Home / Labor Law / Payment and benefits / Maternity payments

Back

Published: 03/05/2016

Reading time: 12 min

0

3679

A newborn brings not only great joy to the family, but also additional financial expenses. After the birth of the baby, the mother does not work, spending all her time caring for the baby. During this period, financial assistance is very important. The state provides it through maternity payments, which the expectant mother receives during pregnancy and after the birth of the child.

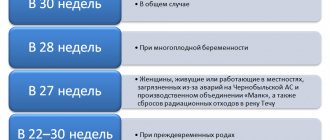

Such payments to a woman are due for a period that usually includes 70 days before childbirth and can last the same amount after it.

The exact duration is determined by the doctor, which is recorded on the sick leave certificate.

Maternity benefits are calculated in accordance with Federal Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children.”

The amount of payment, methods of payment and receipt are specified by Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.”

- Categories of maternity leave recipients in 2021

- Indexation of maternity payments and minimum wage in 2021

- What does the amount of maternity leave depend on?

- Limit amount of maternity benefits

Maternity payments in 2021

The maximum amount of payments in connection with the birth of a child is established for a specific year. Let's consider what maximum maternity benefits are provided for the current year.

Maximum maternity benefit

The main and most significant payment in terms of amount is due for the period of sick leave for pregnancy and childbirth. Typically, such sick leave is issued for 140 days. In case of complicated childbirth, for example, caesarean section, an additional 16 days of sick leave is issued. If a woman gives birth to twins, the period of temporary disability lasts a total of 194 days. The average daily earnings, which are determined based on the wages of the two previous calendar years, are multiplied by the number of days of sick leave. Moreover, if this employee has been working in the company recently, that is, the employer does not have data on her salary for the entire pay period, then the missing information is taken from the certificate of average earnings. The form of such a certificate was approved by Order of the Ministry of Labor of Russia dated April 30, 2013 No. 182n, and it is filled out and given to the employee upon dismissal, just so that he can provide the information necessary to calculate social benefits from the next employer.

Example 1:

Employee of Alpha LLC Ivanova M.A. provided a sick leave certificate in connection with pregnancy and childbirth, opened on February 3, 2021 for a period of 140 calendar days. In 2021, Ivanova’s total salary was 345,000 rubles, in 2015 – 84,000 rubles. At the same time, the employee got a job at Alpha LLC only in September 2015. According to the certificate in order form 182n, the previous employer’s earnings amounted to 158,000 rubles. The calculation of sick leave payment will be:

(345,000 + 84,000 + 158,000)/730 x 140 = 112,575.34 rubles

As already mentioned, the law provides for a maximum amount of maternity leave. In 2021, sick leave payment for a standard 140 days cannot be more than 266,191.78 rubles, and in 2016 this limit was 248,164.38 rubles. If the number of sick days changes, the maximum amount of maternity benefits is recalculated accordingly.

The limits are determined based on the maximum value of the base for calculating insurance contributions to the Social Insurance Fund, determined for each year. In 2021, this figure was equal to 718,000 rubles, in 2021 – 670,000 rubles, in 2015 – 624,000 rubles. Thus, in the example under consideration, the calculation does not exceed the maximum maternity payments in 2021 established for this benefit. If the employee’s salary were higher, that is, she would receive amounts in the billing periods that exceed the threshold values, then her average earnings would be taken into account only on the basis of the indicated limits.

The maximum maternity benefit is not the only limitation in this case. The minimum benefit amount is also determined, and it is calculated based on the minimum wage in force in the billing periods.

How are maternity benefits calculated?

The benefit is calculated based on the duration of maternity leave and the amount of income of the child’s mother at her place of work, study or service.

In a standard situation, maternity leave lasts 140 calendar days: 70 of them before the birth of the child and 70 days after. But then, when the birth did not occur without any complications, the second part of the vacation is increased by 16 days. And in situations where a mother is about to give birth to not just one child, but twins or triplets, maternity leave is increased by 14 days before and 40 days after the birth of the baby.

A mother who has adopted a child under three months of age is also entitled to such leave; it is given for 70 days (or 110 days if there is more than one such child).

Now, in order to directly calculate the amount of maternity payments, the duration of the vacation is multiplied with the mother’s daily income for the last 24 months. But at the same time, if a mother has several official jobs, she has every right to include the salary from each job in the calculation of earnings.

