Purposes of reconciliation of settlements with the Pension Fund of Russia

Reconciliation of calculations for pension contributions between the employer and the controlling government agency can be initiated by either party. The mandatory verification is established for the period of preparation of summary data for the preparation of annual reporting. Reconciliation of calculations helps solve the following problems:

- confirm the fact of transfer of excess funds;

- identify amounts that were collected by the regulatory authority in an inflated amount;

- make decisions on payments that require clarification;

- check the totals for obligations to the budget.

Reconciliation procedure

Reconciliation begins with the preparation of all necessary documents. To do this, the employer submits an official request to the Pension Fund for the issuance of a certificate, which will reflect the current state of settlements as of a specific date. You can make such a request in writing or contact the service department via the Internet. Additionally, you will need to obtain information from the regulatory authority about the status of payments made for contributions.

REMEMBER! Information from the certificate will help you figure out whether the final data in the employer’s accounting records and the personal account in the Pension Fund of the Russian Federation coincide. Decryption is needed for a detailed check of all payments made in order to identify the reasons for discrepancies (if they exist).

If arrears or overpayments are detected, the business entity must initiate a reconciliation in terms of payments for insurance premiums, penalties and fines. This is done by submitting a corresponding application to the Pension Fund. The application template is not legally approved. Each employer has the right to develop its own sample document.

After processing the application documentation, the Pension Fund department, together with the employer, will reconcile the calculations for the reporting period. The results of this procedure are reflected in writing by drawing up an act.

IMPORTANT! If, according to the data from the certificate and the transcript of payments, no discrepancies were identified taking into account the employer, then at the stage of checking these two forms, the reconciliation ends.

Policyholders can submit requests electronically to the Pension Fund in two ways:

- with the help of a specialized operator who ensures delivery of electronic reporting;

- through the services of the Policyholder's Account, which is available on the Pension Fund website.

The advantage of online services is that requests will be responded to within 1 business day. This period is fixed in Order No. 85r dated March 10, 2011, issued by the Board of the Pension Fund of the Russian Federation. To process paper applications and prepare a response to them, regulatory authorities are given up to 5 working days. In response to a request for TCS from the Pension Fund, an electronic register of payments is received, which can be used to check whether all sent payments are included in the database of the regulatory authority.

IMPORTANT! To generate official requests to the Pension Fund in electronic form, it is necessary to use an electronic digital signature.

How to request it

As noted above, the data verification can be initiated by any of the parties. The form of the act can be found on the Internet and is freely available.

You can request a reconciliation document either orally or in writing. The second method of conducting verification activities guarantees the appointment of a responsible specialist and eliminates missed deadlines. Nobody forbids you to create a reconciliation report yourself and send it to the controlling organization. In turn, a division of the Pension Fund or the tax inspectorate can generate a document and send it to organizations in respect of which shortcomings or overpayments of insurance accruals were discovered.

Application-request

Effective practice of business entities involves consistent implementation of counter-verification activities with regulatory authorities. Before processing the reconciliation report, it is best to send a request for clarification of information. Obtaining a certificate from a fund or inspection usually eliminates the need to generate additional documentation. The response to the request can be attached to the file with the primary forms. You can submit such an appeal in person or through telecommunications channels:

- In the personal account of the Pension Fund (Tax Inspectorate), which is available to organizations on the official website. After registering and confirming a corporate account, a company representative (usually an accountant) gets access to the history of interaction with the extra-budgetary fund. The cabinet functions include a request area where you can create an official request on behalf of a legal entity. A response to such a request will also be given within 5 working days in the form of a certificate with current calculation data;

- Through an operator that provides data transfer services to the regulatory authority. Software providers are responsible for providing a secure connection for the exchange of important information.

See also: Claim for collection of debt and penalties under a supply agreement

The use of telecommunications allows you to significantly save time on generating reports and conducting reconciliations between legal entities. Referring to the Order of the Board of the Pension Fund of 2011 No. 85, you can expect a response to your request to the supervisory authority after one business day.

