The introduction of quarantine throughout the Russian Federation significantly affected the usual way of life of Russians. In a number of regions, employees of continuously operating organizations and individual entrepreneurs who have not been transferred to remote mode and are forced to attend their workplace must have a special pass or certificate from their employer. This document confirms that the citizen goes to or returns from work without violating quarantine. A certificate of place of work, as well as income, may be needed in other cases (for applying for benefits, loans, visas, etc.). If a citizen works for an individual entrepreneur or is one himself, he will need a certificate of employment from the individual entrepreneur - we will tell you how to draw it up.

What is a certificate of employment from an individual entrepreneur?

A certificate of employment from an individual entrepreneur (a sample can be found below) is a document that certifies the fact that the person indicated in it actually works for an individual entrepreneur in the declared position, and, if necessary, indicates that he receives a certain salary . This certificate is of a confirmatory nature and should not be confused with the 2-NDFL certificate. The document must contain current and reliable information.

A certificate of employment is used not only during the quarantine period. In everyday life, it may be required when a citizen applies to various institutions and organizations:

- social protection authorities;

- banking and credit organizations;

- government agencies;

- law enforcement agencies;

- embassies of foreign countries, etc.

A certificate from the place of work (a sample will be given below) is requested:

- when receiving a loan from a bank to calculate the solvency of a potential client;

- for calculating social benefits when assigning child care payments;

- to assess a citizen’s solvency when applying for a visa, etc.

Help for the individual entrepreneur himself

If a certificate from the place of work of an individual entrepreneur is needed for himself, then the entrepreneur writes it out for himself. Such a certificate is also issued in any form and it also indicates the amount of income received for a certain period.

In order to confirm only the amount of income received by an individual entrepreneur, it is often enough to present a tax return (copy) at the place of request. However, this option is not suitable for impostors and individual entrepreneurs working on a patent.

You will receive more information about issuing an individual entrepreneur’s certificate to confirm his income from the material “Features of the 2-NDFL certificate for individual entrepreneurs.”

Should individual entrepreneurs issue their employees with a certificate of employment?

If the individual entrepreneur is an employer and hires personnel, he has the right to issue his employees all the documents they need after receiving such a request from them. Of course, if we are talking about official employment with the conclusion of an employment contract and the payment of contributions to various extra-budgetary funds. If the entrepreneur has a personnel officer on staff, you can contact him to obtain a certificate of employment from an individual entrepreneur during quarantine and under other circumstances. If such a specialist is not available, the individual entrepreneur can independently draw up this certificate.

In accordance with the provisions of Art. Labor Code of the Russian Federation, an individual entrepreneur must issue a certificate within 3 working days after receiving a corresponding written request from an employee. In accordance with the norms of current legislation, citizens of the Russian Federation have the right to obtain from their employer any information relating to their work activities.

From the employer's point of view

Let's assume you have opened an individual entrepreneur. But have you ever wondered how the employer at your main place of work will look at this? Actually, this should not bother you much and there are a number of reasons for this:

- A “newly created” individual entrepreneur is not required to provide any information to the company about a change of status. He can do this at will;

- From the point of view of the Civil Code, you have the right to engage in entrepreneurial activity on an equal basis with other citizens of the Russian Federation, therefore, the employer has no right to create obstacles for you. Why then create them for yourself?

- Only information about employment is entered into the work book (exactly your case), and information about the formation of a legal entity is entered into the Unified State Register of Legal Entities. These are completely different spheres that do not come into contact with each other in this case. Moreover, this information will only be available based on an official request, which means that your status does not have to be public knowledge.

The director of the organization in which you work may “not like” only the quality of the work you perform on his territory. Imagine you work in the classic case 5 days a week from 9 to 18 o'clock with a lunch break, say, from 13 to 14 o'clock. A break from work during this period of time (9 hours) is hardly possible. Consequently, you have very little time left for entrepreneurial activity, and this is provided that you have no health problems (and it will come in handy when you are trying to “sit on two chairs”). If this difficulty can be overcome, then the employer can only be happy for you and for his budget. The fact is that an individual entrepreneur is obliged to independently pay insurance premiums and sick leave, which significantly reduces the “cost” of an employee for the company.

What information should be included in a certificate of employment from an individual entrepreneur?

The certificate does not have an approved form; in practice, it is compiled in a free format. To do this, it is recommended to use company letterhead. The validity period of the document depends on which institution it will be presented to. The content of the certificate is also determined by the requirements of the requesting organization, so the employee should clarify in advance what exactly should be displayed in this document.

