The role of bonuses in salary composition

An employee's salary can consist of several components.

One of these parts is incentive payments, represented primarily by bonuses. In order for the bonus to be taken into account as part of the salary, it is necessary, firstly, to include this payment in the composition of wages, and secondly, to establish the rules for its calculation and payment (Articles 129, 135 of the Labor Code of the Russian Federation). The employer resolves both issues independently, recording the decisions made in its internal document.

In relation to the remuneration system, such documents may be a remuneration regulation or a collective agreement. And the bonus rules are set out either in one of the documents on the remuneration system, or in a separate provision called the bonus (or incentive) provision, or directly in the employment agreement with the employee.

Important features are not only the indication of the bonus in the employment contract, but also other essential conditions of the employee’s work. And ConsultantPlus experts talk about them in detail. Get free access to K+ and go to the Ready Solution to find out all the details of this procedure.

Establishing bonus rules involves determining:

- types of bonuses paid;

- frequency of their accrual;

- the circle of employees subject to a certain type of bonus;

- a list of indicators giving the right to receive each of these payments;

- systems for assessing bonus indicators;

- algorithms for calculating specific amounts depending on the results of assessing bonus indicators;

- the procedure for reviewing and documenting the final assessment of the employee’s participation in the labor process;

- grounds serving as grounds for deprivation of the bonus;

- a procedure allowing an employee to challenge the results of bonus distribution.

For information on what a document combining a description of the remuneration system and bonus rules might look like, read the article “Regulations on the remuneration of employees - sample 2020”.

Since there can be several types of bonuses and each of them can have its own rules, the bonus document, as a rule, turns out to be quite lengthy. But its presence allows us to simplify the procedure for determining the terms of remuneration for each specific employee, giving in the employment agreement with him in terms of bonuses not a description of the conditions for accruing each specific bonus, but simply a reference to the internal regulatory act. The contents of the regulatory act on bonuses must be familiarized with the employee's signature.

If the employer’s bonus system is quite simple, that is, it does not imply a variety of types of bonuses and a complex system for assessing the amount due to the employee, then the conditions relating to this type of payment can be specified directly in the employment contract. The same approach can be applied to individual employees whose work assessment requires an individual approach. For example, such an employee would be the hired manager of the employer.

What to reflect?

Let us turn, first of all, to legislative norms. Article 57 of the Labor Code of the Russian Federation establishes that the terms of remuneration must be specified in the employment contract. The legislator also includes additional payments, allowances, and incentive payments. Article 129 of the Labor Code of the Russian Federation says that bonuses, as one of the types of incentives for work, are part of the remuneration system.

Establishment of wages for an employee, according to Art. 135 of the Labor Code of the Russian Federation, is carried out through an employment contract, in accordance with the payment procedure in force for a particular employer. The payment procedure can be regulated by a collective agreement, agreement, or LNA of the company.

Question: Are bonuses to employees paid on the basis of the manager’s order and not provided for by labor and (or) collective agreements (clause 2 of Article 255 of the Tax Code of the Russian Federation) included in expenses for income tax purposes? View answer

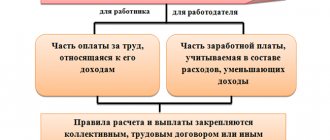

From the above it follows that bonuses can be of two types:

- related to the wage system;

- unrelated to the remuneration system, one-time payments to an employee (for an anniversary, professional holiday, for the successful completion of a single complex project, an innovative proposal, etc.).

The first type of payment must be reflected in the contract with the employee, and for the second, a separate bonus order issued by the manager is sufficient.

Important! It is risky to include language regarding the payment of bonuses in a civil contract; regulatory authorities may reclassify such a contract as an employment contract.

Making an entry about the bonus in the employment contract

So, how to write a bonus in an employment contract?

If there is a provision on incentive payments in the text of the employment contract, it is possible to write, for example, the following content:

“Bonus payments to employees are carried out in accordance with the rules of the employer’s Regulations on Bonuses.”

If the employer does not have an internal regulatory document or an individual bonus scheme has been established for the employee, then, for example, the following entry may be made in his employment contract:

“If the employee performs job duties conscientiously, the employee is paid a monthly bonus in the amount of 20% of the salary.”

Read about what else should be reflected in the employment contract in the material “Procedure for concluding an employment contract (nuances).”

Principles of bonuses for company employees

There are special bonus principles:

- fair and reasonable bonuses;

- financial interest of employees in achieving the desired results;

- general collective interest in work;

- encouraging creative approaches to activities, responsibility, and the desire to produce quality goods and services;

- simple determination of the bonus amount;

- a clear and clear understanding by employees of the relationship between work practice and financial incentives;

- flexible changes in the concept of bonuses in accordance with new goals and objectives of material incentives;

- publicity of the bonus concept as a combination of material and moral incentives in work.

The criteria for bonuses for employees must correspond to the types of production tasks, depending on the labor contribution to the development of the company made by each employee and the entire team as a whole. There should be very few criteria. At the same time, it is necessary that they are sufficient to ensure a connection between incentives and main production goals with the results of the work of hired personnel.

Recommended articles on this topic:

Results

The rules for calculating bonuses, which are part of the remuneration system, require enshrinement in an internal regulatory document. It can be any document dedicated to the description of the remuneration system, or a separate one specifically dedicated to bonuses.

With regard to the terms of bonuses for a particular employee, it is enough to make a reference to this internal document in his employment contract.

If there is a simple or individual bonus scheme, a record of the conditions for calculating the bonus is entered directly into the text of the employment contract. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Hourly wage calculation

To calculate the amount due to an hourly employee, you need to multiply the hourly tariff rate (salary) by the time actually worked and recorded (in hours).

For example, a teacher at a center for the study of foreign languages receives 300 rubles for 1 hour of work with a child. He does not have a clear work schedule: today there may be two classes with children, the next day - three, and so on. In January 2021, the tutor worked for 75 hours. For January he is entitled to 300 x 75 = 22,500 rubles.

ATTENTION! Whatever the cost of the hourly rate is chosen, if during the month the employee has worked the norm according to the production calendar, he cannot receive less than the minimum wage guarantee - today 7,500 rubles

How is payroll calculated?

To clearly present the sample by which piecework wages are calculated under the relevant employment contract, it is necessary to determine, first of all, the calculation procedure. It is determined by taking into account the number of units produced by the contractor.

One unit has a certain cost, therefore, the final indicator will be formed depending on the volume completed.

where T is the employee’s tariff; NP – production rate; Salary – salary of the performer.

If piecework payment is applied:

where PV is the period of time required to complete the entire volume of work, calculated in hours; C – the cost of one hour of work, expressed in rubles.

For a more visual representation, let's look at examples.

Example 1

In one day, according to the norm, a milling machine operator must produce 120 pieces of parts on his machine. Its daily rate is 1200 rubles. In one month, a worker will produce 2,400 pieces of products.

You need to determine a piece rate. To do this, you need to divide the daily tariff by the standard quantitative indicator.

The wages of a milling machine operator will be equal to the product of the price multiplied by the number of manufactured products:

Example 2

If the price is set not per piece, but per time indicator, the calculation will have a slightly different form.

The milling operator should spend no more than ½ hour on one operation. The tariff rate per hour is 130 rubles. In 1 month, the employee performed 600 transactions.

The piece rate is determined:

Based on the calculation, the direct salary for the month worked will be calculated:

An employment contract for piecework wages can take a number of forms, since the actual payment for the “transaction” itself may differ.

Despite a number of nuances, payment for work performed based on results is a fairly profitable option for both parties to the employment contract.

The main thing is to correctly formulate the employee’s work attitude. A man must:

- have a certain incentive to perform a sufficient amount of work;

- produce labor based not only on quantitative, but also on qualitative indicators.

Concept and regulation

Remuneration may directly depend on the result of the work, more precisely, on the volume completed: the number of parts made, consultations provided, knitted scarves or restored paintings (Articles 129, 135, 160 of the Labor Code of the Russian Federation). This possibility is prescribed in a sample employment contract with piecework wages.

Typically, employees transferred to such a system:

- actively take initiative;

- interested in achieving maximum results;

- receive income that directly depends on the efforts invested;

- can prove their effectiveness.

The advantages are obvious, but sometimes in the pursuit of high quantitative indicators, quality suffers.

