What it is

A payment order is considered a special type of administrative documentation, based on which a Savings Bank or other credit institution transfers funds from the client’s current account using the specified details. The reporting papers are filled out by the company's accountant or an employee of the Security Service of the Russian Federation.

The financial institution accepts orders of two types:

- Paper. The document is created in Word format, then printed on an A4 sheet;

- Electronic. A similar copy of the administrative paper is created on remote Internet resources, for example, in Sberbank Business Online.

Orders can be one-time or regular. In the first option, the payment card is considered invalid after the transaction. In the second, a constant transfer of funds from the client’s deposit is carried out after a certain time period.

In the payment order, field 107 is required to be filled in. It is also necessary to indicate the billing period for which insurance premiums are being transferred or the debt to the Federal Tax Service is being repaid.

Filling out line 107 when paying insurance premiums

Since the beginning of this year, the tax office has become the administrator of insurance premiums. In this regard, when registering payment slips for the transfer of contributions, column 107 in the payment order is filled out in the standard format - MS.XX.YYYY. If contributions for injuries are paid, 0 is entered in this field.

Similar articles

- Payment type in payment order 2017

- Reason for payment 106 explanation

- Basis of payment

- Order of payment in a payment order

- How to correctly fill out field 109 in a payment order?

Functions of the “tax period” field and payment order

Payments are required for the following transactions:

- Transfer of funds to counterparties as payment for goods or services;

- Transfer to state and non-state funds (for example, tax police);

- Settlements with credit institutions or replenishing deposits from an existing personal account;

- Financial transactions within the framework of signed agreements and concluded agreements;

- Mandatory regular payments: payment of utilities, telephone, Internet, payment of state duty, etc.

Column 107 is required to be filled out, since it indicates the billing period. It is displayed in the form of ten characters, the first eight digits are the period for which the fee is paid, the remaining two characters are the points delimiting the encoding points.

Example

The first two digits indicate the frequency of payment:

- MS – every month;

- KV – transfer is carried out once a quarter;

- PL – the transaction is carried out once every six months;

- GD - annual payments.

The next two digits specify the billing period. If the payment is made monthly, you must enter a number from 01 to 12, this indicates in which month you want to transfer the money. For quarterly cancellation, an indicator from 01 to 04 (quarter number) is indicated. For semi-annual transactions, encryption 01 or 02 is used, indicating in which half of the year the payment will take place. An operation carried out once a year does not require additional coding and is indicated as 00.

The remaining numbers are the year. For example, if you are transferring a payment to the Federal Tax Service for March of the current year, then the customs authority code in field 107 will look like this: MS.03.2018.

Indication of UIN and individual entrepreneur in the Application for cash expenses (abbreviated) (f. 0531851)

To fill out an Application for cash expense (abbreviated) (f. 0531851) for the transfer of payments to the budget system of the Russian Federation, as well as payments for state and municipal ones, the following operations are used in the document “Application for cash expense (abbreviated)”:

- Transfers to budget revenues (302 10, 20, 30, 70, 90);

- Taxes and fees included in expenses (303 01, 02, 05-13);

- VAT in relation to tax agent transactions (303 04);

- Taxes and fees paid from profit (income) (303 03-05);

- Transfer of funds to the budget to compensate for damage, shortages, receivables from previous years, etc.

When selecting the specified operations, details are available for filling out section 1 “Document Details” of the Application for Cash Expenses (abbreviated) (f. 0531851).

According to the letter of the Treasury of Russia dated December 19, 2013 No. 42-7.4-05/5.3-836 on the “Application” tab of the document “Application for cash expenses (abbreviated)”

- in the “Base document” field you should enter the text “UIN”;

- in the “Number” field you should enter the 20-digit UIN number;

- The “Date” field should not be filled in.

Rice. 5

The payer ID is indicated in the same way as in the “Application for Cash Expense” document, on the “Tax Payment” tab. When specifying code 19 in the line “Taxpayer status (101)”, you should enter the individual entrepreneur code in the line “Number of the basis document (108)”, in the left or right field (Fig. 3).

