What payments are due upon dismissal?

The Labor Code of the Russian Federation establishes three ways to terminate employment contracts: at the request of the employee, at the initiative of the employer and by agreement of the parties. For each of them, the manager is obliged to transfer the following payments to the resigning person no later than the last working day:

- compensation for unused vacation;

- salary for the period worked.

If the dismissal is due to staff reduction, severance pay is transferred. It may also be provided for by agreement of the parties.

If the dismissed person was in the position of a manager, his deputy or chief accountant, he is also entitled to compensation payments.

How to fill out 6-NDFL: vacation compensation upon dismissal

We have determined that payment of compensation for vacations not taken must be made on the day of dismissal. Since this payment is not a standard salary, the date of actual receipt of income here (page 100, section 2 of the 6-NDFL report) is the day of its payment (clause 1 of Article 223 of the Tax Code of the Russian Federation). And on page 020 section. 1 form, this income will fall in the period when it will be paid. Calculation of personal income tax (page 040 section 1), as well as withholding (page 070 section 1, page 110 section 2) occurs on the day of actual receipt of income (clause 3 of article 226 of the Tax Code of the Russian Federation). Page 120 must indicate the day after the tax withholding date (page 110), unless the holiday carryover rules cause it to shift to a later date.

As for the salary paid upon dismissal for the days of the last month of work, according to clause 2 of Art. 223 of the Tax Code of the Russian Federation, if the employment relationship is terminated before the end of the month, then the day of actual payment of wages for this month is recognized as the last working day. This means that the salary on page 100 will also indicate the date of dismissal. According to clause 4.2 of the Procedure for filling out the 6-NDFL calculation (approved by order of the Federal Tax Service of the Russian Federation dated October 14, 2015 No. ММВ-7-11 / [email protected] ), if for different types of income with the same date of actual receipt the tax payment deadlines differ, then 100–140 are filled out separately for each income. Since both for vacation compensation and for salary upon dismissal all dates on pp. 100–120 will be the same, then in Sec. 2 they can be cited collectively, but shown as a separate block from the salaries of other employees who continue to work, and from other payments.

Example

The employee was fired on June 21, 2020. On the day of dismissal, the employer transferred him compensation for unused vacation in the amount of 33,600 rubles. and wages for June 64,700 rubles. These transactions in 6-NDFL for the half-year will be reflected on the lines listed in the table.

| Line number | Meaning |

| 020 | 98 300 |

| 040 | 12 779 |

| 070 | 12 779 |

| 100 | 21.06.2020 |

| 110 | 21.06.2020 |

| 120 | 24.06.2020 |

| 130 | 98 300 |

| 140 | 12 779 |

From what payments is personal income tax withheld upon dismissal?

Personal income tax stands for personal income tax. They are subject to most of the payments, including compensation upon dismissal. For residents of the Russian Federation, its value is 13%, for non-residents – 30%.

Compensation for unused vacation is transferred regardless of the reason for the employment contract. Taxation of personal income tax is a priority: only after the tax has been calculated, alimony and other payments are withheld from the amount received.

Personal income tax is also transferred from the following income:

- salary, bonuses, allowances;

- temporary disability benefits.

The employing organization is a tax agent, therefore the obligation to transfer personal income tax rests with it. Violation of this rule is subject to administrative liability in the form of a fine, so it is very important to comply with the deadlines and procedure for calculating the tax.

Withholding insurance premiums

Regardless of the reason why the employee is dismissed, the employer must, in addition to paying compensation, make insurance contributions to the appropriate funds.

Contributions are calculated as a percentage of the compensation amount before deducting personal income tax. However, they do not reduce the amount given to the employee, but are paid additionally by the employer - even in cases where the employee was fired for serious violations.

Let's list these contributions and immediately calculate how much the employer had to pay for citizen Evgenieva, who received vacation compensation in the amount of 31,535.84 rubles:

- To the Pension Fund for the formation of an insurance pension - 22%, that is, 6,937.88 rubles.

- For medical insurance - 2.9%, that is, 914.54 rubles.

- For social insurance - 5.1%, or 1,608.33 rubles.

Thus, in order to pay an employee 27,479.68 rubles in person (after deducting personal income tax), the employer must spend the following amount:

31,585.84 + 6,937.88 = 914.54 = 1,608.33 = 41,319.59 rubles.

Of this, 13,839.91 rubles will be spent on various types of contributions and taxes.

Income not subject to taxation

The list of income from which personal income tax is not withheld is determined by Art. 217 Tax Code of the Russian Federation. This includes the following:

- monthly payments in connection with the birth of children;

- compensation for harm to health;

- payment of allowances in kind;

- severance pay not exceeding three times the average monthly salary, for residents of the North - six times the amount;

- daily allowance up to 700 rubles. while on a business trip.

