General rules for filling out form 6-NDFL

The rules for filling out section 1 in 6-NDFL are prescribed in the order of the Federal Tax Service dated October 14, 2015 No. MMV-7-11/450.

The calculation is presented for the 1st quarter, half a year, 9 months and a year. All indicators in section 1 are shown in total for all individuals who received income in the reporting period. The section consists of two parts. IMPORTANT! Starting with reporting for the 1st quarter of 2021, Form 6-NDFL will change significantly. It will combine the calculation of 6-NDFL and the 2-NDFL certificate. In this article we will tell you how to fill out the final report for 2021 using the form from Order No. ММВ-7-11/450.

The first part, lines 010–050, contains information about the tax rate, income, deductions and tax amount. Data are presented for the entire period since the beginning of the calendar year. When paying income taxed at different rates during the reporting period, the block is filled in as many times as personal income tax rates were applied.

The second part, lines 060–090, indicates the total number of people to whom income was paid, and data on tax withholding and refund. The information presented here informs about all personal income tax rates applied this year. Therefore, these lines are filled in only once, on the first page of the section.

Report 6-NDFL for 2021

In 2021, the version of form 6-NDFL, approved by Order of the Federal Tax Service dated January 17, 2018 No. MMV-7-11/18, is in effect. Starting from the first quarter of 2021, Form 6-NDFL will change; we will describe how to fill out the new calculation below.

Report form 6-NDFL for 2021 consists of:

- title page;

- section No. 1 with generalized indicators;

- section No. 2 with the dates and amounts of income actually received and personal income tax that needs to be withheld.

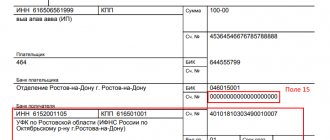

Filling out the title page

Enter the tax identification number and checkpoint of the organization submitting the report. If the report is submitted by a branch, then you need to enter the branch checkpoint. Entrepreneurs, lawyers, and notaries enter only the TIN.

In the line “Reporting period (code)” enter the code:

- 1st quarter 2021 - 21;

- 2 quarters (6 months) of 2021 - 31;

- 3 quarters (9 months) of 2021 - 33;

- 12 months - 34.

The tax period in this case is the reporting year “2020”.

In the “Adjustment number” field, enter “000” - if this is the first report, “001” - if this is a report after clarification, “002” - the second clarification, etc.;

“By location (code)”: code of the tax authority at the place of registration of the business. The first two digits indicate the region code, the second two indicate the code of your Federal Tax Service.

Code by location (accounting) in accordance with Appendix 2 to the filling procedure: write 120 for individual entrepreneurs, 214 for organizations, 220 for separate divisions.

We indicate the abbreviated name of your organization (if it has one) and its legal form. If you are an individual entrepreneur, you must provide your full name. Enter the OKTMO code (municipal body) in whose territory your company was registered.

Important! All lines on the title and other pages are filled in with either values or dashes. You cannot indicate negative amounts in 6-NDFL.

Filling out section No. 1

The data in this section is filled in with a cumulative total from the beginning of the year and is taken from each 6-NDFL certificate. For each bet, you need to calculate a separate cumulative total and fill out a separate section 1.

- 010: first enter the tax rate (13%). If several tax rates were used during the reporting period, you need to compile the same number of copies of the first section. Please indicate each bet in field 010;

- 020: we enter all taxable income of employees in increasing amounts from the beginning of the year. When filling out, we focus on the date of receipt of income for personal income tax purposes, and not on the accrual date. In line 020, do not include completely non-taxable income and income of employees that are below the taxable limit, for example, financial assistance in the amount of 2,000 rubles. Dividends paid must be reflected in line 025.

- 030: we record standard, property, social, professional and investment tax deductions, if they are due to employees, on an accrual basis from the beginning of the year. Immediately indicate other amounts that reduce the tax base under Art. 217 of the Tax Code of the Russian Federation, if income is exempt from tax within the standard.

- 040: this paragraph contains the calculated personal income tax. 040 = 010 × (020 – 030). On line 045, highlight the personal income tax accrued on dividends since the beginning of the year.

- 050: enter the amount of fixed advances paid to foreign employees. If you don’t have them, write 0. This amount cannot be more than the amount of the calculated tax.