The reconciliation report form is assigned the number 21-PFR. The document includes six sections, each of which provides details by type of accrual to the Pension Fund and the Federal Compulsory Medical Insurance Fund. In the header of the form, fill in the data for the business entity. The results of the inspection are filled out in the basement. Responsible officials also sign here.

Required information and subjects

Typically, advanced accountants request a certificate of payment status and information about the status of settlements through the payer’s personal account. Just like the Pension Fund and the Tax Inspectorate, enterprises are required to promptly respond to requests from regulatory authorities. Failure to comply with the requirements will result in prosecution and the appointment of unscheduled inspections.

Any accountant knows how to order a report. You can request a form with information stored in the Pension Fund (until 2021 inclusive), or you can send your own document filled out based on your credentials. In order to save time, organizations can exchange electronic copies of documents that have equal legal force to the originals.

How is the reconciliation of settlements with the Pension Fund carried out?

Before carrying out the reconciliation, the company should prepare the necessary documents. The first step is to send an official request to the Pension Fund for the issuance of a certificate reflecting the status of settlements with the fund as of the current date. This request can be sent either in writing or via the Internet. The fund will additionally need to obtain information about the status of settlements.

The information obtained from the certificate will allow you to understand whether the company’s accounting data matches the information on the fund’s personal account. Decryption will be required for detailed verification of payments, as well as to clarify the reasons for discrepancies (if any).

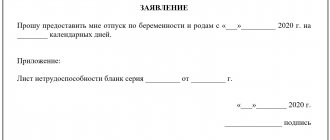

If arrears or overpayments are discovered, the company must independently take the initiative to conduct a reconciliation of insurance premiums (as well as penalties and fines). To do this, you will need to submit an application to the Pension Fund. There is no special form for this document, so you can compose it in free form or develop your own application form (

Benefit

Both practitioners and employees of Pension Fund branches strongly advise sometimes reconciling payments with the Pension Fund. What will it give? Here's what:

- you will be calm that information about your company is accurately and correctly reflected in the PF accounting documents;

- you will be sure that your business will not be affected by any underpayments of insurance premiums.

Let us immediately note that accounting legislation requires an inventory to be carried out before the annual financial statements begin to be compiled.

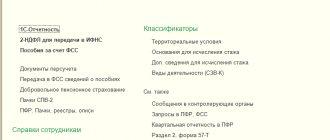

How to send a request to the Pension Fund in electronic form

To send a request to the Pension Fund in electronic form, you can use one of the following methods:

- through a specialized operator that ensures delivery of reports via the Internet;

- through the “Policyholder's Account”, which is available on the Pension Fund website.

The main advantage of using an online service to send a request is that it receives a response within up to 1 business day. It may take the Pension Fund up to 5 working days to process paper applications and prepare responses to them.

Introduction

It is no secret that the policyholder is obliged to timely pay insurance premiums for compulsory pension, medical and social insurance.

Until 2021, such contributions were paid respectively to the Pension Fund, which was the administrator of insurance contributions for compulsory pension and health insurance, and the Social Insurance Fund.

In the process of doing business, an individual entrepreneur had to pay contributions “for himself”, and also in the case of using hired employees, then, accordingly, for them.

Since 2021, the Federal Tax Service has been administering contributions. Nevertheless, there are times when it is necessary to carry out a reconciliation with the data fund in order to avoid arrears.

In the event of termination of activity as an individual entrepreneur, it is extremely important to obtain the insurer’s confidence in the accuracy of settlements with the Pension Fund of the Russian Federation and the absence of arrears.

One of the important steps to “beautifully” “close” an individual entrepreneur is submitting reports to the funds.

This is done by individual entrepreneurs at the stage of preparing documents for registration of termination of activities.

The termination of activities as an individual entrepreneur in itself does not relieve the entrepreneur of responsibility. It’s just that in this case it will happen in relation to an individual, so such a reconciliation is simply necessary, since it is usually carried out before the preparation of annual financial statements, and in the case of “closing” an individual entrepreneur, everything must happen after the fact.

Let's try to figure out how to do all this.

How to submit an application to the Pension Fund for reconciliation of calculations

The procedure for drawing up such a document as an application for reconciliation of settlements with the PRF is not approved by law. Therefore, companies have the right to develop their own forms, but the application must indicate the following:

- recipient's name;

- name, identifying information about the applicant;

- request for reconciliation;

- the date on which payment information is required;

- the manner in which the information should be provided.

As a guide, here is a sample of this statement.

Basic moments

In order to carry out a reconciliation with the Pension Fund, the payer of contributions must request from the control authorities one of the following documents:

| Help | Concerning the status of settlements for insurance premiums |

| Information | Regarding the status of payments on a specific date |

By means of a certificate, the applicant is informed about the presence of arrears in insurance payments or excessive overpayment. The certificate is compiled as of a specific date.

The information provided by the Fund provides a breakdown of all payments made by the policyholder in the period shown in the submitted request.

If there is no arrears or overpayments, the reconciliation process is considered completed.

When the information of the Pension Fund and the policyholder differs not in favor of the payer, there is a need for a more thorough reconciliation of payments.

To do this, all calculations regarding insurance premiums, fines and penalties are checked. The consequence of such a check is drawn up in a reconciliation report with the Pension Fund.

Many payers are interested in how to request a settlement balance, but it is not as difficult as it might seem.

What is the role of the document

First of all, the act of reconciling settlements with the Pension Fund plays the role of a supporting document. Before creating financial statements for the year, an organization or individual entrepreneur is required to reconcile calculations with extra-budgetary funds.

Based on the results of the reconciliation, arrears, erroneously accrued penalties, and overpayments are identified. The payer can return these to his current account or count them against future payments.

The basis is precisely the act of reconciliation. In addition, the policyholder may at any time, on his own initiative, request a reconciliation report.

For example, when for some reason there is doubt that the paid insurance premiums have reached their destination or an unscheduled inventory of calculations is carried out.

The Pension Fund is obliged to send the payer a decision, demand or order on the payment of insurance premiums. If the policyholder does not agree with the data specified in the document, he can appeal the Fund’s request.

But first, it is highly advisable to reconcile the calculations. It is quite possible that the paid contributions were simply not received by the Pension Fund or were not received in full.

The legislative framework

The bodies that control the payment of insurance transfers, in particular the Pension Fund of the Russian Federation, as well as the Federal Tax Service, must conduct a joint reconciliation of paid insurance premiums and related payments based on the payer’s application.

This is stated in paragraph 8, part 1, article 18.4 of Federal Law No. 212 of July 24, 2009.

For example, according to clause 1, part 1, article 18.4 of Federal Law No. 212, an organization may need a reconciliation report for calculations in the case when it wants to receive an installment plan or deferred payment.

The application form for joint reconciliation is not fixed, therefore a document is drawn up in free form. Reconciliation can also be carried out at the initiative of the Pension Fund.

As a rule, control authorities initiate this process if an overpayment of contributions is detected. The possibility of carrying out such a reconciliation is stated in Part 9 of Article 19, Part 4 of Article 26 of Federal Law No. 212.

Based on the results of the reconciliation, the company receives the right to submit an application for clarification of payment or an application for a refund or offset of the excess amount. Any reconciliation ends with the execution of a settlement reconciliation report.

The form of the reconciliation report on insurance premiums, penalties and fines with the Pension Fund of the Russian Federation was approved by Resolution of the Pension Fund of the Russian Federation No. 511 of December 22, 2015.

It is noteworthy that Federal Law No. 212 does not regulate the procedure for delivering a reconciliation report to an organization. But based on the form of the act, two methods can be used to transfer a document - personal delivery or transfer by post.

There are no clear deadlines for the execution of the reconciliation report, nor are there strict regulations regarding the reconciliation procedure itself.

Request for a sample reconciliation report with the Pension Fund of Russia

Before initiating reconciliation with the Pension Fund of Russia, the payer is required to obtain a certificate or information on insurance premiums. To do this, an application is submitted to the Fund. Based on the state of the calculations, the need for reconciliation is determined.

In the absence of discrepancies, the presence of a certificate or information is a sufficient condition for confirming the accuracy of the calculations. The payer can submit an application to the Pension Fund in person.

But you can also request the necessary documents about the status of paid insurance premiums and accrued payments via the Internet.

