Would you like to consult a lawyer for free? Write to the chat on the bottom right or call the hotline, calls within the Russian Federation are free.

Using the website of public services and the Pension Fund of Russia, it is possible to find out the size of your pension online using SNI, as well as view its funded part online. To do this, the user of the State Services website must have a personal account created and have a verified account.

Every year, the possibilities of receiving government services electronically on the Internet are expanding. The pension reforms ongoing in the country require expanding ways of informing the population about personal pension funds.

In 2021, there are several ways in which you can see the funded pension and the insurance part: the official website of government services of the Russian Federation, regional branches of the pension fund of the Russian Federation and multifunctional centers.

A citizen can find out his pension in real time using his personal account on the website of the Pension Fund and State Services. Unfortunately, this cannot be done without registration, so in case of difficulties, it is better to ask your loved ones for help.

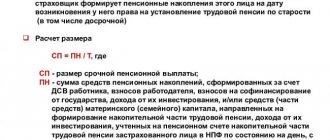

How is a pension formed?

The size of a citizen’s pension directly depends on his income and length of work.

The calculation of pensions includes not only activities under employment contracts, but also work under civil contracts and periods of entrepreneurial activity. The key condition is the deduction of insurance contributions for the formation of a future pension. Pension points and the amount of pension are influenced by several indicators:

- The insurance period is the periods during which a citizen was an insured person in the pension system. These are not only years of labor activity, but also periods during which a citizen could not work: maternity leave, unemployed period (through the labor center), social activities, etc.

- Earnings amount. The amount of contributions towards the formation of a pension depends on the amount of wages. The more earnings, the higher the amount of deductions. For employed citizens, contributions are paid by the employer. Self-employed people and traders pay their own contributions.

- IPC value. This is the number of pension points accumulated over a lifetime. Points are awarded on an individual basis, depending on the insurance period, salary and grace periods.

- Preferential grounds. Working under special conditions allows you to apply for payments ahead of schedule. All types of benefits are enshrined at the legislative level (Law No. 400-FZ). For example, representatives of preferential professions (medics, teachers, law enforcement officers), workers of the Far North, mothers of disabled children and others retire earlier.

- Amount of additional contributions. Citizens have the right to contribute additional funds to the formation of their future pension. Additional contributions are paid by the employer (voluntarily or compulsorily - by law).

- Age of application for benefits. Retirement may be delayed. That is, apply not at the time of retirement age, but later. Additional points are awarded for each year of deferment. The amount of payments increases.

The region of residence also influences the size of pension benefits. For example, special territorial coefficients and premiums are provided for residents of the Far North. Similar surcharges, but in a much smaller volume, are provided in other regions.

