Amount of daily allowance for business trips in budgetary institutions in the Russian Federation in 2021

The amount of daily allowance for business trips in budgetary institutions in the Russian Federation in 2020 is calculated taking into account some features.

They are described in detail in the norms of Russian legislation. Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

(Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

It is extremely important to know exactly how much is charged in the case of daily travel expenses in 2021 and what is specified in Russian legislation about this.

In particular, it is recommended to find out exactly how daily allowances are calculated in budgetary institutions, since it is their employees who are often forced to travel in order to perform assigned official tasks.

What you need to know

A considerable number of hired employees are often forced to go on business trips not only within the country but also abroad.

Moreover, without exception, all costs that are directly related to such trips are forced to be borne by the employer.

To be able to eliminate the possibility of misunderstandings, such employees must know the rules of the law.

Required terms

A business trip means a trip by a company worker, which is considered a forced measure at the request of the employer and only for work purposes - according to Article 166 of the Labor Code of Russia.

It must be remembered that the absence of a worker is not considered a business trip if he returned from it on the day of departure. From this we can talk about the presence of certain time periods.

What exactly is meant by daily allowance and travel allowance? Many citizens are confident that these concepts are no different from each other.

Of course, a worker who has been sent on a business trip must receive funds for accommodation, travel and other related expenses.

At the same time, the employer provides the worker not only with travel allowances, but also with daily allowances.

They mean funds that are aimed at additional needs that are not directly related to:

- accommodation - payment for housing;

- payment for travel;

- and other expenses.

Preparation of documents

After an employee returns from a business trip, he must compile a report. Documentation that can verify the use of accountable funds received must be attached.

These in 2021 are generally considered to include:

| Documentary confirmation of rental premises | In particular, you can provide a receipt, a hotel invoice, or a signed rental agreement. In any case, the document must indicate the number of days of stay and the cost of living per day |

| Documentary confirmation of payment for travel to the place of performance of the official task and back | These include tickets, boarding passes, receipts for bedding on the train, and so on. |

| Documentary evidence of the use of taxi services | Tickets, properly prepared receipts, checks, etc. |

| A memo duly prepared by the hired worker with a check attached. | If a personal vehicle was involved |

| Generated memo | Regarding the fact that the worker is not able to provide documentary evidence of the expenditure of funds, for example, due to loss |

| Documentary evidence of other expenses | For example, a receipt for the use of a storage locker, payment for telephone services, etc. |

At the same time, you need to remember that daily allowances for business trips do not need to be documented in 2020.

Legal grounds

All key issues that are directly related to business trips are regulated by the Labor Code of the Russian Federation.

In addition, the companies themselves must necessarily develop and approve Regulations on business trips.

This is especially true if the company’s hired employees are often forced to travel due to the nature of their employment.

Issues directly related to taxation are clarified by the norms of the Tax Code.

Amount of daily allowance for business trips in budgetary institutions in 2020

Issues directly related to the process of calculating travel allowances are explained in detail in Decree of the Government of the Russian Federation No. 729.

This regulatory document also establishes a fixed amount of transfers directly related to costs for traveling within Russia. As of 2021, for employees of budgetary institutions the amount is 100 rubles.

In order to calculate daily payments in the case of business trips abroad, you should refer to the norms of the Government of the Russian Federation No. 812.

The relevant Regulations to the specified regulatory act reflect the procedure for transferring funds on an individual basis, depending on the foreign state.

What's included

In accordance with the norms of the legislation of the Russian Federation, the definition of “per diem” includes several main groups of costs, in particular:

| Accommodation in another locality | What is directly related to renting housing? |

| Eating in canteens or purchasing groceries | In shops and supermarkets |

| Fare payment | In public transport |

| Organizing a business lunch directly with partners | Including attending various events planned to increase the level of mutual understanding and the general prevailing situation |

| Other costs | Which are accompanied by the performance of the official duties assigned to the employee |

Often in practice there are awkward situations in which it is difficult to figure out what exactly can be considered a daily requirement and what is unnecessary.

What expenses are not eligible for reimbursement?

The given list of expenses, according to the Ministry of Finance of the Russian Federation, is closed. Based on this, any employee expenses not related to renting housing, travel to and from the business trip, and exceeding the amount of daily payments established by the agreement are not reimbursed.

For example, the employer is not obliged to pay for the employee’s trips by taxi or other transport to the place of business travel, the employee’s visits to entertainment venues, or telephone conversations not related to work activities. However, the law does not prohibit the employer from paying any expenses of an employee on a business trip if an agreement has been concluded to this effect.

Author of the article

Amount of daily allowance for business trips in budgetary institutions in the Russian Federation

| Document date | 01.08.2014 |

| Tags | Article |

DAILY ALLOWANCE IN STATE AND MUNICIPAL INSTITUTIONS: WHAT'S NEW?

