Salary is a fixed amount of remuneration based on the assumption that the employee worked the entire calendar month (did not take sick leave or vacation). The salary is described in the employment contract, which the candidate is familiar with when applying for a job.

The salary does not include bonuses, allowances and compensation; it is taken as the basis for subsequent calculations of other indicators of remuneration.

Salary is the sum of all funds that an employee receives after summing up the days actually worked, all allowances and bonuses, while mandatory personal income tax is withheld. When calculating wages, bonuses, allowances, and compensations are added to the salary amount, if any are provided for at a particular enterprise.

For example, remuneration for overtime on official weekends, overtime in the evening, high performance indicators, harmful and dangerous working conditions, length of service, and others.

Differences from salary

So what is salary?

Let's try to understand in more detail the concept that interests us. The salary is the so-called base from which one starts when calculating wages.

What is the difference between salary and salary? First, tax deductions are primarily based on salary. Secondly, appropriate increases can be accrued in case of processing. From there, penalties for damage to property or other fines are deducted, and incentives or bonuses are added.

This is interesting! Posadovy salary in Ukrainian is an official salary.

As a result, the salary is what the employee receives in his hands. It can be either less or more than the salary. As a rule, the salary amount is agreed upon in advance for a certain amount of hours of work, but if during the process the employee exceeded the norm at the request of his superiors by working overtime, then he should be compensated for this.

What salary size is clearly regulated by the legislation of the Russian Federation? It is a fixed amount, which must be prescribed when drawing up an employment contract with an employee, and changing the salary is hardly possible. In order for the concept under consideration to change its size, a number of conditions are necessary. One of them is the Order. In this case, the salary, or rather, changing it, would be advisable. But the salary is a calculated amount, so it is not written down anywhere in advance.

An employee should carefully monitor the amount of his salary, because sometimes the employer writes off damage to materials or equipment as a deduction for the employee’s monetary compensation, although the latter is not actually to blame for anything (indirectly or directly).

For such a gross violation of laws, you can sue the employer.

The work of counselors at a summer camp can serve as the most striking example of such a case. Some property damage is deducted from new caregivers' pay when management does not verify that the previous shift was completed.

The employee has every right to be informed of all deductions of his wages.

So, what is salary in an employment contract? After all, everyone knows that for some important reasons and in some cases, drawing up this type of agreement is simply necessary. Whether the concept itself and the size and other characteristics are indicated in it, we will consider further.

The employment contract must specify the salary of an employee of the enterprise, the procedure for calculating it and increasing it.

As a rule, the salary is calculated based on the remuneration system, which is:

- tariff-free – wages are calculated based on the company’s final profit;

- tariff - the employer evaluates the employee’s work results based on the agreed norm and production time;

- mixed - the employer takes into account the total profit of the company and the contribution of a specific employee to it.

Coefficients for calculating official salaries

According to labor legislation, an official salary is a fixed amount of payment for labor activities for the performance of one’s own official duties. The official salary cannot include social, incentive or compensation payments.

The Labor Code of the Russian Federation defines the basic salary as the wage rate of an employee of a state or municipal organization carrying out the professional activities of a worker or employee without taking into account additional payments.

Thus, the minimum wage established at the state level serves as the basis for establishing the official salaries of employees.

The salary of any employee directly depends on many factors, including:

- work load;

- specialized education;

- qualification;

- work experience.

Attention! The official salary is a fixed amount of remuneration, established depending on the position held by the employee, qualifications, specialized education and length of service at the given enterprise. The amount of remuneration for the work activities of employees is established based on salary schemes that are developed at the level of an organization or an entire industry:

The amount of remuneration for the work activities of employees is established based on salary schemes that are developed at the level of an organization or an entire industry:

- Industry schemes are used to determine the salaries of employees of organizations financed from budgetary sources.

- Salary schemes approved at the level of firms financed from their own funds take the form of a staffing table indicating the range of specialist positions and the corresponding salary amounts.

The salary schedules for both groups may indicate a salary range, called a salary range.

Establishing minimum and maximum wages makes it possible to determine employee salaries individually, based on their qualifications, work experience, volume of work performed and business qualities.

The level of professionalism of both specialists and workers is determined by gradation into categories, due to which employee salaries are differentiated. Most organizations are characterized by a three-stage gradation.

According to labor legislation, the wage regulations may provide for the establishment of a personal increasing coefficient:

- by position;

- for length of service (more on this).