Find out the number of pension points according to SNILS

A card containing an eleven-digit individual code is an insurance certificate of registration of a Russian citizen with the Pension Fund. SNILS Find out the number of pension points according to SNILS. Pension savings: how to find out the amount according to SNILS in the Pension Fund Securing your future pension worries every working person. It is not easy for people to sort out their pension savings, especially in modern conditions, when the pension system has been undergoing serious reforms over the past few years. The principles by which savings are calculated have already been changed several times: The pension has been divided into two parts – insurance and savings. It has become possible to invest not only in state pension funds, but also in alternative pension funds. Funds for pensioners who continue to work are accounted for as a separate item. There are many innovations, and if a person gets lost in them, trying to understand what funds and where exactly are being accumulated for his future pension, SNILS can come to the rescue. So, first things first. How to find out pension savings by SNILS number online? Options for searching information about pensions using SNILS Information about funds in a current account in a state or non-state pension fund is confidential. However, the account holder registered with the Pension Fund or Non-State Pension Fund has full rights to it. This right is confirmed by the SNILS number located on the unified personal card. Therefore, this number is the key to obtaining information about pension savings. Citizens of the Russian Federation have several ways to clarify the issue that interests them. How to find out pension savings by SNILS number? Personal appeal to the Pension Fund. A visit to any branch of the Pension Fund can resolve many questions regarding pension savings. To do this, you need to have an insurance certificate (SNILS plastic card) and an identity card with you. The insured person will receive all the necessary information without any difficulties or delays. How to find out pension savings by SNILS number online without leaving home. Modern technologies make it possible to check your pension “balance” easily and simply: just be an Internet user and register on the government services portal. It is also possible to find information on the official website of the Pension Fund, the new version of which became operational in 2015. Non-state pension funds also have their own official websites, which inform clients about the status of their pension account. IMPORTANT! Information about the funded share of the pension, if it is placed in a non-state pension fund, will not be reflected on the government services portal. Requests for information of interest should only be made on the relevant official websites of certain NPFs. Find out the number of pension points according to SNILS. Instructions for checking pension savings online through “state services” Register on the “Government Services” portal (site https://www.gosuslugi.ru). To register, you will need to enter your last name, first name, mobile phone (or email). Previously, the key for registration was a card with a SNILS number, but now the registration procedure has been simplified. If you have previously registered on this portal, log in by entering your mobile phone (or email) and password. On the main page of the site, in the “Popular on the portal” block, select the “Check pension account” item or through the “Catalogue” select the “Notification of the status of a personal account in the Pension Fund of the Russian Federation”. On the page that opens, click the blue “Get service” button (you will have to wait a little). At the final stage, you will see a page where, in paragraph 2 “Information about the status of your individual personal account,” you can either save on your computer or open a file with information about your pension in your browser. You can also print this statement through your “Personal Account”. Find out the number of pension points according to SNILS. Find out about your future pension through the PFR website If you prefer to use a direct search for information by turning to the “original source,” then you can use the official PFR website. Since January 2015, there has been a new section “Personal Account of the Insured Person”. With its help, you can clarify how much IPC (individual pension coefficients) a citizen has accumulated, as well as what length of service he currently has. New user capabilities allow you to calculate approximate IPCs for each year. In addition, you have access to: an improved online pension calculator; the ability to print out the received notification about the status of the pension account; information about periods of work in a particular place and contributions accrued by certain employers. Residents of Dagestan can use two new electronic services of the Pension Fund. New services related to the provision of two public services have been launched in their personal account on the website of the Pension Fund of Russia: the appointment of professional supplements to pensions for former employees of civil aviation and the coal industry, as well as the appointment of additional material support for outstanding achievements and merit. Let us remind you that the right to a professional supplement to their pension is enjoyed by members of flight crews of civil aviation aircraft, including pilots, navigators, on-board engineers and mechanics, as well as employees of coal industry organizations, which, for example, include miners, drifters, miners and machinists. Additional material support for outstanding achievements and merits is awarded to Heroes of Russia and the Soviet Union, citizens awarded the Order of Merit for the Fatherland, the Order of Labor Glory, Olympic champions and some other categories. You can now submit an application for the specified types of payments from the Pension Fund electronically through the Pension Fund website using the services of your personal account. All electronic services of the Pension Fund of Russia are collected on a single portal es.pfrf.ru. To receive most services, a verified account in the Unified Identification and Authentication System (esia.gosuslugi.ru) is required.

Share news

Why check your pension savings?

All obligations to pay insurance coverage and provide reporting on the insurance period lie with the policyholder. But it is also important for citizens themselves to control savings. For example, the employer pays contributions only from the minimum salary, and transfers the rest of the salary in an envelope. This is a fairly common situation that has an extremely negative impact on the amount of your pension. A citizen is able to determine this on his own; it is enough to check his pension savings online using SNILS. If you have any questions, contact your employer for clarification.

In addition to problems with white and gray salaries, it happens that the employer submits incorrect information about the length of service to the Pension Fund. This will directly reduce points and the amount of your future pension. If the error is not corrected in a timely manner, you will have to confirm your experience in court.

And finally, monitoring your savings in the Pension Fund allows you to eliminate fraudulent activities with the funded part of your pension. Unscrupulous non-state pension funds fraudulently gain access to your savings. Getting your money back is quite problematic.

Is it possible to find out the size of your pension using SNILS online?

SNILS should be understood as the account number in the OPS system, participation in which is mandatory for all citizens working in the territory of the Russian Federation. It is to this account that funds sent to employers as contributions to an employee’s pension come.

Therefore, all data regarding the scope of pension rights of a particular citizen is linked to this number. Also, using SNILS, a citizen can find out the amount of pension savings and other payments through the Pension Fund.

Reference! The insurance number is indicated on a special green card, which until recently was issued to every citizen, starting from the moment of his birth. However, as of April 1, 2021, the Pension Fund of Russia stopped issuing this document, which means a gradual restriction of its circulation. However, the personal account number itself remains the same and is assigned to citizens from birth.

You can find out the amount of payments due using your insurance number either by arriving directly at the Pension Fund of Russia, be sure to have a document with you that confirms the identity of the applicant, or by using various online resources.

How to find out savings by SNILS number

There are several options available to check your pension points.

1. When contacting in person:

- to the territorial branch of the Pension Fund of Russia;

- “My Documents” office or MFC;

- territorial branch of the non-state pension fund to which the savings were transferred.

To obtain information you will have to present your passport and SNILS (insurance certificate). Otherwise, it is impossible to obtain information about pension savings. A citizen or his official representative by proxy has the right to do this.

2. Via the Internet:

- State Services portal;

- personal account on the Pension Fund website;

- personal account on the NPF website;

- Sberbank personal account.

Access to information will only be available after authorization. Logging into your personal account of any of the services is possible only under a personal account. Registration and official confirmation are required. For example, at the MFC, confirm your account on the State Services portal. The login and password to enter your Sberbank personal account will be issued at the branch or the nearest ATM.

In what cases may it be necessary to check SNILS

The need to check SNILS may arise for various reasons. Usually it is carried out if desired:

- make sure that the data specified in the application form is correct;

- check whether changes have been made to the document in accordance with the submitted application;

- get acquainted with existing savings;

- receive a statement of contributions made by the employer.

They are often checked by those who have submitted an application for the issuance or replacement of SNILS. Sometimes this service is used by employers who want to verify the authenticity of the insurance certificate of an applicant for a vacant position.

Checking for readiness

To check the readiness of SNILS, it is not necessary to visit a Pension Fund branch or a multifunctional center (MFC). This can be done remotely via the Internet. Despite the fact that the State Services portal does not allow you to issue a document, you can check its readiness through the website. A convenient way to check is to visit the official website of the Pension Fund of the Russian Federation.

Parents who issue a certificate for their minor children often ask the question of how to find out whether SNILS is ready for a child, via the Internet or other means. The official website of the Pension Fund offers visitors a complete list of telephone numbers of its branches. You can find out if they are ready by calling one of them.

How to check savings on government services

The single portal “State Services” allows you to resolve almost all issues without visiting government agencies and departments. To find out the size of your pension online using SNILS at State Services, it is enough to order an extract on the status of the individual account of the insured person.

SNILS on the government services portal will be needed at the registration stage. Check the insurance certificate number in the citizen’s personal data section. The user does not fill in this information. It is entered automatically upon registration. Later, SNILS will be required to verify the correctness of the generated data.

Instructions on how to work on the portal:

- Log in to “Government Services” using your account.

- In the “Popular on the portal” section, select “Notice on the status of a personal account in the Pension Fund of Russia”.

- Click the “Get service” button on the right side of the screen.

- We are waiting for the data to be generated. It will only take a couple of minutes.

- Print the completed information or save it in PDF format.

Study the information received. Pay special attention to the amounts of accrued wages and deductions made from employers. If there are disagreements or errors, you must contact the Pension Fund for advice.

IMPORTANT!

Check section 3 of your personal account statement at the Pension Fund. The name of the fund to which the funded part of the pension is transferred is reflected here. If you did not manage the funds, then VEB UK (ADVANCED) will be indicated in the statement.

If you did not transfer the funded part of your pension to a non-state pension fund, but section 3 of the statement indicates a non-state pension fund, then your savings were transferred fraudulently. It is necessary to resolve the issue with scammers; to do this, seek advice from the Pension Fund of Russia.

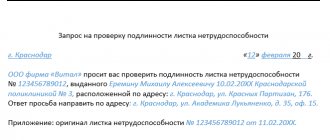

Verification methods and list of required documents

As we said earlier, insurance certificates are most often checked for authenticity and correctness of data. A simpler and more reliable way is to contact the Pension Fund branch. Authority employees will check the documents provided to them and answer all questions.

One of the most popular ways to check for correctness using the database of the Pension Fund of the Russian Federation is online checking. It is usually chosen by people who value their time and are active Internet users.

You can check for reality in various ways.

- use a check number;

- conduct a visual inspection of the document;

- contact a Sberbank branch for help;

- use the State Services portal.

You can also check the authenticity of an individual’s SNILS on the website of the Federal Tax Inspectorate. To do this, fill out a special form in which you indicate your full name, SNILS, passport details or birth certificate. Then send your request.

Each of the listed methods is relevant, so let's look at them in detail.

Visit to the Pension Fund branch

In order to conduct a check through the Pension Fund of the Russian Federation, you only need an insurance certificate and the applicant’s passport. The advantages of this method are that it is possible to ask questions of interest to fund employees.

Insured persons have the opportunity to send a letter to the Pension Fund to update their SNILS. Employees of the Pension Fund of the Russian Federation must clarify the information and provide a written response within 30 days.

How to use certificate check digits

We said that the personal account number displayed on the certificate consists of 11 digits, 2 of which are used to determine the authenticity of the document. Citizens often ask about who this method is suitable for. Unfortunately, not everyone.

It can only be used by holders of certificates with a number higher than 001-001-998. The algorithm for determining the 10th and 11th numbers is similar to the calculation of TIN check digits. The calculation is performed as follows:

- Each digit is multiplied by its position number. The countdown is from the right.

