“Maternity benefits” and who receives them

Let us remind you that only women apply for “maternity” benefits for pregnancy and childbirth, while men can also receive child care benefits. Moreover, if a woman has the right to two benefits at the same time—maternity and child care—she must choose one.

The conditions for accruing maternity benefits to a woman are specified in Art. 6 of the Federal Law of May 19, 1995 No. 81-FZ. According to the Law, the expectant mother will receive benefits if she:

- works;

- unemployed due to company liquidation;

- studies (full-time);

- is undergoing military service under a contract;

- is an adoptive parent and falls into the categories listed above.

Please note that for female part-time workers, the benefit is calculated based on earnings from all places of work. If an employee has not changed employers in the two-year period before going on maternity leave, she has the right to receive benefits from each of them. In the event of a change of place of work, only one employer receives the maternity leave, but when calculating the payment, he takes into account the amounts from the income certificates from the previous places of employment of the expectant mother.

Important! To receive maternity benefits, a female individual entrepreneur needs to conclude an agreement with the Social Insurance Fund in advance and transfer the corresponding contributions - 4,451.62 rubles - for at least one year before going on vacation. in year. Otherwise, the entrepreneur will not receive benefits.

“Maternity benefits” are paid to employed women from the Social Insurance Fund at the place of work (service), and to women unemployed due to the liquidation of the company - at the place of residence.

Another nuance is that “maternity” benefits are paid when a woman actually goes on maternity leave. If the employee does not take advantage of the right to “maternity leave” and continues to work, she will receive only a salary; the employer does not have the right to simultaneously accrue both wages and benefits.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Allowance for a child under 1.5 years of age - calculation features

It is worth clarifying that benefits up to 1.5 years are an independent social payment or financial assistance to a woman with a newborn during the period of her justified incapacity for work.

Calculation of benefits is carried out based on the fact whether the woman worked before pregnancy or not.

Thus, officially working mothers can make the calculation using an online calculator. Moreover, it is quite simple. And the amount of monthly child care benefits is only 40% of the average monthly salary received during professional activity.

Terms of "maternity leave"

“Maternity leave,” also known as maternity leave, is available to employed women who are issued sick leave at the 30th week of pregnancy. The period of maternity leave is set depending on the probable date of birth of the child and can be equal to:

- 140 days, if pregnancy is progressing normally;

- 156 days in case of complications;

- 194 days when a woman is pregnant with two or more children.

Adoptive parents can also go on maternity leave:

- from the moment of adoption until the end of the 70th day after the birth of the adopted child;

- from the moment of adoption until the end of the 110th day after the birth of adopted children (two or more).

To receive maternity benefits, a woman must contact her employer before the end of the sixth month after maternity leave. Maternity benefits are paid in total for the entire vacation period.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Rules for calculating maternity benefits

The first step in determining the due payment due to pregnancy and childbirth is to calculate the average daily earnings based on accrued salaries for the previous two calendar years.

So, if an employee is going to take maternity leave in 2021, then to determine this indicator you need to take the years 2021 and 2021.

It is also necessary to remember that the law sets the maximum amount of taxable earnings. It will also be the limit of earnings for the year, which can be used when calculating benefits.

The values set for contributions to the Social Insurance Fund are used:

- For 2021, this figure was set at 718 thousand rubles.

- For 2021 - 755 thousand rubles.

In addition, from the amount of annual earnings it is necessary to exclude those payments for which contributions were not calculated.

But since maternity payments are being calculated, it will also be necessary to exclude from the two-year calculation period those days on which the mentioned payments fall. These include days of incapacity for work, periods of caring for young children, etc. Attention! The number of days in a year must be taken not as an average, but as a specific value of days - that is, for a normal year the value of 365 days is used, and for a leap year - 366 days.

The total amount of two years' earnings will need to be divided by the number of recalculated days. After this, the result is multiplied by the number of days that will occur during the period of incapacity. Under normal conditions, it is 140 days, but it can increase in case of complicated, multiple pregnancies, etc.

Amount of maternity payments

Benefit amounts may be as follows:

- 100% of average daily earnings - for employed women;

- RUB 12,792 in 2021 - for employees whose work experience is less than 6 months, the benefit does not exceed the minimum wage;

- RUB 708.23 from February 1, 2021 - unemployed due to the liquidation of the company;

- scholarship amount - for full-time students;

- monetary allowance for female contract workers in military service.

