The remuneration system is a method by which the amount of money earned by an employee is determined depending on the amount of work performed, its complexity, working conditions, and the qualifications of the employee.

The payment system is formed by the employer taking into account the key principles of payment formation and the norms of current legislation. Dear readers! To solve your specific problem, call the hotline or visit the website. It's free.

8 (800) 350-31-84

Legislative regulation

The procedure for remuneration of employees is regulated by:

- Labor Code;

- By Order of the Ministry of Education and Science No. 1601;

- By orders of the Ministry of Labor;

- local regulations of regions and organizations.

Art. 135 of the Labor Code of the Russian Federation states that the remuneration system is determined by collective labor agreements or regulations of organizations, taking into account the opinion of the trade union, and Art. 144 of the Labor Code establishes that the rules for remuneration of local and federal officials are established by the relevant authorities.

The order of the Ministry of Education and Science determines for teachers of various positions and categories the standard working hours required to receive a monthly salary determined by the educational institution.

The list of Orders of the Ministry of Labor contains a list of professional standards for various specialties and requirements for them - used to determine the level of qualifications when establishing the tariff rate for remuneration.

Principles of remuneration

The basic principles of forming a remuneration system in organizations include:

- compliance of wages with labor contribution and working conditions of the employee;

- rational ratio when paying for work of different levels of complexity , danger and type (physical or mental);

- equal pay for equal work (no discrimination);

- taking into account the situation on the labor market;

- transparency of the adopted remuneration system;

- independence of private and budgetary organizations in determining the wage system;

- making payment for a specific result of work;

- material interest of workers in improving the quality of work;

- compliance with labor laws.

A rational ratio of salaries for workers of different specialties and levels of training implies the dependence of the amount of payment on the complexity of the work, taking into account the demand for specialists in specific professions in the labor market.

The principle of non-discrimination implies that it is not allowed to set different salary levels for employees performing the same function of the same complexity and having the same qualifications and benefits, according to Art. 132 Labor Code of the Russian Federation.

The remuneration system adopted by the organization must be explained to each employee and described in detail in regulatory documents posted in the public domain for employees. It is not allowed to change the wage system without the consent of the trade union committee.

Organizations independently establish a remuneration system, subject to compliance with labor legislation (Section 6 of the Labor Code of the Russian Federation).

Terms and procedure for payment of wages

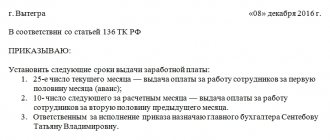

The Labor Code provides for the employer's obligation to pay wages at least every half month on the day determined by the internal labor regulations, collective agreement, and employment contract (Part 6 of Article 136). But you need to establish the days of payment of earnings not with all the listed documents, but with one of them. It is preferable to do this in the internal labor regulations, since there may be no collective agreement in the organization, and the employment contract regulates relations with a specific employee. Such clarifications are given in the Letter of Rostrud dated 03/06/2012 N PG/1004-6-1.

Note! Issuing wages once a month is a violation of labor legislation, for which administrative liability is provided (Letter of Rostrud dated March 1, 2007 N 472-6-0).

The optimal dates for paying salaries are the 5th and 20th of each month. An advance payment is issued on the 20th, and final payment is issued on the 5th. But such payment dates as the 25th - advance payment and the 10th - final payment, can lead to a violation of the rights of workers, since those who start work on the 1st will receive wages for the first half of the month (advance payment) only at the end of the month (25th day), when the month is almost completely worked out, which is contrary to labor legislation (Letter of the Ministry of Health and Social Development of the Russian Federation dated February 25, 2009 N 22-2-709). If the payment day coincides with a weekend or non-working holiday, the payment of earnings is made on the eve of this day. For certain categories of employees, federal law may establish other deadlines for the payment of wages. For example, by virtue of Art. 140 of the Labor Code of the Russian Federation, upon termination of an employment contract, payment of all amounts due to the employee from the employer is made on the day of dismissal. And if the employee did not work on the day of dismissal, then the corresponding amounts must be paid no later than the next day after the dismissed request for payment is presented. If an employee is granted annual paid leave, the employer must pay for it no later than three days before it starts. As for the place where wages are issued to an employee, it may be the place where work is performed, or wages are transferred to the bank account specified by the employee under the conditions determined by the collective or labor agreement. Labor legislation establishes the possibility of paying wages in non-monetary form, if this does not contradict the legislation of the Russian Federation and international treaties of the Russian Federation (Article 131 of the Labor Code of the Russian Federation). The place and timing of payment of wages in this form are also determined by a collective or labor agreement. The employer must remember that payment of wages in kind is carried out at the request of the employee and cannot exceed 20% of the accrued monthly salary. Bonds, coupons, promissory notes, receipts, as well as alcoholic beverages, narcotic, poisonous, harmful and other toxic substances, weapons, ammunition and other items that are subject to prohibitions or restrictions on free circulation cannot be issued as salaries. Salaries are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract. One of these methods is receiving a salary by another person by power of attorney, certified by a notary or by the principal’s employer (clauses 3, 4 of Article 185.1 of the Civil Code of the Russian Federation). Another mandatory rule for paying wages is issuing pay slips to employees. Its form is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Art. 372 Labor Code of the Russian Federation. In this case, the payslip must contain information: - on the components of wages due to the employee for the corresponding period; - on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for the payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; - about the amounts and reasons for the deductions made; - about the total amount of money to be paid.

