages for the fact that he worked for a certain period of time with increased performance.

Simply put, a bonus is an incentive that depends on the performance of the entire company, as well as the quantitative or qualitative characteristics of the employee’s work.

The function of rewards for work and bonuses is to provoke the employee, pushing him to work more actively and productively.

Bonus concept

An employee can find out what types of bonuses the company has when he applies for a job.

Employee bonuses and its role in developing the company’s global development strategy are very large.

This applies not only to production bonuses, when a person is aware of exactly what merits and responsibilities he will be rewarded for, but also to one-time amounts (for example, for marriage, childbirth, final exams, etc.)

In Art. 68 of the Labor Code of the Russian Federation states that before signing an employment contract, the employer must familiarize the employee (under signature) with the internal procedure and other internal standards of the company specifically related to his future work activity, including information about bonus opportunities.

If a company enters into a civil law type agreement with an employee, in other words, hires him as a performer who performs duties under the agreement on a paid basis, then there is no point in talking about a bonus.

If an employer uses the word “bonus” when concluding a civil contract, then this contract can be reclassified as an employment contract. If an employer wants to reward a person with whom such a contract has been concluded, he needs to write about the change in the cost of his services under the contract.

The employee has the right to receive information about how the bonus is calculated; in other words, he must understand what he needs to do to receive this bonus.

The Tax Code of the Russian Federation has Article 252, which states that all expenses for bonuses are accepted as company expenses only when they are reflected in labor and collective agreements.

Therefore, the employer must reflect the bonuses in the employment contract or indicate in it a link to the collective contract, which contains information about bonuses.

Let us highlight the prerequisites for bonuses for employees in companies:

- a bonus can be awarded to an employee for excellent work in the company (implementation of the sales plan, absence of disciplinary measures);

- the bonus can be awarded for special events, including the birthday of the company or employee;

- You can reward employees for full working time, that is, no sick days or days off at their own expense.

Legal standards

The question of how to properly reward employees is very relevant. It is prescribed in the current regulations of the law.

In accordance with the current regulatory legal acts of Russia, we note the following points:

- The bonus is paid to the staff if the document establishes the conditions that define the relationship between the employer and the employee, in other words, a collective contract or an employment contract. Therefore, the bonus cannot be considered mandatory payment for the employee’s work.

- A bonus is part of an employee's salary.

- The calculation of bonuses and the conditions for their payment are set out in Art. 135 Labor Code of the Russian Federation. This provision corresponds to the opportunity and right of the company’s manager to determine the amount of the incentive and the payment rate.

- Deprivation of incentive payments to an employee is studied in Art. 193 Labor Code of the Russian Federation.

- Issues related to the taxation of premiums are regulated by the Tax Code of the Russian Federation and are set out in the article. 255.

Deadlines for payment of annual bonus

An annual bonus in the form of cash remuneration is accrued and paid to employees based on summing up the results of the year by order of the head of the organization. In accordance with Article 129 of the Labor Code of the Russian Federation, this type of bonus is stimulating and is part of the salary. The Labor Code of the Russian Federation regulates the timing of annual bonus payments (Article 136 “Procedure, place and timing of payment of wages”). From the moment the annual bonus is calculated, it must be paid no later than 15 days. The most frequently selected days are:

- after submitting the annual report;

- last working day of the year;

- after acceptance of reports on internal documents by the manager or founder.

If payment terms are violated, employees have the right to file an appeal, and penalties will be imposed on the employer.

Advantages of organizing a bonus system for a company

Bonuses are an additional way of income for an employee, which is paid specifically based on the results of his work, but not for everyone, but only for those who work better.

Questions about what characteristics of an employee’s work, how he is worthy of payments, according to Art. 191 of the Labor Code of the Russian Federation, are determined by the employer.

The company’s activities depend on how correctly the aspects of payment assessment are determined and the entire incentive mechanism is built in it.

Incorrect staff remuneration does not contribute to the development of the company, but is its potential threat. A method for calculating rewards that is unclear to employees can become a cause for conflict within the company.

On the contrary, a well-thought-out incentive compensation system for employees is a massive incentive among them for high-quality personal and team work in order to increase productivity and improve staff skills.

System elements

The choice of the bonus structure remains with the director of the organization. Before choosing a particular system, you need to make decisions on the elements:

- establish the conditions under which remuneration will be paid;

- determine employee evaluation criteria for bonuses;

- set goals that the company will achieve with the effective implementation of labor.

A motivation system is necessary to convince staff of the value and importance of active work. After all, if every employee tries hard, the end result will be an effective team that shows excellent results. A well-designed reward system has an impact on labor incentives, career growth, and staff cohesion. Responsible employees who cope with their responsibilities receive additional financial assistance.

