Taxes on sick leave: legal regulation

The main regulatory document regulating what taxes are charged on sick leave in 2021, how they are withheld and transferred to the state treasury is the Tax Code.

The amounts of benefits themselves are calculated in accordance with the law “On compulsory social insurance in case of temporary disability and in connection with maternity” dated December 29, 2006 No. 255-FZ (hereinafter referred to as Law No. 255-FZ) and can be issued only if there are correctly completed forms disability, in everyday life more often called sick leave.

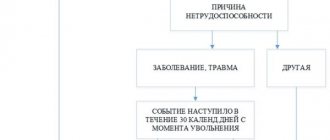

Sick leave may be issued due to illness, or on the occasion of an upcoming birth. Another type of sick leave is associated with an industrial injury or an aggravated occupational disease. In this case, when calculating, taxing and paying benefits, one should also be guided by the Law “On Compulsory Social Insurance against Accidents at Work and Occupational Diseases” dated July 24, 1998 No. 125-FZ (hereinafter referred to as Law No. 125-FZ).

What taxes are paid on sick leave?

According to paragraph. The official document used to confirm the temporary illness of an employee is considered to be a certificate of incapacity for work. In this situation, personal income tax is calculated and accrued from payments based on this medical certificate. Payments for closed sick leave and during the year are subject to personal income tax. Closed sick leave benefits are included in taxable income, which is paid in the current month. However, employees with whom various civil law contracts for the provision of services have been drawn up are not paid for sick leave. Personal income tax is withheld in both the first and second cases.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Are sick leave insurance premiums paid? To the question “Is sick leave subject to insurance contributions?” both colleagues and management should respond negatively.

What taxes are taken from sick leave per year? Are sick leave benefits subject to taxes and insurance contributions? If so, how much percentage should employers withhold when paying temporary disability benefits? There are enough questions about this:

Temporary disability: are sick leave subject to insurance premiums?

A person who falls ill and goes to a medical institution, at his request, is issued a certificate of incapacity for work. It must be submitted to the accounting department of the company (or individual entrepreneur) where the citizen is officially employed. Based on sick leave, salary data for the two previous calendar years, hours worked during the same period of time and the employee’s length of service, the accounting specialist will have to calculate VNIM benefits. Its payment is usually made on the nearest day of payment of salary (or advance payment) after presentation of sick leave.

As you know, all payments related to the performance of labor functions are subject to insurance contributions. What about sick leave? Are insurance premiums calculated on sick leave?

If we turn to sub. 1 clause 1 art. 422 Tax Code of the Russian Federation, sub. 1 clause 1 art. 20.2 of Law No. 125-FZ, we will see that state benefits are exempt from social contributions. That is, insurance contributions for temporary disability benefits - both at the expense of the employer and at the expense of the Social Insurance Fund - do not need to be charged. This applies to contributions to VNiM, compulsory health insurance, compulsory medical insurance, NS and PZ.

Calculation and payment of sick leave in 2019

In practice, there are situations when an employee is paid state benefits, which for various reasons cannot be classified as benefits. On this basis, the noted amounts are not accepted as payment of contributions to the Social Insurance Fund.

Accordingly, since they are not government subsidies, insurance premiums should be calculated from them. In accordance with federal law, each insured employee on the basis of sick leave: for illness, pregnancy, caring for a sick relative, and in other cases, is entitled to payment of a cash benefit, furthermore, a cash subsidy.

The employee's insurance length is decisive when calculating the amount of compensation. Additional payment up to average earnings In addition to the amount of payments determined by law, the management of the organization can assign an additional payment up to average earnings from its own reserve budget.

A doctor may refuse to provide a document to a patient if he has not found any signs of disability - this is the only reason for refusal.

If the patient does not agree, he can write a complaint to the head physician or other senior person of the hospital. Not all employers know whether funds from sick leave are deducted during the year as insurance premiums.

However, personal income tax must be withheld from the entire amount of sick leave benefits. These requirements do not apply to maternity benefits, which are exempt from withholding all types of contributions and deductions.

In addition to the amount of payments determined by law, the management of the organization can assign an additional payment up to average earnings from its own reserve budget.

However, it is not state compensation and, according to the law, is subject to appropriate contributions as the wages of a working person.

Deductions from sick leave 2021

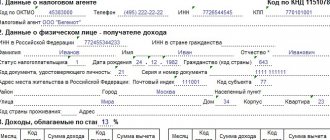

You cannot fill out the certificate of incapacity for work with a ballpoint pen or use ink of a different color. Solovyov V. Engineer Nozhkin G. Somova A. Calculation period Somova A.

The procedure for paying insurance premiums for separate units depends on what powers they are vested with.

In practice, there are situations when an employee is paid state benefits, which for various reasons cannot be classified as benefits. On this basis, the noted amounts are not accepted as payment of contributions to the Social Insurance Fund. Accordingly, since they are not government subsidies, insurance premiums should be calculated from them. In accordance with federal law, each insured employee on the basis of sick leave: for illness, pregnancy, caring for a sick relative, and in other cases, is entitled to payment of a cash benefit, furthermore, a cash subsidy.

Sick leave for pregnancy and childbirth: is income tax (NDFL) charged and are contributions calculated?

Another reason why sick leave is issued may be the employee’s pregnancy and, accordingly, the birth of a baby. It is prescribed by a medical institution when an employee goes on maternity leave. She, in turn, must submit it to the accounting department of the enterprise, where the appropriate allowance must be calculated. The calculation of this particular benefit, as well as the VNIM benefit, is based on data on earnings and hours worked for the last two calendar years.

Important! The employee’s length of service does not affect the amount of the B&R benefit.

In 2021, the taxation of sick leave issued on the occasion of an upcoming birth has not changed: it, as before, is somewhat different from the taxation of general sick leave. The difference is that there is no need to calculate and withhold personal income tax. The fact is that maternity benefits are directly named in the list of income not subject to this tax (clause 1 of Article 217 of the Tax Code of the Russian Federation).

Personal income tax will not be calculated and withheld from other payments related to maternity:

- for registration in the early stages of pregnancy;

- upon the birth of a child;

- benefits issued to care for a child until he reaches the age of 1.5 years.

Absolutely all benefits related to maternity are issued at the expense of the Social Insurance Fund and are not subject to taxation of insurance contributions.

When is income tax transferred to the budget?

The transfer of funds to the state treasury is made no later than the end of the month in which the employee was transferred the disability benefit (Article 226 of the Tax Code of the Russian Federation).

Thus, the period established by law is longer than that adopted according to the general rules.

At the same time, no one forces the accounting department to drag out time. The transfer can be made immediately after personal income tax has been withheld.

Vacation pay taxes: when and how to pay, transfer deadlines.

How are additional payments up to average earnings taxed?

All types of benefits we reviewed are calculated based on the employee’s average earnings for the previous 2 calendar years. However, it must be remembered that the employee’s total income for the year cannot exceed the amount of the maximum base for contributions to VNiM. That is, if the employee’s actual earnings exceed the specified amount, the calculated benefit will be less than if it were determined based on the amount of his earnings. Also, some employees do not have the right to claim sick leave in the amount of 100% of average earnings due to lack of experience, and some are entitled to benefits only based on the minimum wage.

In these situations, local regulations of the employer or employment contracts may provide for additional payment up to the average salary on sick leave, which, of course, is not reimbursed by social insurance.

Since such an additional payment cannot be defined as a state benefit, a different approach to taxation is applied to it:

- Firstly, it is fully subject to personal income tax, since it is not in the list of exempt income from Art. 217 Tax Code of the Russian Federation.

- Secondly, all insurance premiums must be charged on it, because additional payment up to average earnings is already a payment within the framework of labor relations (clause 1 of article 420 of the Tax Code of the Russian Federation, clause 1 of article 20.1 of law No. 125-FZ).

Personal income tax on sick leave benefits in 2021

We described in the article what rules are applicable to personal income tax in 2021 for temporary disability benefits (sick leave). The information will be useful to both ordinary policyholders and participants in the Social Insurance Fund pilot project.

Attention: until personal income tax is withheld, that is, until sick pay is paid, tax is not transferred. The tax agent must first withhold tax from the accrued payment, and then transfer the withheld amount. In the case of a tax agency, it is impossible to repay the debt to the budget from your own funds.

What taxes and contributions are paid on sick leave: example of calculation and posting

Insurance premiums are not charged on the benefit amount. The employer must accrue the money within 10 days from the date of presentation of the certificate of incapacity for work, and transfer it along with the payment of the next salary.

To accept sick leave for credit, it is necessary that at the time of the onset of illness an employment contract was concluded between the employee and the employer. Periods of absence from work due to injury resulting from unlawful acts are not paid.

Sick leave taxes effective in 2021-2021

“It would not be superfluous to consider the duration of sick leave. The minimum period of illness is equal to ten days, although an extension is provided if this is related to health conditions, as confirmed by the attending physician. The therapist can increase the period of temporary disability to thirty days, but in other cases a decision of a special commission is necessary.”

If you pay attention to legislative acts, you will find that compensation for temporary disability is subject to taxation on a general basis. This means that the compensation funds are subject to income tax.

Is sick leave subject to personal income tax in 2021?

The issue of taxing sick periods with insurance premiums is also quite relevant for Russian employers. After all, according to the law, all wage payments to an employee must be subject to additional insurance contributions. But the law does not classify sick leave payments as labor costs and does not include them in the employee’s salary.

- Article 217 regulates the list of income and cash deductions that are not subject to personal income tax as a separate type of tax.

- Article 223 regulates the procedure for paying personal income tax and contains the answer to questions related to the deadlines for paying personal income tax on sick leave in 2021.