- 060: we record the number of employees who have received income since the beginning of the reporting year. It is necessary to indicate the real number of income recipients, and not just those with whom an employment contract has been concluded. If one person gets a job with you twice in a year or receives income at different rates, he appears as one income recipient.

- 070: write the total amount of taxes that were withheld for 2020. Note that lines 070 and 040 may not be the same. This may not be a mistake: it’s just that sometimes taxes can be accrued earlier than they are withheld from employees.

- 080: we pay all non-withheld personal income tax amounts for the year.

- 090: returned tax that was over-withheld or recalculated at the end of the tax period. It doesn't matter when the tax was withheld.

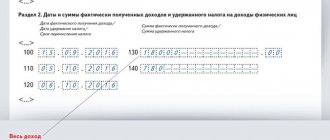

Filling out section No. 2

This section contains information for the latest period: time of payment of income to employees, transfer of personal income tax. Transfer dates are indicated in chronological order. Let's look at the lines in this section individually:

- 100: we write the day when employees actually received income. If there were several transfers for one employee that day, they must be summed up. The transfer date depends on the type of payment to the employee. If this is a salary, then it will become the employee’s income on the last day of the month of its transfer. That is, you can indicate, for example, May 31, but the person will receive their salary in June. In this case, vacation pay and sick pay will become income on the day the employee receives them. The day of payment of financial assistance is also the day of receipt/transfer of income.

- 110: write the day, month and year when the tax was withheld. Personal income tax for an employee from vacation pay, wages, sick leave, financial assistance (from the taxable part), remuneration for work and services, as well as other payments in favor of the employee must be withheld on the day the income is transferred.

- 120: in this line we write the date of transfer of personal income tax to the state budget. As a rule, this is the day that follows the payment day. But, for example, for sick leave and vacation pay - the last day of the month in which the money was paid.

- 130: we write income before personal income tax was withheld, received on the date indicated in line 100.

- 140: indicate the personal income tax required for withholding, take the date from each line 110.

If different types of income were received on the same date, for which the transfer deadlines differ, then lines 100-140 are filled in for each transfer deadline separately.

If the tax base has been reduced by the amount of tax deductions, then the tax must be reflected taking into account the deductions. The personal income tax amount on line 140 must be equal to the amount paid to the budget.

What indicators should I fill in with a cumulative total?

Personal income tax is calculated on an accrual basis from the beginning of the calendar year. Section 1 of 6-NDFL reflects summary data on all income accrued for the reporting year, calculated and withheld personal income tax amounts. Accordingly, in section 1 6-NDFL all total indicators are filled in with a cumulative total: lines 020–050 and 070–090.

Line 020 reflects the total taxable income calculated in the reporting period. The amount of dividends paid as of the reporting date is allocated from line 020 to line 025. Line 030 reflects the amount of deductions provided accumulated since the beginning of the year. Lines 040, 045 summarize the personal income tax calculated for the reporting period. The amount of the fixed advance payment paid during the calendar year is recorded in line 050. Lines 070, 080, 090 accumulate personal income tax withheld, not withheld and returned in the reporting period, respectively.

Video: payment of personal income tax from an advance

The process of submitting 6-NDFL is often accompanied by difficulties in filling out this document correctly. One of the most frequently asked questions is the salary advance in 6-NDFL. That is why it is important for financial specialists to understand the explanations of tax specialists and use them in their daily work.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

How to determine the amount of income

Determining the amount of accrued income is one of the difficulties that arise when filling out Section 1 of 6-NDFL. The fact is that the concept of “accrued income” in accounting differs from the norms of Chapter. 23 Tax Code of the Russian Federation. Determining the amount of income that should be included in the calculation must be guided by Art. 223 Tax Code of the Russian Federation.

For example, wages are reflected in section 1 in the period of their accrual, as in accounting, and sick leave and vacation pay - in the payment period. Material benefit is in the period of its accrual, while in accounting there is no such concept at all.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Payment under GPC agreements is included in the report when money is paid out. It does not matter whether the work is completed or an advance is transferred. Conversely, completed but unpaid work is not shown in section 1.

The date of receipt of income in kind should be determined according to the norms of the Civil Code of the Russian Federation: income arises at the moment of transfer of ownership.