- The resulting numbers are summed up.

- If the result is a number less than 100, then it is the control number. But this is optional. The number may be greater than 101. In this case, the result is divided by 101. There should be no doubt about the validity of the certificate if, after the calculations have been performed, the result turns out to be 100 or 101. In such a situation, the check digits of the document will be 00.

The check number can be checked online.

Checking SNILS on the State Services portal

Government services are a service that allows you not only to order the necessary document or service, but also to obtain the necessary information. Every registered user on the website can check SNILS online via State Services by number. The portal is extremely convenient and understandable, which allows even less experienced Internet users to get a personal account without much effort.

To perform the check you need to do the following:

- Go to the website and select the “Service Catalog” tab at the top of the page.

- From the list that appears, select the “Pension, benefits and benefits” tab. Pension accruals and benefits for all categories of citizens.”

- Find the function “Notification of the status of a personal account in the Pension Fund of Russia”. After clicking on this link, registered users have the opportunity to proceed to filling out the request form.

- After entering the requested data, press the “Request service” button. The system will check the correctness of filling out the form, and if everything is done correctly, after some time the applicant will be sent a statement of personal account.

The site also allows you to check the validity of the insurance certificate. During the registration process, users are required to enter certain personal data in the form provided. If, after entering the number and clicking the “Save” button, a green checkmark appears next to the certificate data, it means that the system has verified the entered information and you don’t have to worry about the authenticity of the insurance certificate.

However, there are times when the system throws an error. The situation may arise not only due to problems with the document, so let's look at it in detail.

What to do if the site gives an error

When checking an insurance certificate, the site may display an error or puzzle the user with the message “SNILS is invalid, please check your data.” Don’t be afraid: State Services is a portal that thousands of people use every day. During its operation, various failures may occur.

Reasons why the site gives an error:

- Error when entering data into the form. Many users do not know that when entering a SNILS number, they need to skip dashes and spaces. This is the most common mistake when working with a website.

- System malfunction.

- There is a genuine problem with the evidence. Typically, such situations arise when obtaining or replacing a certificate. Errors may be made during the registration process, resulting in an invalidity message.

Changes to a citizen’s personal data are entered by Pension Fund employees into the database. Failure to update it in a timely manner may also cause difficulties during verification.

In this case, we recommend that you seek advice from the staff of the nearest branch of the Russian Pension Fund. To do this, you must have a certificate of insurance and identification with you. You can find out from PFR specialists why SNILS is not checked online and ask them to check the authenticity of the document.

Check through Sberbank of Russia

To check your insurance certificate, you don’t have to go to a branch of the Pension Fund or use online resources: the check can be done at Sberbank of Russia. To do this, the owner of the document needs to register in the information exchange system: come to the nearest branch of a financial institution with a passport and insurance certificate. After a simple registration, bank employees will provide the information of interest using the Sberbank Online system.

Visual inspection

Even the most experienced Pension Fund employee will not be able to guarantee, after a visual inspection of the insurance certificate, that he has a genuine document in his hands. An external study will only allow us to determine obvious inconsistencies between the document and the samples provided at the Pension Fund stands. Therefore, you cannot trust this verification method too much.

How to check savings on the website of the Pension Fund of the Russian Federation

Checking the amount of contributions for a future pension is implemented in the personal account of the Pension Fund. Special registration on the site is not required if you already have an account on the State Services portal. If you are not registered, then obtain a login and password from the territorial office of the Pension Fund of Russia.

When entering your personal account, the user immediately sees general indicators about pension savings, length of service and current insurer.

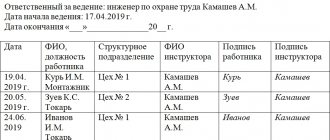

This information is not always sufficient for verification. For example, to check whether contributions are coming from your current employer, request a statement of your personal account. Instructions on how to find out the amount of pension savings according to SNILS in the PFR personal account:

Step 1. Select the “Get information” section.

Step 2. Select the action option of interest - “Get information about the status of an individual personal account.” Here you will learn the principles of calculating a pension or plan your future pension using a special calculator.

Step 3. The statement will be sent by email, which is linked to your personal account account. This will happen within a few minutes.

Step 4. Check the received statement. If there are errors in the form or incorrect information is provided, contact the Pension Fund for clarification.

The relationship between SNILS and insurance savings

Every working citizen in Russia has a SNILS. The presence of a document does not depend on the category of the person - it can be an able-bodied adult, a foreigner or a child working part-time. This document consists of a combination of numbers that are printed on a green laminated card. This set is the pension account number that identifies the person in the insurance system. Therefore, when it is necessary to check the status of accumulated funds, SNILS is used.

