If a working citizen wishes to take sick leave, then he is entitled to temporary disability benefits. The provision of such a “service” is carried out from the “treasury” of a specialized insurance fund, which assumes the absence of any damage to the enterprise where the sick person works. Which groups of people are entitled to payments during illness, and how is the amount of financial support calculated?

Concept and types of temporary disability benefits

Loss of ability to work in the context of labor relations is a person’s condition in which he is unable to perform his professional functions.

Temporary disability benefits are monetary compensation for wages for the period of treatment, rehabilitation or care for a patient. This compensation is assigned to everyone who participates in the compulsory insurance system.

There are several types of payments:

- in case of illness, damage, insertion of a prosthesis;

- quarantine;

- treatment in a medical institution;

- rehabilitation after injuries and illnesses;

- patient care.

Sick leave funds for the first three days are provided by the company where the person works, and the rest of the time they are accrued from the Social Insurance Fund.

When is the benefit calculated?

In order to apply for and receive benefits, you must officially confirm your temporary disability and right to payment.

The basis for payment is:

- injury, mutilation, including abortion or IVF;

- caring for a sick close dependent relative;

- quarantine, forcing you to be isolated from society for some time;

- performing prosthetic procedures with government agencies in the presence of confirmed medical reports;

- the need for a rehabilitation course (such reasons include treatment in a sanatorium located within the Russian Federation).

When determining the legality of rights to social payments, it is necessary to take into account some restrictions under which the transfer of social insurance funds becomes impossible and illegal :

- establishing the fact of intentional harm to one’s health, due to which the employee lost the ability to perform his job duties;

- the employee became unable to work due to the influence of drugs or alcohol;

- injury or general disability occurred during the commission of criminal acts (a striking example of such cases is the theft of factory products over a fence, which resulted in broken limbs when trying to jump over the factory fence);

- failure of the employee to appear for a mandatory medical examination (exception – cases where the employee could not come for a valid reason, confirmed by documents).

Each of the above cases may become a legal reason for refusing to pay or reducing the amount of benefits.

The legislative framework

The right to compensation is prescribed in the Labor Code, Art. 183 “Guarantees for employees in case of temporary disability.” The main law regulating the rules for its provision is Federal Law No. 255 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

The law answers all questions regarding compensation:

- rights of the insured person;

- who can receive funds;

- period of provision;

- benefit amount;

- rules for calculating the amount;

- conditions for reducing or terminating compensation.

Based on this regulatory act, let us consider in more detail the procedure for calculating compensation, conditions and its amount.

Can they refuse to receive it, what to do if they refuse?

In some cases, citizens may be denied benefits. The list of such reasons is strictly regulated and is contained in paragraph 16 of the Government of the Russian Federation No. 384 in paragraph 16 of the Government of the Russian Federation No. 384. It includes :

- Death of a child.

- Inconsistency with the requirements regarding average per capita income for each family member.

- Unreliability and incompleteness of the information provided by the applicant in the application.

- Other situations provided for by the legislation of the Russian Federation and regulations of the constituent entities of the Russian Federation.

Who should

Material support is provided to persons working on the basis of an employment contract, and only if the institution makes contributions to the Social Insurance Fund for its employees. However, citizens who are not employed by enterprises can also become recipients of funds:

- persons engaged in legal practice, notaries and individual entrepreneurs;

- persons working on their own farms;

- representatives of communities of endangered northern peoples.

The main condition is the payment of contributions to the Fund from the income received. Moreover, it does not matter how exactly the contributions were paid - by the enterprise’s accounting department or by the person himself. Also, in order to receive financial compensation, the employee must confirm the inability to work.

Confirmation of incapacity for work is a doctor's conclusion.

Payments under a certificate of incapacity for work are not due or stop being transferred if:

- the person violated the treatment regimen;

- the sick leave was issued by an institution without a license;

- if the employee was suspended without pay;

- if the loss of health occurred as a result of an offense.

Compensation is also not provided to unemployed citizens who do not receive unemployment benefits. But if a person quits his job, but within a month after leaving he loses the opportunity to work, then he is entitled to compensation.

What documents are provided for calculating benefits?

According to Appendix 1 of FSS Order No. 335 of September 17, 2012, the main documents on the basis of which benefits can be assigned are:

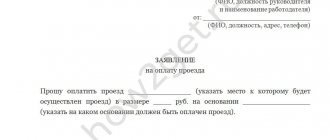

- Application for payment from an employee (on the organization’s letterhead).

- A sick leave certificate confirming the existence of a legal basis for the accrual of social benefits.

