06.06.2019

0

266

6 min.

Each economic entity of the Russian Federation provides various types of reporting to regulatory authorities: based on the results of the month, quarter, half year, for nine months and a year. The article below provides information about the features of filling out and entering data on reflecting contract agreements in the report on Form 6 personal income tax.

Introduction

The relationship between the customer (organization) and the contractor (performer) is formalized by a civil contract. The contract reflects the responsibilities of the contractor - to complete the scope of work, and the customer - to accept and pay for the work in accordance with the acceptance certificate. In addition, the customer is required to reflect the accrued and withheld tax in the calculation.

Each type of profit that individuals receive. persons are subject to taxation. Personal income tax is calculated from each income. The difference between the GPC and the employment contract is only in the date of reflection of the receipt of profit. According to the employment contract, this is the last day of the accrual month.

General rules of reflection

According to the norms of the Tax Code of Article 223, paragraph 1, subparagraph 1, the day of reflection of profit under the GPC is the date of receipt. In part 1 of the declaration, line 020, information about earnings is reflected in the period on the day of payment.

Income is calculated on the day of receipt of profit under a legal contract (TK Article 226, paragraph 3). The day of payment is considered the day when income is paid through the organization's cash desk or transferred to the current account of an individual (Tax Code Article 223, paragraph 1).

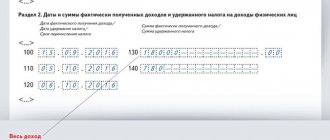

In column 100 of the second part of the report indicate the number of actual receipts of income.

Withholding of personal income tax from profits received under GPC agreements is calculated on the day when the income is paid. Accordingly, the dates indicated in cells 100 and 110 of the second part of the calculation will be the same.

To transfer tax, you must be guided by the general requirements of the Tax Code:

- Article 226 clause 6 paragraph 1;

- Article 6.1 clause 7.

The transfer of tax must be made no later than the day following the date of payment under the GPC agreement.

6-NDFL and GPC agreement

Civil law contracts include contracts for the provision of services on a reimbursable basis (for example, renting property from an individual), etc. They are agreements in which a private person - contractor/contractor/lessor, undertakes to perform a set of works specified in the contract or provide certain services , and the customer must accept and pay for them.

Payment under a GPC agreement is income subject to personal income tax, so the customer has the obligation of a tax agent. He must accrue the payment amount to the contractor, withhold and transfer personal income tax from it, and also notify the Federal Tax Service about the conduct of these operations, i.e. fill out form 6-NDFL.

Contract agreement and 6-NDFL: basic provisions

A work contract is one of the types of civil law agreements (GPC), in which:

- the contractor (performer) has the obligation to perform the work stipulated by the contract according to the customer’s instructions;

- The customer assumes the obligation to accept the results of the work performed and pay for it.

Payment for “contract” work is income subject to personal income tax for the contractor. For the customer, the payment of such income is associated with the performance of the duties of a tax agent and the reflection of this “contract” payment in 6-NDFL.

Find out what to pay attention to when concluding a contract in this article.

To reflect “contract” income in 6-NDFL, the following data will be required:

- the cost of “contract” work - it falls on page 020 of section 1 of the report;

- calculated and withheld personal income tax - it is reflected on lines 040 and 070;

- in section 2 of the report, blocks pp. 100–140 are filled in for each date of “contract” payments (they will be discussed in more detail later).

In order for “contract” payments to be reflected without errors in 6-NDFL, you should remember the following tax requirements:

- all payments under the contract (including advances) are subject to reflection in 6-NDFL (clause 1 of Article 223 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 26, 2014 No. 03-04-06/24982);

- the data in section 1 of the report is presented on an accrual basis, in section 2 - for the last 3 months of the reporting period;

- the date an individual receives “contract” income - the day it is transferred to the card or money is issued from the cash register (letter of the Federal Tax Service of Russia dated July 21, 2017 No. BS-4-11 / [email protected] , see more details here ), including the date of issue advance payment to the contractor ;

- The deadline for transferring personal income tax is no later than the day following each “contract” payment.

Find out the nuances of a contract from the perspective of international standards from the article “IFRS No. 11 Contracts - application features” .