M.A. Kozlov, lawyer, Moscow

Currently, legislation is changing quite quickly. However, there are a number of “eternal” problems that cannot yet be solved. One of these problems is the amount of per diem for federal institutions. Federal Law No. 55-FZ dated April 2, 2014 (hereinafter referred to as Law No. 55-FZ) introduced a number of changes to the Labor Code of the Russian Federation, including regarding the procedure for reimbursement of expenses associated with business trips of employees of state and municipal institutions. However, these amendments have not yet led to a significant improvement in the situation.

Regulatory situation

A daily allowance of 100 rubles per day for institutions financed from the federal budget was established by Decree of the Government of the Russian Federation dated October 2, 2002 No. 729 (hereinafter referred to as Resolution No. 729). And this norm has been in effect for more than 10 years. Obviously, this amount of daily allowance no longer corresponds to the real state of affairs. And, for example, according to paragraph. 13 clause 3 art. 217 of the Tax Code of the Russian Federation exempts daily allowances in the amount of up to 700 rubles from personal income tax. inclusive for each day of a business trip in Russia. Let us recall that the procedure for providing guarantees and compensation when sending employees on business trips is regulated by Chapter 24 of the Labor Code of the Russian Federation. In this case, a business trip is understood as a trip by an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work. Article 167 of the Labor Code of the Russian Federation establishes that when an employee is sent on a business trip, he is guaranteed to retain his place of work (position) and average earnings, as well as reimbursement of expenses associated with a business trip, which include: – travel expenses; – expenses for renting residential premises; – additional expenses associated with living outside the place of permanent residence (per diem); – other expenses incurred by the employee with the permission or knowledge of the employer (Part 1 of Article 168 of the Labor Code of the Russian Federation). Please note that the above list has been supplemented by paragraphs. 12 clause 1 art. 264 of the Tax Code of the Russian Federation, which classifies as business trip expenses: – payment for additional services provided in hotels (except for expenses for service in bars and restaurants, expenses for room service, expenses for using recreational and health facilities); – registration and issuance of visas, passports, vouchers, invitations and other similar documents; – consular, airfield fees, fees for the right of entry, passage, transit of automobile and other transport, for the use of sea canals, other similar structures and other similar payments and fees. Please note that these expenses are included in expenses when determining the taxable base for income tax. The norms of the Labor Code of the Russian Federation are reflected in the Regulations on the peculiarities of sending employees on business trips, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749 (hereinafter referred to as Regulation No. 749), according to which additional expenses associated with living outside the place of residence (per diems) are reimbursed to the employee for each day of being on a business trip, including weekends and non-working holidays, for days of travel (clause

Note. Access to the full contents of this document is restricted.

In this case, only part of the document is provided for familiarization and avoidance of plagiarism of our work. To gain access to the full and free resources of the portal, you just need to register and log in. It is convenient to work in extended mode with access to paid portal resources, according to the price list.

Accounting for travel expenses.

KVR and KOSGU to reflect business trip expenses

From 01/01/2019, the rules for applying the budget classification of the Russian Federation are established by Orders of the Ministry of Finance of the Russian Federation No. 132n[4] and No. 209n[5] (hereinafter referred to as Procedure No. 132n and Procedure No. 209n).

The instructions on the procedure for applying the budget classification of the Russian Federation, approved by Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, ceased to be valid from that date.

According to Order No. 132n, reimbursement of expenses related to business trips, as in 2021, should be made in relation to employees of state (municipal) institutions in accordance with KVR 112 “Other payments to the personnel of institutions, with the exception of the wage fund.” But when choosing KOSGU codes, it is necessary to take into account the following innovations provided for by Order No. 209n:

| Type of expenses | Sub-article KOSGU | |

| In 2021 | In 2021 | |

| Expenses for payment of daily allowance | 212 “Other payments” | 212 “Other non-social payments to staff in cash” |

| Travel expenses to the place of business trip and back to the place of permanent work | 212 “Other payments” | 226 “Other works, services” |

| Expenses for renting residential premises | 212 “Other payments” | 226 “Other works, services” |

| Other expenses incurred by the employee with the permission or knowledge of the employer | 212 “Other payments” | 226 “Other works, services” |

| Compensation for the use of personal transport on a business trip | 212 “Other payments” | 222 “Transport services” |

As you can see, only the procedure for applying KOSGU in relation to expenses for the payment of daily allowances has remained unchanged - they still fall under subsection 212. The rules for accounting for other travel expenses have changed. This is due to the fact that in international statistical practice, the corresponding payments are not considered as payments in the interests of employees, but belong to the category of expenses made by the employee for the purpose of performing work duties. Therefore, legislators decided to move operations for reimbursement of expenses associated with business trips (for travel, accommodation, other expenses related to the performance of official assignments on a business trip), as well as for payment of compensation for the use of personal transport on a business trip, from subarticle 212 “Other payments” ( 2018) in Article 220 “Payment for work and services” (2019) of KOSGU (see Letter of the Ministry of Finance of the Russian Federation dated June 29, 2018 No. 02-05-10/45153).