Expert commentary

Kamensky Yuri

Lawyer

Thus, if on the date of dismissal an employee is due to receive compensation for vacation time and severance pay, these payments will not be taxed. If an employee terminates an employment contract during illness, temporary disability benefits are paid no later than 10 days from the date of receipt of sick leave, while the tax is withheld on the day the benefits are transferred and paid to the Federal Tax Service no later than the last day of the month.

How is compensation for unused vacation calculated?

The minimum duration of annual paid leave for citizens working under employment contracts is 28 calendar days. For some categories of persons, additional days of rest are provided.

How compensation is calculated:

- The number of days of non-vacation is established. To do this, the personnel officer determines the product of the number of days of rest due to the employee for each month worked and subtracts the days already used.

- The resulting number of vacation days is multiplied by the citizen’s average daily earnings.

For example, if a quitter is entitled to 14 days of vacation, and the average daily earnings are 1,500 rubles, the calculation will be carried out as follows: 14 x 1,500 = 21,000 rubles. – the total amount from which personal income tax will be withheld.

21,000 x 13% = 2,730 rub. – personal income tax amount.

21,000 – 2,730 = 18,270 rubles. - the total is in the hands of the employee.

18,270 x 22% = 4,019.4 rubles. – the amount of contribution to the insurance part of the pension paid by the employer.

18,270 x 5.1% = 931.77 rubles. – the amount of payment to the Compulsory Medical Insurance Fund from the employer’s funds.

Why is Personal Income Tax not withheld from Vacation Compensation?

An employee must be granted leave after 6 months of work at the enterprise. If he quits without using his right to leave, compensation is due. It is also considered employee income and therefore subject to tax.

An employee may request additional paid vacation days. They are also taxed. For each day of vacation, the employee's average salary for the shift is calculated. For example, it is 300 rubles. In this case, for 3 days of additional vacation, vacation pay will be 900 rubles. To calculate the tax, you need to multiply this amount by the rate of 13%. Personal income tax will be 117 rubles.

General rules for issuing vacation pay (read more...)

How to withhold personal income tax from compensation upon dismissal: step-by-step instructions

To understand this issue, you must first study the features of the dismissal procedure:

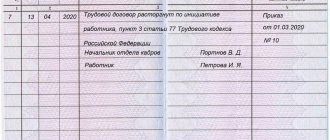

- The employee submits his resignation. If necessary, the employer has the right to assign mandatory work of 2 weeks.

- The manager issues a dismissal order indicating a specific date. The person leaving gets acquainted with it against signature, then the document is transferred to the personnel department and accounting department. It is the accountant who makes all the deductions, but this can only be done if there is a reason - an order.

- The accountant calculates wages, compensation for unused vacation and other payments minus personal income tax, contributions to the Social Insurance Fund and pension contributions.

- On the last working day, the employee is transferred or given cash. He must also be issued with education documents, a salary certificate, 2-NDFL, and information about the status of his personal account with the Pension Fund.

Important! All charges must be reflected in the documentation. The accountant deals with them, and he also draws up the postings.

Why is Personal Income Tax not withheld from Vacation Compensation?

In addition to the annual submission of 2-personal income tax, starting from 2021, the need to submit a quarterly 6-personal income tax certificate was approved in case of compensation for unused vacation. Thus, state control over the activities of employers was increased.

On the last working day, funds are given to the employee together (compensation, salary, and sometimes severance pay), but it is better to fill them out separately in reporting, since these types of income have different codes.

Types of mandatory tax payments and contributions (read more...)

Transfer deadline

The deadline for transferring tax to the budget depends on the method of receiving compensation:

| Cash in the bank | No later than the day of issue |

| To the employee's bank account (non-cash transfer) | No later than the day of transfer |

| Cash from the company's cash desk | No later than the day following the date of issue |

Important! If compensation is paid not upon dismissal, but during the citizen’s work, it must be transferred on payday. Payment according to the Labor Code of the Russian Federation is made every 15 calendar days. If the payment date falls on a weekend, the money must be transferred on the previous weekday.

For example, when an organization pays salaries on the 15th and the date falls on a Sunday, the money must be issued on Friday.

Transfer of funds on the next business day is not allowed, because this will already be considered a delay in wages, and the employer undertakes to pay a penalty for each day of delay.

Calculation and accounting entries

As mentioned earlier, the tax rate on employment contracts for residents of the Russian Federation is 13%. Non-residents are subject to an increased tax of 30%. If citizens have applied for tax deductions or other social benefits, they must be deducted from their salaries, and personal income tax will be withheld from the final amount.

Let's look at practical examples:

A citizen has been working at the company for 3 years. Previously, he received a tax deduction, according to which 1,000 rubles are deducted from the tax amount every month. In May 2021, he decided to quit. The salary for the period worked was 30,000 rubles, compensation for several days of unused vacation was 15,000 rubles. In total, an amount of 45,000 rubles is used to calculate personal income tax and other contributions. How personal income tax is calculated:

45,000 x 13% = 5,850 rub.