Tax deductions and payments under GPA in 6-NDFL, delivery to a separate division

In Form 6-NDFL, Section 1 “Generalized Indicators”, indicate the total amount of accrued income, deductions provided, as well as the total amount of accrued and withheld tax. Fill it out with a cumulative total from the beginning of the year (letter of the Federal Tax Service of Russia dated February 18, 2021 No. BS-3-11/650). For example, in section 1 for the half-year, reflect the indicators for the period from January 1 to June 30 inclusive.

Experts from the magazine “Salaries in an Institution” found out where accountants most often make mistakes when filling out the 6-NDFL report. Test your knowledge of the rules for issuing 6-NDFL with a test in the magazine.

In section 2, list all transactions in chronological order. Don't group them by tax rates. In this section, show:

- dates of receipt and withholding of tax,

- deadline for transferring taxes to the budget,

- the amount of income actually received and personal income tax withheld.

Tax deductions in 6-NDFL

In section 1 of the calculation on line 020, reflect all employee income on an accrual basis from the beginning of the year. Focus not on accruals in accounting, but on the date of receipt of income for personal income tax purposes.

In line 030, show the total amount of standard, property and social deductions that you provide to employees. Also reflect deductions for financial assistance, gifts, etc. here.

For example, an employee received several gifts during the year with a total value exceeding the non-taxable limit (RUB 4,000). The deduction amount is 4000 rubles. Write down on line 030, and on line 070 reflect the amount of tax withheld.

If it was not possible to withhold personal income tax, then show it in line 080.

When you fill out section 2, on line 130 indicate the income that was accrued to the employee in the reporting period. There is no need to reduce it by deductions.

Useful material in the article

Form 6-NDFL in 2021

Download

Standard deductions in 6-NDFL

An employee with a child has the right to receive standard deductions until the month in which the employee’s salary, calculated on an accrual basis, does not reach 350 thousand rubles. As soon as the employee’s total income reaches the limit, do not provide a deduction.

If an employee has not been working in an institution since the beginning of the year, then his income from his previous place of work must be taken into account. To do this, ask him to provide a 2-NDFL certificate from his previous employer.

How to reflect deductions for children in 6-NDFL:

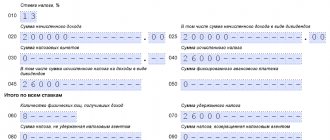

Example 1

The teacher receives a standard tax deduction for a third disabled child. Employee salary – 40 thousand rubles. Deduction – 15,000 rubles. (3000 + 12,000). Income from January to May amounted to 200 thousand rubles, and deductions - 75 thousand.

Property deduction in 6-NDFL

An institution has the right to provide a property deduction to an employee according to two documents:

- Application for property deduction;

- Notification from the tax office.

An employee has the right to apply for a deduction at any time. In this case, the tax paid since the beginning of the year must be returned to the employee. Since the right to deduction arises from the beginning of the year, even if the notification is provided in the middle of the year, for example, in June. The question arises, is it necessary to submit an updated 6-NDFL calculation? There is no need to submit updated calculations for previous quarters.

Reflect the deduction for the period in which the employee brought the notice from the Federal Tax Service. There is no need to clarify the form for previous quarters, since there are no errors in them and the calculations were made correctly. Tax officials came to this conclusion in their letter dated April 12, 2021 No. BS-4-11/6925. And indicate the personal income tax that was returned to the employee on line 090 of Section 1 of form 6-NDFL on a cumulative basis from the beginning of the year.

How to reflect a property deduction in 6-NDFL:

Example 2

In May 2021, the employee brought a notice from the Federal Tax Service and his application for a property deduction.

The amount of property deduction is 500 thousand rubles.

The employee's income from January to April 2021 amounted to 240 thousand rubles. Personal income tax was withheld from them in the amount of 31,200 rubles. (240,000 × 13%).

The accountant recalculated personal income tax from the beginning of the calendar year and returned 31,200 rubles to the employee. In May and June, the employee’s income amounted to 70,000 rubles each. In total, the employee received 380 thousand rubles for the period from January to June. (240,000 + 140,000). This amount is less than the declared deduction, so the employer did not withhold personal income tax from the subordinate’s salary (380,000

The accountant did not submit the updated 6-NDFL calculation form for the 1st quarter of 2021. And reflected the deduction in the calculation of 6-personal income tax for the first half of 2018.