There are several types of rewards:

- lump sum payment;

- for length of service;

- for a long stay in a specific organization;

- for high results over the planned calendar period.

If we talk about the criteria for motivating employees of a budgetary institution, then it’s a little simpler. Rewards are awarded for intensity, high results, and also for holidays. The main type of bonus in such organizations is for length of service.

Disadvantages of organizing a system in a company

The downside of bonuses is that there are some disadvantages.

Common shortcomings and errors in bonus systems that companies struggle with when launching incentive projects can be identified as follows:

- unreasonable use of very complex characteristics to assess labor productivity or insufficient explanation of cause-and-effect relationships in the employee incentive system;

- lack of study of the effectiveness of the bonus system;

- there is no significant difference between the bonuses for productive and low-performing employees;

- in the bonus system, the balance of punishment and reward is not maintained;

- The bonus almost entirely depends on the opinion of managers and executives, who are paid “by agreement.”

Types of awards

There are two types of payments:

- Bonuses provided as part of a remuneration system based on certain characteristics and criteria that have been developed by the company. Such merits are part of the material incentives for employees and motivate them. They are paid at regular intervals (every month, once a year, every quarter, etc.). In addition, in this case the amount of premiums is clearly established. In this situation, the fact that the bonus is paid is important; these incentive payments are very important for the employer.

- One-time prizes, which are not part of the remuneration system, are paid to the employee for certain merits in work, length of service, and for certain events (for example, anniversaries and professional holidays).

Bonus based on monthly performance (monthly)

As the name of this type of bonus suggests, it is paid based on the employee’s performance for one calendar month.

The procedure for bonuses, as already mentioned, can be prescribed in the internal acts of the organization. If there are no such acts, then the employer is free to determine for himself whether to pay bonuses or not, how, and in what amount to do so.

As a rule, the algorithm of actions is as follows:

- The provisions of internal regulations are studied.

- A list of employees who deserve bonuses is determined.

- Using criteria established in the organization, or at the discretion of management, the amount of bonuses for each employee is determined.

- An order is issued. If one employee is awarded, in form T-11, and if several, in form T-11a.

- Employees and performers are familiarized with the order.

- The document is sent to the accounting department for calculating bonuses.

The letter of the Ministry of Labor of Russia dated September 21, 2016 N 14-1/B-911 states that monthly bonuses can be paid in the month following the reporting month, after assessing all employee performance indicators. For example, for August, the premium may be paid in September. It is not prohibited to establish a different order. For example, payment can be made directly in the month in which the results are achieved, or in any subsequent month.

The procedure for issuing bonuses in the organization

Let's consider the question of how to correctly issue bonuses to employees.

If we proceed from the fact that the employment contract is concluded with the employee, then several fundamental details need to be taken into account. The employment contract must clearly indicate under what criteria and in what amount the bonus will be paid.

How to correctly indicate the incentive conditions in the contract in this case?

Simple rules for employee bonuses are listed below:

- The bonus is immediately indicated in the employment contract. The employer rarely uses this option, since in this case he will be able to change the payment data only if he is sure that the employee will agree and sign these changes. But, if the employer nevertheless decides to include a bonus in the employment contract, he must indicate its amount or a formula for calculation. It should be understood that if the award is specified in the employment contract, then the company does not have the right not to issue it.

- The employment contract stipulates that bonuses are paid in accordance with the collective contract. At the same time, the collective agreement specifies who is rewarded, for what and how. However, a collective contract is a rather complicated document, and changes in it are even more difficult than in an employment contract. Therefore, most companies choose the third option, presented below.

- Regulations on bonuses. This document is convenient because it is not a bilateral agreement. However, the employment contract must necessarily contain a reference to this document.

Why do they give an additional payment to the basic accruals?

The amount of the bonus, as well as the basis for its payment, is determined by the employer independently, or in agreement with a representative of the workforce. An enterprise can have its own bonus system, depending on the type of activity, the profitability of the company, and even the manager’s attitude towards rewarding his employees.

Actions of employees for which it is best to pay them bonuses, and reasons for rewards not directly related to the success of employees:

- The bonus is given for time worked. This type of bonus is awarded to employees if they have worked for a whole month without sick leave or without days off at their own expense;

- You can get paid for a job well done. This type of bonus is used not only as an incentive, but also as a kind of incentive to work in the future;

- bonuses awarded in connection with holidays and special occasions.

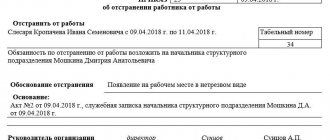

Order on bonuses

The manager's order is drawn up in standardized forms that have been approved by law.