As for the expenses incurred by institutions within the framework of concluded agreements (contracts) for the purchase of travel tickets and payment for the rental of residential premises on business trips, they, similar to the rules in force in 2021, are included in CVR 244 “Other procurement of goods, works and services” and are reflected in accounting under subarticles 222 “Transport KOSGU, respectively.

Correspondence invoices for accounting for travel expenses

Due to changes that have occurred in the procedure for applying KOSGU codes, expenses associated with business trips are reflected in accordance with instructions No. 162n[6], No. 174n[7], No. 183n[8] in the following account correspondences:

- Business trip payments in cash:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Funds were issued to the employee against account from the institution’s cash desk... | |||||

| ...to pay daily allowance | |||||

| 1 208 12 567 | 1 201 34 610 | 0 208 12 567 | 0 201 34 610 | 0 208 12 000 | 0 201 34 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 208 26 567 | 1 201 34 610 | 0 208 26 567 | 0 201 34 610 | 0 208 26 000 | 0 201 34 000 |

| The employee was given compensation from the institution's cash desk for the use of personal transport on a business trip | |||||

| 1 208 22 567 | 1 201 34 610 | 0 208 22 567 | 0 201 34 610 | 0 208 22 000 | 0 201 34 000 |

| The employee returned the unused balances of accountable amounts issued... | |||||

| …to pay daily allowance | |||||

| 1 201 34 510 | 1 208 12 667 | 0 201 34 510 | 0 208 12 667 | 0 201 34 000 | 0 208 12 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 201 34 510 | 1 208 26 667 | 0 201 34 510 | 0 208 26 667 | 0 201 34 000 | 0 208 26 000 |

- Non-cash payments for business trips:

a) using employee salary cards:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Accountable amounts have been transferred to the employee’s salary card... | |||||

| ...to pay daily allowance | |||||

| 1 208 12 567 | 1 304 05 212 | 0 208 12 567 | 0 201 11 610 | 0 208 12 000 | 0 201 11 000 0 201 21 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 208 26 567 | 1 304 05 226 | 0 208 26 567 | 0 201 11 610 | 0 208 26 000 | 0 201 11 000 0 201 21 000 |

| Compensation for the use of personal transport on a business trip was transferred to the employee’s salary card | |||||

| 1 208 22 567 | 1 304 05 222 | 0 208 22 567 | 0 201 11 610 | 0 208 22 000 | 0 201 11 000 0 201 21 000 |

b) using the institution’s payment (debit) card:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Accountable amounts have been transferred to the institution’s settlement (debit) card... | |||||

| ...to pay daily allowance | |||||

| 1 210 03 561 | 1 304 05 212 | 0 210 03 561 | 0 201 11 610 | 0 210 03 000 | 0 201 11 000 |

| 1 208 12 567 | 1 210 03 661 | 0 208 12 567 | 0 210 03 661 | 0 208 12 000 | 0 210 03 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 210 03 561 | 1 304 05 226 | 0 210 03 561 | 0 201 11 610 | 0 210 03 000 | 0 201 11 000 |

| 1 208 26 567 | 1 210 03 661 | 0 208 26 567 | 0 210 03 661 | 0 208 26 000 | 0 210 03 000 |

| Unused balances of accountable amounts transferred... | |||||

| …to pay daily allowance | |||||

| 1 201 23 510 | 1 208 12 667 | 0 201 23 510 | 0 208 12 667 | 0 201 23 000 | 0 208 12 000 |

| 1 304 05 212 | 1 201 23 610 | 0 201 11 510 | 0 201 23 610 | 0 201 11 000 | 0 201 23 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 201 23 510 | 1 208 26 667 | 0 201 23 510 | 0 208 26 667 | 0 201 23 000 | 0 208 26 000 |

| 1 304 05 226 | 1 201 23 610 | 0 201 11 510 | 0 201 23 610 | 0 201 11 000 | 0 201 23 000 |