If an increasing coefficient is established, the amount of upcoming payments is determined by mathematically multiplying the salary by the coefficient.

A personal increasing coefficient can be assigned taking into account:

- vocational training;

- complexity of the work performed;

- employee's degree of responsibility.

The decision on the bonus is made by the head of the enterprise in relation to each employee individually. The length of service coefficient can be established for employees depending on the total professional experience at the given enterprise.

What does remuneration consist of?

The overall level of remuneration for work depends on many factors. Of course, the lion's share of the remuneration comes from the size of the established official salary, which will then be used to supplement other money due to the employee. The final level of income of a citizen will be influenced by:

- presence of harmful and dangerous working conditions;

- the need to work at night or overtime;

- long period of work in one place;

- exceeding established production plans or other indicators by which the company makes a profit;

- actual time worked (salary is paid for the monthly standard of working hours, if they are not worked, payment will be made proportionally);

- the presence of legislative or regulatory documents regulating the conditions of remuneration (for military personnel, civil servants, employees of internal affairs bodies, and other officials).

Calculation procedure

How are official salaries determined?

Even taking into account the factors listed above, establishing specific salary ranges is quite labor-intensive and complex. Especially in organizations that have a multi-stage management system. Typically, in order to distribute salaries by rank, some preparatory steps are required.

First you need to determine the general level of the wage fund that the company allocates to its employees. From this fund, you then need (usually this is done by calculation) to allocate an amount of money on an average monthly basis, which will need to be paid to employees as official salaries.

To do this, the availability of compensation and incentive payments is calculated using the existing remuneration system. You will also need to calculate the average salary level.

Next, you should determine the number of ranks at which different official salaries will apply (usually from 3 to 10, depending on the company).

At the next stage, it is necessary to “decompose” the available number of employees at various levels according to their ranks, starting with the first manager in the form of a pyramid, which will grow downwards.

Using simple calculations, you can calculate the amount of money for each rank, and then simply divide it by the number of required employees at each rank and, thus, set the average salary level.

We must not forget that the company’s salary fund usually ranges from 20 to 90% of the total cash turnover. Therefore, the calculation of official salaries should be approached with the utmost seriousness, so as not to become bankrupt after the first working month.

In this case, the salary is calculated without taking into account the need to pay taxes. They will have to be paid either from the body of the salary (if nothing else is planned to be calculated), or from the general level of wages received by the employee.

When making accruals, the employer has to:

- operate with the size of the salary;

- do not forget about the advance payment;

- take into account sick leave and vacation pay;

- make contributions to state extra-budgetary funds;

- withhold personal income tax;

- take into account the availability of writs of execution, alimony, etc.;

- apply bonuses, allowances, coefficients, etc.

The formula is used: ZP = (O / DR) x DO.

When paying hourly, the tariff rate is multiplied by the hours worked per month. The formula is applied: ZP = TSCH x KOCH.

Piece workers can be paid:

- proportional to production;

- using a progressive scale.

Calculation of earnings during a business trip takes into account the average daily payment and takes into account work on weekends.

Payroll deadlines

Salaries must be paid every half month, i.e. the advance and the remaining amount are paid with a difference of no more than 15 days.

Moreover, the full payment must be made no later than the 15th day of the month following the month worked. Exactly on which days payment is made is established by an employment or collective agreement, or the company’s internal regulations.

Local documents of the organization should not contain vague billing periods, but specific dates.

If the payday coincides with a weekend or non-working holiday, payment must be made before it.

Remuneration: informal and according to an employment agreement

Quite often, a large part of the population does not have the desire or opportunity to find official employment, for various reasons. Therefore, they agree to an informal agreement between the two parties. Working officially was not always profitable and everyone tried to earn the maximum amount of money in any way. With the advent of taxes, people came up with ways to evade paying them. This is where the term “black wages” comes from.

This is an informal payment, without an employment agreement, negotiated with the employer in advance, accepting the agreements of the two parties.

The provision of services under a contract (contract) is the highest income. It specifies the working conditions, deadlines and consequences for violation. The employer in such an agreement is the customer.

There are many reasons why a person agrees to work under a contract:

- High wages.

- Lack of any documents.

- Deviation from alimony payments, credit debts.

- Maintaining social benefits and periodic increases in pensions for older people and people with disabilities.

What is an official salary and how it differs from a tariff rate?

