Is it possible to extend?

The duration of leave used to care for a child is established by Art. 256 Labor Code of the Russian Federation . It states that a woman who gives birth to a child has the right to take leave until the child reaches the age of 3 years. Thus, this period is the maximum allowed by labor legislation.

Where did the often mentioned period of paid leave of one and a half years come from? The fact is that Art. 14 Federal Law “On state benefits for citizens with children” No. 81-FZ indicates that benefits during such leave are paid during this particular period.

After the child is one and a half years old, the woman’s right to receive federal benefits disappears . She can only receive government assistance in the form of a frankly symbolic amount - 50 rubles. This payment was established by Decree of the Government of the Russian Federation No. 1206 in 1994, and it has not been recalculated over the past years.

At the regional level, local legislation may provide for payments even after one and a half years, but these funds will already come from the local budget. And, as a rule, such payments, if they exist, are applied only to mothers with many children.

Thus, we can conclude: a woman has the right to extend her leave to 3 years, but she will only be paid for the first year and a half. She should no longer count on benefits.

IMPORTANT: 3 years is the maximum period established by law. The prevailing opinion among non-specialists that when a disabled child is born or suffers from a congenital chronic disease, one can be on leave for up to 6 or even 14 years, has nothing to do with reality.

State support for a child under 3 years old

Until the child turns 3 years old, compensation in the amount of 50 rubles is awarded. every month, as well as a benefit, the payment of which stops when the baby reaches the age of 1.5 years.

Recently, the issue of extending benefit payments to 3 years has been raised more than once. In particular, on November 8, 2016, bill No. 22852-7, providing for such assistance, was reintroduced to the State Duma. At the same time, the issue of need-tested benefits is being developed. However, in the current economic situation this is impossible.

Social support from 1.5 to 3 years

Another type of payment during the vacation period is compensation in the amount of 50 rubles, which is paid by the employer for 3 years. As for the benefit itself, it is not paid after 1.5 years.

Some regions use coefficients that increase the basic amount of compensation.

In the event that an employee on vacation quit at will or due to the liquidation of the enterprise, and also lost parental rights, all payments are terminated.

Benefit amount

Both employed and unemployed citizens can count on financial assistance, but for the latter, the payment is set at the minimum possible amount.

The benefit is awarded to the person who actually takes care of the child. If there are several such persons, according to the Federal Law “On State Benefits for Citizens with Children,” it is awarded to only one of them.

ATTENTION! The period allotted for filing an application is no more than 6 months after the birth of the child.

Social assistance is calculated based on the salary of the person providing care for the last two full calendar years, and amounts to 40% of this amount. Law No. 81-FZ of May 19, 1995 stipulates possible minimum and maximum values, which are subject to indexation annually.

As of February 1, 2017, the following benefit amounts have been established:

- minimum for the first child - 3065.69 rubles;

- minimum for the second child – 6131.37 rubles;

- maximum for ordinary workers - 23089.04 rubles;

- the maximum for workers dismissed during maternity leave is 12,262.74 rubles.

If the accruals are paid for several children, the amounts add up, however, they are also subject to a restriction: the amount cannot be higher than 100% of the average salary.

Who can get it?

Art. 256 of the Labor Code of the Russian Federation gives the right to this type of leave primarily to women who have given birth to a child. However, the list is not exhausted by them. Paragraph 2 of this article indicates that instead of mother's leave the following may be used:

- father of the child;

- grandmother (find out the nuances of taking parental leave for elderly parents here);

- grandfather;

- any other relative of the child;

- guardian – if the child is not being raised by his parents;

- adoptive parent (according to Article 257 of the Labor Code of the Russian Federation) - if the child was adopted.

Is it possible to re-register if my mother looked after me for up to one and a half years?

Art. 256 of the Labor Code indicates that all of the above persons can use vacation either in whole or in parts . Therefore, a situation is acceptable when, say, the mother sits with the child for the first year and a half, and then the father or other relatives take turns caring for him until he is 3 years old.

Moreover, it is also possible for a situation where a mother goes back to work without using up the first year and a half, and then one of her relatives takes care of the child (find out how to register a return to work from maternity leave here). In this case, the mother loses the right to benefits established by Law No. 81-FZ, but if her salary is high, in the end she may even win money.