- Payment of travel expenses within the framework of contracts (agreements) concluded by the institution:

| State institutions | Budget institutions | Autonomous institutions | |||

| Debit | Credit | Debit | Credit | Debit | Credit |

| Payment was made within the framework of concluded agreements (contracts)… | |||||

| ...travel tickets | |||||

| 1 302 22 834 | 1 304 05 222 | 0 302 22 834 | 0 201 11 610 | 0 302 22 000 | 0 201 11 000 0 201 21 000 |

| ...renting a living space | |||||

| 1 302 26 834 | 1 304 05 226 | 0 302 26 834 | 0 201 11 610 | 0 302 26 000 | 0 201 11 000 0 201 21 000 |

| Paid travel tickets have been received at the institution's cash desk | |||||

| 1 201 35 510 | 1 302 22 734 | 0 201 35 510 | 0 302 22 734 | 0 201 35 000 | 0 302 22 000 |

| Paid travel tickets were issued for reporting to the employee from the institution's cash desk | |||||

| 1 208 22 567 | 1 201 35 610 | 0 208 22 567 | 0 201 35 610 | 0 208 22 000 | 0 201 35 000 |

- Acceptance of travel expenses for accounting:

| State institutions | Budget institutions | Autonomous institutions | |||

| Expenses taken into account... | |||||

| ...to pay daily allowance | |||||

| 1 109 xx 212 1 401 20 212 | 1 208 12 667 | 0 109 xx 212 0 401 20 212 | 0 208 12 667 | 0 109 xx 212 0 401 20 212 | 0 208 12 000 |

| …to pay for travel, rental accommodation and other expenses | |||||

| 1 109 xx 226 1 401 20 226 | 1 208 26 667 | 0 109 xx 226 0 401 20 226 | 0 208 26 667 | 0 109 xx 226 0 401 20 226 | 0 208 26 000 |

| ...to pay compensation for the use of personal transport and travel tickets on a business trip | |||||

| 1 109 xx 222 1 401 20 222 | 1 208 22 667 | 0 109 xx 222 0 401 20 222 | 0 208 22 667 | 0 109 xx 222 0 401 20 222 | 0 208 22 000 |

It should be noted that the Ministry of Finance has currently prepared changes to Instruction No. 183n, which are planned to be implemented from 01/01/2019. According to them, autonomous institutions will indicate the KOSGU codes in the 24th - 26th digits of their account numbers, similarly to budgetary institutions.

A budgetary cultural institution sent a group of 10 workers on a business trip for 5 days. They were given daily allowances in the amount of 5,000 rubles from the cash register. and money for hotel accommodation - 20,000 rubles. The travel is paid by the institution in cash under an agreement concluded with the carrier. Travel expenses amounted to 30,000 rubles. Travel tickets are accepted for accounting as monetary documents and are issued to employees before the trip. All expenses are included in the cost of services for the main type of activity; the operations were carried out as part of the implementation of a state task.

The accounting records of the institution, in accordance with Instruction No. 174n, reflect the following correspondence accounts:

| Contents of operation | Debit | Credit | Amount, rub. |

| Issued to employees against reporting from the institution's cash desk: | |||

| – daily allowance | 4 208 12 567 | 4 201 34 610 | 5 000 |

| - money to pay for the hotel | 4 208 26 567 | 4 201 24 610 | 20 000 |

| Fare transferred to the carrier | 4 302 22 834 | 4 201 11 610 | 30 000 |

| Travel tickets accepted for registration | 4 201 35 510 | 4 302 22 734 | 30 000 |

| Travel tickets were issued to employees for reporting | 4 208 22 567 | 4 201 35 610 | 30 000 |

| Accepted expenses: | |||

| – for payment of daily allowance | 4 109 60 212 | 4 208 12 667 | 5 000 |

| – for hotel accommodation | 4 109 60 226 | 4 208 26 667 | 20 000 |

| – for travel | 4 109 60 222 | 4 208 22 667 | 30 000 |

Features of calculating daily allowances on a business trip

When going on a business trip, an employee incurs expenses in the interests of the employer, therefore, these expenses are subject to compensation. In addition to travel, housing, negotiation costs, and other business expenses, daily allowances are also reimbursed. Per diem refers to additional costs associated with an employee’s accommodation outside his usual conditions. We will discuss below how to correctly calculate and issue daily allowances, how to confirm them for inclusion in the expense report, and what role daily allowance limits play in these calculations.

Business trip and daily allowance standards

The term “daily allowance” is given in Art. 168 of the Labor Code of the Russian Federation, which establishes legal standards for reimbursement of travel allowances to employees. Daily allowances are mentioned in Art. 217 of the Tax Code of the Russian Federation, clause 3, as one of the compensation payments not subject to personal income tax.

Limits have been established for tax purposes: expenses within the country - 700 rubles. per day, and for foreign business trips – 2500 rubles. per day. The lower limit of daily allowance is stated in government decree No. 729 dated 02/10/2002 and is 100 rubles. per day in Russia. The document concerns employees of state budgetary institutions, however, commercial structures should also be guided by this lower limit in payments - a deterioration in the position of an employee of a private company, compared to a government agency, may provoke an inspection by Rostrud or a lawsuit against a commercial company.

