general information

According to current legislation, every woman in a position can receive various types of benefits if she is a citizen of the Russian Federation.

In this case, all programs are conditionally divided into three categories:

- for workers;

- for unemployed people;

- as part of medical care.

The latter apply to both working and non-working women. As part of health care, pregnant women are provided with a number of privileges and benefits that they can use.

Important! The main document giving the right to benefits and allowances is a certificate from a medical consultation. If a woman does not register, then she does not have rights to benefits.

The procedure for paying benefits for BiR until 2021 not under the FSS pilot project

If the employer was not part of the pilot project - i.e. the maternity benefit was paid by the employer - in order to pay maternity benefits, the employee had to provide to the accounting department:

- Certificate of incapacity for work for pregnancy and childbirth.

- Application for payment of benefits (in free form).

- A certificate of the amount of wages received in the pay period from another employer.

In the application, the employee, in addition to her data, could indicate the method of receiving benefits and account details.

An order or other administrative document was not needed for payment.

A one-time maternity benefit was paid if the employee submitted an application no later than six months from the end of the leave under the BiR. Despite the fact that the maternity benefit was paid by the employer, it was calculated entirely at the expense of the Social Insurance Fund.

Medical benefits

First of all, according to Article 41 of the Constitution, all citizens of the Russian Federation have the right to free medical care.

Including pregnant women. Moreover, according to the law guaranteeing the provision of certain medications to pregnant women, these drugs are provided in state pharmacies either free of charge or with a 50% discount.

For example, folic acid and ascorbic acid, necessary for the normal development of the fetus, are prescribed free of charge during all months of registration. In addition, the following types of medical services are provided free of charge:

- Visiting specialized doctors: gynecologist;

- ophthalmologist;

- dentist;

- therapist;

- otolaryngologist (ENT doctor).

Attention! In order for services to be provided free of charge, a referral from the doctor managing the pregnancy is required.

- Carrying out planned manipulations: ECG;

- fluorography for the whole family;

- Ultrasound (planned - three, additional - on the recommendation of a doctor);

- passing all necessary tests;

- physiotherapeutic procedures.

Attention! For all manipulations, a referral is issued by the doctor managing the pregnancy.

What benefits and guarantees are stipulated in the law?

Let us recall that labor guarantees for pregnant women are provided for in local regulations of the employer, collective agreements, and industry agreements. But the minimum that all organizations and individual entrepreneurs with hired employees must adhere to is prescribed in the Labor Code of the Russian Federation. We will focus on its norms.

We will protect you from fines due to errors in personnel documents in the online course “All about personnel records: learning to draw up personnel documents without errors.”

The training is completely remote, we issue a certificate from the Clerk Training Center. You can start training any day and study at your own pace.

Watch the first video of the course:

Early registration benefit

Regardless of whether a woman works, she is entitled to payment of benefits for early registration with a medical organization.

The benefit is paid if a woman consults in the first trimester, before 12 weeks of pregnancy. Funds are paid from the regional fund. The size depends on the regions, on average 500-1000 rubles. around the country.

Required documents

In order to receive benefits, you need to collect a minimum package of documents:

- passport;

- certificate from the antenatal clinic;

- statement;

- an extract from the employment center stating that benefits were not paid there;

- extract from the house register;

- a copy of the personal bank account where the benefit will be transferred (account number, not card number);

- a copy of the work book or a certificate from the employment center about the status of unemployed.

You can apply to write an application at “My Documents” (multifunctional centers) in the region of residence or at the place of registration (registration) at the Department of Social Protection of the Population.

Important! The benefit for registration in the early stages of pregnancy is paid only at the place of permanent registration. If a woman registers at her place of temporary registration, her right to receive benefits is lost. This change came into force in 2016.

If a woman is employed, then such benefits are paid to her by the employer. You must submit an application, passport and a certificate from the antenatal clinic about early registration.

What payments are due to pregnant working women?

If a woman is officially employed, her employer must pay her child benefits. To do this, she must provide a certificate of pregnancy and write an application for a certain type of benefit. According to the law, the employer cannot refuse his employee in this situation. In addition, it is prohibited to fire a pregnant woman or interrupt her maternity leave.

A woman can count on the following types of benefits:

- Payment upon early registration.

- Handbook on BiR.

- Child birth benefit.

- Child care allowance up to 1.5 years old.

- Child care allowance up to 3 years old.

- Maternal capital.

Important!

Of the listed payments, only the last will come from the state budget. Maternity capital is required for the birth of a second child in a family - this is 453,026 rubles. In other cases, the calculation of child benefits is the responsibility of the employer.