Reflect deductions for treatment and education in the same way. But in this case, do not recalculate the tax from the beginning of the year (clause 2 of Article 219 of the Tax Code of the Russian Federation).

How to reflect remuneration for GPA and GPC in 6-NDFL

Remuneration to the contractor for GPD, GPC is also subject to personal income tax

The date of income for 6-NDFL and the date of tax withholding is the day of actual payment to the contractor, and it does not matter whether it is an advance or a final payment

Procedure for withholding personal income tax

Important! If an organization or individual entrepreneur hires individuals under a GPC agreement and pays them income, then they are required to reflect this in 6-NDFL, since in this case they are tax agents. This means that the organization is responsible for withholding personal income tax from payments and paying them to the treasury.

First of all, it is necessary to find out in what time frame the amount of tax on personal income should be calculated, withheld and paid to the budget.

The date on which an employee receives income under a GPC agreement is the tax withholding date. On this day, the individual is paid for work from the cash register, or money is transferred to his card. This date will need to be reflected in 6-NFDL on line 100.

Since the date on which income under the GPC is received is also the date of personal income tax withholding, which means that this date must be indicated in form 6-NDFL on line 110. This date must also be consistent with the one indicated as the settlement date in the agreement contract

As in all other cases when transferring personal income tax to the budget, this must be done no later than the next business day after the payment of funds to the individual. This date is indicated in form 6-NDFL on line 120.

General features of filling out form 6-NDFL

Reporting form 6-NDFL for GPC in 2021 is filled out taking into account the order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/450. It sets out a number of general mandatory requirements:

| Rule | Explanation |

| The form must be filled out for each OKTMO separately | In this case, organizations indicate the code of the municipality in which the given division of the company is located |

| Payment for GPC in 6-NDFL is not included in separate sections | It is reflected in reporting on a general basis. In the first section, data on income, calculated and withheld tax are entered on an accrual basis for a quarter, half a year, 9 months, and a year. The first section is filled out for each tax rate. The second section records reporting data for the quarter. |

| If during one period the tax agent paid personal income tax at different rates, when entering information about GPC agreements in 6-NDFL in 2018, information on each rate is entered separately | It is necessary to check the correctness of the entered data to avoid penalties from the tax authorities. |

According to these requirements, the reflection of GPC in 6-NDFL requires the submission of calculations for each reporting period no later than the last day of the month that follows the reporting period.

Also see “6-NDFL for the 1st quarter of 2021: sample filling”.

Features of reflecting income in 6-NDFL

Organizations and individual entrepreneurs enter into contractual relations with individuals, individual entrepreneurs or non-residents. When companies generate a report, certain filling features will be highlighted for each case. For example:

- Entrepreneurs independently calculate the amount of tax and reflect it in their reporting. If the GPC is issued with an individual entrepreneur, then 6-NDFL will not be filled out, and the organization should not calculate personal income tax. The customer does not reflect in the certificate the payments under the GPC agreement with the individual entrepreneur. This is due to the fact that the individual entrepreneur independently pays personal income tax payments to the budget, and, accordingly, reports on them independently.

- If the contract is concluded with an individual who is not a resident, the personal income tax rate will be 30%.

Tax agent for GPA

If your counterparty-contractor (performer) is an individual who does not have the status of an individual entrepreneur, then in relation to the income paid to him you are recognized as a tax agent for personal income tax. Hence the obligation to include the transactions carried out in such a general tax report of the company as 6-NDFL. Without data on the GPA, the calculation will be incomplete and, in the event of an inspection, the inspectors will simply turn it down. So an accountant should never lose sight of civil transactions with individuals.

When concluding a GPA with a merchant who officially has the status of an entrepreneur, the customer company does not pay personal income tax for it. This means that the obligation to include the amounts paid in 6-NDFL does not arise here.

Attention! The reporting procedure for 6-NDFL for the 2nd quarter of 2020 has changed

In salary reports for the 2nd quarter, take into account the changes that came into force in 2021. Experts from the magazine “Salary” summarized all the changes in 6-NDFL. Read how inspectors compare report indicators with each other. If you check them yourself, you will avoid clarifications and will be able to explain any figure from the report. See all the main changes in salary in a convenient presentation and special service.