The form for a certificate of employment from an individual entrepreneur must contain the following information:

- registration data of the individual entrepreneur who issued it;

- FULL NAME. and employee position;

- if required - the amount of wages for a certain period of time (usually indicate the amount of monthly wages or the amount of earnings received for 3-6 months);

- the duration of work for this entrepreneur (date of hiring);

- the phrase “works to date”;

- you can indicate the details of the order on the basis of which the employee was added to the staff;

- date of preparation of the certificate;

- place of presentation (you can specify “At the place of demand”);

- IP signature, seal (if available).

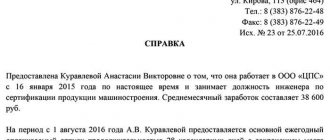

Sample free-form income certificate for 2021:

How to compose correctly

The sample certificate of employment from an individual entrepreneur at the place of request differs in accordance with the status of the person requesting the document.

There are two different forms for an employee or individual entrepreneur, but in general the statement should contain the following information :

- details of an individual entrepreneur - full data of the citizen, passport information, telephone number, numbers of documents issued during registration of activities;

- document title – “Help”;

- date and registration number in accordance with available documentation at the enterprise;

- indicates where and to whom the document is produced;

- details of the employee requesting the extract;

- confirmation of the citizen’s employment;

- the period of work requested from the individual entrepreneur;

- the established title of the employee's position;

- the amount of salary and wages in general, if there are additional incentives in the form of a percentage of revenue and other payments. It is recommended to focus on reporting;

- the position of the employee who prepares the document - this can be an individual entrepreneur himself or an accountant of the enterprise;

- seal of the organization, date of issue and signature of the issuer.

In accordance with the requirements of the applicant, only accurate information can be indicated in the certificate - for example, only confirmation of employment or its period.

For an employee

If a certificate from an individual entrepreneur is required for an employee, it is filled out in accordance with the instructions presented above.

But in this case, the text of the document will be somewhat abbreviated and contain the following information:

- The header of the certificate will also indicate the details of an individual entrepreneur - with full name, address of the registered enterprise and other data on business activities.

- Next you should indicate the name of the document.

- Enter the details of the employee to whom the extract is issued.

- Confirm the fact of his employment and duration - with the exact dates of entry into work.

- The monthly salary or, if necessary, the salary received for the last six months is indicated (depending on the situation, information for the last 3 months may be sufficient).

- Insert information about the employee who prepared the certificate.

- Next, the manager’s signature is left and a seal is affixed.

Can you get help?

Sample filling:

For the leader himself

Often, the individual entrepreneur himself needs a certificate from his place of employment. This can happen in the following cases and subject to certain features of document preparation:

- a certificate may be required in preparing a declaration for the tax service. In this case, this implies confirmation of taxes paid, as well as the fact that contributions were made on time. Such data is required to clarify the controversial situation;

- Often an entrepreneur prepares a certificate for himself to obtain a visa, especially if he intends to cross another state in order to invest and obtain citizenship;

- the certificate is issued to the entrepreneur independently or with the assistance of an accountant;

- There is no sample for the submitted document - it is drawn up in any form. As a rule, an individual entrepreneur indicates the fact that a certificate is issued to a person (full name of the manager) confirming his employment with the individual entrepreneur “Full name of the entrepreneur”;

- To obtain a certificate, there is no need to submit applications 3 days in advance. But often entrepreneurs themselves do this so that there is no confusion in the numbering of documents;

- The manager’s seal and signature are affixed independently. You can involve an accountant who will also sign in a separate, pre-created column for this.

Since the certificate is issued in any form, its text may contain completely different information. You can create a document issued to yourself, but it is better to present everything differently.

For example, as shown in the example:

This certificate was issued based on the need to confirm income, which may be required in obtaining a loan or applying for a mortgage loan. In this case, it is recommended to involve a chief accountant who knows about the manager’s income and checks the data specified in the document.

Can an entrepreneur issue a certificate of employment to himself?

The individual entrepreneur’s certificate is issued to himself in the same manner. The document indicates information about the employer (the individual entrepreneur himself) and, if necessary, the amount of income received. Certification with a seal is not required; the entrepreneur’s signature with a decryption will be sufficient. If there is a seal, its imprint should be placed next to the signature. It should be noted that an individual entrepreneur can also confirm his employment and income level by presenting a state registration document (extract from the Unified State Register of Individual Entrepreneurs) and an income statement or bank statement.

A certificate from an individual entrepreneur to himself about his place of work may have the following structure:

- Full name is written at the top of the sheet. entrepreneur, tax identification number, address, contact phone number. For example: “Individual entrepreneur Kalinina Marina Nikolaevna, INN…, OGRNIP…, address…”.