Note! In accordance with Letter of Rostrud dated December 24, 2007 N 5277-6-1, it is not necessary to issue a payslip when paying vacation pay to an employee, since based on the definition of “wages” given in Art. 129 of the Labor Code of the Russian Federation, payment for vacation is not payment of wages. Information about the total amount of money to be paid (already paid), including vacation pay, is contained in one pay slip issued to employees when the second part of earnings is calculated and paid (usually at the end of the month).

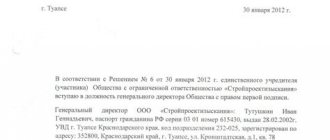

In accordance with Art. 236 of the Labor Code of the Russian Federation, if the employer violates the established deadline for the payment of wages, vacation pay, dismissal payments and other payments due to the employee, the employer is obliged to pay them with interest (monetary compensation) in an amount not less than 1/300 of the Central Bank refinancing rate in force at that time RF from amounts not paid on time for each day of delay starting from the next day after the established payment deadline to the day of actual settlement inclusive. This payment is unconditional and must be paid regardless of whether the employee goes to court or not. The most common violation in the field of wages noted by labor inspectors is the employer’s failure to comply with deadlines for payment of wages, vacation pay, dismissal payments, and compensation for delays. In this case, both a legal entity and an official, namely the manager, can be brought to administrative liability at the same time. Thus, by a resolution of the state labor inspector, he was brought to administrative responsibility under Part 1 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, General Director of KF LLC. Among the violations identified, in particular, were: - violation of the terms for the payment of wages established by the internal labor regulations and employment contracts; — non-payment of compensation in case of delay in payment of wages; — failure to make a full settlement with the employee upon termination of the employment relationship on the day of dismissal. The director considered that this resolution was illegal and went to court, but neither in the first nor in the second instance did the court support it (Decision of the Moscow City Court dated March 20, 2013 in case No. 7-600/13).

Classification and application of remuneration systems

The following main remuneration systems exist:

- time tariffs;

- piece rate tariffs;

- tariff-free;

- mixed.

Tariff systems assume that the salary is a function of the tariff, which can be the volume of work performed (piece-rate systems) or the time spent at work (time-based systems).

Secondary factors of the salary level under the tariff system are coefficients that are set depending on the qualifications of the employee, the quality of the work performed, etc.

Time-based systems

The main factor of the time-based tariff system is the time spent at work, which can be measured in hours, shifts or months.

With a time-based salary system, the employee is given a fixed salary per month, regardless of the number of weekends and holidays, but minus time off, periods of incapacity, etc.

With an hourly tariff system, payment is determined as the product of the hourly rate and the number of hours worked per month. For example, if the hourly rate is 100 rubles per hour and 150 hours are worked per month, then the salary is 15,000 rubles. Salary is determined similarly at the rate per shift worked.

Time-based systems are used to pay non-production workers:

- administrators;

- civil servants;

- teachers;

- accountants;

- cleaners , etc.

To remunerate employees of educational institutions, salary and time systems developed by the educational institution are used.

A teacher’s salary for a specific work week is calculated using the formula:

7 / K * O * (Chned / Nned),

where K is the number of days in a month, O is the amount of the monthly salary determined in accordance with the position by the employment contract, Chned is the number of hours worked per week, and Nned is the standard hours per week established for teachers of all specialties by Order of the Ministry of Education and Science No. 1601.

For example, a 30-hour work week is established for senior educators (clause 2.2 of the Order). The teacher’s salary was determined by contract at 12,000 rubles; in the first week of February, the teacher worked 34 hours, the salary is equal to:

7/ 28 * 12000 * (34 / 30) = 3400 rubles, per month – 13600 rubles.

Teachers who have worked for a certain number of years have the right to count on a proportional increase in salary in accordance with the scheme:

- 3-5 years – 10%;

- 6-10 years – 15%;

- 11-15 years – 20%;

- 16-20 years old – 25%;

- more than 20 years – 30%.