This payment system is applied to engineering, economics, legal, and most technical specialties. At the same time, in order to correctly establish gaps between various professional groups of highly qualified specialists, to establish “forks” and gaps between official salaries, the following are taken into account:

- complexity of the actions performed;

- requirements for the quality of the final result;

- the volume of obligations assigned to a particular employee;

- the required (usually minimum) qualification level of a potential employee.

To assess the complexity of the work, the employer will have to take into account the availability of high-tech equipment, tools, the complexity of existing technological processes, the multiplicity of actions performed, the level of independence of the specialist during decision-making, as well as the degree of responsibility for the final

What functions does wages perform?

Salary has the following functions:

- motivational;

This function is the main one for the employee, since the salary allows him to satisfy his needs. Without material reward, a person would not waste his time on some kind of work activity.

reproductive;

The reproductive function is closely related to the motivational one, but serves for the benefit of the enterprise: the employee must eat well and be in good physical shape. His family also should not need anything, so that the employee could fully concentrate on his duties.

Sufficient monetary remuneration can increase employee productivity and ensure smooth operation of the company.

stimulating;

This function comes down to the fact that the employee must go to work with the understanding that wages primarily depend on the performance of his work. To do this, the employer must provide the person with work instructions, identify specific achievements and motivate the employee for exceeding them, for example, with a bonus.

status;

Provides salary in accordance with the employee’s qualification level, knowledge and experience. The amount of monetary reward is an indicator of his place in a particular social group. For example, it is for this reason that electricians of different categories will have differences in salaries even with equal hourly output.

production-share;

Requires the contribution of each employee to be taken into account in the final production costs.

regulating.

Helps employees and subordinates interact effectively.

What is the median salary in Russia in 2020?

As Rosstat said, the agency previously calculated the median salary twice a year. The sample included employees of large and medium-sized enterprises only. The last calculation using this method was made based on data for April 2021, then the median salary was 34,335 rubles.

Recently, Rosstat began calculating the indicator based on data on insurance contributions to the Pension Fund of Russia (PFR). They reflect all official salaries of all employees insured in the Pension Fund system. The calculation also takes into account fees and other one-time payments of these employees. According to the latest calculations, the median salary in Russia is 30,457 rubles.

Payment types

Not all employers can clearly explain what exactly an employee’s salary will consist of. Of course, it may seem that it makes no difference what the salary consists of. The more you get, the better. But in some cases it will be useful to know what affects the amount of income.

In fact, there are not many types of remuneration:

- Tariff. This type can be divided into piecework and time-based payment. The piecework form will help to objectively assess the labor factor by establishing production norms, for example. There are various calculation schemes based on factors and functionality. Moreover, the salary may depend on the performance of not only one employee, but also the entire team. The time-based form takes into account the employee’s qualifications and the time spent on work.

- Tariff free.

- Mixed.

The latter types of payment do not imply clear indicators, but the employee’s participation in the production process is assessed in terms of performance.

Regardless of what type of payment is used by the employer, the calculation scheme should be as clear and transparent as possible.

Tariff-free wage system

Tariffing is regulated by law for many industries. For example, for employees in the education sector, an individual tariff SOT has been established in accordance with Government Decree No. 583 dated 05.08.2008.

The tariff-free SOP is similar to the option system in startups. There is a payroll and employees. Let’s assume 100 thousand rubles and 10 people. The employer establishes that:

- The payroll can be increased if the company’s profits rise,

- The share of each employee’s salary is 10%.

The share can rank employees by the amount of participation in work or be the same for everyone.

In the employment contract, of course, they will write down 10 thousand rubles - salary per month. It is impossible to mention % according to the Labor Code, and it is not very profitable for the company.

After the announcement of working conditions, there is no need to establish additional incentives; employees themselves will strive to increase the company’s income. This model is applicable to small, start-up companies that will not go public, but want to interest employees without having money for bonuses.

How is salary different from salary?

This indicator is reflected in the employee’s employment contract and is indicated in the order upon admission to work. Salary is the basic characteristic for the subsequent calculation of other indicators. Salary is the amount of money that an employee receives after calculating the necessary allowances and withholding personal income tax.

To calculate it, the salary amount is used, to which interest stipulated by the contract, bonuses and compensation, for example, for hazardous production, are added, and personal income tax is withheld. Why do they share? The most significant difference between them is that one indicator is calculated based on the other. In other words, there is an established base salary for a certain position according to the staffing table, to which all interest and bonuses for quality work done are added and from which personal income tax, deductions for property damage or compensation for material damage caused are deducted.