For employees of government agencies going abroad, daily allowances are calculated according to the norms of Resolution No. 812 of December 26, 2005 and are calculated in foreign currency.

Important! The basic general principles and requirements for calculating daily allowances are set out in government document No. 749 dated 13/10/2008.

The company must develop and adopt a local RA for business trips or take into account all the nuances of the procedure and amount of reimbursement of daily expenses to an employee in the collective agreement. A state institution or municipal institution must be guided by the regulations of the authorities at the appropriate level.

In the LNA, the daily allowance can be specified in any amount, but if it exceeds the maximum norms, the difference is subject to personal income tax. In excess of the established limits, daily allowances and insurance contributions are subject to (Article 422-2 of the Tax Code of the Russian Federation). Contributions “for injuries” are considered in connection with daily allowances according to the rules of Federal Law-125 of July 24, 1998, Art. 20.2-2. Contributions are not subject to all amounts provided for by the employer's LNA.

In practice, when establishing daily allowance standards, employers often take as a basis the maximum limits specified in the Tax Code of the Russian Federation regarding personal income tax in order to minimize the difference between accounting and tax accounting, the number of accounting errors and problems with the tax authorities.

The employer may not take one-day business trips around Russia into account when calculating daily allowance. At the same time, it is quite possible to register something like this in the LNA and compensate the employee for even one day.

Note that the issue of withholding personal income tax from the amount of such a one-day payment is controversial:

- The Ministry of Finance believes that it is illegal to tax income, for example, food expenses in the range of 700 and 2500 rubles, respectively (Letter of the Ministry of Finance of Russia No. 03-04-07/6189 dated 01/03/13).

- The Supreme Arbitration Court of the Russian Federation believes that daily allowances are not the employee’s income and should be compensated to him without personal income tax (Resolution of the Presidium of the Supreme Arbitration Court No. 4357/12 of 09/11/12).

- Federal Tax Service of the Russian Federation, guided by Art. 122, 123 of the Tax Code of the Russian Federation, may charge the employee, in addition to tax, a fine and penalties for the “extra” paid day.

The choice of what to do is left to the taxpayer.

If an employee goes abroad, he must be compensated for a one-day trip in the amount of 50% of the daily payment amount established by the company (Post. 749, clause 20). When calculating income tax or “simplified” tax, daily allowance expenses are taken to reduce the base in full (Article 264-1-12, 346.16-1-13 of the Tax Code of the Russian Federation). If the LNA establishes the calculation of daily allowances for foreign business trips in foreign currency, when calculating the tax base, a recalculation is made at the rate on the date of recognition of the expense (Article 272-10 of the Tax Code of the Russian Federation), i.e. approval of the advance report (clause 7, paragraph 5 of the same article).

When leaving on a business trip, the employee’s daily allowance is advanced: it is calculated in advance and issued. The planned number of business trip days is taken by the accountant from the organization’s order. Upon return, the daily allowance is recalculated depending on the actual duration of the business trip and either additional payment is made to the employee, or they are put on mutual settlements with the subsequent deduction of the overpaid amount.

Days are counted according to the calendar, from the day of departure until arrival at the place of permanent work, including weekends and holidays. The day is taken up to 0 o'clock, i.e. from zero hours it is considered that a new business trip day has begun. For each day, a full payment is issued, without proportional calculations by hour.

If a citizen returns from a business trip on the same day and is simultaneously sent on another business trip, he must receive the daily allowance twice. If an employee travels abroad, he is paid a “Russian” daily allowance until the day he crosses the border with Russia, after which the “foreign” standards established by the company are applied, and upon return they do the same. The moment of crossing can be tracked in the international passport or, if we are talking about the CIS, where crossing the border does not require such marks, using travel documents.

Local NAs may specify different daily allowances for different countries visited by the business traveler. If a business trip involves traveling to several foreign countries, the daily allowance is calculated based on the end of the day and the country visited.

Attention! An employee who, according to the terms of the employment contract, constantly performs his duties on the road or has a traveling nature of work, is not recognized as a business traveler and is not paid daily allowances.

Examples of daily allowance calculation

Across Russia

Manager Martynova went on a business trip on July 1 at 10:00 a.m. and returned on July 15 at 7:15 p.m. The company she represents has set the daily allowance at 1,000 rubles per day.

- Martynova was on a business trip for 15 days.

- 15 * 1000 = 15,000 rub. Daily allowance accrued.

- 700 * 15 = 10,500 rub. Amount not subject to personal income tax.

- 15000 - 10500 = 4500 rub. Amount subject to personal income tax.

- 4500 * 13% = 585 rub. Calculation of personal income tax.

- 4500 - 585 = 3915 rub. Taxable amount minus tax.

