Features of calculating property tax

Taxation of property is carried out based on its specific value.

There are four groups of taxable property, each with its own rules for calculating tax:

- The tax base is the residual value of the property, since fixed assets are subject to depreciation;

- Real estate taxed at its cadastral value;

- Movable property that was registered before January 1, 2013 (furniture, car, equipment). Taxed at the same rates as real estate;

- Movable property that was put into operation after 01/01/2013.

To determine the amount of property tax for its subsequent withholding, it is necessary to calculate the average value of fixed assets for the reporting period that are registered with the enterprise. In other words, the tax base is determined:

The property tax rate may vary by region, since this tax is regional. At the state level, only its maximum limit is set - 2.2%.

Motor vehicles

Until 2013, movable property was taxed according to general rules. After changes were made to the legislation, all movable objects registered before 2013 were excluded from taxation. If the object was registered shortly before this date, then, provided the correct entries are used, the accountant can push back the date the object was registered and reduce the base legally.

– DT08 KT07 – the object has been handed over for installation.

– DT01KT08 – the object is registered as an OS.

To avoid questions from the inspection authorities in the future, you need to supplement these postings with an order to transfer the property for installation.

Features of accounting and accounting display of property tax

Please note that at the legislative level there are no clear recommendations regarding the accounting display and calculation of property taxes. This segment of accounting is most often regulated by the accounting policies of the enterprise itself.

Accounting for property tax obligations can be displayed on several accounts - 20 or 23, or 25, or 26, or 44, that is, on those that have a direct relationship with various groups of expenses:

- Primary production;

- General running costs;

- Sales costs, etc.

You can also use account 91.2 Other expenses to display property taxes, which can significantly simplify the accounting procedure in cases where errors have been identified or recalculations have been made.

Property tax, as a rule, is assessed and paid in advance payments - quarterly, which is reflected in the corresponding expense accounts of the enterprise on the date of their accrual. At the end of the reporting period, if necessary, property tax is adjusted with a subsequent decrease or increase in the enterprise’s profit.

Calculations for preferential property

When an enterprise has preferential property on its balance sheet, the calculation is made somewhat differently. The average annual cost of these fixed assets is calculated in the 2nd section of advance payments in the 4th column and in column No. 4 of the second section of the tax return. The indicator itself is determined exactly as the value of property without benefits.

The amount of the advance payment when calculating tax on preferential property for each month can be determined using the formula:

Advance payment for preferential property under property tax for the tax period (first quarter, first half of the year, 9 months) =

(Average cost of fixed assets for the reporting period - Average cost of fixed assets of preferential property for the tax period) * (Tax rate / 4)

The amount of deduction to the budget for property tax for a calendar year is determined by the formula:

Total amount of property tax for the year =

(Average annual cost of fixed assets for the entire year - Average annual cost of preferential fixed assets for the entire year) * Tax rate - advance payments for property tax accrued for the first quarter and half of the year, 9 months.

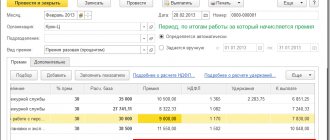

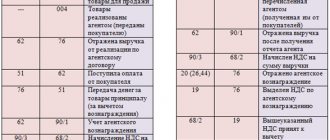

Table of transactions for calculating property tax

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description |

| Calculation of real estate tax | |||

| 91-2 | 68/ property tax | 21 600,00 | Accrual of property taxes while simultaneously writing them off for other expenses |

| 20 (23,25,26) | 68/ property tax | 20 411,00 | Accrual of property tax, which is included in the costs of the usual type of activity of the enterprise |

| 44 | 68/ property tax | 55 458,00 | Accrual of property tax, which is included in sales costs |

| 68/ property tax | 51 | 21 600,00 | Transfer of property tax |

| 68/ property tax | 91-2 | 7 590,00 | Reversal of overpaid property tax |

| 99 | 68/profit | 849,00 | An increase in the amount of tax profit, which is associated with an increase in profitability by the amount of understatement of property tax |

| Accounting for movable property acquired before 01/01/2013 | |||

| 08-1 | 60 (67) | 570 000,00 | Milk bottling equipment purchased |

| 08-1 | 07 | 58 000,00 | Installation of purchased equipment |

| 01-2 | 08-1 | 628 000,00 | The equipment has been put into operation. It is from this moment that property taxes begin to be calculated. |

Base calculation and features

Tax base is a value calculated based on the value of property in accordance with accepted standards in a particular region for a certain category of fixed assets. At the moment, the tax base can be calculated according to two principles - the residual or cadastral value of the property.

Until 2014, it was the residual or book value of property that was widely used. Its peculiarity is that gradually every year the value of property will decrease due to wear and tear. At the same time, each organization determines its service life independently, before the expiration of which the product must reach zero and completely exhaust itself .

The initial cost must include not only the costs of acquisition, but also transportation, putting the facility into operation, that is, all current costs associated with the appearance of new property on the balance sheet.

An experienced accountant will be able to distribute such expenses to current accounts in the required manner in order to reduce the property tax base, thereby reducing the company's expenses.

If the product does not require additional expenses, then the formula for subtracting the average annual cost is as follows:

If you use the cadastral value in calculating the base, then there is no need to make subtractions, since all the data is entered into Rosreestr, and by using the object number you can find out the value without personally contacting the office. It is the cadastral value that will act as the tax base.

Since 2014, in addition to land, the following objects :

- any public building such as a shopping center, store, catering facility, restaurant, etc.;

- residential premises that are not listed on the company’s balance sheet;

- real estate owned by foreign companies without a permanent representative office in the Russian Federation.

What are the property tax penalties?

Please note that the timeliness and completeness of payment of property tax are controlled by the fiscal authorities. Liability of the payer for violations of property tax accounting:

- If the tax amount is displayed untimely and in violation of accounting rules during one reporting period, then the amount of the fine is 10,000 rubles;

- If this violation exceeds several tax periods, the amount of the fine increases to 30,000 rubles;

- If the amount of property tax was underestimated, then a minimum fine of 40,000 rubles is provided. or 20% of the amount of unpaid tax.

Tax accounting. simplified tax system

As a general rule, simplified organizations do not pay property tax. The exception is for organizations that have real estate on their balance sheet, for which the tax base is determined as cadastral value. Property tax on these objects must be paid on a general basis (clause 2 of Article 346.11 of the Tax Code of the Russian Federation).

If an organization calculates a single tax on income, then the property tax paid will not reduce the tax base (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). If an organization pays tax on the difference between income and expenses, include the amount of property tax as expenses in the period when it was transferred to the budget (subclause 22, clause 1, article 346.16, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Transport tax calculations.

Instruction No. 157n[6] does not provide for a separate account for reflecting calculations for transport tax, therefore they should be recorded as part of calculations for other payments to the budget on account 0 303 05 000.

The transport tax is established by Ch. 28 of the Tax Code of the Russian Federation and the laws of the constituent entities of the Russian Federation on tax. When establishing a tax, the legislative (representative) bodies of the constituent entities of the Russian Federation approve the tax rate, tax benefits, the procedure and deadlines for paying the tax.

Tax payers are persons who, in accordance with the legislation of the Russian Federation, are registered with vehicles recognized as an object of taxation (clause 1 of Article 358 of the Tax Code of the Russian Federation).

Vehicle tax is calculated based on engine power, jet engine thrust or gross tonnage of the vehicle.

The tax rates are indicated in Art. 361 Tax Code of the Russian Federation. At the same time, regions have the right to increase (decrease) them by no more than ten times. Rates are based on one horsepower of a vehicle engine, one kilogram of jet engine thrust, one registered ton of a vehicle or one unit of a vehicle.

The tax on expensive cars is calculated taking into account increasing factors in accordance with paragraph 2 of Art. 362 Tax Code of the Russian Federation.

Transport tax is calculated based on the results of the calendar year. Based on the results of each quarter, advance tax payments are calculated. Note: the laws of the constituent entities of the Russian Federation may establish the right not to calculate and not pay advance payments for certain categories of taxpayers (clauses 1, 2.1, 6 of Article 362 of the Tax Code of the Russian Federation).

Operations for accrual and transfer of transport tax to the budget are reflected in accounting (budget) accounting as follows:

| Contents of operation | State institutions | Budgetary (autonomous) institutions | ||

| Debit | Credit | Debit | Credit | |

| Property tax assessed | 1 401 20 291 1 109 xx 291 | 1 303 05 731 | 0 401 20 291 0 109 xx 291 | 0 303 05 731 |

| Tax paid to the budget | 1 303 05 831 | 1 304 05 291 | 0 303 05 831 | 0 201 11 610 off-balance sheet account 18 (KVR 852 / subarticle 291 KOSGU) |

The amount of transport tax calculated by the state cultural institution for 2021 amounted to 25,000 rubles.

Operations for accrual and transfer of tax to the budget will be reflected in budget accounting in accordance with Instruction No. 162n[7] as follows:

| Contents of operation | Debit | Credit | Amount, rub. |

| Transport tax charged | 1 401 20 291 | 1 303 05 731 | 25 000 |

| Tax transferred to the budget | 1 303 05 831 | 1 304 05 291 | 25 000 |

Special cases

At the same time, there are some peculiarities in the formation of postings for various objects.

Capital investment in leased property

Options for the costs of repairing the leased property must be specified in the lease agreement - who will pay them among the parties.

If this is a tenant, and it is he who, by law, must maintain the property entrusted to him in proper condition, it is necessary to include such expenses in the reserve for repair expenses . By the way, you can include not only mandatory work to maintain the premises, but also capital work, if this is specified in the lease agreement or the landlord does not want to carry it out.

The cost of such investments is reflected in account 08 “Investments in non-current assets” . When the work is completely completed, the tenant writes off the accumulated amounts from the credit of account 08 and uses as a debit:

- account 01 , if capital investments are recognized as the property of the tenant;

- accounts 62, 76 , if capital investments become the property of the lessor.

If such investments, according to the agreement, are recognized as the property of the tenant, then they are accounted for as a separate inventory item .

If investments are inseparable from the object, then their repayment occurs through depreciation and is written off as the object is used over a certain period, for example, until the end of the lease.

In the event of non-payment by the lessor, the lessee, using the fixed asset classifier, attributes the costs of major inseparable repairs to the useful life of the premises or the useful use of improvements.

Fines and penalties

In case of incorrect calculation and reflection of tax amounts, the company risks being subject to penalties. The Federal Tax Service has the right to control the correctness of tax and accounting records:

- in case of incorrect reflection of amounts, an administrative penalty of 10,000 rubles is provided;

- in case of repeated error - 30,000 rubles;

- if during the calculation the base for deduction was reduced, the amount of the fine increases to 40,000 rubles.

Similar fines are collected if the procedure for entering tax records is violated.