Regardless of whether the agent acts on his own behalf or on behalf of the principal, he performs transactions at the expense of the principal. The agent does not own the ownership of the goods (work, service) being sold. A mandatory condition of any agency agreement is its remuneration, that is, the agent receives remuneration for his services.

Thus, no matter what agency transactions we are talking about, the agent always has income, expenses and objects of taxation only in relation to the amounts of the agent’s remuneration. Depending on whether the agency activity for the agent is permanent or one-time, it is possible to use both account 62 “Settlements with buyers and customers” (the principal for the agent is the customer of services) and account 76 “Settlements with various debtors and creditors." Given the variability, please note that the accounting treatment must be fixed in the accounting policy. If accounting is planned to be carried out using account 76, then the working chart of accounts must provide for appropriate levels of synthetic and analytical accounting.

Let's look at the wiring

Let's consider an example: an agent receives payment (remuneration) directly from the principal on the terms of 50 percent advance. The following entries are made in accounting:

Debit 51 Credit 62 (76)

— 1000 rubles – an advance on the agent’s fee was received;

Debit 62 (76) Credit 68.2

— 152.54 rubles – VAT is charged on the advance payment;

Debit 62 (76) Credit 90

— 2000 rubles – the agent’s income is recognized at the moment the principal accepts the agent’s report;

Debit 90 Credit 20

— 800 rubles – if there are direct expenses of the transaction agent, they are recognized in the cost price;

Debit 90 Credit 68.2

— 305.09 rubles – VAT is charged on the entire amount of the agent’s remuneration;

Debit 68.2 Credit 62 (76)

— 152.54 rubles – VAT accrued on the advance payment is accepted for deduction;

Debit 51 Credit 62 (76)

— 1000 rubles – the agent’s services are paid for by the principal.

In the absence of an advance payment, the agent's accounting is limited to entries 3, 4, 5 and 7 (for the entire amount of the remuneration). If the agent uses the simplified tax system, we exclude VAT transactions (2, 5 and 6).

Withholding amounts

Now let’s consider the procedure for recording transactions when the agent withholds remuneration from the amounts received from the buyer of goods (services, works) of the principal:

Debit 62 (76) Credit 90

— 2000 rubles – the agent’s income is recognized at the moment the principal accepts the agent’s report;

Debit 90 Credit 20

— 800 rubles – if there are direct expenses of the transaction agent, they are recognized in the cost price;

Debit 90 Credit 68.2

— 305.08 rubles – VAT is charged on the entire amount of the agent’s remuneration;

Debit 76 Principal Credit 62 (76) Principal

— 2000 rubles – the agent’s remuneration is withheld from funds received from buyers to the principal.

Accordingly, if the agent uses the simplified tax system, then it is necessary to exclude the posting for VAT calculation.

Agent's report

Thus, in an agent’s accounting, the main document on the basis of which income is reflected and the tax bases for VAT and income tax or simplified taxation system are formed is the agent’s report. The report is provided within the time limits established by the contract. The report is considered accepted by the principal if, within the period established in the contract, the latter has not received any objections to the data reflected in the document. Since the deadline for submitting the agent’s report is not established by law, and 30 days are allotted for the principal’s objections under the Civil Code of the Russian Federation, it is advisable to establish by agreement the frequency or deadline for the submission of agency reports, as well as a reasonable period for its consideration by the principal.

The form of such a report is not fixed by law, but it is subject to general requirements for mandatory details for primary accounting documents. To avoid disagreements at the stage of accepting the agent’s services, it is better to agree on the reporting form as an annex to the contract. According to existing business practices, the fact that the agent provides services is additionally documented in an act of provision of services, and this act can also be made part of the report. The condition for signing the act or its combination with the report must be fixed in the contract.

How are the terms of an agency agreement and accounting entries related?