- Next, indicate the date of issue of the certificate and the number assigned to it.

What can be the IP address?

The concept of a legal address applies only to organizations.

It could be an office, a warehouse, a store, the founder’s own premises, or even the manager’s apartment in which he is registered. In the case of individual entrepreneurs, government bodies do not use the term “legal address”, but say and write “place of residence of an individual registered as an individual entrepreneur.” An entrepreneur is registered only at the place of residence - permanent registration or temporary registration, confirmed by documents. This can be any type of residential premises:

- apartment;

- House;

- room;

- dormitory;

- service housing;

- specialized residential premises - a shelter, a nursing home or a home for the disabled.

Individual entrepreneur registration is indicated in contracts with clients, counterparties and buyers. With the consent of the entrepreneur, the tax office can conduct an on-site audit at this address.

Registration of an individual entrepreneur is not possible at the place of stay: for example, at the address of a hotel, hostel, holiday home, boarding house, medical institution, etc.

The individual entrepreneur is not at the place of registration, is this a problem?

There is no need to notify the tax office or other government agencies. But keep in mind that even if you are at a different address, mail will continue to arrive at the place of registration of the individual entrepreneur. All letters sent to the “legal” address are considered automatically received.

Is it possible to register at a physical address?

No. The law prohibits this, since premises rented for business may not have an exact address, as is the case with pavilions in a shopping center.

At the same time, real activities can be carried out at the address of a store, workshop, beauty salon and other objects, as well as renting an office for work and meetings with business partners. All this is legal, the main thing is not to forget that all official and business correspondence arrives at the place of registration.

Is it possible to register at a temporary registration address?

Yes, subject to two conditions:

- you have a notarized certificate stating that the temporary registration is valid for at least 6 months;

- There is no registration stamp in the passport.

Such registration entails inconvenience. When the certificate expires, the individual entrepreneur status will be automatically cancelled. To prevent this, you need to renew your registration in a timely manner and report this to the local tax office.

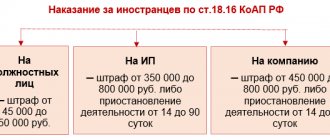

Foreigners and stateless persons can register as individual entrepreneurs at the address where they received a residence permit or temporary residence permit.

Is address registration required when opening a new branch?

Depends on the tax system applied.

- On the simplified tax system, OSN or unified agricultural tax, registration of a new point is not necessary, since all reporting and taxes are sent to the same tax authority.

- UTII or a patent will require registration with the Federal Tax Service at the location of the new points, since each region and even district has different coefficients for calculating tax.

Let's say you open new sales points in two districts of the city. If you use the simplified tax system, you do not need to inform the Federal Tax Service about the expansion of your activities. But if you have a patent, you will have to register each of the branches with the tax inspectorates of the relevant districts.

How to change the IP address?

Since 2011, there is no need to notify the Federal Tax Service about a change of registration; all changes are made to the individual entrepreneur’s documents without your participation.

It happens like this:

- Information about a change of registration is transmitted to the Federal Tax Service within 10 days by the Federal Migration Service.

- Next, Federal Tax Service employees make changes to the Unified State Register of Individual Entrepreneurs within 5 working days.

- After 15 days, the changes should be displayed on the Federal Tax Service website - you can go and check their correctness in the Unified State Register of Individual Entrepreneurs.

Sometimes the system does not work properly or there is no way to wait 15 business days. In these cases, you can independently submit a notification to the Federal Tax Service about changes to the Unified State Register of Individual Entrepreneurs. The request will be processed within 5 working days.

After changing the registration, the individual entrepreneur is assigned to another tax office. Which one can be found on the Federal Tax Service website; at the new address, the system will automatically issue the number and details of the tax department. The TIN and OGRN remain the same, so there is no need to register again.

How to find out the address of an entrepreneur by TIN?

TIN is an identification code that is assigned to an individual to control the payment of taxes. The numbers in this code are not random and have a specific meaning:

- the first 2 indicate a subject of the Russian Federation;

- the second 2 - establish the place of registration of the individual entrepreneur;

- the next 6 are unique and not repeated;

- the last 2 confirm the authenticity of the registration.

To find out the address of an individual entrepreneur by TIN, submit a written or electronic request to the tax office and receive an extract from the Unified State Register of Individual Entrepreneurs.

The register data is constantly updated - you can even get information about new entrepreneurs and liquidated individual entrepreneurs.

Here are step-by-step instructions on how to find out the address of an individual entrepreneur using the TIN: