An experiment continues aimed at paying sick leave benefits directly through the Social Insurance Fund (SIF). The following subjects of the Russian Federation initially took part in this project: Astrakhan, Kurgan, Nizhny Novgorod, Novgorod, Novosibirsk and Tambov regions, as well as Karachay-Cherkessia and Khabarovsk Territory.

Since 2021, the following countries have joined the pilot project: the Republic of Mordovia, Bryansk region, Kaliningrad region, Kaluga region, Lipetsk region, Ulyanovsk region, Republic of Tatarstan, Belgorod region, Samara region, Rostov region, Republic of Crimea, Sevastopol, Astrakhan region, Kurgan region, Novgorod region region, Novosibirsk region, Tambov region, Khabarovsk region, Karachay-Cherkess Republic, Nizhny Novgorod region.

Since July 1, several more constituent entities of the Russian Federation have been added to the list of direct payments to the Social Insurance Fund:

Republic of Adygea, Republic of Buryatia, Republic of Kalmykia, Primorsky Territory, Vologda Region, Magadan Region, Omsk Region, Oryol Region, Tomsk Region, Jewish Autonomous Region, Altai, Altai Territory, Amur Region.

from July 1, 2021, 19 regions were connected to the pilot project: the Kabardino-Balkarian Republic, the Republic of Karelia, the Republic of North Ossetia-Alania, the Republic of Tyva, the Kostroma and Kursk regions, Yakutia, the Trans-Baikal Territory, the Volgograd Region, the Vladimir Region, the Voronezh Region, the Ivanovo Region , Kirov region, Kemerovo region, Kostroma region, Kursk region, Ryazan region, Smolensk region, Tver region.

A year later, from July 1, 2021, the number of participants in the pilot project increased further:

Transbaikal region, Arkhangelsk region, Voronezh region, Ivanovo region, Murmansk region, Penza region, Ryazan region, Sakhalin region, Tula region.

For 2021, it is planned to allow direct payments:

from January 1, 2021: Komi Republic, Sakha Republic (Yakutia), Udmurt Republic, Kirov Region, Kemerovo Region, Orenburg Region, Saratov Region, Tver Region, Yamalo-Nenets Autonomous Okrug.

from July 1, 2021: Republic of Bashkortostan, Republic of Dagestan, Krasnoyarsk Territory, Stavropol Territory, Volgograd Region, Irkutsk Region, Leningrad Region, Tyumen Region, Yaroslavl Region.

In turn, in 2015, a pilot project for the transition to electronic sick leave certificates was launched. The project was based on the Lithuanian experience of switching to electronic sick leave, which turned out to be quite successful. The implementation of electronic document management of sick leave certificates was planned to be completed at the federal level by 2021. But, unfortunately, this did not happen, and the deadline for the transition of all constituent entities of the Russian Federation to electronic sick leave certificates was postponed to 2021.

And today we will tell our readers how sick leave will be paid in 2021. We will also find out the terms of payment for sick leave.

Minimum sick leave payment in 2020

Insured persons with insurance experience of less than 6 months are subject to payment of temporary disability benefits in the amount of no more than for a full calendar month in accordance with the minimum wage.

Let us remind you that for 2021 the minimum wage for the purpose of calculating the minimum sick leave benefit is set at 12,130 rubles.

Thus, the amount of average daily earnings (for calculating temporary disability benefits) can be calculated as follows:

Minimum average daily earnings = minimum wage (12,130 rubles) X 24 months / 730 days.

That is, the minimum average daily earnings in 2021 is 398.79 rubles.

If the region has regional coefficients for these purposes, then the average daily earnings are calculated taking into account the coefficient.

Example 1. Calculate sick leave benefits if the employee’s earnings are less than the minimum

A full-time LLC employee provided sick leave for the period from October 10 to October 16, 2021 (seven calendar days). The employee's total insurance period is seven months. If you have less than 5 years of experience, you are entitled to a benefit of 60 percent of your earnings. Regional coefficients do not apply in this region.

To calculate the average daily earnings, it is necessary to take the calculation period - 2018–2019. But at this time the employee was not working. Therefore, to calculate benefits, you need to take the minimum earnings in the amount of 291,120 rubles. (RUB 12,130 X 24 months), taking into account the minimum wage in force from January 1, 2021.

Thus, the disability benefit amounted to:

RUB 291,120 / 730 days × 60% × 7 days. = 1674.94 rub.

Features of the application of the law

If an employee has several employers, the right to receive compensation due to disability arises in each of the employing organizations .

Actions for calculating and assigning benefits for each employer appear to be within the standard procedure, and the law does not limit the possibility of receiving benefits, regardless of the number of places of work, provided that official deductions of insurance contributions to the Social Insurance Fund were carried out everywhere.

When calculating benefits, it should be taken into account that the assigned amount cannot be lower than the minimum wage established in the region.

It should be noted that a resigned employee is also entitled to receive benefits if the insured event occurred within 30 days after the date of dismissal. In this case, the benefit will be within 60% of the level of earnings for the previous period.

Maximum amount of sick leave in 2020

The maximum payment for sick leave in 2021 is limited by the maximum base for calculating insurance contributions to the Social Insurance Fund. It is the Social Insurance Fund that pays the subsequent days after three days of sick leave paid by the employer. The maximum value is established by regulations of the Government of the Russian Federation for each calendar year. This is the maximum amount with which contributions to the Social Insurance Fund can be paid for the year. In excess of this amount, contributions for temporary disability benefits are not paid. Therefore, the FSS cannot pay benefits in an amount above this limit, since it does not receive contributions for this.

Every year the limits increase with the following dynamics:

If in 2021 the maximum limit for compulsory social insurance in case of temporary disability and in connection with maternity was 718,000 rubles, then in 2021 this limit will be 755,000 rubles. And for 2021, the maximum limit for compulsory social insurance in case of temporary disability and in connection with maternity is 815,000 rubles. For 2021, the maximum limit for compulsory social insurance for temporary disability and in connection with maternity is 865,000 rubles.

In 2021, the maximum limit for compulsory social insurance for temporary disability and in connection with maternity will be 912,000 rubles.

Example 2. Let's calculate the maximum amount of sick leave in 2021

An LLC employee provided sick leave for a period of 7 calendar days from January 16 to January 22, 2021. The employee's total insurance experience is ten years. Accordingly, the benefit will be paid in the amount of 100% of earnings. The employee works full time; regional coefficients do not apply in the region.

- standard billing period is 2018–2019;

- the maximum limit in 2021 is 865,000 rubles;

- the maximum limit in 2021 is 815,000 rubles;

- the employee’s earnings in 2021 amounted to 880,000 rubles;

- The employee’s earnings in 2021 amounted to 840,000 rubles.

It turns out that earnings in 2021 and in 2021 exceeded the limit, and contributions to the Social Insurance Fund were not paid from the difference.

Therefore, sick leave is calculated based on the maximum limits established for 2021 and 2021.

Thus, in 2021, the maximum daily sick leave cannot exceed:

(815,000 + 865,000) / 730 = 2,301.37 rubles.

Who should

Material support is provided to persons working on the basis of an employment contract, and only if the institution makes contributions to the Social Insurance Fund for its employees. However, citizens who are not employed by enterprises can also become recipients of funds:

- persons engaged in legal practice, notaries and individual entrepreneurs;

- persons working on their own farms;

- representatives of communities of endangered northern peoples.

The main condition is the payment of contributions to the Fund from the income received. Moreover, it does not matter how exactly the contributions were paid - by the enterprise’s accounting department or by the person himself. Also, in order to receive financial compensation, the employee must confirm the inability to work.

Confirmation of incapacity for work is a doctor's conclusion.

Payments under a certificate of incapacity for work are not due or stop being transferred if:

- the person violated the treatment regimen;

- the sick leave was issued by an institution without a license;

- if the employee was suspended without pay;

- if the loss of health occurred as a result of an offense.

Compensation is also not provided to unemployed citizens who do not receive unemployment benefits. But if a person quits his job, but within a month after leaving he loses the opportunity to work, then he is entitled to compensation.

Calculation of sick leave in 2021

How to calculate sick leave in 2021? In order to answer this question, you must first determine the number of days that are indicated on the sick leave (days of illness) and multiply by the amount of benefit for 1 day.

The second indicator is calculated based on the average daily earnings. The length of service is determined by the period of registration (and payment of contributions) in the Social Insurance Fund.

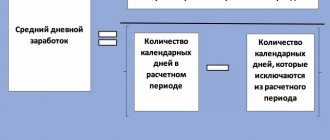

Temporary disability benefits can be calculated using the following formula:

SP = SZ:730XDB, where:

SP - amount of benefit payable;

SZ - the amount of earnings for two years;

DB - number of days on sick leave.

Please note that the percentage of payment (from 60% to 100%) of the average daily salary depends on the length of service and on the person for whom sick leave was received.

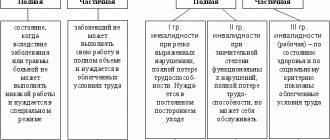

Sick leave was issued due to the illness of the employee himself:

- for less than 5 years of experience, 60% is paid;

- with 5-8 years of experience, 80% is paid;

- with more than 8 years of experience, 100% is paid.

Sick leave was issued to an employee due to his occupational illness or injury at work:

- Regardless of length of service, 100% is paid.

Sick leave was issued to care for a child undergoing outpatient treatment, provided that the child is under 15 years old:

- for less than 5 years of experience, 60% is paid for the first 10 days of sick leave and 50% for subsequent days;

- with 5-8 years of experience, 80% is paid for the first 10 days of sick leave and 50% for subsequent days;

- with more than 8 years of experience, 100% is paid for the first 10 days and 50% for subsequent days.

Sick leave was issued to care for a child undergoing inpatient treatment, provided that the child is under 15 years of age:

- for less than 5 years of experience, 60% is paid;

- with 5-8 years of experience, 80% is paid;

- with more than 8 years of experience, 100% is paid.

The Ministry of Labor and Social Protection of the Russian Federation has made a proposal, starting from 2021, to pay sick leave in the amount of 100% of average daily earnings, starting with 15 years of experience. Moreover, the Ministry of Labor plans to introduce such an increase gradually, increasing it by six months each year. It was planned to start in 2021 with a view to completing the process by 2029. But the Government has not yet accepted the proposal of the Ministry of Labor, therefore, in 2020, payment of sick leave benefits in the amount of 100% is made if you have at least 8 years of work experience.

In what situations is it paid?

The benefit is issued in case of temporary loss of ability to work while at a specific job or after injury within 1 month from the date of dismissal. Also, this is done during such a period - from the date of conclusion of the contract (employment contract) until the moment of its termination (Part 2 of Article 5 of Federal Law No. 255).

Read also: Benefits for blood donors in 2021

Such money is due for the entire relevant period of treatment. Monetary compensation is received until full restoration of the previous working capacity or until the disability group is received (Article 6 of Federal Law No. 255).

On a note! From July 1, 2021, in a local clinic, with the written personal consent of the patient, an electronic sick leave certificate is issued to the patient. This certificate of incapacity for work is signed by the attending physician in this way - using an electronic digital signature (EDS).

How to apply for electronic sick leave

After receiving a disability group, an employee (except for workers with tuberculosis) is accrued benefits for 4 consecutive months as a maximum or for 5 months. per year. When working for less than 6 months, as well as if an occupational illness (injury) occurs during the working period, such money is transferred to the salary card within 75 days according to the calendar as a maximum. In two extreme cases, workers with tuberculosis are paid monetary compensation until the day they fully restore their previous ability to work or receive a disability group.

Similar payments are issued after the introduction of quarantine. This kind of money is paid to those who have been in contact with infected people or have contracted some kind of virus themselves.

Important! After the introduction of quarantine, this money is issued for the entire period of release from official work.

If one’s own children under 7 years of age are infected in a kindergarten or when caring for incapacitated family members on a daily basis, monetary compensation is paid to their parents (guardians) during the corresponding period of the quarantine regulation.

The benefit is also issued after undergoing prosthetics in the hospital, which is prescribed for specific medical indications.

Payments are made for the entire relevant period of sick leave. In such a situation, travel time to the hospital and back is also paid.

Procedure for paying sick leave in 2021

Payment of sick leave in 2021 occurs as follows:

1. Payment for sick leave is made entirely at the expense of the employer if the sick leave period is 3 days. 2. Starting from the 4th day of sick leave, the payment of benefits is made at the expense of the Social Insurance Fund.

Payment for sick leave in 2021 will be made together with an advance payment or salary, depending on which type of payment is closer to the date of calculation of temporary disability benefits. The employer is given 10 days to calculate the benefit.

Calculation period for benefits

The calculation period for benefits for determining average daily earnings is two calendar years before the year in which the insured event occurred. Those. if the insured event occurred in 2020, it is necessary to calculate the average daily earnings for 2021 and 2019.

But there are cases when during these years the employee had no income. For example, an employee was on maternity leave.

Federal Law No. 255, Part 1, Article 14, establishes that employees have the right to change the pay period subject to two conditions:

- in the year being replaced, the employee was on parental leave or maternity leave;

- Changing the years of the calculation period will lead to an increase in the benefit amount.

To do this, the employee must write and submit an application for changing the years of the billing period for sick pay. Moreover, if the Social Insurance Fund allowed to include any years in this period, the Ministry of Labor, by its letter No. 17-1/OOG-1105 dated August 3, 2015, determined that only the years closest to the insured event, and not any, can be taken for replacement.

What documents are provided for calculating benefits?

According to Appendix 1 of FSS Order No. 335 of September 17, 2012, the main documents on the basis of which benefits can be assigned are:

- Application for payment from an employee (on the organization’s letterhead).

- A sick leave certificate confirming the existence of a legal basis for the accrual of social benefits.

Additionally, in case of accidents at work you may need :

- an act establishing the circumstances of the accident (if the disability arose due to an industrial accident).

- act on occupational disease;

- copies of investigation materials.

Also on topic: Cancellation of the certificate of conformity

Period for applying for benefits

The benefit can be assigned within 10 days after the employee contacts the employer, subject to the provision of all necessary documents confirming the legality of rights to disability payments.

The actual accrual of benefits, as a rule, is made on the day of the next salary transfer, i.e. the benefit can be received along with the rest of the salary, or instead of it if the entire payment period was spent on sick leave.

If the organization does not have documentary evidence of an employee’s labor income for the previous period, the basis for calculating benefits will be information received from the insured employee.

It is possible to recalculate benefits within the last 3 years, provided that the employee provides the appropriate certificate of earnings.

In order for social transfers to be accrued, a citizen applies within six months from the date of subsequent return to work, restoration of health, or vice versa - assignment of disability.

The 6-month period during which you can apply for social benefits also applies in other cases of temporary disability - from the moment the process of prosthetics is completed, the recovery of a family member, or the end of the quarantine period. If you apply for benefits untimely, the question of the validity of the payment is transferred to the discretion of the social insurance authorities, depending on the specific situation.

How to correctly calculate sick leave benefits in 2020

The first thing you need to do is determine the calculation period for temporary disability benefits. The billing period means the time for which all payments to the employee (which are subject to insurance premiums) must be summed up. In accordance with Part 1 of Article 14 of Law No. 255-FZ, the calculation period is two calendar years (from January 1 to December 31 inclusive) that preceded the occurrence of the insured event - illness.

The second step is to take into account all the amounts of payments for which insurance premiums were calculated (including payments at the previous place of work in the form of a salary certificate).

Third, determine the total amount of payments that were made in favor of the employee over 2 years (for the billing period). The amount of payments should not be less than 24 times the minimum wage and should not be more than the permissible size of the base for calculating insurance premiums for a certain period.

The fourth thing to do is find the amount of average daily earnings. To do this, the entire amount of payments to the employee for 2 years must be divided into 730 days. If one of the periods for calculating average earnings falls on a leap year, then the amount of payments must be divided not by 730 days, but by 731 days. The next leap year will be 2021.

Fifth, determine the employee’s length of service. The length of service must be calculated in full years and months. According to the Rules for calculating insurance experience, you must first calculate in the following order:

- Number of complete calendar years.

- Number of complete calendar months.

- Sum up the remaining days and convert them into months - 30 days for each month.

- Convert the resulting months into years - 12 months per year.

- Add up all the resulting years.

WHAT IS THE INSURANCE EXPERIENCE FOR CALCULATING SICK LEAVE IN 2021?

In order to determine the percentage of payment of average daily earnings for sick leave, it is necessary to calculate the employee’s insurance record. It includes:

- work under employment contracts (from the work book);

- public or military service (fixed-term and contract);

- periods of other activities during which the employee was subject to compulsory social insurance in case of temporary disability and in connection with maternity.

In cases where periods overlap each other, only one of them is taken into account.

Form of certificate of incapacity for work

The document is issued at the medical institution. It states:

- Address and name of the medical organization.

- Full name of the patient.

- Cause of disability.

- Type of employment.

- Data on average income, information about employer, length of service.

- Period of release from work.

The sheet is filled out by the medical professional, then by the employer.

Sample certificate of incapacity for work

EXAMPLE OF CALCULATION OF SICK LEAVE IN 2021

Employee Tabuleev I.P. provided the accounting department of the company Flamingo LLC with a sick leave certificate, which indicated the date of onset of the illness - February 5, 2021 and the date of recovery - February 11, 2020 (8 calendar days). Work experience of employee Tabuleev I.P. at the time of illness was 6 years and 3 months (80% of average daily earnings).

To determine the average daily earnings, we will take the period for 2018 and 2021. In 2021, the earnings of Tabuleev I.P. amounted to 750 thousand rubles, and in 2021 - 870 thousand rubles. We see that for 2018 the limit was not exceeded, but for 2021 there is an excess of 5,000 rubles. Therefore, to calculate for 2021, it is necessary to take into account not actual earnings, but the maximum limit - 865,000 rubles.

We determine the average daily salary of an employee:

(750,000 + 865,000) / 730 = 2,212.33 rubles

We calculate the amount of payment for sick leave:

2,212.33 × 80% X 8 days = 14,158.91 rubles

The first three days of sick leave are paid by Flamingo LLC - 6,636.99 rubles, and the rest of the payment in the amount of 7,521.92 is compensated by the Social Insurance Fund.