The relationship between the parties under an agency agreement is not limited to the direct purchase or sale of goods (work, services). Effective interaction in a principal-agent pair is impossible:

- without competent organization of document flow (including ensuring its completeness and timeliness);

- correct use of accounting accounts when reflecting transactions under an agency agreement (for the formation and presentation of reliable reports to interested users, as well as for the error-free execution of tax obligations).

Features of accounting procedures of the parties to an agency agreement directly depend on its terms. It is from the contract that the accounting staff of the agent and the principal need to learn such important accounting nuances as:

- whether the agent acts on his own behalf or on behalf of the principal;

- whether he participates in the calculations;

- whether goods pass through its warehouses;

- what terms and form of reporting by the agent to the principal are established and within what time frame the report is approved by the principal (or refusal to accept it);

- algorithm for calculating agency remuneration (in percentage, in a fixed amount, etc.);

- nuances of receiving remuneration (through deduction from amounts received from the counterparty or a separate transfer from the principal);

- frequency of agent reporting (as the contract is executed or after its completion);

- other important features that may affect the specifics of accounting and reporting under the agency agreement.

The materials in this section of our website will help you cope with the difficulties of drawing up various business agreements.

Before signing an agency agreement, be sure to check the terms for tax risks. ConsultantPlus experts explained how to do this correctly. If you do not have access to the K+ system, get a trial online access for free.

Principal's counterparties

The terms of the contract may provide for the participation of an agent in settlements between the principal and buyers or suppliers. The cash flow in this case does not generate income or expenses for the agent, but transits through account 76 “Settlements with various debtors and creditors.” In addition, the principal’s assets may be transferred to him for subsequent sale to the buyer, or the agent may accept from suppliers assets purchased on behalf of the principal. In this case, ownership of the assets does not pass to the agent, and if there are documents on the transfer of assets to him (acts, TTN, etc.), he reflects the assets in off-balance sheet accounts 004 “Goods accepted for commission” or 002 “Inventory accepted for commission” for safekeeping."

Agency agreement: types and rules

The essence of an agency (intermediary) agreement comes down to the presence between the 2 parties to the transaction (seller and buyer) of a third party (intermediary), whose role can be:

- commission agent;

- agent;

- attorney.

For a sample agreement, see the material “Agency Agreement - Sample Completion for Legal Entities.”

The activity of an intermediary is to carry out legally significant actions on its own behalf or on behalf of the guarantor (principal, principal, principal), leading to the consequences of these actions for the guarantor.

Despite the fact that in the Civil Code of the Russian Federation (Chapter 52) the agency agreement is distinguished as an independent type, it, in fact, combines two types of agreements:

- orders (Chapter 49), when the agent acts on behalf of the guarantor and the rights/obligations under the transaction arise directly from the guarantor;

- commission (Chapter 51), when an agent acts on his own behalf and he also acquires rights/obligations under the transaction.

The following features of agency agreements are important for accounting:

- income and expenses from intermediary transactions arise from the guarantor;

- the income of the intermediary becomes the agency fee paid to him by the guarantor;

- The money and property of the guarantor received by the intermediary in connection with the order assigned to him are only means for executing the order and are not reflected in the income/expenses of the intermediary;

- the intermediary's costs associated with the execution of the agency agreement and reimbursed to him by the guarantor do not constitute the income/expenses of the intermediary;

- the volumes of functions performed by the intermediary and the reimbursable costs incurred by him, confirmed by documents, are reflected in the intermediary’s report, which is the primary accounting document for the guarantor and is considered accepted if he has no objections to it.

Ready-made solutions from ConsultantPlus will help you check the agency agreement for risks:

Get free access to K+ and go to the Ready-made solution for the principal.

And this link will take you to the Ready Agent Solution if you have access to K+. If you don't have it, you can get trial access for free.

There are two main schemes of actions passing through an intermediary:

- sales;

- purchases.

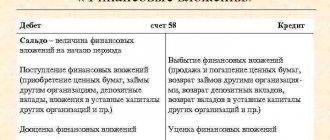

When concluding agency agreements, accounting should be organized using postings through account 76 with details of the types of calculations for analytics. The intermediary’s income, depending on the accounting policy, can be generated either on account 90 or 91.