Amount of benefit paid

Payments during parental leave in accordance with Law No. 255-FZ of December 29, 2006 are financed by the social insurance fund for up to one and a half years, putting a conditional line in the vacation period. Accrual is carried out monthly based on a calculation using a mathematical formula:

| Benefit up to one and a half years | = | Total income taxable for contributions to the social insurance fund for 2021 and 2021, excluding amounts received for the unworked period | : | The total number of days of estimated time, excluding the period during which the employee did not perform labor functions | * | 30.4 (average number of days per month) | * | 40% |

The calculated benefit amount is compared with the maximum established values. The upper limit will remain unchanged when paid to any of the newborn babies. The lower limit is set to differ depending on the first or subsequent children.

From 01/01/2019, the maximum benefit limit was 26,152.27 rubles, the indexed minimum from 02/01/2019:

- 3277.45 rub. – for the first child;

- 6554.89 rub. – for the second and subsequent children.

The minimum amount of payments is made in the absence of a place of employment for the citizen providing care for the baby, and is paid by social protection authorities. If the amount received by calculation is higher than the maximum established value, then the payment is limited to the maximum.

How to apply?

To take advantage of the leave, the employee (as already mentioned - not necessarily the mother) must provide the necessary documents to register the leave.

How should I write an application for grant?

Leave is granted on the basis of an application from the child’s mother or another person who has the right to replace her . There is no officially approved form for this document, so it is drawn up in any form. However, it is generally accepted that the application must consist of the following parts:

- A cap. This includes the full name and position of the head of the organization in which the applicant works, as well as the full name and position of the employee.

- Document's name. The word “Statement” is quite sufficient.

- Content part. Here you indicate the request for leave, the period for which it is taken (the law allows the possibility of taking not all three years, but a shorter period), the full name and date of birth of the child.

- List of documents attached to the application. Usually this is the child’s birth certificate, and if the child is adopted, then a copy of the court decision on adoption.

- The employee’s signature, its transcript and the date of submission of the application.

When applying for leave, the following must be considered:

- If an employee works in several places at the same time (part-time), then an application must be submitted for each place of work.

- The application is submitted after the expiration of maternity leave.

- The employee may not indicate the end date of the vacation. It will still be contained in the leave order.

- If during the vacation the organization where the applicant was employed ceased its activities, the application is submitted to the district social protection department.

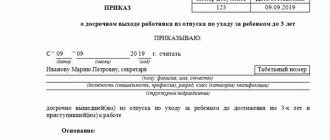

Order

Unlike a statement, an order has a unified form. Her number is T-6. However, the law allows enterprises to prepare their own HR documentation forms.

The order contains the following information:

- Name of the organization and its OKPO code.

- The name and position of the employee receiving leave. If the company uses employee personnel numbers, then the number is also indicated.

- Start and end dates of leave (if leave is taken before 3 years, it ends on the first working day after the child’s third birthday).

- Duration of vacation in calendar days.

- Date of issue of the order and its registration number in the accounting book.

- Signature of the head of the organization.

- The employee’s signature confirming familiarization with the document.

ATTENTION: The order is made in at least two copies. According to Art. 62 of the Labor Code of the Russian Federation, an employee has the right to receive copies of documents relating to his official duties, so it is better to play it safe and hand over one copy.

For more information about when and how to write an application, about issuing a leave order and other nuances of applying for parental leave, read in a separate article.

Order processing time

There is a time frame within which the employer needs to prepare and carry out the order if the employee has already brought the necessary documents. The deadline is the 10th day from the date of submission of documents.

The amount of maternity leave is regulated by Article 255 of the Labor Code of the Russian Federation and may vary depending on certain circumstances:

- 70 days - if pregnancy proceeded normally;

- 86 days - if complications arose during childbirth, or the child was born by caesarean section;

- 110 days - if a woman gave birth to two or more children at the same time.

It happens that the employee has not yet returned from her first maternity leave, but the time has already come to write an application for leave on the occasion of a new pregnancy - what is called “from maternity leave to maternity leave”. In this case, the start date of the vacation is considered to be the date following the third birthday of the first child. This happens because, according to the law, two vacations are not granted at the same time.

How to calculate benefits?

During care leave, the employee receives the following payments:

- Until the child reaches 1.5 years old - 40% of the average earnings for the last 2 years of work for each child, but in total no more than the full average monthly earnings.

- From 1.5 to 3 years - state assistance.

Payment of benefits is carried out as follows:

- The employee submits an application at his place of work. The unemployed submit it to the regional social security office.

- The employer calculates the average earnings for two years. If the length of service in this organization is shorter, then information about the previous place of work is also requested.

- The benefit is paid in the same manner and on the same days as the salary.

- The employer contacts the Social Insurance Fund and provides documents confirming the payments made.

- The Social Insurance Fund compensates the employer for payments. This is done either by transferring funds to the organization’s current account, or by offsetting payments to the Social Insurance Fund for other employees.

Some regions use a different scheme. In it, payments are made directly by the FSS - but then the employer is not entitled to any compensation or deductions for transfers to the fund.

Find out what the size of payments depends on, the calculation formula and other subtleties of applying for child care benefits here.

Allowance for the third and subsequent children

Separately, it is necessary to mention the monthly allowance that is paid to large families. Decree of the President of the Russian Federation No. 606 in 2012 established that from December 31, 2012, special assistance can be paid at the regional level if a third child is born in a family or to a single mother.

The benefit is paid from the regional budget in the amount of the subsistence minimum established for the child . Unlike federal benefits, these payments must be provided for by regional legislation. As of the beginning of 2021, such benefits are paid in 79 constituent entities of the Russian Federation. It is envisaged that these payments will be made in regions that meet the following criteria:

- The local budget allows these funds to be paid.

- The birth rate is less than 2 (therefore, for example, such a benefit was not introduced in Chechnya or the Kurgan region, where the birth rate is consistently above two children per woman). If, according to statistics, the coefficient begins to exceed the threshold value, the benefit is canceled for 2 years.

At whose expense is the monthly compensation payment of 50 rubles made?

Separately, it is necessary to mention the 50-ruble compensation that is paid during leave from one and a half to three years of the child - all these funds are paid at the expense of the employer and, unlike benefits, they are not reimbursed by the Social Insurance Fund. However, they are also not taken into account when calculating contributions, and, in addition, they can be counted as expenses when calculating income tax provided for by the Tax Code of the Russian Federation.

Since payment is made at the expense of the employer, unemployed people who are registered and receiving unemployment benefits do not have the right to count on compensation.

You can apply for a 50-ruble compensation as follows:

- The employee submits an application to the place of employment requesting payment. The application is written in free form, but it is subject to the same requirements as for an application for leave.

- The employer issues an order to assign payments. This must be done no later than 10 days from the date of receipt of the application.

- Money is paid in the same manner and within the same time frame as benefits or salaries.

Any person using carer's leave can apply . Moreover, payments can be assigned retroactively (clause 12 of the Government of the Russian Federation No. 1206) - but the employer will pay for no more than 6 months preceding the application.

The exception is the situation when payments were not made due to the fault of the employer - here they can be claimed without a time limit. In addition, with the consent of the employee, a one-time payment of compensation is allowed immediately for the entire time after the care leave has ended.

IMPORTANT: It must be remembered that payments are made only upon a special application from the employee. Without this document, the employer will not pay - and at the same time will not break the law. Part-time workers must submit an application for each place of work - and payments will also be made by each employer.

Order form

The current legislation does not stipulate the employer’s obligation to draw up a document on any unified form. The company may well create its own form and use it in its work. You just need to include all the necessary data and details.

The following options are practiced:

- If an employee takes a full leave for 3 years , then the text must contain information about the period of benefit payment - until the child reaches 1.5 years of age.

- If an employee decides to extend the vacation from 1.5 to 3 years , then the document must indicate on what basis it is being extended. The basis in this case will be an order for initial leave.

- If relatives decide to split the vacation and take turns taking care of the baby , the order is issued for part of the vacation at the place of work of each of them.

This is important to know: Compensation for unused vacation under the GPC agreement

When is the exit?

The maximum duration of parental leave is three years from the date of birth of the child . Consequently, it ends on the first working day after the child’s birthday (the birthday itself still counts as vacation).

However, this is only the maximum duration. As already mentioned, many parents look after their children only until they are one and a half years old (if there is only one or two children in a family, then there are no additional regional benefits, and federal benefits stop paying exactly at one and a half years).