Also, starting from June 2021, the rules for calculating average earnings for employees who had no salary over the previous two years or were below the minimum wage have changed. Now, for women on maternity leave who work in areas with a regional coefficient, when comparing average earnings with the minimum wage, the established coefficient must be taken into account (Federal Law No. 175-FZ dated 06/08/2020). Previously, the average earnings calculated by income were compared with the minimum wage × 24 / 730 (without the RK) and only if it turned out to be less, and the calculation was based on the minimum wage, the regional coefficient was applied to the final benefit amount.

Payment amounts in 2021

The minimum wage and average daily earnings influence most payments for new mothers. The state has brought the amounts as close as possible to the subsistence level. Procedure for paying maternity benefits:

- Pregnant women who have officially worked for less than 6 months count on a payment of 35 thousand rubles. Citizens who transferred from one maternity leave to another receive the same amount.

- Women who were unemployed receive a payment of 630 rubles per month.

- Military women under the terms of a contract with the Russian army expect an amount of 35 thousand rubles.

- Full-time students receiving scholarships are tied to the payment of scholarship amounts. Therefore, their maternity leave amounts to 1.5 thousand rubles.

- Expectant mothers officially employed in any organization receive payments based on wages for the last two years. With a net salary of 40 thousand rubles, they will receive approximately the same for maternity leave.

To receive all the necessary payments for caring for a child who has already been born, the family needs to collect certain documentation. It includes an application form, birth certificate, certificate from the official place of work or study.

Basis for calculating maternity benefits

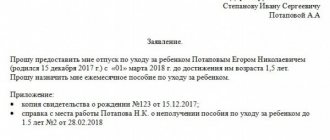

To receive maternity benefits, the following documents are required (clause 5, article 13 of Federal Law No. 255 of December 29, 2006):

- information about the insured person. They can be requested upon employment or during the period of employment. Employees are required to provide information in a form approved by the Social Insurance Fund in the form of a paper or electronic document;

- a paper “maternity” sick leave or an electronic sick leave number, which contains the corresponding disability code;

- a certificate of income received in the pay period from another employer;

- application for changing years in the billing period (if necessary).

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

How to calculate maternity benefits?

All necessary calculations are made by representatives of social services or the accounting department. For a preliminary determination, everyone can independently calculate the funds allocated to them. It should be remembered that women in labor going on maternity leave should expect payments corresponding to their wages for 2 years before maternity leave. The calculation algorithm is quite simple and does not require determining individual indicators:

- First, you should calculate the amount of all wages received over two years by adding them up.

- The resulting amount must be divided by 730 (the number of calendar days during the billing period).

- We multiply the resulting average daily profit by the number of required maternity days.

This result is the amount that the woman will receive for the estimated maternity period. This algorithm applies to officially employed individuals, therefore, if there were days of temporary disability in the work experience, then they must be subtracted from the total period of work. The payment amount is not subject to any taxes. This means that the calculation will immediately show the net amount of profit that the woman will receive in her hands.

Algori

The amount of the “maternity” benefit depends on which years are accepted as the calculation period, on the maximum amount of payments that can be taken into account, and on the minimum wage.

If the expectant mother’s experience is more than 6 months, step-by-step instructions for determining “maternity leave” will look like this:

Step 1. Select a billing period. The two years preceding maternity leave are taken into account. For example, if the maternity leave is in 2021, then the billing years are 2021 and 2021.

The law allows you to “move” the calculation period if a woman did not receive income in the years preceding the vacation due to another maternity leave or to care for a child under 1.5 years old. Please note that replacement of both years is acceptable.

Step 2. Determine the amount of payments for the billing period. Income for the accounting years should consist only of payments that were subject to insurance premiums. In this case, the amounts taken into account cannot exceed the maximum values. See the table for the maximum income from 2010 to 2021:

| Year | Income limit, thousand rubles. |

| 2021 | 966 |

| 2020 | 912 |

| 2017 | 755 |

| 2016 | 718 |

| 2015 | 670 |

| 2014 | 624 |

| 2013 | 568 |

| 2012 | 512 |

| 2011 | 463 |

| 2010 | 415 |

Step 3. Determine the number of days for the calculation years. To determine maternity leave, the actual number of calendar days in the billing period is taken (Article 14, paragraph 3.1 of the Federal Law of December 29, 2006 No. 255). It could be 730 days, but if the calculation period falls into a leap year, it could be 731 or even 732 days. The following days are excluded from this number:

- temporary disability;

- maternity leave and parental leave;

- exemption with preservation of earnings on which contributions were not calculated.

Step 4. Calculate average daily earnings. In this step, the amount of income received in the second step is divided by the number of days from the third step.

Step 5. Calculate the maximum allowable amount of average daily earnings. The maximum benefit amount is determined by annual income limits. In 2021, the maximum income for 2021 and 2019 is taken into account - this is 912 thousand rubles. and 865 thousand rubles. respectively. Hence, the maximum average daily earnings is 2,434.25 thousand rubles ((865,000 + 912,000) /730 days). Even if over the previous two years the maternity leaver earned more than 5 million rubles, the maximum benefit that can be paid in 140 days is 340,795 (2,434.25 rubles × 140 days).

Step 6. Select average daily earnings. At this stage, you need to compare the values obtained in the fourth and fifth steps and select the smaller one.

Step 7. Compare the average daily earnings with the earnings calculated according to the minimum wage. In 2021, the minimum wage is set at 12,792 rubles, hence the minimum average daily earnings: 12,792 × 24 / 730 = 420.56 rubles. Additionally, the average daily earnings received must be increased by the regional coefficient, if it is established in the region. Then we compare the average daily earnings selected in the sixth step with the minimum and select a larger amount (Federal Law No. 175-FZ dated 06/08/2020).

Let us remind you that from June 19, 2021, the minimum wage for comparison must be taken taking into account the regional coefficient (Federal Law dated 06/08/2020 No. 175-FZ).

Step 8. Calculate maternity benefits. The amount of the benefit is determined by multiplying the average daily earnings by the number of days of maternity leave.

The algorithm described above can be expressed by the formula:

Benefit amount = Income for the billing period subject to contributions / number of days in the billing period x duration of maternity leave

If a woman’s insurance period is less than 6 months, the maternity benefit is limited to the amount of the minimum wage, taking into account regional coefficients, if they are established in the region (clause 3 of Article 11 255-FZ).

For example, sick leave from January 1, 2021, less than 6 months of experience, no earnings in the previous two years. Average daily earnings: 12,792 × 24 / 730 = 420.56 rubles. Sick leave on average in January: 420.56 × 31 = 13,037.36 - and this is more than 12,792, which means that 12,792 must be paid (if there is a regional coefficient, the minimum wage must be increased by it). For February, respectively: 420.56 × 28 = 11,775.68 rubles. - this is less than 12,792, which means that for February the benefit will be 12,792 rubles. etc.

Submit electronic reports via the Internet. Kontur.Extern gives you 3 months free!

Try it

Minimum benefit

For some categories of persons entitled to a monthly benefit, it is established without reference to earnings, but in a fixed amount. The established value is a minimum, below which payments cannot be determined. This level, in accordance with Art. 15 of Law No. 81-FZ of May 19, 1995, mandatory for:

- Mothers whose employment contract was terminated during pregnancy. If a woman is fired due to the closure of an organization, individual entrepreneur, expiration of a contract with a military unit, if she was outside the country.

- Parents (guardians), if they are not subject to social insurance (do not have a job, are studying full-time, etc.).

- Relatives who do not pay contributions in case of disability and maternity, if the parent is dead, missing, convicted, deprived of parenting rights or incompetent, is unable to support the child.

The minimum payment for a child under 1.5 years old was revised back in July 2021. Due to the unfavorable economic situation regarding the coronavirus, Vladimir Putin decided to increase the lower threshold to 6,572 rubles per month.

Thus, until the turning point, the minimum payment was considered 40% of the minimum wage. For example, in 2021 (before the changes), the payment for the first-born was only 4,852 rubles per month (12,130 rubles * 40%). A new minimum of 6,752 rubles in 2021 will be received for both the first child, the second and all subsequent children. And from 02/01/2020, the amount will be increased again, as an annual indexation of child benefits will be carried out at the expense of the Social Insurance Fund.

However, the exact indexation percentage for 2021 has not yet been confirmed. Rosstat previously calculated inflation at 4.9%.

Instructions for the online maternity leave calculator

To avoid wasting time calculating maternity benefits, use our free calculator. With its help, in just three steps you will determine the amount of maternity benefits:

1. From the proposed list, select the calculation of sick leave for pregnancy and childbirth and indicate the dates from the “maternity” sick leave. Then set the billing period years and click Next.

2. Indicate the employee’s monthly earnings for the period under consideration. If your region has adopted a regional coefficient, the woman works part-time and/or her work experience is less than six months, check the appropriate boxes. Go to stage 3.

3. In the final table you will receive a detailed calculation of maternity leave by month.

Download the new maternity leave table for 2021

We recommend downloading and familiarizing yourself with maternity payments in 2019. The table contains all the information you need.

File size: 48 Kb. Downloads: 1006386. Document format: doc

Pregnancy and childbirth are considered a difficult economic period in the life of a young family. Therefore, government assistance is necessary for almost everyone in conditions of instability.