See also “How to correctly make entries under an agency agreement.”

Agent Summary

The agent organizes and establishes in the accounting policy the procedure for reflecting transactions and analytics for accounting for agency fees, settlements with the principal and his counterparties, and document flow for these transactions.

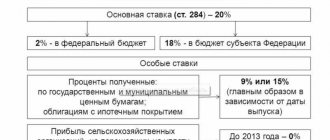

VAT for payment to the budget is calculated by the agent (if he does not use the simplified tax system) only on the amounts of the corresponding remuneration. To calculate income tax (tax under simplified taxation system), the agent takes into account only the agency fee in income, and his current expenses in expenses. In addition, all settlements in the interests of the principal are carried out in the agent’s accounting through account 76, without participating in the calculation of income, expenses and tax bases. And the assets of the principal transferred to the agent do not become his property; in accounting they are reflected in an off-balance sheet account.

The accounting records of the principal reflect separately transactions on agent remuneration and separately transactions on the purchase and sale of assets in which the agent is involved.

note

30 days are allotted to receive the principal’s objections in accordance with the Civil Code of the Russian Federation.

Documentation of such transactions depends on the type of agency contract, but according to the general principle, if an agent acts on his own behalf, then all primary documents and invoices for the main transaction are issued in his name, and he also transfers their certified copies to the principal for the latter to reflect transactions in your account. If the company acts on behalf of the principal, then the final documents are also drawn up on his behalf (in the person of an agent by proxy) and their originals serve as the basis for recording transactions in accounting.

Also, if the agency agreement provides, in addition to remuneration, compensation for the agent’s expenses incurred in the interests of the principal, copies of documents confirming expenses, including invoices, are attached to the corresponding report. Based on it and copies, expenses are reflected in the principal’s accounts.

Accounting under an agency agreement with an agent

The intermediary is not the owner of the goods and services purchased or purchased in the interests of the principal. That is, goods and services received cannot be recognized as expenses, and those transferred cannot be recognized as company income. Income will only reflect the amount of the agency fee issued under the agreement. It will also be necessary to calculate and pay VAT to the budget if you work for OSNO. The receipt of material assets in accounting is reflected in off-balance sheet accounts:

- 002 - if assets acquired on behalf of an order were received;

- 004 - if assets have been received that the agent is instructed to sell.

Agency agreement: accounting entries for the commission agent.

| Contents of operation | Debit | Credit |

| Asset acquisition | ||

| Goods, works, services supplied by the seller | 76 | 60 |

| The receipt of material assets is reflected | 002 | |

| Payment has been made to the seller | 60 | 51 |

| Material assets were transferred to the principal | 002 | |

| Sale of assets | ||

| Received valuables for sale from the consignor | 004 | |

| Payment received from buyer | 51 | 62 |

| The advance payment received from the buyer is transferred to the principal | 76 | 51 |

| Material assets were sold in the interests of the principal | 62 | 76 |

| Assets written off balance sheet | 004 | |

| Accounting for payment for intermediary services | ||

| Remuneration accrued under the mediation agreement | 76 | 90 |

| VAT charged on agency fees | 90 | 68 |

| Reimbursement of expenses and payment for intermediary services was received from the principal | 51 | 76 |

Please note that the intermediary does not reflect in its accounting VAT on goods and services received and sold in the interests of the principal. An invoice received from a supplier cannot be reflected in the purchase ledger. It should be reflected in the journal of received invoices and re-issued to the principal in accordance with the requirements of Decree of the Government of the Russian Federation of December 26, 2011 No. 1137.