Workers neglect safety precautions, violate technological processes and do not save materials. But this can be influenced by excluding defective products from payment.

Working time and rest time

4.1. The employee is assigned [a five-day work week with two days off/a six-day work week with one day off/a work week with days off on a sliding schedule/a part-time work week].

4.2. The duration of daily work/part-time work is [value] hours.

4.3. The start and end times of work, the time of the break and its duration [in the case of providing days off on a sliding schedule - alternating working and non-working days] are established by the internal labor regulations.

4.4. The employee is assigned an irregular working day.

4.5. The employee is granted annual basic paid leave of [value] calendar days.

4.6. The employee is granted annual additional paid leave of [value] calendar days [indicate the basis for granting additional leave; for an irregular working day cannot be less than three calendar days].

4.7. For family reasons and other valid reasons, the Employee, upon his written application, may be granted leave without pay, the duration of which is determined by agreement between the Employee and the Employer.

back to contents

Regulations on bonuses

Employee bonuses: registration rules

If a company enters into a GPC agreement with an employee, that is, hires him as a contractor who performs duties under a contract for the provision of paid services, then there can be no talk of any bonus. Therefore, if an employer uses the word “bonus” when concluding a GPC agreement, he is at great risk - such an agreement can be reclassified as an employment agreement. An employer can encourage a person with whom a GPC agreement has been concluded by writing about a change in the price under the agreement.

Terms of payment

5.1. The employee is provided with a [time-based or time-based bonus system of remuneration].

5.2. The basis for calculating the amount of wages is [tariff rate or official salary] according to the organization’s staffing table and the amount of time worked by the Employee.

5.3. Wages are paid to the Employee [indicate specific dates of the calendar month]./Wages are paid to the Employee at least every half month on the day established by the internal labor regulations.

5.4. When performing work outside the normal working hours, at night, on weekends and non-working holidays, when combining professions (positions), when performing the duties of a temporarily absent employee, the Employee is paid appropriate additional payments in the manner and amount established by the collective agreement and local regulations.

5.5. During the period of validity of this employment contract, the Employee is subject to all guarantees and compensation provided for by the current labor legislation of the Russian Federation.

back to contents

Rights and responsibilities of an employee

2.1. The employee has the right to:

— conclusion, amendment and termination of an employment contract in the manner and under the conditions established by the Labor Code of the Russian Federation and other federal laws;

- providing him with work stipulated by the employment contract;

— a workplace that meets state regulatory requirements for labor protection and the conditions provided for by the collective agreement [if any];

— timely and full payment of wages in accordance with their qualifications, complexity of work, quantity and quality of work performed;

— rest provided by the establishment of normal working hours, reduced working hours for certain professions and categories of workers, the provision of weekly days off, non-working holidays, paid annual leave;

— complete reliable information about working conditions and labor protection requirements in the workplace;

— training and additional professional education in the manner established by the Labor Code of the Russian Federation and other federal laws;

— association, including the right to create trade unions and join them to protect their labor rights, freedoms and legitimate interests;

— participation in the management of the organization in the forms provided for by the Labor Code of the Russian Federation, other federal laws, if any, and by the collective agreement;

— conducting collective negotiations and concluding collective agreements and agreements through their representatives, as well as information on the implementation of the collective agreement and agreements;

— protection of one’s labor rights, freedoms and legitimate interests by all means not prohibited by law;

— resolution of individual and collective labor disputes, including the right to strike, in the manner established by the Labor Code of the Russian Federation and other federal laws;

- compensation for harm caused to him in connection with the performance of his job duties, and compensation for moral damage in the manner established by the Labor Code of the Russian Federation and other federal laws;

— compulsory social insurance in cases provided for by federal laws;

— [other rights provided for by the current Labor legislation

and other regulatory legal acts containing labor law standards, collective agreements, local regulations].