After withholding personal income tax, 39,150 rubles remain. Insurance premiums and payments to the Compulsory Medical Insurance Fund must be paid from this amount. They are transferred by the employer from the enterprise budget.

39,150 x 22% = 8,613 rubles. – the amount of contributions to pension insurance.

39,150 x 5.1% = 1,996.65 rubles. – payment to the Compulsory Medical Insurance Fund.

The second example is the payment of state contributions for a non-resident of the Russian Federation:

A foreign citizen works at the enterprise for 2 months, i.e. less than 183 days. This alone does not give him the right to be considered a resident. The decision to resign was made by him in November 2021. He does not yet have the right to leave, so no compensation will be paid. Only wages for the period worked are subject to transfer. In a month, a citizen earned 50,000 rubles. From this money, the employer must withhold 30% of personal income tax - the tax is paid from the employee’s funds. Also, 22% is withheld for the insurance part of the pension, and 5.1% for the Compulsory Medical Insurance Fund. The last two payments are made from the organization's budget.

50,000 x 30% = 15,000 rub.

50,000 – 15,000 = 35,000 rub. – the foreigner finally received it.

35,000 x 22% = 7,700 rub. – transferred by the company towards pension contributions.

35,000 x 5.1% = 1,785 rubles. – the amount of contributions to the Compulsory Medical Insurance Fund.

Accounting entries

In the postings, the accountant reflects all payments as follows:

| DT 44 Kt 70 “F.I.O. employee" | Payroll |

| DT 70 (full name of the employee) Kt 68 Personal Income Tax | Tax withholding |

| DT 70 (full name of employee) Kt 50 (51) | Issuance of wages |

| DT 68 Personal income tax Kt 51 | Transfer of tax to the budget |

Basic Concepts

Compensation payments for vacation upon dismissal According to Russian law, income such as compensation for vacation is subject to all taxes and fees. That is, the employer is obliged to make a deduction from the final amount in favor of the state. Moreover, we are talking not only about personal income tax, but also about transfers to the Pension Fund, Social Insurance Fund, and so on.

Vacation pay represents financial support during vacation. Rely on employees who have worked for the company for at least six months. If an employee does not exercise his right to leave and resigns, he is entitled to compensation. The amount of vacation pay depends on the following factors:

Responsibility for non-payment of personal income tax

The employing organization is a tax agent, and the obligation to remit personal income tax rests entirely with it.

The agent's responsibility for untimely transfer is assigned to Art. 123 Tax Code of the Russian Federation. It all depends on the specific situation:

| The tax was withheld from the employee, but was not transferred to the budget | Arrears of 20% of the unpaid amount will be charged. An additional penalty will be charged for each day of delay. |

| The tax is not transferred to the budget and is not withheld | According to the Tax Code of the Russian Federation, personal income tax is always withheld only from employee salaries. Collection of tax from the employer for personnel is not allowed (clause 9 of Article 226 of the Tax Code of the Russian Federation). If the arrears cannot be recovered, no penalty will be charged. |

When to make tax payments?

Let's look at an example . IMPORTANT! According to the explanations of the Federal Tax Service, code 2012 should be used. However, the use of other numbers will not be considered a serious error.

As mentioned earlier, the tax rate on employment contracts for residents of the Russian Federation is 13%. Non-residents are subject to an increased tax of 30%. If citizens have applied for tax deductions or other social benefits, they must be deducted from their salaries, and personal income tax will be withheld from the final amount.

When compensation is not taxable

In all cases, compensation for unused vacation is subject to taxation. The exception is when relatives of a deceased employee apply for it: in such a situation, there is no need to withhold personal income tax.

To receive compensation and other salary payments for a deceased relative, you must do the following:

- Guided by Art. 141 of the Labor Code of the Russian Federation, according to which relatives of the deceased employee are entitled to payments, draw up an application and collect the necessary package of documents for the employer. This must be done within 4 months from the date of death of the citizen.

- Submit a package of documentation to the organization. Money must be transferred no later than 1 week from the date of application.

Along with the application, the employer is provided with a death certificate, passport and a document confirming the relationship of the citizen with the deceased employee.

Important! If wages are paid into staff bank accounts, the employer must not transfer funds upon learning of the employee's death, otherwise it will no longer be considered a legal payment. The money must be given to close relatives. If they do not apply within 4 months, the amount is included in the inheritance mass, and only the heirs can apply for it after six months.

In addition to compensation for unpaid vacation, the employer must give relatives the amount of salary for the period worked, as well as other payments due to the employee during his lifetime. There are no taxes or insurance contributions, since a citizen’s tax obligations cease due to death.

Compensation for unused vacation and other payments upon dismissal are subject to personal income tax without fail, with the exception of the death of the employee: in this case, his relatives receive the amount without withholding tax.

If personal income tax is not paid on time, the tax agent may oblige the Federal Tax Service to pay arrears and penalties, so it is very important to comply with the deadlines for the transfer and know the specifics of accounting entries.