Maximum maternity payment for child care up to 1.5 years

The last benefit is a monthly payment for child care up to 1.5 years. It is 40% of the average earnings of a female worker. An employee can apply for such a payment at the end of sick leave for pregnancy and childbirth and until the child reaches one and a half years of age.

Example 2:

At the end of maternity leave, Ivanova M.A. wrote an application to grant her maternity leave for up to 1.5 years. Let's use the wage data from the previous example to calculate this monthly benefit:

(345,000 + 84,000 + 158,000)/730 x 30.4 x 40% = 9,777.97 rubles

For this benefit, minimum and maximum amounts of maternity payments are also established. When determining the minimum threshold, it is important what kind of child was born in the family. The established minimum payment for the first child from February 2021 is 3,065.69 for the second and then 6,131.37 rubles. Previously, the amounts were equal to 2,908.62 and 5,817.24 rubles, respectively.

The 2021 maternity maximum for child care benefits is 23,120.66 rubles. It is also determined based on the maximum values of the base for calculating insurance contributions to the Social Insurance Fund. If the benefit was calculated for the first time in 2021, that is, the calculation period included 2014-2015, then the maximum amount of maternity leave of this type was 21,554.85 rubles.

What exactly is maternity leave and maternity benefits?

Strictly speaking, the word “maternity leave” and all its derivatives have not been used in legislation for a long time, but are a common designation for several statutory holidays for the baby’s mother and the benefits assigned during these holidays.

First, the expectant mother will have maternity leave. This is the time, more than four months, that is given to a woman in order to carry her through the final stage of pregnancy without harm to her health and the health of the baby and to recover after delivery of the pregnancy. During this period, the mother is freed from the need to earn a living, she retains all her income in full and her workplace, and she herself most often stays in a medical institution.

The second leave that a mother is entitled to is child care leave. Its duration often does not have any clear boundaries. The law only says that the mother retains her job for three years, and for the first one and a half of these three years she can receive 40% of her previous income.

Procedure for payment of benefits

All benefits must be calculated for payment by the employer within 10 days from the receipt of the necessary documents. This rule also applies to minimum and maximum maternity benefits in cases where the calculation is made not based on real wages, but based on established limits.

The list of papers that an employee must provide to the employer in order to receive a particular benefit is based on the need to confirm her right to receive a specific payment. In the future, the company will have to submit all these documents to the Social Insurance Fund in order to receive compensation for the amounts paid. These are the employee’s applications for the calculation and receipt of appropriate benefits, sick leave, birth certificate, as well as certificates from the place of work of the child’s father stating that he did not receive a lump sum birth benefit (this benefit can be received by either parent) from his employer, and also that he is not granted maternity leave to care for a child up to 1.5 years old.

An employee has the right to claim payment of any of the benefits described above within 6 months from the date of the relevant event. For sick leave payment according to the BIR, this period is counted starting from the last day of the sick leave period. After the expiration of the six-month period, the employer must not make such payments.

Where to go to get maternity assistance

To begin with, it is worth remembering that financial support is paid to the expectant mother when she goes on maternity leave (70 days before the birth of the baby). Therefore, before you calculate maternity payments, or go shopping for your unborn child, you should rush to the hospital.

After the examination, the observing doctor will indicate the expected day of birth on the sick leave. This document is considered the basis for receiving finance.

A woman receives payments at work, because maternity leave is paid for by the employer, who, in turn, receives compensation from the social insurance service. Therefore, next, the young mother needs to collect all the required papers and go to the address of her official place of work. Pre-prepared documents should be provided to the HR department employee.

Unemployed expectant mothers also have a legal right to support from the state. To receive maternity benefits, a non-working woman should undergo an examination and obtain a doctor’s certificate, and then contact the social protection office. However, it is worth understanding that the amount of assistance paid to an unemployed mother will be more modest.

Payments to the unemployed

Expectant mothers who do not have an official place of work can receive maternity payments only if their status is confirmed by a certificate from the employment service.

Based on the fact that the average employed women are paid assistance from funds that were generated from contributions from the insurance company, and unemployed mothers did not replenish the fund, unemployed women are provided with the smallest amount. The maximum amount of maternity payments in 2021 for women who are unemployed will be 581 rubles 73 kopecks per month. The total amount of payments for the standard duration of maternity leave will be equal to 2 thousand 670 rubles.

