Classification of employment agreements

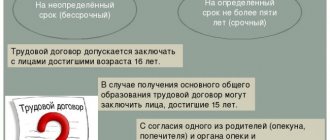

The type of employment contract can be determined depending on the period during which such a document is valid.

They can be:

- urgent;

- temporary;

- concluded for an indefinite period (up to 5 years), provided that such a period is not regulated by federal legislation.

The most widespread is the one that involves imprisonment for an indefinite period.

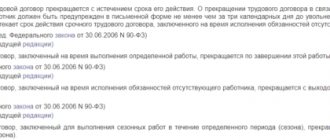

Fixed-term contracts are drawn up in situations in which the employment relationship cannot exist for an indefinite period of time, as indicated by the nature of the work required to be performed, as well as the amount of effort that will be expended to complete the assigned tasks. Situations in which labor relations are urgent are indicated in Part 1 of Art. 59 Labor Code of the Russian Federation.

The performance of work duties can be continued even after the completion of the period established in them; if the parties to the agreement do not make demands for termination, and the employee continues to perform work functions, the agreements will be considered extended for an indefinite period.

It is impossible to determine the period during which the employee’s activities will be necessary for the employer, and also if there is such a need on an ongoing basis, contracts are concluded that do not contain a specific period of validity.

Sample temporary rental agreement

The structure of civil contracts includes the following sections:

- details of the parties (they must contain the wording “employer”, “employee”, as well as the date, time and place of conclusion of the contract);

- subject of the agreement (description of the assigned tasks, place of their implementation and payment provisions);

- validity period and start date of the activity;

- penalties for violations provided for by the Civil Code;

- signatures of the parties.

A sample temporary employment agreement is available here.

When is it compiled?

Along with the conclusion of contracts on the performance of labor functions, the employer fills out work books. The employee must present such a document when hired.

In the absence of a work book, the following workers can be employed:

- taken for the first time;

- those who have lost the document (including due to its unsuitability) and are taking measures to restore it;

- who have entered into a civil agreement between the employer and the employee.

Sample civil contract:

Page 1

Page 2

Page 3

Personnel document flow when applying for a job

To begin with, let us remind you that, according to labor legislation, micro-enterprises are not required to conduct full-fledged personnel records. Therefore, if all points of the relationship are reflected in the employment agreement, you can limit yourself to concluding a contract.

If an individual entrepreneur maintains internal personnel document flow, after drawing up an employment contract, an order is issued that confirms the employee’s employment in the company.

When issuing an order, you need to take into account that its basic provisions must contain the terms of the employment contract. So, if a test period is determined, this fact must be reflected in the corresponding block of the order. Naturally, the employee’s position, start date, type of contractual relationship, etc. must be correctly indicated here.

A person hired is required to sign an order ratifying his employment. Please note that the period allotted for this is 3 days from the date of hiring. A template for an order for hiring an employee can be viewed via the hyperlink.

The legislation does not provide for special requirements for registration and storage of employment agreements. As a rule, the contract is filed in a personal file or, being a document containing a person’s personal data, is put away in a fireproof cabinet along with the work book. The agreement can be registered in a separate journal or simply filed in a separate folder, maintaining alphabetical, chronological or numerical order.

Documents required for concluding a contract between an individual entrepreneur and an employee

When applying for a job, the employed person must submit several documents to the entrepreneur:

- Passport of a citizen of the Russian Federation or another document that proves his identity (temporarily replaces a passport).

- Work book with the exception of the following options:

- when an employment agreement is concluded with a person for the first time. Here the employer must issue a new book for the employee, complying with all legal requirements;

- if an employee enters a job on a part-time basis.

- Insurance pension certificate (SNILS).

- Military registration document (for those liable for military service and persons subject to conscription into the army).

- Diploma of education, qualifications if specialized knowledge or special training is required.

Copies are made of all documents with the exception of the employment document, which remains in the employer’s storage. This package of documents is attached to the employee’s personal file. A personal card is created for him.

The employment agreement must contain all the basic provisions defining the relationship between the individual entrepreneur and his employee. It must be remembered that the contract can be fixed-term or indefinite, with or without a trial period. It must reflect the essential conditions for performing job functions, for example, working on a rotational basis or remotely.

- Author: ozakone

Rate this article:

- 5

- 4

- 3

- 2

- 1

(0 votes, average: 0 out of 5)

Share with your friends!

Does the form have legal force?

The concept of working relationships is defined in Art. 15 Labor Code of the Russian Federation. As such, we understand relationships in which the parties are the employee and the employer, for the purpose of performing certain functions by the employed person, with his subordination to the internal working order, as well as the creation by the employer of such working conditions as determined by the legislator or the provisions of the employment contract.

Almost all the conditions that are fixed are determined by law. The parties do not have the right to change them, except in cases where such changes improve the situation of the participants.

In situations where an agreement implying the existence of civil legal relations is recognized by the court as one that regulates labor relations, labor law norms are applied to it.

The main task assigned to the legislator is to provide citizens who are participants in labor relations with the full range of guarantees stipulated by the Labor Code of the Russian Federation and other legislative acts regulating labor relations.

Related questions on labor relations

The conclusion of an employment contract between two individual entrepreneurs is not prohibited by law. The contract in this case is no different from the usual, standard one, with the only difference being that the parties to the contract are individual entrepreneurs.

In civil practice, there are cases when an individual entrepreneur enters into an employment contract with himself, despite the prohibition of such a procedure by the civil code. This is possible when the individual entrepreneur acts as an independent subject of civil law and does not represent himself as the head of his company.

Nuances

| No work record | The provisions of the Labor Code of the Russian Federation indicate that when hiring an employee to the main place of work, making a corresponding entry in the work book is mandatory. The absence of such a document serves as the basis for its establishment within a five-day period. For persons who are part-time workers, entries in the employment record are not mandatory. Part-time workers cannot work for more than 4 hours on those days when they perform their functions at their main place of employment. On weekends, they can be hired to work part-time on a full-time basis. As a result, part-time work during the month should not exceed half of the monthly working time. |

| For individual entrepreneurs and LLCs | Citizens engaged in individual entrepreneurship have the right to employ individuals. To confirm employment, the parties enter into an agreement (contract), on the basis of which working conditions, required performance results and their payment are regulated. Concluding an agreement has a number of subtleties:

The conclusion of a rental agreement, the parties to which are the individual entrepreneur and an individual, allows you to determine the range of functions performed by the citizen, for the implementation of which remuneration will be paid by the individual entrepreneur. This type does not generate labor guarantees and benefits for employees established by the Labor Code of the Russian Federation. This means that additional payments (including bonuses) are provided to the employee solely at the request of the individual entrepreneur. At the same time, the individual entrepreneur does not pay insurance payments for the employee. |

| Between individuals | Individuals who do not have individual entrepreneur status do not have the right to make entries in work books. The performance of any work by individuals is formalized in the form of a written contract. Only those citizens who are entrepreneurs withhold and transfer taxes and insurance premiums specified in Art. 419 of the Tax Code of the Russian Federation. Personnel documentation for an employee is not drawn up only when employees carry out their activities on the basis of civil contracts that do not give rise to the emergence of labor relations. |

| Without registration | It is impossible to refuse employment to applicants on grounds that are not related to their professional qualities due to Art. 64 Labor Code of the Russian Federation. As such, we can consider the lack of registration and registration data. In this regard, refusal of employment to a person who has a residence permit in another city is not allowed. Many employers violate this provision. Upon receipt of a refusal to hire, a candidate for a position may request from the employer a written justification for his decision. If such a document is available, the received refusal can be appealed. |

Guarantees for signing papers

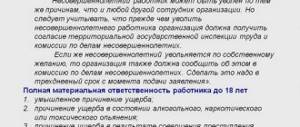

All other things being equal, some categories of citizens have a chance of being refused employment. To avoid controversial situations, the legislation of the Russian Federation provides a list of prohibitions:

- An individual - individual entrepreneur cannot refuse to sign an agreement without justification.

- Registration in another locality is not a valid reason for rejecting a person’s candidacy.

- Pregnant women or women with children should also not be denied.

- It is prohibited to refuse a request to hire young people after graduating from university.

- It is not recommended to neglect quotas.

It is impossible to refuse to hire an employee after returning from military service, studying in the direction of the enterprise, or holding an elective position.

Taxes and fees

The obligations imposed on the entrepreneur to make insurance contributions for hired employees continue to exist. The tax office collects such transfers.

The employer must pay for each employee:

- Personal income tax (rate 13 or 30%);

- contributions to the Pension Fund;

- contribution for medical and social insurance associated with the loss of the employee’s ability to work while performing work.

Is it possible to conclude an employment agreement between two individual entrepreneurs?

Based on the norms of the legislation of the Russian Federation, only an individual can act as a TD employee. Therefore, TD between two individual entrepreneurs is not acceptable. Many may argue that an individual entrepreneur is an individual, but in labor relations he acts only as an employer.