In this case, there are two options for interacting with the Pension Fund online:

| Contacting the Fund through a specialized operator | Namely, the one through which reporting is submitted to the Pension Fund. In most cases, in this way you can only obtain a certificate about the current status of insurance payments and related payments |

| Using the Policyholder's Account on the official website of the Pension Fund | By registering and creating a personal account, the payer gains access to his personal account. Here you can view the history of any payments ever made to the Fund. It is also possible to request a certificate about the current status of settlements for insurance payments |

Contacting the Pension Fund through Internet resources significantly reduces the payer’s time costs.

According to clause 5 of section 2 of the Order of the Board of the Pension Fund of the Russian Federation No. 85 dated March 10, 2011, a certificate requested electronically is provided no later than one business day.

Clause 7, clause 3, Article 29 of Federal Law No. 212 states that a request submitted in paper form is processed within five working days.

Important! From January 1, 2016, you can log into the Payer’s Account on the Pension Fund of Russia website only through an account in the Unified Identification and Authentication System (USIA). To create an account, you must register on the EPGU (Unified Portal of Public Services).

When, based on the information received from the Pension Fund, debts or surpluses in insurance premiums are identified, a reconciliation of payments must be carried out.

What data does it contain?

To draw up a reconciliation report on insurance payments, the unified form 21-PFR is used.

It was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 511 dated December 22, 2015. What is a sample reconciliation report with the Pension Fund of Russia in 2019?

The upper part of the first page of the form contains the document details, namely:

| Name of control body | For payment of insurance premiums |

| Full name of the organization | Or full name entrepreneur (individual) |

| Registration number | At the regulatory authority |

| Legal address of the organization | Or address of permanent residence of an individual entrepreneur or individual |

Next is the title of the document. The date of drawing up the act and its registration number are indicated under the heading.

The following information identifies the parties, in particular:

| Position of the Foundation representative | His full name and contact details |

| Last name, first name and patronymic of the payer | Head of the organization, individual entrepreneur, individual with telephone number |

The following is a description of the procedure. It is indicated that the parties carried out a joint verification of calculations for insurance contributions for compulsory pension insurance in the Pension Fund for the period from ___ to ___ as of ___.

The next stage of filling out is filling out a special table on the second or third pages of the act.

The tabular part consists of several columns, which indicate the amounts in rubles and kopecks received by the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund.

In this case, payments received to:

- insurance pension;

- funded pension;

- contributions at additional rates.

At the same time, during the filling process, arrears, deferred payments, overpaid or collected, debt, debts due to fines, and outstanding payments are displayed.

The table is filled out by an official of the Foundation indicating his signature with a transcript and date.

This is followed by a line indicating the presence or absence of disagreements with the payer. The method for receiving the act is also displayed. Finally, the signature of the payer or his legal representative is affixed.

How to request

Clause 7, Part 3, Article 29 of Federal Law No. 212 defines the obligation of the bodies monitoring the payment of insurance premiums to issue to the payer, upon his request, certificates about the status of settlements for insurance payments.

The document is drawn up based on data from the Pension Fund. The certificate is issued after receiving a written request from the payer within five days.

Letter of the Pension Fund of the Russian Federation No. TM-30-24/7800 dated July 23, 2010 provides the recommended form for such a certificate. The presence of a discrepancy in the calculations becomes the basis for reconciliation.

In this case, both the Fund and the payer have the right to initiate the process. The law does not define a unified form of application to the Pension Fund for the provision of a reconciliation report.

Video: reconciliation report with the buyer (example)

Therefore, this document is submitted in free form. When drawing up a document, it is important to display in it all the necessary data that allows you to most accurately identify the applicant and the period of interest.

Writing an application

How to write an application to the Pension Fund for a sample reconciliation report? First of all, you need to write who the document is intended for, that is, the name of the territorial branch of the Pension Fund.

The following should indicate the applicant's details:

- name of the organization or full name the applicant;

- details of the organization or passport details of the payer;

- legal address or place of residence;

- Contact details.

Next, write the title of the document and the text of the appeal itself. Here you need to indicate a request for data regarding the status of payments for insurance premiums from the applicant for the specified period. The date of compilation and signature are indicated.

When accepting an application in person, the document must receive a registration number, and the official marks the acceptance.

Completed sample

You can reconcile payments not only as of the current date, but also for any period of time.

To receive a reconciliation report in a timely manner, the main thing is to submit the application correctly, indicating the correct information about the payer and the time period being verified.

Sample of filling out 21-PFR

The form of the act of joint reconciliation of settlements (21-PFR) was approved by Resolution of the Board of the Pension Fund of December 22, 2015 No. 511p (Appendix 1). The “header” of the act indicates the body that controls the payment of insurance premiums, as well as the full name or name (for individual entrepreneurs) of the premium payer, its registration number in the Pension Fund and address.

The date and number of the act are indicated under the heading, followed by a list of officials on both sides responsible for drawing up the reconciliation act, and the period for which the reconciliation is being carried out is indicated.

Next comes the main tabular part of the reconciliation report with the Pension Fund of Russia, a sample of which we provide below. The table lists all types of settlements between the payer and the Fund for pension and medical contributions separately, and their status as of the reporting date: debts, overpayments, overpaid or collected amounts, outstanding payments, etc. Amounts are indicated in rubles and kopecks according to the Pension Fund of Russia and according to the data of the payer of contributions.

The Fund specialist who carried out the reconciliation puts his signature and date. In the line “Agreed by the payer of insurance premiums,” the payer, upon agreement with the reconciliation act, writes the phrase “without disagreement.” If the payer does not agree with the act, then he must indicate that the act was adopted “with disagreements”, and later, together with the Fund, determine their reason.

The legislation does not contain precise instructions on the procedure and timing for issuing a reconciliation report to the payer. The recipient indicates the actual date and method of receipt of the act - in person or by mail, then the signature of the head or authorized representative of the payer is affixed. After signing, the payer keeps one copy of the reconciliation report and sends the second to the Pension Fund.

Note! From January 1, 2021, control over the payment of insurance premiums passes to the tax authorities. This means that reconciliation of calculations for contributions accrued and paid for compulsory pension and health insurance from 01/01/2017 must be carried out with the tax office, and not with the Pension Fund of Russia branch.

Application template development

Application documentation to the Pension Fund regarding the issues of conducting reconciliation and providing the information necessary for this is not regulated by law. Each subject has the right to develop its own sample. The form must indicate:

- recipient of the application;

- information identifying the employer;

- essence of the request;

- the exact name of the document that is the subject of the application;

- the date as of which it is necessary to obtain calculation data;

- It is recommended to specify a method for transmitting the response decision.

An application for a certificate may look like this:

Office of the Pension Fund of the Russian Federation in Feodosia, Republic of Crimea from Zabeg LLC 298100, Feodosia, st. Gorky, 22 INN/KPP 2125478421/212585472 Reg. No. in the Pension Fund: 547-685-452101

statement.

We ask you to issue a certificate about the status of our company’s settlements for insurance premiums as of the date of the request – 02/15/2018. The document is required to reconcile payments made since the beginning of the year and confirm the absence of arrears or overpayments. The preferred method of receiving a response is by post. Send the certificate to the address: 298100, Republic of Crimea, Feodosia, st. Gorky, 22.

02/15/2018

Markin S.V.

If a request for reconciliation is generated, then the following phrase can be written in the text of the application: “We ask you to set a date and conduct a mutual reconciliation of calculations for insurance premiums for the period from 01/01/2017 to 31/12/2017.”

Application of the organization for reconciliation of calculations

Filled out by the policyholder in any form to obtain information about the status of settlements with the Pension Fund. According to paragraph 3 of Art. 11 of the Federal Law of December 6, 2011 No. 402-FZ, clause 27 of the Order of the Ministry of Finance of July 29, 1998 No. 34n, reconciliation is mandatory before the preparation of annual financial statements.

The application must contain:

- In the upper right corner: name of the Pension Fund branch; from whom is the application (company name, details, address, registration number in the Pension Fund of Russia;

- Main text: “we ask you to issue a Certificate of the status of settlements for insurance premiums, penalties and fines as of “” ___________;

- position, signature and full name of the applicant (CEO).

Other publications:

- What determines the size of the maternity benefit Maternity benefit The right to a maternity benefit is available to women who are: subject to compulsory social insurance in case of temporary disability and in connection with maternity; dismissed due to [...]

- Complaint against the decision on deprivation of rights Complaint against the decision on deprivation of rights To the Central District Court of Omsk K., residing: Omsk, st. . house . complaint against the magistrate's decision to impose administrative liability. August 2007, magistrate […]

- Agreement for road repairs Agreement for road repairs Organizer: Ussuriysky LVRZ Publication date: 09/28/2016 Acceptance of proposals until: 10/06/2016 12:00:00 Moscow time General information 1.1. Customer: Ussuri Locomotive Repair Plant - a branch of JSC […]

- Order 641 dated 06082019 on unscheduled inspections of Rospotrebnadzor Posted: September 26, 2021 Order of Rospotrebnadzor dated July 17, 2017 No. 632 “On approval of the Regulations on the personnel reserve of the Federal Service for Supervision of Consumer Rights Protection and Human Welfare” Type of document - Order Number - […]

- International passport validity period for travel abroad What is the validity period for an international passport and travel abroad? Currently, there are two types of foreign passports (Articles 8, 10 of the Law of August 15, 1996 N 114-FZ): an old-style foreign passport valid for five years; international passport, […]

- Magistrate Court of the Saratov Kirov District Magistrate Judges of the Kirov District of Saratov Date of publication of the article: 06/16/2015 Judicial site No. 1 of the Kirov District of Saratov Magistrate Judge: Anna Nikolaevna TitovaAddress: 410080, Saratov, Stroiteley Ave., 1, 3rd floor (building […]

Sample application for a reconciliation report to the Pension Fund

Reconciliation result

The results of joint reconciliations with pension authorities are documented in an act in Form 21-PFR. The template of this document is unified. The form was approved by Resolution No. 511p dated December 22, 2015 (author – Pension Fund Board). The structure of the act is represented by the following information blocks:

- Document header. It states the name of the Pension Fund of the Russian Federation, which carried out the reconciliation of contributions jointly with the employer, and provides information about the payer with whom the payments were verified. When designating an employer, its name and the registration number assigned to it in the Pension Fund of the Russian Federation and contact information must be indicated.

- The title of the document with the date of its execution and serial number.

- List of officials who are responsible for implementing the reconciliation of contribution calculations. Representatives of both parties must be present on the lists.

- The time interval for which settlement transactions between the parties were verified is specified.

- A table block with basic information on the results of all procedures.

- Signatures of the parties.

The table block of the document indicates the types of settlement transactions for which transfers and balances are checked. In separate columns, the balances as of the required date are shown, arrears, the amount of funds transferred in excess, and the amount of collections made are displayed. Payments for which information remains unclear and requires more detailed verification are shown separately. All amounts must be reflected in rubles and kopecks. It is necessary to indicate the final balances according to the Pension Fund of Russia and those figures that appear in the employer’s records.

Under the tabular block, the Pension Fund employee who carried out the joint check with the contribution payer endorses the document with his signature. The employer's representative studies the contents of the act and expresses in writing his agreement or disagreement with the reflected results. If the payer believes that the data in the act is reliable, he writes “without disagreement” in the specially designated field. If the policyholder believes that the information shown is not true, then he must express his disagreement with the indicated results with the phrase “with disagreements.”

If discrepancies are recorded based on the results of the reconciliation, the responsible employees of the Pension Fund of the Russian Federation, together with representatives of employers, after the date of signing the act, identify the reasons for the discrepancies. To do this, the transcripts of payments are analyzed, the correctness of payment invoices is verified and the amounts are allocated to the appropriate types of contributions.

Reconciliation request by full name and SNILS

In the main window of the service you need to select “PFR” , then “Request an extract” :

Then you need to indicate the type of statement “Reconciliation of full name - insurance number” , and below - information about the employee that needs to be clarified:

There are three options for entering information:

- Manually. First name, last name and patronymic must be entered in separate fields, as well as SNILS. If you are reconciling data for several employees, you should use the “Add line” button.