The material has been edited in accordance with changes in the legislation of the Russian Federation, relevant as of 10/11/2019

Children under one and a half years old

Financial assistance for child care up to 1.5 years is calculated as standard, but there are still some differences. These include the following:

- When calculating, the amount of average earnings per day is multiplied not by the number of vacation days, but by the average number of days in a month. That's 30.4 days.

- The benefit is paid monthly.

Only 40% is also calculated from the amount received.

For example, the daily income of a young mother is 1 thousand 600 rubles. how the amount of one day's earnings is calculated . Further calculation is carried out as follows: 1, 600 * 30, 4 = 48 thousand 640 rubles. But you should also determine 40% of this amount: 48, 600 * 0, 4 = 19 thousand 456 rubles. This is the amount of benefit that a woman will receive monthly for up to one and a half years.

If a woman wants to increase the duration of maternity leave by another 1.5 years, then the amount of the benefit will be 50 rubles.

Its size was established back in 2001 and has never been indexed since then.

This might also be useful:

- Vacation schedule for 2021

- How to obtain a duplicate work book

- Local regulations in 2021

- Model employment contract in 2021

- Stamps in work books are canceled

- Bonus payment deadlines in 2021

Is the information useful? Tell your friends and colleagues

Dear readers! The materials on the TBis.ru website are devoted to typical ways to resolve tax and legal issues, but each case is unique.

If you want to find out how to solve your specific issue, please contact the online consultant form. It's fast and free!

Payment procedures

As a rule, the majority of citizens receive payments from social insurance with the direct participation of their employer, at the place where they receive their salary.

In some cases, citizens contact the Social Insurance Fund directly:

- if the disability arose a month after dismissal;

- if employees belong to the category of self-employed persons (individual entrepreneurs, notaries, lawyers, etc.);

- if the employer ceased its activities, closed, was declared bankrupt, etc.

By making regular contributions to the social insurance fund, each employee can count on receiving various types of benefits, which will be a good help during the period of inability to perform work duties, provided that the cause of incapacity is temporary.

Comments

View all Next »

Elvira 04/16/2015 at 00:04 # Reply

Part-timers

Nothing is said about such a common phenomenon as part-time work (for example, among teachers). In one educational institution, a person is paid on a basic time basis; during illness, a person cannot go to work. in the second organization - hourly payment, and the teacher continues to work (for example, compiling a methodological development at home). Is it possible to get sick leave only for the first job, and how to calculate it?

ostapx1 04/16/2015 at 04:27 pm # Reply

Theoretically, you can go on sick leave at your main place of work, but you can work part-time at another job. Although, from January 1, 2007, sick leave is paid not only for the main place of work, but also for part-time work. Therefore, you can get paid sick leave at your second job. To do this, you must present an original sick leave certificate for each employer for each place of work. Those. If you work two jobs, then you must receive two sick leaves. The principle of calculating sick leave is the same for all types of work - main, part-time and for all methods of calculating salaries. To calculate sick leave, you need to know: - Average daily earnings - DZ - Experience-S - Number of days of temporary disability - VN If the experience is more than eight years: Amount of sick leave = DZ x VN If the experience is less than eight years: Amount of sick leave = (DZ x VN) x 80% Moreover, the employer pays only for the first three days of sick leave, the rest of the time is paid by the Social Insurance Fund.

Olga 06/05/2015 at 00:10 # Reply

Number of days of incapacity - calendar or working? Thank you.

Natalia 06/05/2015 at 01:13 pm # Reply

Calendar.

Olesya 07/08/2015 at 09:21 # Reply

Sick leave after maternity leave

Good afternoon, please tell me I have been on BiR leave since 2012, then maternity leave. Is the income of 2012 taken into account when calculating sick leave, since sick leave was issued for pregnancy and childbirth this year? Thank you. Total work experience is more than 5 years .

Natalia 07/08/2015 at 10:40 am # Reply

The calculation period for payment of sick leave benefits is two calendar years preceding the year of onset of illness. If during the billing period (or in one of the years of the billing period) the employee was on maternity leave or child care leave, he can replace the corresponding calendar years (or year) from the billing period with the previous calendar years (year) by submitting an appropriate application. Provided that this will lead to an increase in the benefit amount.

Irina 07/22/2015 at 09:43 # Reply

If the experience is less than one year, or 1 year. sick leave from 03.26-05.24.15

Elena 09/24/2015 at 11:36 am # Reply

Calculation of average earnings for calculating benefits

Hello. Please help me figure out how to calculate the average earnings for 2 years. The employee brought sick leave in September 2015. The period for calculation is Wed. earnings -2013-2014 He joined our organization in 2014. I didn’t bring any certificates about the amount of my salary from my previous places of work. How to calculate avg. earnings? For 2014 - what I earned in our organization. And for 2013 - zero or based on the minimum wage?

Natalia 09.25.2015 at 11:05 # Reply

Elena, you yourself answered your question correctly: - for 2014 - the average earnings received in your organization - for 2013, based on the minimum wage, taking into account the regional coefficient. Look at the coefficient on the FSS website of your region.

Elena 01/28/2016 at 11:14 # Reply

Please tell me, on the basis of what legislative documents will you in 2013 (in this specific example) assign an employee’s income “based on the minimum wage, taking into account the regional coefficient”? Very necessary.

Natalia 01/28/2016 at 05:11 pm # Reply

Elena, good afternoon. The Regulations approved by Decree of the Government of the Russian Federation No. 375 of June 15, 2007 (On the specifics of the procedure for calculating benefits for temporary disability) talk about calculating benefits based on the minimum wage, taking into account the regional coefficient. But officials had different interpretations of the calculation of benefits from the minimum wage, taking into account the coefficient, until the Supreme Arbitration Court of the Russian Federation, in determination No. VAS-5881/14, approved that the coefficient is applied at the first stage to the calculation of benefits, i.e. not to the accrued benefit, but to the minimum wage.

Anna 08/12/2015 at 02:47 pm # Reply

Hello, when paying for sick leave (there were 2 in a row: 1st - 07/9/2015-07/14/2015; 2nd - 07/15/2015 - 07/22/2015) the company received payment only for 6 days of sick leave (i.e., the first 3 days from each sick leave), and the remaining days (3 days from the first sick leave and 5 days from the second) were not paid. Is this legal?! And who should pay for the remaining days of sick leave? thank you in advance.

Natalia 08/12/2015 at 15:34 # Reply

Anna, you receive payment for all days of sick leave from your employer. The first three days of sick leave are paid from the employer's funds, the subsequent days of sick leave are paid for by the Social Insurance Fund by transferring money to the employer's account. In all likelihood, the FSS has not yet transferred money to your employer to pay for your sick leave. But usually the employer does not have to wait for this transfer, but is obliged to pay sick leave to the employee on the day the wages are issued at the enterprise. By law, the employer issues salary 2 times a month - advance payment and salary. On the nearest date, the employee must receive the amount of sick leave benefits (minus personal income tax). If the terms of payment of sick leave by the employer are violated, the employee has the right to file a complaint with the labor inspectorate, the prosecutor's office or the court. When drawing up a complaint, you must briefly outline the essence of the case and attach evidence of the unlawfulness of the employer’s actions. The following documents may be used to confirm that the payment terms for sick leave have been violated: A copy of the sick leave note; A copy of the employment contract; A payslip with the accrued amount; A copy of the statement or statement from a plastic card account (for non-cash payments to staff); Other documents.

Ruslan 08/12/2015 at 20:05 # Reply

Hello! Please tell me, in 2015 I was sick 4 times for 10-14 days and got sick again, if there are restrictions on the number of sick days per year and can the employer apply any (sanctions)

Natalia 08/12/2015 at 09:21 pm # Reply

Ruslan, there are no restrictions on the number of days on sick leave. Up to 30 days, sick leave is issued as usual, after 30 days, according to clause 14 of the Procedure, if the period of temporary disability exceeds 30 calendar days, the issue of further treatment and issuance of a certificate of incapacity for work is decided by a medical commission.

Natalia 08/12/2015 at 09:37 pm # Reply

Ruslan, sick leave is paid based on the amount of average earnings. To calculate the average earnings of an employee, you need to take all payments for which insurance premiums were calculated in the two previous calendar years. Therefore, of course, the amount of sick leave is affected by being on sick leave for two years preceding the next sick leave.

Maria 08/19/2015 at 09:17 pm # Reply

Is it possible to be on sick leave and go to work? those. receive salary and give sick leave for payment, because in fact I worked and received treatment!

Natalia 08/21/2015 at 14:34 # Reply

Maria, how is it possible, while working at the same workplace, to be sick and go to work at the same time? In this case, what should your employer put on your time sheet - working day or sick leave? The answer is no.

Ksenia 08/21/2015 at 01:55 pm # Reply

It is not entirely clear how to calculate sick leave if the employee’s length of service is more than 6 months, but less than 2 years? (8 months) How to calculate the average earnings for two years if the employee works for only 8 months?

Natalia 08/21/2015 at 14:31 # Reply

Ksenia, sick leave is calculated from the amount of earnings you received over two years, but if your work experience is only 8 months, then the average salary for the time worked is calculated - 8 months.

Anna 08/21/2015 at 14:25 # Reply

Deadlines for paying sick leave

Hello. I work as a teacher at school. During my annual paid leave I was on sick leave. I took my first sick leave on August 4th. The second sick leave (continuation of the first one was handed in on August 21). The accounting department told me that sick leave payment is not included in the advance payment. And that the first sick leave will be paid only after September 20, since now most teachers are on vacation. How could this be related? How legal are the actions of accounting in this situation?

Natalia 08/21/2015 at 14:38 # Reply

Anna, sick leave must be paid on the nearest date of payment of salary, no matter the advance or full salary. The employer is obliged to pay the employee monetary remuneration at least 15 days. Those. Payments must be made twice a month. Therefore, the actions of your accounting department are illegal. File a complaint against them with the prosecutor's office.

Anna 08/21/2015 at 02:34 pm # Reply

Compensation for annual paid leave

Good afternoon. During my annual paid leave, I was on sick leave (from July 21 to August 18). According to the order, I must return to work on August 26th from vacation (excluding my sick leave). I work as a teacher at school. The director asks me to go to work now on August 24, since there is no one to replace me in my class. Can I, in accordance with the labor law Art. 126 take monetary compensation for part of the unused vacation? I don’t want to postpone my vacation to another date. How to do this legally?

Natalia 08/21/2015 at 14:51 # Reply

Anna, of course you can. Write a statement in any form addressed to the manager. Indicate the reason, date of interruption of annual leave and desire to receive compensation for unused vacation days. After the application is signed by the manager, and the personnel service prepares an order for recall from the next vacation, the vacation will be interrupted. The ORDER must indicate the period for providing the remaining unused days or AS in your case - the AMOUNT of payment of monetary compensation.

View all Next »

Right to benefits and terms of payment

The right to temporary disability benefits arises, as a rule, for an employee, firstly, in the event of incapacity for work during the period of work, including the period of probation and the day of dismissal. The period of work begins not from the moment the employment contract is concluded, but from the day the work actually begins.

Before January 1, 2007, benefits to persons who fell ill after dismissal were issued as an exception if: a) temporary disability occurred within a month after dismissal; b) the incapacity for work lasted more than a month; c) the employee was dismissed for good reason. Currently, benefits are issued if illness or injury occurs within 30 calendar days from the date of termination of work or in the period from the date of conclusion of the employment contract until the day of its cancellation.

If temporary disability occurs during a dispute about the correctness of dismissal, benefits are issued in the event of reinstatement at work from the day the decision on reinstatement is made.

Secondly, the right to benefits arises if the fact of temporary incapacity for work is confirmed by a certificate of incapacity for work. A certificate of incapacity for work, issued in the prescribed manner, is the only document on the basis of which benefits are paid.

Certificates issued in cases established by law and certifying the fact of incapacity for work do not give the right to payment of benefits. In case of loss of a certificate of incapacity for work, a duplicate is issued. However, a duplicate can be issued upon presentation of a certificate from the place of employment stating that benefits were not paid under a previously issued certificate of incapacity for work. If a person, despite having a certificate of incapacity for work, continues to work, he receives a salary, and not a temporary disability benefit.

Under certain circumstances, insured persons are not entitled to temporary disability benefits.

The grounds for refusal to grant benefits are:

- the onset of temporary disability as a result of a court-established intentional infliction of harm to one’s health by the insured person or an attempted suicide;

- the onset of temporary disability as a result of the commission of an intentional crime by the insured person.

The legislation provides for certain periods for which benefits are not assigned, namely:

- for the period of release of the employee from work with full or partial retention of wages or without payment, with the exception of cases of loss of ability by the employee due to illness or injury during the period of annual paid leave;

- for the period of suspension from work, if wages are not accrued for this period;

- during the period of detention or administrative arrest;

- during the period of the forensic medical examination;

- during the downtime period.

Providing insured persons with temporary disability benefits is carried out in the following cases:

- loss of ability to work due to illness or injury, including in connection with an operation for artificial termination of pregnancy or in vitro fertilization;

- the need to care for a sick family member;

- quarantine of the insured person, as well as quarantine of a child under 7 years of age attending a preschool educational institution, or another family member recognized as legally incompetent in accordance with the established procedure;

- implementation of prosthetics for medical reasons in a hospital specialized institution;

- follow-up treatment in the prescribed manner in sanatorium-resort organizations located on the territory of the Russian Federation, immediately after the provision of medical care in an inpatient setting.

In accordance with the Procedure for issuing certificates of incapacity for work, approved by the Ministry of Health and Social Development on June 29, 2011, the terms for which certificates of incapacity for work are issued have been significantly changed. In case of illnesses and injuries, the attending physician alone issues a certificate of incapacity for work for a period of up to 15 calendar days inclusive. If temporary disability lasts more than 15 days, the decision on extending the certificate of incapacity for work is carried out by a medical commission appointed by the head of the medical organization. By decision of this commission, with a favorable clinical and work prognosis, the certificate of incapacity for work can be extended until full restoration of working capacity, but for a period of no more than 10 months, in some cases (injuries, conditions after reconstructive operations, tuberculosis) - no more than 12 months, with extension intervals commission no less than every 15 calendar days.

As a general rule, temporary disability benefits are issued from the first day of loss of ability to work until it is restored or disability is established, even if the employee was fired at that time. There are a number of exceptions to this general rule when the timing of benefit payment is differentiated.

When an insured person undergoes further treatment in a sanatorium-resort organization located on the territory of the Russian Federation, immediately after the provision of medical care in a hospital setting, temporary disability benefits are paid for the period of stay in the sanatorium-resort organization, but not more than 24 calendar days.

An insured person recognized as a disabled person in accordance with the established procedure is paid a temporary disability benefit (except for tuberculosis) for no more than four months in a row or five months in a calendar year. If these persons fall ill with tuberculosis, temporary disability benefits are paid until the day of restoration of working capacity or until the day the disability group is revised due to tuberculosis.

A person who has entered into a fixed-term employment contract (fixed-term service contract) for a period of up to six months, as well as an insured person whose illness or injury occurred during the period from the date of conclusion of the employment contract until the day of its cancellation, temporary disability benefits (except for tuberculosis) paid for no more than 75 calendar days. In case of tuberculosis, temporary disability benefits are paid until the day the ability to work is restored (disability is established). In this case, an insured person whose illness or injury occurred during the period from the date of conclusion of the employment contract until the day of its cancellation is paid temporary disability benefits from the day on which the employee was supposed to start work.

Special terms for payment of benefits are established in the case of caring for a sick child, depending on his age, nature of the disease, conditions of treatment (outpatient or inpatient).

A benefit for caring for a sick child under seven years of age is issued to the insured person:

- for the entire period of treatment of a child in an outpatient setting or a joint stay with a child in a medical organization when providing medical care to him in an inpatient setting, but not more than 60 calendar days in a calendar year for all cases of care for this child;

- in the case of a child’s illness included in the list of diseases determined by the federal executive body, no more than 90 calendar days in a calendar year.

A benefit for caring for a sick child aged 7 to 15 years is issued for a period of up to 15 calendar days for each case of treatment of a child in an outpatient setting or joint stay with a child in a medical organization when providing medical care in an inpatient setting, but not more than 45 calendar days in a calendar year for all cases of care for this child.

In the case of caring for a sick disabled child under the age of 18 years, the benefit is issued for the entire period of treatment of the child in an outpatient setting or a joint stay with the child in a medical organization when providing medical care to him in an inpatient setting, but not more than 120 calendar days in a calendar year. year for all cases of caring for this child;

In the following cases, benefits are issued for the entire period without limitation to the maximum period:

- in the case of caring for a sick child under the age of 18 who is HIV-infected - for the entire period of joint stay with the child in a medical organization when providing medical care to him in an inpatient setting;

- in the case of caring for a sick child under the age of 18 with an illness associated with a post-vaccination complication, with malignant neoplasms - for the entire period of treatment of the child on an outpatient basis or a joint stay with the child in a medical organization when providing medical care to him in an inpatient setting.

In cases of caring for a sick family member during outpatient treatment, the benefit is issued for no more than 7 calendar days for each case of illness, but no more than 30 calendar days in a calendar year for all cases of care for this family member.

The quarantine benefit is paid to the insured person who was in contact with an infectious patient or who was found to be a carrier of the bacteria for the entire period of his suspension from work due to quarantine. If children under 7 years of age attending preschool educational organizations, or other family members recognized as legally incompetent in the established manner, are subject to quarantine, temporary disability benefits are paid to the insured person (one of the parents, another legal representative or other family member) for the entire quarantine period .

Temporary disability benefits in the case of prosthetics for medical reasons in a stationary specialized institution are paid to the insured person for the entire period of release from work for this reason, including travel time to the place of prosthetics and back.

The benefit is paid to the insured person in all cases for calendar days falling within the corresponding period.

The benefit is not paid: a) for calendar days falling during periods of release of the employee from work with full or partial retention of wages or without payment in accordance with the legislation of the Russian Federation, except for cases of loss of ability by the employee due to illness or injury during the period of annual paid leave; b) for the period of suspension from work in accordance with the legislation of the Russian Federation, if wages are not accrued for this period; c) during the period of detention or administrative arrest; d) during the period of the forensic medical examination; e) during the period of inactivity.