What is the difference between a tariff rate and a salary?

That is, wages in this case will be calculated depending on the amount of time worked by the employee.

In this case, wages are calculated using a simple formula: the tariff rate is multiplied by the amount of time worked. For example, if an employee’s rate per hour is 120 rubles, he works 176 hours per month, which means his salary will be 21,120 rubles. So, we have looked at what salary and rate are, what the difference will be discussed further.

The two payroll systems have several differences.

We recommend reading: Questions regarding a private complaint regarding alimony

The main one is that according to the salary system, wages are accrued to the employee for the pay period, that is, a month or a year, depending on the specifics of the work and the position he occupies. A tariff rate is a payment for a certain period of time; it is mainly applied during a shift work schedule. Another difference is that the salary

Features for the military man

The salaries of these categories of persons include the official part and the amount in accordance with the rank to the salaries by position and by rank. For military personnel on a contract basis, the income tax is the same as for civilians and is equal to 13%.

- The salary for the position is added to the salary according to rank.

- They add payments related to length of service, place of service, and others.

- Qualifying tax deductions are given to certain military personnel.

So, an employee’s salary may differ in monetary terms every month. But all changes in wages must be supported by an order or an additional agreement to the employment contract. Otherwise, the employer, changing the salary portion, will act illegally.

What is better - a stable salary or work for interest? The answer to the question is in this video.

About compensation payments

Compensation payments as part of wages

These payments also relate to wages and represent a variable component of the employee’s salary. It depends on working conditions and employer guarantees. These are payments that do not depend on additional remuneration if the work is performed in fact, as well as on production tasks completed in full.

Payments for work under special conditions of the labor process, namely when working with harmful or dangerous factors, as well as when working in the Northern regions, that is, under climatic conditions that do not correspond to normal ones.

Performing work duties in areas where radioactive, chemical or nuclear contamination of the environment has occurred.

Compensation for labor is calculated on the basis of local regulatory documents of the enterprise, these can be standards, collective agreements or other provisions, and labor agreements also stipulate the amount of these payments to the employee. Moreover, increased wages are paid to employees who work in the Northern regions, as well as in areas close to them.

To correctly understand what compensation is, you need to understand that for work in hazardous conditions, based on a special assessment of working conditions, an additional percentage of wages is paid. It may also be a bonus to the official salary for possession of information related to state secrets, the percentage of which is determined by employees of the security-secret department.

This component of wages is not constant, its indicator is a variable value, that is, it may or may not be paid by the employer. It all depends on how the employee completed the production task, what efforts he put in to get the perfect result.

This part of the payments is in no way subject to regulation by law. That is, it depends on the decision of the management of the enterprise, and if the organization has a wage fund and bonuses, then the latter can always be distributed at the discretion of the employer.

It can be understood that payments stimulating the employee’s work also fall under the motives characterizing the qualifications of labor. This is also an incentive to achieve exactly the kind of results that are aimed at productivity and improving the quality of the work process, while calculating the official salary is not enough.

The purpose of these payments is to stimulate the work of employees, which is aimed at improving qualifications and reducing the turnover of the enterprise’s personnel.

Criteria for which incentive payments are awarded:

- for skill and professionalism in performing production tasks;

- for achieving a high qualification level of workers;

- for working for a long time at the enterprise as a labor incentive so that the employee does not move to another organization;

- for knowledge of other languages, the knowledge of which is in demand at this job.

Advanced formula: how to take into account additional payments

If, in addition to salary, an employee receives incentive and compensation payments, an expanded formula is used to calculate wages:

Moreover, if the employee worked all working days in the billing month (KRD = KOD), this formula takes the form:

How to calculate the salary amount if the employee is paid a bonus or other additional amounts? Let's continue the previous example, changing the conditions in it.

Let's assume that the janitor P. G. Samoilov worked in January without any comments or disciplinary sanctions. Then he will receive a bonus (15% of the salary) in addition to his salary. And to calculate wages, you can use an extended formula (without adjusting the salary for days worked):

Salary = 16,250 + 16,250 × 15% = 18,687.5 rubles.

How to calculate salary for part-time work? ConsultantPlus experts know the answer to this question. Get trial access to K+ and you can see the calculation formulas and solution for this example.