Art. 256 of the Labor Code of the Russian Federation provides for the possibility of using leave in parts , so even a situation is acceptable when a mother goes to work, and then takes leave again and sits with the child until he is three years old.

How long is maternity leave?

It is customary to divide vacation up to 1.5 and, separately, up to 3 years.

According to the rules of law, such a division is conditional, since there is only one vacation. It lasts almost three years, although benefits are paid only half of the term. Thus, a woman can start working as soon as the baby turns 1.5 years old (or at another point) or wait a little longer . There is no need to extend your vacation.

Who has the right to issue it?

Not only the woman who gave birth to a baby has the right to go on paid leave. Art. 256 of the Labor Code of the Russian Federation provides for the possibility of other persons directly caring for the child being on leave.

It can be:

- dad;

- grandparent;

- other people who are related to the child;

- adoptive parents or guardians (they must be in an employment relationship).

However, such a guarantee applies only to those citizens who were officially employed.

Relatives can receive leave, as well as benefits, in cases where the mother works, is on maternity leave for another child, or is unable to provide care.

It is not necessary to use the entire vacation. There are situations when a woman starts working after 1.5 years or at another time. Another relative or guardian has the right to take the rest of the leave.

Persons who care for the child may change. There is only one limitation: the same vacation is not granted to two or more people at the same time.

Is it possible to work?

Art. 256 of the Labor Code of the Russian Federation provides that it is possible, while on vacation and receiving benefits, to simultaneously work and receive a salary. However, this requires one condition: the work must be on a part-time basis (find out whether it is possible to go part-time while maintaining child care benefits and how to register for going back to work here). This, according to Art. 93 of the Labor Code of the Russian Federation means the following:

- Or the employee works every day, but for fewer hours.

- Or he works a full shift, but not every day.

In any case, per week, an employee who is on vacation should not have more than 40 working hours (Article 91 of the Labor Code of the Russian Federation), while it must be taken into account that working women whose children are less than one and a half years old are provided with breaks for feeding (Article 91 of the Labor Code of the Russian Federation). 258 Labor Code of the Russian Federation). They are included in working hours and are at least 30 minutes every 3 hours.

To simultaneously receive wages and benefits, the employee must take the following actions:

- An application is submitted to the employer with a request to be allowed to work under the above conditions. The application must specify the exact conditions under which the work will take place.

- An additional agreement to the employment contract with new conditions is drawn up.

- The employer issues an order according to which the employee is allowed to work. The order also reflects the new part-time work schedule. Based on this order, the accounting department will calculate salaries.

Labor legislation also allows for the possibility of working from home for persons caring for a child. To apply for this type of work, you need to follow the same steps.

Distinctive features of the document

Let us pay attention to the standards in accordance with which orders for employee leave are issued. All relevant documents should be drawn up according to the existing template. An employee of the personnel department or any other authorized person fills out the order form. Then the form must be submitted for approval. For a document to be valid, it must be certified by the signature of the head of the organization or department.

Important! When the order has already been approved, the employee also signs. You should also enter information about the vacation into the employee’s personal card. Data is entered based on the order. Also, no later than three days before the first day of vacation, payments must be made, if any.

There is also a list of papers attached to the order. The following official papers are prepared:

Remember! The employee is obliged to notify of the need for leave in advance. A specific deadline is also defined: the information is provided by the employee at least 15 days before the first day of the proposed vacation. Calendar days are taken into account.

There are a number of other documents that can be attached to the order in the T-6 form.

- Child's birth certificate.

- Help-call from an educational institution.

- Certificate of work experience.

- Certificate of incapacity for work.

- Certificate of death of a close relative. It is needed if time off is provided to organize a funeral.

Can they call?

According to Art. 125 of the Labor Code of the Russian Federation, an employee can go to work while on leave only if he agrees to it. Thus, any action by employers that requires early termination of parental leave is illegal . They only have the right to offer the employee to return to work - but the employee can ignore these offers.

In the same case, if the employer insists on leaving and, moreover, proceeds to threats, the employee has the right to file a complaint with the Rostrudinspectorate or the prosecutor’s office. In this case, the perpetrators may face punishment.

Employer's liability

An employer who does not provide care leave or forces an employee to terminate it early is liable under Art. 5.27 Code of Administrative Offenses of the Russian Federation. It provides for a fine:

- for individual entrepreneurs or officials – from 1 to 5 thousand rubles;

- for organizations - from 30 to 50 thousand rubles.