As an exception, you can enter into an agreement with an entrepreneur as an individual, without indicating in the contract that he has the status of an individual entrepreneur. Without observing this nuance, the agreement cannot be considered an employment agreement. It qualifies as civil law and is regulated by the norms of the Civil Code of the Russian Federation.

Pros and cons of working without a work book

Carrying out employment, formalized in the form of a contract that does not require recording in the labor contract, has certain disadvantages and advantages for each party:

| Plus | Minus |

|

|

Sample employment contract for part-time work:

Page 1

Page 2

Page 3

Page 4

Page 5

Drawing up an agreement between individuals

If an individual who is not registered as an individual entrepreneur wants to hire another individual, then a number of conditions must be met:

- formalizing the agreement between the parties in writing;

- the document must be registered with local authorities;

- mandatory indication of information about the transaction, including the exact date, place of conclusion, passport details and residential addresses of the parties;

- rights, obligations and options for resolving disputes in the event of force majeure situations.

The more information the document contains, the higher the chances of being able to accurately perform the work and the due remuneration, without participating in legal proceedings.

Differences from a regular employment contract

Subjects of labor relations are not always able to determine for themselves the most acceptable form of contract within the framework of which labor activities will be carried out. You can decide on the type of template to be concluded by determining the most important characteristics of the future relationship.

Civil contracts have significant differences from employment contracts:

| Characteristics | Civil law | Labor |

| Parties | Performer, customer | The employee is a citizen, the employer is a business entity |

| Validity | Limited by duration of service provision | uncertain |

| Experience | Not recorded in labor records | Entered into the labor record |

| Executor | Performs work, including with the help of third parties | Performs the range of job responsibilities specified in the contract and job descriptions |

| Payment | The full price for fully completed work is agreed upon. The calculation procedure is determined by the parties | The salary is established by agreement and staffing schedule. The calculation is performed twice a month. Accrual is carried out in accordance with the wage system |

| Working conditions | Not provided | Provided |

| Social guarantees | Not provided | Provided in accordance with the law |

| Tax obligations | Insurance premiums are not charged or paid | Personal income tax, salary taxes and insurance contributions are transferred |

| Responsibility for quality indicators arising from the performer | Violation of the terms of the contract may result in penalties | Possible disciplinary action |

Proper document preparation

To avoid serious mistakes when hiring an employee, it is better to review a sample employment agreement so that no disagreements arise later. It is better to use resources that contain reliable and up-to-date information, for example, “Consultant Plus”, “Garant-Service” and others.

An employment contract can be reclassified as an employment relationship in the following cases:

- availability of a fixed salary, issued twice a month;

- issuing a workplace and equipment to the employee;

- clear daily routine;

- there are no deadlines for fulfilling the contract.

Also, the customer should keep in mind that the court most often takes the side of the working personnel. Before drawing up an employment contract, it is better to verbally discuss all the nuances of the upcoming work and make sure that the employee agrees to them. If this is a short-term job, then most likely the court will take this into account and regard the claim as an opportunity for the employee to receive additional payments.

The Constitution of the Russian Federation stipulates that a person independently agrees to any work and how it will be formalized. This means that no one can force him to sign any documents.

Employer Responsibilities

The employer, acting as a party to the labor relationship, bears a number of obligations, failure to fulfill which may become a reason for the application of liability measures.

Upon conclusion, the employer is assigned responsibilities for:

- compliance with labor legislation and the terms of the concluded contract;

- creating safe working conditions;

- providing workers with the required documentation, materials, tools, etc.;

- payment of wages;

- consideration of collective complaints, elimination of violations of the provisions of employment contracts;

- social insurance;

- providing material compensation;

- providing time for rest;

- conclusion, communication to employees and fulfillment of requirements.

Customers are obliged to accept the results of the work performed and pay for them in accordance with the conditions reached by the parties.

Samples of documents and procedure for registration

The employment contract between the individual entrepreneur and the employee, according to Article 303 of the Labor Code of the Russian Federation, must not only be drawn up and signed, but also registered with the department of labor and social issues.

Article navigation

- General provisions in the contract, sample document

- Nuances of the agreement between the individual entrepreneur and the employee

- Mandatory registration with local authorities

- Sunday is not necessarily a day off

- Additional conditions for dismissal

- Agreement between individual entrepreneur and individual entrepreneur

- Completed contract with individual entrepreneur

New jobs are created not only by large enterprises, but also by individual entrepreneurs. At the same time, everyone must comply with labor laws in the relationship between employer and employee. This primarily concerns the preparation and execution of an employment contract.