Important! If you are considering your own case related to payments to working pregnant women, then you should remember that:

|

Maternity benefit

So-called maternity payments are accrued to women 70 days before giving birth and 70 days after. For multiple pregnancies or births with complications, the leave period is longer. For example, benefits for the birth of twins must be paid not for 140 days, as usual, but for 194 days: 84 days before the birth, and 110 after.

- Female students, if a woman is studying full-time, the amount of the payment is equal to the amount of the monthly stipend.

- Dismissed due to the liquidation of organizations during the 12 months preceding the day they were recognized as unemployed, having ceased their activities as an individual entrepreneur, notary, or lawyer. — 300 rubles per month are taken into account. For an appointment, contact the FSS.

- Working women.

The benefit is accrued after the pregnant woman provides sick leave to the employer. The mechanism for calculating benefits is as follows: the average daily wage is multiplied by 140 days of vacation. In 2021, the maximum amount of maternity benefits was 301,095.89 rubles, the minimum was 51,918.90 rubles. From 2021, the maximum monthly benefit will increase to 27,900 rubles.

Legal basis

According to Federal Law No. 81 of May 19, 1995 “On state benefits for citizens with children”, it establishes the circle of persons who have grounds to apply for state support:

- Working persons registered with the Social Insurance Fund (have an employment contract and are officially employed).

- Military personnel serving under contract in the Russian Federation and abroad.

- Women who are trained in educational and scientific institutions.

- Unemployed if they acquired this status due to bankruptcy or liquidation of the company within 12 months from the date of dismissal.

Foreign citizens working in Russia under employment contracts also have the opportunity to receive financial support..

One-time benefit for the birth of a child

This is a one-time payment provided to one of the parents. When two or more children are born, this benefit is paid for each child. If the child was stillborn, no benefits are provided.

Methods of obtaining:

- paid by the employer if the woman is employed;

- paid to the employed father of the child if the woman is not employed;

- is paid by the USZN if the parents are not officially employed.

The benefit amount in 2021 was 17,479 rubles 73 kopecks.

Until what age is maternity leave for the third child?

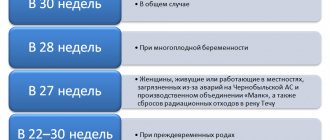

The period of sick leave can be increased to 86 days after childbirth if the delivery was accompanied by complications, which may include a caesarean section. 1 year - 3 years Until what age are child benefits paid in Russia? Maternity leave Since at the time of registration of maternity leave the date of birth of the child is no more than forecast, the woman goes on leave at the 30th week of pregnancy.

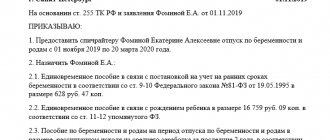

After the employee writes a leave application indicating the dates, the company issues an order, on the basis of which benefits are calculated. The benefit is paid from the Social Insurance Fund, which in turn is based on social payments from employers for the time worked by employees.

Child care allowance up to 1.5 years old

Regardless of whether a woman works or not, she has the right to receive benefits for up to 1.5 years per child.

If a woman is not employed, it is paid from the regional fund. You can obtain it by contacting the USZN or the Multifunctional Center.

The amount of the benefit for the first child in 2021 was 3277 rubles 45 kopecks, for the second and subsequent children 6554 rubles 89 kopecks. Payments are made from the moment the child is born until the age of 1.5 years. You can apply for an appointment at any time during the specified period.

Working women are paid this benefit by their employer. Its size is determined based on the average salary for the last 2 years and is equal to 40% of its size. The algorithm for calculating the benefit is as follows: divide the average earnings for the two previous calendar years by 730 (the number of days in a calendar period), multiply by 30.4 (the average number of days per month) and multiply by 40%.

The maximum amount of such benefits for working women is 26,152 rubles 27 kopecks. The minimum is 3277 rubles 45 kopecks for the first child and 6554 rubles 89 kopecks for the second and subsequent children.

Maternity payments up to 3 years in 2020

Strictly speaking, the concept of “maternity leave” does not exist in the laws. The Labor Code of the Russian Federation provides for exemption from work due to temporary disability during pregnancy and childbirth: seventy days before the birth of the child and seventy days after. This entire period is paid from the average daily earnings for the last two years worked. Usually this particular leave is called maternity leave.

How is payment made for days off from work due to child care? After the employee writes a leave application indicating the dates, the company issues an order, on the basis of which benefits are calculated. The benefit is paid from the Social Insurance Fund, which in turn is based on social payments from employers for the time worked by employees. The employer calculates the benefits and transmits the results to the Fund along with a copy of the leave order.

Benefits for citizens with children

Families with an income below the subsistence level established in the region have the right to apply for benefits, which are assigned from birth until adulthood for each child separately. In some cases, the child's age can be up to 23 years. The benefit is paid monthly, and the amount of the benefit is set in each region separately, taking into account the regional coefficient. For mothers (fathers) raising children without a second parent, the benefit amount has been increased. To apply for benefits, you need to contact the UMSZ or a multifunctional center. The amount of the benefit is determined by each region independently.

Example

The family collectively receives 24,000 rubles.

There are three people in the family.

The cost of living is 9,470 rubles.

The family is considered low-income: 24,000/3 = 8,000 rubles.

In this case, benefits for up to three years are assigned and paid monthly.

In addition to payments, women can count on labor benefits. For example, if working conditions for a pregnant woman are too difficult or have a negative impact on health, then she has the right to write an application to the employer for a transfer to another position or a reduction in output. The employer is obliged to maintain the wages that the woman previously received. No changes are made to the work book.

Important! The employer does not have the right to fire a pregnant woman, and is also obliged to provide annual paid leave upon request, even if it does not fit into the approved vacation schedule.

Until what age is child benefit paid?

- after 30 weeks of pregnancy, the expectant mother has the right to receive the first maternity benefit payments;

- within six months after childbirth, a one-time benefit is paid, which can be received not only by the mother, but also by the father and the baby’s guardians;

- maternity capital for the second, third and more children in the amount of about 450 thousand rubles. (not provided for the firstborn);

- up to one and a half years, assistance is paid in the amount of 40% of the salary, but not less than RUB 3,795.60. for a working mother, and for an unemployed mother - in the amount of 3,163 rubles. 79 kopecks;

- up to three years, paid from 50 rubles. monthly;

- innovation from 2021 - monthly cash payments (only for families with low incomes and for children born after December 31, 2021) for the first and second child in the amount of the regional subsistence minimum for children for the second quarter of last year, until the baby reaches 1 ,5 years of age. In this case, payments for the second child are made from maternity capital funds.

We recommend reading: Where to change your passport when changing your last name

According to Article 11 of Federal Law 81, on the occasion of the birth of a child, a special benefit is paid, different from maternity benefit. These are also one-time payments; from February 2021 this amount is 16,873 rubles. 54 kopecks, and for the Far North it is additionally increased by a special regional coefficient; for the Ural District certain allowances are added to the amount.

Peculiarities of assigning benefits for employment and labor to a part-time worker

The calculation of maternity benefits for a part-time worker has some peculiarities. Who pays maternity benefits if there are multiple employers?

It is important to know that an employee can apply for a one-time maternity benefit from any employer. The employee must provide the selected employer with a certificate from another employer stating that he does not assign or pay her maternity benefits.

If an employee cannot provide a certificate from another company because it has already been liquidated, this does not mean a loss of increased maternity benefit payment. At the request of the employee, the new employer can send a request to the Pension Fund of Russia office about earnings, bonuses and other remunerations based on personalized accounting data.

Let us remind you: if an employee does not have a certificate of the amount of earnings on the day of applying for benefits under the BiR, then maternity benefits are paid based on the available documents. And then - when the employee provides the missing documents - the accounting department must recalculate . It is done no more than 3 years prior to the day the salary certificates are provided.

It is worth knowing that if the employee has at least 6 months , she has the right to a one-time pregnant woman’s benefit in the amount of 100% of average earnings.

The procedure for payment of benefits for the BiR under the FSS pilot project from 01/01/2021

Since 2021, all organizations operate on the principle of direct payment of benefits and do not participate in the payment of benefits for pregnant women themselves. However, to assign, calculate and pay for sick leave for pregnancy and childbirth, the accounting department needs the appropriate documents. Their list is similar to the previous list.

In this case, the application is filled out in the form established by Order No. 578 of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017. In the application for the Social Insurance Fund for maternity benefits, the employee can indicate information about the replacement of calendar years in the billing period.

The application must be completed by hand in block letters.

important

From 01/01/2021, all regions of the Russian Federation switched to direct payments of benefits from the Social Insurance Fund. Reason: Federal Law dated December 29, 2020 No. 478-FZ. Law No. 478-FZ abolished the obligations of insurers (employers, educational institutions, etc.) to calculate and pay benefits, as well as a number of regulations regulating this process. Now the policyholder only has to provide the Social Insurance Fund with complete and correct information to calculate benefits.

However, the policyholder’s representative still needs . According to the new Law No. 478-FZ, if the FSS incorrectly calculates the benefit according to the policyholder’s data and in connection with this incurs expenses (for example, it overpays the benefit or underpays and the underpayment will be collected with interest), the FSS will be obliged to reimburse the policyholder for such expenses.