Additionally, in case of accidents at work you may need :

- an act establishing the circumstances of the accident (if the disability arose due to an industrial accident).

- act on occupational disease;

- copies of investigation materials.

Also on topic: Cancellation of the certificate of conformity

Period for applying for benefits

The benefit can be assigned within 10 days after the employee contacts the employer, subject to the provision of all necessary documents confirming the legality of rights to disability payments.

The actual accrual of benefits, as a rule, is made on the day of the next salary transfer, i.e. the benefit can be received along with the rest of the salary, or instead of it if the entire payment period was spent on sick leave.

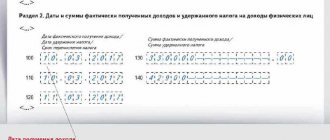

If the organization does not have documentary evidence of an employee’s labor income for the previous period, the basis for calculating benefits will be information received from the insured employee.

It is possible to recalculate benefits within the last 3 years, provided that the employee provides the appropriate certificate of earnings.

In order for social transfers to be accrued, a citizen applies within six months from the date of subsequent return to work, restoration of health, or vice versa - assignment of disability.

The 6-month period during which you can apply for social benefits also applies in other cases of temporary disability - from the moment the process of prosthetics is completed, the recovery of a family member, or the end of the quarantine period. If you apply for benefits untimely, the question of the validity of the payment is transferred to the discretion of the social insurance authorities, depending on the specific situation.

Step-by-step instructions for applying for benefits

Final recommendations for citizens wishing to apply for a payment will be developed only after the signing of local regulations governing the appointment and payment of benefits.

When can you apply for payment (beginning of accepting citizens’ appeals)

It is expected that the acceptance of documents for payment of benefits will be open from June 1, 2021, however, the final decision will be made by the authorities of the constituent entities of the federation. If the relevant decrees on the acceptance of documents are signed, the acceptance of citizens’ applications can begin as early as May 1.

IMPORTANT! Regardless of the date of application and submission of the application to the authorized bodies, the payment will be made retroactively, that is, from January 1, 2021, if the child met the conditions for the payment. Payment of benefits for the period from January 1, 2020 until the moment of filing the application will be made in a lump sum (subject to filing the application before December 31, 2020).

Where to apply for payment from 3 to 7 years

In accordance with the provisions of paragraph 9 of the Government of the Russian Federation No. 384, paragraph 9 of the Government of the Russian Federation No. 384, an application for payment must be submitted to the Social Security authorities at the place of residence.

This can be done in several ways:

- Personally handing over the required package of documents to the employees of the authorized body.

- By contacting one of the offices of the Multifunctional Center.

- By filling out the appropriate application on the State Services portal.

- By sending an application by registered mail with notification via Russian Post.

Required documents

In order to receive benefits, the applicant will need to provide only a statement of the established form.

All documents that social security employees will need to make a decision on assigning a payment will be requested by them independently, in the format of interdepartmental interaction.

The applicant is only required to provide a document confirming the birth of the child if the registration of the child was not made on the territory of the Russian Federation. Service employees cannot request other documents from the applicant. In this case, to make a decision on the assignment of payment, the following data will be required :

- Information about the birth of children.

- Information about the death of a child or his parents, adoptive parents or guardians.

- Information about registration or divorce.

- Information about establishing custody of a child.

- Information about the child's legal representatives.

- Data on the deprivation, restriction or cancellation of restrictions on parental rights.

- Information about limiting the legal capacity of the child’s legal representative or declaring him incompetent.

- Information about income received by members of the applicant’s family.

- Information about the applicant’s real estate or other property.

- Information about registration of family members.

Deadlines for consideration of applications and decision-making

The application must be considered within ten working days from the date of receipt of the application.

If a citizen is denied a benefit, a corresponding notification must be sent to the applicant within one working day from the date of the decision.

Where is the money transferred and within what time frame?

If the decision is positive, the money will be transferred to the citizen’s account specified in the application within 10 calendar days from the date of the decision on payment.

Calculation of temporary disability benefits

The amount is affected by:

- cause of loss of health;

- insurance experience;

- salary amount;

- number of calendar days of incapacity.

Sick leave is calculated using the formula:

SD x PTS x D = Amount of monthly benefit.

- SD – average daily earnings;

- PTS – percentage of experience;

- D – number of days spent on sick leave.

To calculate the average daily salary, you need to calculate the total amount of income received and divide it by 730 days.

The next required indicator - the percentage of work experience - is defined by Federal Law No. 255.