The document has 2 distinctive features:

- it remains unchanged throughout the person’s life, no matter what (change of surname, loss of documents, etc.). Each change is displayed in the form assigned to SNILS, and not in the number itself;

- SNILS is personal information that is unique. Thanks to this number, a person can be recognized in many electronic systems. The insurance certificate itself does not prove identity, but is only a representation of the insurance number of an individual personal account.

How to check savings through Sberbank

To enter your Sberbank personal account, you need a separate login and password. You can obtain the details at an ATM or at a bank service office. How to work with the Sberbank.Online service:

Step 1. Log in to the system using your username and password.

Step 2. To confirm security, an SMS with a code will be sent to your phone. Enter the code in the special field. Do not share your SMS number with anyone!

Step 3. After logging in, select the “Pension programs” section through the “Other” tab.

Step 4. Click the “Get statement” button.

Step 5. The system will offer to verify personal data. Please carefully check that all information about you is up to date. If everything is correct, submit your request.

Step 6. You must confirm sending the request via SMS. This service is free. Follow the instructions on the website.

After confirmation, the requested statement will be sent by email and will be available for downloading in your Sberbank personal account.

Brief summary

To avoid problems with pension savings and not become a victim of a fraudulent scam, you need to be able to check the document issued to you for validity and correctness of execution. If you have the slightest suspicion that something is wrong with your compulsory pension insurance insurance certificate, it is better to contact the Pension Fund and find out all the details.

Checking SNILS will not take much time and will not require any money, but it will help to avoid serious problems, especially since this will require only two documents - a passport and the certificate itself.

Other ways to check savings

There are other ways to get information about pension savings using SNILS. For example, through the website or office of a non-state pension fund. There are many services and applications on the Internet that provide similar services. Be careful, some services provide services for a fee.

If you are required to provide a phone number, the service fee will be debited from your balance. Use proven and free services: Gosuslugi, Pension Fund and Sberbank.Online.

Is it possible to check SNILS by last name?

Is it possible to check SNILS by last name?

Yes, you can. But this cannot be done online. You have two ways to check your SNILS by last name. In the first case, you just need to contact the Russian Pension Fund with your passport and make a request. Foreign citizens will be required to present any identification document. In the second, contact the HR department or accounting department at work. In small organizations, the accounting department usually does not even ask for documents, since all information about employees is always at hand. However, in large organizations an ID card will still be required.

Why is it necessary to check your pension savings yourself?

The need to independently check pension savings using the SNILS number arose due to the fact that in 2013 written notifications to all participants in the state pension insurance program were canceled. From that moment on, only those who wrote a special application receive notifications from the pension fund. Therefore, the SNILS number has become even more important and useful - it can be used to find out whether the employer makes contributions to the pension fund in good faith.

What to do if errors are found or deductions are not received

Any doubts or shortcomings in the extract received cannot be ignored. For any questions, please contact the Pension Fund. Take your passport and SNILS with you.

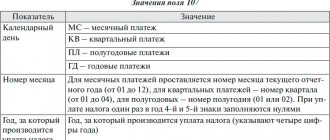

Please note when working with electronic services:

- Data on wages and length of service are updated quarterly, but only after employers submit quarterly reports in the DAM form. The deadline for submitting calculations for insurance premiums is the 30th day of the month following the reporting month. Before this period, information is not uploaded to the extract from the Pension Fund.

- Data on points are recalculated quarterly and at the end of the year, after employers provide the annual reporting form SZV-STAZH.

- If technical work is underway on the site, then ask for information later or personally visit the MFC and Pension Fund.

- If you change your personal data, you must check that your details are up to date in the system.

Solve other problems personally at the MFC or Pension Fund.

In what cases is SNILS considered invalid?

The most common problem that citizens encounter when checking an insurance certificate is when the last name, first name and patronymic do not correspond to the specified SNILS number. Such situations usually arise when personal data changes.

A certificate containing an error is considered invalid.

Both cases will entail quite serious problems not only for the owner of the document, but also for his employer. Any inaccuracy made during registration will lead to an error in the calculation of insurance premiums, because the employee’s SNILS was not found. As a result, the employer will no longer be able to make regular contributions to the employee's retirement account.

Paying taxes and other fees is the responsibility of every business owner to the state. Failure to comply with these requirements will result in penalties. And for the employee himself, an error not detected in time will result in him receiving a smaller pension. Therefore, an incorrect SNILS is a serious problem that needs to be eliminated promptly.