Features of accounting for the principal

Let's consider the transactions when the agent sold the principal's non-residential real estate:

Debit 26, 91 Credit 60

— 1000 rubles – based on the agent’s response, the expenses for the agent’s remuneration are reflected;

Debit 19 Credit 60

— 180 rubles – based on the report and invoice, VAT on agency fees is reflected;

Debit 26, 91 Credit 60

— 300 rubles – based on the copies of documents attached to the agent’s report, notary expenses, fees, and appraiser services are reflected;

Debit 19 Credit 60

— 36 rubles – based on the attached report, a copy of the invoice from the appraisal organization reflects VAT on appraisal services;

Debit 68.2 Credit 19

— 216 rubles (180 + 36) – VAT is accepted for deduction;

Debit 60 Credit 51

— 1516 rubles – the agent was paid a fee and compensated for additional expenses;

Debit 62 Credit 90

— 11,800 rubles – at the time of transfer of ownership rights, proceeds from the sale of property are recognized;

Debit 90 Credit 68.2

— 1800 rubles – VAT accrued on the sale of property;

Debit 90 Credit 41 (01)

— 6,500 rubles – the cost of sold property is written off.

Thus, the principal has the following formed on OSNO:

- costs for calculating income tax on the services of an agent and compensation for his expenses;

- “input” VAT;

- tax base for VAT in terms of proceeds from the sale of property;

- tax base for income tax as the difference between income and expenses from the operation of selling property.

note

The agent organizes and establishes in the accounting policy the procedure for reflecting transactions and analytics for accounting for agency fees, settlements with the principal and his counterparties, and document flow for these transactions.

With the simplified tax system, accounting will be somewhat simpler. First, we generate income and expenses without charging VAT and including “input” VAT in expenses, or generally take into account only income from the disposal of property if we use only income as the tax base under the simplified tax system.

Accounting for agent and principal

To reflect transactions under an agency agreement in accounting, various accounting schemes are used to record the relationship between the parties to an agency agreement in the following situation:

- sales of products (goods, works, services) by an agent;

- purchasing intermediary operations.

Accounting for an agent under an agency agreement and accounting for agency agreements for a principal are presented in the figures:

Agency for sale

Agency for purchase

You can also read about the features of an agency agreement in accounting here.

Participation in settlements

Let's consider another example when the agent sells the principal's goods and at the same time participates in the settlements.

Debit 45 Credit 41

— 20,000 rubles – goods are transferred to the agent for sale (act or TORG-12);

Debit 44 Credit 60

— 1000 rubles – based on the agent’s report, remuneration expenses are reflected;

Debit 19 Credit 60

— 180 rubles – based on the report and invoice, VAT on agency fees is reflected;

Debit 90 Credit 45

- 10,000 rubles - according to the report and copies of documents for the sale of goods, the cost of products sold is reflected;

Debit 62 Credit 90

— 17,700 rubles – based on the report and copies, sales revenue is reflected;

Debit 90 Credit 68.2

— 2700 rubles – VAT is charged on the sale of goods;

Debit 60 Credit 51

— 1180 rubles – the agent has been paid a fee;

Debit 51 Credit 62

— 17,700 rubles – funds received from the agent for goods sold.

VAT accounting for the parties to the agency agreement

An agent acting on his own behalf and at the expense of the Principal when selling goods (works, services) to third parties issues an invoice to them on his own behalf. The Agent enters this invoice into the book of issued invoices. At the same time, he sends this document to the Principal, who in turn issues an invoice to the Agent on his own behalf in the name of a third party, where he duplicates all the information on the invoice received from the Agent. That is, in the invoice on the Seller line there will be the name of the Principal, and on the Buyer line the name of the third party, and not the name of the Agent. The Principal registers the issued invoice in the sales invoice book and sends it to the Agent. The agent records the received invoice in the received invoice ledger.

Note: An agent acting on his own behalf and at the expense of the Principal, issued invoices for the sale of goods (work, services) to third parties, as well as invoices issued for funds received for future deliveries of goods (work, services) to third parties (advances) are not reflected in the sales book.

The Agent issues an invoice to the Principal for the agency fee, and the Agent registers this invoice in the sales book. The principal records it in the book of purchase invoices and in the book of received invoices.