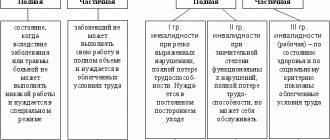

It depends on the length of service and the reason for losing the opportunity to work. Table of dependence of length of service and percentage of sick leave payments

| Cause | Experience | Percentage of salary that is taken into account when calculating benefits |

| Illness or injury, quarantine, prosthetics, rehabilitation | Up to 5 years | 60% |

| From 5 to 8 | 80% | |

| From 8 | 100% | |

| If a child under 15 years of age is sick, treatment at home | Up to 5 years | 60%. |

| From 5 to 8 | 80% | |

| More than 8 years | 100% | |

| If a child under 15 years of age is sick, treatment in a medical institution, as well as care for an adult family member at home. | Up to 5 years | 60% |

| From 5 to 8 | 80% | |

| More than 8 years | 100% |

The numbers in the third column are the percentage of average earnings that is taken into account when calculating material compensation.

If a person has had several jobs over the last two calendar years, the amount will be calculated taking into account all income that was subject to insurance premiums.

How will child benefit amounts change from February?

Every year since February, state benefits for citizens with children are indexed. Payments increase by the amount of inflation for the previous year, in this case 2021.

According to Rosstat, prices over the past year increased by 4.9%. Accordingly, benefits will be increased by this amount. This level of growth is indicated in the draft resolution prepared by the Ministry of Labor.

Exactly what payments will increase by 4.9% is indicated in Article 4.2 of Federal Law No. 81-FZ of May 19, 1995.

To find out what the benefit amount will be from February 2021, you need to multiply its size by 1.049.

The formula in this case will look like this:

Size until 02/1/2021 X 1,049 = Size from 02/1/2021

Everyone can do this on their own. We did the math too.

One-time benefit for women registered with medical organizations in the early stages of pregnancy:

- until 02/01/21 — 675.15

- after 02/01/21 - 708.23

One-time benefit for the birth of a child:

- until 01.02.21 - 18004.12

- after 02/01/21 - 18,886.32

Monthly child care allowance (minimum amount):

- until 01.02.21 - 6752

- after 02/01/21 - 7,082.84

Calculation of sick leave if the length of service is less than 6 months

If the work experience is less than six months, the amount of security should not be more than the minimum wage per month.

Also on the topic: Wage arrears: how to collect a debt

In this case, when calculating the average income for 6 months, it is not the salary level that is taken, but the minimum wage amount. Calculation formula:

Payment amount = minimum wage x 0.6.

Where:

- Minimum wage – minimum wage;

- 0.6 is 60%.

According to this formula, persons without experience can count on small benefit payments.

Let us give some illustrative examples of calculating benefits paid due to an employee’s illness.

Example 1.

The employee of the institution was on sick leave from January 1 to January 7, 2021. His insurance experience is 8 years 5 months, his earnings in the billing period were:

- in 2021 – 190,200 rubles;

- in 2021 – 240,000 rubles.

The average daily earnings will be 589.32 rubles. ((190,200 + 240,000) rub. / 730).

Sick leave will be paid at 100%, since the employee’s work experience is more than 8 years.

The amount of temporary disability benefits for 7 calendar days will be 4,125.24 rubles. (RUB 589.32 x 100% x 7 days).

Example 2.

According to the certificate of incapacity for work, the employee was ill from February 6 to February 15, 2021. His experience is 6 years, and his earnings in the billing period:

- in 2021 – 69,300 rubles;

- in 2021 – 98,700 rubles.

The average daily earnings will be 230.14 rubles. ((69,300 + 98,700) rub. / 730), which is less than the minimum amount of average daily earnings in 2021 - 370.85 rubles. Therefore, to calculate sick leave, the established minimum is taken.

Sick leave will be paid in the amount of 80% of the average daily earnings.

The amount of temporary disability benefits will be 2,966.80 rubles. (RUB 370.85 x 80% x 10 days).

Example 3.

The former employee fell ill 5 calendar days after his dismissal. According to the certificate of incapacity for work, which was submitted to the institution, the period of illness was 8 calendar days. The amount of income of a former employee subject to insurance contributions to the Social Insurance Fund for the two previous calendar years is 1,010,000 rubles.

The average daily earnings is 1,383.56 rubles. (RUB 1,010,000 / 730).

The percentage of sick leave payment to a former employee is 60% of the average daily earnings.

The amount of temporary disability benefits will be 6,641.09 rubles. (RUB 1,383.56 x 60% x 8 days).

What to do if you don't have insurance coverage?