- From file. This refers to a request file that was previously submitted and saved. The list will be loaded into the form automatically.

- From the service. In this case, you need to use the button “Load from the list of employees in Externa” .

When the list is formed, you need to click “Send request”.

Offset of overpayment

After the Pension Fund employees receive an application for offset or return of the amount of money, as well as upon completion of the reconciliation and signature of the act, the offset period begins. The decision on a refund or credit is made within 10 working days from the date of:

- signing the reconciliation report;

- if this has not been carried out, receive an application for credit.

If the fund makes a positive decision, based on Articles 26 and 27 of Law No. 212-FZ, the amount is credited within 30 calendar days

. If, after approving the application, the PRF has not returned the overpaid amount 30 days later, it will be possible to recover interest from this body, accrued daily at a refinancing rate of 1/300.

Also, upon approval of the application for offset, the enterprise can recover from the Pension Fund an amount in the amount of excess penalties and fines with interest at the same refinancing rate (1/300). But if a company has debts on these fines, it will first have to pay them, and then the Pension Fund of Russia will return the excess amount.

There may also be a case in an organization when an accountant made an error in the details, discovered it, compiled and paid for the correct report and submitted a letter to the bank. Then the organization overpays, and Social Insurance becomes a debtor.

The FSS informs the debtor of the discovery of an error after the expiration of the payment period for insurance payments within 10 working days. But it would be much better for the insurer not to wait for the fund to discover the error, but to independently contact the authorities and request a reconciliation.

Test Rules

Each billing period is a calendar year, within which the offset is made. For previous offsets in the current billing period, overpaid amounts are not refunded.

Article 10 No. 212-FZ indicates the timing of the reporting and billing periods. One calculation report consists of four reports - not quarterly, but for 1 quarter, half a year, 9 months and a year. Interim reports are submitted to the FSS of the Russian Federation and the Pension Fund on a quarterly basis. If, after repaying the debt in the next quarter, the policyholder becomes the debtor, then the settlement period may extend until the end of the current year.

The amount of money is fully returned only after the policyholder has paid off all debts on fines and penalties

. Money from the Social Insurance Fund is also returned by the territorial authority within 10 working days from the date of submission of the full package of documents, which is established by Article 4.6 No. 255-FZ. The amount is indicated in column 7 of table 3 of the reporting.

Why is verification with the Pension Fund required?

The reconciliation report is essentially a supporting document. It makes it possible to check all the necessary information on contributions to the fund during a specified period of time. Making payments to government agencies is the direct responsibility of every company that operates in Russia.

Accountants in organizations must monitor economic activities and actions to pay all legally required funds to the budget. If there are shortcomings under these articles, this may cause a number of difficulties for the organization.

Every quarter, special reports are compiled and sent to supervisory authorities. They exercise control over the economic activities of each company. Based on the results of the submitted papers, the authorities conduct reconciliations for the presence of discrepancies in the submitted documents and the information that they have.

To resolve such issues that arise, additional documents may be required. Or on-site inspections are scheduled to identify violations in the field of budget legislation.

You can avoid such nuances by using a service such as reconciliation of payments with the Pension Fund. This appeal allows you to clarify the funds being deducted. Using this act, you can also check information when preparing annual reports, which must be submitted to the tax authorities within a specified period of time.

The certificate contains all the necessary information about financial transactions that were carried out at a certain time. A timely requested act allows you to avoid further disagreements when checking annual reports in tax authorities.

Exodus

When can we consider the reconciliation completed? And when the information from your accounting sources completely coincides with the contents of one of the documents indicated in the table.

In the opposite situation, when everything is not in order with your payments, be prepared to enter into a more detailed mode of joint reconciliation of payments with the Pension Fund. Based on its results, the fund’s employees will draw up a special act (form 21-PFR). Moreover, you can still submit your objections to it.

The joint reconciliation will necessarily cover the following deductions:

- for an insurance pension;

- for a funded pension;

- at additional rates;

- for compulsory medical insurance in the FFOMS in the TFOMS (until December 31, 2011).