Attention: Personal income tax arises under a number of other civil law contracts, in addition to contracts and agreements for the provision of services. For example, when renting from an individual his property (car, phone, laptop, etc.)

The algorithm for filling out 6-NDFL will be the same.

Reflection in the form of payments under the contract

Information on the amounts of income accrued under work contracts is entered into the report form upon payment. Payment is considered to be any partial transfer, and not just full payment for work performed. Regardless of when the work was carried out or the document was concluded, information is entered into the report only upon transfer of funds to the contractor.

Indication of information on construction contracts in 6-NDFL is as follows:

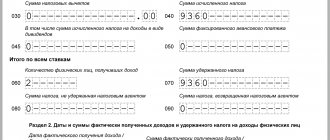

Section 1:

- Line 020 contains information about the amount of payments made under all construction contracts;

- 030 provides information about the amount of deductions due;

- 040 - amount of calculated personal income tax;

- 070 - withheld personal income tax.

Section 2:

- 100 – day of actual receipt of funds;

- 110 – date of tax withholding, coincides with line 100;

- 120 – day of transfer of withheld personal income tax;

- 130 – total amount of accruals under contract documents paid on the specified date;

- 140 – the amount of tax withheld from the income indicated in line 130.

It is noteworthy that payments that were made on the last day of the quarter will be reflected only in the first section. They should be included in the second section of the report for the next quarter.

Filling out 6-NDFL for payments under contract agreements

Hello, I just can’t figure out section 1. (Everything is clear with the second section) Please help.

There are no accruals for the first quarter.

The question is: in section 1, line 020 “Amount of accrued income,” what amount should I have?

in line 040 “Amount of calculated tax” what amount of personal income tax should I indicate? in line 070 “Amount of withheld tax” what amount of personal income tax should I indicate? and whether it is necessary to fill out line 080 “Amount of tax not withheld by the tax agent” and maybe others in this situation.

Personal income tax from payments dated July 13 will go to line 070 in 6-personal income tax for 9 months.

The tax office also told me to show only those amounts under GPC agreements that were paid during this reporting period. Where can I read exactly how to proceed? Where can I find confirmation of your words? I don’t want to submit the correction twice. Help me figure it out.

This is interesting: Chapter 7 of the Labor Code of the Russian Federation - Collective agreements and agreements

But in an article in the magazine “Simplified” they write differently:

“Question In our organization, in addition to wages, remuneration was accrued every month under civil contracts. Salaries and remuneration under GPC agreements for January 2016 were paid on February 10, 2021, for February 2021 - March 10, 2016, for March - April 8, 2021.

Any use of materials is permitted only with a hyperlink.

Payments under GPC agreements in 1C ZUP 2.5 (8.2)

When registering an agreement in 1C 8.2 ZUP 2.5, the term of the GPC agreement is indicated, which is reflected in the personal accounting reporting. When filling out the cost of the GPC agreement, you should take into account that this amount will be reflected in the payroll, so the cost can be omitted or indicated as 0:

In the 1C ZUP 2.5 (8.2) database, it is not possible to indicate the payment date in the “Payroll” document. Therefore, income under GPC agreements is registered by default on the last day of the month. If the payment under the GPC agreement falls on another day, then accruals under the agreements should be registered using the document “Registration of one-time accruals for employees of organizations.” In this document it is possible to indicate the actual date of payment for 6-NDFL. On the “Additional” tab accruals" is indicated

- Employee's name,

- accrual type “Payment under contract agreements”,

- the amount of the GPC agreement is indicated.

- If necessary, a professional deduction is registered:

When carrying out the document “Registration of one-time charges”, payments under GPC agreements in 1C ZUP 2.5 with the specified date are included in the income register, and also reflected accordingly in 6-NDFL:

Examples of reflecting various types of income in 6-NDFL are discussed in the Master Class: 6-NDFL - Revolution in personal income tax accounting in “1C” in the module “Filling out 6-NDFL with examples in “1C”.

Please rate this article:

Reflection in 6-NDFL of interim payments and final settlement under the GPC agreement

Section 1: 1 section is completed in the usual manner. All payments made under the GPC agreement will be included in total income and reflected on line 020. From this amount, personal income tax will be indicated below on lines 040 and 070.