Calculating maternity benefits is not an easy task, which can be done either independently or using an online maternity benefit calculator. For many families, this money is extremely important, so they want to do the preliminary calculations themselves to control the accuracy of the payments they receive.

Years to calculate

When calculating maternity benefits in 2021, the 2 years preceding the year of maternity leave are taken into account. For example, in 2021, this is from January 1, 2021 to December 31, 2021. When choosing years for calculation, the date of the start of maternity leave is important, but when the birth occurs is not important. Always take only the full year from January 1 to December 31.

According to the law, it is not permissible to take two identical years, just as it is impossible to take into account the year of maternity leave in the calculation (if a woman goes on maternity leave in 2021, she cannot take it into account).

If in the calculation years or year the woman was on maternity leave, if desired, this year can be replaced with the previous year. You can only change a year for this reason, and only to the previous year. It is impossible to take any years for calculation.

Example:

The woman is going on maternity leave in 2021. Before that, she was on maternity leave for 3 years 2017-2020. You can take any 3 years from 2015 to 2021 into account. For example: 2021 and 2021.

If in the calculation year the woman was on maternity leave, this year can be taken. It does not affect the calculations in any way, because all of its days are excluded. It is also worth remembering that you cannot take two such years. It is necessary that one has a salary and an income. If this requirement is not taken into account, payments will be minimal.

Situations are different, and sometimes women wonder whether it is possible to calculate maternity benefits for only one year. In the example given above, the calculation is actually made for one year, since maternity leave days are excluded. But documented, two years are still taken for calculation.

Accounting for salaries and income when calculating

When calculating maternity benefits in 2021, the full salary with personal income tax is taken. Vacation pay, official bonuses, and travel allowances are also considered income.

Sickness, maternity and child benefits are not taken into account.

There are maximum income limits each year. Even if the income is higher, FSS contributions are not paid from it, which means these amounts are not taken into account. For example, for 2019 the limit amount cannot exceed 865,000 rubles.

Popular questions about the article

✅ Where to complain if maternity benefits were calculated incorrectly?

It is best to try to resolve this issue peacefully with the accountant. If this doesn’t work, then you should contact the labor inspectorate or the Social Insurance Fund. The employee has the right to ask for recalculation within 3 years.

✅ Who will pay if the maternity leaver was fired during the liquidation of the organization?

It is necessary to collect all the certificates and contact the social security authorities. RUSZN will continue to pay benefits.

✅ Can I go to work before the end of maternity leave?

A woman has the right to go to work before the end of maternity leave. However, according to the law, she will not be able to receive both maternity payments and child care benefits. Therefore, you can go out unofficially.

✅ Can a pregnant employee with whom a fixed-term employment contract be concluded be fired?

If an employee has a fixed-term employment contract and she becomes pregnant, the contract is extended until she returns from maternity leave. An employee cannot be fired before this period.

✅ Do maternity benefits pay to a student?

Women have the right to maternity benefits:

- those undergoing full-time studies at universities;

- receiving postgraduate professional education.

The allowance for female students is paid in the amount of the scholarship in this educational institution.

✅ How do maternity workers get paid if their lifetime experience is less than six months?

If your work experience is less than 6 months in your entire life, then maternity leave is 1 minimum wage rubles per month. If during the calculation the amount turns out to be less than the minimum wage, then the calculation is taken according to the minimum wage.

✅ How will maternity pay be calculated if I work part-time?

If an employee works part-time, the minimum wage for minimum maternity leave must be recalculated. Minimum wage / 2 = amount of payments

✅ Will an unemployed woman receive maternity payments?

Unemployed women should contact the district social welfare department. The benefit is paid by the territorial body of the Social Insurance Fund that assigned the benefit. You can also register with the employment center and receive unemployment benefits.

✅ Is it possible to recalculate maternity benefits if 2 children were born instead of one?

If a woman was initially given sick leave for 140 days, but unexpectedly gave birth to twins, maternity leave is extended by 54 days. Accordingly, the amount of the benefit is also recalculated.

✅ How will maternity pay be calculated if a woman did not work during the billing period?

It is important that during the billing period the woman has official income from which payments to the Social Insurance Fund of the Russian Federation are calculated. If there was no such earnings, payments will be calculated based on the minimum wage.

✅ On what basis can you replace years for the billing period?

It is possible to replace the years of the billing period with previous years only if the woman was on maternity leave during the billing period. This is stated in Art. 14 FZ-255. If a woman recently got a job and wants to change the years of the pay period only on this basis, then this is not permissible. Also, do not forget that you can only replace it for the previous year; any years are not suitable for replacement.