Organizations have the right to establish additional payments to teachers from funds received from paid educational activities.

Piecework systems

With piecework wages, the time worked does not matter; the amount of wages is determined by the volume of work performed (output) and the tariff rate per unit of work volume.

There are the following types of piecework systems:

- simple;

- progressive;

- premium;

- indirect;

- chord.

With a simple (or direct) piece-rate system, wages are calculated as the product of the tariff T and the volume of work done A. For example, the tariff for assembling 1 device is 100 rubles, a worker assembled 100 devices, the salary is 10,000 rubles.

Progressive and bonus systems include the concept of a labor standard, when exceeded, the tariff rate per unit of work increases . For example, the assembly of the first 100 parts is paid for 100 rubles per piece, each subsequent part is paid for 120 rubles per piece. This system is designed to encourage workers to achieve maximum output.

The indirect system is designed to pay the labor of auxiliary workers who are not directly involved in production - repairmen, helpers, etc. Their wages depend on output not in direct proportion, but indirectly - as the ratio of actual work to the production rate.

The chord system is intended for payment of temporary work - here the salary amount is agreed upon in advance and is issued after acceptance of the completed work to the entire team - to each employee in accordance with his output.

Article 135 of the Labor Code of the Russian Federation. Setting wages (current version)

Bonuses can be paid based on one or a group of agreed indicators. Experts identify four main groups of bonus indicators that stimulate workers for individual labor results. These include:

1) quantitative indicators: fulfillment and overfulfillment of production targets for product output and nomenclature, percentage of fulfillment of production standards, ensuring uninterrupted and rhythmic operation of equipment, compliance with or reduction of planned deadlines for repair work, carrying out work with a smaller number compared to the standard, reducing the labor intensity of products and etc.;

2) quality indicators: improving the quality of products, the percentage of products delivered from the first presentation, reducing the percentage of defects, increasing the product grade coefficient, etc.;

3) saving resources used: economical use of raw materials and materials, saving fuel and electricity, reducing costs for maintenance and repair of equipment, etc.;

4) rational use of technology: meeting the deadlines for the development of new equipment and progressive technology, maintaining technological discipline, increasing the equipment load factor, etc.

The condition for bonuses is usually work during the accounting period and achievement of established indicators. One of the most important conditions for bonuses is compliance with labor discipline. Employees who have met bonus targets, but are absent from work or appear at work in a drunken state, or have committed another disciplinary offense (for example, violating technological rules for manufacturing products) do not acquire the right to a bonus in full. As a rule, they are either not awarded a bonus (in case of serious misconduct), or the bonus is paid to them in a smaller amount than to employees who have fulfilled both the indicators and the terms of the bonus. This is a common rule included in bonus provisions. Unfortunately, many economists view this situation as a reduction in bonuses or deprivation of bonuses. In fact, no deprivation of the bonus occurs. The employee simply does not acquire the right to a bonus or does not acquire the right to a bonus in the established (basic) amount, since he has not fulfilled all the conditions for the bonus.

The size of the bonus is determined, as a rule, as a percentage of the tariff rate (salary). The size of the bonus for a specific employee is determined by the manager (employer - individual entrepreneur) taking into account the degree of fulfillment of indicators and bonus conditions.

The frequency of bonuses is monthly or quarterly. It is possible to establish bonuses that are paid based on the results of work for the year.

Regular bonuses, paid according to pre-approved indicators (in accordance with the bonus system), form part of the salary. They must be distinguished from one-time (one-time) bonuses, which are an employee’s encouragement for special achievements in work and are paid for completing particularly important tasks, in connection with holidays or special occasions, based on the results of shows or competitions (Article 191 of the Labor Code).

6. Remuneration systems as a percentage of revenue, grader systems, taking into account the employee’s contribution to the overall results of the organization’s activities, etc., have also become widespread.

7. The remuneration system of any employer is established in accordance with labor legislation and other regulatory legal acts containing labor law norms. This means that the terms of remuneration for each employer must be based on those guarantees provided by the Labor Code, federal laws, decrees of the President of the Russian Federation, decrees of the Government of the Russian Federation and other regulatory legal acts. The legislator specifically emphasizes the inadmissibility of worsening the employee’s position or diminishing the rights established at the state level (Part 6 of the commented article).

The Constitutional Court of the Russian Federation also draws attention to this. The Determination dated 01.10.2009 N 1160-О-О notes that remuneration systems are developed on the basis of the requirements of labor legislation and must guarantee to each employee the determination of his wages, taking into account the criteria established in the legislation, incl. working conditions.