Section 2: the advance payment, as well as the final payment that was paid over the last three months, will be indicated in a separate block on lines 100-140. This is due to the fact that they were paid at different times.

How to reflect a contract in 6-NDFL

Reporting form 6-NDFL is submitted by employers indicating the amount of income and deducted tax for all employees.

Hired persons are considered not only those with whom employment contracts have been concluded, but also those who perform the specified volumes of work under civil law agreements, including work contracts.

A work contract in 6-NDFL is reflected taking into account some nuances, because the payment of labor to persons hired under such documents is carried out according to different rules, and therefore requires a different approach when entering data.

Cases of concluding civil contracts

Civil agreements are contracts that are concluded:

- Between one legal entity and another legal representative.

- Between several individuals.

- Between a legal entity and an individual.

Individuals mean:

- Individual entrepreneurs.

- Private notaries, lawyers and other specialists conducting their own practices.

- Employees who, due to certain circumstances, choose this type of employment.

Speaking about 6-NDFL reporting, we mean the relationship between a legal entity, as an employer, and an individual, as a performer of a certain amount of work.

https://www.youtube.com/watch?v=AmUFgieBIFQ

A work contract cannot replace an employment contract. When an employee is hired to perform some permanent series of jobs that has no time limit, an employment agreement is concluded with him.

Unlike a contract document, an employment agreement allows you to provide an employee not only with a workplace, but also provide him with permanent work. In addition, such agreements provide a number of social guarantees, in the form of annual paid leave, compensation for sick leave and much more.

But work contracts deprive the hired person of all these privileges, therefore, according to the norms of labor legislation, special conditions are required for its conclusion.

A contract with an individual is concluded in the following cases:

- The need to perform a specific type of work.

- When there is a clear list of actions that should be performed.

- The result of cooperation should be a concrete result.

- There is no strictly defined workplace.

- There is no strictly regulated work schedule.

- The hired person is not obliged to follow the employer’s internal local documents, such as job descriptions, labor regulations and various orders.

Typically, contract agreements are concluded for one-time work, for example, construction or finishing work, or other types of labor.

Withholding taxes on remuneration

When drawing up a contract, the contractor undertakes to complete the scope of work specified in it within the established time frame, and the customer undertakes to accept it and pay for it. When setting payment for work, one should be guided by the norms of the Civil Code of the Russian Federation.

Article 709 of the Civil Code of the Russian Federation states that the contract price is formed from two main indicators:

- The cost of the work performed.

- Compensation for the contractor's expenses.

The first point has no special restrictions and questions

When reaching an agreement on the final value of the relationship, only the opinion of the two parties is important. The agreement can include both a fixed price and a floating one, which allows you to reduce or increase it later

But the second point raises many more questions. What exactly should the customer compensate? Compensation may relate to rental housing and food, but the customer is not obliged to pay travel allowances in their full understanding.

If compensation amounts are included in the agreement, should personal income tax be paid on them under the agreement? This is perhaps the key question because it affects exactly what amounts taxes will be calculated on.

The income of contractors is subject to personal income tax tax at the general level. Residents are charged 13%, non-residents 30%. But contributions to the Social Insurance Fund and Pension Fund are made only if such a condition is reflected in the agreement.

Tax calculation

To calculate tax, the amount of income of an individual must be determined. Income is considered to be payment in cash and in kind received by the contractor from the customer. The amounts paid by the customer are subject to taxation, but the cost of work and compensation costs should be separated.

Contract agreement in 6-NDFL example of filling out 2021

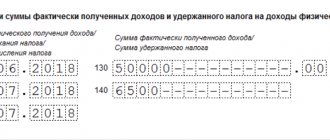

Let’s say that on the last working day of March 2021—Friday the 30th—the parties signed an act of completion of work and recognized the GPC agreement as completed. On the same day, remuneration was paid for the work performed.

In total, March 30 is recognized as the day of receipt of income. The accountant withheld tax on this date.

The deadline for transferring the amount to the budget falls on March 31. But this is Saturday, so the deadline is legally postponed to April 2 - working Monday.

The calendar lines in section 2 of form 6-NDFL will be filled out as follows:

- line 100: 03/30/2018;

- line 110: 03/30/2018;

- line 120: 04/02/2018.

However, the operation will fall into section 2 not for the first quarter, but for the first half of the year. Look - the last date in the block is in April. Therefore, the entire operation will be reflected in section 2 of form 6-NDFL for the six months. And the amounts will appear in section 1 in the report for the first quarter. And then they will be shown in all reports for 2021, since the first section is filled in with a cumulative total from the beginning of the year.

Next Personal Income Tax Declaration 4: who must submit

How to fill out reports?

The report is filled out with a total of all individuals. persons. Payments under contract agreements are filled out similarly to remunerations for ordinary employees.

Important! The only difference is the reflection of the advance payment. When issuing an advance to employees of a company, tax is not withheld; it is calculated after the end of the month and is deducted from the salary. When concluding a contract, personal income tax is withheld from each remuneration.

The first section is filled in with a cumulative total from the beginning of the year. In field 010 the tax rate is indicated; a separate sheet is filled out for each rate. The contractor may not be a resident of Russia, then his tax will be withheld at a rate of 30%. Lines 020 and 040 show the amount of remuneration for the performance of work, services and the tax calculated on it. Field 070 reflects the amount of tax withheld.

If the contractor under the contract has the right to tax deductions (for example, professional), they are reflected in field 030 and reduce the amount subject to taxation. Such a right must be documented.

Filling in line 060 is carried out once, in total for all bets (if there are several of them). The value is entered in the field on the first sheet; on the remaining pages this line remains blank. All physical persons who received income during the year (filled in with a cumulative total). If several contract agreements were concluded with the same person (in the current tax period), he is shown on the line only once.

Section 2 is completed for the current period - 3 months. All payments under the contract are shown.

For contract agreements, lines in 6 personal income tax are filled out as follows:

- 100 - date of receipt of income by the contractor. Here you indicate either the day of transfer of funds or the day of cash issuance;

- 110 - date of personal income tax withholding (coincides with the day of payment of income);

- 120 - date of transfer of the fee according to the law. It is legally established that the transfer of fees to the budget must be made no later than the day following the withholding of personal income tax. Thus, even if the tax was paid on the day the reward was issued, the report reflects the next business day;

- 130 - the cost specified in the contract. If an advance payment is implied, then the amount of the advance and the settlement amount;

- 140 is the amount of tax withheld.

Important! If the income was transferred on the last day of the reporting (tax) period, it is not taken into account in the 6th personal income tax. The payment is included in the report for the next quarter.

Filling out form 6-NDFL

Filling out form 6-NDFL requires reflecting all accrued income and deductible taxes from individuals who work in the organization during the reporting period. The work contract is also reflected in 6-NDFL.

To fill out a report on Form 6-NDFL, the employer must:

- Quarterly summarize data on accrued income.

- Submit information on a cumulative basis from the beginning of the year - for the first quarter, six months, nine months and a year.

- Reflect the dates of payments made of both the income paid and the tax transferred to the Federal Tax Service.

The report itself consists of a title page and two sections.

- The title page contains the details of the tax agent, as well as information about his authorized representative.

- The first section provides generalized data for the entire enterprise as a whole.

- In the second section, the dates of specific payments are entered. Amounts paid on the same dates are added together.

For zero information, a zero or dashes are placed in the columns.

Filling rules

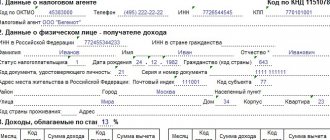

The document form (KND form 1151099) is filled out for all payments made to individuals during the calendar year. It consists of the following parts:

- Title page with general information: name of the report, codes of the submission period and tax authority, details of the tax agent or authorized person, marks confirming the accuracy of the transmitted information, stamp if available, signature with transcript, date of preparation, records of reception by the controlling organization.

- Section number 1 includes lines: 010, 020, 030, 040, 050, 060, 070, 080 and 090 (reflection of total data from the beginning of the year).

- Section number 2 consists of an unlimited total number of lines: 100, 110, 120, 130 and 140 (detailed breakdown of accrued, withheld and received amounts of income and calculated tax for the quarter), depending on the number of payments during the last three months of the reporting quarter period.

The procedure and rules for filling out 6-personal income tax are specified in detail in MMV-7-11 / [email protected] - Order of the Federal Tax Service dated October 14, 2015, with subsequent additions and changes. In 6 personal income tax, a contract must be reflected if a legal entity has used the services of a citizen (not an individual entrepreneur).