This information will be reflected in the relevant sections of the printed form “Application for cash expense (abbreviated)” and in the upload file.

During the transition period from January 1, 2014 to March 31, 2014, in settlement and payment documents for payments to the budget system of the Russian Federation, as well as payments for state and municipal services, the following identifiers are indicated:

- UIN – in the details “Purpose of payment”;

- Individual entrepreneur – in the “Number of the basis document (108)” (Fig. 3).

When selecting the specified operations, the “Base Document” tab is available, on which the details for filling out section 2 “Base Document Details” of the Application for Cash Expenses (f.0531801) are indicated.

According to the letter of the Treasury of Russia dated December 19, 2013 No. 42-7.4-05/5.3-836, in the “Type of document” column, the text “UIN” is indicated by choosing from the directory “Types of primary documents”, the corresponding position must first be entered into the directory.

In the “Number” column you should enter the 20-digit UIN number, the “Date” column is not filled in, and in the “Subject of the basis document” column you should enter a dash.

Rice. 2

The payer ID is indicated on the “Tax Payment” tab of the “Application for Cash Expense” document.

When specifying code 19 in the line “Taxpayer status (101)”, you should enter the individual entrepreneur code in the line “Number of the basis document (108)”, in the left or right field.

Rice. 3

This information will be reflected in the relevant sections of the printed form “Application for Cash Expenses” and in the upload file.

Rice. 4

Field 106, when to fill it out

This column is intended to indicate the basis for the transfer. Is it possible to leave it blank? No! In line 106 you must write one of the following values:

- TR – requirement for payment from the tax police;

- RS – installment repayment;

- FROM – date when the deferred transfer ends;

- RT – calculations according to the debt restructuring schedule;

- IN – repayment of investment loan;

- PR – covering a debt suspended for collection.

In column 107 indicate the period indicated in line 106. If the basis is an audit report from the tax inspectorate, then zeros are entered in field 107.

Here is OKTMO

The OKTMO code is given in field 105 in accordance with the All-Russian Classifier of Municipal Territories (approved by Order of Rosstandart dated June 14, 2013 No. 159-ST). It replaced the OKATO code.

This code can consist of 8 or 11 characters:

- 8-digit is indicated when taxes either go entirely to the regional budget, or partially or completely to the budgets of municipalities (urban or rural settlements);

- 11-digit is given if taxes are distributed between settlements included in municipalities.

The OKTMO in the payment order must correspond to the OKTMO specified in the tax return.

We talked about the nuances of indicating OKTMO in payments here.

Incorrect completion of line 107

Be that as it may, the payment order is filled out by a person, so it is impossible to completely eliminate the risk of error. If the column is filled in incorrectly, this is not a reason to refuse payment.

If an error is detected, the payer can contact the nearest tax police department with a statement about the error. You must have a duplicate of the payment with you. The application is written in free form. Based on the results of the appeal, Federal Tax Service employees draw up a report and correct the translation.

Structure and purpose of props

When transferring payments for taxes, fees, contributions and other types of fiscal payments, take into account the special procedure for filling out a payment order. So, for example, to pay money to the Federal Tax Service, you will have to fill out special fields in the payment slip: tax line (fields 104 to 110 inclusive).

Field 107 is the tax period in the payment slip, 2021 - the format of this detail is presented as follows: “ХХ.ХХ.ХХХХ”, where the alphabetic and numeric values of the code are separated by dots.

The key purpose of the code is to determine for what period the settlement with the Federal Inspectorate is carried out. For example, when funds are received into a current account, tax authorities must know exactly in favor of which reporting period to credit the funds.

Tags: loan, tax, order, expense, transport

How to fill out a payment order in Sberbank Business Online

To start working with Internet banking, follow the link https://sbi.sberbank.ru. Carry out the authorization procedure. On the main page in your Personal Account, select the “Ruble Transactions” category. It is located in the quick access menu, which is on the left side.

In the “Payment orders” section, a window with filters will open, where you can find completed payments and select the appropriate option. This will eliminate the need to re-enter details and save time.