- 3915 + 10500 = 14415 rub. Daily allowances to be issued to Martynova before the trip.

Abroad

The conditions are the same as in the previous example, but Martynova is sent abroad. The daily allowance for all trips abroad is fixed - 4,000 rubles per day. Let Martynova have already been given an advance payment earlier, but now it is necessary to calculate the actual amount. Martynova crossed the border on June 2, fulfilled an official assignment and returned to Russia on July 14, judging by the marks in the document when crossing the border.

- 1000 * 2 = 2000 rub. 700 * 2 = 1400 rub. 2000 - 1400 = 600 rubles. Calculation of daily allowance and taxable amount in Russia.

- 4000 * (15 - 2) = 52,000 rub. 2500 * 13 = 32500 rub. 52000 - 32500 = 19500 rub. Calculation of daily allowance and taxable amount for the foreign part of a business trip.

- 600 + 19500 = 20100 rub. 20100 * 13%= 2613 rub. Calculation of personal income tax on taxable amounts.

- (2000 + 52000) – 2613 = 51387 rub. Daily allowance for issue.

From the taxable amounts it is necessary to calculate and transfer the same contributions, except for the amounts “for injuries”.

Documentation and accounting

Within three days after returning, the employee is required to report on travel expenses, including daily allowance, and draw up an advance report, on the basis of which the previously issued advance will be recalculated.

For daily allowances, these are mainly travel documents and border crossing marks. If an employee used a personal car for the trip, he can present a waybill and any other document proving the official nature of his absence from work.

Based on these documents, a note-calculation for daily allowance is drawn up, which indicates:

- Full name of the employee, his personnel number;

- details of the order for sending on a business trip;

- business trip period;

- legal norm of daily allowance;

- actual issuance of daily allowance per day.

The main element of this note is the calculation of the issue: according to the norm, in fact, and the calculation of the excess amount issued, taking into account the days of the business trip. Exceeding the standard is considered if the organization has adopted increased norms for issuing daily allowances compared to the maximum established ones.

Attention! The calculated daily allowance is entered into the advance report as a separate line.

What are the daily allowances for business trips abroad in 2021?

The amount of daily allowance for business trips abroad in 2021 is important for calculating income tax, as well as for the purposes of calculating and paying personal income tax.

Let us remind you that the employer sets the amount of daily allowance independently, fixing the amounts in a collective agreement or in a local regulatory act (Article 168 of the Labor Code of the Russian Federation).

Some companies set different daily allowances for foreign business trips depending on the country to which the employee is sent to perform a work assignment.

However, for budgetary organizations, the amount of daily allowance for business trips abroad is established by the Government of the Russian Federation. And commercial organizations, if desired, can be guided by these daily allowance amounts.

Daily allowances for business trips abroad: in what currency should they be issued?

The employer himself determines in what currency he sets and pays the daily allowance for business trips abroad. For example, the amount of such daily allowance may be set in foreign currency, but the employee will receive an amount in rubles equivalent to these foreign currency daily allowances.

Foreign business trip: how to calculate daily allowance

Calculation of daily allowances for business trips abroad in 2021 depends on the number of days spent by the employee outside the Russian Federation.

As a general rule, daily allowances are paid to an employee as follows (clauses 17, 18 of the Regulations, approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749):

- when going on a business trip abroad, the daily allowance for the day of crossing the border is paid as for the time spent abroad;

- when returning from a trip abroad, per diem for the day of crossing the border is paid as for a business trip within the country.

However, the company has the right to establish its own procedure for calculating daily allowances paid.

Daily allowance for business trips abroad in 2021: table

Here are some daily allowances for business trips abroad established by the Government of the Russian Federation for state employees (Resolution of the Government of the Russian Federation dated December 26, 2005 No. 812):

Daily allowance standards for employees of organizations financed from the federal budget for business trips outside the Russian Federation from January 1, 2006.

Daily allowance in US dollars

When traveling from Russia to the territory of another country

When traveling on business trips of employees of foreign institutions of the Russian Federation within the territory of the country where the foreign institution is located

Organizations in the commercial sector establish their own rules

Organizations can establish a specific procedure for reimbursement of expenses, including the amount of compensation.

The amount of reimbursement for expenses incurred can be set by the organization depending on the status of the posted employee. It is absolutely not necessary to set uniform limits for spending money on business trips for everyone. Thus, for company management, an increased amount of compensation for travel expenses may be established, and for ordinary employees, the limits for spending money on business trips may be more modest (letter of the Ministry of Labor of Russia dated February 14, 2013 No. 14-2-291).

If a company employee overspends during a business trip and personal funds are spent, you can write an application for reimbursement of expenses incurred, attaching supporting documents (for more information, see “Excess expenses are reimbursed upon application (sample 2017)”).