When establishing a remuneration system, each employer must equally comply with both the norm that guarantees an employee who has fully worked the standard working hours for the month and fulfilled labor standards (job duties) a salary not lower than the minimum wage, and the requirements of Art. Art. 2, 22, 130, 132, 135, 146 and 147 TK, incl. the rule on establishing for employees engaged in heavy work, work with harmful and (or) dangerous and other special working conditions, wages in an increased amount compared to tariff rates, salaries (official salaries) provided for identical types of work, but with normal working conditions.

At the same time, the employer (jointly or taking into account the opinion of the representative body of workers) is free to choose the method of accounting for the quantity of labor (piecework or time-based payment), accounting for the quality (including complexity) of labor and qualifications of workers (choice of the tariff system and its parameters) , determining the size of the main (tariff) part of wages, establishing bonus systems, incentive payments and allowances to the extent that they are not defined by labor legislation and other regulatory legal acts containing labor law norms.

As for compensatory additional payments and payments, the obligation to pay them, the terms of payment and the minimum amount are, as a rule, determined by labor legislation. The employer can only establish the amount and clarify the payment procedure (see commentary to Articles 146 - 148, 151, 154).

Special rules for establishing a remuneration system are established for employees of organizations financed from the budget (see commentary to Article 144).

8. The remuneration system must be reflected in a collective agreement, agreement of any type (in practice, these are agreements concluded at the industry, inter-industry, professional levels) or local regulations.

The employer and employee representatives have the right to choose the legal form of establishing the rules of remuneration that seems preferable to them. It is important to keep in mind the rules of correlation between various sources of labor law. Thus, a local regulatory act cannot worsen the situation of workers in comparison with a collective agreement, and a collective agreement cannot worsen the situation in comparison with an agreement concluded at a level higher than the organization (industry, professional, etc.).

In practice, the remuneration system is usually established by a collective agreement or local regulations. There is also this option: some of the rules are established by a collective agreement, some by local regulations.

In recent years, the practice of including in the collective agreement as an appendix provisions on remuneration, bonuses on various grounds, and payment of remuneration based on the results of work for the year has become widespread. When using this model of legal regulation, it is important to remember that the annex to the collective agreement is an integral part of it. Thus, the provision on remuneration, which is an annex to the collective agreement, becomes part of it, and not an independent local regulatory act.

In the case where a collective agreement is not concluded in an organization or the remuneration system is not defined in it, it is established in a local regulatory act. Typically, such an act is called a wage clause. It is possible to establish a remuneration system by several local regulations that are in systemic unity, for example, regulations on the tariff system, regulations on bonuses, regulations on incentive bonuses and regulations on compensatory additional payments.

9. A local regulatory act establishing a system (or some elements) of remuneration is adopted taking into account the opinion of the representative body of workers. The procedure for taking into account opinions is determined by Art. 372 TK.

10. Part 3 of the commented article mentions a special type of legal act - unified recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of organizations financed from the relevant budgets. The need to adopt such an act was first determined by Federal Law dated August 22, 2004 N 122-FZ. Currently, there are Unified Recommendations for the establishment of remuneration systems for employees of state and municipal institutions for 2014 at the federal, regional and local levels, approved. by decision of the Russian Tripartite Commission for the Regulation of Social and Labor Relations dated December 25, 2013, Protocol No. 11.

The recommendations define:

— principles for the formation of federal, regional and municipal wage systems, which include, in particular, ensuring that the wages of each employee depend on his qualifications, the complexity of the work performed, the quantity and quality of labor expended; provision by the employer of equal pay for work of equal value; ensuring an increase in the level of real wages of employees of public sector institutions;

— a list of standards and conditions of remuneration regulated by federal laws and other regulatory legal acts of the Russian Federation;

— the procedure for establishing remuneration systems for employees of state and municipal institutions;

— basic approaches to the formation of remuneration systems for employees of state and municipal institutions;

— the procedure for the formation of remuneration systems for employees of federal government institutions, heads of state and municipal institutions, their deputies and chief accountants, etc.

The recommendations also establish the rules for the formation of wage funds in state and municipal institutions; features of the formation of remuneration systems for pedagogical workers of state and municipal educational institutions, employees of state and municipal health care institutions, employees of state and municipal institutions of culture, art and cinematography.

11. The current version of the commented article provides a legal mechanism for overcoming disagreements between the parties to the Russian Tripartite Commission in the preparation of uniform recommendations for the establishment at the federal, regional and local levels of remuneration systems for employees of organizations financed from the relevant budgets. In the event that the parties were unable to reach an agreement, the recommendations are approved by the Government of the Russian Federation, and the opinion of trade unions and employers' associations is brought to the attention of the constituent entities of the Russian Federation.