2.2.The employee is obliged:

— conscientiously fulfill his labor duties assigned to him by the employment contract;

— comply with internal labor regulations;

— maintain labor discipline;

— comply with established labor standards;

— comply with labor protection and occupational safety requirements;

— take care of the property of the Employer (including the property of third parties held by the Employer, if the Employer is responsible for the safety of this property) and other employees;

— immediately inform the Employer or immediate supervisor about the occurrence of a situation that poses a threat to the life and health of people, the safety of the Employer’s property (including the property of third parties held by the Employer, if the Employer is responsible for the safety of this property);

— [other duties provided for by the current Labor legislation

and other regulatory legal acts containing labor law standards, collective agreements, local regulations].

back to contents

Types of bonuses for employees: brief classification

The diagram below shows a sample of types of bonuses for employees.

There are bonuses:

- production. They are issued if employees fully solve production problems and cope well with their job responsibilities. Production bonuses are systematic. That is, companies can make payments every month, every quarter or at the end of the year;

- incentive. Such bonuses are not directly related to the employee’s performance of his official duties.

- At the end of the year, based on the results achieved;

- Every year for length of service;

- Bonuses are given to employees with high performance indicators;

- Payment of bonuses is tied to memorable dates, anniversaries, etc.

https://www.youtube.com/watch?v=ytdevru

According to the forms of payment, bonuses are:

- monetary;

- commodity (we are talking about memorable gifts, for example, personalized watches, sets of stationery, household appliances, all kinds of certificates).

Depending on the assessment of labor performance indicators, bonuses for company employees are:

- individual - the bonus is awarded to one or more employees taking into account their personal contribution to the activities of the enterprise;

- collective - the bonus is given to all personnel for achievements in their work activities. Such payments are calculated based on the collective performance of the department or company as a whole. Next, the received amount is distributed among employees depending on their personal contribution. Personal contribution is determined taking into account time worked, basic salary and labor participation rate.

The methods for calculating bonuses can be:

- absolute, which are paid in a fixed amount of money;

- relative, calculated as a percentage.

According to frequency they are distinguished:

- systematic bonuses, which are made on a regular basis;

- one-time bonus. That is, the company financially rewards employees, for example, for solving a task of increased complexity.

- Features of the activity of the enterprise, its departments or specific employees;

- The nature of bonus indicators;

- Accounting for labor results over certain periods of time.

According to the intended purpose, bonuses can be:

- general, when bonuses are given for success at work;

- special, when employees are rewarded for solving specific problems.

You may also be interested in: How to establish crisis management in an enterprise

Types of awards

There are two types of awards:

1. Bonuses that are provided for by the remuneration system based on specific indicators and bonus conditions developed in the company.

Such bonuses are part of the material motivation of employees; they are stimulating in nature. They are paid periodically (monthly, annual, quarterly, etc.) and are usually set in a certain amount.

2. One-time bonuses that are not included in the remuneration system.

Paid to an employee for certain achievements, many years of conscientious work, completion of an urgent and important task, or for significant events (for example, anniversaries and professional holidays).

Payment of a one-time bonus is carried out at the unilateral discretion of the employer. The basis is the Order of the head.

Convenient and error-free maintenance of personnel records in a web service

Order for a bonus

The manager's order is drawn up according to unified forms approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1: Form T-11 or Form T-11A (for bonuses to a group of employees).

The Instructions for Application and Completion of Forms state that Form T-11 and Form T-11A:

- used to formalize and record incentives for success in work;

- are compiled on the basis of a proposal from the head of the structural unit of the organization in which the employee works;

- signed by the manager or authorized person;

- are announced to the employee against signature.

Based on the order, an entry is made in the employee’s personal card (Form T-2 or Form T-2GS (MS)) and his work book.

When registering all types of incentives, except for monetary rewards (bonuses), it is allowed to exclude from Form T-11 the requisite “in the amount of ______ rubles. _____ cop.”

When filling out Form T-11, the full name, structural unit, and type of incentive (gratitude, valuable gift, bonus, etc.) are indicated. If we are talking about material assistance and valuable gifts as elements of bonuses, then, according to clause 28 of Art. 217 of the Tax Code of the Russian Federation, personal income tax is not calculated if material assistance does not reach 4,000 rubles. per year, and if it has been reached, then personal income tax is accrued only on the excess and is separately exempted, also in the amount of 4,000 rubles, increasing from the beginning of the year, a gift.

Arbitration practice shows that a gift is not money, but a thing. However, sometimes the tax authorities regard money as a gift. Therefore, you need to be prepared for an ambiguous approach from the tax authorities to such situations.