How to reflect a contract in 6-NDFL

Income from contract work and the transferred tax are reflected in 6-NDFL as follows:

The first section of the report indicates

- in field 010 – tax rate (13 or 30%);

- in field 020 – the amount of payments for work/service performed on an accrual basis from the beginning of the year;

- in field 040 – the amount of accrued tax on an accrual basis from the beginning of the year;

- in field 070 – the amount of personal income tax withheld since the beginning of the year;

The second section of the report indicates:

- in field 130 – payment amount (including personal income tax);

- in field 140 – the amount of tax withheld;

- in field 100 – the date of receipt of the payment;

- in field 110 – the date of personal income tax withholding from the income received;

- in field 120 – the date no later than which the personal income tax must be transferred.

To correctly file 6-NDFL for contract payments, you must remember the requirements of the Tax Code of the Russian Federation:

- each payment, incl. advance or partial payment must be reflected in the report;

- information on them is recorded in the 1st section on an accrual basis, in the 2nd - for the reporting quarter;

- the day the contractor is paid for the work performed (including advance payment) is considered the day the income is received;

- Tax on each payment must be transferred the next day after payment.

The 6-NDFL report reflects only the income received and only in the period in which it was received. For example, if the contractor’s work was completed in March 2021, and the remuneration was paid to him in April 2021, then the tax agent will reflect his income in the report for the 2nd quarter of 2021.

Taking into account all the requirements of tax authorities, we will consider how to reflect a contract agreement in 6-NDFL using examples of the performance of work and the provision of services.

Examples of formatting a 6 personal income tax report on contract payments

An example and its solution will help in considering the features of filling out the first and second sections of the 6-personal income tax report on contract services:

I. G. (not an individual entrepreneur) entered into a GPC agreement with Afanaskin for the period from December 25, 2021 to the end of the 1st quarter of 2021 for contract work (construction of podiums for the presentation of products in several retail outlets). The total cost under the terms of the agreement was 134,000 rubles.

An advance in the amount of 17,400 rubles (to the card) and personal income tax of 2,600 rubles were transferred on December 28, 2021, and the final payment was made on March 29, 2021 through the organization’s cash desk.

To simplify the situation: no other accruals and payments were made to individuals, and no application for deduction was submitted.

Filling out sections 1 and 2 of the annual report:

| Field No. | Filling | A comment |

| 10 | 13 | Not an individual entrepreneur, resident (tax rate in%) |

| 20 | 20000 | Total accrued income |

| 40 | 2600 | Calculated personal income tax |

| 60 | 1 | Number of recipients |

| 70 | 2600 | Personal income tax withheld |

| 100 | 28.12.2018 | Date of actual receipt of income |

| 110 | 28.12.2018 | Personal income tax withholding date |

| 120 | 29.12.2018 | Deadline for payment of personal income tax to the IRS |

| 130 | 20000 | Actual income received (including personal income tax) |

| 140 | 2600 | Personal income tax withheld |

The report for the 1st quarter of 2021 must be completed as follows:

| Field No. | Filling | A comment |

| 10 | 13 | Tax rate for a resident, individual entrepreneur is not |

| 20 | 114000 | Total accrued income (final payment under the contract, that is, 134,000 minus the advance payment of 20,000) |

| 40 | 14820 | Personal income tax calculated (13% of 114,000) |

| 60 | 1 | Number of individuals who received accruals |

| 70 | — | Personal income tax withheld (total value for section 2) |

| 100-140 | — | The columns are not filled in, since the deadline for transferring personal income tax to the budget (from payment of income on March 29, 2019) falls on the next reporting period |

For the first half of 2021, the sample for filling out the 6-personal income tax will take the form:

| Line no. | Filling | A comment |

| 10 | 13 | Tax rate for resident |

| 20 | 114000 | Accrual of income from January to June |

| 40 | 14820 | Personal income tax calculated (for half a year) |

| 60 | 1 | |

| 70 | 14820 | Personal income tax withheld (for 6 months of 2021) |

| 100 | 29.03.2019 | Date of actual receipt of income |

| 110 | 29.03.2019 | Personal income tax withholding date |

| 120 | 01.04.2019 | Deadline for personal income tax payment (according to the rules of transfer if the last day of the month falls on a weekend or holiday) |

| 130 | 114000 | Actual income received (including personal income tax) |

| 140 | 14820 | Personal income tax withheld |

The report must show all payments under construction contracts, including advance payments (personal income tax is also withheld from them). Income is considered received (accrued) on the day of actual payment to an individual from a current account or from a cash register (the moment of signing the act of completing the task does not matter).