How to apply for daily allowance for a business trip

What counts as travel expenses?

A business trip is a trip by an employee of an organization away from his place of permanent work for the purpose of fulfilling an official assignment for a certain period of time. An employee goes on a trip only on the basis of a written order from the head of the institution.

The procedure and rules are established by law. Thus, Government Decree No. 749 dated October 13, 2008 regulates the list of travel expenses (per diems in 2021), which the employer is obliged to reimburse:

- costs of renting residential premises;

- travel expenses;

- average earnings for travel days;

- other expenses agreed (permitted) by the employer;

- additional expenses associated with accommodation.

The rate of daily travel expenses in 2021 (additional expenses related to accommodation) is enshrined in the Tax Code (Article 217 and paragraph 2 of Article 422 of the Tax Code of the Russian Federation) and is equal to 700 rubles for trips within Russia and 2,500 rubles for trips abroad per day. However, the organization has the right to set its own limit for additional expenses related to accommodation, more or less than the legal norm.

What do you need to pay?

Starting this year, employees are sent on business trips according to the new 2021 rules; daily allowance and other expenses are reimbursed slightly differently.

The employee must document the costs of travel, renting accommodation and permitted expenses. Otherwise, no payment will be made. There is no maximum limit on daily allowances, but the institution has the right to independently approve the norms. As for average earnings, the accountant makes calculations according to the working time sheet and the order of the manager.

With per diem, things are different. This type of expense does not require documentary confirmation by checks and receipts. However, previously, accountants used a travel certificate to confirm and accrue such payments. The document indicated the dates of departure for the trip and return from it (arrival date). But in January 2015 the form was canceled. Now the employee’s departure and return dates must be confirmed on the basis of tickets, residential rental agreements or fuel receipts. It’s a complicated method, which is why many organizations continue to issue travel certificates to their employees.

How to set per diem

The budget organization must approve the Regulations on employee business trips. It should detail the rules, procedure and amount of travel expenses in 2021, and daily allowances for business trips. If there is no such document, then it must be developed and approved. Or issue an order indicating the norms for travel expenses for the current financial year.

Legal Aid Center We provide free legal assistance to the population

Is per diem paid for a one-day business trip?

Business travel days are not paid when the employee, due to transport accessibility and the nature of the work, can return home every day. It should be noted that the head of the organization determines the possibility and feasibility of compensation for expenses in each specific case separately and taking into account the totality of business trip factors.

The justification for refusing to pay for a one-day business trip follows from the very wording of the daily allowance given in Part 1 of Art. 168 TK. Since they are compensation for expenses associated with living away from home, and a business trip for one day does not provide for it, then the payment of daily allowances is out of the question.

Amount of daily allowance for a business trip for 2021 - changes in the law

When an employee is assigned on a business trip, the company not only pays expenses for transportation and rental housing, but also pays daily allowances. The latest expenses have accountants and managers raising questions. It is not always clear in what cases these payments are assigned, what their size is and the calculation procedure.

Daily allowances for business trips - changes in legislation for 2018

First, you need to understand what daily expenses are on a business trip. According to Article 168 of the Labor Code of the Russian Federation, the legislation defines these payments as an opportunity to compensate an employee for expenses in connection with his residence outside his permanent place of residence.

Until recently, such payments were not subject to tax upon settlement. From the beginning of 2021, the Government Decree prescribes certain limits, which are still not subject to tax and insurance contributions:

- 700 rubles for trips within Russia;

- 2500 rubles for business trips abroad.

The limit for these payments is not limited as before. However, amounts in excess of the specified limit are now subject to contributions in the standard manner.

Daily allowance for a business trip in Russia

The minimum daily allowance for a business trip for 2021 in Russia, as well as abroad, is not provided for by law. That is, in practice, accrual is carried out at the discretion of the employer in accordance with the local standards of the organization.

However, the rules for posting on a business trip stipulate that the employee should not find himself in worse conditions than the current ones. Therefore, in order to avoid labor disputes when making calculations, it is recommended to adhere to the following minimum framework:

- when prescribed within the same region - 200-300 rubles;

- for another region - from 500 rubles.

The legislation provides that the daily allowance rate must be specified in the local regulations on business trips . It may also be specified in the regulations under which the employee is sent on a trip.

Business trip abroad - daily allowance in 2021

Separately, it is necessary to consider travel expenses when sent abroad. In this situation, it is recommended to be guided by Government Resolution No. 812 . This legislation prescribes certain expenditure levels for each country.

This requirement applies to employees of budgetary organizations. Therefore, for extra-budgetary companies they are rather advisory in nature. In this matter, it is also necessary to take into account the established threshold of 2,500 rubles. All funds that exceed this value are subject to taxation.

