Which accounting accounts are involved in the postings?

All operations for calculating taxes are displayed on the credit of account 68. To display the accrual of income tax, a special sub-account is opened for it.

When calculating profit taking into account the norms of PBU 18/02 (approved by order of the Ministry of Finance dated November 19, 2002 No. 114n), reduction to the general value of the desired value calculated in tax and accounting is observed. In order to link the differences that arise (temporary and permanent) when calculating income tax, various accounting entries are used. The appearance of these differences is due to the fact that not all expenses in tax accounting reduce taxable profit, but at the same time they are taken into account in accounting. It is for the purpose of subsequent correction of the profit calculated in accounting that it is necessary to take into account all the differences that arise.

Read more about the differences between accounting and tax accounting here.

Depending on what difference the taxpayer received during the reporting period (deductible or taxable), different entries are applied.

Posting income tax accrual

The income tax transaction is accrued: the debit amount is reflected in account 99 “Profits and losses”, account 68 “Calculations for taxes and fees” is credited with the same amount. The advance payment for this transaction is calculated by multiplying the amount of profit received for the period by the current tax rate according to the law. In the event that an enterprise incurred losses from business activities during the reporting period, a reverse entry is made (reversal), and the amount is calculated by multiplying the rate by the amount of losses.

We reflect SHE

If, when calculated in tax accounting, the profit value is higher than the same indicator in accounting, then a deductible difference arises, which means there is a deferred tax asset.

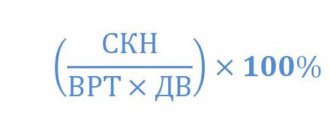

SHE = Svr * NS, where:

OTA - deferred tax asset;

Свр — amount of temporary difference;

NS is a tax rate that is equal to 20% (17% is paid to the regional budget, and 3% to the federal budget).

To be reflected in accounting, the following correspondence is made:

Dt 09 - Kt 68 - accrual of ONA.

Examples of when SHE and IT arise can be found in the Typical Situation from ConsultantPlus. Learn the material by getting trial access to the system for free.

Postings for the calculation and payment of income tax

Income tax is accrued every quarter on an accrual basis. This means that the current one is added to the results of the previous reporting period. To do this, three wires are used:

- Debit 99 Credit 68 “Profit” - accrual of profit according to accounting. accounting

- Debit 68 “Profit” Credit 99 – reflection of profit taking into account temporary differences.

- Debit 68 “Profit” Credit – payment of tax to the budget.

The tax is paid to the federal (3%) and local (17%) budgets.

Example

At the end of the quarter, the organization received a profit of 258,120 rubles. and transferred to the budget.

Postings for payment of income tax:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 99 | 68 "Profit" | Posting: Income tax accrued | 258 120 | Help-calculation |

| 68 "Profit" | Income tax transferred | 258 120 | Ref. Payment order |

Reflecting IT

If the accounting profit is greater than the tax profit, then a deferred tax liability arises.

This can be reflected in accounting using the following correspondence:

Dt 68 - Kt 77 - accrual of IT.

If a situation arises when temporary differences remain outstanding for some reason, the following entries are made to write them off:

To write off a deferred tax asset by posting income tax - Dt 91 - Kt 09

To write off deferred tax liability - Dt 77 - Kt 91.

Methods of paying income tax

Profit tax can be calculated and paid in two ways:

- Four times a year, quarterly advance payments. In this case, this tax is calculated on an accrual basis. The actual difference between accruals for the current and previous periods is paid quarterly.

- Monthly, based on the actual amount of profit received by the company.

The choice of one of the two options for payment schedules is arbitrary and is determined based on the accounting policies of the organization.

Accounting for PNR and PND

Fixed tax expenses arise if, based on the results for the reporting period, the value of profit in tax accounting is greater than in accounting.

PNR = Prp * NS, where

PNR - permanent tax expense;

Note! PNR and PND were previously called PNO (permanent tax liability) and PNA (permanent tax asset). In connection with amendments to PBU 18/02, their names were changed.

Prp - constant difference (positive);

NS is the tax rate, which is equal to 20%.

The accounting entries for income tax in this case will be as follows:

Dt 99 - Kt 68 - accrual of constant tax expense.

In a situation where profit is less in tax and not in accounting, accordingly, the constant difference turns out to be negative. A permanent tax income arises.

Income tax is reflected in accounting entries as follows:

Dt 99 – Kt 68 - accrual of conditional tax expense.

The value is equal to the profit in accounting multiplied by the tax rate.

The loss resulting from the operation, which is also multiplied by the tax rate, constitutes conditional income, and is displayed as follows:

Dt 68 – Kt 99.

The calculated profit in tax accounting, multiplied by the tax rate, is the current income tax. There is no need to create correspondence to display it.

As a result of the operations performed, the financial result for income tax becomes equal to the current tax value.

For small businesses, income tax entries look like this: Dt 99 – Kt 68.

Check whether you are taking into account fixed tax expenses/income correctly using tips from ConsultantPlus. If you don't have access to the system, get a free trial online.

You can learn more about tax incentives for income tax in our article “What incentives for corporate income tax are established for 2021 - 2021?”

Posting the transfer of income tax to the budget

When the tax amount is actually transferred to the treasury accounts, funds are debited from the enterprise’s current account under credit 51 of the “Settlement accounts” account and account 68 “Calculations for taxes and fees” is debited:

| Account Dt | Kt account | Wiring Description | Transaction amount, rub. | A document base |

| 99 Profit and loss | 68, subaccount Income tax | Advance payment of income tax for the first quarter | 10 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 Current account | Transfer of advance payment to the budget for the first quarter | 10 000,00 | Payment order |

| 99 | 68, subaccount Income tax | Advance payment of income tax for six months | 15 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 | Transfer to the budget of an advance payment for 6 months | 15 000,00 | Payment order |

| 99 | 68, subaccount Income tax | Accrual of advance income tax for three quarters | 25 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 | Transfer of advance payment to the budget for 9 months | 25 000,00 | Payment order |

| 99 | 68, subaccount Income tax | Calculation of annual income tax amount | 40 000,00 | Help-calculation |

| 68, subaccount Income tax | 51 | Transfer of the total annual amount | 40 000,00 | Payment order |

If a loss is received additionally for any period, a third entry adds a corrective reversal:

| Account Dt | Kt account | Wiring Description | Transaction amount, rub. | A document base |

| 99 | 68, subaccount Income tax | Accrual of advance income tax for three quarters | 25 000,00 | Help-calculation |

| 68, subaccount “Income taxes” | 51 | Transfer of advance payment to the budget for 9 months | 25 000,00 | Payment order |

| 99 | 68, subaccount Income tax | Adjustment (reversal) of the income tax amount for 9 months | 40 000,00 | Adjustment declaration |

Results

The application of PBU 18/02 often raises questions. But once you clearly understand the concepts of ONO, ONA, PNR and PND discussed above, you can easily cope with bringing the balance in account 68 to the amount of income tax shown in the declaration.

See also: “What is the procedure and deadlines for paying income tax (postings)?”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for calculating and paying tax

The above regulatory document describes the objects of taxation, methods and methods of calculation, regulates the frequency and timing of payments to the accounts of the budgets of the Treasury of the Russian Federation and the region of registration of the enterprise:

All relationships regarding the payment of taxes to state budgets of different levels are reflected in accounting on a specific account. In the accounting chart of accounts, to display the movement of funds for the payment of all taxes, a 68 account “Calculations for taxes and fees” was created, in which a subaccount of the same name “Income Tax” is created for income tax transactions. For a more detailed reflection of the movement of funds in analytical accounting, this subaccount can be divided into subordinate subaccounts for each recipient of the tax payment (federal, local or municipal tax authorities).

Accounting for income tax in accounting

Accounting displays profit or loss at the end of the reporting period; this result is used to calculate the payment of current income tax to the budget . The accounting account for recording calculations is given below.

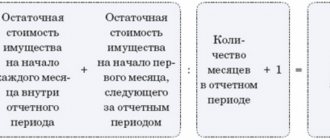

The amount of profit or loss resulting from the activity (line 2300 of the income statement) is multiplied by the current tax rate - 20%, which leads to the creation of amounts of conditional income or conditional expense. But this is not the final figure for transferring tax; it is adjusted for differences. In their absence, the amount received will be equal to the tax payable.

If the company has an unimportant result of its activities, that is, a loss, then a conditional income is formed by multiplying the amount of the loss by a rate of 20%. The entries that display it are as follows:

Kt 99, with the opening of a separate sub-account “Conditional expense (income) for income tax” - Dt 68 (calculation of income tax).

The resulting accounting profit, multiplied by 20%, is a conditional income tax expense. It must be written down with the following entries: Dt 68 – Kt 99.2.

Income tax - which account to use for accounting

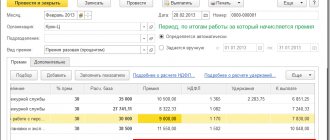

To account for this tax, use a subaccount to account 68. In the 1C accounting program, it is assigned the number 68.04, and two subaccounts, in turn, are linked to it: 68.04.1 “Calculations with the budget” and 68.04.2 “Calculation of income tax.”

If you do not apply PBU 18/02, then the question of which income tax account to use is easily resolved: the tax is calculated by posting Dt 99 Kt 68.04.1, and is immediately attributed to the subaccount for accounting settlements with the budget.

If the company applies PBU 18/02, then the amount of income tax is calculated in accounting through a system of accounting entries with the participation of subaccount 68.04.2. As a result, in subaccount 68.04.2, when calculating tax payable, the amount recorded in the declaration should be formed. Then the total amount of subaccount 68.04.2 is completely closed to subaccount 68.04.1, where the tax is divided among budgets. It also takes into account further settlements with the budget based on the amount accrued for payment.

Accounting for income tax in tax accounting

They are deducted from the income received by the organization, but not all expenses can be recorded in tax accounting.

According to the general rule established by Art. 252 of the Tax Code, the company’s expenses in tax accounting must be:

a) justified, that is, economically necessary for the company, for example, the purchase of coffee for accounting employees cannot be written off as an expense, they cannot be called justified;

b) confirmed by documents drawn up correctly, in accordance with legal requirements. These can be any supporting documents: travel cards, orders, reports on work performed, etc. If documents are submitted from a foreign state, they must be translated into Russian. But you must take into account that you must have a complete set - if this is a contract, then it must include a certificate of completion of work, an invoice, shipping documents, etc. When only an invoice is attached to the contract, such expenses cannot be recognized. The Federal Tax Service also recommends using a universal transfer document to confirm expenses.

c) expenses must be made to generate income, which is generally the main thing for the commercial activities of any company. If there is no income in a given month, then the expense can still be recognized, the main thing is that the expenses were incurred for their type of activity.

If an expense does not meet at least one of the above requirements, it cannot be accepted, so some of the expenses are not recognized in tax accounting at all.

Tax authorities also pay attention to expenses that brought a loss in the reporting period, did not bring profit, and do not correspond to the main type of activity. Expenses that are taken into account within established standards are called standardized . There are also non-standardized ones, they are taken into account completely.

Expenses from core activities include those associated with production and sales, namely: costs of performing work, providing services, manufacturing, storing and delivering goods, maintaining fixed assets, insurance, etc.

Income tax entries

Calculation and payment of income tax is the responsibility of every company that operates according to the rules of the general taxation system. Exactly how these actions occur is stated in the accounting policy for tax purposes. However, the very fact of accrual of income tax and its subsequent payment are reflected in accounting. Like any fact of a company’s economic activity, the fulfillment of tax obligations requires the execution of certain transactions.

Income tax accrued: posting

Calculations for income tax in accounting are reflected in account 68 “Calculations for taxes and fees”. In general, this is a standard account, through the sub-accounts of which most of the company’s taxes are posted, for example, personal income tax withheld from employees’ salaries by the tax agent, VAT, “simplified” tax under the simplified tax system, and so on. In a separate sub-account “Income Tax” to account 68, entries are made for the tax we are considering.

It should be noted that account 68 is active-passive, which means that the balance on it must be considered in expanded form. The credit of the account reflects the debt to the budget, and the debit reflects the overpayment of taxes.

Accordingly, the accrual of income tax is reflected by the posting: debit 99 “Profits and losses” - credit 68, subaccount “Income tax”. The amount of this accrual must correspond to the estimated tax amount for the corresponding reporting period, and the posting itself is made on the last day of this reporting period.

Let us recall that the calculation of income tax occurs on an accrual basis, that is, each subsequent reporting period includes data on income and expenses from the beginning of the year. This state of affairs can lead to the fact that, for example, in the first quarter the company’s income tax return reflects a certain income, but at the end of the six months its amount turned out to be less, or the company even went into a loss. In this case, the income tax advance accrued earlier in the same year must be adjusted. The following entry is made in accounting:

Reversal Debit 99 “Profits and losses” - Credit 68 , subaccount “Income Tax” - for the amount of overcharged tax.

Income tax transferred to the budget: posting

Payment of income tax to the budget is formalized, as you might guess, using the company’s current account, with the following posting:

Debit 68, subaccount “Income Tax” - Credit 51 “Current Accounts” - income tax is transferred to the budget. The amount in this transaction corresponds to the amount of the actual tax remittance. However, due to various circumstances, it may differ from the amount of accrued tax reflected on the credit of account 68.

Income tax postings: quarterly and monthly

According to Article 285 of the Tax Code, the reporting period for income tax for most situations is a quarter, half a year and 9 months, and the final tax calculation occurs for the year as a whole. Based on this postulate, the accountant will prepare income tax entries quarterly. Those companies that are required to pay taxes based on the results of the month will accrue income taxes on a monthly basis in their accounting. This is the difference between the various reporting periods prescribed for income tax - relatively speaking, monthly and quarterly.

Date of accrual and tax debt

Please note: since the entry according to which income tax is calculated is issued on the last day of the reporting period, until the date of payment of the tax, the company will have a debt on it. This is a completely standard situation, even taking into account the fact that formally the deadline for transferring the payment to the budget - until the 28th day of the month after the end of the reporting period - may not yet be missed. Moreover, in the balance sheet submitted at the end of the year as of December 31, tax arrears in terms of payment for the last reporting period will also not raise questions from controllers.

It is worse if a situation occurs that there is not enough money in the company’s account on the date of payment to transfer to the budget the entire amount of tax calculated based on the results of the reporting or tax period. Then the company will have overdue debt. In accounting records, it will not differ in any way from ordinary debt recorded at the end of the reporting period. However, having compared the deadlines for transferring payments provided for by tax legislation with the dates of their actual payment, and having discovered such a delay, controllers, unfortunately, in 100 percent of cases use their right to charge the company a penalty. Let us remind you that penalties are calculated as 1/300 of the key rate for each day of delay in payment of the amount of the debt. But a fine for a slight delay in the transfer and voluntary repayment of debt is not provided for by law.

Postings to the debit of account 68 when generating income tax

You can understand which income tax account should be used when applying PBU 18/02 using the following algorithm. The tax in this case is formed as follows:

- The tax calculated from accounting profit is documented by posting Dt 99 Kt 68.04.2.

- Tax amounts (permanent tax liabilities) accrued from the permanent difference are taken into account:

- Dt 68.04.2 Kt 99 – from income not taken into account for tax purposes;

- Dt 99 Kt 68.04.2 – from expenses not taken into account for tax purposes.

3. Tax amounts accrued from temporary differences at the time of their occurrence in accounting are taken into account:

- Dt 09 Kt 68.04.2 – deferred tax assets (for expenses accepted in accounting earlier than in tax accounting);

- Dt 68.04.2 Kt 77 – deferred tax liabilities (for expenses accepted in tax accounting earlier than in accounting).

4.Tax amounts are taken into account for previously accrued temporary openings for which it became possible to close in a given period. Which account - deferred tax assets or deferred tax liabilities - is closed depends on the type of temporary difference:

- Dt 68.04.2 Kt 09 – deferred tax assets (for expenses accepted in accounting earlier than in tax accounting);

- Dt 77 Kt 68.04.2 – deferred tax liabilities (for expenses accepted in tax accounting earlier than in accounting).