The instructions for using and filling out the forms indicate that the bonus order:

- used to register and account for bonuses and incentives to increase the profitability of the company;

- signed by the manager or an authorized person;

- announced to the employee upon receipt.

Based on the order, an entry is made in the individual card and his work book.

A sample order for bonuses for employees is presented below.

Regulations on bonuses

This provision is defined for the entire organization as a whole, but applies to all employees at once.

The content of the bonus provision may be as follows:

- general provisions (who is entitled to receive rewards, in accordance with what rules they are accrued);

- sources of bonuses (if payments are paid from incentive funds or company income, you must indicate from which funds the bonuses will be paid and their sources);

- bonus indicators;

- circle of persons for bonuses;

- frequency of payments;

- bonus percentage or specific amount;

- conditions for reduction and non-payment of bonuses.

Sometimes the regulations indicate the basis for depreciation.

Payment decision

To develop a motivation system, a special working group is often created. She makes decisions about who, when and for what will receive salary increases. Within the group itself there is also a distribution of responsibilities. This usually happens like this:

- general management and control is carried out by managers and their deputies;

- employee evaluation criteria for bonuses are developed by department heads;

- The HR department is faced with the task of collecting data on wages from third-party companies operating in a similar direction;

- economic departments and accounting evaluate the possibility of payments and their size.

Ready information is displayed in the text of the organization’s internal documents. Candidates for a vacant position in any enterprise are usually introduced to the labor motivation system.

Formulation of the grounds

For what an employee can be awarded a bonus and the wording of the grounds may vary depending on why the bonus is awarded. It is necessary to understand what regulates the order of formulations in the remuneration system, and which of them are better to apply in certain cases.

What can an employee be rewarded for? The wording of the grounds in these situations can be indicated as follows:

- for the implementation of the work plan;

- for significant achievements in work;

- for timely submission of reports;

- for the implementation of particularly responsible work;

- for initiative;

- for quality work;

- for holding some events;

- for advanced training.

The terms of bonuses are determined on the basis of the employee incentive scheme developed by the organization.

When applying general payments, the main condition is the implementation of certain (often averaged) characteristics of the activities of the entire company.

If the company's targets are successfully achieved, the bonus is assigned by general order for a month, quarter or other period.

What can an employee be rewarded for and the wording of the grounds for such bonuses look like this:

- for successful completion of the task;

- for the high quality of the work performed;

- for achieving high results in work.

When using a personally targeted bonus system, the payment of amounts may not be determined by a time period, but is paid for certain achievements. Accordingly, the order contains a description of the merit:

- for successfully representing the company’s interests in negotiations with the client and concluding a profitable contract;

- for the implementation of a particularly difficult task;

- for introducing a creative approach to problem solving.

Successful participation of employees in various competitions is a big plus for the company's image.

It is completely reasonable to hold different competitions with financial incentives. With a reasonable approach, the financial effect from improving the qualifications of employees, increasing the quality of work, and teamwork will be an order of magnitude higher than the funds spent on bonuses.

What can an employee be rewarded for and the wording of the grounds for such bonuses look like this:

- for participation in a professional skills competition;

- for representing the company at an international competition;

- for winning the mini-volleyball competition.

Another method to improve the organizational climate in the company and increase the responsibility of employees is to pay personal bonuses suitable for certain dates in the employee’s life (birth of a child, marriage, anniversary, etc.).

The fundamental nuance of the company is the desire to retain trained and experienced employees. Prizes for loyalty to the company, long-term successful work in it - all this is of great importance.

Indicator criteria

In practice, assessing the work of a specific employee or the team as a whole sometimes turns out to be very problematic. Moreover, often simultaneously several neighboring units directly influence the final result established by the indicator. Therefore, when setting individual indicators, the following basic criteria should be taken into account:

Indicators can be:

- Individual. The work of each individual employee in particular is assessed. Usually applied to managers.

- Collective. Here it is necessary to evaluate the final result of the labor activity of an individual team (team, site, workshop, division).

In this case, the evaluation criteria should cover the following points:

- the employee’s influence on the established indicator (direct, indirect, partial). From this follows the amount of the accrued bonus for implementation;

- positive dynamics of changes in the productivity of the contour section;

- adequacy of remuneration, the ability of the team to influence negligent employees whose actions reduce overall work results;

- specification of directions in order to individualize the approach to assessing labor results;

- optimal choice of quantity and quality of indicators. For an individual unit (employee) it is considered normal if 3 to 5 indicators are established. Below is not effective. If there are more of them on the list, this does not make it possible to concentrate on completing the key task.

Remember, the right approach to determining key bonus criteria will increase the level of motivation of employees to perform the actions necessary for the company. In the end, both sides win.