The Ministry of Finance and the Federal Tax Service for a long time could not decide on the procedure for including bonuses in Section 1 of 6-NDFL. According to the latest version of the departments, one-time bonuses not related to performance are included in the calculation on the date of payment, monthly bonuses for performance are taken into account along with the salary, quarterly and annual bonuses are taken into account on the date of the bonus order.

Obviously, accounting data is not enough to prepare a calculation in Form 6-NDFL - all the necessary information should be taken from special tax registers for tax. The maintenance of such registers is provided for in paragraph 1 of Art. 230 Tax Code of the Russian Federation.

Filling lines 010–050

Filling out begins by indicating in line 010 the tax rate at which income was taxed.

Next, line 020 reflects the total amount of taxable income accrued for the reporting period related to the rate from line 010. Payments that, in accordance with Art. 217 of the Tax Code of the Russian Federation are not fully taxed; they do not need to be shown in line 020.

Line 025 reflects the amount of dividends paid.

If deductions were applied to taxable income, their cumulative total is recorded in line 030. The line takes into account all types of deductions. This also includes the non-taxable portion of the cost of gifts and prizes. The list of tax deductions can be found in the order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/387. The indicator cannot be greater than the tax base.

Line 040 records the amount of calculated tax at the appropriate rate. The indicator is calculated using the formula: (p. 020 − p. 030) × p. 010.

Line 045 additionally shows the dividend tax equal to line 025 × line 010.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

The block is completed by the amount of a fixed advance payment, which must be indicated in line 050. The line is filled in by employers of foreigners working on the basis of a patent and who have the right to reduce personal income tax by the amount of payments made under the patent (Article 227.1 of the Tax Code of the Russian Federation). The amount cannot exceed the indicator in line 040.

Filling lines 060–090

Line 060 indicates how many people received income in the reporting year. Each citizen is counted once, regardless of the type of income received and the number of hires and dismissals.

Line 070 contains information about the amount of tax withheld when paying income from the beginning of the year. This includes only those amounts that were actually withheld upon actual payment. So, for example, amounts of personal income tax on wages accrued on the last day of the reporting period, but not yet paid, are shown in line 040, and are not included in line 070.

If it is not possible to withhold tax when paying income, the unwithheld amount is reflected in line 080. Please note that personal income tax on unpaid wages for the last month of the period is not shown in this line. Information about tax not withheld during the calendar year must be reported to the inspectorate by March 1 of the following year.

The last line 090 reflects the amount of personal income tax returned to the individual, which was previously over-withheld. Excess withholding may arise, for example, in connection with a taxpayer's claim of a deduction.

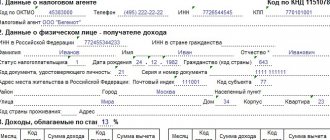

An example of filling out section 1 of form 6-NDFL

Let's look at how Section 1 of 6-NDFL is filled out using an example.

Example

In the accounting of Rodnik LLC for 2021, the following data was collected for all individuals:

- wages accrued in the amount of RUB 3,119,000, including RUB 450,000 not paid as of the reporting date;

- sick leave payments were accrued in the amount of 7,500 rubles, including 3,500 rubles paid;

- 325,000 rubles were paid under GPC agreements with individuals, including 320,000 rubles for completed work, prepayment 5,000 rubles;

- in the 4th quarter, LLC participants (residents of the Russian Federation) were paid dividends accrued by decision of the meeting - 350,000 rubles;

- gifts worth 53,000 rubles were given, including one gift worth 3,000 rubles. and two for 25,000 rubles, all gifts were given to different employees;

- provided standard deductions of 25,200 rubles;

- number of people who received income, 8;

- unwithheld personal income tax RUB 6,370;

- withheld personal income tax RUB 525,231.

In section 1 of form 6-NDFL for the year, Rodnik LLC will record the following indicators:

- line 010 – 13%;

- line 020 - 3,847,500, that is: 3,119,000 + 3500 + 325,000 + 350,000 + 50,000 (the calculation does not include unpaid sick leave and gifts, the cost of which does not exceed 4,000 rubles);

- line 025 - 350,000;

- line 030 - 33,200 (25,200 + 4000 × 2) - the non-taxable part of the cost of two gifts is added to the amount of deductions;

- line 040 - 495,859, that is (3,847,500 − 33,200) × 13%;

- line 045 - 45,500, that is (350,000 × 13%);

- line 060 - 8;

- line 070 - 525 231;

- line 080 - 6370.

An example of how to reflect an advance in 6 personal income taxes

Let's look at examples of filling out 6 personal income taxes with an advance in various situations.

Example 1

Klubnika LLC registered as a legal entity in January 2020. For the first quarter the following accruals arose:

- January 25 – advances to staff in the amount of 200,000 rubles;

- February 10 – salaries of 250,000 rubles.

Let us assume that there were no other payments during the period. How is it reflected in payroll calculations:

- column 100 – date of actual receipt of income – January 31, 2020; because the moment of payment is considered the last day of the month;

- column 110 – tax withholding date – February 10, 2021; since the form records the actual day of payment of tax to the Federal Tax Service for January;

- column 120 – tax payment date – February 11, 2021;

- column 130 – amount of income actually received – 550,000;

- Column 140 – amount of tax withheld – 71,500.

Let's look at the procedure in the case of a specific employee.

Example 2

Borisov Yuri works as a security guard. On January 23, 2021, he received an advance in the amount of 16,000, and on February 6, he was credited with the rest of his salary in the amount of 20,000 rubles. In total, he earned 36,000, of which the employer withheld 13% tax - 4,680 rubles. Consequently, on February 6, Borisov was given 15,320 rubles.

To simplify, let’s assume that the security guard had no other income during the quarter. What we write down in 6 personal income tax:

- line 100 – 01/31/2020;

- line 110 – 02/06/2020;

- line 120 – 02/06/2020;

- line 130 – 36,000;

- line 140 – 4,680.

Conclusion: the salary is recorded by the date of the month for which it was accrued, even if it was actually issued in the next month.

So, Borisov received the rest of his earnings for January on February 6, but all income for January is recorded as received on January 31, but the dates of tax withholding and transfer are real - on the day of the transaction from the current account or the issuance of money from the cash register.

Note! Completed Form 6 Personal Income Tax must be submitted electronically if it includes more than 10 employees. For employers with up to 10 employees, the right to submit reports on paper is retained.

Owners of electronic signatures with enhanced qualifications send reports to the Federal Tax Service online, through the personal account of an individual entrepreneur or legal entity, or through another TCS,

How to identify and correct errors

You can check on your own the correctness of the calculation using the tax inspectorate algorithms using letters from the Federal Tax Service dated March 10, 2016 No. BS-4-11/3852 and dated November 1, 2017 No. GD-4-11/22216. The control ratios contained in them make it possible to identify not only the inconsistency of indicators within the 6-NDFL form, but also to verify the calculation with the 2-NDFL certificates.

What to do if errors in the submitted form 6-NDFL in section 1 could not be avoided? If the inaccuracy led to the incorrect reflection of the amount of tax or other information, you will have to submit an updated calculation. The law obliges tax agents to correct the submitted data, regardless of how the distortion affected the declared tax amount. This rule is contained in paragraph 6 of Art. 81 Tax Code of the Russian Federation.

When preparing the clarification, you must keep in mind that if, after sending the form for the year, an error was discovered in the report for the half-year, you must submit three adjustments: for the half-year, 9 months and a year, respectively (letter of the Federal Tax Service dated July 21, 2017 No. BS-4 -11/14329). This is due to filling out the indicators in section 1 with a cumulative total.

How to submit 6-NDFL to a merchant combining regimes

An entrepreneur’s combination of OSNO or simplified tax system with UTII or PSN is a reason to figure out how to submit 6-NDFL.

Important! UTII has been canceled from 01/01/2021.

The general approach is taken as a basis: 6-NDFL is submitted to the inspectorate at the place of registration. But one nuance must be taken into account: when combining regimes, there may be several places of registration (clause 7 of Article 226 of the Tax Code of the Russian Federation), so the merchant must submit at least 2 reports:

- the first 6-NDFL with data on income paid to employees engaged in activities taxable under OSNO or USN - to the inspectorate where the businessman is registered as an individual entrepreneur (at his place of residence);

- the second report is sent to the inspection, on the territory of which the activities of the individual entrepreneur, transferred to UTII, PSN, are carried out. It must reflect income paid to employees associated only with these types of activities.

This issue is discussed in more detail here.