If the employee has less than six months of official work experience in the workplace, the payment is made in the amount of the minimum wage in the region.

Following from the current legislation, the formula by which benefits are calculated for citizens with a small amount of experience is as follows:

Payment amount = Minimum salary x 0.6

It is easy to calculate that the benefits provided for citizens with less than six months of official insurance contributions will be forty percent less than the minimum wage.

Do I need to write an application for temporary disability benefits?

To apply for work benefits, you must present a sick leave certificate indicating your release from work. The application is only necessary when applying for benefits from the Social Insurance Fund. You only need to go to this body for payments in three cases:

- the organization in which the employee is registered is at the stage of bankruptcy;

- the organization was liquidated;

- the person has been on sick leave for more than 1 month.

In these cases, when contacting the FSS, an application will be required. When applying for benefits at your place of work, you only need to present a sick leave certificate.

Form of certificate of incapacity for work

The document is issued at the medical institution. It states:

- Address and name of the medical organization.

- Full name of the patient.

- Cause of disability.

- Type of employment.

- Data on average income, information about employer, length of service.

- Period of release from work.

The sheet is filled out by the medical professional, then by the employer.

Sample certificate of incapacity for work

Payment terms and duration

How long can an employee receive compensation:

| Reason for inability to work | Payment period |

| Illness or serious injury | Until complete recovery, but no more than 4 months in a row or 5 months in total per year |

| Rehabilitation | Up to 24 days |

| If a preschooler is sick | Up to 3 months |

| If a child aged 7 to 15 years is sick | No more than two weeks for each sick leave, but no more than 45 days a year |

| If an incapacitated child under 15 years of age needs care | Up to 120 days a year |

| Quarantine | For the entire term |

| Inserting a prosthesis | For the entire period until complete recovery |

Also on the topic: Features of filing a lawsuit against an employer for non-payment of wages

Temporary disability benefits in 2021 are paid from the Social Insurance Fund budget, but the first 3 days of sick leave are paid by the employer.

Such accrual rules apply only if the cause of disability is illness or injury of the employee himself. In other cases, compensation is calculated by the FSS.

Features of the application of the law

If an employee has several employers, the right to receive compensation due to disability arises in each of the employing organizations .

Actions for calculating and assigning benefits for each employer appear to be within the standard procedure, and the law does not limit the possibility of receiving benefits, regardless of the number of places of work, provided that official deductions of insurance contributions to the Social Insurance Fund were carried out everywhere.

When calculating benefits, it should be taken into account that the assigned amount cannot be lower than the minimum wage established in the region.

It should be noted that a resigned employee is also entitled to receive benefits if the insured event occurred within 30 days after the date of dismissal. In this case, the benefit will be within 60% of the level of earnings for the previous period.

Payment procedures

As a rule, the majority of citizens receive payments from social insurance with the direct participation of their employer, at the place where they receive their salary.

In some cases, citizens contact the Social Insurance Fund directly:

- if the disability arose a month after dismissal;

- if employees belong to the category of self-employed persons (individual entrepreneurs, notaries, lawyers, etc.);

- if the employer ceased its activities, closed, was declared bankrupt, etc.

By making regular contributions to the social insurance fund, each employee can count on receiving various types of benefits, which will be a good help during the period of inability to perform work duties, provided that the cause of incapacity is temporary.

Who can apply for compensation?

The above-mentioned law of the Russian Federation provides for the payment of benefits to citizens when the following situations occur:

- Employees who have become unable to work due to illness or a traumatic situation. This also includes abortion and in vitro fertilization;

- When caring for one of the family members (for example, an employee may have a wife with a disability to support, etc.);

- Those who are in quarantine due to their own illness or the illness of children under seven years of age;

- For the installation of prostheses as prescribed by doctors in public hospital clinics;

- During the period when citizens are sent to sanatorium resorts located on the territory of the Russian Federation for further treatment or to have prosthetics installed.

When can compensation be denied?

The grounds for a negative response to payment to a temporarily disabled citizen may be the following:

- In case of intentional harm to one’s own health;

- If the damage was caused to oneself under the influence of alcohol or other types of deliberate impairment of consciousness;

- Failure of an employee to appear at a medical institution at the appointed time for examination without an obvious reason. Significant factors are those in which a person is physically unable to appear for examination;

- Acquiring disability at the time of committing a crime of any kind (for example, after an illegal theft at the workplace, an employee tried to climb over a fence and broke his leg).

If one of the above conditions is observed, benefits for the loss of the ability to carry out work activities are significantly reduced or completely canceled.