It is important to know! The personal income tax is transferred no later than the next working day after the payment of income to the contractor - an individual - according to the BCC (budget classification code) corresponding to this tax.

If several GPAs are concluded with an individual during a calendar year, then in line 060 the citizen is counted as one recipient of income. The number of agreements does not matter.

How to reflect GPC agreements in 6-NDFL example of filling out

Form 6-NDFL should include not only standard salary payments, but also remuneration under civil contracts for the performance of work (rendering services).

In accounting terms, these are GPC (civil law) agreements or GPA agreements. This is the only way you will fulfill your obligation to fill out “income” reporting.

What “civil” amounts and in what order should be included in 6-personal income tax - read in our article.

If your counterparty-contractor (performer) is an individual who does not have the status of an individual entrepreneur, then in relation to the income paid to him you are recognized as a tax agent for personal income tax.

Hence the obligation to include the transactions carried out in such a general tax report of the company as 6-NDFL. Without data on the GPA, the calculation will be incomplete and, in the event of an inspection, the inspectors will simply turn it down.

When concluding a GPA with a merchant who officially has the status of an entrepreneur, the customer company does not pay personal income tax for it. This means that the obligation to include the amounts paid in 6-NDFL does not arise here.

GPC agreement

If companies or individual entrepreneurs engage individuals to perform any work, they enter into civil law agreements (GPC) with them. Under this agreement, the date of receipt of income is in fact considered the date of payment of funds to the individual. In this case, it will not matter what was paid - an advance or the final amount. Each payment in 6-NDFL will be reflected in a separate block and under a separate date.

Important! If we compare a GPC agreement with a regular agreement, then according to the latter, the date of receipt of income will be considered the last day of the month for which wages are paid. In addition, in this case, personal income tax will not be withheld from the advance.

Withholding taxes on remuneration

Each concluded contract document has an agreed upon financial reward.

When drawing up a contract, the contractor undertakes to complete the scope of work specified in it within the established time frame, and the customer undertakes to accept it and pay for it. When setting payment for work, one should be guided by the norms of the Civil Code of the Russian Federation.

Article 709 of the Civil Code of the Russian Federation states that the contract price is formed from two main indicators:

- The cost of the work performed.

- Compensation for the contractor's expenses.

The first point has no special restrictions and questions

When reaching an agreement on the final value of the relationship, only the opinion of the two parties is important. The agreement can include both a fixed price and a floating one, which allows you to reduce or increase it later

But the second point raises many more questions. What exactly should the customer compensate? Compensation may relate to rental housing and food, but the customer is not obliged to pay travel allowances in their full understanding. If compensation amounts are included in the agreement, should personal income tax be paid on them under the agreement? This is perhaps the key question because it affects exactly what amounts taxes will be calculated on. Only those expenses that are supported by documents (checks, invoices and other forms) and that fall within the framework of the preliminary agreement are reimbursed.

The income of contractors is subject to personal income tax tax at the general level. Residents are charged 13%, non-residents 30%. But contributions to the Social Insurance Fund and Pension Fund are made only if such a condition is reflected in the agreement.

Example of filling out a declaration

- The advance is 70,000 rubles;

- On November 30, a transfer was made minus income tax - 9100. The tax was transferred to the treasury simultaneously on November 30:

- the act for contract work was signed on December 29;

- professional deduction amounted to 95,000 rubles;

- the transfer of profit to the contractor in the amount of 100,000 rubles was made on December 30;

- personal income tax withholding, taking into account the deduction, was made on December 30 in the amount of 650 rubles;

- The accountant completed the transfer of income tax on the first working day after the holidays - January 9.

The GPC agreement in declaration 6 of personal income tax in the annual report will be as follows:

The final payment is not included in the annual report. You show it in the second part of the report for January – March.