The manager has the right to independently decide in what currency he pays the traveler money. The calculation is made in accordance with the current exchange rate of the Central Bank of the Russian Federation.

Daily allowances for business trips in budgetary institutions

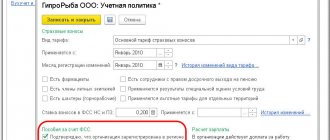

Government Decree No. 729 regulates the calculation of all travel allowances. It also prescribes a fixed amount of charges for expenses per day for trips within Russia. For 2021, the daily allowance for employees of budgetary institutions is 100 rubles.

To calculate payments per day when traveling abroad, you must refer to Government Resolution No. 812. The appendix to this document regulates payments according to the calculation for each country separately.

Payment of daily allowances for business trips

One of the main questions that arises when issuing travel allowances is how daily allowances are calculated on a business trip. It is not difficult to calculate this situation. To do this, you need to set the number of travel days. The resulting value is multiplied by the amount specified in the standard.

If, for example, an employee is outside Russia for 4 days and arrives on the fifth day, then the payment is calculated according to these values. That is, 4 days are paid as abroad, the fifth - as inside Russia.

Calculation of daily allowances for business trips in 2021

For clarity, you can consider an example of calculation for 2021. The employee goes on a business trip from the first to the ninth of October. He is traveling abroad and, by order, arrives on the evening of the ninth, that is, only eight days.

The organization has established that for the destination country the payment of funds per day is 2800 rubles, and in Russia - 600 rubles. The first value must be multiplied by seven days - the result is 19,600. 600 rubles per day in Russia are added to this, for a total of 20,200 given to the traveler.

But since the limit has been exceeded, taxes must also be deducted. Together with insurance premiums, for example, they will amount to 18%. The limit has been exceeded by 300 rubles, they also need to be multiplied by 7 days - 2100. Next, you need to find the specified percentage of the amount received - 378 rubles will need to be paid for exceeding the limit.

Business trip for one day - daily allowance in 2021

The law stipulates that a one-day business trip does not require the accrual of daily allowances. That is, only transport services and organizational expenses are actually reimbursed. However, the local situation of the organization may provide for such an accrual of expenses.

This amount is usually issued at the rate of 50% of the established amount of accruals for trips abroad. In Russia, such funds may not be paid at all, but the employer can arrange them as a separate payment for current expenses. Tax on such payment is not withheld during calculation if the amount is within the limit.

Procedure for paying daily allowances

Daily allowances are mandatory:

- for all days of a business trip, including those falling on weekends and official holidays, days en route to the destination and back, forced stops;

- for days of incapacity for work that occurred during official travel.

To establish the amount due for payment, the number of days of official travel is calculated, which is recorded in the order. Payment of daily allowance occurs no later than the day before departure, in cash or by crediting to a salary card.

order to establish the daily allowance rate: form and sample

The daily allowance is paid to the posted worker in the appropriate currency of the host country. It is permissible to replace the currency with the cash equivalent in Russian rubles at the official exchange rate on the date of payment of funds. Then, when crossing the border, the employee independently exchanges for local currency and confirms this fact with a check from the exchange office.

The dates of arrival and departure from one country to another are determined by the marks in the foreign passport or travel documents (in the case of crossing the border with the CIS).

Extension of a business trip must be agreed with the company management. Then, for the additional days, the daily allowance is calculated and transferred to the employee’s bank card or by transfer to his name.

Calculation of daily allowances for business trips abroad in 2021

Standards for business trips abroad are established by law for employees of government agencies. They are expressed in US dollars for each country (see table above).

The daily allowance is calculated in accordance with the standards and duration of the business trip. Therefore, to issue amounts in person, a formula is used that takes into account the number of days of stay in the territory of a foreign state and the time spent in the Russian Federation:

Рsut = Kz × Tz + Kr × Tr , where

- Kz – standard daily allowance for one day abroad per person;

- Тз – days of actual stay abroad;

- Kr – standard daily allowance for one day of business trip in Russia per person;

- Tr – business trip days across Russian territory.

Example : Citizen M. was sent on business from July 13 to July 17, 2021. The first four days he spent in Europe, on the last day, the 17th, he was in Russia. The regulations on business trips of Sila LLC establish that the daily allowance rate in Norway is $79 per day, in Russia 800 rubles. in a day. On the day of the advance, the dollar exchange rate is 63 rubles.

Calculation of daily allowance in rubles:

$79 × 4 days × 63 rub. + 800 rub. = 20,708 rubles.

If during one work assignment an employee has to visit more than one country, then each of them has its own standard. The traveler is given a daily allowance based on the days of stay in each country. The employer converts the currency into the ruble equivalent at the current official exchange rate on the day of calculation.