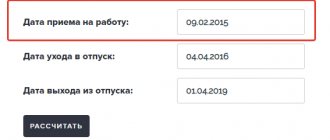

If such a payment has not been made before, click on the “Create a new document” link. Here you will have to fill in all the fields (billing period, amount to be written off, etc.). Before creating a payment order, check that the information entered is correct. Make sure that tax period 107 in Sberbank Online is filled out correctly.

The completion of the payment order formation will be the choice of execution order. This is convenient if you create several documents at the same time. The fact of write-off is confirmed via SMS or electronic signature of the manager (chief accountant).

Payment information

A payment order is the main document used by organizations for non-cash payments. Its form and composition of details are determined by the regulation of the Bank of Russia “On the rules for transferring funds” dated June 19, 2012 No. 383-P. It is acceptable to draw up instructions in electronic form and on paper.

The fields of the payment order are presented in the figure below.

Let's look at the detailed procedure for filling out the payment fields.

This is field 101. It is filled in on tax bills. The list of status codes is given in Appendix 5 to the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Basic codes:

- 01 - taxpayer (payer of fees) - legal entity;

- 02 - tax agent;

- 08 - payer-legal entity (IP) paying insurance premiums and other payments to the budget system of the Russian Federation;

- 09 - taxpayer (payer of fees) - individual entrepreneur;

- 14 - taxpayer making payments to individuals;

- 24 - an individual payer who pays insurance premiums and other payments to the budget system of the Russian Federation.

The following fields are provided for it:

- 8 - it provides the full or abbreviated name of the legal entity, full name of the entrepreneur and his legal status, or full name and indication of the type of activity of private practitioners;

- 60 - TIN;

- 102 - checkpoint.

After indicating the payer, his bank details are given:

- account number - field 9;

- bank name - field 10 (filled out only in a paper order);

- BIC - field 11;

- bank correspondent account - field 12.

For the payee, you must provide the same information as for the payer, only in a slightly different order. First, his bank details are indicated: bank name (in a paper payment), account number, BIC and corr. score (fields 13, 14, 15 and 17).

IMPORTANT! Be careful when specifying your bank! If you make a mistake, the tax (contribution) may be declared unpaid (clause 4 of Art.

45 of the Tax Code of the Russian Federation). This means that penalties will be charged.

After the bank details, information about the recipient is provided: his name, TIN and KPP (fields 16, 61 and 103).

The TIN and checkpoint can be found on the websites of the Federal Tax Service of Russia and the Social Insurance Fund.

Read about where to find out the details for tax payments here.

In orders to transfer money to counterparties, only the purpose of the payment is indicated: the account or agreement number, for which VAT is paid (this is field 24).

In payments for taxes and contributions, fields 104–110 are also required to be filled in. In this case, you need to be guided by the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n. Let's look at these fields further.

Regulation No. 383-P of the Central Bank of the Russian Federation dated June 19, 2012 approves the form and appearance of the payment order. Therefore, in all financial organizations of the Russian Federation the document form looks the same. The regulatory act also establishes the rules and procedure for filling out the fields of payment slips. The tax document number in the payment order is no exception. It is indicated in field 108, which is located in the very bottom line on the right.

The document number in the payment order is transferred from the document officially received from the tax office. The column must be filled out if payment is made to the state budget. If the payment card has a different purpose and the bank specialist sees field 108 filled in, the money transfer will not be made due to an error, and the client will receive a refusal.

Filling out details “107” in the payment slip for personal income tax on premiums

The date of actual receipt of income in the form of monthly bonuses, which are an integral part of wages, is recognized as the last day of the month for which the specified income was accrued.

Thus, when paying personal income tax on monthly premiums, for example, for November 2021, “MS.11.2020” is indicated in detail “107”, since the frequency of payment of this tax payment is a month.

For quarterly and annual bonuses for employees, detail “107” indicates the month in which the bonus was paid.

So, if the bonus for 2021 is paid in February 2021, then “MS.02.2021” is indicated in detail “107”.

Also on topic:

Payment of annual bonus to employees