Features of the maternity leave

Maternity leave is usually called the time during which a woman is on leave related to pregnancy and childbirth. It has a clearly limited duration and is financed by the employer, who subsequently receives material compensation from the social insurance fund, where part of the tax payments from wages is constantly transferred, therefore, officially employed women or students can count on its registration. You can also call this period of time a kind of insurance for a pregnant woman, because during maternity leave a pregnant woman cannot be fired, but in the case of unofficial employment, her job will be lost. It must be said that many people also call maternity leave, which is provided for by law to care for a child up to three years of age, but these concepts need to be separated, because they have distinctive features.

Today it is difficult for many to say how maternity leave appeared in Russia, although this event still has a history. It is known that the government of the Russian Federation adopted a bill on allocating a couple of days off to pregnant women back in 1917, only then they were allocated very little time, but today the situation has changed. In modern times, according to the Labor Code of the Russian Federation, women can count on 170 days of leave, half of which is allocated for the last months of pregnancy, and the other half is spent on recovery after childbirth and the joy of motherhood (in the case of a complicated or multiple pregnancy, the duration of maternity leave increases to 194 days ).

Maternity leave dates in 2021

It must be said that the duration of maternity leave in 2021 has not changed, because its duration is regulated by the Labor Code, but information about when to go for it should be discussed separately. In the past, women indicated on their sick leave the most favorable date for them (the period was determined by the date of their last menstruation), because then they could leave work a little earlier than expected, but modern diagnostic methods allow the doctor to determine the date of the expected birth with almost maximum accuracy, therefore, it will be possible to go on maternity leave only on a clearly established date.

Related news:

- How to calculate maternity payments in 2021 in Russia?

- What will be the amount of maternity benefits in...

- What will maternity payments be in 2021?

- What will the pension be in 2021?

- What will the unemployment benefit be for 2021 in Russia?

- Prospects for life in Russia in 2021

In order to correctly calculate maternity leave in 2021 in Russia, you need to see a doctor while still two months into your pregnancy, because this makes it possible to receive a small benefit of 500 rubles. Then, throughout the entire pregnancy, you will need to be observed by a doctor, and at 28-30 weeks of pregnancy you will need to take a sick leave certificate from the doctor, which will indicate the date of birth, give it to the accounting department at the enterprise and within 10 days receive financial compensation from the employer . Today there are even special calculator programs where you enter the approximate date of conception and the characteristics of pregnancy, and they will carry out the calculations themselves and allow you to determine the date of maternity leave.

Special attention must be paid to collecting all the relevant documentation, because without them, not only will you not be able to go on vacation and keep your job, but you will also not be able to receive financial compensation. It will be possible to go on maternity leave in 2021 on the basis of sick leave (or certificate of incapacity for work), which must be obtained from a doctor, a certificate of registration in the antenatal clinic, as well as a specially drawn up application for leave and a certificate of receipt of wages (for two full years of work , there may be several certificates for official employment in several places of work).

How to find out the amount of financial assistance

You should consider in more detail how to calculate the amount of maternity payments.

Initially, the average daily earnings of a citizen for the two years preceding the decree are determined. To do this, it is enough to calculate the amount of income for a given period and divide the resulting number by the number of days (two years - 730 days).

For example, if in the first year a woman’s monthly salary was 30 thousand, and in the second year – 40 thousand rubles, then the amount of income for two years will be equal to 840 thousand, and the average daily earnings will be 1 thousand 150 rubles.

The resulting number should be multiplied by the number of days of maternity leave (standard – 140). That is, if the income per day was 1 thousand 150 rubles, then the amount of maternity assistance will be equal to 161 thousand rubles.

This calculation can be used by mothers whose salary is within the minimum and maximum wages established by law at the time of going on maternity leave.

If there is a need to calculate maternity payments for wages beyond the period outlined by law, certain nuances should be taken into account. The same applies to officially unemployed women.

Maximum limits on maternity benefits

Thus, a woman receives her average salary, since maternity leave is equivalent to sick leave. The state regulates this moment, and therefore boundary indicators are prescribed, beyond which accrual is not possible:

- For a regular vacation: up to 248.1 thousand rubles;

- At the birth of 2 or more children: up to 343.8 thousand rubles;

- For complications: up to 276.5 thousand rubles.

If the mother did not work for the previous two years, then she is entitled to benefits from the state. It is very insignificant and is fixed - 4.6 thousand rubles.

Thus, the maximum maternity payment in 2021 depends on the amount of wages, as well as on the duration of the vacation.

Step-by-step instructions for receiving maximum maternity benefits