Repeated violations will result in increased fines. If there has already been a punishment for a similar offense, the fine will be:

- for individual entrepreneurs or officials - from 10 to 20 thousand rubles (for officials, disqualification from 1 to 3 years is also possible);

- for organizations - from 50 to 70 thousand rubles.

How to write an order correctly

Now we will look in detail at how to correctly compose an order. First of all, the date of preparation is indicated, you need to write down the number of this official document, enter the name of the organization or department.

Orders begin with the wording “provide leave.” It is indicated who exactly goes on vacation. In the dative case the surname, first name, and patronymic of the employee are written. For example: Vakhrusheva Maria Nikolaevna. Then, in the appropriate fields, write down the name of the department and the position held by the employee. Indicate his specialty, profession. If you use the personal card of a working citizen as a sample, all information will be as accurate as possible.

Then you need to pay attention to the line where the specific working period is indicated. Lines A, B, C should be filled out in accordance with the type of vacation planned. We have the Labor Code of the Russian Federation. According to it, any employee has the opportunity to rest every year, while receiving monetary compensation, for 28 calendar days. The issue is resolved by the manager individually if the employee has not worked for 12 months. For example, bosses are often ready to give their subordinates paid time off if they have worked for at least 6 months. Then this must be indicated under the letter B. In our example, the most common option is annual basic paid leave (letter A).

Then all that remains is to sign the document. The order is certified with signatures not only by the manager, but also by the employee himself. The document is sent to the accounting department, human resources department, so it must be prepared in two copies .

Video on the topic

The video talks about the important nuances of taking parental leave:

On our website you can also familiarize yourself with all the nuances associated with the dismissal of an employee on parental leave.

Child benefits: changes from 2021

For example, if in the region the cost of living for the second quarter of 2021 for the working population was 12,130 rubles, and for children - 11,004 rubles, then in 2021 in this region the payment for a child will be 11,004 rubles. Families whose monthly income does not exceed 24,260 rubles will be able to receive payments.

We recommend reading: Payments at the birth of a child in 2021 in Moscow

Monthly compensation for children under 3 years old

An application for assignment of payments for the second child is submitted to the territorial branch of the Pension Fund. Since payments for the second child are made at the expense of maternity capital, only parents who have received the appropriate certificate/sent an application for a certificate can apply for payments (Clause 4 of Article 1 of Federal Law No. 418-FZ dated December 28, 2021).

The main thing to remember here is that such leave is issued by order and can begin and end at any time convenient for the employee, until the child reaches 3 years of age. It is the application that is the document on the basis of which the employer will be obliged to issue an order to provide parental leave for up to 3 years. Such an order can be found at the bottom of the article.

Order for maternity leave

Remember that here it is also extremely important to correctly fill out the order. A pregnant employee not only gets the opportunity to rest in accordance with it, but also has the right to monetary compensation. This right is regulated by the Labor Code of the Russian Federation.

The very fact of pregnancy, the upcoming birth of a child is not yet a reason for rest, because everything must be officially confirmed, a corresponding application must be registered, and an order must be issued.

An order for the leave of a pregnant woman is drawn up in form T-6 based on a set of papers. The expectant mother must first submit an application in which she asks to be given maternity leave and to receive cash payments. An official document indicating the planned date of birth of the child is also required.

A woman gets the opportunity to go on vacation 70 calendar days before the expected date of birth of the child.

You need a corresponding certificate from a medical institution - a antenatal clinic, as well as a certificate of incapacity for work. Any expectant mother will receive such documents without any problems at the institution where her pregnancy is being carried out.

Let's consider a few important points. Pay attention to the name of the vacation. It is customary to call it maternity leave, but you need to use the official name given in the Labor Code: maternity leave. This wording fits into line B.

Then you need to indicate the duration of the vacation. When a woman is pregnant with two or more children, complications arise, it is 192 days. In this case, the standard maternity leave period is most often used - 140 days. Be sure to indicate the start and end date of the vacation.

Often women decide to use the period of annual leave that they have left. You can apply for both vacations in one document T-6. In column A they write about the main leave, and then enter in line B the data about maternity leave, after which in line C they summarize the information about the two periods of rest.