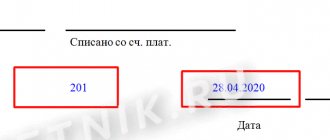

Unique order to change (increase) official salary

A change in an employee's salary can be initiated by a memo indicating the reasons for the change in salary. If the salary is subsequently reduced, the wishes of the line manager will not be taken into account.

Reasons for increasing the salary may be:

- systematic overfulfillment of the plan;

- training;

- successfully completed certification;

- extensive work experience.

In addition, salary increases may be initiated as a result of changes in job responsibilities.

To raise the issue of a salary increase:

- The employee's manager must provide his superiors with a memo containing information about the reasons for increasing the salary of his subordinate.

- Subsequently, the document must be agreed upon with an authorized person or director of the organization.

- After the salary increase is approved, the HR department employee must prepare a unique order to adjust the salary portion of the employee’s salary, as well as to make adjustments to the staffing table.

- In addition, all changes must be reflected in the employment contract. To do this, it is necessary to prepare an additional agreement, which will subsequently be signed by both parties.

- If an agreement of any kind is reached, a unique order is drawn up to change the official salary and an additional agreement to the employment contract.

Since this order does not have a form approved at the legislative level, any institution has the right to draw it up in a free format on the company’s letterhead

It is extremely important that the order reflects the following data:

- information about the enterprise;

- order details;

- the city or town where the order was drawn up;

- date of document preparation;

- changes in working conditions;

- argumentation of the need to change the official salary;

- signatures of the parties.

Thus, the final version of the order to change the salary of an official will look something like this:

Changes in the terms of payment for professional activities will come into force immediately after the documents are signed by both parties.

The main thing to remember is that no matter how the terms of payment for work change, if any agreement is reached, an order and an additional agreement to the employment contract on changing working conditions must be drawn up between the parties. Without this documentation, the change to the salary portion will be considered invalid.

How is it calculated?

Wages are a quantitative expression of work performed. That is, during a specific period of time, an employee performs some work. For this he receives payment, that is, a salary.

Its size is specified in the employment contract. But the law sets a minimum threshold below which the employer cannot lower the monetary reward. In this case, the employee must work a full month at full production.

The employment contract specifies the value indicated in the staffing table. It is drawn up by the responsible employee and approved by management. The procedure for awarding bonuses to employees is prescribed in the relevant Regulations for the enterprise.

All time worked must be accounted for accordingly. For this purpose, there is a time sheet in which management notes presence/absence at the workplace, full/part-time. At the end of each month, the timesheet is submitted to the appropriate department for payroll calculation.

The main document for calculating wages is the payslip, for payment – the payslip. These documents record not only the accrual procedure, but also deductions and bonuses.

Time-based form of remuneration

There are two forms of remuneration: time-based and piece-rate, which in turn are divided into several forms.

- Time-based form of remuneration.

- Simple time payment. This type of payment is made for a certain amount of unworked time and does not depend on the quantitative characteristics of the work. It is calculated by multiplying the hourly or daily rate by the number of hours or days worked. If the employee has a salary, then wages are calculated based on the time worked based on the monthly salary.

- Time-based bonus wages. This form of payment implies that the bonus specified in the employment agreement with the employee or enshrined in other internal documents of the organization is added to the time payment calculations.

- Piece wages.

- Direct piecework wages. Carried out on the basis of established piece rates per unit of products or work produced by the employee. This form of remuneration also takes into account the qualifications of the employee.

- Piece-bonus form of remuneration. Provides for the accrual of bonuses for exceeding the production plan or achieving certain quality indicators of the work performed

- Piece-progressive form of remuneration. The essence of this form of remuneration is to increase payment for the production of products or work in excess of the established norm.

- Indirect piecework form of remuneration.

Produced for workers in auxiliary production as a percentage of the wages of workers in main production (adjusters, assemblers, assistant foremen, etc.). In practice, mixed forms of remuneration are often used. This applies, first of all, to workers combining several positions at one enterprise. - Accordal payment. It is used to calculate payment for a set of works or the production of a certain volume of products or work, and not for a specific production operation.

Do not confuse the concepts of “payment system” and “form of payment” - they are not identical, although in the literature they replace each other.

A system is a set of rules for remuneration. Form is one of these rules.

Art. 131 of the Labor Code of the Russian Federation establishes two forms in which labor can be paid:

- Cash – made in rubles.

- Non-monetary - in kind - paid in any material or immaterial form not prohibited by law. The size of the natural part is no more than 15% of the person’s entire salary.

With a simple time-based wage, the time worked in the period is paid. Periods can be recognized as: hours, days, months and variations of these periods.

With a bonus, a bonus for the quality of work is added to the salary for time, calculated as a percentage of the salary at the rate. The bonus may be one-time or applied on an ongoing basis.

With a salary, the employee has the right to count on a monthly salary in the amount as established in the employment contract. Upon achieving a certain qualification (determined subjectively by the employer), the salary may be increased.

The organization of remuneration represents all activities that should reward an employee for his work.

This takes into account the number of hours spent or the final result, as well as the quality of work. The organization of wages in Russia is influenced by:

- wage system;

- form of payment;

- labor rationing.

The payment system has already been mentioned above: the company chooses what is closer to its structure and type of production. It is beneficial for small enterprises to make calculations based on a tariff-free system in order to motivate all employees to effectively carry out their work activities. Large companies more often resort to a tariff system.

In this case, it is important to take into account the conditions, including logistical ones, of a particular enterprise. If we are talking about office work, then the calculation is made for the result of intellectual activity, which must also be measurable

The form of payment can be time-based, piece-rate, or mixed.

Time-based is payments calculated in accordance with the employee’s time spent. The salary is based on special tariff scales, which take into account the level of qualifications of individual employees and the amount of salary depending on the position and profession.

Piece payment is based on the specific result of the work. This form of salary is often found in the field of trade and in various sales at the corporate level, when the employer needs to encourage the employee to perform his duties as efficiently as possible.

The mixed remuneration system includes characteristics of two other types simultaneously.

What is the difference between salary and salary? – website about

When you are looking for a job or getting a new position, you have to figure out what kind of salary it can provide.

Every worker should know what determines the amount of money that will be transferred to the card. You need to clearly understand what the salary offered by the employer is - is it a salary or not.

Then you won’t have to be disappointed when you receive what you earn in an amount that is less than expected.

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

How does a salary differ from a salary: in detail

Salary and wages... Concepts related to one economic category - employee remuneration. Are there differences between them or are they identical to each other? It is necessary to understand this issue in more detail.

Definition

The salary represents the amount of money that the employer initially offers to calculate the final amount. This indicator is reflected in the employee’s employment contract and is indicated in the order upon admission to work. Salary is the basic characteristic for the subsequent calculation of other indicators.

Salary is the amount of money that an employee receives after calculating the necessary allowances and withholding personal income tax. To calculate it, the salary amount is used, to which interest stipulated by the contract, bonuses and compensation, for example, for hazardous production, are added, and personal income tax is withheld.

: Where is the best place to open an Ethereum wallet?

Salary and wages - what is the difference in accordance with the Labor Code of the Russian Federation and legislation

Before you begin to consider how a salary differs from a salary, it is worth determining what these concepts mean and how exactly their legal regulation is ensured in Russian legislation.

Thus, these concepts and the aspects that regulate them are disclosed mainly in Article 129 of the Labor Code of the Russian Federation, but in practice they are used and regulated in a much larger number of articles of the Labor Code, as well as in other all-Russian and regional normative documents and acts.

At the same time, differences in the concepts of salary and wages are directly fixed in labor legislation, and despite the fact that in practice they can be interchanged with each other by both employers and workers themselves, in all official documentation it is necessary to adhere to the terminology enshrined in the Labor Code of the Russian Federation. Otherwise, confusion in these terms may lead to possible recognition of it as a violation of labor laws.

For example, if an employee’s salary is actually set below the minimum wage for a full-time job, this is not a violation. But if the employment contract stipulates the payment of wages below the minimum, then for the very fact of such a mention in the text of the employment contract, the employer can already be brought to administrative responsibility under Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Salary.

Labor salary is calculated for the employee’s fulfillment of work standards, completed work plans (for a certain time), without taking into account compensation, incentives or social payments.

They are ready to pay well for this right away.

This payment is fixed and is the minimum guarantee of remuneration for an employee, below which he cannot receive, subject to the performance of job duties.

The Labor Code of the Russian Federation states that the tariff salary (tariff rate) must be reflected in the employee’s employment contract, together with other mandatory terms of the employment contract. The salary is a figure that is fixed in the employment contract; the salary consists of the salary and those percentages, bonuses and deductions that are provided for by law and the terms of the employee’s employment contract.

The salary with all allowances and bonuses will be the employee’s wages, that is, the amount of money that he will receive after the end of the calendar month or upon his dismissal.

We recommend reading: