What is severance pay

Severance pay is considered to be the payment of a month (or two weeks) of earnings for the period of subsequent employment of the employee or as compensation.

Severance pay is covered in Art. 178 Labor Code of the Russian Federation.

Also, for a detailed understanding of this issue, we have posted material for you, which you can read in the article “Payment of severance pay upon dismissal.”

Next, we will look at the issues of taxation of severance pay.

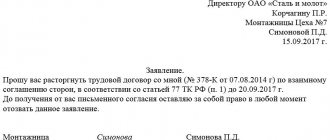

How to document compensation payments for unused vacation days

When calculating days to determine the amount of compensation, the accountant must take into account all types of vacations not taken by the employee. As a rule, payment for them is made:

- without an application, special instructions from management, on the basis of an order confirming the fact of dismissal of an employee, and the Labor Code of the Russian Federation;

- when making a payment using form T61. A special form is filled out by personnel officers and accounting department indicating a detailed calculation of the amount to be paid and the accrual of personal income tax;

- minus income taxes withheld from the worker's income.

The final settlement with the employee upon his dismissal is carried out on the last day of work. When calculating accounting, it is necessary to correctly determine the amount of tax and Social Insurance contributions based on the tax base.

- Moscow and region:

+7-499-938-54-25 - St. Petersburg and region:

+7-812-467-37-54 - Federal:

+7-800-350-84-02

Personal income tax and insurance contributions from severance pay according to the Labor Code of the Russian Federation

When deciding on the imposition of personal income tax and insurance premiums, the reason for dismissal does not matter. Whether it is a reduction in staff, dismissal for health reasons, refusal to transfer together with the employer to another location, agreement of the parties - it does not matter .

What matters is the amount of severance pay paid. If you still doubt whether severance pay is taxable during a layoff, let’s figure it out together.

In accordance with labor legislation, upon dismissal on the grounds listed in Art. 178 of the Labor Code of the Russian Federation, the employer must pay the guaranteed amount of severance pay. However, an employment contract or local company regulation may establish an increased amount of benefits. In this case, payment in the specified amount is also mandatory in accordance with Part 1 and Part 8 of Art. 178 Labor Code of the Russian Federation.

However, the Tax Code sets a limit that is not subject to insurance contributions and personal income tax. If the severance pay is greater than this, the difference is subject to taxes.

The amount of severance pay established by the Labor Code that can be paid to an employee is three times the average monthly salary . And for regions of the Far North and equivalent territories, this value can be up to 6 average earnings.

If, in the process of settling the severance pay with the employee, the amount of actual payments turns out to be greater than the amount determined by average earnings in accordance with the Labor Code of the Russian Federation, must be withheld from the difference and insurance premiums must be charged.

EXAMPLE

An employee resigning due to conscription into the army was paid compensation in the amount of half the salary in accordance with the local act of the company.

The employee's salary is 30,000 rubles. Severance pay – 15,000 rubles (according to internal regulations).

Average earnings, calculated according to the rules established for the payment of benefits, are 1,300 rubles per day.

In the two weeks following the day of dismissal there are 10 working days. Thus, according to labor legislation, the amount of the benefit should have been:

- 1300 × 10 = 13,000 rubles.

13,000 rubles from the payment are not subject to personal income tax or insurance contributions. But the “extra” 2000 rubles must be taxed on both.

Rules for taxation of payments upon dismissal

Taxation of payments upon dismissal: rules

In different situations, the following features related to personal income tax should be taken into account:

- If the dismissal occurs at one’s own request, then the tax must be transferred on the same day when the amounts themselves are transferred to the citizen.

- Additional severance pay is transferred in the event of staff reduction or liquidation, for the duration of employment. Such payments are not subject to taxes.

- Tax is not paid in cases where the dismissal is associated with changes in management.

- But if there are violations in connection with which the employee is fired, all payments are subject to tax.

- The general rules for withholding fees are also used when the basis for dismissal is an agreement of the parties.

- If the reason for leaving was health problems, then the tax is also waived.

Taxes on additional compensation upon reduction or liquidation of a company

Also, upon dismissal due to layoff, an employee may receive additional compensation. The procedure for its payment is prescribed in Art. 180 Labor Code of the Russian Federation.

This compensation is paid upon dismissal before the expiration of the notice period for layoffs.

Please note that the payment of this benefit is not subject to personal income tax and insurance contributions. And it is not included for calculation in the limit value that we discussed above. This fact is indicated by clause 1 of Art. 217 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 04/01/2019 No. 03-04-05/22289, dated 03/20/2018 No. 03-15-06/17473, dated 07/31/2017 No. 03-04-07/48592.

The situation is similar with compensation paid before the date of liquidation of the company.

Now you know that taxes on severance pay during a layoff are not paid within the limit established by law.

Personal income tax on compensation for unused vacation

Compensation for unused vacation upon dismissal is subject to personal income tax in full, since this type of payment is not in the list of income not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation).

In this case, the reason for dismissal (staff reduction, voluntary, etc.) does not matter.

The tax amount must be withheld upon actual payment of compensation and transferred to the budget no later than the day following the day of payment to the employee (clauses 4, 6 of Article 226 of the Tax Code of the Russian Federation).

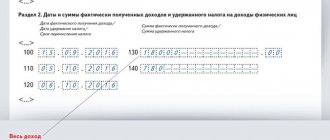

In the 2-NDFL certificate, code 2013 should be indicated for the specified income.

If the employee, instead of payment of compensation, was granted leave followed by dismissal, then compensation is not paid and the employee receives vacation pay in the usual manner.

Income tax and severance pay

Let's consider the issue of accounting for severance pay for profit tax purposes.

According to Art. 255 of the Labor Code of the Russian Federation, severance pay is taken into account in labor costs. And in this case, on the contrary, the size of the benefit does not .

However, one should not forget one very important point - the economic feasibility of expenses.

For example, a company is being liquidated, there are a lot of debts to creditors, and it has been decided to pay severance pay to the financial director in the amount of 10 salaries. This may raise questions from inspectors. And in case of a dispute, you will prove your case in court. This is indicated by letters from the Ministry of Finance of Russia dated 03/18/2020 No. 03-03-06/1/20894, dated 03/19/2019 No. 03-03-07/17871, dated 02/11/2019 No. 03-04-06/8796, dated 04/25. 2017 No. 03-04-06/24848, No. 03-04-06/24850, No. 03-04-06/24853 (clause 3), dated 08/19/2016 No. 03-03-06/1/48797, dated 07/24 .2017 No. 03-03-06/1/46887.

Filling out the 2-NDFL certificate

Personal income tax is withheld from severance pay in a preferential regime due to the fact that they are compensation payments, the amount and procedure for payment of which is regulated by current legislation, as well as federal and municipal regulations.

Thus, VP that does not exceed 3 times the amount of average earnings in general cases or 6 times the size of the SZ in areas with a “northern” allowance or territories equivalent to them is not reflected in the 2-NDFL certificate (Letter of the Ministry of Finance of Russia No. 03-04 -06/8-118 dated 04/18/2012). Severance pay is indicated in the 2-NDFL certificate if it exceeds the above norms of the Tax Code of the Russian Federation. When filling out the certificate in the VP part, code 4800 “Other income” is used.

Personal income tax

This tax must also be withheld. As in other cases, it is 13% of the amount of income, since this payment will also qualify as income.

Amounts and calculation of taxes

Let's take the matter to a more practical level and give the exact amounts of deductions that will need to be paid, and also carry out calculations of exactly how much money will be paid to the employee, and how much will go to the state budget or funds. First, let's establish the amounts of taxes and contributions.

Let's start with the personal income tax; its size will depend on whether the payer is a resident of the Russian Federation. For residents, the tax level is set at 13%, for non-residents – 30%. Note that the right to standard tax deductions in accordance with Article 218 of the Tax Code in relation to compensation is not granted, since they are made only once a month, and in this case they will be deducted from wages.

Now let's look at other payments - their difference from personal income tax is that if it is formally paid by the employee himself, then the remaining fees are borne by the employer. As a result, the employee usually sees that personal income tax was deducted from the payment, and therefore almost everyone knows about the notorious 13%, but the amount of the remaining fees is not indicated. What is he like?

Contributions to the Pension Fund are the most substantial - 22%, this is the amount that is always charged from wages, and it will also need to be paid from compensation for unused vacation. Subsequently, on the basis of this money, pension payments to the citizen will be formed.

Contributions to the Federal Health Insurance Fund are less - 5.1%, but unlike pensions, which are returned to the citizen in the form of money, albeit only when he retires, in this case the return is assumed in the form of medical services, which not everyone uses at all – after all, many citizens now prefer to be treated in private clinics.

Contributions to the Social Insurance Fund are 2.9% - it is from this money that payments are made in case of illness and receipt of a certificate of temporary disability, that is, the employee provides them for himself. In addition to this payment, another contribution is established for insurance against accidents at work, but its size will greatly depend on the working conditions.

Now let's do the calculation based on these numbers. The payment for unused vacation before taxes for an employee is 37,000 rubles (you can read about how this payment is calculated in separate articles). Our task is to establish how much the employee himself will receive, as well as how much the company will pay for it to state funds .

First you need to calculate personal income tax: 37,000 x 0.13 = 3,810 rubles

Now we subtract the resulting figure from the original: 37,000 - 3,810 = 32,190 rubles - thus, we have received the amount that should be issued to the citizen, since all other payments will no longer reduce it.

How much will go to the Pension Fund? 37,000 x 0.22 = 8,140 rubles.

To the Social Insurance Fund: 37,000 x 0.029 = 1,073 rubles.

To the Medical Insurance Fund: 37,000 x 0.051 = 1,887 rubles.

To this should also be added a payment for insurance against industrial accidents, but since it is not fixed, we will not take it into account in this calculation.

As a result, it turns out that the company must pay an additional 8,140 + 1,073 + 1,887 = 11,100 rubles. The total amount spent by the employer was 48,100 rubles, of which the employee received 32,190.

What taxes are charged on compensation upon dismissal 2021

Therefore, contributions to the Pension Fund, Social Insurance Fund and Federal Compensation Fund must be calculated from the amount of compensation according to the general rules - the same as from other taxable payments in favor of the employee (Part.

1 tbsp. 7 of the Law of July 24, 2009 No. 212-FZ). The deadline for contributions to be transferred to the budgets of extra-budgetary funds is the 15th day of the month following the month in which contributions were accrued (Part 5, Article 15 of Law No. 212-FZ of July 24, 2009)

Please note: failure to pay required contributions and tax deductions on time may result in the imposition of penalties for the organization.

Yes, this is relevant this year.

The situation is explained by the fact that this compensation is an exception to the above list. When tax is withheld The transfer of funds to the current account of a dismissed employee is considered the moment he receives income that is subject to taxation. This is stated in paragraph 1, paragraph 1 of Art.